Acceptance: definition of the concept

Acceptance is an official response to the seller that the buyer is ready to accept the offer (offer to sign a contract based on its terms). When signing a contract, before acceptance is made, both parties need to discuss all the nuances of the future agreement.

According to the legislation in force in the Russian Federation, an acceptance can be considered executed only if it is complete.

The transaction will be concluded unconditionally only upon receipt of acceptance. Thus, in order to conduct a successful business and avoid misunderstandings between partners, it is necessary to determine the criteria for the possibility of paying invoices with full acceptance.

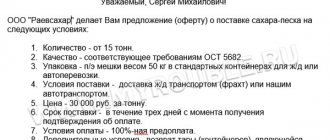

Offer

In the case of an invoice, everything is very clear: acceptance is agreement to the conditions specified in the invoice and an obligation to pay it. In the case of an offer, the term means consent to sign or conclude an agreement on the terms specified in this offer.

Acceptance occurs both using a digital signature and a corresponding inscription

It should be understood that the offer may be quite large, so the other party needs time to study it and respond. If the other party responded to it by commenting on the text of the agreement or asking questions about the agreements, this does not constitute confirmation.

Attention:

If acceptance is received simultaneously with a comment or review, the transaction is not considered confirmed. Be sure to take this point into account when concluding agreements so as not to start working under an agreement that is not signed by the other party. First, you need to settle all the issues and make all the adjustments, and only then accept the document.

Only the second party, that is, the one to whom the offer was sent, can confirm the offer.

What does invoice accepted mean?

If acceptance is accepted, the contractor should begin to fulfill his duties specified in the signed agreement. Since the value of an accepted invoice will indicate a guarantee of receiving payment on time. This procedure significantly saves time, which can no longer be spent on reviewing, agreeing, and signing documents related to the offer. Acceptance can be implemented in various ways; there is no possibility of defining a unified method. However, you can consider an approximate option:

Receipt of an offer for the supply of goods or provision of services.- Consideration of the proposal on its merits. In this case, no counter adjustments or demands will be made to the proposal received, and it, as well as the form of the contract, will be completely satisfactory to both parties.

- Compiling a response letter. In this letter, you must voice your consent to cooperate and indicate the obligation to pay for the services provided in full, subject to their full implementation.

- The documents are marked “accepted”, as well as the signature of the head of the organization and its stamp.

Definition of acceptance, its purpose

When concluding an agreement, both parties read each clause in detail, familiarizing themselves with the terms and discussing them. If the counterparty is satisfied with the agreement without making adjustments or changes to it, this means that the document has been accepted.

Thus, acceptance means satisfaction with the written terms provided by the other party to the transaction and written confirmation of consent to make payments under the obligations of the agreement.

Also, acceptance is the inscription “accepted” on any document with the signature and seal of the party who agrees to pay its obligations enshrined in it in full.

The legislation of the Russian Federation also provides some clarifications regarding the definition:

- the absence of any response from the other counterparty cannot be considered acceptance. The agreement to accept must be voluntary and confirmed, if this clause is not specified in the already concluded agreement;

- in conditions where the second party fulfills the terms of the agreement, but has not given consent to acceptance, the agreement is recognized as accepted automatically.

In addition, the letter of the domestic law states that acceptance must be complete and unconditional, that is, only part of the obligations under the contract cannot be accepted.

The need for the procedure

According to the current legislation, the acceptance procedure has a number of significant points:

Acceptance will not be the absence of refusal by the party to whom the offer was sent.- In the event of full fulfillment of obligations by the offeree within the prescribed period, such fulfillment can be considered acceptance (even in the absence of an official response). This scenario is usually possible in long-term relationships.

Thus, the need to carry out the acceptance procedure is determined by minimizing disagreements between partners, as well as confidence in the timely fulfillment of contractual obligations.

Use of acceptance

The concept of “use of acceptance” is very widespread in accounting, as well as in international legal relations. And here the acceptance will be:

- Indisputable confirmation of the intention to conclude a transaction, as well as approval of all provisions of the agreement.

- Unilateral acceptance of obligations under a concluded agreement.

- Agreement with the bill of exchange coverage period and acceptance of bill settlement obligations.

- Positive decision on settlement for monetary documents.

