Fiscal reporting form

The tax form, mandatory for all payers of the Unified Agricultural Tax, is established by Order of the Federal Tax Service of Russia dated July 28, 2014 No. ММВ-7-3/ [email protected] The report has a standardized code - KND 1151059. The latest changes to the form were introduced back in 2020.

IMPORTANT!

It is unacceptable to use other forms or outdated forms to submit reports. Before sending the declaration, be sure to check the relevance of the document. Otherwise, the Federal Tax Service will not accept the reports and will impose penalties.

Who reports

All categories of single agricultural tax payers are required to submit a reporting declaration to the Federal Tax Service. These include commodity producers of agricultural products, not only organizations, but also individual entrepreneurs and entities that provide services in the field of crop and livestock production for agricultural producers.

Please note that in accordance with clause 2.1 of Art. 346.2 of the Tax Code of the Russian Federation, fishing organizations and merchants who fish aquatic biological resources are also recognized as payers of the Unified Agricultural Tax.

Firms that carry out only primary or secondary processing of agricultural products are not entitled to apply the Unified Agricultural Tax. Also, budgetary organizations, manufacturers of excisable goods and participants in the gambling business do not have the right to switch to agricultural tax.

The procedure for transition to a single agricultural tax

You can switch to this system at the time of registration of an individual entrepreneur or when opening an LLC by submitting a corresponding application to the tax office, or from the beginning of the calendar year. In the latter case, notification of the application of the Unified Agricultural Tax must be sent no later than December 31 of the year preceding the year in which this regime began to be applied.

In addition, enterprises and individual entrepreneurs that have recently registered with the Federal Tax Service retain the right to switch to a single agricultural tax for another thirty days from the date of their registration. In this case, the date of registration indicated in the certificate from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs will be considered the beginning of activity at the Unified Agricultural Tax.

You might be interested in:

Fixed payments for individual entrepreneurs in 2020 for themselves: size, terms and payment procedure

Companies submit applications for transfer at their location, and individual entrepreneurs at their place of registration. This decision is made by taxpayers independently, by comparing the profitability of taxation systems.

If a transition is made from another regime, then the application must indicate the share of proceeds from the sale of agricultural products. It is determined based on the enterprise’s performance data in the previous year.

It is important to remember that in order to apply the Unified Agricultural Tax, the entity must notify the Federal Tax Service about the start of using the regime with a single agricultural tax. If he does not do this, the relevant authorities will not recognize his right to this system, and it will be considered that the enterprise or individual entrepreneur is operating under the same regime.

Attention! To switch to agricultural tax, you must submit an application on Form 26.1-1 within the established time frame. Having decided to use the unified agricultural tax, it must be applied before the end of the year. It will not be possible to leave on your own if the criteria are met before the end of the year.

We specify the deadlines for delivery

The reporting period for the Unified Agricultural Tax is a calendar year. Consequently, all payers are required to report to the Federal Tax Service on the results of the reporting year.

The deadline for submitting the report is no later than March 31 of the year following the reporting year. For example, the Unified Agricultural Tax return for 2020 is due by March 31, 2019. If the delivery day falls on a weekend or holiday, the deadline will be postponed. In this case, you should report on the first working day.

IMPORTANT!

If an entrepreneur or organization has ceased activities subject to the Unified Agricultural Tax, then they will have to report to the inspection much earlier. The deadline for filing declaration 1151059 is until the 25th day of the month following the month in which the type of activity was terminated.

Eskhn in 2020 changes latest news

Unified Tax Code in 2020: changes concern property tax, and from 2019. agricultural producers will become VAT payers. The article contains important details, forms, samples and reference books.

To make things easier, we recommend using the following links:

For other documents that will help you in your work, see the end of the article, and you can also download them.

You can now report on the Unified Agricultural Tax online. To prepare, check and submit a declaration, simply click on the button below:

Prepare an Unified Agricultural Tax declaration

Until relatively recently, the single agricultural tax as a special tax regime was not popular. But the sanctions imposed on Russia led to the growth of enterprises engaged in the production of agricultural products. Therefore, the unified agricultural tax in 2020 is of interest to both legislators and entrepreneurs.

In the article, we will look at the main features of the Unified Agricultural Tax 2020, determine the list of organizations that have the authority to practice this regime, see what rates and tables are available for the Unified Agricultural Tax in 2020, and also touch upon many other important issues.

Unified agricultural tax in 2020: features

The Unified Agricultural Tax system positions the taxation system used in the activities of companies operating in the field of agriculture. The main task of the regime is to ease the tax burden, because Agriculture is a type of business associated with sufficient risk, due to factors beyond the control of the entrepreneur.

