When concluding cooperation agreements with a new counterparty represented by an individual entrepreneur, it is advisable to check its reliability. This allows you to draw conclusions about the prospects for working together, as well as avoid all sorts of troubles. Today there are a number of opportunities to check IP without making significant efforts.

Where can I check my IP?

IP verification is carried out mainly for two purposes: in order to minimize tax or credit and financial risks. In the first case, information about the reliability of a business partner makes it possible to reduce the likelihood of claims in terms of the validity of VAT deductions, as well as expenses that reduce the tax base due to income taxes. The second deals with the legality of a businessman’s work.

Important! You can check not only a third-party entrepreneur, but also competitors, as well as yourself.

At the tax office

You can request information from the Federal Tax Service about whether an individual entrepreneur has arrears in tax payments and receive an extract from the Unified State Register of Individual Entrepreneurs. To do this, you must personally contact the tax service department and provide the required documentation, as well as a receipt for payment of duties. Passport details and TIN will be required.

The state duty is 200 rubles. The requested information is provided on paper.

On the website of the Federal Tax Service

It is much easier to determine the status of an individual entrepreneur and obtain certain data about its activities through the Federal Tax Service website. There are 13 services available here that are designed to verify the counterparty. They allow you to obtain information about:

- Information contained in the state register of the Unified State Register of Individual Entrepreneurs.

- Tax debts

- The entrepreneur undergoes the official registration procedure

- Termination of activities.

The Unified State Register of Individual Entrepreneurs records information about all citizens who are registered as individual entrepreneurs. This data is retained even after liquidation. Every businessman is obliged to promptly report all changes so that the data in the register is corrected in a timely manner. Accordingly, you can get up-to-date information here.

Other online services

You can check your individual entrepreneur by TIN and other data using several specialized services:

- On the web resource of the bailiff service, you can raise the question of the existence of enforcement proceedings against a businessman. On the FSSP website you need to indicate the region in which the individual entrepreneur or legal entity is registered. It is allowed to conduct an inspection in the region where the counterparty’s property is located. In addition, the full name of the entrepreneur is entered.

- On the website of the Arbitration Court it is possible to obtain information about legal proceedings taking place with the participation of the counterparty. This requires TIN, OGRN and full name. Data is provided from the corresponding file cabinet.

- The Unified Data Register, containing information on the activities of legal entities and individual entrepreneurs, provides information on the existence of bankruptcy proceedings against the entrepreneur, on net assets and OKVED codes.

- The Register of Unscrupulous Suppliers contains a list of unreliable entrepreneurs who were suppliers of products for municipal or state needs. For verification, the TIN is indicated.

- The Migration Department issues information about the authenticity and validity of the individual entrepreneur’s passport details.

When receiving information in any of the listed databases, it is advisable to save the received data in the form of screenshots. Subsequently, this will help to confirm that before starting cooperation with the counterparty, it was checked.

Important! There are many third-party online services that allow you to find out all the necessary information about an individual entrepreneur without any extra effort. But for this information a certain fee is charged.

How to understand that they will come to you

Before each tax audit, inspectors collect information about the taxpayer in advance and conduct a pre-audit analysis.

The main document used by tax specialists is the concept of a planning system for on-site tax audits. It identifies 12 criteria by which each taxpayer can independently analyze their financial and economic activities and determine the risk of being audited. The more matches tax officials find, the higher the likelihood of an audit. Let's take a closer look at what each criterion means:

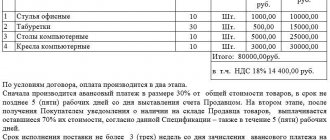

| Criterion | Taxpayer category | Notes |

| Low tax burden | For all organizations and individual entrepreneurs | The total tax burden is the ratio of the amount of taxes paid to revenue within one year. If this ratio is below the industry average, it will raise suspicion among tax authorities. |

| Unprofitable activity for two or more years | For all organizations and individual entrepreneurs | Taxpayers will be interested in losses in both accounting and tax reporting. |

| Significant amounts of VAT deductions | For organizations and individual entrepreneurs on the general taxation system | If VAT deductions for 12 months exceed 89%, this may be a reason for a tax audit. 89% is the overall figure. Additionally, for each subject of the Russian Federation, separate average indicators are calculated, deviating from which is dangerous. |

| Expenses are growing faster than income | For organizations on the general taxation system | It is necessary to compare the growth rates of expenses and income from sales according to tax and accounting reports. This also includes situations where income falls faster than expenses, or if income falls and expenses rise. |

| The average monthly salary per employee is less than the industry indicator in the region | For all organizations and individual entrepreneurs | Information on the average salary level in the region can be found on the websites of the territorial branches of Rosstat. |