Video on how to make a deal:

When using acceptance, issues of payment of receipts or bills of exchange are addressed. This method of payment is also typical when paying for a product, service, or a certain type of work.

The acceptor is the person who accepted the terms of the transaction and agreed with their execution.

What is acceptance

In a broad sense, “acceptance” means the consent of a citizen or company to enter into a contract. The simplest example of acceptance is the purchase of goods. Imagine that you came to the store and saw pickled cucumbers, with a price tag next to it - 95 rubles. Having taken the jar, you go to the checkout and pay for your purchase. That's it, this is acceptance. You agreed to enter into a contract for the purchase and sale of pickled cucumbers at the price offered by the store.

In the Civil Code of the Russian Federation, several articles are devoted to acceptance (Article 438 – Article 443, Article 621). All of them are related to the contracting process. And this is no coincidence. Acceptance is a mandatory stage in concluding any contract. Closely related to this concept is the term “offer” - an offer to sign an agreement on specified conditions.

It all always starts with a proposal, where one of the parties to the agreement describes the terms and rules of the future contract. Then the second party gives consent and acceptance. So she approves of the proposed terms of the contract and expresses her desire to sign it.

The main terms used in the text come from the words “ offer ” - proposal, and “ acceptance ” - agreement.

The person who made the offer is usually called the offeror .

The acceptor is the one whose consent is sought. To accept means to approve the agreement.

Restrictions on action

In acceptance, as in any financial procedure, there are some restrictions on action. All restrictions or prohibitions will always follow from international regulations, as well as the legislation of the Russian Federation. In order not to violate the law during this procedure, it is necessary to remember that acceptance will be a confirmation of the intention to pay, but not a guarantee of its implementation. However, immediate settlement cannot be required. But the very meaning of the restriction will not only be the fulfillment of the obligations specified in the contract. You also need to issue an invoice. At the same time, this account must be accepted by the second party to the transaction for accounting.

Further, all settlement transactions are carried out through the cash settlement centers of the transaction participants. On the part of the recipient of the service, a payment transaction will be completed and the funds will be transferred to the performer’s RCC. There is a mandatory intermediary - a financial organization (bank). To ensure that the transaction is not regarded by regulatory authorities as an illegal financial fraud, only this payment method is used.

Deadline for acceptance

According to Art. 440 of the Civil Code of the Russian Federation, the contract will become “concluded” only if the acceptance is approved within the deadline. And now Art. 441 of the Civil Code of the Russian Federation clarifies the provisions of the previous article. Moreover, if, when sending a written offer, the sending organization did not determine the period for acceptance, then the contract will receive the status “concluded” if the sending organization received acceptance before the expiration of the period established by law or other regulations.

An agreement without specifying a specific period for acceptance will be concluded upon acceptance by the party to whom the offer is addressed orally, with an immediate application for acceptance under this agreement.

What are the offers?

To understand what types of acceptance there are, you should analyze the available options for offers, the differences between which lie in the addressee and the types of implementation of the conditions.

To begin with, this is a public offer addressed to a certain circle of persons, not limited by anything. For example, a retail outlet offers the purchase of any product with a set price to each person. There are some special features for this situation:

- Often the proposal is made verbally and the client does not need to sign documentation to accept the terms. That is, a person pays money, receives a product and a purchase receipt.

- Anyone can be a client.

- No application for acceptance is required.

It is the public offer that is the most widely used type of advertising on the Internet, the media and traditional retail outlets. Based on this, each advertisement can have one of two variations:

- Act as an offer, guaranteeing the validity of certain conditions until a specific time.

- Not to be an offer and not to provide any guarantees.

For example, an Internet provider sends letters by mail, where it offers its services, supplementing the letter with key terms of the contract, including tariffs, connection speed, and so on. This proposal is a public offer, because a legal entity will need to enter into a contractual relationship and provide the Internet services mentioned in the newsletter for each person who wishes to accept the terms of the agreement.

In fact, such an agreement is used by banking institutions offering various types of lending. The website of this structure has a list of conditions and a mention that the proposal is an offer, and signing an application for a loan will be an acceptance. We have already figured out what acceptance is in simple words.

When a potential lending entity completes an application, by law it is accepted, and the agreement is successfully confirmed on the stated terms. Lenders have to act in a similar way to reduce the risk of doing unnecessary work, including checking the financial status of clients and reviewing applications.

