The Tax Code empowers regional legislative authorities to establish regional taxes, while at the same time limiting their list in order to avoid overburdening taxpayers.

The taxation system of the Russian Federation is built in a certain way and consists of a number of levels:

- Federal;

- Regional;

- Local.

This level system made it possible to assign certain tax deductions to a specific budget (local, republican, federal).

Regional taxes are taxes, the establishment of which is provided for by the Tax Code of the Russian Federation and which are put into effect when one or another federal subject adopts the relevant law.

These taxes are subject to mandatory payment only on the territory of the relevant federal subjects.

The system of regional taxes includes taxes whose effect by tax legislation extends to the entire Russian territory, as well as those established by the laws of individual subjects of the federation. Payment of both is mandatory on the territory of these respective subjects by persons recognized by law as taxpayers.

The Federal Tax Code, Article 14, provides for only three taxes that subjects of the Russian Federation have the right to introduce on their territory. Regional taxes include:

- on property collected from organizations;

- for gambling business;

- transport.

Composition of regional taxes

As noted above, regional taxes include:

- taxes that apply to the entire territory of the Russian Federation in accordance with federal laws on taxes and fees, as well as the Tax Code of the Russian Federation;

- taxes established by the legislative bodies of independent constituent entities of the Russian Federation, which are valid only on the territory of the corresponding constituent entity.

Until the modern Russian Tax Code was put into effect, the domestic tax system was characterized by the division of regional taxes into:

- mandatory;

- optional.

The essence of such a division was the possibility of limited application in regions (regions) of taxes separately established on the territory of the country. Local government authorities were empowered to impose taxes of regional significance in those quantities that they considered necessary independently without any restrictions. Some subjects of the federation, due to the exercise of such powers by the authorities, were overloaded with taxation to the maximum.

The current Tax Code of the Russian Federation was intended to limit the tax burden and bring the taxation system throughout the country into a single state. It was he who established an exhaustive (closed) list of regional taxes that have the right to be introduced in individual regions by local laws, thereby reducing the unaffordable tax burden on taxpayers.

From now on, it is prohibited to establish additional regional taxes that are not included in the Tax Code of the Russian Federation, which has a beneficial effect primarily for business entities - legal entities.

Main characteristics and differences

So, all fiscal payments can be divided into three types: federal, regional and local taxes and fees. The key difference between these payments is the level of government that sets the basic rules and regulations for applying taxation. That is, if the authority to determine the rate, benefit, period and principles is transferred to the authorities of the constituent entity of Russia, then the payment is considered regional.

However, it should be noted that fiscal payments are regulated in the Tax Code of the Russian Federation. That is, the Tax Code of the Russian Federation is the legal basis of the current tax system of the state. This means that municipal authorities, as well as the authorities of a constituent entity of Russia, do not have the right to introduce additional (new) obligations. Their powers include specifying the taxation procedure for existing fiscal levies.

The second difference is the level of the budget (treasury) into which the payment is credited. Thus, taxes and fees by budget level are:

- federal - credited directly to the treasury of the Federation (first level);

- regional - entering the treasury of the subject (second);

- local - transferred to the municipal budget (third).

The third difference is the territorial feature, that is, the territory in which the basic principles of taxation apply. Not the obligation itself, but precisely the procedure for its application.

Thus, obligations of the first rank apply throughout the entire state. The principles, rules and norms enshrined in the Tax Code of the Russian Federation are uniform for implementation throughout Russia.

Features of second-rank encumbrances are established for a specific region. For example, the authorities of one region introduce regional tax breaks, reduce rates, approve reporting periods and advance payments that are mandatory for residents of this region. Consequently, other norms may be adopted in another subject.

It is important to know: What is the object of indirect taxation

For fees of the third, local, rank, the algorithm and features of taxation are valid only on the territory of the municipality. Consequently, unlike local taxes, federal taxes and the procedure for their application cannot be changed at the municipal or regional levels. Below is a closed list of federal, regional and local taxes.

