What it is

Such an agreement is concluded if one party gives money, and the other performs all the necessary actions that will bring profit in the future.

The one who gives money is called an investor; the party that performs the work can be called the customer or the builder, it all depends on the field of activity.

What is his role

The investment agreement is designed to consolidate the relationship between the customer and the investor. The document is proof that the parties have entered into a relationship. Moreover, here the parties to the relationship must be clearly and specifically described, and not just who gave money to whom, for how long and how many dividends he wants to receive.

In addition to the amount of funds issued by the investor, the contract must include clauses about what exactly the customer must do, and determine deadlines for all types of work or transactions. It is imperative to include clauses on risks and force majeure, define the specific components of these concepts, and develop measures to overcome such phenomena.

Legal basis

The rules for drawing up an agreement and its legal basis are regulated by the Civil Code of the Russian Federation.

Specific and specialized issues are addressed in two federal laws:

- “On investment activities in the Russian Federation, carried out in the form of capital investments.”

- "On investment partnership."

Nature of the investment agreement

In a legal sense, this is a written agreement on the basis of which the investor finances a business project, and the recipient of the investment implements this project. This type of contract, such as an investment contract, is not legally established, but is widely used.

The agreement is mixed, that is, it contains elements of various obligations. An analysis of judicial practice shows that the courts accept such a contract as adequate evidence of the conclusion of a transaction, operate with the concept of “investment agreement”, and in the reasoning part of the decisions they refer to Articles 420 - 423 of the Civil Code and apply general provisions on obligations (Articles 307 - 419 of the Civil Code of the Russian Federation ).

A significant problem is that the legislator has not established the essential terms of the investment contract; as a result, lawsuits arise to recognize the agreements as not concluded. Analyzing the current practice, we will highlight the features of an investment agreement:

- The parties to the agreement are a municipality, a subject of the Russian Federation, the Russian Federation, an individual or a legal entity. An investment agreement is also concluded between an individual and a legal entity.

- Investors (depositors) invest their own material resources in the project being implemented.

- The customer (recipient of investments) implements the project under certain conditions and with the aim of making a profit.

- Contractors, subcontractors, and co-investors are additionally included as parties to the contract.

- The object of the agreement is the development of small businesses (“start-ups”), construction, modernization, restoration, re-equipment, newly created property complexes and enterprises.

- Investments are material goods (money, real estate, securities) invested in a business project by an investor in order to make a profit or achieve another useful effect.

An investment contract is most often used in construction. Investment partnership agreements and interest-free investment loans are concluded. Securing investments depends on the risks of the project and the requirements of the attracted investor; often, a pledge of intellectual property (know-how, inventions, programs) and shares in an LLC is used as security for loan repayment.

In order to optimize taxes, an investment agreement between legal entities must also contain provisions that comply with the requirements of the tax legislation of the Russian Federation.

Features of an investment agreement under the Civil Code of the Russian Federation

For correct registration, it is necessary to comply with certain points:

- All alleged mutual actions between the investor and the customer must be documented.

- The money received for the development of the project is spent only for the purposes described in the investment agreement. Other expenses of invested funds are prohibited.

- The document is drawn up in writing, secured with signatures, seals or other means of authentication. Oral agreements, even in front of witnesses, are not valid.

- It is imperative to take into account the specifics of the tax system for each party signing the document.

- The profit that arises from the implementation of an investment agreement can be paid either as a percentage or as a fixed, specific amount.

- Investments can be simultaneous or paid in installments; how this will happen must be documented.

Types of agreement

Types of investment agreements:

- purchase and sale;

- barter;

- annuities;

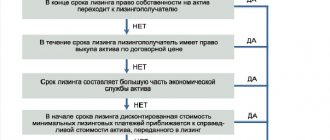

- financial lease (leasing);

- construction contract;

- loan, with interest payment, monetary or commodity credit;

- financing against the assignment of a monetary claim;

- bank deposit;

- insurance;

- concessions;

- simple partnership;

- creation of business companies;

- alienation of exclusive rights;

- licensed.

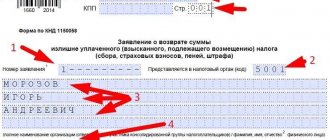

To draw up an investment agreement, the following documents are required:

- identification of an individual;

- for legal entities - registration;

- powers of attorney, when the parties act through authorized representatives;

- the project for which investments are given;

- When transferring funds, you must draw up an acceptance certificate.

If the specifics of the situation require certified additional actions, then these are also supported by documents.

Essential conditions

The subject of the contract is its essential condition. It must be specifically and clearly described and secured by the parties without the possibility of ambiguity.

We must not forget that all the nuances in each case should be recorded on paper, so that later, in case of discrepancies, you can refer to the text of the investment agreement.

In the case of co-investment, the conditions must be specified for each investor.

Business investment agreement

What is a business investment agreement?

Almost always, at the initial stages of business development, an entrepreneur needs additional funds for its development. But bank lending rates often remain prohibitive. What to do in this case? One of the ways of additional financing is to search for an investor and conclude an investment agreement with him to provide funds for business development with the condition of their return within the agreed period.

Thus, a business investment agreement is a document according to which the investor provides the entrepreneur with funds for business development in order to receive, within the period stipulated by the agreement, a portion of future profits agreed upon by the parties. Thus, under the Investment Agreement, the investor has an obligation to provide financing and has the right to receive a part of future profits, while the entrepreneur has an obligation to transfer a part of future profits to the investor and has the right to receive initial financing. The investment agreement contains the full agreements of the parties regarding financing, including the financing schedule, responsibility, mutual obligations of the parties, the procedure for resolving disputes, the conditions for receiving part of the profit and the timing of such receipt, etc.

Parties to the agreement

The investor providing the funds is on the one hand. The customer taking on the project, on the other. There may be individuals and legal entities on each side.

Therefore, agreements exist between:

- two individuals;

- legal entities;

- an individual and a legal entity (both on one and the other side).

Between legal entities

In this case, the company or organization transfers funds to another for the implementation of the agreed project. The forms of legal organization should be taken into account. persons and features of taxation.

Between individuals

This type of agreement is permitted by law. In this case, personal income tax is more often paid, but when trading on the stock exchange, deductions for dividends paid are taken into account.

Between an individual and a legal entity

If an individual transfers his money to an organization or vice versa, one must take into account the possibility of insuring the agreement. As a rule, such transactions are not insured. Therefore, there are risks of non-fulfillment of the transaction.

Types of investment agreements

We classify contracts depending on the investment objectives and other terms of the agreement identified by the parties as essential.

The main ones are investment agreements under Federal Law No. 39-FZ dated February 25, 1999 “On investment activities in the Russian Federation, carried out in the form of capital investments.”

Government contracts signed on the basis of the specified Federal Law should be distinguished from investment agreements in which private parties act on both sides. Such contracts are concluded for the purpose of construction or reconstruction of state capital construction projects or acquisition of real estate objects into state ownership during the implementation of business projects.

The conclusion of contracts is carried out on the basis of the Federal Law dated 04/05/2013 No. 44-FZ “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs.” Their distinctive feature is investment in the form of capital investments.

Capital investments are the same investments, but aimed exclusively at fixed capital (fixed assets of the enterprise). We are talking about design and survey work, modernization of existing enterprises, updating machines, introducing modern technological equipment, updating tools and equipment.

What does the transfer act look like?

The financial transfer act must contain the entire amount in words, the date of execution, and signatures. In addition, you need a clear indication of the party that transferred and received the money. So that it is clear from the text who gave and received how much.

What can you invest in?

To invest in a business, you need to take into account market conditions, while the scope of investment is practically unlimited.

This could be construction, business projects - from trading on the stock exchange to financing a retail outlet or network. You can buy land or housing for rent. Help an organization or individual buy cars for various purposes and receive a portion of the profits from their operation.

The main thing here is to correctly determine the possibilities of generating income, its size and the integrity of the contract executor.

Sample filling

The transfer deed may take different forms, but the following points must be clearly stated in it:

- The document must have names that do not allow double interpretations.

- Date and time of conclusion.

- Complete information about the two parties who entered into the agreement.

- All details about the investment project: amount of money, remuneration for implementation, planned income, goal, implementation deadlines and other specific parameters.

- Rights and obligations of both parties.

Validity

The maximum validity period of an investment agreement is 15 years. This happens when the parties have not specified specific time parameters in the text of the document. But if the contract specifies a period, then upon expiration the agreement is considered invalid. In addition, when drawing up the document, you can indicate the reasons, if any, the agreement can be terminated.

Structure and current sample contract

When drawing up a contract, it is important to follow a certain structure of the document. Sections should not contradict, but complement each other.

Contents of the investment contract:

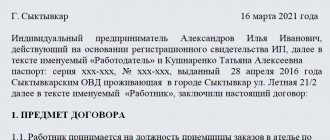

- Name of the document, date and place of signing.

- Acting participants in the transaction (in rare cases, the third party is the contractor).

- Terminology used. The text of the agreement specifies generally accepted concepts.

- Subject of the agreement. The investor and the owner of the project undertake to jointly implement it. The investor makes an injection of the specified amount, and the recipient of the funds is obliged to confirm their intended use.

- Validity. The contact comes into force from the moment of signing and is valid until all obligations are fulfilled by both parties.

- Payment procedure. The payment amount depends on the chosen option for generating income and the size of investment injections.

- Rights and obligations of the parties. The most voluminous section of the agreement, in which all the nuances and powers of the participants must be spelled out.

- Timing and procedure for implementing investment activities. This section specifies the exact date for receiving the result of investment activity and options for extending the deadline.

- Responsibility of the parties. It is stipulated what exactly both parties will do if they fail to fulfill their obligations, it is indicated that all disputes and disagreements will initially be resolved in pre-trial proceedings.

- Confidentiality. The agreement establishes that the financial situation of the parties and the terms of contact cannot be disclosed to third parties.

- Force Majeure. If the failure of one of the parties to fulfill the obligations was caused by force majeure circumstances, it is released from liability.

- Grounds and procedure for termination of the agreement. The agreement loses legal force only by mutual decision of the parties.

- Dispute resolution. Claims of the parties are considered in accordance with the current legislation of the Russian Federation.

- Other conditions.

- List of applications.

- Addresses and details of the parties.

- Signatures of the parties to the transaction.

Example of an investment agreement:

Special investment contracts (SPIC)

A relatively new instrument for interaction between the state and private business is a special investment contract (SPIC). The conclusion of a SPIC is permissive in nature and is regulated in the Decree of the Government of the Russian Federation dated July 16, 2015 No. 708 “On special investment contracts for certain industries” and in the Federal Law dated December 31, 2014 No. 488 “On industrial policy in the Russian Federation”. The independent conclusion of a SPIC by a constituent entity of the Russian Federation is regulated by the legal acts of the constituent entity of the Russian Federation itself.

All concluded SPICs are included in a special register - a database containing the most complete information about the current status of the contract. Investors report on the compliance of the project with the schedule and confirm the validity of the work performed under the investment contract.

SPIC is an agreement under which a private party, within a certain period of time, is obliged to create on the territory of Russia (including on the continental shelf, in a special economic zone) a new production of industrial products, or to modernize existing production, or to master the production of such products that have no analogues yet in Russia, and the public side guarantees the stability of tax and other conditions in relation to the target products and provides the private side with other special incentive measures and government support.

The introduction and development of modern technologies makes it possible to produce innovative products that can compete in the global market. The list of technologies in which the state is interested is formed and updated by the Government of the Russian Federation.

Thus, four distinctive features of SPIC stand out:

- Special contract item.

- Special procedure for concluding a contract.

- One party to the contract is always the Russian Federation (subject of the Russian Federation, municipal entity), the second party is a private company.

- As a result of investment activities, the investor receives certain preferences and support from the state (incentive measures). This design makes it possible to modernize the industry by providing benefits to interested investors, create jobs, and increase the investment attractiveness of specific industries.

SPIC participants are assumed to be Russian or foreign legal entities or individual entrepreneurs who are not in the process of bankruptcy and who do not have overdue debts on mandatory payments to budgets of various levels and extra-budgetary funds. Participants in the SPIC are also third parties attracted by the investor to implement the investment project (multiple persons on the part of the investor).

A summary report on the implementation of investment contracts is submitted annually to the Government of the Russian Federation. The report is an important tool for monitoring the progress of work on the SPIC for the interested authorities; on its basis, a conclusion is drawn up on the fulfillment (non-fulfillment) of their obligations by investors.

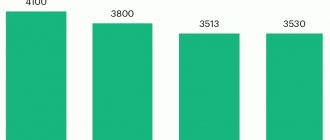

Current situation in Russia

The format of special investment contracts is becoming popular among investors from various industrial and manufacturing sectors. There are 10 operating SPICs in Russia.

The state project of such an investment model attracts more and more private resources into the industrial and manufacturing national spheres.

The legislative and executive framework governing SPICs is constantly being improved. At the moment, regulations are being prepared that are aimed at expanding the list of potential investors, at considering a new procedure for studying investment proposals, at expanding the time range of agreements, and at simplifying tax rules.

Nuances of legislation

Despite the fact that the concept of an investment agreement is not established at the legislative level, established laws should be taken into account when drawing up a contract. Only in this case will the agreement have legal force.

The investment contract must necessarily contain the following points:

- name of the contract;

- date and time of signing the document;

- data of all parties to the contract;

- full information about the project - the purpose of creation, the amount of investment, the cost of remuneration, and so on;

- obligations of contract participants and their rights.

An investment agreement concluded for the construction of a facility must contain the address of the building and the exact area.

Risks for investment projects in construction

- Violation of the layout of the property, as a result of which the investor may have problems when registering ownership rights;

- Expiration of the lease period for the construction site or the customer’s lack of ownership of the site;

- The facility was built with design violations not specified in the investment agreement;

- The object has significant defects.

Under any investment contract, the investor is exposed to the greatest risks. Therefore, having decided to enter into an investment contract, you should:

- Get acquainted with the customer’s reputation;

- Request information about the customer’s credit history;

- Before drawing up the contract, study the documents regarding the lease of the plot for construction or documents on the right of the customer’s owner to the plot.

- Carefully study and conduct an examination of the project.

Investments in the construction sector

Investment flows in construction are most popular among potential investors. Almost all major construction projects today are financed by third-party sources. Residential complexes, as a rule, are built at the expense of the funds of future residents - ordinary Russian citizens. Commercial real estate is financed by large companies and municipalities.

In the construction field, an investment agreement for the construction of a real estate project involves the investor receiving real estate from the customer (developer) in return for the invested money after the completion of its construction. In fact, such transactions are not classified in any way by Russian legislation. The legal status of an investment construction contract is considered a mixed agreement. Guarantees of its legitimacy are prescribed in the Civil Code of the Russian Federation, Article 421, paragraph 2.

The structure of such agreements presupposes the presence of components that are characteristic of contracts in different fields of activity. For example, construction contract agreements may contain language found in loan, partnership, or contract agreements. This depends on the specifics of the activities of the construction company receiving investment support.