Important: new reporting form for 2020

By Order No. ED-7-21/ [email protected] dated July 28, 2020, the Federal Tax Service made amendments to the form of the corporate property tax declaration. The procedure for filling it out and the format for submitting it in electronic form have been adjusted. Taxpayers will begin using the new form with reporting for 2020. There have been several changes compared to the current declaration:

- The “Taxpayer Identification” field has been added to Section 1, which is intended to indicate the right to deferment. If it is not there, then the legal entity must enter the code “3” in the new field. If the right to defer tax payment is granted on the basis of a government resolution, code “1” is used, and if on the basis of regional acts - “2”.

- The field “SZPK Sign” has been added to the form, indicating that the taxpayer has entered into an agreement to protect and encourage investments.

- The procedure for filling out the tax benefits field for legal entities that have had their property taxes written off for the second quarter has changed.

- Additional benefit codes have been introduced.

The amended order will come into force on 01/01/2021.

Unified reporting

Taxpayers registered with several tax authorities on the territory of one constituent entity of the Russian Federation can submit unified tax reporting (unified tax returns for tax and unified tax calculations) in relation to all real estate objects, the tax base for which is determined as their average annual value, in one of the tax authorities with which they are registered on the territory of the specified subject of the Russian Federation, at their choice.

Source:

"Clerk"

Heading:

Organizational property tax

property tax of organizations property tax declaration preparation and submission of reports 2020 instructions for an accountant

- Inna Kosnova, Clerk columnist, accounting and taxation expert

Who submits property tax reports and when?

A fiscal declaration for property tax is mandatory for all legal entities that own taxable property. Required to report (Article 373 of the Tax Code of the Russian Federation):

- all Russian companies;

- foreign organizations operating in the Russian Federation through official representative offices;

- foreign companies without representative offices in the Russian Federation, but who are owners of Russian real estate.

Exemptions are provided for taxpayers using preferential regimes. They do not pay tax on property, the value of which is determined by the average annual value. That is, if a company owns property on the simplified tax system or UTII that is taxed at cadastral value, then it will have to pay tax and submit reports. There are other exceptions for Russian and foreign companies; exemptions are enshrined in clause 1.2 of Art. 373 Tax Code of the Russian Federation.

Ordinary citizens and individual entrepreneurs are exempt from reporting. They do not independently calculate property taxes for individuals, nor do they fill out declarations. This category of taxpayers pays obligations under special notifications sent by the Federal Tax Service.

The property tax return for 2020 for legal entities is submitted within the deadline established by the Tax Code of the Russian Federation (Article 386). Submit your reports to the Federal Tax Service no later than March 30 of the year following the reporting year. There are no transfers for 2020.

IMPORTANT!

We have detailed the general rules and recommendations for filling out this fiscal reporting form in the article “Property tax return for 2020: deadlines for submission and rules for filling out.”

Deadline for filing property tax returns in 2020

The tax period for property tax is a calendar year

.

The property tax declaration is submitted at the end of each year by March 30

.

Note

: If March 30 falls on a weekend or holiday, the deadline for filing the declaration is moved to the next business day.

The property tax return for 2020 must be submitted by March 30, 2020

.

The property tax return for 2020 must be submitted by April 1, 2020

.

Fines

for late submission of reports:

- If the tax payment deadline has not arrived or the tax was paid earlier - 1,000 rubles;

- If the tax is not paid, the fine will be 5% of the amount of tax payable to the budget under this declaration for each month of delay, but not more than 30% of the amount under the declaration and not less than 1,000 rubles.

Conditions to fill out

Let's look at a clear example of filling out a property tax return for 2020. The conditions are as follows:

, TIN 7727098760, checkpoint 772701001. Located in Moscow. The company's balance sheet includes:

- A building whose address coincides with the address of the organization’s location (OKTMO code 45908000). The cadastral number of the building is 77:06:0004005:1234. The tax base for it is determined as the cadastral value (clause 2 of article 375, article 378.2 of the Tax Code of the Russian Federation). The cadastral value of the building as of January 1, 2020 was 25,000,000 rubles.

- Warehouse located outside the organization's location (OKTMO code 45906000). The tax base for it is determined as the average annual value of property (clause 1 of Article 375 of the Tax Code of the Russian Federation). The conditional room number is 77:06:0004005:5678. OKOF code - 210.00.11.10.520.

