Previous articles on bonds:

| • Bonds and their properties • Long-term bonds • US bonds • OFZ • Eurobonds • Bond ETFs • Risks of high-yield bonds • Convertible bonds • Perpetual bonds • Exchange traded bonds |

High yield bonds (HYBs) are called differently depending on what they want to emphasize: high potential profits or risks. In the latter case, the terms junk or junk bond are also used due to the high risk of default by the issuer and loss of all invested funds. But of course, for sales it is much more profitable to use the first name.

Junk bonds should not be confused with long-term securities of completely reliable companies that pay high coupons. The latter is due to the fact that in previous years the key rate was higher than today’s, so the coupons tied to it may well be 6-7% per annum in foreign currency. Let's say the coupon of a 30-year bond of the famous Ford Motor Company is 7.125% per annum. But this indicator for the investor is offset by the increased price of the bond, as a result of which the yield to maturity upon purchase approximately corresponds to the market rate. Read here.

In English and in foreign bond screeners, VDO also has several designations: high-yield bond, non-investment-grade bond, speculative-grade bond or junk bond. Overall, when used wisely, high yield bonds can be part of a portfolio strategy. The instrument, which has been popular in the West for more than 30 years, is now beginning its journey in Russia.

High yield bond criteria

Bonds as an investment vehicle are usually classified as conservative and stable instruments that work for the long term. High yield bonds fall almost entirely out of this definition. This type of securities is considered risky for a number of reasons:

- the issuer has a low credit rating (not higher than BB) or may not have one at all;

- are issued by little-known companies, often new, with an extremely scant public history;

- serve to attract funds to a business that is not able to guarantee their return with its property and assets;

- At the same time, they announce a profitability that is noticeably higher than the market rate.

There are known cases when high-yield bonds were used during aggressive financial transactions: repurchase of businesses or acquisitions. The early history of American VDOs is replete with such examples (for example, construction, stolen with the help of “junk” bonds).

The scheme is something like this. A small, often little-known or even specially created for fraud company buys shares of a well-known large company, acquiring a controlling stake. Money for the acquisition appears through the issue of VDO, and shares of the acquired company are used as credit collateral for this transaction. All this fully justifies the unofficial “junk” name of the securities, since the investor significantly exposes his funds to risk.

On the other hand, high-yield bond issuers often hide promising startups, thereby raising funds for further development. Particularly striking examples occurred at the dawn of VDO turnover on the stock market: it was with the help of this instrument that the American companies MCI Communication and AT&T Mobility - one of the first cellular operators - and even the famous cosmetics manufacturer Revlon entered big business.

Criterias of choice

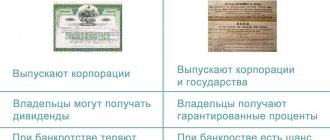

A bond is a debt security. It is purchased by the investor for a certain period, after which he receives interest. Issuers can be the state, individual regions of Russia or commercial companies.

HDOs are high-yield bonds, they are also often called “junk”. They received this name due to the low reliability of issuers and too high risks. Companies have difficulty obtaining bank loans, so they attract investment by issuing securities. It is dangerous for novice investors to invest in them; to do this, you need to have sufficient experience in working on the stock exchange and knowledge. At the same time, this is one of the opportunities to get high income from investing.

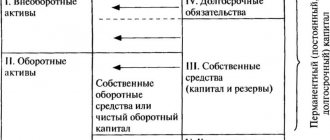

Bonds are not the easiest tool for generating income, but they are often recommended for beginners just taking their first steps in the stock market. First you need to decide what features of bonds you should pay attention to:

- Profitability . Ultra-high profitability is not the best indicator, no matter how much you want to earn money. Too high a percentage indicates that the issuing company has serious problems and there is a high risk of default. A reliable yield on bonds is around 8%-10%, securities with a little more risk claim 11%-14%. Over 15% are already high-risk transactions; you need to choose such bonds extremely carefully and only if you have experience playing on the stock exchange.

- Maturity . Choosing long-term bonds is risky because it is impossible to predict their price. And the company may go bankrupt. The optimal repayment period is up to 3 years.

- Liquidity , that is, how quickly these bonds can be bought and sold. Reliable securities are valued on the stock market, so there will be no problems with their sale in the future. To understand how liquid they are, it is worth assessing the turnover of their transactions per day. Traditionally, the most popular are government debt securities and “blue chip” securities (that is, the most reliable companies). And only half of the bonds on the stock exchange are liquid; for the rest, the turnover of transactions per day is zero.