| In special mode - repeated approach to limit values | For organizations and individual entrepreneurs in special modes | Inspectors will be suspicious if two or more times in a year you have approached the income limit under the special regime and the difference between your actual income and the limit is less than 5%. Inspectors may consider that you are deliberately underestimating your indicators so as not to “fly” out of the special regime. . |

| IP income is almost equal to expenses | For individual entrepreneurs on the general taxation system | An entrepreneur may also be suspected of fraud if personal income tax deductions are higher than 83% of income. |

| Activities through a chain of counterparties | For all organizations and individual entrepreneurs | Working with resellers, intermediaries without justified economic reasons, attracting fly-by-night companies, disabled workers, etc. |

| Ignoring requests from the Federal Tax Service | For all organizations and individual entrepreneurs | The attention of tax authorities is drawn to cases when a company does not provide explanations about errors identified during desk audits; did not keep the documents necessary for calculating and paying taxes. |

| Activities with high tax risk | For all organizations and individual entrepreneurs | Working with shell companies, withdrawing part of your funds to offshore companies, cashing out money - these actions will lead to inspectors suspecting you of receiving unjustified tax benefits. |

| Migration between tax offices | For all organizations and individual entrepreneurs | Inspectors will pay attention to taxpayers who changed their address two or more times after registration. Perhaps the businessman is trying to avoid the attention of the tax authorities and evade inspections. |

| Low level of profitability | For organizations on the general taxation system | For comparison, inspectors will take two indicators: profitability of sales and assets according to accounting data. |

Criteria for conducting an on-site tax audit

We collect legislative news and tell you exactly how they will affect your business. Without complex accounting terms and water. Subscribe:

What data is searched for?

You can find an individual entrepreneur and check information about him in different ways. But in any case, some initial data will be required, which is indicated in requests or entered into the appropriate fields of online services. Most often we are talking about TIN, surname and OGRNIP.

By TIN

The data contained in the Unified State Register of Individual Entrepreneurs is not classified. Any interested person has the right to receive information, but strangers are not provided with information about the individual entrepreneur’s passport details or bank account number. It will not be possible to find out the IP address.

To check an individual entrepreneur by TIN on the tax authorities’ website, you need to:

- Select the “Business Risks” section.

- Select IP in the top field.

- In the search field, select an option based on known data (TIN, OGRN, full name, region).

- Enter your 12-digit Taxpayer Identification Number.

- Enter the numbers shown in the picture.

- Click "Find".

Using the same principle, you can check a legal entity, but in this case you need to indicate the name of the organization.

Important! If the search for an individual entrepreneur did not produce results, information about it was not found, it means that he did not go through the registration procedure and is conducting his activities illegally. All registration documents provided by him are false.

If the entrepreneur is registered in the Unified State Register of Individual Entrepreneurs, the system will issue a corresponding document in PDF format, available for download.

By last name

When the search for individual entrepreneurs on the Internet resource of the Federal Tax Service was carried out by last name and region of residence, all namesakes will be present in the search results. In the list of businessmen, you should select the person of interest and click on his full name. After this, the document will begin downloading to your computer.

By the last name of an individual entrepreneur, it is possible to obtain information on other sites. But most often, additional information will have to be added to this data, mainly regarding the TIN. Verification of individual entrepreneurs by last name is carried out on the FSSP resource. You can also find customer reviews about his work on the Internet by the name of a businessman.

According to OGRNIP

When registering, the entrepreneur is assigned not only an INN, but also a OGRNIP - the main state registration number of the individual entrepreneur. This identifier encrypts important data about its owner. The number is unique and cannot belong to two merchants at the same time.

If you look closely at the OGRNIP, you can get some data from the number itself:

- The first digit 3 means that the number really belongs to an individual entrepreneur.

- Next come two digits indicating the year the registration entry about the individual entrepreneur was made in the register.

- The next two digits are the code of the subject of Russia, defined by law.

- Two more digits indicate the number of the interdistrict tax division that made the registration record.

- The next seven digits correspond to the entry number in the Unified State Register of Individual Entrepreneurs for a specific year.

- The last digit is the control digit. If you divide the first 14 digits of the OGRNIP by 13, you get the remainder, which must match the last digit of the number. If this is not the case, the OGRNIP is invalid.

According to OGRNIP, it is possible to obtain an extract from the Unified State Register of Individual Entrepreneurs in paper form for 200 rubles or electronically through the Federal Tax Service website for free. For 400 rubles, the document is issued urgently; in other cases, its preparation takes 5 working days.

Important! An individual entrepreneur who ordered a paper statement for himself does not pay the fee.

Find out the status of an individual entrepreneur via the Internet

In the second case, you can get the information you are interested in by going to the official website of the federal tax service. There you can also find the closing date of the individual entrepreneur.

