Hello! Today we’ll talk about financial pyramids so that you know what they are, how they work, and so that you don’t fall for such “earning money” schemes in your life.

A market economy is characterized by freedom of enterprise and freedom of choice in the way of doing business. For any businessman, the main goal of his business is to make a profit. The universal measure of performance evaluation is money. The functioning of a legitimate business is based on the production, sale or resale of goods, provision of services and other schemes. There is such a term as financial pyramids. Most often, although not always, these are deliberately created fraudulent models for obtaining money by their creators.

Content

- What is a financial pyramid

- History of financial pyramids

- Reasons for the emergence of financial pyramids

- The essence of a financial pyramid

- How does a financial pyramid work?

- Signs of financial pyramids

- Types of financial pyramids

- Single-level (Ponzi scheme) pyramids

- Multi-level financial pyramids

- Matrix financial pyramids

- Financial pyramids on the Internet

- HYIPs are also pyramids

- Magic wallets - a regular financial pyramid

- Financial pyramids in Russia (list)

- Financial pyramids and network marketing

- What to do if you have already invested money in a financial pyramid?

How to avoid becoming a victim of financial pyramids

With common sense and composure, you can easily avoid contact with scammers with their unique offers of investing in financial pyramids. So, first of all, ask yourself the following questions:

- How long has the project been in existence? Very few pyramids exist. Therefore, if the history of the organization is less than 2 years, then you should be wary.

- Why is high profitability expected? Even cool mutual funds are not able to provide stable returns above 12% per annum, then where does any organization have such opportunities? Let them try to explain and show examples of their work. When talking about trading on stock exchanges, they will try to hide everything. In this case, stay away from them, because if the profitability were really 30% per month, then why would they need other people’s money? In a year they would already become billionaires and so on.

- Are they persistent and in a hurry? Hang up and don't think about it. No normal organization will be persistent and rush you.

- Ask about licenses and ask them to provide them to you.

What is a financial pyramid

In the economic sense, a financial pyramid is an organized scheme for its participants to generate income by attracting funds from new participants. That is, people entering the pyramid today “provide” for those who came there earlier. Or all the money can be accumulated by one person - the organizer.

The average person will immediately remember the MMM financial pyramid in Russia in the early 90s, which ended in a loud collapse with thousands of people affected. And indeed, in most cases they disguise themselves as investment, charitable funds, companies with goods that have no real value, or simply promise to make money out of thin air.

However, the classic business scheme can lead to a financial pyramid. This happens when the owner miscalculates profitability and the company runs at a loss or has difficulty covering its cost. Money borrowed or raised from investors cannot be returned. To support the business, new loans are taken out and used to pay off previous debtors. It is incorrect to interpret this as fraud; this situation is closer to the concept of illegal entrepreneurship.

Fraudsters often take advantage of this loophole, carefully covering up financial pyramid schemes in order to evade responsibility. A business may bring in a small profit, but if systematically the added value (the result of the company’s work) is less than the income payments, then this project is a financial pyramid. In fact, most of the profit in this case is money from new investors.

Financial pyramids disguised as MLM.

As a rule, the organizers of such a pyramid conduct a very aggressive and vigorous advertising campaign. You will be informed that a new and very promising company has opened. New technologies, or a new super product. If there is no product, then this is usually very necessary training or other services. To be fair, it is worth noting that online businesses also use a similar advertising company. But MLM, unlike pyramids, offers a real, sought-after product. In a pyramid, they offer you a product that has no value. Or a product at such a price that no one will buy it. For example, you may be offered new services on the Internet, communications, etc. at a fairly high price. But these same services can be obtained from ordinary companies much cheaper, or even free.

History of financial pyramids

To denote a deceptive scheme, this expression began to be used in England from the early 70s. last century, although financial pyramids originated much earlier. The first company operating under a financial pyramid scheme is the joint-stock company (JSC) “Organization of India” by John Law. According to the plan, it was supposed to invest the funds raised in the development of the Mississippi River. In fact, the investments were minimal, and the enterprising Scot used most of the proceeds to purchase government bonds. In fact, he paid off all of France's foreign debts. Law promised that the shares bought today would soon rise in price. Because of the hype, within six months the cost of one paper exceeded the original price several times. France was forced to issue more and more paper money. When the money supply became enormous and the price of shares rose to unprecedented levels, this pyramid collapsed. Prices for goods rose sharply and paper money was not accepted as payment.

Subsequently, financial pyramids began to appear periodically in other countries. He organized a large fraudulent scheme related to coupons in 1919. in the USA Charles Ponzi. This was the first analogue of the modern single-level pyramid. It collapsed because coupons could not be sold for cash, but could only be exchanged. Payments to the first participants came from the following newcomers. In Russia, the pyramid boom occurred during the transition period to the market in the early 1990s, when the famous MMM JSC was created by Sergei Mavrodi.