Elements of regional taxes

Regional taxes are recognized as a set of taxes established throughout the territory of the Russian Federation by its laws and the Tax Code in particular, as well as on the scale of a single region, but taking into account the provisions of the current federal tax legislation.

Both levels of taxes include separate, narrower classifications; in particular, for regional taxes, the classification is represented by a list of taxes that can be established within a subject by its bodies:

- property tax;

- gambling tax;

- transport tax.

An analysis of existing regional taxes shows that for the most part, the taxpayers are legal entities - organizations engaged in economic activities, and in rare cases individuals.

Gambling tax

In the legislation of the Russian Federation, gambling business is usually understood as activities that are aimed at generating income from various types of gambling, as well as betting. This includes organizing the operation of casinos, slot machine halls, and accepting bets on the results of sports competitions.

In 2009, norms appeared in the legislation of the Russian Federation according to which it became possible to conduct gambling only in the territory of special gambling zones, namely in the Altai and Krasnodar territories, Primorye, and also in the Kaliningrad region. Residents of these constituent entities of the Russian Federation began to pay the corresponding regional taxes in full. The year 2014 was characterized by fairly high activity of legislators in some areas of tax policy, however, in terms of changing the structure of regional fees, the authorities did not establish significant innovations.

Gambling tax is paid by the 20th day of the month following the established tax period. The company also needs to provide declarations for this type of collection. These documents, as well as others of a similar type, must reflect indicators for the tax period.

Characteristics of regional taxes

The characteristics of regional taxes depend on a particular tax introduced in the region. In general, each of the types allowed for introduction within the region is characterized by the following:

1. For the property tax of a legal entity, it occupies the most significant layer in the regional taxation system. On average, regional budget revenue is generated by paying this tax by 6% or more.

Taxpayers are legal entities on whose balance sheets there is property that, according to tax legislation, is regarded as an object of taxation.

The objects in this case are movable and immovable property for domestic legal entities, which, according to accounting, are accounted for as fixed assets of the organization.

For foreign legal entities engaged in economic activities in Russia through representative offices, the object is recognized as movable and immovable property, which is also fixed assets according to financial statements, as well as property received under a concession agreement.

If a foreign enterprise does not carry out its activities through representative offices in the Russian Federation, then the object is real estate in Russia, which is the property of this organization, as well as property received under a concession agreement.

2. For the tax on gambling business, taxpayers are legal entities or individual entrepreneurs whose business activities are related to generating income in the field of gambling business by charging fees for gambling, betting, etc.

The objects of taxation are tables, machines recognized as gaming, as well as betting or bookmaker's office cash desks.

In this case, the registration period is 2 or more days before the day of installation (opening of an office or betting shop) for each individual unit.

To register, the taxpayer must submit an application, after which a certificate of the appropriate uniform form is issued.

3. Transport tax is regional, with characteristic features.

Thus, the object of taxation:

- motor vehicles;

- motorcycles;

- scooters and others, including watercraft and aircraft that have been registered on the territory of the Russian Federation in the manner prescribed by its legislation.

Taxpayers are individuals in whose name the specified objects are registered. This category of regional taxes contains a fairly large list of persons who are granted benefits for paying this tax.

Categories of regional taxes and fees

In Russia, only 3 types of regional taxes are relevant:

- Organizational property tax for legal entities;

- Gambling tax for legal entities;

- Transport tax for all economic market participants. Here you will learn how to prepare a tax return for transport tax.

The range of regional fees is one position higher than local ones and has a very small list; this specificity is due to several significant factors.

Organizational property tax

This type is regulated by Article 373 of the Tax Code of the Russian Federation and is mandatory for all organizations with property in accordance with Art. 374 Tax Code of the Russian Federation.

