The latest changes in the rules for filling out payment orders for insurance premiums occurred in 2020 in connection with the transfer of administration of insurance premiums to the Federal Tax Service. Among other things, the details of the payee have changed, the status of the payer, which must be indicated in field 101, and the KBK has been updated. All changes adopted then remain relevant in 2020.

In this publication, we will find out how to fill out payment orders in 2020 and offer readers a sample payment order for insurance premiums in 2020.

Many entrepreneurs in Russia, in order not to waste time tracking changes in legislation, use a convenient online service. This saves time, minimizes risks and ensures the accuracy of payments and reports.

Recipient details in the payment order for insurance premiums 2020

Starting from 2020, most of the contributions must be transferred not to the funds, as in previous years, but to the Federal Tax Service. Only one type of contribution needs to be paid to the Social Insurance Fund: contributions from employees’ salaries for compulsory insurance against industrial accidents and occupational diseases, as before. The remaining contributions are now payable to the Federal Tax Service. Namely:

- contributions in a fixed amount for compulsory pension insurance of individual entrepreneurs “for themselves”;

- contributions in a fixed amount for compulsory medical insurance of individual entrepreneurs “for themselves”;

- contributions from employees' salaries for compulsory health insurance;

- contributions from employees' salaries for compulsory pension insurance;

- contributions from employees' salaries for compulsory insurance for temporary disability and maternity.

Accordingly, for insurance premiums paid to the Federal Tax Service, it is necessary to indicate the details of the Federal Tax Service Inspectorate with which the individual entrepreneur (organization) is registered.

Field 16 - “Recipient” in the payment order for insurance premiums 2020

So, according to the letter of the Federal Tax Service dated December 1, 2016 No. ZN-4-1/ [email protected] , in field 16 “Recipient” the abbreviated name of the Federal Treasury body must be indicated, and in brackets the abbreviated name of the tax office to which the payment is transferred. For example: “UFK for Moscow (Inspectorate of the Federal Tax Service of Russia No. 7 for Moscow).

Field 61, 103 - “TIN”, “KPP” in the payment order for insurance premiums for 2020

In fields 61 “TIN” and 103 “KPP” the TIN and the reason code for registration with the tax office must be indicated, as when paying taxes.

Field 101 - payer status in the payment order for insurance premiums 2020

At the time of updating the rules for filling out payment orders in 2017, perhaps the most unclear question was the status of the payer, which must be indicated in field 101. Previously, field 101 in the payment order for the payment of insurance premiums was filled out on the basis of Appendix No. 5 to Order No. 107n of the Ministry of Finance of the Russian Federation. However, the transfer of administration of contributions to the Federal Tax Service changed the status of the payer in relation to the recipient, which called into question the previously applied rules.

Due to the lack of official clarifications, there were then several points of view regarding filling out field 101. But on 02/08/2017, official clarifications from the Federal Tax Service came out, according to which the payer’s status is indicated as follows:

- Status 01 – indicated when paying insurance premiums by a legal entity;

- Status 09 - indicated when an individual entrepreneur pays insurance premiums for himself and for employees;

- Status 10 – indicated when paying insurance premiums by a notary engaged in private practice;

- Status 11 – indicated when paying insurance premiums by the lawyer who established the law office;

- Status 12 – indicated when paying insurance premiums by the head of a peasant (farm) enterprise;

- Status 13 – indicated when paying insurance premiums for employees by an individual (who is not an individual entrepreneur);

- Status 08 – indicated when companies and individual entrepreneurs pay insurance premiums for injuries.

Field 104 - KBK in the payment order for insurance premiums 2020

By Order of the Ministry of Finance No. 230n for 2020, new KBK codes were approved. A complete list of budget classification codes is available here.

Please note that for insurance premiums (except for “injury” contributions), the first three digits of the BCC, meaning the chief administrator of budget revenues, have changed. In connection with the transfer of administration of insurance premiums to the Federal Tax Service, the first three digits of the BCC are now 182. In past years, the first three digits of the BCC were 392.

Receipt samples: Form PD-4 Sberbank (tax)

- payments credited to the budget (personal income tax, simplified tax system, UTII, etc.) and extra-budgetary funds (pension, medical insurance, social insurance);

- payments for provided housing and communal services (housing and communal services, gas, electricity, water supply);

- payments for other paid services provided (Internet, TV, services, etc.);

- payments for goods (via an online store, a store by order);

- insurance payments (pension, medical insurance, social insurance);

- voluntary contributions (voluntary pension insurance, charity);

- payments in favor of individuals carrying out entrepreneurial activities without forming a legal entity (IP);

- payments for the purchase of real estate, contributions to the accounts of housing, housing construction, garage and other cooperatives (organizations), except for rent and utility bills;

- payments received from refugees, internally displaced persons and other categories of the population to repay long-term interest-free repayable loans;

- contributions accepted from individuals in favor of the Non-State Pension Fund of Sberbank;

- other payments (housing and communal services receipt, utilities, court receipt, Russian Post receipt, registry office receipt, income tax receipt).

