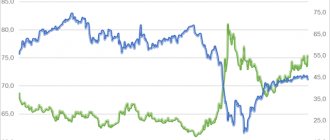

TASS DOSSIER. On March 10, 2020, the US dollar/ruble exchange rate at the opening of trading on the Moscow Exchange increased by 6.4% compared to the closing level of previous trading, to 72.99 rubles. The euro exchange rate jumped by 9.7%, reaching 85 rubles. At the end of two hours of trading, the dollar was at 72.1 rubles, and the euro was at 81.8 rubles.

TASS talks about the largest daily jumps in the ruble exchange rate in modern history. In the 1990s, daily falls of the Russian national currency against the dollar by 10% or more were recorded 21 times, and by 20% or more six times. In the 2000s, there were no drops of more than 10%, even during the global financial crisis of 2008-2009. In the 2010s, the ruble fell by more than 10% twice.

Black Tuesday 1994 - 38.5% drop

On October 11, 1994, on the Moscow Interbank Currency Exchange, the ruble to dollar exchange rate fell by 38.5% from 2,833 rubles to 3,926 rubles. Just a day after the interventions of the Central Bank of the Russian Federation, the exchange rate of the national currency almost recovered the entire fall - up to 2,994 rubles. Black Tuesday led to a sharp increase in inflation - in October it jumped from 8% to 15% and caused serious damage to the reform agenda. To investigate the reasons for the fall in the exchange rate, a special state commission was formed, which found that the reasons for the sharp drop were mainly speculative and occurred due to the actions of large commercial banks. Due to the sharp depreciation of the exchange rate, Russian President Boris Yeltsin resigned on October 12. Minister of Finance of the Russian Federation Sergei Dubinin, October 18 - Chairman of the Central Bank of the Russian Federation Viktor Gerashchenko.

1998 default - several daily drops to 29.6%

On August 17, 1998, a technical default was declared in Russia on the main types of government debt obligations. At the same time, the government abandoned the fixed exchange rate of the ruble against the dollar and announced a transition to a floating exchange rate within the framework of a new “currency corridor”, the boundaries of which were sharply expanded. The economic crisis and the depreciation of the Russian currency were facilitated by the artificial overvaluation of the ruble in order to reduce inflation and the crisis in the countries of Southeast Asia. World energy prices, which accounted for a significant portion of Russian exports, also fell sharply. From August 18 to September 9, the dollar rose 3.2 times against the ruble: from 6.50 to 20.83 rubles, followed by a short-term strengthening to 8.67 rubles. On August 23, Russian President Boris Yeltsin signed a decree on the resignation of Russian Prime Minister Sergei Kiriyenko, and on September 11, the head of the Central Bank, Sergei Dubinin, left his post. Until the end of the year, several more sharp jumps in the dollar exchange rate were recorded: September 17 (by 29.55%, from 9.61 to 12.45 rubles), September 18 (by 17.27%, to 14.6 rubles), October 17 (by 14.38%, from 13.56 to 15.51 rubles).

What will happen to the ruble exchange rate in 2020

The ruble has several opponents in 2020:

- The worsening foreign policy situation.

- Official sanctions that were postponed to the 19th year.

- No OPEC agreement on oil production.

- The internal political situation in the country.

All this could very well lead to a significant outflow of capital and the flight of foreign investors from the Russian market. The ruble exchange rate still depends on the price of oil. And two factors speak in favor of cheap oil: in the United States they are beginning to develop equipment for selling oil; an agreement to limit oil production cannot be reached. Our country’s main commodity on the world stage will weaken, and along with it, the ruble will go down.

Only GDP growth speaks for the strengthening of the ruble. But relative to the dollar, GDP is not growing as fast as predicted. We are very far from the pre-crisis period of 2013.

Optimistic forecast

According to optimistic predictions from experts, we will get a relatively stable year. The dollar will continue to strengthen on the world market, but in Russia everything will remain the same.

The US government is seriously considering new sanctions legislation in 2020. But now there is a specific discord within the country, and perhaps the implementation of the Russian issue will be delayed or postponed until better times. If the American government maintains sanctions or our side manages to achieve a peaceful scenario, then the price of the ruble against the dollar in 2019 will decrease.

For an optimistic version of economic development, Russia is highly discouraged from getting involved in international conflicts. It is worth canceling all external contacts and “support for democracy” in developing countries. Then there will be order on the world stage again, which means that sanctions against the Russian Federation will stop.