Residual value of warehouse space:

| date | Sum |

| As of 01/01/2019 | RUB 5,760,000 |

| As of 02/01/2019 | RUB 5,730,000 |

| As of 03/01/2019 | RUB 5,700,000 |

| As of 04/01/2019 | RUB 5,670,000 |

| As of 05/01/2019 | RUB 5,640,000 |

| As of 06/01/2019 | RUB 5,610,000 |

| As of 07/01/2019 | RUB 5,580,000 |

| As of 08/01/2019 | RUB 5,550,000 |

| As of 09/01/2019 | RUB 5,520,000 |

| As of 10/01/2019 | RUB 5,490,000 |

| As of 11/01/2019 | RUB 5,460,000 |

| As of 12/01/2019 | RUB 5,430,000 |

| As of 12/31/2019 | RUB 5,400,000 |

In relation to real estate, VESNA LLC does not have benefits established by the Tax Code of the Russian Federation and regional legislation.

Property tax rates are:

- 1.6% (conditionally) - for the building (clause 1.1 of Article 380 of the Tax Code of the Russian Federation);

- 2.2% (conditionally) - for the rest of taxable property (clause 1 of Article 380 of the Tax Code of the Russian Federation).

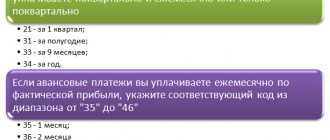

The amount of advance payments calculated by the organization for the reporting periods of 2020 is equal to:

- in relation to the building - 300,000 rubles. (RUB 100,000 + RUB 100,000 + RUB 100,000);

- in relation to a warehouse - 93,556 rubles. (RUB 31,433 + RUB 31,185 + RUB 30,938).

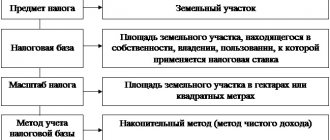

Property tax rates

Property tax rates are “tied” by legislators to the method of determining the tax base. Currently, there are two such methods: by inventory value and by cadastral value of property. Now there is a gradual transition to the method of calculation based on cadastral value throughout Russia. And from 2020, cadastral valuation results will be used everywhere for tax purposes.

The rate and base for calculating property tax are established by legislative acts of local authorities based on the rates determined by the Tax Code. What property tax rate applies in a particular area can be found in the section “Reference information on rates and benefits for property taxes” on the official website of the Federal Tax Service of Russia.

The rates for the “cadastral base” depend on the type of property, and if the real estate tax is determined by the inventory value, then the rates are determined by the value of the inventory value. Thus, the rates applied when using the cadastral value of property as the tax base can be divided into general and special.

- Special rates - 0.1% and 2% apply to real estate directly named in paragraph 406 of Article of the Tax Code of the Russian Federation.

- 0.1% is used for housing, small country houses (up to 50 sq. m), etc., as well as for garages and parking spaces. The size of this rate can be changed by local authorities: reduced to zero or increased by no more than three times (clause 3 of Article 406 of the Tax Code of the Russian Federation).

- For real estate with a cadastral value of more than 300 million rubles. 2% rate applies. The same applies to objects legally included in a special list. In particular, these are shopping centers and complexes, administrative and business, office, retail facilities, etc. For other facilities that do not relate to any of the above, a rate of 0.5% is applied.

The limits of the base rates for calculating tax on the inventory value of an object are specified in paragraph 4 of Article 406 of the Tax Code of the Russian Federation. Their value is determined by the indicator obtained by multiplying the total inventory value by the deflator coefficient.

| The total inventory value of the property, multiplied by the deflator coefficient | Amount of the bet (clause 4 of Article 406 of the Tax Code of the Russian Federation) |

| Less than or equal to 300 thousand rubles. | Up to 0.1% |

| From 300 thousand rubles. 500 thousand rubles each. | Over 0.1 to 0.3% |

| More than 500 thousand rubles. | Over 0.3 at 2% |

You do not need to calculate the tax yourself. Tax office employees will do this and send a notification about the amount of tax due. You can find out the tax amount for your property in advance on the Federal Tax Service website. To do this, you need to select the type of tax (on property of individuals), the year and your region in the calculator form. Next, you need to enter the cadastral number of the property.