A special feature of the Unified Agricultural Tax 2020 is that agricultural producers pay only one tax. Table 1 presents a list of taxes that are replaced by the Unified Agricultural Tax regime.

Table 1.

Unified agricultural tax in 2020

| Type of tax | annotation |

| Income tax (for organizations) | with the exception of collection on income from dividends and a number of other transactions |

| Property tax | in terms of property operated for agricultural purposes |

| VAT | until the end of 2020 |

| Personal income tax (for individual entrepreneurs) | in relation to activities subject to the Unified Agricultural Tax |

The advantages of using this tax regime include:

- exemption from payment of a number of taxes;

- simplified accounting system;

- simple and voluntary transition.

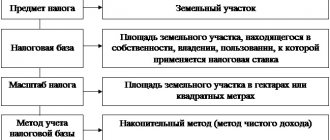

The tax rate is measured at six percent of the difference between profits and costs. In this case, income is taken into account on the day of receipt, and expenses are taken into account after actual payment. There are no restrictions on the limit on income received for the year in this taxation system.

To calculate the tax, you need to sum up the income and expenditure parts as a cumulative total from the beginning of the year, find their difference and multiply the resulting total by a rate of 6%.

Unified agricultural tax can only be combined with the patent taxation system and UTII. Combination with other tax regimes is impossible: you must either be a payer of the unified agricultural tax, or completely switch to the taxation system in its general form.

Eskhn 2020: who can apply

Payers of the Unified Agricultural Tax can be legal entities that meet the following requirements:

- Agricultural enterprises that produce, process and sell their own products.

- Village- and city-forming Russian fishing companies, the number of employees in which is half or more of the total number of people living in the settlement.

- Companies and individual entrepreneurs engaged in fishing using their own vessels or working under a charter agreement and not related to settlements and towns.

- Organizations providing services to agricultural producers, which include services for:

- preparation of fields, their cultivation;

- growing and caring for agricultural crops;

- care and maintenance of farm animals, etc.

According to the law, the following companies cannot count on the application of the unified agricultural tax in 2020:

- Producing excisable goods.

- Belonging to the category of budgetary, state-owned and autonomous institutions.

- Having less than 70% of income coming from specialized activities.

- Fishing enterprises, the average staffing level of which during the tax period exceeded 300 people.

In addition, persons who did not promptly submit an application for the transition to this taxation regime will not be able to continue working for the Unified Agricultural Tax. Also, in order to operate on the unified agricultural tax in 2020, it is necessary to produce agricultural products, and not just process them.

Unified agricultural tax in 2020: how to switch

The transition of companies associated with the production of agricultural products to a single agricultural tax in 2020 is the right of every entrepreneur, and not his responsibility.

You can safely work on a general or simplified taxation system.

But if the company meets all the requirements for the transition, then it is better to do so: after all, the tax rate is only 6% of the tax base.

There are certain deadlines for the transition to the Unified Agricultural Tax:

- at any time of the year within thirty days after entry into the state register - for a newly created company;

- from the beginning of the next year if you are already carrying out activities under a different tax regime - in this case, you must inform about your decision by December 31 of the previous year.

A unified form is used as an application, in which you must indicate:

- registration data and deadline for transition to Unified Agricultural Tax – from the beginning of next year or from the date of state registration;

- share of income from the sale of agricultural products of own production - for companies already operating.

Please see the completed sample notification in the window below, you can download it:

The completed document must be submitted to the tax service at the place of registration of the individual entrepreneur or the legal address of the legal entity. You will need two copies, the second of which, with the tax service visa, must be kept.

If a company decides to refuse to pay the unified agricultural tax in 2020, then this must be done before January 15 of the next year. You can return to this tax regime only after exactly one year of conducting business under a different taxation system.

In addition, a company may lose the right to apply the Unified Agricultural Tax if, at the end of the year, it no longer meets the necessary conditions. In this case, the taxpayer must himself report this fact to the tax service and inform about the transition to another tax regime within fifteen days after the end of the tax period.

Eskhn in 2020: changes

2017 and 2020 became significant years for the unified agricultural tax. Thus, the Unified Agricultural Tax in 2020 underwent changes in terms of payment of property tax and VAT:

- from 2020, payers of the Unified Agricultural Tax must pay property tax, subject to certain restrictions;

- from 2020 they will lose their VAT exemption.

Until the beginning of 2020, Unified Agricultural Tax payers were completely exempt from paying property tax, except for individual entrepreneurs, for whom the privilege extended only to property used for business purposes.

From 2020, all payers of the single agricultural tax receive the right to exemption from property tax, but only in relation to the property that was used in business activities related to:

- production of agricultural products;

- primary and industrial processing of these products;

- sales of produced agricultural products;

- providing services to producers of agricultural goods.