To obtain this data, you need to fill in the appropriate fields on the resource page:

- Full name of individual entrepreneur

- OGRN (main state registration number)

- TIN

- The place of registration of the individual who had the status of an individual entrepreneur is also indicated.

There is a third way to clarify information about the closure of an individual entrepreneur. You can take advantage of special offers where you are automatically provided with all the necessary information about the status of an individual entrepreneur. This is a fairly fast and convenient way. But, please note that it is not official, so no one is responsible for the accuracy of the information provided there. But an entrepreneur should still contact the tax office for it.

This also includes some paid services that can be found on the vast information network. However, the situation with them is the same. If you want to receive 100% accurate information about closing the status of an individual entrepreneur, use one of the two methods above.

Yes, and a supporting document will be issued to you by the tax office. And it will have legal force only if it is stamped and signed by an authorized employee of the Federal Tax Service.

What you can learn about an individual entrepreneur

The extract received through the official Internet resource of the Federal Tax Service indicates the following data:

- Full name of the entrepreneur.

- INN, OGRNIP.

- Registration information.

- Main and additional activities.

- Information about tax registration.

- Information about the changes made.

- Data on bankruptcy or liquidation process.

In addition, the place of business of the businessman, information about the document confirming the receipt of information and the state register, a list of licenses received are indicated.

How to check the existence of an individual entrepreneur

It is possible to verify the real existence of a specific individual entrepreneur using the Federal Tax Service web resource. An existing entrepreneur is an individual who has undergone appropriate registration in the prescribed manner. If the registration procedure is completed, this will be reflected in the document received from the tax authorities on paper or in electronic format. The second option is an extract from the Unified State Register of Individual Entrepreneurs.

You can check the businessman’s TIN. The number contains encrypted information about:

- region of issue (first two digits);

- local branch of the Federal Tax Service (next two digits);

- tax record number (six digits).

The last two digits are control digits; they can be used to check the authenticity of the number. This is done according to a special formula.

Ways to check the status of an individual entrepreneur

When an entrepreneur has decided to temporarily or permanently cease activities in this capacity, accurate knowledge of whether his application to terminate business activity is satisfied and, if so, the date of making the corresponding entry in the Unified State Register of Individual Entrepreneurs (USRIP), becomes of key importance for him. After all, the status of an individual entrepreneur, even after its termination, entails such obligations to the state as:

- the need to declare income from business activities, even if it is zero or we are talking about losses, for the last reporting period (calendar year or the time actually elapsed from its beginning until the closure of the individual entrepreneur), no later than the 25th day of the next month after the closure date;

- the need to pay contributions to extra-budgetary funds for yourself and, if applicable, employees; these contributions, if the entrepreneur worked for less than a full year in the next reporting period, are calculated strictly by day for the entire time while the individual entrepreneur’s status was relevant.

The presence of a certificate of state registration of an individual entrepreneur may not mean anything, because an entrepreneur has the right to close at any time

To calculate the amount of obligations to extra-budgetary funds, an individual entrepreneur or a former individual entrepreneur who has undergone the closure procedure has the right at any time to apply directly to the Pension Fund (PFR). However, it is recommended to do this in any case.

Contractors of an individual entrepreneur need to check its status to avoid possible problems with the state. After all, if the functions of a contractor or executor under a civil contract are assigned to an individual entrepreneur, the customer has an obligation to him for timely and complete payments. And the entrepreneur, who is his own tax agent, must deal with the state himself. But when such an agreement is concluded with an ordinary individual, the customer has an obligation to withhold and transfer personal income tax to the budget from his income and make contributions to the Pension Fund. If he does not do this, including due to the fact that he did not know about the termination of his business activity by his partner, the regulatory authorities will still have questions for him. And he cannot avoid the sanctions provided for in such a case.

In 2020, three options are available for checking the status of an individual entrepreneur:

- using an extract from the Unified State Register of Individual Entrepreneurs;

- on the website of the Federal Tax Service (FTS) of Russia;

- on the government services portal.

Extract from the Unified State Register of Individual Entrepreneurs

Current data from the Unified State Register of Individual Entrepreneurs is used in any method of checking the status of an individual entrepreneur, since the information is provided precisely on their basis. But a paper official extract from the Unified State Register of Individual Entrepreneurs differs in that it is a full-fledged document, certified by a regular, rather than electronic, signature of a tax inspector and a “wet” seal.

You can also order an official statement in electronic form, but in this case only the electronic version is considered an official document, and a printout is regarded as a copy.

To receive a paper extract, you need to provide the tax office at the place of registration of the individual entrepreneur:

- a completed application in the established form, which indicates the full name of the entrepreneur, his TIN, OGRN, region of registration and the reason for issuing the extract or place of request;

- a copy of the passport of the individual entrepreneur or his authorized representative;

- a copy of the power of attorney, if applicable;

- receipt of payment of state duty.