The optimistic forecast is this: the ruble will remain in its previous position and even strengthen slightly. This is only possible if OPEC finally regulates the production and sale of oil, and Russia stops being drawn into interethnic conflicts.

The probability of such a forecast is extremely low.

Neutral forecast

Neutral forecast - the ruble will gradually weaken. Under the pressure of sanctions, with capital flight and cheap oil, the ruble will never strengthen. The United States is introducing additional restrictions, investors are fleeing the Russian economy, and Middle Eastern countries continue to dump on the oil market.

One fact speaks in favor of the fact that the ruble will gradually weaken: the world market is oversaturated with oil. And satiety will only increase. The shale revolution in the United States is over, and a whole infrastructure is being built to sell oil from America to Europe.

Even in favorable periods for the economy, when oil prices rise, the ruble will remain stable and only slightly strengthen its position. Simply because the Ministry of Finance spends budget revenues, with the cost of oil above $40, to create reserves. These reserves will be used to compensate for capital flight and cheap oil.

There won't be a big fall. The Central Bank has increased its gold and foreign exchange reserves to the level of early 2014 and has no intention of reducing them. This suggests that the government will not allow the exchange rate to fall significantly. But the fall of the ruble within 5-10 rubles per dollar is quite possible.

The probability of such a forecast is high.

Pessimistic forecast

There is also a pessimistic scenario. It is possible if a strong crisis arises in the world market. Now the trend is just beginning: shares of technology companies are starting to fall in price. American stock exchanges are gradually coming to the realization that the securities of large companies are actually worth much less, and their prices are inflated by speculators.

And if another economic crisis occurs due to inflated stock prices, it will affect all countries in the world. With such a crisis, the events of 2008 will be repeated. When the dollar began to fall rapidly, dragging many currencies of the world with it. Because of this, many companies closed, the unemployment rate increased, the purchasing power of a number of currencies and inflation jumped sharply.

The pessimistic forecast is this: a financial crisis is quite possible throughout the world, and Russia will be among those countries that will be hit the hardest. But even during this period, there can be no talk of any devaluation or redenomination of the ruble.

The probability of such a forecast is low.

The crisis in the foreign exchange market of 2014-2015 - a drop in the stock exchange by 48%

In 2014, the ruble was under serious pressure from the unrest and subsequent coup d'etat in Ukraine, and then sanctions imposed against Russia by the United States and other countries. Since the fall, the main role in the fall of the ruble has been played by the reduction in oil prices: from $107 per barrel of Brent oil in August 2014 to $60 in December. A critical situation in the market arose on December 15, 2014. Against the backdrop of cheaper oil, the main factor contributing to the devaluation of the ruble was the rush demand for foreign currency. The decisions of the Central Bank of the Russian Federation to raise the key rate (to 17% per annum) did not have an immediate effect. On December 16, exchange rates on the stock exchange jumped sharply: the dollar reached 80 rubles (an increase of 48%), the euro - 100 rubles (38%). At the same time, the official exchange rate as of December 17 was raised to 61.15 rubles (an increase of 10.86%), and the euro to 76.15 rubles (11.08%). The second major drop during that period was recorded on January 12, 2020, the first day after the end of the New Year holidays. Due to the continued fall in the price of oil on the world market, the Central Bank fixed the dollar exchange rate on January 13 at 62.73 rubles (11.53%), the euro at 74.35 rubles (8.74%).

Where will the ruble go by autumn?

Since the beginning of 2020, the ruble has fallen by 30% against the euro, media reports. A number of Russian banks have already introduced fees for servicing accounts in European currency. The dollar is also falling in price against the euro, but is growing against the ruble. Vasily Solodkov, director of the HSE Banking Institute, told Rosbalt about what factors influence the exchange rate, and most importantly, what we can expect this fall .

— What happened to the ruble exchange rate and what should we prepare for next?

— The dollar has fallen against the euro, and the ruble is going down against these two currencies. This is the situation we find ourselves in now. The reasons for what is happening are quite obvious. First: before the adoption of amendments to the Constitution and “zeroing,” the Central Bank of the Russian Federation maintained the ruble exchange rate, but now there is no need to do this. Second: the events that happen in Belarus and with Navalny naturally have a negative impact on the appearance of the Russian Federation and are reflected in the ruble exchange rate. Third: in the context of a possible budget deficit, it is beneficial for the Ministry of Finance to have a weak ruble in order to replenish the deficit.