Based on the above criteria, let’s look at the TOP most attractive bonds of 2020. We will also give examples of high-risk assets, although their stated high returns are not at all guaranteed. So, what kind of debt securities can you invest in?

The emergence of VDO on the world market

The USA became the birthplace of VDO, and Californian businessman Michael Milken is considered their father. It was his company, Drexel Burnham Lambert, that in the late 70s and early 80s of the 20th century began to actively operate this type of paper, giving its clients a chance to discover new opportunities.

Milken's success in the low-rated market soon attracted the attention of not only private investors, but also financial companies. The largest mutual and pension funds, insurance companies and hedge funds began to regularly invest part of their funds in VDO. Financial analysts like to mention that a significant portion of US corporate debt consists of investments in high-risk securities. The rapid development of the VDO market in the 1980s is partially written in the book “Liars' Poker.”

From the USA, income bonds came to Europe and began to gain popularity. A colossal leap in the European VDO market occurred in the late 2000s, when the share of risky investments immediately doubled. The market volume was estimated by the Fitch rating agency at 7 billion euros in the crisis year of 2008, and at 18 billion euros in the next year. The demand for high-risk securities was to a certain extent provoked by traditional financial institutions refusing to lend to businesses on favorable terms.

High yield bond market in Russia

The Russian high-yield bond market lags significantly behind the European and especially the American ones - in fact, it has only just begun its development. From the point of view of generally recognized international agencies, Russian issuers have a low credit rating, including the state - so almost all Russian debt securities issued in foreign currency can be classified as income bonds. Although Russian agencies, of course, have much higher ratings.

Statistics speak volumes about the fact that the high-yield bond market in Russia is just beginning to emerge. Officially, trading of domestic VDOs began for the first time in 2020. Securities of 9 issuers were available for purchase. In 2020, this number increased to 12, and by the end of 2020 it was 20. The market volume, according to financial analysts, also still looks very modest - 6 billion rubles, especially in comparison with American indicators:

| USA | Russia | |

| Market size ($ billion) at the end of 2018 | 188,5 | 0,92 |

| Major Investors | Insurance companies, mutual funds and other large financial institutions. institutions | Individuals |

| Availability of funds | Yes | No |

| Average profitability (% per annum, for 2018) | 9-17% | 13-19% |

| Availability of indexes | Many, for example from Goldman Sachs, Barclays, Merrill Lynch, etc. | Cbonds-CBI RU High Yield |

Note The calculation base for the Cbonds-CBI RU High Yield index includes bonds with a volume of up to 1 billion rubles inclusive, the remaining period until maturity / early repayment of which exceeds 182 days, and the current coupon rate is equal to or more than the value of “Key rate of the Central Bank of the Russian Federation + 5%” . The starting date for index calculation is January 1, 2020. The lists are reviewed quarterly: on the first working day of January, April, July, October.

At the moment, the index includes 30 companies; its structure can be viewed here: https://cbonds.ru/indexes/methodology/cbonds_cbi_ru_high_yield. Everyone agrees that Russia has great prospects in the VDO market and this segment will certainly grow. Already, many management companies are considering the possibility of including VDO in their mutual funds to ensure greater profitability and attract buyers.

Be that as it may, today we can say that in Russia the demand for high-yield bonds exceeds supply. Investors, even institutional ones, have already developed a need for more profitable instruments. The domestic market now lacks issuers. But for young, little-known companies, which make up the bulk of VDO issuers, the conditions for entering the market remain difficult:

- placement of securities for a large amount (from 200 million rubles);

- transparent reporting;

- ensuring cash flow stability;

- other general financial rules (possibility of early presentation of bonds by the holder upon change of the controlling shareholder, sufficient capital provision, etc.)

VDO issuers

In world practice, it is customary to structure companies issuing revenue bonds into four categories:

- Growing business in need of additional financing;

- Companies that have performed well in the past but are experiencing financial difficulties for various reasons;

- Companies on the verge of bankruptcy;

- Enterprises without other financing options (without their own safety margin and undesirable borrowers for banks)

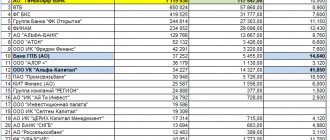

Obviously, the first category of issuers is of greatest interest to investors. The main Russian companies issuing high-yield bonds for public sale are:

- Microfinance organizations (“Money Men”, “CarMoney”, “Master Pawnshop”);

- Leasing, Direct Leasing, Royal Capital);

- Food trade (trade house “Myasnichiy”, “Levenguk”);

- Development (“Zhilkapinvest”, “APRI Fly Planning”);

- IT-);

- Transport) and companies in other industries

The most prominent players in the segment of Russian VDOs are still MFOs and leasing companies; they retain 70% of the market. Experts hope that in the next three years the domestic supply of high-yield securities will increase significantly and cover all sectors of the economy. Already this year, some trading and manufacturing companies are expected to enter the market.

It is not yet possible to invest in the Cbonds-CBI RU High Yield index - there is no fund. But in the United States, there are almost 50 exchange-traded funds with a capitalization of up to $15 billion, which include high-yield bonds of American companies. TOP 3 by capitalization:

- iShares iBoxx $High Yield Corporate Bond ETF (HYG)

- SPDR Barclays High Yield Bond ETF (JNK)

- SPDR Barclays Capital Short Term High Yield Bond ETF (SJNK), etc.

The latter short-term bond fund may outperform as U.S. interest rates rise. The number of bonds in the funds are, respectively, 973, 864 and 771 with ratings BB and B, plus about 10-15% of more “junk” issues (however, there are no bonds without a rating at all).

The cost of funds averages only a few tens of dollars. Management fees are a few tenths of a percent per year, i.e. an order of magnitude less than the coupon income. Some funds can be purchased commission-free by US citizens on the Charles Schwab platform. A Russian investor can purchase them by opening an account with a foreign broker with access to the American market. The dividend yield of such funds is currently about 4-6% per annum, which is noticeably higher than the rate of medium-term government funds. US bonds. The VanEck Vectors International High Yield Bond ETF (IHY) allows you to invest in high-yield corporate bonds from companies outside of America.

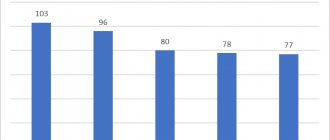

One may wonder why BB-rated bonds are the basis of the funds listed above - after all, there are issuers with lower indicators whose potential returns are even higher. But the fact is that, after a certain point, the number of defaults outweighs the potential profits of bad borrowers:

As you can see, in the presented graph the peak occurs precisely at the BB rating, after which it goes down. You should not pay much attention to absolute yield, since in the last 20 years the double payments of AAA-rated US bonds have been at the level of 2-3% per annum. However, it is true that high yield bonds can add about 2-3% per year to safe bonds (10.7% - 8.2%).

conclusions

Individual high yield bonds carry significant risk. As an active investor, you can try to independently understand the reliability of the VDO issuer by studying its statements. As a passive investor, you can buy a US or international income bond fund where, through diversification, the risk of individual issuer failure does not affect the outcome and only the overall market risk remains.

According to it, VDOs are located between reliable bonds and stocks: for example, during the 2008 crisis, the US stock index at its minimum point fell by 50%, and reliable bonds by less than 10%. VDO indices rated around BB fell by 20-25%. Thus, they are unlikely to be recommended for short-term investments, at least not to a significant extent. But for long-term investments it’s fine.

Is it worth investing in VDO?

Definitely, VDO is an excellent choice if you are looking for an instrument with returns higher than bank deposits and classic bonds, and risks lower than in stocks.

You can invest in VDOs passively, buying ETFs through a foreign broker, or actively, independently selecting the VDOs you like. In the second case, you can work through a Russian broker or a foreign one, depending on what kind of bonds you want to buy. Here are some recommendations for choosing VDO:

- if you want to buy foreign VDOs, buy ETFs right away, thereby immediately solving the issues of internal diversification, selection of securities and regular balancing

- when purchasing Russian VDOs, you can use the list of the Cbonds-CBI RU High Yield index - all liquid VDOs that meet a number of important criteria are reflected there

- keep in mind that bonds of the financial sector (banks, brokers, microfinance organizations, etc.) are characterized by higher risks, since they do not have large volumes of assets that, in case of problems with loan payments, they could sell

- pay attention to the possibility of the issuer receiving support from the state, if any - this is a good signal to buy

- study the business model of the selected issuer - business prospects, debt load (it’s good if the amount of debt does not exceed half of the company’s annual profit), ability to generate stable cash flow

- study the issuer's problems - whether there have been technical defaults or litigation involving the company in the past