Real estate is considered to be one of the most highly profitable areas of investment activity. This fact is due to the fact that the demand for residential real estate remains stable even during the economic crisis. One of the significant disadvantages of this line of business is the high level of entry into the market. In order to purchase such an object, you must have capital in the amount of several million rubles. However, there are several effective methods that allow you to engage in investment activities even in the absence of large funds. In this article, we propose to consider the question of how to invest in real estate with low capital.

You can invest your personal savings in anything

Investing in real estate: the relevance of modern business

According to financial experts, buying real estate is one of the most profitable methods of investing money. It is important to note that this activity involves certain risks. The wrong choice of investment strategy can result in the loss of large capital.

The term “investing in real estate” should be understood as investing money in the purchase of residential or commercial properties for the purpose of obtaining personal gain.

This method of investment activity attracts not only experienced businessmen, but also ordinary citizens. Smart investors know about various methods of increasing the profitability of this type of activity. Ordinary people purchase housing for personal purposes or for subsequent rental to third parties on the basis of a rental agreement. Today, there are two main methods of making money on such objects.

The first method is renting out housing. You need to understand that it will take quite a long period of time to recoup the investment. In some cases, the duration of this period can be more than five years. The second popular method of earning money is reselling the purchased object at a markup. This approach allows you to make a profit in a short time and begin searching for a new object.

Collective investment options

The essence of collective investment is the establishment of a mutual fund with the attraction of investors’ money for investment in commercial projects with the subsequent receipt of profit in equal shares. The management company is responsible for organizing the redistribution of funds.

Western capital is concentrated in the group of REIT funds; in Russia, about 30% of the market is invested by ZPINF - closed real estate mutual funds.

Another option is to create agencies to find investors and receive interest from each transaction. You can simultaneously participate in several projects by contributing funds as a shareholder.

The main advantages and disadvantages of such activities

Each type of business has certain advantages and disadvantages. The advantage of this direction is the stability of the market. Many experts argue that buying real estate is one of the most reliable methods of preserving capital . The value of real estate is not tied to the season, political circumstances or changes in the economy. Another advantage of this direction is the gradual increase in the price of acquired objects. This rule applies to not only residential but also commercial properties. Such assets can be compared to gold, the value of which increases regularly.

Buying real estate allows you to create a new source of passive income. In order to find clients willing to rent housing, you only need to make a minimum of effort. Another advantage of this direction is the minimum amount of risks associated with investment activities.

Despite the above advantages, this activity has a number of significant disadvantages that newcomers to this field rarely take into account. One of these disadvantages is the low level of asset liquidity. The economic indicator “liquidity” is used to indicate the speed at which assets are converted into cash. The low level of this indicator indicates that in order to sell the property at its real value, it will take quite a long period of time.

One of the most significant disadvantages of this direction is the need to constantly invest money in the maintenance of the facility. In addition to utility bills, the investor must pay income tax or tax on profits received. It should also be noted that the transaction for the sale of an asset itself is subject to tax at the rate of thirteen percent . Before starting work in this direction, it is recommended to carefully weigh the pros and cons.

The main thing is that investments generate profit

Examples of investments in real estate in Russia and abroad

In large cities, the issue of an investment object is not acute - housing and commercial properties are always at a premium. But you can be smart and make money, for example, with the help of an apartment building. You purchase suitable real estate that can be divided into studios, rent them out separately and receive regular profits - it is unlikely that all the rooms will be empty at the same time.

Russians are willing to invest in real estate abroad already at the construction stage. According to the international company Deloitte, there will be no problem with tenants: about 54% (in large cities 70%) of housing in Germany is rented by both local residents and foreigners.

In Ireland, the investor receives about 7% per annum. Malta, Portugal, and the Netherlands will provide a return on rental housing of at least 6% per annum.

Where can you invest?

Having decided on the method of earning money, the investor must choose the most suitable capital allocation options. Available funds can be spent on purchasing residential or commercial properties, as well as land. Below we propose to consider the specifics of each area of activity.

Residential Properties

Individuals acting as private investors most often choose residential real estate. This choice is explained by the low risk of losing money. As a rule, such assets are acquired for the purpose of subsequent rental use or resale at a small markup. The cost of an object depends on its location in the city infrastructure, condition and layout.

It is important to note that in this case it is necessary to take into account even those factors that at first glance are of little significance. When choosing an apartment, some people take into account factors such as the floor and the view from the windows. An important factor is the population living in a particular location and the closest neighbors. In order to purchase a residential apartment on the most favorable terms, you will need to refuse the help of sales agents and intermediaries. This step will significantly reduce associated costs. However, in this case, the investor will have to independently check the transaction for possible fraud. Before signing an agreement, you need to make sure that there are no debts or a “bad” history of the asset.

Commercial real estate

This area of activity should be chosen by more experienced entrepreneurs. Having a large budget allows businessmen to purchase large objects that are used to equip small factories, warehouses or retail outlets. If you have a limited budget, you can purchase an ordinary apartment converted into a modern office. Properties belonging to this category are in high demand. As a rule, such assets are used for rental purposes. The main advantage of choosing this direction is the fact that commercial real estate tenants prefer to enter into contracts for a fairly long period of time.

