Greetings, my dear readers! I am with you, Alexander Aparin. Not long ago, my blog covered the topic of what Yandex.Wallet is. All the advantages of Yandex online money do not end there. Today I will tell you what a Yandex Money bank card is, about its conditions, how to get and use it. I'll tell you about the pros and cons of the card. Why purchasing it costs absolutely nothing, and how you can spend the money you earn from Yandex.Wallet using this card completely without interest.

First of all, I want to note that the card is an advantageous addition to your existing Yandex wallet. Card balance and wallet balance are the same thing. The card number and wallet number have different meanings, but they have the same balance. This is very convenient, you can top up Yandex.Wallet and pay with Yandex.Card.

How to get a Yandex money card?

An important point: you must already be registered on the Yandex.Money platform.

Ordering and issuing a card occurs as quickly as possible. To do this, in your Yandex.Wallet, you need to go to a special form and enter your data there: full name and home address. I would like to note that a prerequisite is payment in the amount of 300 rubles. This amount is for delivery and maintenance of the card for 3 years. What should be noted is that it is very economical.

The card is delivered by Russian Post. The card is prepared for shipment within 5 working days, after which an SMS with a tracking number is sent to your phone number. Using it, you can track when the card arrives at your post office. I had my card in my hands within two weeks after completing the application.

After receiving the card, you must activate it on the website. You will find the activation link in the envelope along with the card. And indicate the invented PIN code. With the help of which you will be able to use the card.

How to start using poison

To use all the features of Yandex Money, you just need to create an email account on Yandex and create a Yandex Money wallet.

When opening a wallet, you will have to decide on its status. The wallet can be anonymous, registered or identified. The status of the wallet depends on the completeness of the provision of personal information. If during registration you indicated:

- only login and phone number, then the wallet will be anonymous ;

- basic passport data (number, series, date of issue), then the wallet will be personalized .

- full passport data, then the wallet will be identified .

Please note that obtaining an identified wallet will not be as easy as it seems. It is quite possible that the system will ask you to go through full identification through the Yandex.Money office, Euroset, Svyaznoy, or through a branch of the Russian Post. The status of the wallet determines the limits of financial transactions.

To obtain an identified wallet, persons who are not residents of Russia will have to contact representatives (agents) of Yandex Money in other countries. The addresses and contacts of these agents are available here.

Yandex money card terms and conditions

The most necessary operations, such as cash withdrawals up to 10,000 rubles, payment for goods and services, payment of utility bills, payment of fines, are carried out without the use of a commission.

But there are a number of exceptions when the commission will be debited from your balance:

- when transferring to a card of another bank, 3% of the amount, but not less than 100 rubles;

- for cash withdrawals over 10,000 rubles, the commission amount will be 3% of the amount exceeding the permissible threshold;

The cash withdrawal limit rule of 10,000 rubles applies only to identified users who have received a personalized card. Otherwise, the commission will apply to any amount of cash withdrawal.

It is worth noting that the advantage of this card is the ability to convert currency, which makes it possible to withdraw cash or pay for goods and services anywhere in the world. This is perfect for travelers and people who often have to be in other countries for work reasons.

When converting currencies, funds are converted at the rate of MasterCard + 2.7%.

I would like to note that Yandex Service has introduced a number of restrictions on operations using Yandex.Card.

| Type of operation | Limit per transaction | Monthly limit |

| Restrictions on payments if the card is issued in anonymous mode | 15,000 rubles | 40,000 rubles |

| Limit on payments if the card is issued in a personal wallet | 60,000 rubles | 200,000 rubles |

| If the card is issued in an identified wallet | 250,000 rubles | 3 million rubles for payments |

| Restrictions on transfers from card to card in anonymous | unavailable | unavailable |

| Restrictions on transfers from card to card in a personal wallet | 15,000 rubles | 200,000 rubles |

| Limit on transfer from card to card in an identified wallet | 250,000 rubles | 60,000 rubles |

| Restrictions on cash at an ATM using a card in an anonymous wallet | 5,000 rubles | 40,000 rubles |

| Cash limit at an ATM using a card in a personalized wallet | 5,000 rubles | 40,000 rubles |

| Restrictions on the card in the identified wallet | 100,000 rubles | 1,300,000 rubles |

In order to increase the level of security of your plastic card, it is possible to set up a system of SMS notifications about transactions performed.