Sometimes the opposite situation may arise when the bank considers a person’s independent application for a loan to be an offer. If an organization, after checking information about the borrower, approves the issuance of funds, this becomes a legal acceptance of the offer. A bank account is opened for a person and the necessary funds are transferred to it, and signing an agreement is not required.

What does preliminary acceptance mean?

Preliminary acceptance will mean that the organization making the payment provides its permission to pay for the supplier’s document before the procedure for debiting funds from its current account. The document will be accepted if the payer does not submit an application to the bank to certify the refusal to transfer funds within three working days.

In addition, according to general banking rules, the date of receipt of the payment document by the bank is not taken into account, and the countdown will begin from the next business day.

Types of acceptance

There are several types of accent:

- surety - one party voluntarily assumes an obligation under the bill of exchange of the other party, who has put his signature on it;

- intermediary - they enter into an agreement, under its terms, the assignment of the accent becomes the obligation of a third party party to the document;

- unconditional - a party that assumes all obligations under the contract and fulfills the requirements of the document without claims or disagreements;

- limited - the person who has accepted the acceptance agrees with its requirements, but insists on adjusting some points. For example, the period of acceptance;

- local – the paying party retains the right to choose the territory where it will make the payment. agrees to fulfill its obligations only if this requirement is met;

- conditional - the parties to the contract are ready to fulfill it based on other requirements. If we are talking about repaying a bill, the document automatically invalidates it;

- shared – part of the amount specified in the contract is taken into account.

Reference! Acceptance is characterized by a non-cash payment principle. If one person has fulfilled his obligations under the document, the second person transfers funds to his details from his account. The transaction is carried out through a bank order.

Acceptance of an invoice from a supplier of goods/services

This is a confirmation of the intention to pay the accepted financial document. An invoice paid by non-cash method will be considered accepted. The exact date of payment is established by the signed agreement.

An example of such an operation is payment for the services of an Internet provider, which almost everyone encounters.

First, an agreement will be concluded for the provision of the provider’s services, all conditions will be stipulated in it, including payment terms. An additional agreement is concluded to this agreement, according to which all invoices for payment will be sent immediately to the bank. But the bank repays this acceptance by debiting the required amount of funds from the account of the service recipient to the account of the Internet provider.

The buyer accepted the seller’s invoice: how to reflect it in accounting

The invoice has been accepted - what is the transaction in this case? For example, a supplier’s invoice for incoming fuel has been accepted - postings need to be made using which invoices?

In the expression “The supplier’s invoice for received fuel has been accepted,” the key phrase will be “fuel received.” The receipt of fuel and its payment (as independent business transactions) are reflected by the following entries:

An invoice for payment cannot serve as a basis for accounting entries - it is not a primary document for accounting purposes. Posting for the receipt of materials can be made only on the basis of an invoice or a universal transfer document (UDD) received from the supplier of materials at the time of shipment of goods to the buyer. And the entry in the accounting record of the payment made will be confirmed by a bank statement and a payment order with a bank mark.

Thus, if supplier invoices for received materials are accepted, the postings are:

- are made on the basis of primary documents (invoice, UPD, etc.), but not invoices for payment;

- reflect the fact of the receipt of material assets and their payment in the buyer’s accounting.

An invoice for payment containing the director’s resolution agreeing to pay the amount specified therein will only be attached to other documents related to the transaction (contracts, agreements, invoices, invoices, etc.).

Accepted letter of credit

Otherwise called a fixed-term letter of credit, it differs from an acceptance in that in its terms the supplier organization includes a draft addressed to the advising (paying the invoice) bank. This draft will have an essential payment term: “within a certain number of days.”

In practice, this will mean that instead of making an immediate transfer of funds, the draft will first be sent by the bank to the seller with the account marked “accepted”. Such acceptance will mean that the funds will be credited to the seller’s account within the time period established by the contract.

Acceptance of bill

This is the procedure for using bills of exchange. This procedure is characterized by the fact that the recipient of the bill (remitee) or another person holding this bill makes an offer to the payer (drawee) to pay this bill. Since the payer of such a bill is a third party, his written consent is necessary to make the payment. Such consent will become acceptance. The entity authorized to leave on the bill of exchange is the acceptor.