Renting out commercial properties allows the investor to obtain an additional source of profit. You need to understand that in this case a significantly larger amount of start-up investment will be required. As a rule, the cost of premises where a workshop or retail outlet can be equipped varies from two to eight million rubles. Here you need to take into account the location of the object and the degree of distance from the central point of the city.

It is important that investments protect money from the harmful effects of inflation

country estate

The acquisition of suburban properties can be considered one of the most profitable areas of business. Many residents of large cities often purchase such assets in order to get the opportunity to take a break from the hustle and bustle of the city. By choosing this direction of investment activity, an entrepreneur has the opportunity to save money by purchasing a plot of land and independently building housing.

You can also purchase a property that is under construction or buy a house in a cottage village. Many financial analysts note the constant growth of this segment. When choosing a specific asset, it is recommended to pay attention to factors such as distance from the city and available infrastructure. The selected property must be equipped with all utilities necessary for a comfortable life.

Property under construction

Investing in real estate at the construction stage can significantly increase the profitability of a business by reducing expenses . It is important to note that this line of activity is characterized by high risks. The unreliability of a company acting as a developer can lead to a delay in the delivery of the project or its complete freezing. In the event that the developer does not have the necessary permits, the constructed facility may be demolished by decision of the local administration.

Before choosing this business option, it is recommended to carefully analyze the current market situation. When choosing a developer, you need to focus on such characteristics as the duration of the company and the total number of completed projects . It is very important to find information about whether a particular developer had problems with the commissioning of past projects.

Land

Purchasing a plot of land takes much less money compared to the above options. This area of investment activity is characterized by a whole list of various advantages. Among them, it should be noted that there is no need to hire agents or intermediaries in order to complete the transaction. Also, this line of business is characterized by minimal risk associated with seller fraud. Purchasing a plot of land eliminates the need to pay utility bills, carry out repairs and complete a large number of documents.

All objects belonging to this category can be divided into several separate groups, differing in the purpose of their use. Plots intended for construction allow not only to reduce the size of investments, but also to speed up the process of making a profit. Plots intended for agriculture should be considered as long-term investments. This business has not only advantages, but also disadvantages. Increased taxes on this type of property and strict government control are the most significant disadvantages of such assets.

Real estate will always be in demand, which means it is an excellent investment tool

Real estate abroad

Specialists in the field of investment activities rarely work in the domestic market. Large businessmen prefer to choose objects located in other countries. It is not common for such objects to lose value due to the instability of the global economy. Also, such assets can be used for personal purposes. Many experts in the field of investment activity say that this method of doing business has the most positive prospects.

Other options

Not every entrepreneur has a large amount of money that will be enough to purchase real estate. In this case, it is recommended to pay attention to such activities as the creation of paid parking. Acquiring land for arranging a parking lot requires significantly lower costs with the above types of business. Paid parking is in high demand among residents of large cities. The demand for this area is due to the strict system of fines for incorrect parking. The only drawback of this business is the difficulty of long-term profit planning.

Another promising option is to receive a share in a special fund that deals with the acquisition of real estate. The main advantage of this method is the fact that the investor does not need to register the acquired assets in his name. Mutual funds include specialists with professional experience in investment activities. This method allows you to get quite large profits even with a minimal investment of capital.

Where is it profitable to invest - TOP 5 popular options

Experts believe that investing in real estate carries much less risk than working with shares on the stock exchange, startups or business investments. Residential and commercial properties rarely fall in price, unless, of course, they are in disrepair.

Investments of this type are especially profitable in large cities. There is a direct relationship here - the larger the city, the more profitable it is to purchase housing in it. The liquidity of properties in Moscow is an order of magnitude higher than, say, in Barabinsk.

However, every locality has its own options. In order for your financial transactions to bring you profit, you need to choose the most profitable direction for investment.

Read more about investing in business in a special article in the magazine.

Option 1. To residential real estate

This method is the most accessible and has minimal risks. The meaning of investing in residential properties is very clear: first we purchase living space, then we sell it at a higher price or make money on rent.

When choosing an apartment, the following parameters must be taken into account:

- area (prestigious, remote, “dormitory”, “student”);

- layout;

- state;

- infrastructure (are there transport interchanges, kindergartens, schools, supermarkets within walking distance).

If you want to make a purchase with maximum benefit, you will have to search for the property yourself, without involving a realtor. Every little thing matters, including the view from the window, the ethnic composition of the area and the contingent of neighbors.

Option 2. To commercial real estate

More experienced investors are investing in commercial properties. These can be small office and retail premises, as well as large buildings for warehouses, supermarkets, and production.

Premises for business and office work are in stable demand. Thousands of small, medium and large entrepreneurs are ready to pay rent for the space provided, and the owner can only receive regular dividends.