Pavel Chernyshova

Go to the payment system website >>

The Yandex Money payment system began operating in 2002. This is a project of the famous Russian search engine Yandex, designed mainly for the segment of Russian users.

Initially, the system’s wallet worked only as a client program installed on a computer, and the web interface appeared only 3 years later - in 2005.

Since 2011, it became possible to link your bank card and pay directly from it with electronic money, and a year later the YaD company received a license from the Central Bank and issued Gold MasterCard bank cards under the issuer Tinkoff Bank.

Currently, the Yandex Money system occupies a leading position in money transfers within Russia and is gradually entering the international market through integration into such giants as Nintendo, Aliexpress, TradeEase, Lumia and others.

Legal information

Yandex Money is a non-bank credit organization, and supervision of their activities is carried out by the Main Directorate of the Central Bank of the Russian Federation. The main payment currency is the Russian ruble.

All funds located in the Yandex Money system are secured by real bank accounts located in the following banks:

- Alfa Bank;

- VTB 24;

- KB OTKRITIE (RBR);

- Sberbank;

Main office: 119021, Russia, Moscow, st. Timur Frunze, 11, building 44. Postal address: 119021, Moscow, post office box 57.

Details: INN 7750005725 KPP 775001001 OGRN 1127711000031 OKVED 65.12 OKPO 11366276

Advantages of the Yandex Money system

- Easy to use;

- High-quality legal and legal framework;

- Reliable protection system;

- Anonymity of payments;

- Possibility to issue a free plastic card from MasterCard;

- Pay for many services without leaving your home;

Wallet registration

To log into the Yandex Money system, you just need to indicate your username and password for any Yandex service, for example, Yandex email. After authorization, access is automatically granted to all services operating under the Yandex brand, including the Yandex Money system.

If it so happens that you do not have a single account on the Yandex website, then you need to go through the registration procedure or log in to the system using social networks.

You can transfer money without registering a wallet, but it is better to open a wallet and get all the available features and benefits. Moreover, it will only take a couple of minutes of your time!

After registration, you need to choose a method to protect your wallet:

- You can continue to use the payment password you entered during registration;

- You can choose a one-time password that will be sent when performing transactions on your phone or web application;

Attention! Do not share your passwords with anyone. If you have lost your phone number or code table, please report this to the support service so that an unauthorized person does not gain access to your account.

After completing registration, you will receive your wallet number through which you can make money transactions:

User identification

A newly opened account in the system is anonymous. You can work with the system in anonymous mode, but in this case you will be subject to many restrictions. Anonymous users cannot receive or send transfers at all. The entire list of limits can be found on the system website.

For convenient work, it is recommended to get a personal account, or better yet, go through identification and fully enjoy all the benefits of the system.

To get a personal account, you need to fill in your passport information (this option is only relevant for citizens of the Russian Federation).

The identified user receives all the capabilities of the system and it is easier for him to restore access to the lost wallet - simply present the documents specified during the identification procedure.

If you are a citizen of another country and plan to actively use the Yandex Money wallet, you must go through the identification procedure.

Wallet identification methods

- Personal application to the Yandex Money office with a completed application form and passport. Processing of an application received from you by an office employee may take up to 7 business days.

- Sending an application by mail. In this case, you certify your signature on the completed application form with a notary and send it to PS Yandex Money LLC by registered mail to the address: 119021, Moscow, PO Box 57, PS Yandex Money LLC. Please note that if the application is completed in another language, the services of a translator will be required. Certified copies are accepted only in Russian. It will take up to 20 business days to process documents.

- Identification through the CONTACT system. You need to come to the nearest CONTACT system point with your passport and make a payment for identification in Yandex Money (this is how the name of the money transfer is formulated). Payment amount - 250 rubles. Over the next day, your data will be transferred to Yandex Money, and a request to confirm this data will appear in your wallet.

- Identification payment in the Euroset showroom. Can be done at any Euroset store. You need to have your passport with you. The size of the identification payment is 50 rubles. Of these, 1 rub. will be credited to your account (verification transaction). This type of identification can only be completed by adults, and it is not possible to make an identification payment for another person.

- Using trusted agents in other cities. You need to select the nearest city from the list, print out the completed application in duplicate and come to the office of the identification agent with your passport. The agent will take your application and take a copy of your passport. After 10 working days, open the Yandex Money website and confirm your identification. The cost of sending documents may vary.