Tax Code of the Russian Federation Article 373. Taxpayers

1. Taxpayers (hereinafter referred to as taxpayers in this chapter) are organizations that have property recognized as an object of taxation in accordance with Article 374 of this Code. 1.2. FIFA (Federation Internationale de Football Association) and FIFA subsidiaries specified in the Federal Law “On the preparation and holding in the Russian Federation of the 2018 FIFA World Cup, the 2020 FIFA Confederations Cup and amendments to certain legislative acts of the Russian Federation are not recognized as taxpayers. " Confederations, national football associations (including the Russian Football Union), the Organizing Committee “Russia 2018”, subsidiaries of the Organizing Committee “Russia 2018”, producers of FIFA media information, suppliers of FIFA goods (works, services) specified in Federal Law “On the preparation and holding in the Russian Federation of the 2020 FIFA World Cup, the 2020 FIFA Confederations Cup and amendments to certain legislative acts of the Russian Federation”, in relation to property used by them only for the purpose of carrying out activities provided for by the said Federal Law . 2. The activities of a foreign organization are recognized as leading to the formation of a permanent representative office in the Russian Federation in accordance with Article 306 of this Code, unless otherwise provided by international treaties of the Russian Federation.

Based on the list given in the last article, it turns out that companies are required to use as a taxable base all their property, which acts as a fixed asset.

This type, in particular: rate, period, tax base, payment procedure are regulated by regulatory documents of regional authorities.

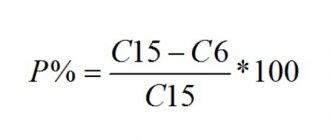

The base for this tax is the residual value of fixed assets for the last calculation period available in the balance sheet. The payer is obliged to calculate the size of the base independently, guided by the requirements of the Tax Code of the Russian Federation.

Important: if the payer’s property is located in another region, then to deduct the amount of tax it is necessary to use the regulations established by this subject.

It should be noted that the property tax for individuals fills the local budget, unlike the property tax.

Gambling tax

According to Article 366 of the Tax Code of the Russian Federation, the object of taxation in this case can be gambling tables, slot machines, bookmakers, processing centers, while the opening of such an establishment must be submitted to the Federal Tax Service 2 days before installation.

Most of this business in the Russian Federation is concentrated in certain regions, such as Altai, Krasnodar, Kaliningrad, however, there are small establishments in other districts.

When liquidating such a business, the tax authority must also be notified 2 days before the event.

Regions have the right to independently regulate the payment obligations of participants in this process, however, if one of them does not provide for special rates for gambling business, then the minimum amount provided for by the legislative acts of the Russian Federation is used.

Transport tax

It is the third legally established regional tax, but it has a significant feature - not only enterprises, but also citizens who own a vehicle are required to pay it.

Main categories of regional taxes.

At the same time, the tax payment procedure is different for these two categories of payers:

- Organizations are required to independently deduct the amount of the fee;

- This is done for individuals by tax officials based on data received from the institutions registering vehicles.

In this case, the owner must own the vehicle specified in Art. 358 Tax Code of the Russian Federation. Also in the same article there is a list of vehicles that cannot be taxed.

Tax Code of the Russian Federation Article 358. Object of taxation

1. The objects of taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) ) and other water and air vehicles (hereinafter in this chapter - vehicles) registered in the prescribed manner in accordance with the legislation of the Russian Federation.

2. The following are not subject to taxation: 1) rowing boats, as well as motor boats with an engine power of no more than 5 horsepower; 2) passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received (purchased) through social welfare authorities in the manner prescribed by law; 3) fishing sea and river vessels; 4) passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations and individual entrepreneurs whose main activity is passenger and (or) cargo transportation; 5) tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance), registered to agricultural producers and used in agricultural work for the production of agricultural products ; 6) vehicles owned by the right of operational management to federal executive authorities and federal state bodies in which the legislation of the Russian Federation provides for military and (or) equivalent service; 7) vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by the authorized body; airplanes and helicopters of air ambulance and medical services; 9) ships registered in the Russian International Register of Ships; 10) offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships.