As for VAT, until 2020, companies that used the Unified Agricultural Tax were exempt from paying this tax. “Input” VAT was taken into account in expenses and was not subject to the right to tax deduction.

When issuing an invoice to a counterparty with allocated VAT, the company that applied the unified agricultural tax had to transfer it to the budget no later than the 25th day of the month following the quarter in which the document was issued.

Even if payment for services performed or goods received has not been received, the Unified Agricultural Tax payer must pay the budget.

In addition, the Unified Agricultural Tax payer must submit a VAT return to the tax service.

Invoices can only be issued by companies that pay the Unified Agricultural Tax and are:

- intermediary;

- trustee;

- member of a simple partnership.

From January 2020, companies that used the unified agricultural tax will pay VAT if they do not take advantage of the prerogative to be exempt from paying this tax. For Unified Agricultural Tax payers in 2020, changes will affect Art. 145 of the Tax Code of the Russian Federation, which will be amended regarding VAT exemption.

Important!

The VAT exemption benefit is not always beneficial: often counterparties who are VAT payers do not want to cooperate with companies that are not VAT payers.

And if the payer of the Unified National Tax Service has exercised the right to be exempt from VAT, then he will not be able to change anything in the future.

The only option would be a violation of the requirements for applying the Unified Agricultural Tax regime and the resulting loss of this right. In this case, the taxpayer returns to the general tax regime.

Taking into account the changes being made, 2020 can be called a transitional year for Unified Agricultural Tax payers. During this period, they can decide for themselves whether to take advantage of the right to the benefit or not.

In the second case, you will have to study the entire regulatory framework relating to maintaining tax registers for VAT, learn how to issue invoices and keep books of purchases and sales.

The work also includes filling out a VAT return and monitoring the payment of tax to the state treasury.

Eskhn in 2020: rates, table

From 2020, Federal Law No. 51-FZ of 03/07/2018 comes into force, according to which the constituent entities of the Russian Federation will be able to set their own tax rates for the unified agricultural tax.

Locally, the constituent entities of the Russian Federation will have to develop a law for payers of the Unified Agricultural Tax in 2020 on rates and develop the corresponding tables.

Thus, depending on various factors for different categories of taxpayers, it will be possible to set a rate from 0 to 6%. These factors include:

- Type of agricultural products produced and list of services provided.

- The amount of profit from the sale of manufactured agricultural products, which also includes primary processed products from agricultural raw materials of own production.

- Place of business activity.

- Average staffing level.

Reporting, payment, fines

For the Unified Agricultural Tax, the tax period is a calendar year, and the reporting period is a half-year. Tax payment deadlines are presented in Table 2.

Table 2.

Payment dates for the unified agricultural tax in 2020

| Type of tax | Term |

| Advance payment | Until July 25 |

| Total amount | Until March 31 next year |

Data on the unified agricultural tax must be declared once a year until March 31 of the year following the reporting year. In this case, you need to visit the tax office at your place of residence or place of registration of the company.

If an entrepreneur decides to terminate his activities, he must submit a declaration based on the results of his work no later than the 25th day of the month following the month of termination.

See the window below for the current declaration form, you can download it:

The declaration form is established and consists of a title page and three sections:

- In the first, you must indicate the amount of the transferred advance and the final tax to be transferred or reduced.

- The second section is devoted directly to the calculation of tax, indicating the amount of financial losses for previous periods (for this, subsection 2.1. is completed).

- The third section is necessary to reflect the targeted use of property received through charity, targeted receipt or financing. Filled out only upon receipt of such property or financial resources in the reporting period.

A current example of filling out a declaration is presented in the window below, it can be downloaded.

In addition to the declaration, individual entrepreneurs who are in this tax regime must keep a book of expenses and income.

Organizations are exempt from maintaining this document: they reflect all transactions in accounting registers.

Despite the benefits provided and the filing of a tax return only once a year, this tax regime is considered difficult to manage, as it requires specialized programs to correctly account for expenses. Therefore, you need to think about it several times and decide for yourself whether this system will be beneficial.

If the declaration is not submitted on time, the organization may be subject to penalties ranging from five to thirty percent of the tax amount for each partial or full month of delay. The smallest amount of such a fine is one thousand rubles.

Evasion of tax transfers to the state treasury also has its sanctions: in this case, the fine will be twenty to forty percent of the amount of the non-transferred payment.