- According to a simplified system. If you have previously submitted any application to Yandex Money providing the system with your passport data (for example, to restore a payment password), you can obtain the status of an identified user using a simplified procedure, provided that since then your passport data not changed. To undergo identification using the simplified procedure, you need to send a message with the subject “Identification by application” to the Yandex.Money support service. In this message you must indicate your last name, first name and patronymic; the account number that appeared in this application; approximate date of application.

You can also get a professional account with the ability to accept payments up to 500,000 rubles without restrictions on the number of transfers. To do this, you need to go through identification, link your phone number to your virtual account and read the terms of use.

Wallet replenishment

You can top up your wallet in the following ways:

- Link your bank card and conduct cash transactions directly;

- Using any bank card. For each transfer, a commission of 1% of the transfer amount will be charged;

- From the balance of your mobile phone linked to the Yandex Money wallet;

- In cash at Sberbank offices, Euroset communication shops and other replenishment points;

- Through transfer and payment systems - CONTACT and Unistream;

- Through self-service terminals. The list of terminals connected to this service is quite extensive;

- With help - 0% for replenishment using trusted Yandex Money banks;

- By exchanging another electronic currency for Yandex Money. A list of the best online exchangers working with Yandex Money can be found here >>

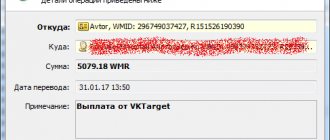

Withdrawing money from your wallet

There are several ways to withdraw your funds from Yandex Money:

- Apply for a card from the Yandex Money service and pay with it directly or withdraw money from any ATM;

- To the card of Alfa Bank, KB OTKRITIE (RBR) or RosEvroBank linked to your account. Enrollment time is a few minutes, commission is 3%;

- To an individual's account in any Russian bank. Such money transfers usually take 3-7 business days. The system commission for this method of withdrawing money is 3% + 15 rubles. An additional commission is charged by the bank;

- Money can be received in cash without opening an account at any point of the CONTACT payment system or the Migom system.

The Yandex Money commission is 3%, the CONTACT commission is 1.5%, but not less than 60 rubles, the Migom commission is 1.5%; The minimum amount for withdrawal is 100 rubles, the period for receiving payment is 1 - 2 days. When filling out the form, you need to indicate the branch and fill out your passport details correctly, and upon receipt, present your passport, indicate the amount and payment number. You will be able to receive money within 1-2 business days after submitting your application; - Through online exchange offices, exchanging Yandex Money for another electronic currency (WebMoney, Perfect Money, Payeer, etc.);

Money transaction

Transferring funds in the Yandex Money system is very simple. It is enough to know the recipient's wallet, phone number or card number. Next, indicate the payment amount and send it. If desired, you can specify a protection code and add a message to the recipient. All payments occur instantly.

Refund of payments and transfers

Yandex Money has a payment refund function. If you received money from another user of the system, then by clicking on the icon that says “Return money” in the payment history, you can easily and quickly return it to the sender. In this case, the system itself will calculate what amount, taking into account the charged commission, you need to transfer so that the same amount of money is returned to the sender’s account as was debited from it.

Commissions and limits of the poison system

A commission of 0.5% is charged to the recipient of funds when receiving a payment to the Wallet from another user. By the way, the system has a limit on the amount of direct money transfer (from Wallet to Wallet): 75,000 rubles up to 2 times in 1 day.

If you transfer money to a plastic card, take into account a commission of 3% + 45 rubles!

When exchanging electronic money, 3% of the payment amount is charged from those wishing to exchange Yandex Money for another currency; 0.5% is charged from the recipient of the payment from the exchange office to the account in the Yandex Money system.

If you transfer money from a card to a wallet, you will be charged a commission of 1% of the payment amount.

When transferring from card to card, the commission is 1.95%. but not less than 40 rubles. You can send 4 transfers per day from one card: 70,000 rubles at a time, 600,000 rubles per month. The same restrictions apply to the recipient's card. The transfer occurs instantly.

You can send a transfer from card to card only if both of them are issued in Russia.

More details on the official website of the system

Plastic cards

In addition, Yandex.Money has unique services for working with bank cards.