Functions of regional taxes

Regional taxes are funds paid by legal entities to the regional budget, which allows the subsequent subject of the federation, represented by its governing body, to use these deductions to perform a number of functions:

- accumulation and use of funds received by the regional budget to achieve regional goals;

- the exercise by regional authorities of their representative and administrative powers;

- self-sufficiency in the implementation of programs of social significance developed and operating within the territory of the region (region);

- development of the region's infrastructure;

- maintaining the environment and natural resources, since they are the natural basis for the existence, development and prosperity of the region.

stimulating business activity, carrying out structural reforms that will make the region (region) more attractive in terms of investment, which will subsequently have a positive impact on the future well-being of the regional budgetary and tax sphere.

The importance of regional taxes

The importance of regional taxes in the budgets of the constituent entities of the Russian Federation is colossal. This is because modern realities entrust them with the function of a lever regulating the uninterrupted formation and replenishment of the regional budget.

The main role of regional taxes is that they are designed to materially provide and nourish the regions. These material resources are subject to redistribution and direction for the benefit and development of the region, solving primary problems and implementing socially significant programs that are not financed from the federal budget or are financed in a significantly smaller amount than necessary.

The regional government, thanks to such taxes, as well as benefits and sanctions that complement the taxation system within the region, has an impact on legal entities and their economic behavior, thereby maximally leveling the conditions for all participants in social reproduction.

What category does land tax fall into?

Update: February 2, 2020

All taxes in force on the territory of the Russian Federation are enshrined in the Tax Code. One of them is land tax. Land tax is a mandatory type of payment for everyone who owns a plot of land. Exceptions to this rule, as well as the specifics of this payment, are prescribed in Chapter 31 of the Tax Code.

In order to understand the difference between local, regional and federal taxes, and also in order to answer the question whether land tax is local, or regional, or federal, you need to consider each category separately.

Briefly about the tax system in the Russian Federation

All taxes established in the Russian Federation can be divided into local, regional and federal.

Federal taxes are tax payments that are established by the Tax Code. They must be paid throughout Russia.

Regional taxes are established by the main tax document and the laws of the constituent entities of the Russian Federation. These payments must be made on the territory of the subject of the Russian Federation that established the tax.

When establishing such taxes, the legislative bodies of state power of the constituent entities of the Russian Federation must determine (if this is not established in the Tax Code):

- tax payment procedure;

- bid;

- payment terms.

For regional taxes, all other elements, including the range of taxpayers, are determined by the Tax Code.

Representative bodies of each subject of the Russian Federation are authorized to establish the specifics of the definition:

- tax benefits;

- the procedure and grounds for applying benefits;

- tax base.

Local taxes are taxes that are established by the Tax Code and municipalities (regulatory legal acts of their representative bodies). Such taxes must be paid in the territories of these municipalities.

Municipalities are authorized to determine (if these elements are not established by the Tax Code) the tax rate, timing and procedure for its payment. Taxpayers of local taxes and other elements are established by the Tax Code.

Municipalities have the right to independently establish tax benefits, a list of reasons for their application and the procedure for obtaining them, as well as a special procedure for determining the tax base.

Land tax - what kind of tax is it?

In Art. 387 of the Tax Code states that the tax in question is established by the Tax Code and regulatory legal acts of municipalities (its representative bodies). The same documents put this payment into effect and regulate the procedure for its termination. The tax must be paid in the territories of these municipalities.

Answering the question whether land tax is a federal tax or a regional one, we can answer unequivocally: neither one nor the other. Based on the definition given above and in accordance with Article 15 of the Tax Code, land tax is a local tax.

This payment is established directly in relation to the taxpayer’s property, which serves as the basis for taxation. This means that land tax belongs to the category of taxes that are commonly called direct.

Federal Law dated October 6, 2003 N 131-FZ (as amended on July 3, 2016) includes the following as municipal entities:

- urban district;

- urban or rural settlement;

- urban district with intracity division;

- municipal district;

- intracity territory of a city of federal significance;

- inner city area.

Which budget is the land tax credited to?