Renting is a classic example of passive income, when an investor’s earnings do not depend on his labor costs. In the case of commercial real estate, there is a significant nuance - investments in such objects start from 5-7 million rubles.

Option 3. Into the ground

Land plots are cheaper than apartments and especially commercial premises.

This type of investment has significant advantages:

- the likelihood of fraudulent transactions with land is minimized;

- the plots do not require any repairs or payments for housing services;

- buying land is much easier than any other real estate;

- low (relatively) taxation;

- paperwork has been simplified;

- The involvement of intermediaries (realtors) is also not required.

Land plots are classified according to the purposes of their exploitation. Short-term investments with minimal costs are made in land intended for construction. Long-term investments are made in agricultural and industrial lands.

The negative point is the tightening of state control over the use of territories. Literally at the time of writing this article, it became known that the order of tax assessments on land had changed upward.

Option 4. To foreign real estate

Investments in housing abroad are regarded by experts as highly profitable and reliable. In other countries, real estate also does not become cheaper over the years, but, on the contrary, increases in value.

Such investments are justified both in terms of future income and as backup housing in case of traveling abroad.

Option 5. To suburban real estate

Purchase/sale transactions with country cottages and dachas bring investors stable profits, especially in big cities. The reason is obvious - every resident of the metropolis wants to relax in the fresh air, away from noise and gas pollution.

There are numerous options for purchasing suburban housing:

- purchase of an unfinished property;

- finished cottage;

- plot for construction.

Such investments become more and more promising over time. However, when choosing a property, be sure to take into account the location, infrastructure, availability of communications and other indicators important for comfortable living.

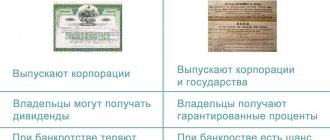

To visually compare different investment options, let’s combine them into a table:

| № | Property type | Profitability | Peculiarities |

| 1 | Residential | High (from 20 to 70% over 2-4 years) | To receive rental income, count on long terms |

| 2 | a commercial | High | Designed for long-term use |

| 3 | Land | Average | Minimum taxes and simplified purchase procedure |

| 4 | Foreign | Not determined | Profitability depends on economic factors in the country of purchase |

| 5 | Zagorodnaya | High | Infrastructure dependency |

Other options for highly profitable and safe investments are discussed in the article “Investing for Beginners.”

Choosing the most effective investment method: comparative analysis

All of the above types of real estate investments have unique specifics that distinguish them from each other. In order to better understand all the advantages and disadvantages of each method, we recommend that you familiarize yourself with the following table:

| Type of investment | Profit level | Specifics of activity |

| Residential properties | High. Within five years, the value of the property may increase by thirty percent. | Renting out an object for rental use significantly increases the payback period of the asset. |

| Commercial assets | High. | It is recommended to invest money for the longest possible period of time. |

| Country houses | High. | The level of income is tied to the level of infrastructure development and the degree of remoteness of the object from the city. |

| Land | Average | Ease of paperwork and minimal tax. |

| Projects under construction | High. From the start of construction to the delivery of the facility, the value of the asset increases by thirty percent. | High level of risk of loss of investment when choosing an unreliable developer. |

Based on the data presented in the table, we can conclude that the acquisition of real estate as a type of investment activity is long-term in nature.

How to invest in real estate with low capital?

An alternative way, where the entry amount is significantly less than the cost of the entire property, is to invest in real estate mutual funds. Funds by specialization are divided into:

- developer;

- land;

- rental;

- mixed;

- construction

All investment funds are of a closed type and to participate in them you must purchase shares at the time of formation. You can demand redemption of shares only at the end of the agreed period for which the management company offered its offer. The minimum lifespan of such mutual funds is 3 years, the maximum is 15 years.

Common methods of generating income from investing in real estate

According to experts, the choice of a specific type of investment is of secondary importance. Investments in collateral real estate differ from investments in other assets only in the nature of the transaction. Of primary importance are the methods for generating profit from the use of the acquired asset. Below we propose to consider the main methods of earning money from real estate.

From rental

The first method is to rent out the purchased property. The main factor in this area of activity is the level of demand for the asset. In the case of residential premises, the infrastructure of the area is of paramount importance. Distance from metro stations, schools and kindergartens can lead to a significant decrease in the value of the asset.

Further resale

Purchasing apartments for the purpose of subsequent resale deserves special attention. In this case, the entrepreneur must carefully consider his strategy. The set price must include not only personal profit, but also the costs of completing the transaction, as well as related costs.

Other ways

Another interesting method of earning money is creating a hostel in a purchased property. The hostel is a comfortable apartment converted into a budget version of a hotel. As a rule, the capacity of the average hostel is twelve people. The available space should be distributed into several separate areas, equipped with all the necessary equipment for a comfortable stay for guests.

You can invest money in real estate at the initial stage of construction

Ways to invest in real estate

There are several options for purchasing real estate to make a profit in Russia and abroad.

