Standard

The new rules are due to the adoption of several regulations.

- Federal Law No. 12-FZ of February 21, 2019 “On Amendments to the Federal Law “On Enforcement Proceedings”;

- Directive of the Central Bank No. 5286-U dated October 14, 2019 “On the procedure for indicating the type of income code in orders for the transfer of funds,” registered with the Ministry of Justice on January 14, 2020;

- Letter of the Central Bank No. 45-1-2-OE/8224 dated 06/08/2020.

What are the features of advance payment?

Salary according to the employment contract, according to Art. 136 of the Labor Code of the Russian Federation, must be paid at least once every half month. More often it is not forbidden to pay remuneration for work, but still employers usually divide the salary into 2 parts:

- the amount paid based on the results of work for the 1st half of the billing month (it is “unofficially” called an advance, although such a term is not mentioned in the Labor Code of the Russian Federation);

- the main part paid based on the results of work for the 2nd half of the billing month.

You can learn more about the legal requirements for setting the deadline for paying wages in the article “How wages are paid - procedure and verification.”

If the salary is paid through a bank account, the payment slip in both of the above cases is filled out almost identically. The only difference is in filling out the details “Purpose of payment”: when transferring the advance, you need to provide wording reflecting the fact that the salary is transferred specifically for the 1st half of the month.

IMPORTANT! An employee has the right to independently choose a bank to receive wages. Imposing a bank convenient for the employer is strictly prohibited. There are sanctions for this.

How to properly agree with an employee on the conditions for receiving wages, incl. advance payment, and what sanctions are provided for the employer’s refusal to replace the credit institution, ConsultantPlus experts explained. Get trial access to the system and go to the HR Guide.

See also “Do I have to pay personal income tax on an advance payment?”

Let's consider exactly how this wording will sound and how other important payment details are filled out.

Codes

Law 12-FZ establishes that persons paying a citizen a salary or other income, in respect of which Article 99 FZ-229 (on enforcement proceedings) establishes restrictions or for which, in accordance with Article 101 229-FZ, cannot be levied, are required to indicate in the payment documents the corresponding code for the type of income.

What is it for? The fact is that the bank needs this information in order to understand whether it is possible to write off funds from the amount received on the card according to the executive document or not.

Central Bank Directive No. 5286-U regulates the procedure for indicating the code in the payment order. The code of the type of income is indicated in detail 20 “Name. pl." payment order.

List of codes and cases of their use:

When transferring funds that are not income, for which restrictions are established by Articles 99, 101 of Federal Law No. 229-FZ, the type of income code is not indicated.

Executing a payment order for VAT payment

When creating a payment order for VAT transfer, you must be guided by the requirements of two documents:

- Regulations of the Bank of Russia dated June 19, 2012 No. 383-P - it contains the form on which the payment order is generated, and describes those details without which the use of this document is impossible in principle (amount and purpose of payment, details of the payer and recipient).

- Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n - here are the rules for filling out the information required to be included in the payment document generated for the tax payment. Without this data (fields 101, 104-110 are intended for them in the payment form), the tax received by the budget will not be identified.

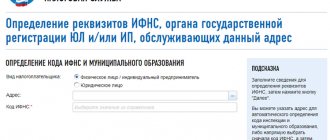

The recipient of the VAT payment will be the Federal Tax Service with which the taxpayer is registered, and its name and details will characterize the recipient’s data in the payment slip.

The purpose of payment should indicate the name of the tax being transferred and indicate the period for which it is paid.

In a special column there is a code characterizing the order of payment.

The fields required to be filled in when making a tax transfer will reflect:

- Taxpayer status (field 101). Its code must be selected from those given in Appendix No. 5 to Order No. 107n. When paying VAT, it may be code 01 (for a legal entity payer), 02 (for a tax agent), 09 (for an individual entrepreneur payer).

- KBK (field 104) - for VAT it will correspond to the code 18210301000011000110.

- OKTMO code (field 105), characterizing the linking of the payment to a specific territorial unit.

- Payment basis code (field 106) - for quarterly tax paid on time, it is indicated as “TP”.

- Code corresponding to the paid tax period (field 107). For example, for a payment for the 1st quarter of 2020, it will look like “Q.01.2020”.

- The date the VAT return was sent to the tax authority (field 109).

To fill in fields 108 and 110 of the payment document for the current payment, the number “0” will be used.

Sample payment order for payment of quarterly VAT in 2020

Purpose of payment

Federal Law 12-FZ introduced another innovation for accountants.

From June 1, 2020, persons paying wages or other income to the debtor by transferring them to the debtor’s bank account were required to indicate in the payment order the amount collected under the writ of execution.

The Central Bank explained how to do this in letter No. IN-05-45/10 dated February 27, 2020.

When transferring income from which amounts were withheld under executive documents, in the “Purpose of payment” details you must indicate:

- symbol "//";

- combination of letters “VZS”, that is, the amount collected;

- symbol "//";

- the amount collected in numbers (rubles from kopecks must be separated by a dash sign “-„, if the collected amount is expressed in whole rubles, then after the dash sign “-” “00” is indicated);

- symbol "//".