Receipt samples

5. Payments are not accepted if the payment documents do not contain the details necessary to transfer payments for their intended purpose, or if individual clients do not have cash in the amount specified in the payment documents, is not accepted.

By bank transfer from an individual entrepreneur's current account, if the entrepreneur has his own current account. To do this, you need to create a payment order to transfer money from your account to the territorial branch of the Pension Fund. The payment order must indicate:

select a payment category in 2020: on account of compulsory pension insurance within the tariff limits, 1% on account of compulsory pension insurance in excess of the established income limit, on account of compulsory medical insurance (form a separate order for each category) indicating a separate BCC;

PP IP PFR

In 2020, the fixed amount of contributions to the compulsory pension insurance account is 19,356.48 rubles; towards compulsory medical insurance – 3796.85 rubles. They must be paid by December 31, 2020. If the income is higher and the fixed payment increases by 1%, the additional amount must be paid before April 1, 2020. Don't forget that this year there are new BCCs for paying dues.

It is very important to fill out the KBK correctly (the code used by the state to group items of the state budget), because if you fill out the KBK incorrectly, the payment will not be credited and you will have arrears on insurance premiums. BCCs change periodically, so it is important to keep track of changes before paying your dues.

» data-medium-file=»https://wilhard.ru/wp-content/uploads/2020/10/strakhovye-vznosy-ip-300×169.jpg» data-large-file=»https://wilhard .ru/wp-content/uploads/2020/10/strakhovye-vznosy-ip.jpg" src="https://wilhard.ru/wp-content/uploads/2020/10/strakhovye-vznosy-ip.jpg" alt=”Fixed and variable insurance premiums for individual entrepreneurs” w /> Try not to pay. Criminal liability...

KBC for payment of insurance premiums in 2020

| Name of insurance payment | KBK | KBK fines | KBK penalties |

| for compulsory pension insurance (for employees) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| for compulsory health insurance (for employees) | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| for maternity and sick leave (for employees) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| for injuries in the Social Insurance Fund (for employees) | 393 1 0200 160 | 393 1 0200 160 | 393 1 0200 160 |

| for compulsory pension insurance (for yourself) | 182 1 0200 160 | 82 1 0210 160 | 182 1 0210 160 |

| for compulsory health insurance (for yourself) | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

| in retirement with an income of 300 thousand rubles (1%) | 182 1 0210 160 |

KBK of pension contributions of individual entrepreneurs “for themselves” in 2020

Separately, it is worth mentioning the issue of KBK paying pension contributions to individual entrepreneurs “for themselves” in 2020. The final amount of these contributions is determined by the income of the individual entrepreneur. If it does not exceed 300,000 rubles, then contributions are paid in a fixed amount, depending on the minimum wage established as of January 1 of the year for which contributions are paid. If the income of an individual entrepreneur exceeds 300,000 rubles, then one percent of the amount exceeding 300,000 rubles is added to the above contribution in a fixed amount.

To pay these contributions in 2020 for periods up to December 31, 2016, two separate BCCs are provided. To pay these two contributions for periods after 01/01/2017, one BCC is applied. See the table below for details.

| Accrual period | In a fixed amount for an insurance pension with income of no more than 300,000 rubles for individual entrepreneurs “for themselves” | In a fixed amount for an insurance pension with income over 300,000 rubles for individual entrepreneurs “for themselves” |

| Codes for insurance premiums accrued for periods before 12/31/2017 | 182 1 0200 160 | 182 1 0200 160 |

| Codes for insurance premiums accrued for periods from January 1, 2017 | 182 1 0210 160 | 182 1 0210 160 |

You will find more information about calculating insurance premiums for individual entrepreneurs “for yourself” here.

KBK for pension contributions at an additional tariff in 2020

According to the general rule (clauses 1, 2 of Article 428 of the Tax Code of the Russian Federation), the additional tariff for pension contributions for employees working in hazardous work ranges from 6% to 9%, depending on the type of work. But, according to paragraph 3 of Art. 428 of the Tax Code of the Russian Federation, if a special assessment carried out by the employer established other classes of working conditions, other additional tariffs are applied - from 0% to 8%.

In past years, payment of contributions at additional tariffs was made to one of two KBK, the choice of which did not depend on whether a special assessment was carried out. One BCC was used to pay insurance premiums for workers engaged in work, the types of which are specified in clause 1, part 1, art. 30 Federal Law No. 400-FZ, the other - for payment for workers engaged in work, the types of which are listed in paragraphs. 2–18 hours 1 tbsp. 30 Federal Law No. 400-FZ.