Financial pyramids are prohibited in many countries (Canada, Mexico, Germany, Italy, Kazakhstan, Poland, etc.), including Russia (Article 172.2 of the Criminal Code of the Russian Federation). In the UAE and China, there is even a death penalty for building such a structure. If the country does not have a separate article for financial pyramids, then such fraud may be classified as illegal entrepreneurship.

Reasons for the emergence of financial pyramids

The emergence of financial pyramids is due to a number of changes in the economy and government policy. Basic prerequisites:

- free securities market;

- the activities of such structures are not regulated by law;

- improving the standard of living of the population;

- moderate inflation and stable economic growth;

- the country's transition to a market economy;

- the emergence of various financial institutions offering both to preserve their savings and increase them;

- lack of reliable information and illiteracy of the population in financial matters.

The essence of a financial pyramid

The main goal of such a scheme is to enrich the organizers of the pyramid due to the influx of new people. Perhaps those who immediately joined the front ranks and then withdrew their money on time will also benefit. Contributions from participants are not invested anywhere and go to reward the upper levels, that is, those people who invited them and others above them along the entire chain of the pyramid. Accordingly, if the current investor also invites people, he will receive his income from them, etc. In some models, it is possible that some product may be present to cover the “business,” but the essence does not change: profit in the pyramid is obtained through investments new members.

The distribution of funds of joining members occurs according to different schemes. The principle of a financial pyramid is as many newcomers as possible. But when the flow of investors decreases and there is no money to pay out the promised money, the pyramid collapses. The fact is that the number of people on our planet is finite. Not everyone has a chance to get their money back, not to mention the promised interest. The last ones who entered are unlikely to see their money. The organizers may withhold payments for some time, and then collect all available savings and disappear.

Types of financial pyramids - how to identify scammers

2.1. Single level pyramids

Single-level financial pyramids are also called “Ponzi schemes” (he was the first to implement this approach a long time ago). The main idea here is that you are investing money at high interest rates. Where does the money come from? Most often, investment projects or Forex trading may be considered as an activity. At the same time, it is impossible to really somehow check their activities and real results. You can only get their imaginary reports.

Although on Forex you can really earn 10% in just a day. Perhaps even the next day you will also be in the black. However, it is impossible to consistently receive such a profit.

In such organizations, initial payments come either from the organizers or from new investors. Thus, the pyramid quickly grows, gaining positive reviews. After all, there really are payments. Where does the income come from? So here is a nice report on the company's work.

With payments, such a company may experience completely favorable times. After all, many investors reinvest their income and do not withdraw profits. Many people don’t even withdraw interest. This was the case with fx-trend and mmcis, which existed for more than one year. The end comes when the influx of new investors ends and the old ones begin to demand their money back.

The most important sign that this is a pyramid is a high, stable percentage of profitability. It is impossible to earn that much money consistently every month. However, they are trying to convince us otherwise and inexperienced people are being fooled.

The lifespan of single-level pyramids can be up to 2 years. In rare cases there is more.

This is how MMM and Khoper-invest acted.

The largest financial pyramid is considered to be the Madoff scam from the United States. The organization was called Madoff Investment Securities (LLC). For more than 10 years, he attracted money from investors and paid interest up to 15% per annum. During the 2008 crisis, the bubble burst. There were no new investors and the whole scam was exposed. The total damage amounted to $17 billion.

Note Such organizations are often called “hype” (hayp).

2.2. Multi-level pyramids

Income comes from attracting new members. They charge a fee to join some dubious organization. As a rule, small in order to attract as many segments of the population as possible. There can be many reasons to make a contribution. For example, you become the unique owner of some product, information, etc. that can be sold.

To make a profit, you need to either sell the product, or simply attract new participants and from their contribution you will receive a reward.

The lifespan of such pyramids is shorter and rarely exceeds 6 months.

How does a financial pyramid work?

There are many variations of fraudulent pyramid schemes. The essence remains the same, but the ways to “show off” the average citizen are becoming more and more sophisticated. Let's look at 2 illustrative examples:

| Example 1 | Example 2 | |

| Stage 1 | The organizers are conducting an advertising campaign for growing flowers, mushrooms, exotic plants, etc. at home. People are invited to buy seeds and make a certain “entry fee.” The total amount is 4 thousand rubles. After 3–4 months, the company promises to buy the seedlings for 8 thousand rubles. | The organization presents itself as an investment fund. You need to invest at least 5 thousand rubles. You need to invite 4 more people to the project and then you can get your profit in the amount of 10 thousand rubles. When the first 6 people join, the company’s profit at this stage is 25 thousand rubles. |

| Stage 2 | Rumors about this quickly spread among the population, and there is no end to those interested. Seeds are actively being bought, and the first participants are already receiving their profits. In fact, this is money from new buyers. | Each of the 6 applicants invites 4 people, who also contribute 5 thousand rubles. The company already has: 25+6*4*5=145 thousand rubles. Of these, she pays the first participants: 10 * 6 = 60 thousand rubles. The company's profit will be 145-60=85 thousand rubles. |

| Stage 3 | At some point, the “boom” for this idea passes and there are fewer and fewer new members of the pyramid. The organizers disappear without a trace with all the money. It turns out that the plants are ordinary and are not worth the money claimed. Therefore, many people do not receive the promised profit or investment. | Participants of the second level also invite 4 people who invest 5 thousand rubles each. The company already has 85+24*4*5=565 thousand rubles on hand. Of these, she pays off the second investors: 10*24=240 thousand rubles. The company's profit will be 565-240 = 325 thousand rubles. The growth of the pyramid will be exponential (geometric progression, when the growth rate is proportional to the number of participants). The time will come when new entrants will no longer be able to find new members. The pyramid is collapsing, and the organizers are skimming off the cream. |