Real estate investment in Kapir

Residential and commercial real estate under construction

In some cases, a person invests funds at the stage of construction work (planning a construction site, at the excavation stage or before signing the acceptance certificate for the finished house).. The larger the share of investments, the greater the profit will be. Another investment option is also practiced - buying an apartment in a house before it is built. The prospect of making a profit is postponed for 1-2 years, the risks are quite high, but the price of the finished apartment is actually twice the initial cost.

Abroad, you can buy a plot of land profitably: when a buyer appears who decides to build something on it, you can sell the land for 25% more. However, the real estate market in the US and Europe is not active enough, and the forecasts are very disappointing.

Ready-made real estate in areas with developing infrastructure

Another example of a profitable investment. Large cities are becoming crowded, they are growing in all directions, and most people are trying to move from the city center to quieter areas with new buildings.

Developing infrastructure is a strong argument in favor of investing in real estate in the suburban area. Just 100 years ago, virtually all of Moscow fit inside the Third Ring Road (and 200 years ago – the Garden Ring), but today it is only the central part of the city.

Ready real estate for transfer to non-residential premises

A real estate investment business will be profitable if you purchase a residential property located on the ground floor of a building in the city center or another “travelling” location with a lot of traffic. You will have to spend time and money on paperwork and pay for the services of a lawyer in order to avoid pitfalls. If you offer an adequate rental price, several applicants will respond to your offer at once.

For example, a person inherited an apartment in another city, located on the first floor of a building in a prestigious shopping district. Dealing with issues of renting out housing is troublesome, but money won’t hurt. If you regularly monitor the real estate market, there is every chance of finding a profitable investment property.

Residential property to be demolished

This category includes dilapidated buildings, land plots (sometimes in the city center) with private houses of old construction. Owners of such properties, as a rule, are willing to make concessions on price, especially if the property has not been sold for a long time, and money is needed urgently.

You will have to spend money on demolishing the building to get a new piece of real estate - this option is successfully practiced in Russia.

Search for undervalued objects and redevelopment

We touched on these methods in the block on investment goals.

How to become an investor: step-by-step instructions

How to invest wisely in real estate, where to start creating a business? These questions are often asked by newcomers to the field. First, you will need to obtain start-up capital, which will be used to purchase the property. People having financial difficulties are advised to consider the option of a mortgage or buying not a whole apartment, but one room. Another promising area is participation in shared construction.

The next important step is to study the real estate market. Some newcomers to this business make a big mistake by purchasing the cheapest apartment. When choosing a specific option, it is necessary to study the infrastructure of the area and its prestige . It is important to note that the best options sell out quite quickly. People moving to other countries often sell their apartments at minimal cost. Quite often, the investor receives not only the apartment itself, but also additional property values.

The next important step is to complete the transaction. As a rule, such a procedure is carried out with the participation of a notary. Next, information about the transaction is registered in a special register. A specific feature of this transaction option is that there is no need to involve a lawyer. Employees of the notary office independently prepare the contract and check the seller for possible fraud.

When using credit funds to purchase an object, the banking institution itself acts as a guarantor of the integrity of the transaction. An insurance company acts as a third party and undertakes to cover all current risks. It is important to understand that the involvement of intermediaries significantly increases the costs of concluding a contract.

How to buy real estate cheaply - tips for a novice investor

If everything goes well, you can save 40% of the cost of the apartment, which will then come back to you in the form of profit from the subsequent sale of the property.

The purchase at the construction stage has already been mentioned. Purchasing an “unfinished” property is profitable and cost-effective, but risky. Construction is not always completed as planned. It even happens that it never downloads at all.

In every big city, from time to time, committees of “defrauded investors” appear - people who invested in real estate and were left with nothing. Suing a development company is not the most enviable prospect.

Read detailed material on this topic - “Investment in construction”.

Another way to save money is to buy an apartment without renovation, do it at your own expense and sell the property at a price that covers your costs. Depending on the quality of consumables and level of finishing, the difference in cost can be 10-20%.

Advanced investors know even more radical ways to save. For example, they buy confiscated property, which is sold at free auction.

Real estate that is put up for auction during the bankruptcy of individuals and companies is often sold at a reduced price, since the appraisal of such properties is not always carried out by professionals.

Banks periodically put up for sale collateralized real estate that they have seized from mortgage defaulters or creditors who took out a loan for their apartments and did not return it. You can also find profitable options here.

There are special websites where fresh lots with mortgaged and confiscated apartments are published for sale. Information is also available in the Unified Register of the Russian Federation on bankruptcy of legal entities.

What to do if personal funds are not enough

According to many people, the lack of large capital can be one of the main difficulties in this business. However, experienced investors know how to acquire such assets at minimal cost. For this purpose, funds received from third parties are used. Below we propose to consider several different methods for obtaining start-up capital.

The first method is to apply for a loan from banking institutions and other financial institutions. Using this method, you should remember that the borrowed funds must be returned in an amount exceeding the loan amount itself. When developing an investment strategy, you need to pay increased attention to the financial side of the issue. The size of the projected profit should include not only the income of the investor himself, but also the payment of interest charges on the loan.

It is recommended to apply for a loan only in large financial institutions that have a positive reputation among the population.