The state fee in 2020 is 200 rubles for a regular extract and 400 for an urgent one.

There are two ways to send this package to the tax office:

- carry it personally;

- send by Russian Post by registered mail with acknowledgment of delivery; for reliability, you can also fill out a list of attachments at the post office.

A regular statement takes five working days to prepare, an urgent one - one. An individual entrepreneur or his authorized representative can receive it in person by visiting the inspection office of the Federal Tax Service (IFNS) or by mail.

However, only a limited number of applicants have the right to order such an extract:

- the individual entrepreneur himself;

- his confidant;

- judicial or law enforcement agencies.

This means that it is impossible to legally obtain such an extract for the counterparty, except in cases where he himself has issued the appropriate power of attorney.

The individual entrepreneur himself usually requires a paper extract from the Unified State Register of Individual Entrepreneurs to resolve issues related to his activities, for example, when opening a bank account or to participate in competitions for the distribution of government orders. When business activity has already been terminated, in most cases an electronic document is sufficient.

The extract from the Unified State Register of Individual Entrepreneurs contains all the necessary information about the individual entrepreneur: personal data, legal and postal addresses, TIN

On the website of the Federal Tax Service of Russia

On the Federal Tax Service website you can check whether an individual entrepreneur is closed in two ways:

- using the service “Business risks: check yourself and your counterparty”;

- through the taxpayer’s personal account.

Contractor verification service

The first option has the following advantages:

- information about individual entrepreneurs can be obtained by anyone who has a minimum set of details - it is enough to know the full name of the entrepreneur and the region of his registration;

- you don’t have to pay to use the service;

- information is provided online; it takes no more than 10 minutes to generate and process a request.

There is only one drawback - the information provided does not have legal force. However, in the case of checking a counterparty, it is quite sufficient. In addition, this is the only legal way to obtain information from the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities, not only for yourself or your principal.

Service for checking yourself and your counterparty in the list of electronic services on the website of the Federal Tax Service of Russia

An extract from the Unified State Register of Individual Entrepreneurs about a specific individual entrepreneur in the form of an electronic document signed with an enhanced qualified electronic signature can be obtained through a special electronic service on the Federal Tax Service website. Most entrepreneurs consider this method optimal. You can get all the necessary information here.

To use the Federal Tax Service service, you need to act in the following order:

- On the main page of the Federal Tax Service website, in the list of electronic services, select the option “Business risks: check yourself and your counterparty.”

- On the page that opens, select the form for individual entrepreneurs.

- Select a search option - by full name or OGRNIP and INN.

- Enter IP information.

- Enter the captcha.

- Give a command to search for information.

- Wait for the result.

Personal account of individual entrepreneur

To receive an official electronic statement through the Federal Tax Service website you need to have:

- personal account on it;

- electronic digital signature.

The procedure for obtaining information is as follows:

- Open the website of the Federal Tax Service of Russia.

- Log in to it.

- Select your region.

- In the “Services” menu sub-item, select the “Extract from the Unified State Register of Individual Entrepreneurs” option or find it using the search form.

- Fill in all required fields.

- Read and agree to the terms of service.

- Click on the “Get” button.

- Wait for the result. Depending on the option chosen, an extract from the Unified State Register of Individual Entrepreneurs, containing information about the closure of the individual entrepreneur, if applicable, will be sent electronically to your email or in paper form to a regular postal address.

On the public services portal

In 2020, using the public services portal, it is impossible to submit an application to close an individual entrepreneur, nor check the result of its consideration, nor order an extract from the Unified State Register of Individual Entrepreneurs, even if there is an individual entrepreneur’s personal account, which is created in addition to the same account for an individual without individual entrepreneur status.

The portal contains only a description of government services for registering the termination of the activities of individual entrepreneurs and requesting an extract from the Unified State Register of Individual Entrepreneurs. However, the first is classified as non-electronic, and the second contains a reference to the website of the Federal Tax Service of Russia.

Video: all about closing an individual entrepreneur

Why do they search?

It is necessary to check the individual entrepreneur in order to identify an unscrupulous businessman among potential partners. The absence of such verification significantly increases business risks. Studying data about an entrepreneur allows you to avoid:

- delays in payment for goods and services, large debts;

- non-receipt of paid goods;

- participation in fraudulent schemes;

- problems with VAT deduction;

- signing an agreement with the future bankrupt.

If tax officials suspect that the partner’s unreliability was known in advance, they will have to prove non-involvement in illegal actions through the courts. That is why, when checking an individual entrepreneur, it is worth obtaining an extract, which can be presented in such circumstances as evidence of innocence.