These descriptions are presented in a simplified version. There are complex, intricate schemes with the presence of a real product and are very similar to network marketing, which is a legal business. Financial pyramids survive only due to the influx of new people: there are no other sources of income payment. The collapse of any such organization is inevitable.

Perhaps, just a few months after the start of work, the company begins to feel a “shortage” of new members. At the same time, liabilities grow, and panic often begins among investors. They begin to sell “securities” en masse, if any. Or they impulsively decide to withdraw their investments. And if someone says that they were able to make money on the pyramid, it means that they were among the first, or at least in the middle. The top (organizers) will earn more in any case. Sooner or later, a huge number of participants will be scammed, leaving them without money.

Network marketing

Many analysts automatically classify companies that use network marketing principles in their work as financial pyramids.

The key difference between fraudulent structures hiding under the guise of a reputable network company and respectable companies is the absence of a real product with added value that can provide the promised profitability.

A classic network company is interested in attracting new distributors for the sake of stable network expansion. The bonus fund is formed from profits from the sale of advertised products, and not from contributions from new team members.

Photo 8. Amway advertising brochure

In the United States and Europe since the 1970s. there were a number of trials against network companies suspected of disguising pyramid schemes (the most famous was against the Amway company, which is still thriving today).

Most companies managed to avert suspicion and prove the absence of illegal schemes for accruing and paying remuneration to their employees.

Financial analysts and law enforcement officials, however, warn of a significant presence in the sector of outright fraudulent projects that abuse advertising and mislead customers about the purpose of their activities.

A true distinctive feature of such companies is the possibility of receiving remuneration solely for the very fact of attracting a new participant to the structure.

The activities of a significant number of promoted projects are periodically criticized due to the lack of transparency of financial reporting.

From time to time, such online trading giants as Emgoldex (investments in precious metals), Talk Fusion (development of video marketing systems) and many others are suspected of involvement in “gray” schemes.

Signs of financial pyramids

In order not to fall for the bait of scammers, you need to know the main signs of financial pyramids. It happens that a person knows about such schemes, but skillful psychological influence and misinformation leads him to the decision to invest his hard-earned money. Signs by which it is highly likely that a business proposal is a financial pyramid:

- High interest rates and fast payback period . A yield above 30% should already raise alarm bells. There are not many legal ways to secure such returns, and those that exist are all medium to high risk. If a company promises to pay back a project in a few months or even weeks, then a logical question arises: why is it looking for investors among ordinary people, and not among large businessmen and experienced investors?

- Large amount of “entry fee”. More often in the range of 5–20 thousand rubles. However, then the deceived person is unlikely to go to court for this money. This sign is not always clearly expressed.

- In exchange for the money invested, a person may receive goods at an inflated price and that do not correspond to the declared characteristics, or counterfeit securities. Documents confirming the receipt of funds are not issued, or the person is given an agreement indicating that if the investment strategy does not work, then the invested funds cannot be returned.

- The company's emphasis on PR. Impressive presentations, product know-how, a beautifully designed website, convincing salespeople, mailings and SMS - all this is aimed at reaching a large number of people. There are slogans like “Hurry to be among the first!”, “Hurry up and buy a device that has no analogues in the world!” At the same time, the advertising is vague: a specific product or method of generating income from participation in the project is not indicated.

- Concealment of information about the owners of the enterprise, lack of licenses and permits to engage in financial activities. However, all this can happen if the company is registered under a dummy person or is registered far abroad. If there is no company at all, and a person is invited to an office where only money is exchanged, this is definitely a financial pyramid.

- Unusual and unclear compensation plan. The abundance of information, complex terms and overly optimistic forecasts should make you wary.

- They indirectly or directly talk about the need to involve their relatives and friends in the project. At the same time, they offer to learn special psychological techniques or neurolinguistic programming (NLP) methods.

- Excessive persistence of the organizers. Convincing a person to make a decision and give money “here and now”, requiring him to sign a non-disclosure agreement and promising easy money for minimal effort.

Signs

Probably the most important part of the article. Let's look at the signs by which you can recognize a pyramid:

- Aggressive advertising campaign in the media, the Internet, on the street, in mailings, etc. Mass events are often held to recruit new members: webinars, seminars. Be careful when attending such meetings. Leaders often have special psychological techniques, easily gain trust, convince, rush to make a decision and morally suppress with their activity.