The next interesting method of attracting third-party capital is searching for potential business partners. It is necessary to find not only those people who have the required amount, but also to convince them to invest their money in the developed project.

The effectiveness of this business depends on the literacy of plans. Investments in commercial real estate and any other real estate require certain knowledge in this area. There are several investment clubs operating in our country, where newcomers to this business can receive advisory support. In such clubs, experienced specialists conduct various activities in order to protect beginners from the most common mistakes.

Like any other financial instrument, investing in real estate has both pros and cons.

What is profitable to invest in?

There are two investment options: commercial and residential real estate. The term commercial includes non-residential objects: shops, warehouses, offices, workshops, hostels, etc. The term residential includes, respectively, apartments and houses.

Attention:

There is a direct relationship between the size of a settlement and the profitability of real estate investments. In big cities you can earn more and find tenants faster than in small cities.

Good real estate is always liquid

Residential properties

Experts believe that when working in residential real estate, the risks of losing money are minimal, especially if you work in medium/large-sized cities (500,000 or more people). At the same time, purchasing real estate in them is quite possible even for an ordinary person, and not an entrepreneur. In addition, this could be a second home, received as an inheritance, or acquired as a result of a wedding (the spouses live together and rent out the apartment). There are two options for making money on residential real estate:

- Purchasing an apartment for the purpose of renovating it and then selling it. With proper planning, you can earn 10–15% of the cost of the property in 2–6 months.

- Purchasing an apartment for the purpose of subsequent rental.

It is noteworthy that it is not necessary to buy real estate with cash. For example, you can take it out on credit and pay off the monthly payment from the rent plus a small additional payment. If the cost of an apartment is 1.5 million, it can be rented out for 15 thousand, while the loan payment will be right around these 15 thousand. When choosing an object, you should pay attention to the following nuances:

- Where exactly is the object located? Everything is simple here: the closer to the center, the more developed the infrastructure and the better the yard, the more liquid the apartment and you can ask for more money for it.

- What condition is he in? The more recent the renovation, the more convenient the layout, the larger the kitchen - the more prestigious the housing and the more expensive it can be rented out.

- Apartment details. In what area is it located (center, settlements, residential area, student area), what floor and what neighbors live nearby, what view opens from the windows.

Attention:

Today, most real estate is sold through realtors, who charge up to 10% of the value of the property or 100% in the case of rent for their services. Try to look for options on your own: this will significantly reduce costs and allow you to bargain with home owners.

There is one more nuance here: very quickly you will learn to understand real estate after you have examined a dozen or two objects. You will understand whether the price is reasonable, whether the neighbors are good (you can just talk to them), whether the apartment and house have problems. But be careful during the transaction: you need to check that there are no debts or encumbrances on the property, that minors are not registered on it, etc.

Commercial properties

The option of investing in commercial real estate is suitable for both beginner and experienced businessmen. The main thing is to understand what is in demand and will quickly go away, and what will remain idle for months. There are also two options here: purchasing at an affordable price with subsequent resale and purchasing for rental purposes. But the first option does not always work, since experienced businessmen watch for profitable offers and immediately buy them, especially in large cities, and you are unlikely to be able to make money on the difference. But the second option is more realistic. Moreover, it does not have to be a premises in the city center: you can buy a warehouse on the outskirts or a workshop in a factory area, and then rent it out at a good price.

Real estate price growth is 3–5% per year

One of the disadvantages of commercial properties is their rather high price: even in medium-sized cities, you can spend 3–7 million rubles to purchase a premises of 40–100 m2. Keep in mind that the facility must have appropriate communications: a three-phase network for industrial premises, water, sewerage, ventilation, etc. for ordinary premises. Objects need convenient access, often a parking area, etc. At the same time, commercial properties are much more profitable and hassle-free than apartments, especially if they are located in a convenient location. They are rented for at least a year, and if the business takes root, the lease is extended for 5–7 years, repairs to the premises are often done by the renter himself, and you simply receive income every month.

country estate

Separately, you should consider investing in cottages and country houses. There are quite serious risks in investing in real estate, since you need to clearly understand whether the property will be in demand and whether people will want to leave the city. Country real estate is bought today for two reasons:

- Having your own garden. Many Russians return to their roots and prefer to grow their own cucumbers, tomatoes, peppers, and potatoes rather than buy them in markets and supermarkets.

- Having a place to relax from the bustle of the city. People buy a cottage and go there to be alone, to breathe fresh air, take a walk in the forest or go fishing.

From this we can conclude: you should focus on two target audiences. The first is people with a small income who buy themselves a dacha to provide food, the second is the middle class who can afford a second home (as an option, people prefer to live near the city in a private house and commute to work, rather than live in multi-apartment high-rise buildings ). You can purchase country real estate in three different ways:

- Purchase of a finished object. A common option is to get everything ready, and often housing can be bought cheaper than its actual cost, because people are leaving, cannot maintain the house, etc.

- Purchase of a property under construction. This usually happens when building a new cottage community.