In addition, a lot of money was spent to fight the coronavirus. At the same time, the budget received less taxes, and there was a noticeable decline in GDP. Accordingly, you and I are now facing a budget deficit of 3-5%. And if so, then the easiest way to solve this problem is to devalue the ruble. Why? The main taxpayers are exporters who receive revenue in foreign currency. Accordingly, when the ruble is devalued, the exchange rate changes, that is, they receive the same amount in foreign currency, but they have more in rubles. And taxes are collected from them in rubles. As a result, everyone is satisfied and happy.

— Do you think such a scenario is possible?

97457

Banning the dollar became possible

- Why not? Some call it the “life-giving force of devaluation.” There is no increase in oil prices and is not expected. They will either remain at this level or, most likely, will fall. At a price of $50 per barrel, shale oil producers are actively involved. Plus, before the pandemic, the world was actively looking for and finding good sources of alternative energy. In particular, in Germany they generated half of the electricity.

— After what happened with Alexei Navalny, Russia is threatened with new sanctions. Such conversations are already heard in the public space. What role will this story play?

“The Russian leadership has done everything to make a negative attitude towards our country a brand. Therefore, new sanctions are indeed possible.

— If they are introduced, the ruble will obviously continue to fall.

— If the Central Bank does not interfere, then yes. On the other hand, he may be forced to intervene. Accordingly, when sanctions are introduced, the Central Bank can play against the market for some time and maintain the ruble exchange rate, having at its disposal reserves accumulated through the sale of oil - the largest in the entire historical period.

On the other hand, the Ministry of Finance has a problem, which needs to “close” the budget. On the third hand, it is unlikely that anyone will give us external loans in the current conditions. What remains is our unfortunate population, which will pay for all this. Including, obviously, due to the devaluation of the ruble.

— You said that after the reset, the Central Bank became uninterested in maintaining the ruble exchange rate. Why might this change due to sanctions?

15523

How much will a rebellion against Lukashenko cost us?

“The fact is that we do not have a consistent policy as such. Putin will say: “Why is it that the ruble has collapsed?” - we will have the same policy. If he says: “To hell with the ruble, we need to replenish the budget,” the policy will be different. You and I now cannot predict where the curve will take us. Because the official position of the Central Bank of the Russian Federation is that it does not regulate the exchange rate. However, we see that very noticeable interventions occur in the foreign exchange market.

— How will the upcoming presidential elections in the United States affect the foreign exchange market? Will this affect us in any way?

“Right now there is no clear leader in the United States. Neither Biden nor Trump can be called such yet. The United States as a country is split into two groups that genuinely cannot agree with each other on whom to vote for. But in any case, we see that both Republicans and Democrats are talking about introducing sanctions against Russia to increase their popularity. These conversations alone already affect the ruble exchange rate.

— What influences the fall of the dollar against the euro?

— The United States has the highest incidence of coronavirus. Now the Americans, as I understand it, have even more casualties than they lost in World War II. There are already more than 170 thousand deaths there from COVID-19. Moreover, in total, 250 thousand people died on European territory during World War II. In this regard, GDP falls, a soft monetary policy is introduced, when money is poured into the economy on a huge scale. Against this backdrop, the dollar is falling.

— Will it end with the elections?

8651

Coronavirus crisis: it will only get worse

— The exchange rate is not predicted, as are the election results. In the last election, everyone was sure that Hillary Clinton would win, but Donald Trump won, because, firstly, people vote, and, secondly, they have a stupid habit of counting votes. Therefore, everything that will happen is difficult to predict.

— Is it right for me, as an ordinary person, to think that the only reasonable thing in such a situation would be to buy euros?

- This is not at all obvious. You and I don’t understand what inflation will be like for either the euro or the dollar. There was an absolutely unlimited amount of money poured in both here and there. This money will go somewhere. This trickle will turn into a river, and somewhere, in some prices, this will be reflected. Now we have zero rates on the euro, and there is no inflation yet. But no one says that it won’t be there tomorrow. It is not at all clear what you will gain by investing in euros now. You can lose your money or, conversely, make good money. Traditionally, savings need to be divided into different currencies. The problem is that everyone is now expecting high inflation.

— It turns out that in the fall the situation will worsen, and we will see different prices in stores?

— Maybe even a little later than in the fall, closer to the new year. Russia, compared to other countries, has an “advantage” - we did not distribute money at the height of the pandemic. The country is experiencing a record number of bankruptcies. As a result, the lack of effective demand restrains inflation.

Interviewed by Anna Semenets