- Guarantee of excess profits from 100% per annum. Sometimes it is promised in a day or a month. No professional investor can guarantee a return on investment. Anything over 25 - 30% per annum is considered a high-risk investment.

- Short period of existence of the company. Pyramids do not stay on the market for long, so if this is a young but promising project, you should at least be wary.

- Absence of a company at the specified address, no information about the director, refusal to provide registration and permitting documents. Often such companies are registered offshore.

- Nomination as a condition for attracting new investors.

- Sometimes scammers hide behind investments in the development and sale of some innovative product, as they say. Only the lazy do not know about miracle remedies for losing weight, prolonging life, treating joints and other drugs and devices. In fact, this is a low-quality product that costs a penny on the market.

- Calls to invest in the system here and now. No real investor will rush to make a choice. Money issues should be resolved with a cool head.

- Refusal to provide more details or vague information about how investors receive income on their investments. At the same time, such people, as a rule, do not suffer from a lack of eloquence. Don't let yourself be talked into something irrelevant.

Not all of the listed signs may be present. But the presence of even one of them is a reason to be wary and think everything over again.

An interesting fact, but in a completely legitimate business, a financial pyramid can form over time. For example, when a company cannot pay off its obligations. Takes out new loans to pay back old ones. But the products produced do not cover the increased costs. The matter may lead to bankruptcy.

Types of financial pyramids

All fraudulent pyramid schemes are divided into 3 types according to their structure. Sometimes there are assurances from the organizers that they have created a completely new project. However, upon closer examination, the scheme will belong to one of three types known today.

Single-level (Ponzi scheme) pyramids

Ponzi scheme (Ponzi) is one of the most common and simple types of financial pyramids. It got its name from the name of a famous Italian who was the first to organize a massive deception of the population.

The creator attracts the first participants with high interest rates and guaranteed income for a short period of time. Everyone who joins is not required to attract other people. He can pay the first profit to investors from his own funds. When this project becomes more popular and the number of participants increases, money is transferred - the organizer pays the old participants with the funds of the new ones. The number of people wishing to join is growing steadily and many are re-investing.

Of course, there is no declared activity in this pyramid. It can present itself as an investment project, a charity project, a mutual aid fund, etc. The game of “sack” continues for a certain time. There comes a period when obligations to investors increase, and the influx of new participants decreases. The organizer curtails his activities and disappears along with all the money.

Schematically, such a pyramid looks like this:

In the center is the organizer of the financial pyramid. Contributors are highlighted with small circles:

- 1st stage;

- 2 lines;

- 3 lines;

- 4 queues.

The lifespan of such a pyramid depends on its popularity. More often, such schemes last from 4 months to 2 years. About 80–90% of investors remain at a loss. Examples of financial pyramids of this type: the first MMM JSC S. Mavrodi, investment pyramid in 2011. in Moscow, B. Tannenbaum’s project for investment in drugs to combat AIDS, “Vlastilina”, “Hoper-invest”.

Multi-level financial pyramids

The structure of these pyramids is very similar to network building in network marketing companies (especially with a binary plan). Such an organization can position itself as a trading company or as an extremely profitable investment program. If a product is present, it is of low quality or not worth the stated price. This is done to “distract” people’s attention. Advertisements for such companies usually indicate returns of 100–500% per annum.

Each entrant pays an entrance fee. This money is distributed among the upper levels of the pyramid: the participant who invited him and several higher ones. After this, the new investor must bring several people into the pyramid (usually from 2 to 5). They explain to him in an explicit or hidden form that in order to make money in the project, it is new participants who are needed. He will begin to receive money from them, that is, recoup his investments and make a profit.

In essence, this is a simple transfer of money, just like in a Ponzi scheme. As the depth increases, the number of participants increases very quickly and after 10–15 levels it will comprise the entire population of the entire country. Obviously, investors at lower levels will lose their money, since there will come a time when there will be no one to invite. Such people make up 85–90% of the entire financial pyramid. At this time, the organizer closes the project, taking the maximum amount of money from it.

Schematically, this structure looks like this:

Such organizations do not last long. The collapse (scam) of the pyramid occurs after 2–6 months. To increase this period, the organizers rename the name of the pyramid and move to another city to continue the “work.” Many people go into virtual space for better camouflage. Examples of such companies: MMM-2011, MMM-2012, Binar, Talk Fusion.

Matrix financial pyramids

These schemes are a complicated modification of multi-level pyramids. Usually there is a real product (for example, gold, silver, a set of weight loss products, etc.) although there may be a fictitious “entrepreneur training system” that costs money. These organizations belong to the new financial pyramids and many people sincerely believe that these are investments.

Let us illustrate the operation of such a structure using the example of the Emgoldex company:

Upon entry, a new participant under number 4 invests 540 Euros, enters the matrix and waits for the entire level to be filled. Next, the matrix is divided into 2 of the same, the person rises to a higher level and must bring 2 people to fill part of the lower level. Perhaps the participant number 3 on the left who invited him will promise that he will find people instead of him. Investor No. 1 receives his reward - 7 thousand. Euros (less commission) in the form of a purchased gold bar, which he can sell back to the company. Essentially, 14 people chip in for a “gift” for one.