- The system issues virtual MasterCard Prepaid cards (in rubles, dollars or euros) for a period of 1 year, allowing you to pay for purchases on any sites where regular MasterCard cards are accepted. For example, you can pay with such a card at PayPal, App Store, Android Market and Amazon.com.

- The system allows you to link your bank card to your Yandex Money account to make purchases and payments. If the card is issued by a Yandex Money partner bank (Alfa Bank, RosEvrobank, Otkritie Bank), then, in addition to payments, the user can replenish the account in the system from the card and withdraw money from the account to the card.

- The system issues its own cards from MasterCard for 3 years. The cost of the card is 199 rubles. You can order a card with your name on the website: it will be sent to you by mail. Bonus for those who live in Moscow, St. Petersburg and Nizhny Novgorod: at Yandex Money offices you can get an instant card for yourself. It doesn't have the owner's name on it, but it works the same way.

More details on the official website of the system

Safety of poison

The Yandex Money system uses a special cryptographic algorithm RSA-67 with a key length of 1024 bits and a hash function. In other words, to crack a password, you need to calculate an algorithm of 1024 characters. All messages in the system are signed and encrypted by the sending party, that is, all messages via the open Internet are transmitted only in a protected form.

Yandex Money has a well-thought-out system for ensuring continuous transactions even with a weak Internet connection. The communication protocol is updated several times per second, so at any time the operation is interrupted, all data about it is saved, and money cannot be lost.

Protection of money transfers

When registering with Yandex Money, each user is given a unique payment password. Any important actions in the Yandex Money system are confirmed by this password. Therefore, keep it safe and do not share it with other people under any circumstances.

If you have forgotten your payment password, you can recover it. For this, a recovery code is provided - a combination of 5 or more numbers, which you must come up with when creating an account in the Yandex Money system. To change your payment password, enter the recovery code and your date of birth, then create a new password.

Therefore, if an attacker finds out your main password for logging into the system, he will not be able to change anything in your wallet, since for this he also needs a payment password and a recovery code.

To enhance account protection, the system has developed one-time passwords that confirm each account transaction with a unique one-time code. Remember: if you choose this method of protection, you will not be able to return to your payment password in the future.

Deposit and withdrawal of Yandex Money through the best online exchangers >>

How to top up a Yandex bank card?

A rather surprising fact is that in order to top up a Yandex.Money card, the card itself is not needed. Special ATMs are also not required.

They accept replenishment without commission:

- Internet banking and mobile application Sberbank;

- from a card of any bank, through Sberbank ATMs;

- in cash, through Sberbank terminals;

- in cash at Euroset stores;

- in Svyaznoy stores, in cash.

To top up, you need your wallet number and card number.

Any method of replenishment through the Yandex.Money service can be made through the “Top up” button. It could be:

- replenishment from a bank card directly on the site itself;

- from mobile balance;

- in cash, the service will show the nearest replenishment points;

- through Sberbank Online.

I have listed for you the main methods of replenishment, without unnecessary commissions and costs. But the list of possibilities is much wider, you can use other methods of replenishment, but be careful, study the conditions before choosing them

On the service, it is possible to link your any plastic card and constantly use this service and pay directly from a card of any bank.

Withdrawal methods Money Yandex

There are several options for media to which Yandex wallet users can send funds. This:

- Other electronic wallets and plastic cards from Yandex Money.

- Bank cards of other financial institutions.

- Payment services operating on the World Wide Web.

If you delve deeper into each type listed, you will get dozens of possibilities that you can take into account. In most cases, the service does not charge a commission. However, before making a withdrawal, carefully study the terms of the transfer on the page of the transaction being performed. The advantage of Yandex is that when you enter the amount, it immediately shows what the commission fee for the offer will be.

- How to create a Yandex wallet in 2020

- Certificate of income 2-NDFL for individuals in 2020

- Withdrawing money from Yandex Taxi

Plastic card details

If there is a need to receive funds from a legal entity, employer or other company, you must provide Yandex Card bank details. Which will indicate:

- Recipient bank: Limited liability company non-bank credit organization “Yandex.Money”

- Correspondent account: 30103810945250000444 in Branch 3 of the Main Directorate of the Central Bank of the Russian Federation for the Central Federal Authority in Moscow.

- Recipient's account, also known as current, personal account: 30232810600000000010.

- INN: 7750005725

- Gearbox: 770401001

- Bank BIC: 044525444

- Recipient: full name of the recipient (wallet owner);

- Purpose of the transfer: replenishment of the wallet (indicate the wallet number), not subject to VAT.