Useful documents

The following documents, which can be downloaded for free, will help you report and make payments under the Unified Agricultural Tax on a timely basis:

Source: https://www.BuhSoft.ru/article/1510-eshn-godu-izmeneniya

Report submission methods

Report to the Federal Tax Service in one of three ways:

- Personal inspection visit. The report is submitted on paper. The declaration is submitted by the manager or an authorized representative. Be sure to take 2 copies of the report with you (one will remain with the Federal Tax Service, and the second, with the controller’s mark, will be kept in the organization). Also take a passport, power of attorney and other documents certifying the applicant’s authority.

- Sending information by mail. The declaration form is sent to the Federal Tax Service by post. When sending by mail, the sending option is important: use a registered letter with a list of attachments. Of course, it is not prohibited to send reports by simple letter. But the taxpayer will not have any confirmation of the fact of sending. And the inventory of investments is documentary evidence; it can be used when resolving disputes with the inspectorate.

- Electronic reporting. It is possible to submit a declaration report via the Internet: through the taxpayer’s personal account or via secure communication channels. The declaration is generated electronically. The report is certified with an enhanced digital signature. Be sure to receive confirmation from the Federal Tax Service that the report has been accepted.

They fill out the reporting document using specialized accounting programs or use Internet resources. But some services and programs charge fees for providing services.

Design rules

Fill out the declaration form taking into account the standard rules for preparing fiscal reporting. Let us recall the main recommendations:

- Double-sided printing and binding pages together is prohibited;

- corrections are unacceptable, corrector cannot be used;

- text values are entered in capital block letters;

- if there is no data, put a dash;

- filling out fields and lines starts from the first left cell;

- numerical indicators are indicated in full rubles, taking into account rounding.

IMPORTANT!

Information on accrued and paid amounts of fines and penalties under the Unified Agricultural Tax is not reflected in the declaration. These amounts do not apply to tax calculations.

Instructions for filling

Detailed instructions for drawing up the Unified Agricultural Tax declaration were approved by Order of the Federal Tax Service of Russia dated July 28, 2014 No. ММВ-7-3/ [email protected]

Title page

INN and KPP: we register taxpayer codes. If the report is prepared by an individual entrepreneur, then do not fill out the checkpoint code, but put dashes.

Tax period: enter code “34” if you are submitting a report for a full calendar year. If the activity subject to the Unified Agricultural Tax has been discontinued, then enter code “96”. When switching to another taxation system - code “95”.

Reporting year: enter the year for which you are reporting.

Federal Tax Service code: enter the four-digit code of the receiving inspection.

Taxpayer codes by place of registration:

- 120 - the declaration for peasant farms and individual entrepreneurs is indicated;

- 214 - for Russian organizations;

- 213 - for the largest taxpayers;

- 331 - for foreign companies.

Next, indicate the full name of the taxpayer or full name. entrepreneur. Enter the OKVED code. Enter your phone number.

Fill out information about the person who signed the report only for the organization. Individual entrepreneurs put dashes in the corresponding section of the title page.

Section No. 1

Lines 001 and 003 are OKTMO codes that identify the municipalities in which taxpayers are registered.

In line 002 we indicate the amount of the advance for the first half of the year.

Line 004 is the amount of tax to be transferred to the budget.

Line 005 is filled in only if the advance payment exceeds the amount of the annual tax.

Section No. 2

We calculate the tax payable to the budget. We indicate in the appropriate lines of the form:

- income received by the taxpayer;

- the amount of costs incurred in the reporting period;

- tax base (the difference between income and expenses);

- the amount of losses that were received in previous periods;

- tax rate applicable in the region;

- calculated tax amount.

Section No. 2.1

Fill out this section only if the taxpayer incurred losses. The company has the right to take losses into account when calculating the tax base for 10 years. The 2020 loss can be taken into account up to and including 2029.

Section No. 3

Disclose information about the targeted funding received during the reporting period. If the taxpayer did not receive targeted property, charitable contributions, grants or other targeted investments, then section No. 3 does not need to be filled out.

Now check the report, sign and indicate the date of preparation.

What are the deadlines for paying the Unified Agricultural Tax for 2019 and is there any liability for their violation?

Business entities pay the unified agricultural tax twice a year:

- at the end of the first half of the year, an advance tax payment is made; the deadline for its payment is July 25;

- at the end of the year, the amount of tax calculated for payment is transferred minus the advance payment already paid; Here you need to make the transfer before March 31st.

Transferring the advance payment and the tax itself later than the deadlines established by law is fraught with the imposition of sanctions by regulatory authorities. Sanctions are expressed in the form of penalties under Art. 75 of the Tax Code of the Russian Federation. If the tax authorities identify non-payment or incomplete payment of tax at the end of the tax period during an audit, this may already result in a fine calculated in the amount of 20 or 40% of the amount of tax not transferred on time (Article 122 of the Tax Code of the Russian Federation). In addition, it is possible to face administrative and, in some cases, criminal liability.