Current legislation limits the period for filing for bill acceptance. The period will be one year from the date of its preparation. When working with a bill of exchange, you can accept not the entire amount specified in it, but only a part. To do this, you also need to make a corresponding entry on it.

An important detail will be the date of acceptance. This condition is necessary if payment must be made within a certain period.

A protest can be applied to the bill. Protest is carried out in two cases:

- Refusal to reflect information about the date on the title of the bill (if there is a payment condition in the existing agreement within a certain period of time, after the date of acceptance).

- Refusal of the subject of payment to accept the bill. The amounts under the bill are withheld from the drawer or the one who endorsed the endorsement.

Endorsement is an inscription on a bill of exchange that transfers and establishes the legal transfer of rights to the bill of exchange to third parties. Such an entry is made on the reverse side of the bill or an additional sheet is attached.

The protest procedure itself when working with a bill of exchange is of great importance. Upon signing and issuance, the very fact of the existing debt is automatically established. Therefore, there is no possibility that it will be necessary to prove the right to collect debt in court.

But a bill that has already been protested must be submitted to court. In this case, no court hearing will be scheduled, the secretariat will automatically initiate enforcement proceedings, and the writ of execution will be handed over to the bailiffs for subsequent collection.

Types of acceptances, scope of their application

The following types of acceptances are distinguished:

- with the participation of an intermediary. This type of acceptance implies the presence of a third independent party who agrees to execute the counterparty’s instructions on the basis of the agreement;

- with the participation of a guarantor. This type of acceptance assumes that obligations will be transferred to a third party when he signs the bill;

- unconditional acceptance. It implies complete adherence to the contract by both parties, without violations or disputes, in conditions where a statement of acceptance is not required and the contract is accepted by default;

- limited acceptance. It implies the readiness of the second counterparty to fulfill its obligations, but with adjustments and changes. One of the most common changes made is the adjustment of demand payment terms;

- conditional acceptance. It involves concluding an agreement when making major adjustments or completely changing the terms.

Important fact

If the transaction is carried out using bills of exchange, then this type of acceptance will annul the legality of the transaction;

- local acceptance. Means that the counterparty must return the borrowed funds in a specific prescribed place;

- partial acceptance. It assumes that only part of the amount indicated on the papers will be required for payment.

Today, acceptance is widespread and is used by many organizations to carry out various transactions, among which are:

- banking transactions;

- confirmation of the offer;

- agreement to the terms of the agreement;

- agreement to the terms of the letter of credit.

Thus, acceptance is used to speed up settlements between counterparties, who are guaranteed the inviolability of financial assets and their mandatory return after a clearly defined period. In addition, the presence of such a document greatly facilitates the control of all financial documentation.

Important fact

To conclude and sign an acceptance, the parties do not have to meet in person, which saves time and speeds up the process of fulfilling the terms of the agreement.

Acceptance of offer

An offer will be an offer from a supplier/seller sent to the buyer with the opportunity to purchase a product or use a service. Almost all advertising offers are considered an offer and any citizen can take advantage of it. Such an offer will be considered public. The offer always contains basic information about the product.

The buyer’s positive decision to take advantage of the offer will be called acceptance. When expressing acceptance, the buyer confirms his interest in purchasing the offered product.

There are several ways to accept an offer:

- Sending a written response-consent to purchase the goods

- Immediate purchase of the offered product

Irrevocable offer - the seller cannot unilaterally change the conditions for the provision of services or the sale of goods.

Free offer - the seller can change the conditions at any time before signing the contract or completing the transaction.

Offer and acceptance

So, let's move on to a deeper study of the terms that can either appear next to the word “offer” or accompany it in specific articles or regulatory documents. An offer, as we have already found out, is an offer of something. The following parties may participate in the offer:

- Offeror. This is the one who directly offers the offer. He can be either a legal entity or an individual, and supply goods or services.

- Acceptor. This is the one to whom the offer is addressed and who is intended to be the “recipient” of the goods or services in question.

- Acceptance. It is the process or form of accepting an offer in the manner in which it was offered. For example, buying a product in a store for the price offered is acceptance of the offer.

In the example with a store and an offer, the store is the offeror, the acceptor is the person who is going to buy something, and the buying process is the acceptance.

In many situations, acceptance occurs without requiring the direct consent of the acceptor. Most often, this can be found on any sites that provide access to software. By agreeing to the license agreement and checking the appropriate boxes during downloading, you thereby accept the offer offered by the site. Or the company that owns this site.