If you want to understand the tax calculation procedure yourself in order to check the accuracy of the calculation by the tax authority, read on.

Calculation of property tax based on cadastral value

Calculation of property tax for individuals based on cadastral value has been used relatively recently, since 2020. Gradually, all regions of Russia are switching to determining taxes in this way. This transition will be completed completely by 2020.

The basis for calculating the tax is the cadastral value of the property. The cadastral value, unlike the inventory value, is as close as possible to the market level. Therefore, the tax amount calculated is now higher compared to previous years.

In order not to sharply increase the tax burden when switching to a new calculation method, legislators have provided for a transition period. For three years, the tax is calculated taking into account the reduction coefficient established by paragraph 8 of Article 408 of the Tax Code of the Russian Federation. For the first year the indicator is 0.2, for the second - 0.4, for the third - 0.6. From the fourth year the coefficient is not used.

Before applying this coefficient, you need to make sure that the full tax base based on cadastral value is greater than the base determined in the old way - based on inventory value. Otherwise, the tax is calculated without applying the transitional rules.

The formula for calculating property tax for individuals is described in paragraph 8 of Article 408 of the Tax Code of the Russian Federation. To determine the amount of tax payable, you need to multiply the difference in taxes determined by cadastral and inventory values by a reducing factor. To the resulting figure, add the amount of tax calculated based on the inventory value.

In addition, clause 8.1 of Article 408 of the Tax Code of the Russian Federation establishes an additional condition, starting with the calculation for the third year of the transition period. First, you need to multiply the tax amount for last year, calculated without taking into account coefficients, by a coefficient of 1.1. Compare the resulting number with the tax for the current year, also without taking into account coefficients. If the first indicator is less than the second, then the current tax is set equal to the estimated tax amount based on the previous year’s indicator.

Data on the cadastral value of an object can be obtained by submitting a request for an extract from the Unified State Register on the cadastral value of the object. The request can be sent to the territorial body of Rosreestr, or you can use the services of the MFC. In addition, this information can be found on the Rosreestr website.

When calculating tax on certain types of property, the tax authority is obliged to take into account the deductions provided for in paragraphs 3 to 5 of Article 403 of the Tax Code of the Russian Federation. Namely:

- cadastral value 20 sq. m of total area is deducted from the cost of the apartment;

- cadastral value of 10 sq. m is deducted from the cost of the room;

- for the cadastral value of 50 sq. m, the cost of a residential building decreases;

- and finally, the cadastral value of a single real estate complex, which includes at least one residential premises, is reduced by 1 million rubles.

Deductions are taken into account for each object. In other words, if a citizen is the owner of two apartments and three houses, the cadastral value when calculating the tax will be reduced by a deduction for each house and for each apartment. If the deduction is greater than the cadastral value, the tax base will be zero. Accordingly, the tax will also be zero.

Let's look at an example of how to calculate property tax for individuals based on cadastral value.

Example 1 . Pugovkina Victoria Fedorovna is the owner of an apartment in the center of Gelendzhik. Apartment area 50 sq. m. In the Krasnodar Territory, the calculation of property tax based on cadastral value has been applied since 2020. The cadastral value of the apartment is 3.5 million rubles. The inventory value of the apartment according to the BTI was 300 thousand rubles. Victoria Fedorovna does not belong to any category of beneficiaries.

Let's calculate the apartment tax for 2020. First, let's determine the amount of tax deduction. For an apartment it amounts to a cadastral value of 20 square meters. m. Having divided 3.5 million rubles. for an apartment area of 50 sq. m we get the cadastral value of one meter - 70 thousand rubles. Accordingly, the amount of the deduction will be equal to 1.4 million rubles. (70 thousand rubles multiplied by 20 sq. m)

Having applied the deduction, we obtain a tax base equal to 2.1 million rubles. Next, we calculate the tax according to the formula of the Tax Code. (2.1 million rubles * 0.1% – 300 thousand rubles * 0.1%) * 0.2 + 300 thousand rubles * 0.1% = 660 rub. Victoria Fedorovna will have to pay real estate tax to the budget for 2020 in the amount of 660 rubles.