What to do after registering an individual entrepreneur? This question worries many novice businessmen. We will try to figure out what steps an individual entrepreneur should take after registering with the tax office.

In our publication today, we will tell readers how to register with the Pension Fund of Russia, the Social Insurance Fund, how to receive notification from state control authorities, as well as other actions that an individual entrepreneur needs to take after completing registration with the Federal Tax Service at his place of residence.

Documents and necessary actions after registering an individual entrepreneur

After the expiration of the three-day period after submitting documents for registration of an individual as an individual entrepreneur, the tax office issues the applicant:

- OGRNIP certificate.

- Extract from the Unified State Register of Individual Entrepreneurs.

Starting from 2020, the individual entrepreneur receives the above documents electronically to his email address. If you need to obtain original documents, you must submit a corresponding application to the Federal Tax Service.

Next you need to do the following:

- register with the Pension Fund of Russia;

- register with the Social Insurance Fund within 30 days after registration (if the individual entrepreneur is an employer);

- notification of state control authorities (when carrying out certain types of activities);

- decide on the taxation system;

- receive a letter from the statistics department (Rosstat);

- open an individual entrepreneur's current account in a bank;

- purchase and register a cash register (for individual entrepreneurs on the simplified tax system, OSNO, who plan to engage in retail trade and catering). From July 1, 2020, the use of a cash register with a fiscal registrar is mandatory for all individual entrepreneurs and LLCs making payments in cash or electronic payments. An exception is made for entrepreneurs who work without hired personnel: for them, work without a cash register is possible until July 1, 2021;

- order a print (if necessary).

In order to order a seal, an individual entrepreneur must submit the following documents to a specialized company engaged in the manufacture of such products:

- passport;

- TIN;

- USRIP extract.

To open a bank account, the following documents are required:

- application for opening an account;

- IP passport;

- state registration certificate or USRIP extract;

- extract from the Statistics Service;

- samples of signatures and seals.

We propose to consider in more detail how individual entrepreneurs are registered with extra-budgetary funds.

Individual entrepreneur registration

State registration of a citizen as an individual entrepreneur is carried out by the Federal Tax Service on the basis of an application. You can submit a basic package of documents to the tax office in person, by registered mail, or through special online resources.

Step-by-step instructions for opening an individual entrepreneur.

The following documents are required for registration:

- Application on form 21001;

- Photocopy of passport (all pages);

- Copy of TIN;

- Confirmation of payment of state duty (receipt).

Simultaneously with submitting documents for registration of an individual entrepreneur, you can declare your intention to switch to a simplified taxation system.

A citizen receives a registration certificate (OGRNIP) and an extract from the Unified State Register of Individual Entrepreneurs within five working days, after which he officially becomes an individual entrepreneur. But this does not mean at all that at this stage you can relax and immerse yourself in new activities.

Read on to find out what to do after registering with the tax office in our step-by-step instructions.

Registration of individual entrepreneurs with extra-budgetary funds (PFR, MHIF, Social Insurance Fund)

After completing the registration procedure as an individual entrepreneur, the tax office, within five days, transfers information about newly created individual entrepreneurs to extra-budgetary funds. Individual entrepreneurs are registered:

- to the Pension Fund of Russia (PFR);

- in the MHIF (Compulsory Health Insurance Fund).

An individual entrepreneur who is an employer is registered with the Social Insurance Fund of the Russian Federation (FSS).

Please note that, despite the fact that it is not necessary to independently register with extra-budgetary funds of individual entrepreneurs, the entrepreneur must receive a notification of registration in each of the funds.

Each notice contains a registration number, which is necessary for the entrepreneur to submit reports and pay insurance premiums.

If you need workers, you need to register them correctly

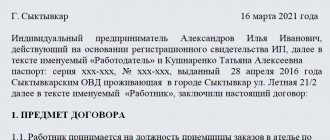

Business is built on attracting and using resources, including human resources. It is very difficult to earn big money alone, so many individual entrepreneurs hire workers. If the amount of work is small or one-time assistance is needed, you can hire a contractor temporarily, under a civil contract. And permanent workers are hired and an employment contract is concluded with them.

But the employer’s responsibilities are not limited to concluding a contract. The employee must pay wages on time and transfer insurance premiums for him. Contribution rates depend on the type of agreement:

- for labor – from 30.02% to 38.5% of wages;

- for civil law – 27.1% of the remuneration amount.

The difference in tariffs is explained by the fact that under a civil contract the customer does not pay contributions for social insurance and against injuries, only for pension and medical benefits.

You also have to submit reports for employees, which are quite complex:

- once a month - SZV-M in the Pension Fund of Russia;

- once a quarter - DAM and 6-NDFL to the tax office, 4-FSS to the social insurance fund;

- once a year - 2-personal income tax and average number to the tax office, SZV-Experience in the Pension Fund of the Russian Federation, certificate confirming the main type of activity in the Social Insurance Fund.