When dividing matrices (in Emgoldex they are called “tables”), participants gradually move towards their “top”. Participant #1 opens a new table and ends up in the lowest level. Accordingly, new participants are needed to fill out the matrices. The purchase of gold in an online store itself is legal, but the mechanism for collecting money and making a profit is a financial pyramid. As long as there are newcomers, the system will work.

The Emgoldex company itself is registered in Germany; gold purchases are carried out in Dubai. The belief that gold is rapidly growing in price and that this is what brings good interest to the investor is not supported by real facts. By all indications, this is a clever way of laundering money abroad. After all, as the number of people joining increases, there will be more and more tables. And the time will come when there will be no one to fill them.

It is worth noting that in matrix pyramids the conditions for receiving remuneration are vague: you have to wait until the matrix is complete, and the company does not guarantee when this will happen or whether it will happen at all. Therefore, they function longer than other types of pyramids. But the “hour X” will come for them too. Most investors will be left at a loss.

A comparison of the characteristics of all 3 types of financial pyramids is presented in the table:

| Single-level | Multi-level | Matrix | |

| Structure | The center of interaction is the organizer. It accepts deposits and pays interest up to a certain time. | There is no single center. Each participant is in contact with their higher levels. The organizer supervises only the first people and monitors the activities of the pyramid. | The center of interaction in matrices is 1–2 active participants. Subsequently, they can easily “forget” about the newcomer if he does not bring new people. |

| Source of profitability | A “profitable” business opportunity, investment or charity project. | New member contributions only. It is possible to disguise it with direct sales to confuse the scheme. | New member contributions only. Complicated schemes involving the purchase of real goods serve to “fuss the brains” of new participants. |

| Life cycle of a pyramid | It can take a long time, it all depends on the ingenuity of the organizer and his ability to persuade | Short as the number of participants is growing rapidly | It can take a long time, since the company does not promise exact deadlines for filling out the matrices |

Scheme two: cryptocurrencies

The most famous pyramid scheme in recent years, offering investments in cryptocurrencies (as well as in real estate and stock exchange transactions), is . Clients were promised a profit of up to 1% per day of the loan amount. In 2020, the Bank of Russia saw clear signs of a classic financial pyramid in Cashbury and passed information about it to the Prosecutor General’s Office and the Ministry of Internal Affairs. According to preliminary data, the damage from the activities of this company amounted to 3 billion rubles.

The title of the largest financial pyramid of 2020 is claimed by the company AirBitClub, which attracted funds from clients to issue cryptocurrency and promised them the opportunity to make money on the growing exchange rate. However, in reality, investors could only get money by selling the company's internal currency to their friends in misfortune. According to expert estimates, it was possible to involve about 60 thousand people in the pyramid, and the amount of their investments exceeded 500 million rubles.

“Buzova doesn’t lie.” Cashberry depositors still do not consider themselves deceived Read more

Financial pyramids on the Internet

The emergence of the World Wide Web provided new opportunities for the creation and development of pyramids. The geographic reach of potential participants has increased significantly, and material costs for advertising have decreased. It is more difficult to track the movement of money through electronic payment systems. Registration of sites often occurs with fictitious persons or so that the owner’s data is not exposed. This makes it difficult to find a virtual fraudster and bring him to justice.

The largest financial pyramid in the Stock Generation network was organized by S. Mavrodi. Under the guise of gambling, shares of virtual companies were traded in this pyramid. The scenario was somewhat reminiscent of the MMM project, but on the website for many of these companies there was a disclaimer: prices can go both up and down. This “game” worked for 2 years, the number of victims ranged from 300 thousand to several million.

Mavrodi’s projects MMM-2011 and MMM-2012 are also large-scale. The virtual currency “Mavro” was invented, the purchase and sale of which was carried out in the first project through level managers - foremen, centurions, thousanders, etc. In the second project (referred to as the “mutual aid cash desk”), payments were made directly by the participants themselves. When the influx of deposits began to decline, delays in payments began to be noted, cases of theft of money from the system and the pyramid were closed. Mavrodi announced a restart several times, but there was no longer any trust in him and the scale of the following projects was much smaller.

Among active Internet users, the NewPro pyramid is known, offering to buy a key for 99 rubles and attract 3 newcomers. Next, a second level key is purchased. However, reaching the coveted level 28 is unrealistic. This will require more than 20 trillion people. Pyramids with a similar structure: SuperProgik, Power MLM, MoneyTrain.

Among the variety of online pyramids, HYIPs and seven “magic” wallets stand out in separate categories.

HYIPs are also pyramids

Investment projects with high returns according to the financial pyramid scheme are HYIPs (hype projects). They justify their interest by investing in shares, mutual funds, and trust management, but they may simply remain silent about their activities. There is an opinion that investing in HYIPs is one of the most profitable types of earnings if you invest your funds wisely. On the Internet you can even find articles where experienced participants in these projects talk about the correct investment strategy with the goal of “exiting the game in time” before the closure of the hype and at the same time making money.

In essence, all online pyramids go through the same life cycle stages as their offline counterparts. Money is transferred from the pockets of some to the pockets of others and no further activity is carried out. Therefore, there will be people who actually make a profit from such investments. But you need to understand that this happens at the expense of other participants, whose total contributions are always greater.

There are websites of venture capital - investments with a high level of risk - companies that actually invest money in risky and high-yield financial instruments (such as Forex). In contrast, HYIPs have the following characteristics:

- colorful design of the resource and excessive advertising about the need for investments and a guarantee of return;

- the profitability is promised to be 0.5–10% per day, which is an unreasonably high figure, however, there are projects offering 15% per month and this feature is not applicable to them;

- fictitious investment objects or lack thereof;

- there is no information about the company (address, phone number, management), licenses, official registration and other documents or they may be fictitious;

- a complicated scheme for generating income, the essence of the project is not clearly clear.

To conduct financial transactions, HYIPs offer participants electronic payment systems Perfect Money, Bitcoin, Payeer, Qiwi and a number of others, which do not require personal identification. Most HYIPs do not work with WebMoney. Based on income level, all HYIP projects are divided into 3 categories:

- Low-income financial pyramids. They exist from 1.5 to 3 years and offer relatively low rates - up to 15% per annum per month (up to 0.5% per day). They are characterized by a well-thought-out pyramid scheme and large-scale advertising. Very similar to legal investment programs associated with asset trust management.

- Mid-income financial pyramids. They exist from 6 months to 1 year and offer returns of 15–60% per annum per month (up to 3% per day). They promote quickly, but reach the peak of popularity very soon.

- Highly profitable financial pyramids. They work for 2–5 weeks and offer rates above 60% per month (over 3% daily). They have aggressive, intrusive advertising like “Register quickly and get a lot of money!”, “Hurry, these rates are only for 1 month!” They close unexpectedly and try to attract as many new investors as possible.

In addition to the organizers of such projects themselves, so-called referral guides play an important role in the system. They spread information about the new project and encourage network users to become participants. The success of the project largely depends on their actions. The creators of HYIPs work with these “agents” through affiliate programs, that is, they award the “referral leaders” a certain percentage of investors’ deposits. The distributors themselves try to advertise the hype project more colorfully and in detail on social networks, forums and blogs. Often, investors are asked to promote hype themselves and participate in the referral program. This gives maximum promotion among online investors and a large influx of money.

For a certain period of time, the hype operates successfully, and some investors receive the promised interest due to the growing popularity of the project. But there comes a time when the volume of cash payments begins to exceed the volume of cash receipts. The hype is closed (scammed) and all the money remains with the organizers.

Thus, their creators, advertising distributors and network users who manage to withdraw their money on time make money from hype projects.

Magic wallets - a regular financial pyramid

A potential participant is invited to send a small amount (within 10–70 rubles) to seven electronic wallets in the WebMoney or Yandex-money system. After that, remove one of the top wallets, enter your own and post a message on 100–200 forums, message boards, and sites where people are looking for work. It is believed that if everything is done correctly, money will “fall out of a bag” because the next participants will send money to your wallet and also begin to promote information. In fact, this is an ordinary financial pyramid, and also uncontrolled.

There is no guarantee that the person who falls for this will not write down their wallet numbers in order to “squeeze out” more for themselves. But even if all participants follow the instructions and only 5 people respond to mass spam, the pyramid will grow to gigantic proportions. These 5 participants will also attract 5 newcomers, and the total earnings of the first person in theory will be 600–900 thousand rubles. By this time, there will be about 98 thousand participants in the pyramid. This figure grows exponentially: after 2 levels you need 2–3 million connected, then several tens of millions, then trillions, etc. It is clear that the entire population of the planet will cover only a few levels of such a pyramid.

Payment systems are actively fighting such messages, even to the point of blocking the wallet. Financial monitoring and security services monitor the distribution of such spam and identify pyramid schemes within a few days.

The most famous pyramids in the world

Let's look at the TOP global investment companies.

Medoff's Pyramid

More than a million people have invested their savings with Madoff Investment Securities. The deception was revealed only during the 2007 crisis, when many investors asked to return their money (about $7 billion). The organization did not have funds for this.

There is another version of how the deception came to light. Some sociologists and economists argue that Bernard told his sons what his company really was. The children turned out to be more conscientious and turned to the police. Soon all accounts were frozen, losses amounted to more than $50 billion. Among the victims were the largest banks, investment companies, and hedge funds. The consequences were not long in coming; Bernard Madoff was sentenced to 150 years in prison.

Not a single person in America was able to detect the “scam” for many years (the company operated for 16 years). If the company existed in 2020, then even now few would have caught on to the fraud. This is because Medoff acted very carefully and did not promise mountains of gold.

Lou Pearlman stock

Trans Continental Airlines Travel Services was founded in 1981 by Lou Perlman. In addition, he was the owner of a dozen more similar companies. However, the companies existed only formally on paper, in reality they did not exist, they did not conduct any activities.

This did not stop Perlman from selling stocks and shares of companies for more than 20 years. No one could have thought that the man was a fraudster. He raised more than $300 million for his criminal activities.

European Royal Club

Founded in 1992 by Damara Bertges and Hans Spachtholz. He was very influential in finance.

Members of the European Club could purchase a “letter”, which was regarded as shares. The papers cost 1400 CHF.

The illegal actions were discovered a couple of years later. During this time, about $1 billion was invested in the project. The woman was sentenced to 7 years, and the man to 5.

Double Check

This ingenious scheme was invented and implemented by Syed Sibtul Hasan Shah from Pakistan. He lived in Dubai for some time, after which he returned to his hometown of Wazirabad. There he started a rumor that he managed capital on the stock exchange and did it very successfully.

Initially, a dozen people believed him. They invested under the guarantee that their capital would double. The young man fulfilled these conditions, and after 1.5 years more than 300 thousand citizens became his investors. The project had about $1 billion in cash. Soon the crime was discovered and Shah was convicted.

Ant farms

In 1999, Chinese entrepreneur Wang Feng founded a company whose activities consisted of breeding medicinal ants. The insects cost $1,500 and were expected to return 32% per year on the investment.

Feng was written about in newspapers and talked about on television. However, there has been no confirmation of the medicinal properties of ants. The organization collapsed when it had collected over $2 billion. The founder was detained and sentenced to death.

Cure for AIDS

The strategy was invented by a famous person - Barry Tanenbaum. He was the grandson of the founder of a large pharmaceutical company. The young man offered to invest in medicines and guaranteed huge profits.

Having collected $1.5 billion, Barry fled to Australia. The man has still not been punished and denies involvement in fraud.

Financial pyramids in Russia (list)

The first pyramids came to Russia after the collapse of the USSR. JSC MMM became one of the largest and most famous. The company issued large volumes of shares (about 27 million) and tickets (about 72 million). Investors were promised 500–1000% per annum. Powerful propaganda in the media brought 10–15 million people into this financial pyramid. No documents were given to people. These “papers” were not allowed into free circulation; only the company itself could buy them back. The price of shares and tickets was set by the organizer S. Mavrodi himself.

Due to the hype, their cost rapidly increased and reached 125 thousand rubles. per share. In reality, these papers were not worth that much money. Rumors spread among investors about Mavrodi’s problems with paying taxes and illegal entrepreneurship. The ensuing panic led to a sharp drop (by more than 100 times) in the cost of shares and tickets. In fact, they turned into worthless “pieces of paper”. The office of MMM JSC was stormed by law enforcement agencies. Mavrodi was arrested and sentenced to 4.5 years in prison. In total, he managed to earn about 3 billion rubles. Subsequently, this man created other pyramids.

In addition to MMM, large financial pyramids in the 90s and 2000s were:

- "Vlastilina";

- "Russian House Selenga";

- "Tibet";

- "Hoper-invest";

- "Rubin" ("SAN").

The number of victims amounted to millions, the lost amounts of investors varied from several million to trillions of rubles. As a result, almost all the organizers received real prison sentences, and only a few managed to escape.

Despite this, financial pyramids continued to exist in Russia. This is explained primarily by people’s desire to get “free” money, their gullibility and greed. The development of the Internet also played an important role. Participating in such roulette is comparable to playing in a casino: someone will get a “piece of the pie,” but the owners will earn money in any case, and most players will lose.

New financial pyramids include:

- Super Piggy Bank;

- Eleurus;

- GO-Partner$

- MMM-2012

- MMM-2016;

- SuperProgik;

- Give1 Get4;

- SETinBOX;

- Recyclix;

- Credex and a number of others.

For organizing pyramids in Russia, along with criminal penalties, administrative liability has been introduced (Article 14.62 of the Administrative Code).

Definition

If you believe official statistics, then there are no financial pyramids in our country. But if they are not officially there, this does not mean that they really do not exist.

Many structures simply do not advertise their activities as a financial or commodity pyramid and hide behind completely innocent names.

This greatly complicates the task for our compatriots who have decided to invest their savings for the first time. In addition, the consequences of the crisis, which caused distrust of banks on the part of depositors, served as fertile ground for the growth of financial pyramids.

In addition, bank deposits not only do not generate income, but due to rising inflation they even become unprofitable.

Therefore, many investors began to look for other options for preserving and increasing their cash savings.

For example, the financial pyramid that everyone believed in - “MMM” by Sergei Mavrodi or the “Russian House of Selenga”, which is discussed in the documentary presented at the end of the review.

It is in the search for a profitable solution that it is most difficult for beginners, who risk falling into the traps set by financial pyramids that lure investors with the promise of high and stable income.

