Debt securities are a type of loan agreement that fixes the relationship between the organization that issued the debt security (issuer) and the organization/individual that purchased the security (investor). The investor receives the nominal value of the paper and profit in the form of interest within the agreed period.

The types and principles of interest calculation may be different, but the main essence of the relationship is this: the issuer sells securities at a certain price and raises funds, the investor buys securities for a certain amount and the obligation to return it within a specified period with additional payments. The issuer receives money at its disposal, which it can use at its discretion, the owner of the securities makes a successful investment and can count on passive income.

Debt securities are traded on various exchanges and come in different types - bills and bonds, certificates of deposit and treasury bills, but the most popular are bonds (government or corporate) and bills.

Unlike equity securities, where the owners of shares, for example, act as shareholders, in this case, all types of debt securities turn their owners into creditors.

Thus, debt securities (bonds, notes or other types) act as a financial instrument that is issued by the issuing company and sold to anyone who is willing to contribute the required amount of funds. Debt security is the issuer's promise to return the amount spent by the investor with interest before the instrument matures.

In the modern world, debt securities are an effective means of attracting additional borrowed funds for public and private companies, and for investors they are an excellent option for obtaining higher and safer earnings than a bank deposit or a regular loan to a private person at interest.

Characteristics and features of securities

The parameters of government bonds are similar to other debt securities:

- par value - price at issue;

- market value - the selling price on the market, resulting from the interaction of supply and demand;

- coupon rate - interest on the use of the holder's money;

- redemption date—the day the coupons are redeemed;

- maturity is the length of time the bond is held by the investor;

- redemption amount - funds paid by the issuer upon redemption.

The features of OFZ include:

- Low investment risk.

- Preferential taxation, which increases the attractiveness of this instrument and compensates for the low profitability.

- Low profitability compared to corporate ones.

Where are securities circulated and how are they issued?

Debt securities are traded on stock exchanges and securities markets. Individuals and legal entities (ordinary people and organizations) have the opportunity to buy and sell them, pledge them and use them in all cases provided for by the rules and conditions of work on the exchange. The range of applications for debt securities is quite wide.

Securities are issued by issuers, which can be the state, government organizations, or private institutions. The structure must have a good reputation, undergo an inspection and an emission procedure. The issue is carried out on the stock market, trading is conducted by intermediaries.

Kinds

Debt securities can include a variety of instruments, but there are only four main ones. Some of them are more in demand and widely used (bonds, for example), others are less common.

Bonds

A bond is a payment obligation of the issuer to return the value of the security to the holder and pay additional income in the form of interest. Funds are returned only within the specified period (repayment date).

Types of bonds by term:

- Short-term – up to 5 years

- Medium term – 5-15 years

- Long-term – from 15 years

The main advantages of bonds for the issuer:

- Saving on loan servicing – usually similar loans involve higher interest and costs.

- Possibility to obtain funds for a long term (compared to a bank).

- The ability to keep the organization’s capital indivisible, without giving control to anyone (there are no ownership rights to assets, unlike shares, for example).

- A chance to attract serious investors, increase the liquidity of securities, and make more profitable transactions.

- The terms of repayment and interest are strictly defined.

Depending on the type of payment, bonds can be either coupon or zero-coupon. A coupon is the interest rate on a security. Zero-coupon bonds assume that the interest rate is 0, payment will be made only at the end of the term.

Types of coupon bonds:

- Constant coupon - payments are regulated, made according to the terms, fixed at the very beginning of the interest rate.

- Variable – the terms are fixed, the rate can fluctuate.

- Indexed – the rate is adjusted to the level of inflation, payments are made periodically.

As a rule, all payments on bonds are clearly defined and are realized at the end of the term, but there are other options. Returnable bonds can be “handed over” to the holder before the expiration of their validity period; callable bonds can be redeemed by the issuer ahead of schedule.

Bill of exchange

A bill of exchange is a security that confirms the holder's right to receive a certain amount from the issuer at the end of the security's circulation period. A bill of exchange is a lending instrument, as it allows the issuer to use borrowed funds. This type of debt paper can also be used as a means of payment for services and goods.

Types of bills by probability of repayment:

- Commodity – is an obligation to pay for a product within a specified time frame, relevant for payments for services and goods.

- Financial – the result of a loan agreement, involves working with money, often used by companies to increase working capital.

- Bronze - has no real monetary security, is used in fraudulent schemes where one or more participants are fictitious.

- Friendly - issued when the participants in the transaction are real people/organizations and provide financial assistance, but there is no real transaction and the investor does not expect a refund.

The first two types of bills are legal and protected by law.

Main groups of bills:

- Downtime is a confirmation of the owner’s right to wait for payment of the debt at a specified time, in a fixed amount, from the issuer.

- Transferable - makes it possible to receive the amount of debt on behalf of the owner to a third party, about which a corresponding entry is made on the form of the bill itself. This procedure must necessarily suit all 3 parties to the relationship - if the debtor agrees to pay the amount to a third party, he will receive the money.

An individual/legal entity can present a bill of exchange for payment. The circulation of a security does not require mandatory registration of actions with government agencies. Central Banks can be transferred to each other on the basis of endorsement - a special inscription on the back of the form. The last owner, who is recorded on the back of the paper, can make demands on the debtor.

Main distinctive features of bills:

- A trade bill can be used to pay for work/services/goods.

- To issue paper, a company must have a license from the Central Bank of the Russian Federation.

The participation of 2 entities (promissory note) is required, during which the issuer’s commitment to the investor is necessarily fixed. At least 3 entities take part in the transfer form, when one is simultaneously a creditor and a payer.- In the case of treasury bills, the issuer is the government.

Advantages of investing in bills:

- Repayment is undeniable - the risks are minimal.

- Bills of exchange are transferable.

- The Central Bank acts as both an investment and a means of payment.

Treasuries

Only the state has the right to place such obligations on the market. When purchasing this type of securities, a company or individual makes a contribution to the country’s budget and receives a profit throughout the entire period.

Upon expiration of the security period, the amount is returned to the investor. Such bills act as part of the state’s internal debt and are issued for a period of 1-10 years.

Savings certificates

A certificate of deposit is a debt security that confirms the bank's obligation to repay the invested money with interest upon maturity. A savings certificate is an analogue of a deposit, but it provides a number of advantages, such as: clear forecasting of profits due to a fixed interest rate, the ability to use it as collateral/guarantee, and a higher interest rate.

On the stock market, certificates are sold at market or face value. Personalized certificates cannot be transferred; bearer certificates (without indicating the owner) can be freely used in various market transactions.

Role in the country's economy

Debt securities play an important role in the country's economy. They guarantee investors a high level of reliability of capital investments and profit. Companies and the state get the opportunity to solve various problems, conduct business more successfully, and give investors the opportunity to earn money.

Why are securities deposits needed in the country’s economy?

- An opportunity for companies and government agencies to receive financing without additional costs and risks.

- Attraction of large investors and companies by private companies in order to increase the liquidity of securities.

- Attraction of funds by the state to the budget without additional release of money into circulation, effective financing of state programs for social security, construction, etc.

- Development of the stock market, attracting all layers of investors to it.

The role of state securities in the economy:

- Regulation of the inflation process.

- Redistribution of capital according to the priority development of different sectors of the economy.

- Impact on stabilization of exchange rates.

- Use as a tool for regulating the volume of money supply.

Pros and cons of government bonds

The advantages of investing in government bonds include:

- low financial risk;

- state guarantees of refund;

- a large selection of issued debt securities;

- their yield is less dependent on the term than bank deposits;

- availability;

- right of inheritance;

- possibility of early return of your money.

The disadvantage is the relatively low level of profitability. In this regard, corporate coupons are more profitable.

Is it profitable for an issuer to take loans using securities securities?

Borrowing using debt securities is clearly beneficial to the issuer. This is a good tool for raising capital. And this method is definitely better than a bank loan or mortgage.

What attracts DSBs:

- cheaper than a bank loan

- longer borrowing period possible

- opportunity to attract more funds

- no collateral required

- financing flexibility

- increasing the financial rating of the enterprise on the market

Despite some difficulties in issuing debt securities, they are more profitable for the issuer than a bank loan. However, their implementation will require a positive company rating on the financial market.

Types in the Russian Federation

In our country, government debt securities are called federal loan bonds. They are issued by the Russian Federation through the Central Bank and the Ministry of Finance.

Facts about OFZ

- Profitability from government bonds is at the level of the Central Bank rate.

- The income received by the investor is also affected by the maturity period - the longer it is, the higher the profit.

- OFZs are issued for short, medium and long terms, with the maximum term being 25 years.

- According to the method of redemption, OFZs are divided into ordinary (repurchased at the end of the term) and depreciation (funds are returned in installments).

- Income received from any bonds is taxed at 13%.

- Government debt securities are often called “risk-free bonds.”

OFZ N

These are securities with a circulation period of 3 years, placed by the Russian Ministry of Finance exclusively for individuals. Their cost is low, but their reliability is maximum. They are purchased from Sberbank and VTB 24.

OVVZ

These are foreign currency loan bonds - government debt securities traded on foreign stock markets. The denomination of these bonds is set in American dollars.

Eurobonds

These are foreign currency securities placed by the Ministry of Finance of the Russian Federation. Their reliability is higher than that of OFZs, since these are international debt obligations.

Different terms of redemption

In addition to the traditional method of repayment, there are possibilities for unilateral termination of the debt obligation:

- callable bonds - with the right of the issuer to redeem coupons early;

- convertible - provide for the holder’s obligation to exchange bonds for shares of the same issuer at the end of the term;

- with the right of early disposal - provide the investor with the opportunity to return the securities at any time.

Coupon rate

The coupon, or guaranteed interest rate, is the amount of compensation for the use of the investor’s money that he will receive from the state. There are several types of them:

- fixed - unchanged for the entire circulation period;

- floating - depends on certain conditions that may change;

- inverse floating - changes inversely in proportion to a certain value;

- zero - with no interest charges.

Bond classification

Due to the fact that there is an even greater variety and variety of bonds, to describe their different types, we classify bonds according to a certain number of characteristics. By type of issuer. Thus, depending on the issuer itself state , municipal , corporate , and foreign bonds are distinguished.

- government bonds:

The simplest, most reliable and attractive means for all investors is the state. a bond loan, which in turn allows the state, as the issuer, to receive certain additional funds, without increasing taxes and at the same time without leading to inflation, and for bond buyers, in turn, generates income. Many countries constantly use state. bonds to obtain certain investment resources and thus solve many financial problems. In the structure of the state The state debt of almost every developed country accounts for a significant part of the debt. bonds placed mainly on domestic and foreign markets. Bonds can also be issued by any commercial enterprise, however, purchasing private bonds for a specific owner is much more risky, since in the event

If the business goes bankrupt, he will lose his money, despite the fact that the bonds initially provide for priority repayment of the existing debt. State bonds are issued by almost all developed countries.

- municipal bonds:

Bonds of certain local governments do not per se constitute government bonds. internal debt of the Russian Federation. For example, bonds under a general obligation to repay a debt are issued without collateral, under an absolute obligation to repay the debt and pay all interest. Under the conditions of issuing such bonds, the purpose of the general tax capacity is clarified.

Thus, we have considered that a bond is a long-term debt instrument with a special structure, which provides a guarantee to its owner that a certain debt will be repaid within a limited period of time. They often take the form of a designated amount of money, winnings, or any other means.

We briefly looked at what a bond is, the history of this concept, as well as the features, functions and classification of bonds. Leave your comments or additions to the material.

Risks

Risks accompany any investment. And although government bonds are recognized as a risk-free investment instrument, situations are still possible when their holder incurs losses.

Liquidity in the market

Liquidity is the speed at which an asset is sold. Taking into account the fact that bonds are not always in high demand, they can be sold quickly only due to a loss in price.

Interest rate

When interest rates rise, bond prices fall. As a result, if debt securities are returned early, their face value may be lower than when purchased, and the investor will lose part of his money.

Currency

Due to fluctuations in quotes, the value of securities issued in foreign currencies may also change. Accordingly, when exchange rates change, they are likely to be sold at a lower price.

How are all these types different?

The differences are presented in the table.

| Characteristic | Bond | Bill of exchange | Treasury bond | Savings certificate |

| Release form | Electronic or paper | Paper | Electronic form | Paper |

| Payment form | Money or property | Money | Money | Money |

| Circulation | Big | Single copies | Big | Big |

| Nature and time of interest payment | Interest is paid at different frequencies and at different rates | The interest is fixed, paid at the time of return of capital | At the time of return of capital | At the time of return of capital, a fixed percentage is paid |

| Validity | For 3–5 years | Up to 1 year | Up to 3 years, usually up to 6 months | Up to 3 years |

| Remuneration for the use of capital | + | Maybe | + | + |

| Can it serve as a means of payment? | — | + | + | — |

| The need for state registration | + | — | + | + |

Not only interest rates and frequency of payments differ, but also the very economic essence of each type.

Loans

Government loans can be external, internal and foreign currency. For an internal loan, the issuer receives funds from citizens and enterprises, as well as from other countries and international associations.

Foreign exchange domestic

This type of loan is aimed at attracting foreign currency funds. There are bonds with a par value in foreign currency (US dollars) and those that have been indexed. They are issued for 1 or 3 years.

External

An external government loan is a form of government receiving funds from external creditors. It is provided, as a rule, for 1-2 years by foreign companies and banks. For a period of more than 5 years, loans are issued by insurance organizations, banking houses and global investors.

Legal regulation

Legal aspects of the issue and circulation of OFZ are established by Federal laws:

- “On the securities market” dated April 11, 1996

- “On the peculiarities of the issue and circulation of state and municipal securities” dated July 17, 1998.

Functions of bonds

A bond, as a special money market security, performs certain following functions. She happens to be:

- source of financing budget deficits at various levels and certain expenses of government bodies;

- is a source of financing investments of joint-stock companies;

- is a form of saving funds of the population, enterprises, financial and credit organizations and generating income for them.

Bonds can be divided into certain types. The number of types of bonds existing in world practice could safely be called theoretically infinite. This is explained by the fact that a bond is an excellent way of direct access to a lender, who can most often make his own personal, individual demands on certain conditions under which he will agree to lend his personal free capital to any other market participant. Often in life, bonds are often issued on certain terms, which in turn are of particular interest to some designated layer or group of creditors. Various differences in the conditions for issuing any bonds underlie certain types and their varieties.

Government bond yield

The level of profit on government bonds is set at the level of the rate of the Central Bank of the Russian Federation. It is higher than for bank deposits, but lower than for corporate bonds.

The profit from such securities is determined by their market price at purchase, the size of the coupon and the term. The longer the coupon is held by the holder, the more income it brings.

The profit on foreign currency bonds is determined by a number of factors, but when sold, their cost can be several times higher than the nominal value.

It should be remembered that in case of early sale of government bonds, a commission fee will be withheld from the holder. Its maximum size is 3%. Accordingly, the proceeds from the sale will be less than planned.

Buying and selling

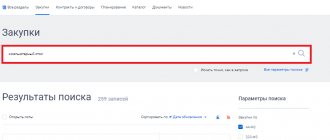

The turnover of government bonds occurs on the stock market.

They are purchased in three ways:

- Through a broker.

- By IIS. This method gives the investor the right to receive a tax deduction of 13%.

- By contacting Sberbank or VTB 24.

OFZ-n are allowed to be sold only at the financial institution where they were purchased. It is prohibited to transfer, give, use as collateral or a contribution to capital. But you can bequeath and transfer government bonds by inheritance.

Cost of federal loan bonds

The average unit price is about 1000 rubles. The minimum number that can be purchased is 30 pieces, and the maximum per person is 15 thousand pieces.

Bonds with constant coupon income

As of April 1, 2019, the cost of OFZ with constant coupon income is 1,000 rubles. Profitability ranges from 6.4 to 8.15% based on issue.

Variable coupon bonds

Their price today is set at 1000 rubles per unit. Their yield varies from 7.3 to 8.3%.

Bonds with indexed par value

The price of such bonds is set taking into account the consumer price index for goods and services. As of April 4, 2020, their denomination is set within the range of 1171.07 - 1198.19 rubles per unit. The accumulated coupon income, taking into account indexation, ranges from 0.72 to 8.29%.