Free accounting services from 1C

Within 30 days after concluding an agreement with the first employee, the individual entrepreneur must register as an employer with the Social Insurance Fund. There is no need to register with the Pension Fund; the tax office will provide the necessary information to the Pension Fund.

Registration of an individual entrepreneur with the Pension Fund of Russia and the Social Insurance Fund as an employer

Individual entrepreneurs must additionally register with the Social Insurance Fund as an employer after hiring their first employee.

The period for registering an entrepreneur with the Social Insurance Fund is 30 calendar days. The countdown starts from the moment of concluding the first employment or civil contract between the individual entrepreneur and the employee.

Individual entrepreneurs are not required to register with the Pension Fund of Russia as an employer in 2020. This is due to the fact that the administration of pension and medical contributions is carried out by the Federal Tax Service, and in this organization an individual entrepreneur is considered registered from the moment of registration of the individual entrepreneur. The Federal Tax Service is also responsible for transferring the entrepreneur’s data to the Pension Fund.

After January 1, 2017, registration with the Pension Fund occurs automatically; there is no need to visit the Pension Fund in person. The tax authority independently, without the participation of the individual entrepreneur, after its registration, transfers the necessary data to the local branch of the Pension Fund.

In order for an individual entrepreneur to be registered with the FSS as an employer, the following documents must be submitted to the territorial office of the FSS:

- passport of an individual entrepreneur (pages with photo and registration);

- certificate of state registration of an individual as an individual entrepreneur;

- certificate of registration with the tax authority (TIN);

- extract from the Unified State Register of Individual Entrepreneurs;

- work book of the first hired employee, if the employee is hired part-time without a work book, then an employment contract;

- application for registration.

We invite the reader to take a break from reading and watch a video dedicated to the issues of paying fixed fees:

Obtaining statistics codes OKPO, OKATO, OKTMO, OKOPF, OKFS, OKOGU

In his work, an individual entrepreneur must use statistics codes, in particular to indicate them in primary documents and when preparing reports.

In 2020, obtaining statistics codes has been significantly simplified compared to previous years. They can be obtained without visiting the territorial statistics departments in the following ways:

- using the official website statreg.gks.ru;

- using the services of an intermediary;

- when registering an individual entrepreneur with the Federal Tax Service.

When to notify the Pension Fund

Is it possible to open an individual entrepreneur with temporary registration? What is needed for registration?

Another answer to the question of what to do next after registering an individual entrepreneur with the tax office is mandatory registration with funds. Usually, the Federal Tax Service and the Pension Fund register individual entrepreneurs on their own. But this only applies to situations where a person works independently, without involving third parties in the work. If you decide to hire employees, you will have to notify the Pension Fund and register yourself.

Registration in funds

Within 30 days from the date of signing the first employment contract, you must contact the Pension Fund and the Federal Tax Service with originals and copies of the following documents:

- application for registration;

- registration certificate;

- license to carry out activities;

- passport;

- IP INN;

- the first employment contract concluded with the employee.

Within five days the businessman will be registered. In the future, he is obliged to pay taxes on his employees.

Notification of state control authorities

Before starting certain types of business activities, individual entrepreneurs must notify the relevant state control authorities about this. As a rule, this is Rospotrebnadzor.

You can see the full list of types of business activities for which it is necessary to submit a notification to Rospotrebnadzor in Decree of the Government of the Russian Federation dated July 16, 2009 N 584 (as amended on September 23, 2017).

Here are some of them: tourism, hotel activities, publishing business, trade, provision of personal services, printing, textiles, production of certain types of products, fish processing, provision of cargo transportation services and so on.

Individual entrepreneurs can submit a notification of the start of business activities in paper form (in 2 copies) in person or through an authorized representative, by mail (by registered mail with a list of attachments) or electronically (via the Internet or using the online service on the State Services website) .

Notifications to Rospotrebnadzor about the start of business activities can be found at this link:

After the expiration of the ten-day period, the updated individual entrepreneur data will appear in the Rospotrebnadzor register.

What is advisable to do after receiving documents for an individual entrepreneur?

I opened an individual entrepreneur but did not work - do I have to pay taxes and contributions to the Pension Fund?

The first thing you need to do is find out whether there is a need to obtain a license to carry out the chosen type of activity. In particular, it may be necessary if the goods have the potential to affect public health. A certificate will be required for enterprises operating in the medical, hotel and tourism industries, food and textile industries.

Important! The list of activities for which a license is required is specified in Art. 12 Federal Law No. 99 dated 04.05.11

If a license is needed, you must contact the organization responsible for issuing them. Thus, the Ministry of Emergency Situations provides a license for companies related to fire activities, Roszdravnadzor - for medical ones.

To obtain a license, you must provide originals and copies of the following documents:

- registration certificates;

- TIN;

- extract from their Unified State Register of Entrepreneurs.

What else to do after opening an individual entrepreneur? You must visit the statistics department and receive a letter with statistical data and individual entrepreneur codes. You will need them when opening a bank account.