A financial (investment) pyramid is a way of generating income through the constant attraction of funds by project participants. The income of its first participants is paid from the contributions of subsequent ones.

Financial pyramids and network marketing

With the development of the network marketing industry (MLM business), financial pyramids increasingly began to disguise themselves as it.

The fact is that a multi-level structure occurs both in fraudulent schemes and in legal businesses.

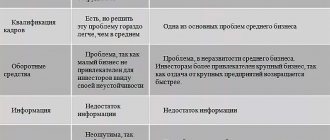

But a closer look reveals significant differences. The network business is absolutely legal (according to the decision of the US court in 1979 against the Amway company) and is based on creating a network of consultants (distributors) to promote goods from the manufacturer to the buyer. A comparison of features is presented in the table:

| Sign | Financial Pyramide | Network marketing |

| What does the entry fee go towards? | Fully or almost entirely for payments to the upper levels of the pyramid, that is, people who joined earlier | To receive a starter kit of products for a consultant, training materials, brochures. In some companies, a certain amount (20-30% of the contribution) goes to reward sponsors (upper levels). |

| Product Detail | Unclaimed, fake or overpriced | High-quality products that people periodically buy (usually cosmetics, cleaning products, dietary supplements, etc.). The largest players in the MLM business have a fairly large assortment and may include durable goods (filters, dishes, clothing). |

| What the company offers | Unreasonably high interest rates for a short period of time. They may promise low interest rates, but do not mention the exact time of return on investment. The entry fee is often large. They say that there is practically no need to work. | Part-time work with a flexible schedule and, as a result, a small increase in the basic income. In the future, it is possible to create a passive source of income (with a large and stable turnover), but this will not happen quickly. The amount of profit directly depends on the work of the consultant. |

| Source of income | Entry fees for new members. The product serves only to cover up a fraudulent scheme. | Trade turnover structure of each consultant. The price of goods includes distributors’ profits (15–25%), which are distributed throughout the network. Simply connecting people without them purchasing goods does nothing. At the same time, the remuneration plan is designed in such a way that you can outstrip higher levels in terms of income. |

| Company characteristics | Official documents are hidden, forged, or made in the name of a fake person located far away. The information on the websites is vague and illogical. | All activities are conducted openly; many online companies have their own websites with detailed information (product properties, address, company phone number, trainings, etc.) |

| Behavior of people promoting to join the company | Obsessive beliefs, emphasis on advertising and quick money. They demand to give money immediately and often without presenting supporting documents (checks, receipts). | A calm story about this type of business, emphasis on personal consumption of products, studying the action and purpose of each product, mastering sales skills, making presentations, communicating with people. A beginner may want to think twice before engaging in online business (usually they give 2-3 days). |

All kinds of funds or mutual aid funds.

The main slogan of such pyramids is that only their brilliant creators know how to redistribute the money of investors so that there is enough for everyone, with unrealistic interest, and there is also left for all kinds of charitable events. A striking example of such a pyramid is the now deceased “Mercury Mutual Fund”. I will not dwell in detail on this type of pyramid here, because... I've written enough about this. I just want to emphasize that this particular type of pyramid has all their characteristic features. And it is this type of pyramid that is most dangerous, due to all sorts of disguises, gullibility and stupidity of investors.

What to do if you have already invested money in a financial pyramid?

First of all, you should calm down and soberly assess the situation. First you need to contact the office of the company where you gave the money or the person who invited you. The chances of getting your money back increase if you have documents confirming the receipt or transfer of money.

If the return is refused, hint to the scammers that you plan to contact the police and prosecutor's office. And if this does not help, then immediately contact these authorities. It is recommended to provide detailed information about the scammers: external signs of the people, what product they are promising, the name of the organization, office address, etc. There is a possibility that by the time law enforcement agencies begin to act, the “businessmen” may disappear.

Despite the illegality, financial pyramids will continue to be created, trapping gullible citizens. To recognize them, you need cold calculation and an understanding of the essence of how pyramid schemes work.

Action plan when invested

There are situations when people have already invested money and only then realized that it was a pyramid scheme. You need to calm down, soberly assess the situation and take the following actions:

- Contact the office where the money was transferred or the person who invited you to the project. There is a much greater chance of returning the deposit if there is evidence of the transfer of funds.

- When they refuse to return the money, you need to warn that you will contact the Prosecutor's Office or the court.

- If this does not bring results, you must write a statement to law enforcement agencies. The following materials on the case will help the investigation: address and full name of the company, full name. founders, signs of what they promised, what kind of activities they conduct, etc. The more evidence, the higher the chances of finding scammers. Additionally, it is recommended to enlist the support of experienced lawyers.

The sooner you write a statement, the better. If you delay this, there is a high probability that the scammers will disappear and will not be found again.

No one is safe from the threat of investing in a financial pyramid. Students and retirees who need easy money are more at risk. To better understand the structure of fraudulent schemes, watch documentaries on YouTube and read specialized literature.