The term for crediting funds is from 2 to 5 business days, the timing depends on the executing bank. Details can be found both on the Yandex website in your personal account and in attachments to the letter in which the card arrived.

Customer Support

The Yandex Money website has a “Problem Solving” section, where you can find answers to frequently asked questions. If you could not find a solution to your problem, you can go to the “I have another problem” tab, fill out the form and send a message to the support service.

After some time (usually after a couple of hours, but sometimes it happens right away), an automatic response will be sent to the specified email box, in which you will be told that the request has been processed and that “everything will definitely be fine.” As a rule, the user support service processes such requests within 24 hours and sends a response by email.

If the situation that has arisen requires an immediate solution (or you are simply impatient, like me, for example), then you can call the Yandex.Money office and discuss your problem with a specialist.

The technical support hotline operates 24 hours a day. From any country in the world you can call the company by number.

They answer quickly, politely, inspire optimism, and have been tested many times. From my own experience, I can say that, basically, problems arise with payment delays, when money does not arrive in the account after five banking days.

But creating a request to the customer support center on the website, as well as calling one of the above numbers to the office, solves the problems that arise literally within 24 hours. Therefore, I personally have no reason not to trust the Yandex.Money service. I think 30 million users of the system will agree with me.

Where and how can I pay by card?

The Yandex.Money plastic card is no different from any other traditional card. It is equipped with a built-in chip and magnetic stripe, and also has the possibility of contactless payment.

With this card you can:

- make any online payments by simply indicating its number and confirming payment via SMS;

- payments in regular stores, restaurants, hotels and other establishments where non-cash payments are provided;

- If necessary, you can withdraw cash;

- You can send transfers to cards of another bank.

If you like to often leave the country and at the same time make various payments abroad using Yandex.Card. Use the “Tell me about your trips” service.

This will help the Yandex.Money service understand that in another country it is you who is making the payment, and not the fraudster who stole your card data.

Advantages and disadvantages

The Yandex.Money card, based on user reviews and my own experience, deserves attention. People who have a constant source of income on the Internet will appreciate the benefits of plastic. I analyzed my list of pros and cons and adjusted it based on feedback from other clients. This is what happened.

Advantages:

- A small amount of annual maintenance (only 200 rubles for 3 years).

- Ability to set your own restrictions.

- Contactless payment system.

- Ability to change PIN code.

- Payment for telephone, internet and some other services without commission.

Flaws:

- A small number of offices (only in Moscow, St. Petersburg and Nizhny Novgorod).

- High commission for cash withdrawals.

- There are no own ATMs.

- A time-consuming procedure for identifying an electronic wallet if you want to have the best rates and conditions for the card.

Cashback on Yandex money card

It is worth noting that the percentage of return for purchases with a Yandex.Money card is slightly high, such as with Tinkoff Black or Alfa Bank cards. But its presence evokes positive emotions. Points are received instantly and are counted separately from the main funds. 1 point=1 ruble. The cashback amount is 5%; it is not credited for real purchases or online purchases.

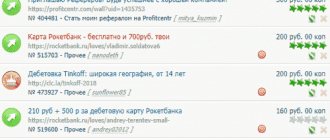

What you can earn points for:

- for payment for goods from the category of the month;

- If the product is not included in the category of the month, then points are returned for every fifth purchase.

To receive 5% cashback, you need to spend more than 1000 rubles per month. If the amount spent does not reach this amount, the bonus is reduced to 0.5%.

How it works

Now it’s time to highlight step-by-step instructions for working with virtual finance.

Step 1. The client replenishes his personal wallet using any of the methods available to him.

Step 2. If the user purchases a particular product, for example, in an online store, then the funds are transferred to the store details.

Step 3. As soon as the finances are transferred, they are immediately sent to the processing center, whose purpose is to check the received amount for accuracy.

Step 4. If verification is successful, the buyer is sent a receipt for the purchase.

Step 5. The funds are successfully transferred to the seller, and you receive the desired purchase.

Yandex money virtual card

The Yandex.Money virtual card is the same MasterCard bank card, only the main difference is that you cannot physically hold it in your hands. The card exists virtually, without the use of plastic. Basically, such a card works on the Internet, but thanks to modern technologies it can also work in the real world if its data is saved using Apple Pay or Google Pay. The number of such a card is located on the Yandex.Money service, and the expiration date and CVC will be sent by SMS to the number linked to the wallet.

Just like the plastic Yandex.Card, the virtual one has the same balance as the wallet. You can monitor your balance on the Yandex.Wallet service or set up SMS notifications.

The card is issued free of charge, valid for 1 year from the date of issue. A virtual card is obtained instantly; to do this, you need to select a virtual card in the “Yandex.Money Cards” section and, with one click of the “Get card” button, issue it.

A phone number must be linked to the card; without it, the card cannot be issued.

Tariffs for using the Yandex.Money virtual card.

| Service | for free |

| Replenishment through Sberbank, Euroset, Svyaznoy | for free |

| Payments | no commission |

| Cash withdrawal Google, Apple, Samsung Pay | 3%, minimum 100 rubles |

| Transfer to another card or another electronic wallet | 3%, minimum 100 rubles |

| Validity | 1 year |

| Cashback | 1% on the Internet 5% in the category of the month 5% in other categories for every 5th payment |

When replenishing your wallet, you can immediately spend money from the card. If goods or services were paid with a virtual card, the wallet balance will decrease.

What else is the commission charged for?

The virtual account may, among other things, be charged monthly fees in the following cases:

- Service – 270 rubles. Provided that no financial transactions have been performed from the wallet for more than two years.

- Closing an account – 20 rubles. The commission is assigned when submitting an application online through the service.

- Information – 50 rubles. A report on all transactions will be sent to the linked mobile number in the form of SMS.

- Connection to – 2500 rubles per year.

The identification procedure may also be subject to a fee if the requirements are not met – refusal to provide personalized data. The commission will be 60 rubles.

Pros and cons of the Yandex Money card

I noted several advantages of the card and of course there were some disadvantages.

Advantages:

- The annual maintenance amount will be only 100 rubles.

- Basic payments are made without commission.

- Contactless payment.

- No need for ATMs to top up your card.

- Automatic conversion to currency when withdrawing cash anywhere in the world.

- Cashback of 5%

Flaws:

- Few offices.

- Commission for cash withdrawals is 3% or at least 100 rubles.

- Restrictions on cash transfers and withdrawals.

Reviews about the card

I read the reviews about the card, almost all the reviews are positive. Of course, there are also negative ones, but mainly about the commission for cash withdrawals and the fact that they require identification. As far as I remember, it has been necessary to do this with electronic wallets in Russia for a long time. I did this on a Qiwi wallet immediately and on Yandex money. Understand that if there is a law, there is no escape from it.

Brief overview of the map

Conditions Card maintenance is free - you only need to pay for issue.

Use

The card is suitable for those who actively use Yandex.Money

Bonuses

Purchases earn you points that can be spent with partners

Availability

You can order delivery by mail throughout Russia and abroad

Advantages

- Fast processing with delivery throughout Russia

- The card is linked to the e-wallet account

- Completely free service

- Convenient deposit and withdrawal of cash

- Bonus points on all purchases

Flaws

- Card conditions depend on wallet status

- Inconvenient use of points

- Not suitable for passive storage

Advantages

- Fast processing with delivery throughout Russia To issue a card, just register on Yandex.Money. You can order delivery by mail or courier.

- The card is linked to an electronic wallet account.

Money from your wallet account is used to make payments. You can use it to pay in any stores in Russia and abroad. - Completely free service

The card is serviced free of charge without any additional conditions. You just need to pay for its release. - Convenient replenishment and withdrawal of cash

You can top up your card using the same methods as your wallet. You can withdraw cash from it without commission at any ATM. - Bonus points for all purchases

The card accumulates increased points in selected categories and with every fifth purchase. You can also get additional cashback from partners.

Flaws

- The terms of the card depend on the status of the wallet. If the wallet is anonymous, then there are strict limits on all transactions. To use a card with fewer restrictions, you need to pass identification.

- Inconvenient use of points

Bonuses can only be spent when paying for purchases with a wallet. They cannot be used in regular stores. - Not suitable for passive storage.

The balance does not accrue interest, there are strict limits on transactions, and the money in the account is not insured. The card is not suitable for storing large sums.

You can order a Yandex.Money card and read the detailed terms and conditions on the official website of the wallet. Here you can also clarify any questions with the support service.

More details