Legally, an individual entrepreneur is not required to open a bank account. It is necessary only if you intend to work with other organizations and there is the possibility of non-cash payments.

Important! Banks must independently notify the Pension Fund of the Russian Federation and the Federal Tax Service about the opening of a bank account by a businessman. This is their responsibility, not the entrepreneur's.

It is important to open a bank account

To open an account you will need the following documents:

- statement;

- passport;

- OGRNIP;

- TIN;

- certificate from Rosstat;

- USRIP extract;

- samples of seals and signatures.

If revenue will be accepted through bank card terminals, then an online cash register is required.

A cash register may be needed depending on the chosen tax system. CCP is required when working with the tax systems of the simplified tax system, OSNO and unified agricultural tax. It is necessary to register the device with the Federal Tax Service where the individual entrepreneur was opened. It is important that a service agreement is also concluded with a special center.

What to do after registering an individual entrepreneur, is it necessary to register somewhere else? Yes, some types of activities will require registration with Rospotrebnadzor. In particular, if you plan to conduct activities in such areas as hotel and tourism, publishing and trade business, printing, textiles, personal services, and cargo transportation.

Notification of the commencement of activity is submitted in two copies on paper in person or through an authorized representative. Submission by mail or electronically is also acceptable.

Speaking about the issue, I registered an individual entrepreneur and what next, it is necessary to note the need to issue a seal. It can be ordered immediately after registration. Although the individual entrepreneur has the right to work without it. To receive you need to provide:

- passport;

- TIN;

- OGRNIP.

Important! Having a seal allows you to quickly gain the trust of partners and service customers.

After receiving the IP, what should you do next if all formalities have been completed? One of the most important steps that entrepreneurs rarely take is organizing document flow. It is important to immediately divide the documents into separate folders, since during any check, the absence of someone or a long search for what is needed can become a significant problem. There are several main folders:

- government certificates and licenses;

- bank documents;

- contracts with suppliers;

- personnel documentation;

- cash documents and strict reporting forms.

Completing all the necessary paperwork should not take much time, a few weeks at most.

Typical mistakes of individual entrepreneurs when starting a business activity

Having insufficient information about the tax legislation of the Russian Federation, many beginning entrepreneurs make mistakes, which in the future can lead to the imposition of significant fines on them and the cessation of their activities.

We list the most common mistakes that have serious consequences:

1. The deadline for transition to a special tax regime has been missed. This point will be an exception for individual entrepreneurs who have chosen OSNO for their work. For other individual entrepreneurs, in future work there will be many difficulties associated with a greater administrative and tax burden, in contrast to the use of the simplified tax system, PSN or UTII.

2. Late registration with the Social Insurance Fund in the presence of personnel will result in administrative punishment:

- violation of the deadline for registration with the Social Insurance Fund up to 90 calendar days inclusive - 5,000 rubles;

- Violation of the deadline for registration with the Social Insurance Fund for more than 90 calendar days - 10,000 rubles.

3. Ignoring Rospotrebnadzor. If an entrepreneur does not submit a notification about the start of activities on time, a fine will be imposed on him, in accordance with Article 19.7.5-1. Code of Administrative Offenses of the Russian Federation, in the amount of 3,000 to 5,000 rubles.

4. Late submission of reports. The Tax Service, Pension Fund and Social Insurance Fund require entrepreneurs to report on the payment of taxes, contributions and fees by filing declarations. The volume of reporting is quite large in some cases. For late submission of reports, administrative sanctions and blocking of the current account are applied, because this is a violation of the direct duties of the individual entrepreneur after registration.

We hope that our publication on what to do after registering an individual entrepreneur will help you in developing your business!

The material was updated in accordance with current legislation 10/11/2019

Choose a tax system

Only a registered individual entrepreneur falls into the main taxation system (OSNO) by default. In this tax regime, he must pay three taxes: VAT, personal income tax and property tax. To reduce the tax burden on business, the state has provided special regimes in which instead of three taxes you need to pay one. You can select a special mode during or after registration. Let's consider the options.

STS - simplified taxation system

The tax rate depends on the object of taxation. At the object “income” - 6%, at the object “income minus expenses” - 15%. Some regions reduce rates for all or certain types of activities. Read more about this taxation system in the article “What is the simplified tax system.”

You can switch to the simplified version within 30 days after registration. To do this, fill out form 26.2-1 and submit it to the territorial inspectorate of the Federal Tax Service. Read more about how to switch to the simplified tax system in 2020.

UTII - single tax on imputed income

UTII is valid only for certain types of activities that are chosen by regions (Part 2 of Article 346.26 of the Tax Code of the Russian Federation). From January 1, 2021, UTII will be abolished.

The single tax replaces the three taxes that individual entrepreneurs pay on OSNO. For calculating the amount payable, actual income does not matter. The tax depends on the imputed income that you should receive according to the tax authorities. The rate is 15%.

An individual entrepreneur must submit an application to switch to UTII within 5 days from the moment he actually began to apply this taxation system (Part 3 of Article 346.28 of the Tax Code of the Russian Federation). Application form No. UTII-2 was approved by Order of the Federal Tax Service of Russia dated December 11, 2012 No. MMV-7-6/ [email protected]

PSN - patent tax system

The essence of this regime is the acquisition of a patent, which gives permission to engage in a certain type of activity for a period of 1 to 12 months. Purchasing a patent replaces the payment of VAT, personal income tax and property tax. The list of activities for which a patent can be purchased is given in Art. 346.43 of the Tax Code of the Russian Federation, regions can expand the list.

An application for the transition of an individual entrepreneur to PSN must be submitted no later than 10 working days before the start of application of this taxation system. The application form was approved by the Federal Tax Service - this is form 26.5-1.

Unified agricultural tax - unified agricultural tax

The application of this regime is limited to the scope of activity: it can only be used by agricultural producers. The tax rate is 6% of the difference between income and expenses.

You can submit a notification about the transition to the unified agricultural tax in form 26.1-1 within 30 days after registering an individual entrepreneur or before December 31 of the current year - for the transition to the unified agricultural tax starting next year (part 1 of article 346.3 of the Tax Code of the Russian Federation).

This might also be useful:

- State duty for registration of individual entrepreneurs in 2020

- We draw up a competent business plan for an employment center

- How to select OKVED codes for individual entrepreneurs?

- Help in opening a sole proprietorship - quickly and easily

- Which is better: LLC or individual entrepreneur?

- How to open an individual entrepreneur: step-by-step instructions

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

When is it time to open an individual entrepreneur and how to work legally while remaining an individual

Our store at the Masters Fair turns 7 years old this year and our business is registered in full compliance with the law, we regularly pay all required taxes. However, like many, we started working without official registration. This went on for some time, while the income was quite modest, so when writing this article we decided not to disclose the name under which we operate. At the beginning of our journey, we physically did not have the opportunity to register a business in accordance with all the rules - taxes would become such a heavy burden that they would not allow us not only to develop the business, but even to simply keep it afloat. Fortunately, by a fortunate coincidence, we were able to get advice from a competent lawyer who told us how a novice master in the creative field can start his own business while remaining an individual, in general, safely and legally. This is the information I want to share in this publication. As practice shows, not everyone knows this. We don't mind, you might find it useful. Much has changed over time, but we have clarified everything new ourselves so that the text of this publication remains relevant in 2020.

So, how much does it cost to open and run an individual entrepreneur in 2018?

Anyone who is faced with the question of whether it is time to register their business should know the answer to this question, because it is very difficult for novice entrepreneurs to estimate all the expenses that will appear when registering an individual entrepreneur.

1. Registration of individual entrepreneurs.

Everything here is very modest - the state duty is 800 rubles. and if you are going to submit documents yourself without intermediaries, then the registration costs will end there. If you want to use the services of organizations that will take care of all bureaucratic issues, you will have to pay 2000-7000 rubles for this.

The registration procedure is very simple and you can complete it yourself. Moreover, now if the application is filled out incorrectly, there will be no need to re-pay the fee, as was the case before.

2. Opening a current account for an individual entrepreneur.

Banking services for individual entrepreneurs' accounts cost 200-600 rubles per month on average. At the same time, many banks offer discounts on services, or even free opportunities for new clients or subject to active use of the account (as a rule, active use means a large number of debit transactions on the account - 30-40-50 thousand rubles or more monthly). That is, in order not to pay for services, you need to spend a lot. In general, as a rule, these offers are temporary and, sooner or later, you will have to pay for maintaining the account.

3. Online cash registers.

From July 1, 2018 , the law obliging all entrepreneurs to open an online cash register finally comes into force and applies to almost everyone. A couple of small exceptions still remain for the coming year, but if they apply to you, chances are you already know about it. The general essence is that all individual entrepreneurs and organizations that make payments to individuals (including online sales), that is, all of us, are required to have an online cash register.

Online checkout is expensive. The device itself costs from 15 thousand rubles (these are the simplest and not very reliable models, which can only send electronic checks, but cannot print paper ones). The average cost of a simple online cash register of more or less acceptable quality is about 25-30 thousand rubles. Instead of buying an online cash register, you can rent it, but the rental prices, in my opinion, are extortionate - up to 3-5 thousand rubles monthly.

In addition to the cost of the device itself, you will have to pay for a contract for its maintenance, as well as the services of the OFD (fiscal data operator). OFD is a special organization that will store information about your transactions and mediate between your cash register and the tax office. The cost of an agreement with the OFD varies greatly, on average 2000-4000 per year.

I would like to end the conversation about online cash registers here, but there is one more unpleasant nuance. The law obliges sellers to provide a receipt to the buyer (including in electronic form) within no more than 5 minutes from the moment of payment. That is, if you sent the buyer your account details during the day, and he read your message in the middle of the night and immediately made the payment, the law requires you to get up and make the payment through the cash register at the same moment, sending a check to the buyer. This is difficult to achieve and liability for violating this deadline can only arise in the event of an official complaint from the buyer about the late delivery of the check, which, you see, is unlikely in real life. But still, if you intend to follow the law and fulfill this requirement, you will have to connect an additional payment service that will automate the operation of your cash register and will automatically process a payment through it immediately when making a payment. Such services usually charge a commission on each payment, the amount of which may vary.

4. Internet acquiring.

An optional expense item, needed only by those who want to facilitate the payment process for their customers and provide them with a convenient payment form that allows them to accept payment from any bank cards without commission, instead of providing full details of their current account. The buyer does not pay a commission, simply enters the number and other standard data of his card, pays for the purchase and enjoys life. The seller will pay the commission. Usually this is about another 2-3% of the amount.

You can avoid this by opening a current account at a bank that allows you to issue a card for the account. Then it will be possible to give the buyer the number of this card and leave the payment process relatively familiar for the handicraft industry and inexpensive. However, you will most likely still have to pay for card maintenance.

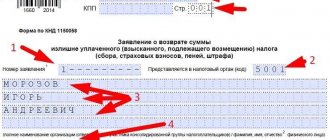

5. Taxes and insurance premiums.

Fixed payments of individual entrepreneurs for compulsory pension insurance in 2020 - 26,545 rubles.

Deductions for compulsory medical insurance - 5,840 rubles.

If your annual income is more than 300,000 rubles, you will have to deduct an additional 1% of the excess amount.

If an entrepreneur works on a simplified taxation system, taking into account only income, then the tax burden will be 6% of revenue.

It must be remembered that an individual entrepreneur without employees can reduce his tax deductions by the full amount of insurance premiums.

To make it clearer, let's look at a couple of examples. Let’s say a master earns about 20,000 rubles a month, which makes 240,000 rubles a year.

Insurance premiums will be 26,545 rubles + 5,840 rubles = 32,385 rubles.

Tax of 6% - 14,400 rubles

The amount of insurance premiums is greater than the amount of tax, so you can reduce it completely and pay only 32,385 rubles.

If the master earns 40,000 rubles monthly or 480,000 rubles per year, then to the amount of 32,385 rubles of insurance premiums we add 1% of the amount exceeding the threshold of 300,000 rubles. We think like this:

480,000 rubles - 300,000 rubles = 180,000 rubles.

1% of 180,000 rubles = 1,800 rubles. The total amount of insurance premiums will be 32,385 rubles + 1,800 rubles = 34,185 rubles.

The 6% tax according to the simplified tax system will be 28,800 rubles, which again turns out to be less than the amount of contributions, so it can be fully repaid with them.

And finally, the third situation. Let's say your business has taken off and your annual income is 1,000,000 rubles.

Insurance premiums: 32,285 rubles + 1% of (1,000,000 rubles - 300,000 rubles) = 32,285 rubles + 7,000 rubles = 39,285 rubles.

Tax 6% of 1,000,000 rubles = 60,000 rubles.

This is already more than insurance premiums. If you subtract them from the tax amount, you get 60,000 rubles - 39,285 rubles = 20,715 rubles.

Thus, the entrepreneur will need to pay 39,285 rubles in insurance premiums + 20,715 rubles in taxes.

If you use a patent, the amount of payments will be fixed and determined by the specific type of activity.

To summarize, I would like to note that everything described above is very generalized and average information, rough estimates, so please do not treat it as the ultimate truth, but use it only for information and approximate calculations, with the obligatory adjustment for your own situation.

So, the minimum cost of maintaining an individual entrepreneur in the first year after registration in 2020 is about 55-70 thousand rubles. This includes the cost of registration, annual banking services, purchase of an online cash register and an agreement with the OFD, taxes and insurance premiums at the minimum rate.

Of course, from the second year the financial burden will be reduced due to the cash register, but you still have to live to see it, so evaluate your capabilities yourself. After all, we must not forget about other costs of doing business - purchasing materials, paying for club cards, transport, communication services, postal services, housing and communal services and other things.

If your handicraft business is ready for such payments, then there is no need to doubt it, it’s time to open an individual entrepreneur and work as expected. If these numbers shock you, then the next part of the article is for you.

How can a master work while remaining an individual?

Calmly and without unnecessary nerves.

First, you need to understand how you can attract the attention of the tax office.

There are three main ways: the first is the attention of the bank, in which you hold an account as an individual and regularly accept payments from other individuals.

However, if your one-time payments are less than 30 thousand rubles, and your monthly payments are less than 60-100 thousand rubles, if your goods cost differently and the payment amounts are not identical, if you don’t have a dozen or two transactions going through every day, you don’t have to worry too much , this is unlikely to come to the attention of the bank. And do not believe the stories that appear regularly, which talk about supposedly tightened control and mandatory verification of all payments between individuals. Just imagine how many bank employees have to drop everything they’re doing and start calling tens of thousands of their clients to interrogate them to whom and why they sent their 500-1000 rubles?

The other two ways to come to the attention of the tax authorities are a complaint from a dissatisfied customer or competitor. If everything is relatively simple with buyers - try to resolve issues peacefully and negotiate without conflict, then with competitors it is somewhat more complicated. The tax authorities are reluctant to take such measures as test purchases with small artisans, but competitors can gladly take on these unpleasant responsibilities, conduct it themselves and provide the tax authorities with all the facts and evidence “on a silver platter.”

How to protect yourself from such a situation from a legal point of view?

Enter into an offer agreement. This only sounds scary, but in practice it is an elementary thing. Don't be afraid, such an agreement does not need to be concluded with each buyer separately; the public offer is addressed to an indefinite number of persons. Essentially, this agreement contains information about what type of deal you are offering and under what conditions. The section with the rules of the store at the Masters Fair, by and large, can already be considered such an agreement, since if it is written well and in detail, it contains all the information that, by law, such an agreement must contain. The only thing worth adding there is information about what constitutes acceptance of the contract. Acceptance is a conditional “signing”, some expression of the buyer’s consent to your offer, which you can record in one way or another. Typically, acceptance of an offer involves payment.

So, if you write in the rules of your store about what you sell, under what conditions (it is not necessary to indicate specific prices, you can simply refer to the fact that they are listed on the store page for each product), describe the rights and obligations of the parties (although in the simplest words) and indicate that this information is a public offer and acceptance is made upon payment - the contract can be considered posted and valid. From now on, every customer in your store accepts it as soon as they pay for your product.

What does this give?

This gives you the opportunity to legally report to the tax office, being an individual, if it becomes interested in your activities and calls for a conversation, having in hand facts proving that you have conducted a commercial transaction. Until the systematic activity is proven (don’t worry about reviews, the date of registration of the store, etc. - this is not proof yet), you only face the need to report for this transaction in form 3-NDFL (income tax) - that is, you will have to pay 13% of the amount of the proven income at the end of the reporting period. If you have to go to the tax office, your offer agreement will confirm your intention to do this. In fact, even if several transactions have been proven, you nevertheless report (or convincingly declare your intention to report) for them as an individual. face, then most likely no serious punishments will follow.

Of course, such a solution can only work once. You should not play with these things and try to re-report on 3-NDFL if in reality your activities are systematic. After such a call, it is absolutely necessary to either register the business or close it.

I hope this information will be useful to those who are just starting their business or have doubts about certain legal aspects. As soon as you feel that you can “pull” official registration, be sure to go through it, because this is not only an opportunity to sleep peacefully, but also concern for your future.

Comments

View all Next »

Tatyana 09/07/2015 at 14:15 # Reply

deadlines for receiving notifications from extrabudgetary funds

Within what time frame after receiving the certificate should you contact the Pension Fund and the Compulsory Medical Insurance Fund for notifications?

Natalia 09/07/2015 at 14:42 # Reply

Tatyana, the deadlines for registration in the funds are provided only for individual entrepreneurs who are employers. When hiring the first employee, no later than 10 days after hiring - submit an application to the Social Insurance Fund for registration of individual entrepreneurs by the employer; no later than 30, submit an application to the Pension Fund for registration of individual entrepreneurs by the employer in the Pension Fund. Violation of the deadlines for filing such applications entails administrative liability. For individual entrepreneurs who are not employers, there are no deadlines for receiving notifications. When registering an individual entrepreneur with the tax authority, the tax authority independently transmits data about the individual entrepreneur to the Pension Fund of the Russian Federation. You only need to pick up a notification from them, which indicates the registration number of the individual entrepreneur in the Pension Fund (FFOMS).

Evgenia 09.21.2015 at 14:11 # Reply

I officially work and am an entrepreneur

I officially work and am an entrepreneur without hired workers, should I pay all these insurance premiums, if my employer pays all these contributions for me, to the relevant authorities?

Natalia 09.22.2015 at 12:23 # Reply

Evgenia, you are required to pay insurance premiums for yourself as an individual entrepreneur, despite the fact that your employer pays contributions for you from your official salary. These are completely different categories; in the first case, you are an employee and your employer pays for you to the funds - Pension Fund, Federal Compulsory Medical Insurance Fund and Social Insurance Fund. In the second case, you are an independent individual entrepreneur and are required to pay to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund, as well as pay taxes depending on the type of your business activity and the taxation system.

Valentin 09.24.2015 at 21:39 # Reply

Hello! Please tell me, I rented space for a store, and I want to make a luminous sign outside the entrance with the name, where do I need to go for this and do I need to pay some kind of tax?

Natalia 09.25.2015 at 11:07 # Reply

Valentin, you only need to obtain permission from the owner of this premises. It is quite possible that you have such a clause in the Lease Agreement; if not, then draw up an additional agreement to the Agreement.

Alina 05/28/2016 at 10:26 pm # Reply

There is no need to pay taxes for the sign. It is necessary to conclude an energy supply agreement with a resource supplying organization, since there is electricity consumption, under this agreement you will pay for individual consumption, but there is no need to pay for general household needs. Basic documents: application, copy of TIN, OGRNIP, Unified State Register of Legal Entities, statement of balance sheet boundaries, lease agreement.

Alexander 05.10.2015 at 17:52 # Reply

Taxi

Good afternoon, I opened an individual entrepreneur for taxi activities in July 15th. I opened the PC and made a print. But there were no corporate clients very lucky in terms of income. And I closed the PC. I don’t work much, I had twins, I don’t have time to work, over the entire period I managed to earn 20-25,000 in total income. I definitely didn’t count. I did not take any further action with the tax authorities. Tell me, if possible, step by step, what I should do, what taxes I should pay. thank you in advance.

Natalia 10/05/2015 at 08:04 pm # Reply

Alexander, good evening. You did not write which tax system you work on. In all likelihood, on UTII, this system is usually chosen for your type of activity. If you work for UTII (registered with the tax office as a UTII payer), then you need to pay the UTII tax amount by October 25 (next payment by January 25, 2016) and submit the UTII report by October 20 (next report by January 20, 2016). Also, by the end of the year you must pay fixed contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund. I calculated the amount of contributions for you, taking into account the fact that you registered as an individual entrepreneur on 07/01/2015 (you did not indicate the exact date): Pension Fund - 9,305.40 rubles FFOMS-1,825.29 Since your income is not large (less than 300 thousand rubles per year) , then you do not need to pay additional contributions to the Pension Fund, pay only the amount of fixed payments that I calculated for you. If you worked for the simplified tax system and were not registered as a UTII payer, then the declaration under the simplified tax system must be submitted by April 30, 2020. Pay the advance payment of the simplified tax system for 9 months before October 25, 2020 and pay the simplified tax system for 2020 by April 30, 2020. Fixed payments to the Pension Fund and the Federal Compulsory Medical Insurance Fund should be made within the same period and in what sums for UTII (written above). Do not forget that under any taxation system you must keep a Book of Income and Expenses, which is filled out on the basis of primary documents, in your case these are BSO (strict reporting forms for taxi services). Read about BSO on our website.

Alexander 10/06/2015 at 11:36 pm # Reply

Taxi

Good evening! Thank you so much Natalia for responding to my letter so quickly. After rummaging through the documents, I saw that I was registered with the Internal Revenue Service on June 10, 2015. Accordingly, it is from this time that taxes are counted. I don’t understand what tax system I work under. When I opened the IP, I did not take this point into account. How can you find out or whether taxi activities automatically fall under the UTII please clarify. My second question is related to the closure of the individual entrepreneur. Can I close a business without paying taxes or should I automatically open it already? Next, regarding the ledger of expenses and income, I’ll ask this: when getting out of a taxi, do you often ask the driver for BSO? don't bother, I'll answer you. not even once in all this time. How to fill out a book (of an incomprehensible format) without having any receipt stubs. Forgive me for such a frivolous style, I am writing from the heart and have no experience in correspondence. Once again I would like to thank you, Natalia, for your responsiveness and substantive answers. Sincerely, Alexander PS, can I talk to you, privately, so to speak? if yes, please email the place and time or phone number. As you understand, getting to any beautiful place in Moscow is no problem.

Natalia 11/12/2015 at 10:56 am # Reply

Alexander, Good afternoon. I apologize for the late reply, for some reason your question did not reach me on time. I answer: You had to submit an application to choose a tax system within 30 days after registration. If you have not done this, then automatically you should work on OSNO. Only this system assumes automatic application if the application for choosing a tax system is not made on time. Look in your registration documents to see if you have an application for a special tax regime. You had to submit two copies, the tax office put a mark of acceptance on one of them and returns it to you. From the date of registration, fixed contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund are calculated; these amounts do not depend on the availability and amount of your income. I will calculate for you based on the fact that you registered on 06/10/15: Pension Fund - 10,391.03 rubles. FFOMS -2,038.24 rub. payment deadline - no later than December 31, 2015. These contributions are paid regardless of which taxation system the individual entrepreneur operates on. Now the whole question is which taxation system are you registered in, because if you stayed on OSNO and still haven’t submitted a single report, and individual entrepreneurs on OSNO are VAT payers. Even if you do not pay VAT, you still submit reports. Regarding the BSO and the book of income and expenses - the formats are all approved by law, the rules for filling them out too, but the fact that taxi clients do not require them is another matter - you must write them out in any case. As for talking in person, this is only if you come to Sevastopol, I live in this city. All the best.

Sergey K. 11.11.2015 at 18:05 # Reply

I am submitting a Notice of Commencement to Rostransnadzor (intercity passenger transportation). Question: Does the start of tax time and payment of insurance premiums begin from the date of filing such a notice or are these events not related?

Natalia 11/12/2015 at 09:24 # Reply

Sergey, good morning. All calculations - payment of insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund, payment and submission of reports, are calculated from the date of registration as an individual entrepreneur. You will see this date in the individual entrepreneur registration certificate.

Marina 02/10/2016 at 10:31 pm # Reply

Hello. I am a beginner individual entrepreneur, 6%. I plan to open a retail outlet in another city by purchasing a patent. I plan to hire 2 local workers. Do I need to register as an employer with the Pension Fund of Russia and the Social Insurance Fund at the place of registration of employees and the location of the retail outlet or at the place of my registration?

Natalya 03/14/2016 at 12:19 # Reply

Hello. I registered as an individual entrepreneur, but I can’t choose which system to report on. I have 16 meters, I will work without a cash register.

ostapx1 03/14/2016 at 01:47 pm # Reply

Hello. The features of each tax system are discussed here: https://tbis.ru/nalogi/sistemy-nalogooblozheniya-dlya-ip Of course, each case is individual, and we are ready to give you advice on the most optimal option. But to do this, you need to know not only the area of the premises, but also the type of activity, as well as the region of work.

Olga 05/11/2016 at 01:19 pm # Reply

registration with the Social Insurance Fund

Good afternoon Law No. 125-FZ says that registration is within 30 days, for individual entrepreneurs there are special rules for 10 days?

Natalia 05/11/2016 at 14:54 # Reply

Olga, good afternoon. Law 125-FZ “ON COMPULSORY SOCIAL INSURANCE AGAINST WORK ACCIDENTS AND OCCUPATIONAL DISEASES”, in part of Article 6 Federal Law No. 394-FZ of December 29, 2015, was amended and the period was changed from 10 to 30 calendar days from the date of concluding an employment contract with the first employee, both for legal entities and individual entrepreneurs.

Ellya 06/22/2016 at 10:56 am # Reply

Registration with the Social Insurance Fund and the Pension Fund of Russia

Individual entrepreneur was registered on June 14, 2016. 2 contract agreements are planned. Do I need to register with the Social Insurance Fund and Pension Fund?

Natalia 07/04/2016 at 08:18 # Reply

Ellya, by concluding a Contract, you acquire the status of an employer, therefore you are required to register as an employer with the Pension Fund of the Russian Federation and the Social Insurance Fund. You will be assigned registration numbers to pay your dues.

View all Next »

What taxes and fees do you need to pay?

Registration of an entrepreneur at the end of the year gives rise to the obligation to submit reports and pay fees. If a businessman has managed to receive income, he will have to transfer taxes to the budget. Obligations will depend on the taxation regime:

- PSN. No reporting provided. The payer will only need to purchase a new patent.

- USN. Taxes for 2020 will have to be paid in December, and the declaration must be submitted before the end of April 2020.

- UTII. The report for the last quarter is required to be sent by January 25. If the activity was not carried out for all three months, the tax is calculated according to the time worked.

- BASIC. The procedure for submitting reports on the general system will not differ. The entrepreneur is obliged to make calculations for personal income tax, VAT, etc.

If there are no employees, there is no need to send documents to extra-budgetary funds. Since 2012, entrepreneurs are no longer required to fill out multi-page forms. They only need to remit fixed fees in a timely manner before the end of December of the current year. In 2018, their cost will be 26,545 (PFR) and 5,840 (MHIF) rubles.

Accrual algorithm! The base rate should be divided by the number of days in a year, and then multiplied by the number of days the entrepreneur status is valid. Contributions are required to be transferred by December 31st. Additional calculations will be made until July 2020. It is necessary to transfer 1% of income exceeding the annual limit of 300,000 rubles to the Pension Fund. The amount of contributions should not exceed the maximum limit of 218,200.

Let us remind you that the administration of fixed fees is carried out by the tax service.

Register with the funds and receive statistics codes

Whether or not an entrepreneur needs to make additional visits to funds (Pension and Social Insurance) depends on whether he has employees. Often, a newly opened individual entrepreneur works alone for the first time; in this situation, he does not need to register with the funds, since his tax office will independently send his data there.

The situation changes as soon as a businessman enters into his first contract with an employee; after this date he has 30 days to visit the Social Insurance Fund (Article 6 of Law 125-FZ).

Attention! It is necessary to register with the Social Insurance Fund of the Russian Federation as an employer not only when concluding a full-fledged employment contract, but also if the contract is of a civil law type.

In addition to the usual documents on entrepreneurial activity, the funds must be provided with papers confirming the status of the employer: a copy of the signed employment contract, an extract of the employment order. For late registration, you can be fined from 5 to 10 thousand rubles (Article 26.28 of Law 125-FZ).

As already noted, at the first stage there is no need to visit Rosstat. In the future, to generate statistical reporting, you will need codes such as OKPO, OKATO. You can get them through the official website of Rosstat by filling out the entrepreneur’s details online: TIN and OGRNIP. The first time they are issued free of charge, repeated issuance is subject to a small amount. Codes are also updated free of charge if a businessman’s credentials change.

Important! These codes are needed not only for statistical reporting, but also when opening a current account. Every year, Rosstat publishes on its website lists of selected entrepreneurs who must report to the department. The obligation arises when the businessman is included in the annual monitoring. Continuous observation is carried out at least once every 5 years.