- Purchase of land on a site intended for construction with subsequent sale.

The first option is considered the most common and safe: you see the finished object, you can assess its condition, you understand the general level of occupancy of the village, the existing infrastructure, prospects, and you can make an informed decision.

Estimated payback periods

A distinctive feature of this business is its long payback period. According to experts, this factor is one of the most significant shortcomings of this area of investment activity. The average duration of this time period is ten years.

Quite interesting is the fact that such periods are large even for those areas of investment activity that are characterized by a long-term nature. An example is an investment in a business that pays off within five years. It is important to understand that these areas of investment activity have similar features, in the form of the same volume of invested funds.

Resale of objects

We have considered options for renting, but we should also explore options for purchasing real estate for the purpose of its subsequent resale. Here you need to understand that purchase is possible only with available funds, since options with mortgages or loans are unprofitable (the rate is 6–10% per year with an increase in the cost of the apartment by 3–5% per year). Let's look at how you can make money:

- We are buying a plot of land. Everything is simple here: you need to choose a good plot in a convenient location or purchase an old house with land and utilities. Then the plot is sold to the new owner at a certain markup. The advantages of such a solution include a small investment, good liquidity of land in the right location and the absence of utility bills (land taxes are low today). There are many plots of land on the market in all regions of Russia, so you can choose the right option without any problems. In the future, it will be possible to build a cottage on it and sell everything together.

- Purchasing real estate at the pit level. We have already described a similar method above, and now we will talk about it in more detail. The earlier the purchase is made, the more profitable it is. It is desirable that this be a pit or foundation: in this case, the cost of the object will be minimal. Another advantage of such a solution is that the developer can be paid money gradually, and not all at once. After construction is completed, you either simply sell the apartment in the finished building (usually this is +30% of your investment), or do a full renovation of it and sell it (you can earn up to 50% of the investment amount).

- Purchasing an apartment or property that is in poor condition (after a fire, after marginalized sections of society, etc.). Such real estate can be purchased quite inexpensively. Then you'll just have to throw out everything on the property, remove the floors, chip away at the plaster, and replace it with new stuff. After this, the apartment is sold either in a state prepared for renovation, or with final renovation. The profitability in such a scenario can also reach 30–50%, and you do not have to wait one and a half to two years for the house to be completed and put into operation.

- Redemption of an object that is pledged. Investing in collateralized real estate is quite an interesting and profitable thing; the main thing is to figure out how to properly pay off collateral and know a little about the laws. The principle is simple: someone took out a mortgage on an apartment for 10 years. He paid the bank for 5 years, and then lost his job and cannot maintain his home. The apartment is pledged to the bank and the mortgagee cannot simply sell it. In this case, he advertises the sale, finds a person willing to pay off the existing loan, and simply gives him the property. You come to the bank, pay off the debt, give the person a certain reward and receive the property for yourself. Typically, this option is 10–20% cheaper than buying a new apartment, but it all depends greatly on the situation.

Attention:

Often mortgage holders simply abandon the collateral. In this case, the bank sells them through auctions, by participating in which you can also find a good housing option.

How to increase your chances of success

The profitability of this business depends on the value of the transaction. You can increase the level of profitability by purchasing an object at the lowest possible price. However, there are other methods to increase income. Let's look at the options experienced investors use:

- Careful selection of the developer offering to purchase the property during the construction phase . By choosing this option, the investor takes on a certain risk. If the developer does not fulfill his obligations, the entrepreneur may lose all his money.

- Buying an apartment in disrepair for the purpose of further resale allows you to reduce the amount of investment in organizing a business. It is important to note that the cost of repairs must be included in the final cost of the property. Some entrepreneurs make a profit of forty percent of the original cost of the asset.

- Proper redevelopment can also increase the cost of housing. The only downside to this idea is the need to obtain permission from authorities. Otherwise, the entrepreneur may be subject to penalties. In addition, regulatory authorities may oblige the investor to carry out additional repair work.

- Purchasing assets pledged from credit institutions allows you to start investment activities even if you have a small amount. The cost of such objects can be forty percent lower than on the real estate market.

- Entrepreneurs who bought an apartment on the ground floor of a residential building located near a highway can increase the value of the property by removing it from the housing stock. Converting an ordinary apartment into a commercial property is a long procedure that requires additional costs. However, the cost of renting such objects is significantly higher than the prices of residential premises. This approach can significantly increase business profitability.

What are the advantages and disadvantages of investments?

Keeping your savings under your mattress is not a good idea because inflation is constantly eating them up. Over the past year, the Russian ruble has lost about 10% in value, the dollar has also fallen in price by 3-4%, so all economically developed and literate people are trying to invest money somewhere so that it simply does not depreciate. One of the good options for saving available funds is to invest money in real estate.

Real estate is a good investment option

Let's consider what advantages and disadvantages this solution has. The advantages include the following factors:

- Correctly selected objects have good liquidity and can always be quickly sold.

- By renting out a property, you can create passive income. Your labor costs will be minimal and you will be able to engage in another type of business or work at work.

