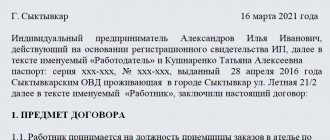

Document for the provision of services between individuals

An agreement, the subject of which is the provision of services, is signed by several parties to the transaction (customer, contractor). The employee, within the framework of the agreement, fulfills his obligations to the customer.

The contract must indicate the obligations and rights of all parties, and also describe in detail the transaction and the amount that the employer must transfer to the contractor after the implementation of his part of the contract.

This type of agreement can be concluded with both a legal entity and an individual. The legislative framework does not impose restrictions on the provision of services from various legal entities. individuals or individual entrepreneurs, although many types of activities require legal entities. a person with a license or permit does not perform this type of activity, which the employer must be familiar with before signing the contract.

Otherwise, the agreement will be declared invalid, and you may then have to deal with legal services. The contract for the provision of services is drawn up in writing, the number of copies depends on the parties to the agreement.

To recognize the contract as valid, the following information is entered into it:

- Information from the passport and details of the document confirming the identity of the individual. persons, specifying place of residence and registration, as well as providing contact information (mail, telephone). For legal entities persons – details in accordance with the company’s charter;

- a list of services provided, specifying the scope that the employee must perform under the agreement, as well as the timing and order of implementation, the cost of the work, the rights and obligations of the participants, fines in case of failure to comply with the terms of the agreement and other information;

- signatures of all parties to the agreement , if the participant is considered a legal entity. face, then the signature must be sealed. And the rights of representatives must be confirmed by a power of attorney (notarized or simple). If a legal representative If a person is considered to be the head of a company, he will need: an extract from the Unified State Register of a legal entity, a decree on his appointment, an employment contract, and so on.

After signing the agreement, all participants receive a copy of the agreement. Other important documents are attached to the agreement: a schedule for the provision of services, an estimate, a technical assignment, samples of documentation that are drawn up by the parties during the execution of the contract, and so on.

ATTENTION! To confirm the fulfillment of the terms of the agreement, the contractor needs to report the documents that he collected during the execution of the contract (estimate, drawing, technical assignment, certificate of work performed, etc.).

Legal aspects

Individual entrepreneurship represents one of the most popular niches in the Russian economy. Just look at the official data from the tax service. At the beginning of 2020, the number of individual entrepreneurs was more than 6 million people, while legal entities were about 500 thousand. This is due to a fairly simple process of registration and liquidation, taxation procedures and submission of financial statements. To carry out income-generating activities, the formation of an individual entrepreneur is a prerequisite.

Is it possible for an individual to make a profit when providing services without forming an individual entrepreneur?

An individual entrepreneur is an individual carrying out income-generating activities (entrepreneurial activity).

Entrepreneurial activity is the activity of an individual in providing services, performing work, manufacturing products, etc., during which he regularly receives profit.

This type of economic activity is regulated by civil, tax and administrative legislation.

A citizen providing services for profit must be registered with the state tax authorities.

However, with a detailed analysis of the legal aspects, it is possible to identify individual cases when an individual can legally receive income without forming an individual entrepreneur.

Kinds

Russian legislation has established that agreements signed with individuals can be considered civil law . So, we can conclude that with the help of an agreement, legal relations appear, change and cease.

Contracts are divided into two types:

- paid provision of services. The employee provides a service to the Customer, who must pay for it in the future. For example, a medical company undertakes to perform a primary type of medical examination when hiring Igor Petrov. The cost of these services is 6,000 rubles. Acceptance is made through the acquisition of a therapist’s report;

- contract work. The employee undertakes to carry out, on the instructions of the employer, a list of construction manipulations within a specific period. For example, Makarov P.A. undertakes to replace the floor in the house of G.D. Ivanov. until December 10, 2018. The cost of replacement is 30,000 rubles. Acceptance is carried out according to the work completion certificate, which is signed by the parties.

In the case of concluding such agreements, the customer must not provide the specialist with a workplace and construction materials , and the fulfillment of obligations under the contract shifts all responsibility to the employee.

2020 sample

Most often, a standard agreement for the provision of services to individuals. by a person is formed only for a specific area of activity (transportation, audit services, contracts with teachers, and so on) and is approved by government services, large firms or public organizations to save time of structural units when preparing and concluding such contracts.

GK R.F. defines only general requirements for the content of the agreement, according to which it must indicate a list of services or works, their cost and the obligation to transfer money. There are several main provisions of the law:

- The specialist performs work duties on the instructions of the employer (the initiative to conclude an agreement comes, most often, from the customer).

- Services are provided in person . That is, the performer directly, using personal physical and/or intellectual abilities, forms the result through his work. Moreover, the law does not prohibit the involvement of co-executors. For the employer, the most important thing is the result.

- The customer can legally refuse the agreement by reimbursing the employee for expenses and paying for the work performed. Basically, the agreements stipulate the guilty actions of the employee or force majeure circumstances, which may become the reason for the unilateral completion of the transaction.

Agency agreement and commission agreement

Another way to earn money for an individual can be a type of agency agreement - commission agreement or commission agreement . You can read more about it and download it HERE. The commission agent concludes transactions with third parties, and the customer of the service (principal) pays a monetary payment to the commission agent (performer) for this. This type of agreement is analogous to an agency agreement. Often, this type of agreement is used to conclude purchase and sale transactions.