In view of this, it is recommended to be as careful as possible about your actions on the Internet. So sometimes stories appear in the news about how a developer added clauses not intended by users to the license agreement, after which a large number of people accepted them without looking. At the moment these are just jokes, but who knows what carelessness may turn into in the future. You need to be careful with offers.

Acceptance of the contract

The acceptance of the agreement will be concluded as an addition to the main agreement. At the same time, the specifics of acceptance will directly depend on the agreement. This procedure will be considered approval of all terms of the agreement.

When using acceptance, the agreement must reflect the following details:

- ABOUT

- Visa of the accepting organization

If you disagree with certain clauses of the contract, acceptance cannot be concluded.

Deadlines for sending acceptance

It is often impossible to specify in a contract the exact time allotted for its acceptance. If a deadline is specified in the offer, then it should be accepted within a reasonable period. It will depend on the specifics of the proposal, on the relationship of the partners, that is, it is determined individually.

If the contract does not specify a period, you must immediately give verbal consent, for example, simply call the first party to the transaction who put forward their terms. In this case, written confirmation can be sent later. Even if written acceptance is late, oral consent will allow the contract to be concluded faster.

Postings of acceptance

Table 1. Reflection of the transaction in accounting.

| Category | Operation | Dt | CT |

| When purchasing materials | Acceptance of an invoice received from the supplier carrying out the delivery | 10 19.3 | 60 (excl. VAT) 60 (VAT only) |

| Acceptance of an invoice received from a third party organization for the supply of materials providing consulting services | 10 19.3 | 76 (excl. VAT) 76 (VAT only) | |

| Subject to availability and movement of goods | Acceptance of invoices for goods received Acceptance of invoice for delivery of goods | 41 19.3 | 60 (excl. VAT) 60 (VAT only) |

| In case of availability and movement of goods using account 44 | Acceptance of invoices for goods received | 41 19.3 | 60 (excl. VAT) 60 (VAT only) |

| Acceptance of invoice for delivery of goods | 44 19.3 | 60 (excl. VAT) 60 (VAT only) | |

| If there are invoices from suppliers supplying electricity, heat and water for the needs | Main production | 25.2 | 76 |

| Auxiliary production | 23 | 76 | |

| General purpose | 26 | 76 | |

| Acceptance of invoices for communication services | 26 | 76 |

Examples of operations reflected on video:

Can the bank revoke consent?

The situation when a bank can withdraw its consent to acceptance should be considered from the point of view of receiving loan funds.

In banking practice, as a rule, there are no situations when a bank first approves the issuance of credit funds and then withdraws its approval. But there is a right to this. Any credit institution will willingly take advantage of such a right when identifying additional unwanted and compromising data about the prospective borrower.

What does not accepted mean?

In economic and legal practice there is also the concept of “unaccepted invoice”. This concept means that one of the participants in contractual legal relations did not agree to their terms.

In this case, it is necessary to completely rework the contract. Otherwise, such relations will not have legal force, and the transaction itself will never be completed. If the situation continues unfavorably, the invoice, bill or offer is considered invalid.

The concept of acceptance is widely used in both accounting and banking. The considered nuances of the procedure do not cause difficulties in their application. The accounting entries are clear and simple. Working in the banking sector using acceptance significantly speeds up the process of processing payment orders.

Top

Write your question in the form below

What does “acceptance at the bank” mean?

The document is used as an economic instrument of market relations. Acceptance is a guarantee that the banking transaction will be executed and the terms of the agreement will be met.

Acceptance at the bank is an ideal solution when concluding transactions with foreign participants. The popularity of a financial institution, its capital and network coverage are factors in the security of the procedure. The bank takes on the role of an intermediary, for which it receives a financial reward in the form of a percentage of the transaction amount.

The bank's acceptance takes the form of a payment request. When one party has completed its work, the paper is presented to the other party for payment. If everything is completed within the framework of the contract, and the payer has no claims against the contractor, the payment request is satisfied. If there are violations of the terms of the contract, the party who does not want to pay submits a written justification of its reasons to the bank.

If the requirements of the document are fulfilled, the paying party signs the paper, puts a stamp and marks “accepted”. From this moment, the contract goes into the execution phase - the money goes to the account of the participant who has completed his work.