For example, when withholding alimony in the amount of 10,000 rubles, the following is indicated: //VZS//10000-00//.

What is it for? The fact is that executive documents also come to banks where employees have accounts. And it turns out that the bank does not know that some income has already been withheld within the amount established by law.

What is a payment order?

A payment order is a document that contains the payer’s information for the bank engaged in servicing him about the payments necessary to make from his current account to the accounts of counterparties or to government agencies for a certain amount.

There are two types:

- in electronic;

- in writing.

If the organization does not have remote access to Internet banking, then this order can be downloaded from the link and filled out by hand or on a computer.

Example 3

Child benefit was transferred to the employee

By the way, the payment card for transferring child care benefits has one more feature. The Central Bank indicated this in a letter dated August 14, 2019 No. 45-1-2-07/22917.

The fact is that some benefits, including child care benefits up to 1.5 years old, must be transferred to a bank account attached to the Mir card. This applies to payments assigned after May 1, 2020.

In this case, the payment slip must indicate code 1 in the “110” field.

Types of payment orders

Payment orders can be urgent payment orders or early payment orders.

Urgent payment orders are used in the following cases:

- making an advance payment, that is, payment is made before the goods are shipped, work is performed, or services are provided;

- making payment after shipment of goods, performance of work, provision of services;

- making partial payments for transactions involving large amounts.

A payment order can be paid partially or in full if the necessary funds are not available in the payer’s account. In this case, the bank makes a corresponding mark on the payment document.

Banks learn about the transfer of funds only to the Mir card from the payment order

According to the Directive of the Central Bank of the Russian Federation dated July 5, 2017 No. 4449-U, banks are required to ensure that transfers provided for by the law on the national payment system come exclusively to the Mir card. The list of such payments is established in clauses 5.5 and 5.6 of Art. 30.5 of the law on the payment system, as well as by Decree of the Government of the Russian Federation of December 1, 2018 No. 1466.

According to Decree of the Government of the Russian Federation dated April 11, 2019 No. 419, from May 1, 2019, these include payments established by the law on state benefits to citizens with children. Thus, from May 1, 2019, banks are prohibited from transferring newly assigned benefits to cards of other payment systems, including Visa and Mastercard:

- for pregnancy and childbirth;

- one-time – for women who registered with medical organizations in the early stages of pregnancy;

- one-time – in connection with the birth of a child;

- monthly – until the child is 1.5 years old.

Banks exercise control in accordance with Appendix No. 13 to the Regulation of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P (hereinafter referred to as Regulation No. 383-P), which states that if the payment code is indicated in detail “110” of the order and the funds are to be credited to a bank account recipient of funds - an individual, the recipient's bank verifies the link to the bank account of the issued payment card, which is a national payment instrument.

At the same time, Regulation No. 383-P from 08.08.2019 requires filling in the “110” detail when transferring funds to individuals in order to make payments from the budgets of the budget system of the Russian Federation, including the above “children’s” payments.

Please note: it does not matter whether the payer is located in cities participating in the Direct Payments program. Social insurance specialists have repeatedly pointed this out on their official website on the Internet (information from 05/07/2019, from 06/28/2019).

If the recipient of the state benefit does not have a Mir card, the amounts sent to him in accordance with Regulation No. 383-P are sent to bank accounts for unidentified funds. No later than the next business day after receiving the corresponding payment, the credit institution must offer the addressee to receive the money in cash or order its transfer to another account linked to a card of the national payment system or that does not provide for payments using cards. If the recipient of the funds does not respond to the bank’s request, the latter is obliged to return the funds to the sender on the 11th business day from the date of receipt of the disputed payment, indicating the reason for the return.

We also note that current legislation does not provide for the obligation for employers to issue national payment system cards to employees. On the contrary, parliamentarians yesterday, in the third reading, adopted amendments to the Labor Code of the Russian Federation, providing for punishment for imposing specific banks on staff. However, in order to protect the interests of employed citizens, social insurance requests that employees be informed about changes in the procedure for paying benefits.

For example, the Lipetsk branch of the fund makes such a request to employers on its official website. Officials also ask to remind the insured that in accordance with Appendix No. 1 to Order No. 578 of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017, the application for payment of benefits indicates only the Mir payment card number without additional details of the credit institution: account number, name and BIC.

How to fill out payment order fields 104-109

Fields 104-109 of the payment order need to be given special attention. An error when filling them out threatens that the payment will fall into the unknown, and you will have to clarify it. Let's look at how to fill out these lines.

| Line title | Number | Note |

| 104 | Budget classification code | When paying insurance premiums for health insurance for employees, indicate the code 182 1 0210 160 |

| 105 | OKTMO code |

|

| 106 | Payment basis code | For compulsory health insurance contributions paid on time, the TP code (current payments) is indicated. |

| 107 | Taxable period | The tax period for contributions to compulsory pension insurance for employees is a calendar month. Therefore, the payment slip must indicate “MS”, month number and year. For example, for contributions for January 2020 you need to enter “MS.01.2020” |

| 108 | Document Number | For contributions to compulsory pension insurance, in these fields we indicate the value “0” |

| 109 | Document date |

Sample payment order to the Pension Fund 2020