Contracts of the same type also include a contract of agency. The use of this agreement is possible in cases where the personal participation of the principal is impossible, for example due to illness, business trip, lack of special knowledge, etc.

Such an agreement is concluded for the provision of legal assistance, representation in court, customs authorities, Rosreestr authorities (registration of rights to real estate) and other government agencies, as well as when concluding transactions on behalf of another person. This type of agreement is accompanied by the issuance of a power of attorney to the guarantor.

Unlike an agency agreement, a mandate agreement has a short term, the period for performing entrusted legal actions. For this transaction to be completed successfully, the contract must be properly executed. To avoid misunderstandings, it is necessary to agree on all points of the contract. The agreement is drawn up in two copies. The transfer of funds under this agreement may be accompanied by a receipt.

You can act under this agreement as a realtor, lawyer or other person carrying out any transactions on behalf of your customer.

How should you accept revenue under an agreement between two individuals?

If the services are unlicensed, then the following method can be used. Its essence is that one individual is engaged in independently concluding a contract and personally providing services (work). After receiving payment for the service provided (work performed), the individual is issued a corresponding receipt (certifying that he has received the money).

If you use this method, it is worth considering a number of nuances:

- For it to be successfully implemented, it is necessary to correctly draft the contract itself. In any type of contract, all conditions must be clearly stated.

- You can take money into your hands only after the client has signed two copies of the contract. One of them must be kept with you. The client must also take a receipt indicating that the money has been received. The receipt should also be in two copies - just in case.

Registration procedure

The conclusion of an agreement for the provision of services is controlled by Russian legislation. Phys. a person can provide services to individuals and legal entities, and everything depends on the party; there are a number of differences. Initially, it’s worth figuring out what the differences are.

IMPORTANT! Concluding a service agreement between individuals seems to be a fairly simple process, although there are a number of complex issues.

For example, the form of the agreement:

- oral. If the amount is small and the volume of work is small, then it will be appropriate. For example, manicure, apartment cleaning, beauty salon services, haircut, and so on;

- written. This form is suitable for any agreement, and if the contract amount exceeds ten minimum wages, it is considered mandatory. There is no clear structure for agreements, but for each type of agreement there are personal recommendations: what clauses should be included, and so on;

- notary certified. Such a form can become mandatory only if the person entering into the agreement is unable to sign it with his own hand due to illness or the presence of a certain defect. In this option, the representative signs, indicating the official reason, and the notary certifies the agreement.

Although in some situations, notarization of contracts is mandatory . For example, a rent agreement, a mortgage agreement, a will.

What to pay attention to:

- the contractor periodically performs this activity, he is obliged to officially register himself as an individual entrepreneur;

- When signing an agreement with companies, you need to check the credentials of the citizen who signs it. In other options, the title documentation establishes restrictions on the powers of management.

For example, the charter of a legal entity. person establishes that an agreement worth more than 2 million rubles is drawn up only with the consent of the founders of the legal entity. faces. It turns out that this kind of transaction is concluded only upon receipt of the minutes of the meeting of founders:

- the legislation does not make it mandatory to allocate the amount of tax, although in order to avoid difficulties with the tax service, it is necessary to indicate in the agreement after the amount of the transaction “ VAT is not subject to ”;

- if it is necessary to involve other persons for execution , then this must be stated in the agreement;

- fulfillment of the agreement is confirmed by an acceptance certificate for completed work , which is signed by all parties.

What prevents a lawyer from becoming self-employed?

The new law contains 2 significant contradictions regarding the application of the NAP for private lawyers and notaries.

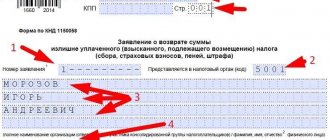

Not objects of taxation

Article 6, paragraph 2 indicates the types of income that are not subject to NIT under the bill under discussion. In paragraphs 12 and the profit from the activities of a private lawyer is located. It is not clear how to understand such a contradiction with clause 11 of Article 2 of Federal Law 422, where the professional category was specified. However, the indication in the general provisions of the Federal Law on the use of a special tax regime by lawyers, notaries and others is a stronger argument.

In addition, the income of nannies, caregivers, tutors and personal household workers is also indicated as non-taxable. But with an indication of clause 70 of article 217 of the Tax Code of the Russian Federation. Which classifies this category as those for whom tax holidays are provided.

Attorney-client privilege

The activities of lawyers are regulated by Federal Law No. 63, where Article 8, paragraph 1 states that information about the principal is a lawyer’s secret, which cannot be disclosed to third parties. Even the investigative authorities do not have the right to force a defense lawyer to testify, or bring him to criminal responsibility for concealing a crime. Including a search of a lawyer’s office is an extreme measure that can only be initiated by the court.

The law on self-employed people under discussion obliges the payer to generate receipts in the mobile application, which indicate the type of service, the buyer’s full name and his Taxpayer Identification Number. Which, in principle, is a sign of disclosure of the principal’s personal data.

The check is required both for reporting to the Federal Tax Service and for organizations that interact with the self-employed. Only if they have such a document, they avoid contributions to the Pension Fund and insurance, as well as the responsibility of the tax agent for paying personal income tax for the employee.

Therefore, it is realistic to work with the population without generating checks, and to warn legal entities about the disclosure of the TIN and the name of the organization in reports for the Federal Tax Service. But this is, to put it mildly, strange.

A lawyer is obliged to keep secrets about the client in accordance with the provisions of Federal Law No. 63 “On Advocacy”.