To pay contributions at additional tariffs, in 2020, four BCCs are used. Now the BSC must be selected not only depending on the type of work, but also on the fact of a special assessment. The BCCs for such contributions are shown in the table below:

| The additional tariff does not depend on the results of the special assessment (9%) | 182 1 0210 160 |

| Additional tariff depends on the results of the special assessment | 182 1 0220 160 |

| The additional tariff does not depend on the results of the special assessment (6%) | 182 1 0210 160 |

| Additional tariff depends on the results of the special assessment | 182 1 0220 160 |

How to generate a tax receipt for an individual entrepreneur: step-by-step instructions

Our fictitious individual entrepreneur Apollo Buevy, with the help of “Clerk,” learned to generate payment documents for the payment of contributions, and now we will tell him how to generate receipts for paying taxes through the “Pay Taxes” service on the website of the Federal Tax Service.

We select the document we want to fill out. We fill out a receipt for payment through a bank or the State Services portal, but the payment order is filled out according to the same principle.

Having marked the necessary lines, go to the next page

We are not filling out the KBK yet, it will appear in the required field after selecting the required payment

Many individual entrepreneurs cannot find taxes under special tax regimes (USN, UTII, PSN and Unified Agricultural Tax) in this list. And you need to look for them in the “Taxes on total income” group.

We choose the tax we need. Please note that the type may vary depending on the date. Thus, payments under UTII for periods before 2011 have other BCCs.

When choosing a BCC according to the simplified tax system, pay attention to the object of taxation. There are two of them: “income” and “income reduced by expenses.” There is no separate BCC for the minimum tax as of January 1, 2020; there is no need to look for it.

Now let's choose what will be paid. The tax (payment), penalty or fine. We are not interested in the interest line; taxpayers do not pay them. After making your selection, click the “Next” button and the required code will appear in the KBK field.

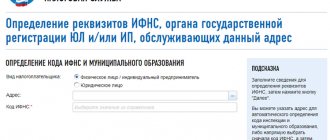

On the next page, fill in the address (select the required addresses from the list). The code of the Federal Tax Service and the municipality will appear automatically.

Now let's select the basis for the payment. If we pay the tax within the period established by law, without delay, then we indicate the TP. If tax is paid for previous tax periods, but the claim has not yet been submitted, then select ZD. If the request has already been received, then indicate the TR.

When choosing a tax period, you must take into account that with UTII the period is always a quarter. Those. There is no period of a year or half a year. With the simplified tax system, the periods in the payment document can be quarter, half-year and year. A period of 9 months is not provided, so they usually write the period “quarterly payments” and select the 3rd quarter. Click the “Next” button and proceed to filling out your personal data

The TIN field is not required in the payment document, however, if you are going to pay non-cash electronically, that is, through an online bank or State Services, then the TIN must be filled out.

By clicking the “Pay” button we get a choice of payment method. Please note that if the TIN was not specified, there will be no cashless payment option; you can only save or print a receipt. You can pay the receipt at the bank's cash desk or through a bank terminal that reads the bar code.

Other fields of the payment order for insurance premiums in 2020

In field 106 “Basis of payment” - for payment of insurance premiums in 2020 for the periods of 2020, the value “ TP ” is entered.

In field 107 “Period” - to pay insurance premiums in 2020 on a monthly basis, the following construction is used: “ MS.XX.2020 ”, where XX is the month for which insurance premiums are paid. For example, when paying insurance premiums for January, the value “MS.01.2020” is entered in field 107.

In field 108 “Document number” - for payment of insurance premiums in 2020, the number “ 0 ” (zero) is entered monthly.

In field 109 “Document date” - for payment of insurance premiums in 2020, the number “ 0 ” (zero) is entered monthly.

In field 110 “Payment type” , enter “ 0 ” (zero).

This might also be useful:

- Deadline for submitting a declaration under the simplified tax system for 2020

- Property tax deductions in 2020

- Payment for negative environmental impact in 2020

- Declaration 3-NDFL 2020 for 2020

- Which OKVED code should be indicated in the reporting for 2020?

- Reduced insurance premium rates in 2020

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Federal Tax Service website

On the main page of the portal www.nalog.ru there is a publicly accessible “Pay taxes” service.

The section consists of three subsections:

- individuals;

- individual entrepreneurs;

- legal entities.

The service allows you to generate a tax receipt, print it, or make an online payment.

Individuals

The section for individuals consists of four subsections:

- Personal Area;

- payment of taxes;

- state duty;

- filling out a payment order.

Each section is intended for generating bank documents for various types of fees.

Paying taxes

In the subsection “payment of taxes, insurance contributions of individuals”, payment orders for the listed types of fees are filled out:

- property;

- land;

- transport;

- on the income of individuals;

- insurance premiums;

- fines for late submission of the 3-NDFL declaration.

Attention: Debt repayment is carried out according to the UIN notice or by filling out a payment order manually.

If the citizen does not have a notification about the need to transfer the fee, then he should select “proceed to filling out the payment document.” On the page that opens, you need to provide payment information: