The best bank for individual entrepreneurs

Being an individual entrepreneur in Russia is not an easy burden. They press in from all sides. Either there is great competition, then every step is taxed, or checks are stifling. But this is the distinctive feature of Russian entrepreneurs: neither rain nor heat is a hindrance to them. They will break through everywhere, achieve everything. Because in our country you can’t survive otherwise. Especially if you want to be law-abiding. And if jokes aside, then in addition to self-confidence and determination mixed with good performance, it is also advisable for an individual entrepreneur to actively understand the opportunities that, at least somewhere, are still provided. So, for example, those who wave their hands at bank offers to open a current account, without trying to figure out what’s what and what benefits there are, are obviously losing to thoughtful entrepreneurs who know how to properly use what they have.

Yes, the law does not prohibit individual entrepreneurs from operating without a current account. Moreover, a significant part of small entrepreneurs do just that. There is logic in this and it is very simple. Firstly, a current account is an additional expense. After all, no one will support you for free. Secondly, this is additional reporting and some vulnerability. After all, the account can easily be blocked.

But at the same time, these are additional opportunities. At least some of your potential clients can only work with those who have an open current account. This is about the trust rating of an entrepreneur. It just so happens that those who have this account are primarily inclined to cooperate. Or the fact that cash payments in our country are limited to one hundred thousand rubles may be important. By business standards, this is an insignificant figure and it is often simply impossible to fit into it.

Well, why not just open an account for everyone? What to be afraid of? And the fact that a current account is still a certain expense. The bank opens the account. The bank manages and maintains it. Well, naturally, for a bank such services are quite a specific source of income. This is where we come to the topic of our article. After all, there are many banks. And each banking organization has its own vision of how you can make money on current accounts for entrepreneurs. Alas, some believe that there is nothing wrong with fighting for every “look” and every “breath” towards your own bank account. Hence, there can be considerable prices for opening an account, outrageous commissions for each transaction on the current account, and even more so, you need to make money on the simple desire of an individual entrepreneur to withdraw cash from this account.

So the entrepreneur, inspired by the opportunities that have opened up, is faced with the question - where, in fact, is it more profitable to open this account? Alas, the wrong choice of a banking organization can greatly undermine this inspiration, if not discourage the desire to do business altogether.

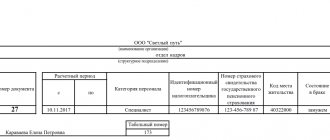

How is the current account number deciphered?

A current account for individual entrepreneurs is not just a set of numbers. This contains information about the currency, bank, client, etc. From left to right, account decoding

will look like this:

1. The first 3 digits indicate the balance account number. If an account begins with the numbers “408”, then it belongs to the “other accounts” category.

2. 4th and 5th digits – second order number. Thus, the first five digits mean that the account belongs to the “other” category and is assigned to a specific business entity.

3. The next 3 digits are the code of the currency in which transactions are performed on this account. For example, the code "810" means Russian rubles.

4. The ninth digit in the code is the control one. Therefore, the validity of the number is checked using it.

5. Numbers 10 to 13 are the code of the bank branch servicing a specific current account.

6. The last digits are the internal number of the bank client. It is installed directly by the bank branch.

Thus, decryption of the account

quite simple and logical.

Many novice businessmen are interested in the correct spelling of the current account number in the details. Here, in addition to the account number, you must indicate the details of the banking institution, the bank identification code and its correspondent account. These requirements allow you to avoid errors when making translations.

What is a convenient current account for individual entrepreneurs?

In order to understand which of the banking offers, of which there are now many, is better for an individual entrepreneur, it is worth identifying the evaluation criteria.

The current account must be:

- Convenient

- Profitable

- Customer oriented

Please note that we are talking specifically about the service. The convenience of a current account lies in modern software. If a client, that is, an entrepreneur, has to visit a bank branch every time to use a current account, then it would be hard to call it convenient. After all, we do not live in the twentieth century. Nowadays it is only possible to apply for SNILS via the Internet. And everything else - please. From running a business to ordering food and building materials to your home. Therefore, if a bank does not offer a convenient program for using an account, then it is already an inconvenient bank.

Profitability, as everyone understands, consists of the tariff points at which your account will be serviced. If you already need to shell out a third of your small income just to have an account, this is clearly an unprofitable offer for you.

Customer focus is an important indicator. Because if this is not the case, instead of a convenient and profitable service, you will get a clumsy opportunity on which you will spend a lot of time and effort. And whether it will ultimately be beneficial for you is a big question.

Customer focus can be defined by several important points:

- Communication line availability. If, when questions or difficult situations arise (they most likely will), it is difficult for you to get a banal quick consultation over the phone from a bank manager, then this is anything but customer-oriented.

- Availability of branches. If a bank has one branch for the entire city, then this is not an indicator of savings, but a banal inconvenience.

- Time of receipt. There are cases when the bank receives its own clients strictly every third Thursday of the month from twelve to two. It’s exaggerated, but the idea is clear - if it’s difficult to get an appointment with an operator on any working day, then you will have difficulties.

- Security of operations. After all, it's about money. About your money! Bank clients must be sure that when transferring from account to account, the bank will not lose your hard-earned money somewhere. It is clear that this is now a rarity, and transfers are not stagecoaches so that they can be robbed so easily, but at least high-quality and reliable encryption channels must be provided.

- Reputation. Yes, everyone knows about black marketing and that fake reviews are now common advertising tools. But if the bank is really good, positive reviews about it will greatly prevail.

Banks

Despite the fact that there are indeed a lot of proposals for opening a bank account specifically for individual entrepreneurs, we still advise you to take the time to study them. By choosing the most suitable tariff, you can greatly facilitate the continued existence of your business and save yourself a lot of nerves and money. Well, we, in turn, will try to make this task a little easier and discuss several options here.

Among the leaders in reviews of work and tariffs for opening and maintaining a current account are primarily Promsvyazbank and Tinkoff, Moscow Credit Bank. They are the ones who have the most preferences in the entrepreneurial environment. However, let us remind you that the rating is compiled overall, based on average indicators. And in each specific case of opening a current account, you need to choose individually, directly evaluating the bank’s offer. Therefore, we recommend that you familiarize yourself with the tariffs in person.

To get acquainted with reviews about the activities of banks, the article used the resource www.banki.ru. We recommend using this resource when choosing tariffs in order to imagine possible problems that you may encounter in the future.

Is it worth opening a current account?

you open an account for an LLC

is a necessity, then individual entrepreneurs have a choice. To understand whether opening an account is worth the time, you need to weigh the advantages and disadvantages. Today, an increasing number of individual entrepreneurs decide to open an account due to the following advantages:

1. Ease of making tax payments.

2. Possibility of attracting major partners.

3. Conclusion of contracts without restrictions.

4. You can use trade acquiring, which is indispensable in modern trading business.

5. By connecting to Internet banking, an entrepreneur will be able to carry out payment transactions without leaving home. In addition, he has access to business statistics, reporting, expense tables and other convenient tools.

FZ-115

When analyzing reviews from individual entrepreneurs who used the bank’s services for cash settlement activities, it was noticed that problems often arise with blocking the account and subsequent requests for documents. And if the individual entrepreneur cannot provide the full package of requested documents on time (usually several days), the bank offers to terminate the cooperation agreement and close the current account. The reason is often not explained at all. And bank employees refer to a certain federal law 115. Problems of this nature are now encountered in almost every bank. The massive scale of the matter has reached the point where clients accept with stoic calm another block with a request for documents, despite the fact that they are losing both profit and nerves because of this. Moreover, in most cases, the bank really only fulfills the requirements of state law. In the majority - because, alas, it happens that a banking organization uses Federal Law-115 for its own purposes.

So what is it? What is Federal Law-115, because of which honest entrepreneurs have become unable to breathe lately? This is the federal law “On combating the legalization (laundering) of income...”.

And apparently, the supervisory authorities are firmly committed to checking everything and everyone, since banks began to massively use this project to block accounts, without really understanding what is suspicious and what is not. You can familiarize yourself with the law (and we strongly recommend if you plan to connect your life with entrepreneurship) here: https://www.consultant.ru

We will not talk about it in detail now, because this is material for another rather large article. We just want to remind you that these days, account blocking is unfortunately a very common occurrence. And you need to be prepared for this, even if you plan to be a completely open and law-abiding entrepreneur.

Operations carried out on the current account

The decision to open an account

significantly expands the capabilities of an entrepreneur. Let's consider the main operations that can be performed on a current account:

1. Deposit money into your account. This can be done through any terminal or bank teller.

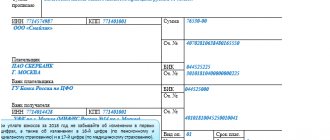

2. Transfer money. If the transfer is made to the account of a legal entity, this can be done through a payment order. This operation is performed online. In addition, the order can be submitted to the bank in paper form.

3. Withdraw money. The withdrawal conditions are determined by the specific tariff. In some cases, you can only get cash at a bank teller. Then the applicant is required to present a checkbook.

4. Pay taxes and contributions to various organizations. Just like a transfer to a legal entity, payment of taxes requires the execution of a payment order. If funds are sent to government funds, then most banks carry out such transactions without commission.

5. Payment of salaries to employees. When transferring funds to an individual, you will have to pay a certain commission. Therefore, to make monthly payments, a businessman can order a certain package of services.

6. Receiving money transfers. Using bank details, clients and partners will be able to pay for the businessman’s services. You can transfer money to your current account through acquiring terminals and bank tellers. You can also use Internet banking services.

How to open a bank account for an individual entrepreneur. Step by step instructions.

Note: there are companies that can do this for you for a certain amount. Whether to contact them or not is a matter of desire and availability of funds. But since banks benefit if you open an account with them, the procedure is simple in most cases. Therefore, you should not be afraid of paperwork.

Step-by-step instructions for individual entrepreneurs who want to open a current account.

Step 1. Understand why you need a current account. There are few main options for using it.

- If you are an entrepreneur, then using a current account you can pay for goods and services in your business.

- You will be able to accept payment for your goods via bank cards. This is perhaps the most relevant function, since most consumers have already switched from cash to cards.

- Using a current account, you can issue wages to your employees.

- Using a current account, you can quickly transfer money to the accounts of your partners among legal entities. Amounts can be more than 100,000 rubles, which is necessary in many areas. Since legal entities are prohibited by law from accepting more than 100,000 rubles in cash at a time.

As can be seen from the list, it is difficult to carry out business activities without a current account.

Step 2. In which bank should I open an individual entrepreneur’s current account?

There are a lot of banks now. Almost everyone provides services for opening a current account. How to choose? To at least narrow down the search area, you need to find banks that meet the main criteria.

- The size of the bank and the period of its existence. Obviously, the higher these indicators, the better and more reliable.

- Prices. Banks charge fees for everything. Every transfer, and even more so, cash withdrawal from a current account. They take money both for the opening itself and for the maintenance. However, most banks have interesting offers for those who will use the services of maintaining a current account for the first time. It is important to know how much the bank charges for opening an account and what the monthly maintenance fee is.

- The amount of cash available for withdrawal from a current account. The question is important. Because there is no escape from necessity. Cash is still needed. And not every bank freely allows them to be withdrawn.

- Is there interest accrual on the account balance? Not necessary, but often nice and profitable if you always have a large amount in your account.

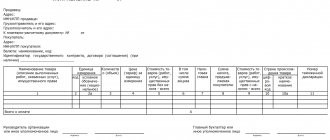

Step 3. A package of documents for opening a bank account for an individual entrepreneur.

- First of all, it is important to understand what documents you will need to open. Here is a list of documents for individual entrepreneurs.

- Application for opening a bank account.

- Bank questionnaire.

- Extract from the Unified State Register of Individual Entrepreneurs (USRIP).

- A photocopy of the document on registration with Rosstat. Must be notarized.

- Licenses and permits to conduct your business.

Attention! The list of documents should always be clarified with the bank in which you intend to open a current account. Since the requirements of banks may differ from each other.

Step 4. We are waiting for the account to open.

The waiting period is short. Usually - one day. If the bank accepts documents remotely – via the Internet, then an account can be opened within half an hour.

Step 5. We use a current account for individual entrepreneurs.

You can use this privilege immediately after opening. You will be able to accept payments and connect acquiring and, most importantly, manage your own funds. Typically, this is done using Internet banking, which is provided by the banking organization.

Remember that account transactions must confirm your actual activities, otherwise the tax office will have questions. And if they arise, your account will simply be frozen until they are resolved. It doesn't matter whether it hurts your business or not. Banks do not argue with the tax authorities. There is an order - there is a blocking. So be careful and careful.

Necessity of a current account

Before you open an account

, the entrepreneur needs to figure out why he is needed. Having an account makes doing business much easier. Revenue is accrued on it; it can be used to pay for services that were ordered by the company. This also includes taxes.

It’s safe to say that a modern entrepreneur simply needs a current account. Through it you can perform the following functions:

1. Deposit company funds into the account. Most entrepreneurs store their proceeds this way.

2. Receive payment for goods or services. The account can receive funds from business partners and clients. To do this, you can use an acquiring system.

3. Distribute salaries among employees by transferring funds to their cards.

4. Pay your bills. The company rents premises, purchases equipment, materials, goods, etc. It is very convenient to use a current account for payment.

5. Calculation of taxes, as well as payment of contributions.

The current laws of the Russian Federation require that any LLC have a settlement account as a mandatory condition for the operation of any LLC. Fortunately, there are no such restrictions for individual entrepreneurs, so opening an account in this case is voluntary.

Having a current account is required for the following types of business:

1. Trade acquiring. POS terminals are present in most retail outlets, allowing customers to pay using bank cards. Funds received as a result of non-cash payments are transferred to the businessman’s bank account.

2. Cases when the settlement amount under one agreement exceeds 100 thousand rubles. In accordance with the legislation of the Russian Federation, such transactions should be carried out only by bank transfer. 100 thousand is a significant amount, but even representatives of small and medium-sized businesses have to deal with such operations. For example, an entrepreneur decides to pay rent for a premises for a year in advance. If the monthly payment is 15 thousand rubles, then in a year you will have to pay 180 thousand. And this can only be done by bank transfer.

3. Payment of taxes. Most entrepreneurs have long refused to pay taxes at the cash register. This is due to the many controversial situations and problems that arise with this method of calculation. It is much easier and safer to pay through a checking account.