- Relatively small investment (the purchase is comparable to the amount required to open a small cafe or small “garage” production).

- The market provides a wide range of real estate in various cities and regions of Russia.

- Real estate wears out slowly and does not become obsolete, so you can receive income for years and even decades.

But like any business, real estate has its drawbacks. Let's look at them in more detail:

- It is necessary to navigate the market and be able to find “good” objects.

- Sometimes the value of objects decreases for objective reasons (fall of the national currency, deterioration in living standards, increased taxes, etc.).

- For a beginner, this is not the best option, because the cost of real estate is still quite high compared to the average salary in the country.

- The need for additional costs: utilities, taxes, major repairs, etc.

- Possibility of force majeure events: fire, earthquake, environmental problems, changes in infrastructure, etc.

In general, these problems can be neglected. You just don’t need to buy the first object you come across, but conduct a competent analysis and purchase something that will really be popular and will not suffer from the sudden construction of a pig farm for 10 thousand heads nearby.

Possible risks and consequences

Any direction of investment activity is accompanied by a high level of risk of loss of funds used . Careful study of the most common fraudulent schemes can significantly minimize the risk of capital loss. One of the schemes that scammers often use is creating a “soap bubble”. All transactions are carried out with the help of shell companies that sell “air”. In most cases, these companies actually own the land, which is used to persuade clients to sign a contract.

As a rule, such schemes involve the involvement of legal organizations. As a result, the investor has a complete feeling of the legality of the transaction. The scammers simply disappear after they have collected the amount they need. A distinctive feature of the “soap bubble” is the low cost of the object. In most situations, investors are told amounts that differ significantly from the average cost of similar offers. In order to ensure the reliability of the selected developer, it is recommended to contact the state register . If the selected company is not on this list, you should refuse the transaction.

To avoid most problems, it is important to conduct a preliminary analysis before investing.

Risks in investing in real estate may be associated with the bankruptcy of the developer. There are several different factors that can contribute to a company's loss. Among them are:

- High level of costs due to inappropriate use of assets.

- Low efficiency of the chosen business management strategy.

- Lack of financial resources.

In order to protect yourself from such a development of the situation, it is recommended to cooperate only with large companies with a rich history . However, even large companies can miss the delivery deadlines. As a rule, those investors who use funds issued on credit suffer from this problem. The main task of the lender is to return funds in accordance with the agreement with the bank. Delays in construction work can have a detrimental effect on business.

In addition to all of the above, there are various circumstances associated with unpredictable changes in the situation in the construction market. Any force majeure may cause partial loss of funds. One example of such a situation is the global economic crisis. In such a situation, the number of offers for the sale of real estate significantly exceeds the level of consumer demand. Many people are starting to reduce the price of their apartments in order to sell them as quickly as possible.

The emergence of a crisis helps reduce the price of an object to twenty percent of the original cost. In addition, there are force majeure circumstances in the form of natural disasters. You can protect the acquired asset from this risk by taking out insurance.

It is most profitable to invest in real estate in large cities

Risks when investing in real estate under construction

The danger of losing your money exists in any type of investment. Investments in housing are no exception. To reduce risks, you need to know in advance what you really should be wary of and what schemes scammers use for their real estate scams.

"Bubble"

The first method of dishonestly taking investors’ money is the most banal. Shell companies sell investors air instead of real objects. If construction work is carried out at the sites, it is only to divert attention.

Often such projects are carried out jointly with representatives of legal structures, which gives the transactions the illusion of legality. In fact, having collected a sufficient amount, scammers simply disappear with their clients’ money in an unknown direction.

The first sign of a “soap bubble” is low real estate prices. Be sure to compare the cost per square meter with the average price in the area. If the offer seems too attractive to you, this is a reason to be wary.

Information about legal developers can always be found in the official registers of construction companies. If the developer is a real legal entity, its presence in such a list is mandatory.

Developer bankruptcy

Unprofessional management, lack of funds or their misuse, costs - all these reasons can cause bankruptcy of the developer. When there is nothing to build on, not only the company itself, but also its investors are in the red.

This can be avoided by choosing a large and experienced developer, who already has several dozen commissioned objects under his belt.

Violation of project deadlines

Missing deadlines is not the worst, but also a very unpleasant option. Unfinished construction can cause constant headaches for those buyers who took out bank loans for deposits. Banks are not interested in why construction is not completed on time; it is important for them that the debt is repaid in full and with interest.

It is estimated that each week of delay reduces investor returns by 0.01%. It would seem not much, but in terms of rubles it amounts to a decent amount. After all, delays often amount to months, or even years.

Example

While your “long-term builder” was erecting a multi-story building in a promising area, his competitor managed to lay down and build another building next door with similar characteristics and slightly lower prices per square footage. The cost of your living space will fall by tens of percent in such a situation.

Force majeure and unpredictability of the real estate market

A typical example of force majeure is a protracted economic crisis in the country.

Example

In 2020, in the city of my residence, Novosibirsk, the real estate market experienced a real predominance of supply over demand. Apartments were sold at a discount of 15-25%. Now the situation has improved slightly, but investors have already lost part of their income.

Other types of force majeure are natural disasters, military actions, industrial accidents.

To protect against such troubles, there is real estate insurance.

Watch a useful video on the topic of construction investments.

Where to start investing

First of all, you need to have a sufficient amount of money available to invest in real estate. Why are loans and borrowings for these purposes a bad idea? Because, as mentioned above, it is difficult to guarantee regular income from this type of investment. There may also be associated expenses and you already have a credit burden. It is optimal to have on hand the entire amount necessary for investment.

Once you decide on the size of your investment, you must choose the area in which you want to earn income. There are enough such areas in real estate to make a choice that suits you and not make a mistake.

The concept of real estate includes many income categories. Investments in each of them have individual characteristics, and vary greatly in the degree of investor involvement and the amount of remuneration. Let's look at the main ones:

Which construction is better to invest in: top 5 options

| Type of real estate | Peculiarities | Pays for itself in... | ||

| Premises in apartment buildings | Rental | Resale | Change | Sale |

| Higher income, longer payback | Lower income, pays off faster | from 5 years | 1–2 years | |

| Private houses, cottages | It is essential to consider the location and accessibility of infrastructure | 3–5 years | ||

| Hotel areas | For resort areas and large cities | 4–6 years | ||

| Industrial premises | Option for collective investments, including mutual funds | 8–10 years | ||

| Commercial real estate | Requires experience and strong business acumen | 6–10 years | ||

Investments in the hotel business

Some creative investors are considering investments in the hotel business. No, we do not mean buying a share of a chain of famous hotels (although this is also an investment). We are referring to the purchase of residential property (house or apartment) and conversion into small premises for short-term living. This type of business is widely developed in our resort towns. And in the capital, to be honest, hostels are in demand.

Pros:

- high profitability due to a constant flow of clients;

- It is not necessary to make a good profit. So that all beds are constantly occupied;

Minuses:

- high cost of purchasing real estate. Since the establishment of hotels and hostels in residential apartments is prohibited by law, you will have to transfer the apartment to non-residential status or immediately buy commercial real estate;

- high investments in good repairs and the purchase of necessary furniture;

- maintaining the internal environment at the proper level;

- active advertising to ensure that as many places as possible are constantly occupied;

- it is necessary to register an individual entrepreneur and bear all associated expenses - accounting reports, taxes, etc.

Who can help with investing in residential or commercial real estate - review of 3 companies

You can invest money in real estate yourself or contact specialists in this field. Now there are many companies that offer their services in the real estate investment market.

You buy an apartment and register it as your property, and the company handles its further sale. For example, the company Activo offers its services and guarantees a profit of 11% per annum (which is higher than any deposit in a reliable bank), plus you still have a liquid asset in the form of real estate or cash from its sale.

By transferring your asset into trust management, you receive monthly funds into your account with full reporting of actions. Very convenient, isn't it?

We strongly recommend doing just this with foreign real estate. To do this, you can contact the international company Gordon Rock .

If you do not yet have sufficient funds to purchase a full-fledged property, but have decided to invest in it, then we recommend contacting the E3 Investment . This company has been on the market for a long time and offers its investors to start investing in real estate from 100,000 rubles.

It's up to you to choose a company or invest on your own.

How to start investing: step-by-step instructions

To make an investment, you need to go through 5 steps:

- choose the direction of investment according to your financial capabilities;

- explore the market by comparing available offers;

- choose an investment object;

- complete a transaction to purchase real estate;

- extract income.

Determining the level of financial capabilities

At the first step, I recommend not only assessing your own capabilities, but also working on the option of collective investment. It is worth looking for others who want to invest in real estate in order to buy a residential or commercial property together (with the allocation of shares).

Studying offers

Next, you need to analyze the market, consider proposals regarding the potential profitability of each property for sale.

Selecting an investment object

It is necessary to check each object for compliance of the characteristics declared by the seller with the actual situation.

When inspecting apartments, you need to make inquiries about neighbors, the environmental and criminal well-being of the area, social infrastructure, etc.

When choosing commercial real estate, you must immediately evaluate options for renting out space to tenants and correctly assess the potential income.

Purchasing a property

It is necessary to complete the transaction correctly and pay the tax correctly. If a tax deduction is due, contact the Federal Tax Service for it.

Making a profit

The last step is to resell or rent out the property at the highest possible price. It is important not to undercut the price and not to set the price too high.

Opportunity to start a real estate business without start-up capital

Earning money from real estate is also available for beginning entrepreneurs who do not have start-up capital. As a first step, you need to find a room, which can be:

- Personal garage.

- Own apartment.

- Dacha.

Next, the first capital is earned, based on the rental price paid by the guests. Housing conditions should be gradually improved and the cost of living should be raised. After a few months, it will be possible to rent a room and open a real estate agency there.

Attention! If you don’t want to wait several months for profit, then you should consider the option of lending. Banks have special lucrative offers for entrepreneurs.