The Budget Code of the Russian Federation established that land tax is credited at a rate of 100 percent to the budgets:

- urban districts;

- municipal districts;

- urban settlements;

- urban districts with intracity division;

- intracity areas;

- rural settlements.

Economic essence of land tax

The economic essence of land tax lies in forced taxation established by current legislation. The tax is paid every year and its amount depends on the area and size of the land taxation unit. This means that the payment does not depend on the owner’s income and the profitability of the site.

Also read:

glavkniga.ru

The procedure for establishing regional taxes

The introduction of regional taxes and their termination in the territories of federal subjects is carried out on the basis of the provisions of the Tax Code of the Russian Federation and the territorial laws of the subjects of the Russian Federation governing taxation issues.

Legislative bodies of state power of a federal subject, when establishing taxes for their region (region), are guided by federal tax norms concentrated in the Tax Code of the Russian Federation. They also define:

- tax rates;

- payment procedure;

- payment terms.

The remaining elements of taxation, as well as the range of taxpayers, are provided for by the Tax Code of the Russian Federation itself.

The regional legislative power, specified by the laws, taking into account the provisions of the Tax Code of the Russian Federation, can additionally provide for tax breaks (benefits) for certain categories of taxpayers, as well as the procedure and grounds for their application. From the site advokat-malov.ru

Deductions of regional taxes to local budgets

To begin with, it is useful to pay attention to Article 58 of the RF Budget Code. It states that the constituent entities of the Russian Federation have the authority to implement standards for financial contributions from federal and regional fees in favor of local budgets. At the same time, the activities of the authorities of the constituent entities may concern all types of municipalities: urban, rural settlements, districts, urban districts, etc.

It is described in detail how regional taxes and fees should fall into the local budget in Chapters 8 and 9 of the Budget Code of the Russian Federation. A scenario is also possible in which financial resources generated at the level of local budgets will, on the contrary, be transferred to higher financial systems. However, it is considered by many experts as promising. Its practical implementation depends on how the system of municipal government in the Russian Federation will develop, and how ready cities and districts will be to become sources of financial flows into the systems of distribution of monetary resources at higher levels.

Simplified taxation system - simplified tax system

The simplified taxation system - simplified taxation system - can be used by organizations and individual entrepreneurs.

The tax rate in the case of income taxation is 6%, and when choosing the object of taxation “income minus expenses” - 15%.

Taxpayers are required to keep records of transactions for the purpose of calculating the tax base for taxes in the book of income and expenses.

Taxpayers applying this tax regime are exempt from paying taxes on profits, property and VAT.

2. The following are not subject to taxation: 1) rowing boats, as well as motor boats with an engine power of no more than 5 horsepower; 2) passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received (purchased) through social welfare authorities in the manner prescribed by law; 3) fishing sea and river vessels; 4) passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations and individual entrepreneurs whose main activity is passenger and (or) cargo transportation; 5) tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance), registered to agricultural producers and used in agricultural work for the production of agricultural products ; 6) vehicles owned by the right of operational management to federal executive authorities and federal state bodies in which the legislation of the Russian Federation provides for military and (or) equivalent service; 7) vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by the authorized body; airplanes and helicopters of air ambulance and medical services; 9) ships registered in the Russian International Register of Ships; 10) offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships.

2. The following are not subject to taxation: 1) rowing boats, as well as motor boats with an engine power of no more than 5 horsepower; 2) passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received (purchased) through social welfare authorities in the manner prescribed by law; 3) fishing sea and river vessels; 4) passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations and individual entrepreneurs whose main activity is passenger and (or) cargo transportation; 5) tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance), registered to agricultural producers and used in agricultural work for the production of agricultural products ; 6) vehicles owned by the right of operational management to federal executive authorities and federal state bodies in which the legislation of the Russian Federation provides for military and (or) equivalent service; 7) vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by the authorized body; airplanes and helicopters of air ambulance and medical services; 9) ships registered in the Russian International Register of Ships; 10) offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships.