The difference between a GPA and an employment contract

When concluding a civil law contract (CLA), it is necessary to carefully ensure that its terms exclude even the small possibility of being classified as a form of employment agreement.

In judicial practice, such requalification is not uncommon, and its consequences are fraught not only with the payment of an administrative fine, but also with additional assessment of insurance premiums and penalties for their late payment. IMPORTANT! Labor relations with an employee are regulated by the Labor Code of the Russian Federation, and civil relations with an individual are regulated by civil law.

To avoid possible problems, the following features must be observed in the terms of the contract:

1. The subject of the GPA is the provision of a certain service, performance of work or transfer of property rights, and not the performance of a labor function by profession. The result of the work should be a tangible result in the form of, for example, a completed project or assembled equipment. Accordingly, the basis for payment is not a time sheet, application or order, but an act of work performed (services rendered).

2. An employee under such a contract is not a full-time employee, which means that he cannot be subject to requirements for compliance with internal regulations and subordination in accordance with the hierarchical structure of the company, as well as standards for setting salaries in accordance with the staffing table. This means that there will be no such conditions in the GPA.

3. The procedure for payment under the GPA is determined by agreement of the parties and is not regulated by the Labor Code of the Russian Federation. Thus, payment of remuneration is possible only after completion of the work (their stages) stipulated by the contract or transfer of rights to property, unless its conditions indicate the need for an advance payment.

4. Unlike an employment agreement, such an agreement, regardless of its subject matter, status of the parties and special conditions, always has a finite period of validity.

5. In the case of providing services under the GPA, special attention should be paid to the frequency of their provision. If, under the contract, certificates of work performed or services provided are regularly issued for amounts of a comparable amount, this will be considered a clear sign of a disguised labor relationship and will attract the attention of inspectors.

About situations in which the courts regard the GPA as a labor one, read the material “GPA with an individual for the provision of services - the risk of reclassification as a labor one.”

What is a GPC agreement

This is a civil law agreement, also known as a civil law agreement, concluded between an organization and an individual. This includes, in particular, contracts:

- according to the norms of Article 779 of the Civil Code of the Russian Federation for the provision of services;

- according to the norms of Article 702 of the Civil Code of the Russian Federation for the performance of work, contract;

- according to the norms of Article 1288 of the Civil Code of the Russian Federation - author's order;

- other.

After completion, the customer and the contractor sign a certificate of completion of work. On its basis, the citizen receives a reward, that is, money earned. This can happen either in stages or for the entire volume at once. Under agreements of this type, an individual acts as a performer of any work or services. In doing so, it can:

- have the status of an individual entrepreneur;

- do not have the status of an individual entrepreneur.

This is of decisive importance for the customer. Why is this so important? Because the obligation of an organization or entrepreneur to pay taxes and insurance premiums on remunerations paid to performers depends on this. In particular, under such an agreement with an individual entrepreneur, the customer of work or services does not have any such obligations; he must pay taxes on his own. But if the performer is an ordinary citizen, then the question of what fees are subject to a civil contract should be of interest to the management of the organization even before it is signed. Because if you underhold or underpay something, you can get a large fine from the tax authorities. But first things first.

Calculation of insurance premiums under GPC agreements in 2019-2020: features

One of the most important advantages of registering relations with an individual in a civil law manner is the possibility of reducing the amount of accrued insurance premiums, and sometimes the complete absence of the need to accrue them.

To understand which payments are subject to contributions and which are not, it is necessary to clearly define the subject of the agreement and its compliance with one of the categories listed in Art. 420 Tax Code of the Russian Federation:

| Subject of the agreement | Is the remuneration subject to insurance premiums? |

| Contracting, provision of services | Taxable |

| Royalties | Taxable, minus the amount of confirmed expenses |

| Alienation of rights to the results of intellectual activity | The amount reduced by the amount of confirmed expenses is taxed. |

| Transfer of ownership or temporary use of property (including lease agreements, donations) | Is not a subject to a tax |

| Reimbursement of expenses of volunteers in charitable organizations | Not taxed, with the exception of food expenses exceeding the daily allowance in accordance with clause 3 of Art. 217 Tax Code of the Russian Federation |

| Reimbursement of expenses for professional training, including student contracts | Is not a subject to a tax |

In the case of concluding an agreement with a mixed subject, for example, providing for both the sale or transfer for use of property and services associated with its transfer, contributions must be accrued only for that part of the remuneration that is subject to taxation. Therefore, in such GPAs it is necessary to distinguish between the amounts of an individual’s income into taxable and non-taxable parts.

ConsultantPlus experts have prepared detailed explanations on the calculation of insurance premiums for payments under a vehicle rental agreement with and without a crew. Go to the Ready-made solution by getting free trial access to the system.

The calculation of contributions does not depend on the form in which the GPC agreement is concluded: on paper or electronically .

Find out when to pay advance payments to the “physicist” contractor here .

See also “Reimbursing the expenses of a “physicist” under the GPA - should I pay fees? .

Features of the GPC agreement and fines

When concluding a “civil” contract, several important nuances must be taken into account.

No labor discipline and personnel records

Persons working under a GPC agreement are not full-time employees and are not required to obey internal labor regulations. This means, in particular, that they do not have to come “to work” every day, or at a certain time. They can also finish performing work or providing a service at any time and go about their business. For such “workers” there are no lunch breaks, vacations or sick leave.

The organization, in turn, should not fill out a time sheet for freelance employees. Also, you should not draw up personnel documentation on them, including orders and work books. All this significantly reduces the non-productive burden on the “employer”.

Compose HR documents using ready-made templates for free

Payment of remuneration and fines

The freelance status of persons with whom GPC agreements have been concluded means that remuneration is paid to them not for their labor function, but for the fact of performing work or providing a service. Therefore, if the work or services are not performed in full, of poor quality or in violation of the deadline, the advance amount paid is subject to return.

The lack of the right of the performer (contractor) to a monthly salary also means that the customer does not have the obligation to transfer remuneration strictly every half month.

The fact that the relationship between a company and an individual is formalized by a GPC agreement makes it possible to have a flexible approach to the issues of establishing and paying appropriate remuneration. All these issues are resolved exclusively on a contractual basis. Therefore, various fines can be included in a civil contract if the work is completed in violation of the deadline or of poor quality.

For example, it is permissible to establish a condition on reducing remuneration for each day of delay in delivering the work. Or determine that the payment is reduced if the work is performed poorly. However, it is impossible to fine an “employee” under a GPC agreement for lateness, absenteeism and other labor violations. After all, as we have already said, the work regime does not apply to freelance employees. At the same time, a fine for untimely start of work or provision of a service, if the start date (time) is directly indicated in the contract, is quite legal (clause 1 of Article 708, Article 783, clause 1 of Article 330 of the Civil Code of the Russian Federation).

Termination of an agreement

When terminating a civil contract, the protective mechanisms provided for by the Labor Code do not apply. And the Civil Code allows the inclusion of any termination rules in a civil contract (subclause 2, clause 2, article 450 of the Civil Code of the Russian Federation). Moreover, the possibility of unilateral refusal to fulfill a contract for the provision of services at any time and without explanation is directly stated in Article 782 of the Civil Code of the Russian Federation. Therefore, there are usually no problems with “dismissal” under a GPC agreement.

IMPORTANT. These rules apply in both directions. This, in particular, means that the “employee” can refuse further cooperation at any time without notifying the customer two weeks in advance. True, in this case, it will be possible to deduct losses incurred due to the early termination of the contract from the amount of remuneration (clause 2 of Article 782 of the Civil Code of the Russian Federation).

In conclusion, we note that any contract or service agreement that an organization has concluded with a non-entrepreneur individual may come under the close attention of regulatory authorities. If inspectors find signs of an employment contract, this will result in a fine and arrears for insurance premiums for the “employer”. To prevent this from happening, you need to correctly draw up the GPC agreement in 2020 and not include unacceptable conditions in it.

Exceptions to the general rule

Chapter 34 of the Tax Code of the Russian Federation, among other things, provides for a number of features in the taxation of insurance premiums relating to both the status of the insured person and the type of contract concluded with him:

1. Remunerations under the GPA, regardless of the subject of the agreement, are not subject to contributions for insurance against temporary disability or in connection with maternity (subclause 2, clause 3, article 422 of the Tax Code of the Russian Federation).

2. Amounts of income accrued to freelance employees are not subject to contributions for insurance against accidents and work-related injuries, unless this is expressly stated in the terms of the contract.

3. Remunerations to foreign citizens who have the status of temporary residents, in accordance with subparagraph. 15 clause 1 art. 422 of the Tax Code of the Russian Federation are not subject to insurance premiums, unless this is expressly provided for by federal laws on specific types of insurance.

4. Income under the GPA of foreign citizens working in company divisions abroad of the Russian Federation is not subject to insurance contributions.

Read about the nuances of calculating contributions on the income of foreigners in the material “Insurance contributions from foreigners in 2020 - 2020.”

5. If a GPC agreement is concluded with an individual in the status of an individual entrepreneur, then he is obliged to calculate and pay insurance premiums independently. This is due to the fact that in the light of Art. 419 of the Tax Code of the Russian Federation, private entrepreneurs are allocated to a separate class of payers.

Read about the specifics of calculating and paying individual entrepreneur contributions here.

Are taxes and fees charged on the GPC agreement?

The following distinguishes a civil law contract from an employment contract:

- under an employment contract, the relations of the parties (employee and employer) will be regulated by the provisions of the Labor Code,

- under a GPC agreement, the parties to which are the customer and the contractor, relations can be built only on the basis of the provisions of civil law.

The subject of the contract is also different: for a labor contract, this is personal, long-term performance of work in accordance with the staffing table, profession and position (Article 15; 57 of the Labor Code of the Russian Federation), for which the employee is regularly paid wages. For a GPC agreement, the subject is the completion of work or services by a specific deadline, that is, some result in favor of the customer (Article 702 of the Civil Code of the Russian Federation), which he accepts under the act and pays remuneration for the entire scope of work.

Having concluded an employment contract, the employer withholds and transfers personal income tax from the employee’s income to the budget. As for income tax from GPC agreements, the customer, as a tax agent, is also obliged to charge, withhold and transfer tax, but only if the contractor is an individual and not an individual entrepreneur (Article 226 of the Tax Code of the Russian Federation). Moreover, it does not matter whether the text of the agreement states that the contractor must pay personal income tax on the remuneration independently or not (letter of the Ministry of Finance of the Russian Federation dated 03/09/2016 No. 03-04-05/12891).

The employer must regularly transfer contributions to pension, health and social insurance from payments to employees, but are civil contracts subject to insurance contributions? Yes, they are taxed, but not all.

GPC agreements for the performance of work or provision of services concluded:

- with IP, because they themselves transfer contributions “for themselves”,

- with foreigners and stateless persons temporarily staying in Russia,

- with full-time students of professional and higher educational institutions working in student teams with state support (in terms of pension contributions).

Also, under civil law contracts, insurance premiums will not be charged if the subject of the contract is the transfer of ownership or other property rights, or the transfer of property for use (Part 3 of Article 7 of Law No. 212-FZ of July 24, 2009). That is, under an agreement, for example, a sale or purchase, there is no need to charge contributions to the funds.

At the same time, there are exceptions to this - insurance premiums for civil contracts must be paid if it is a contract:

- author's order,

- on the alienation of exclusive rights to literary, scientific works and works of art,

- licensing - publishing, or granting the right to use the works indicated above.

Thus, in most cases, insurance premiums will have to be charged under a contract for the performance of work or provision of services.

Expense limit for reducing the taxable base for insurance premiums

In the case of royalties, as well as contracts for the alienation of rights to the results of intellectual activity, the amount of expenses by which the taxable base can be reduced must be documented and have a direct connection with the receipt of such income (clause 8 of Article 421 of the Tax Code of the Russian Federation) . The volume of expenses not confirmed by documents is limited (clause 9 of Article 412 of the Tax Code of the Russian Federation). The limits are set as a percentage of the accrued remuneration:

- for the creation and execution of literary works, scientific developments and works - 20%;

- for the creation of musical works not related to the theatrical sphere or audio design for video films - 25%;

- for the creation of artistic, architectural, audiovisual works, photographs - 30%;

- for inventions, discoveries and creation of industrial designs - 30% of the amount of income of an individual received during the first 2 years of using the results of work;

- for the creation of sculptures, decorative and design graphics, as well as musical works intended for theater or films - 40%.

Read about the cases in which income under the GPA is not subject to personal income tax.

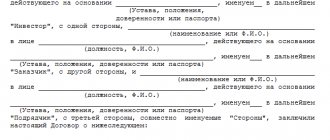

Reporting under a civil contract. What should you pay attention to?

Customer companies must report payments made in favor of persons working under civil contracts in the same manner as for ordinary employees and on the same forms. However, filling out some reporting forms under a civil contract has a number of features. Pay attention to them!

Let's look at an example:

N. Kurochkin from 09/01/2018 to 09/10/2018 performed, under a civil contract, setting up a computer network for Siberian Confectioner LLC. The remuneration under the agreement amounted to RUB 8,500.00. (including personal income tax - 1105.00 rubles). On September 11, 2018 it was paid in full. Personal income tax was transferred on September 12, 2018.

Certificates of income of an individual 2-NDFL

When filling out the 2-NDFL certificate, in the “Income Code” column, you must indicate - 2010 “Payments under the GPA, except for royalties.”

Calculation according to form 6-NDFL

When filling out section 2 of the 6-NDFL calculation, the following lines indicate:

- 100 – day of recognition of income according to GPA, according to paragraphs. 1 clause 1 art. 223 of the Tax Code of the Russian Federation, it is the day of payment of remuneration, and not the last day of the month in which income was accrued;

- 110 – date of tax transfer;

- 120 is the deadline for transferring tax to the treasury. According to paragraph 4 of Art. 226 of the Tax Code of the Russian Federation is the working day following the payment of remuneration;

- 130 – the amount of income paid under the contract including tax;

- 140 – amount of withheld personal income tax.

Calculation of insurance premiums

When filling out individual information about such an employee, in column 180 of the 3rd section of the report, you must indicate code “2”.

The amount of remuneration and other payments received by him must be indicated in column 230.

These payments should not be reflected in lines 010 - 070 of section 2.

Information on the average number of employees

It includes only information about the main employees of the enterprise. Workers under civil contracts and part-time workers are not included in this report.

List of insured persons

The civil contract does not affect the preparation of the SZV M report in any way. This includes everyone working at the enterprise.

Calculation of accrued and paid insurance premiums according to Form 4-FSS

Workplaces where people working under the GPA work are not subject to mandatory special requirements. assessment of working conditions. There is no need to include information about them in Table 5.

SZV experience report – Experience

Here, when filling out information about an employee who worked under the GPA, you need to pay attention to columns 6, 7 and 11. The 6th column indicates the start date of the contract or the date of its signing. In the absence of these dates, the day the provision of services or work began. The 7th column indicates the earliest date:

- signing a certificate of completion of work or acceptance of services,

- expiration of the contract,

- last day of the reporting year.

In the 11th column you need to indicate one of the codes:

- “AGREEMENT” – if the GPA was fully paid in the reporting period,

- “NEOPLDOG” – if the contract has not been paid in full.

If during the reporting year the household. If the contractor entered into several agreements with the organization, it is advisable to reflect each agreement on a separate line. Business contracts carried out simultaneously with work under an employment contract also need to be reflected separately. The only exceptions may be fully paid contracts performed at the same time. Upon completion of work, the SZV-STAZH form must be given to the employee.

Insurance premium rates for GPC in 2019-2020

According to established Art. 425 of the Tax Code of the Russian Federation, the amount of insurance premiums for calculation from the amounts of remuneration under GPC agreements is:

- for compulsory pension insurance - 22%, taking into account the maximum base for calculation and 10% on income exceeding it;

- for compulsory health insurance - 5.1% (there is no limit on the income base for these contributions).

The maximum base for calculating insurance contributions for pension insurance is equal to:

- in 2020 - RUB 1,150,000. (Resolution of the Government of the Russian Federation dated November 28, 2018 No. 1426);

- in 2020 - RUB 1,292,000. (Resolution of the Government of the Russian Federation dated November 6, 2019 No. 1407).

However, the size of the marginal base and the tariffs depending on it cease to play their role if the policyholder has the right to apply reduced premium rates.

What insurance premiums are payable?

In the case of civil contracts, insurance contributions are made exclusively to the Pension Fund (from 2020 to the Federal Tax Service) and to the Federal Compulsory Medical Insurance Fund. Employees hired under a GPC agreement cannot qualify for insurance from the employer in the event of disability or pregnancy. The same applies to contributions to the Social Insurance Fund against injuries during work or the occurrence of an occupational disease.

However, it is worth considering that the text of the contract may directly indicate the need to deduct contributions for injuries - in this case you will have to do this.

When insurance deductions occur in accordance with the GPC agreement, it must be taken into account that compensation for employee costs for materials, auxiliary tools, etc. are excluded from the base subject to contributions.

Application of reduced and additional GPA contribution rates

In Art. 427, 428 of the Tax Code of the Russian Federation clearly regulate cases when the payer can use reduced rates of insurance premiums or, conversely, must apply an additional rate.

The situation with a reduced tariff in relation to civil law contracts is quite simple: if the payer exercises the right to reduce insurance premiums for full-time employees, it has the right to apply the same tariffs under civil contracts.

Note! Since 2020, the list of persons entitled to preferential rates on contributions has been significantly reduced; in particular, the majority of simplifiers have lost this right. Since 2020, this list has decreased even more, at the same time, individuals have appeared who can reduce the general insurance premium rate to 15%.

A more complex analysis is required before a decision is made on the assessment of additional contributions. As you know, this applies to work that is carried out in hazardous and unhealthy working conditions: the legislator lists professions that are subject to additional contributions for pension insurance in paragraphs 1–18 of Part 1 of Art. 30 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

Thus, if the GPC agreement covers work related to the performance of duties in such professions, or it directly states that the work is carried out in hazardous conditions, then additional contributions are necessary. The same approach must be followed in the case where the place of work is the territory of an enterprise, which, as a result of a special assessment of work, has been assigned a certain class of danger or hazard.

However, in a situation where the contract does not indicate the location of the work or the wording of the subject of the contract is vague and does not directly indicate that work is being carried out in conditions of increased danger, the enterprise may not charge additional insurance premiums. But, taking advantage of this opportunity, it is necessary to understand that in case of an audit, you need to prepare to defend your position in the judicial authorities.

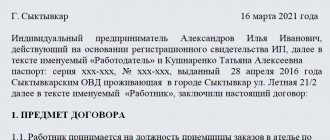

How to apply

A GPC agreement with an individual does not have a unified form.

However, when drawing up a document, it is important to indicate some aspects and nuances of cooperation:

- Preamble indicating:

- Full name and other data of the customer and contractor;

- other authorized persons.

- An item indicating a specific expected result after completing a given task. For example, the subject could be building a house. In this case, it is important to describe the main characteristics of the structure, materials used, colors, etc.

- Deadlines for completion, without which the document cannot be considered legally valid. The GAP must specify the start and end dates of work, as well as the period of intermediate inspection. It is not necessary to indicate a specific date. Typically a time period or condition is used. For example, the term is the fact of completion of construction.

- Quality of work. Quality is determined according to the criteria specified in the contract. It also indicates the warranty period during which the contractor undertakes to correct defects if any are discovered.

- The procedure for performing work or providing services. Here are the basic requirements for cooperation and links to regulations. It is important to indicate which party provides materials, tools, equipment, etc.

- Amount and procedure of payment. Payment is set based on results, tariffs or time spent at the discretion of the parties. This also includes the cost of materials and the nuances of paying taxes. The payment procedure is established - in cash or by transfer to an account, as well as terms.

- Responsibility. The section lists sanctions for failure to fulfill the obligations of the parties to each other. It is advisable to indicate the amount of fines or other sanctions.

- Change or termination. This part lists the conditions under which the agreement may be terminated or become invalid. They also establish the possibility of making changes.

- Conclusion. The final part indicates the validity period of the agreement, contact information and signatures of the parties.

A sample contract is available.

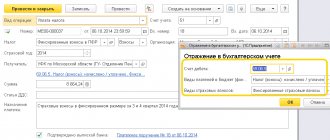

Payment and reporting of GPA insurance premiums in 2019-2020

Currently, reporting on insurance premiums (with the exception of contributions for insurance against accidents and industrial injuries, the calculation of which continues to be accepted by the Social Insurance Fund) is submitted to the Federal Tax Service. The form of this calculation is common to all contributions supervised by the service. For 2020, the ERSV is submitted according to the form approved. by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. For reporting for the 1st quarter of 2020, a new ERSV form is in effect - from the order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] The calculation must be submitted no later than the 30th day of the month following the end of the reporting quarter/year.

This report does not highlight the amounts of payments under the GPA, so the main thing for the accountant is to correctly determine the part of the income paid that is taxable and non-taxable with insurance contributions.

Read more about the rules for filling out the new calculation here.

Reporting on insured persons is not limited to a single calculation form submitted to the Federal Tax Service. On a monthly basis, it is necessary to submit a report to the Pension Fund in the SZV-M form, which must indicate not only all employees who worked in the organization during the reporting period, but also all individuals with whom GPC agreements were concluded.

Among other things, all payers are obliged annually, before March 1 of the year following the reporting year, to provide personalized data on the length of service of insured persons to the Pension Fund in the form SZV-STAZH, approved by Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p.

The savings are obvious

There are two parties involved in the contractual relationship – the contractor and the customer. The contractor undertakes to perform certain work according to the customer’s instructions and deliver it to the customer for the appropriate fee. That is, a contract is an agreement to perform work. Payments under civil contracts, the subject of which is the performance of work or the provision of services, are recognized as subject to taxation as “pension” and “medical” contributions.

But contributions to compulsory social insurance in case of temporary disability and in connection with maternity do not need to be accrued and paid from payments to the contractor.

This is stated in subparagraph 2 of paragraph 3 of Article 422 of the Tax Code of the Russian Federation.

Example 1

The company pays insurance premiums at the general rate - 30%. Petrov's salary is 33,700 rubles. Ivanov works under a contract, the remuneration for which is 33,700 rubles. The company pays pension contributions at a rate of 22%, medical - 5.1%, insurance for temporary disability and in connection with maternity - 2.9%. Amount of insurance contributions for payments to Petrov per month is 10,110 rubles. (RUB 33,700 x 30%). Insurance premiums in case of temporary disability and in connection with maternity are not accrued for Ivanov’s remuneration under the contract. Therefore, the amount of contributions is 9132.7 rubles. (RUB 33,700 x 27.1%).

Results

Despite the obvious attractiveness of using GPA agreements due to the possibility of charging insurance premiums for the payments they provide for in a smaller amount, their legal component requires accuracy in the wording of the terms of the agreement. For an accountant, the presence of freelance workers will mean the need to carefully collect and study documents confirming the possibility of non-payment of insurance premiums, as well as work together with a lawyer to exclude language from civil liability agreements that implies negative consequences for the business.

Sources:

- Tax Code of the Russian Federation

- Federal Law of December 28, 2013 No. 400-FZ

- Decree of the Government of the Russian Federation dated November 6, 2019 No. 1407

- Decree of the Government of the Russian Federation of November 28, 2018 No. 1426

- Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

- Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected]

- Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Legislative acts on the topic

It is recommended to study the following laws:

| Law | Name |

| clause 1 art. 7 of the Federal Law of July 24, 2009 No. 212-FZ | On recognition of remuneration under a civil law contract as an object for taxation of insurance premiums |

| pp. 2 p. 3 art. 9 of the Federal Law of July 24, 2009 No. 212-FZ | The fact that contributions to the Social Insurance Fund are not accrued for GPC agreements |

| para. 4 paragraphs 1 art. 5, paragraph 1, art. 20.1 of the Federal Law of July 24, 1998 No. 125-FZ | Contributions for injuries are accrued to the GPC agreement only in cases where this is provided for by the terms of the agreement |

| Art. 702 Civil Code of the Russian Federation | About the subject of the GPC agreement |

| Art. 426 Tax Code of the Russian Federation | Amounts of insurance premiums |

Contract agreement with foreigners: individuals and legal entities

The tax agent is a Russian organization. When calculating personal income tax, it is necessary to immediately determine whether a foreign person is a resident of our country. This definition includes citizens who have lived within the Russian Federation for at least 183 days a year. If not, the rate will be 30%.

Otherwise, the scheme is the same as when working with an ordinary individual:

- FSS injuries are paid at will, if specified in the contract and at the same rates as those established for other employees.

- There is no need to pay FSS for temporary disability

- In the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund, contributions are made at established rates.