The conclusion of an agreement between the parties to the transaction is an important stage. When one party is represented by the customer, and the other by the contractor, it is necessary not only to draw up an agreement, but also other important papers.

These include an acceptance certificate, which is required to be drawn up.

It reflects not only the basic conditions for accepting the work performed or part of it, but also covers the issue of the presence of defects, methods for eliminating them and other important aspects.

When is an acceptance certificate for completed work drawn up?

If there are two parties, one of which is the customer for performing any type of work, and the other is the contractor, then corresponding rights and obligations arise. They are fixed in the contract, which is signed by the parties even before the start of the agreed work.

However, after the work is completed, the contractor must hand it over.

The customer is obliged to accept the result of the work performed and confirm that the contractor did everything correctly and efficiently.

In order to indicate the position of the parties regarding the results of the actions taken, their acceptance and the presence of shortcomings, an acceptance certificate for the work performed is drawn up.

It can be presented in several versions depending on the presence of defects identified during the delivery process:

- if there are none, the customer indicates this in the act and pays the amount of money established in the contract;

- if there are defects, the act indicates their nature and prescribes the conditions for elimination, or a proportionate reduction in cost, etc.

The acceptance certificate for the work performed must be signed by both parties, which means agreement with the points stated there.

According to the law, the specified document must be drawn up exclusively when concluding a construction contract under Art. 753 of the Civil Code of the Russian Federation.

However, if necessary, the law does not prohibit the parties from signing this act and using it as evidence in the event of a conflict situation.

Thus, the specified document is required to be drawn up as confirmation of acceptance of the work performed by the contractor when signing a construction contract.

It reflects all the characteristics of the quality of performance of the contractor’s actions provided for in the contract. In other cases, it is not legally prohibited to sign such a document.

Errors in drafting and recommendations from lawyers

Considering that a correctly completed act will be the basis for the customer to reduce the amount by income and calculate costs, the sample is drawn up in accordance with the norms of current laws.

For a document to have legal force, the parties must draw it up correctly and without errors. There are the necessary forms on the Internet that transaction participants often use. At the same time, check the presence of the required documentation items.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

The act is an additional document that guarantees that the customer has no claims against the performer of work or services. For their own insurance, the parties are required to draw it up and attach it to the agreement.

There is no special form for the form, so the parties to the transaction have the right to develop a sample on their own. In this case, requests for the preparation of primary documentation are taken into account.

Acceptance of services provided and work performed may be formalized by an appropriate act. When writing such a document, you need to take into account a number of rules and content requirements. Otherwise, the signed document will not gain legal force. It will help you to correctly draw up a work completion report and a sample of such a document.

Responsibility for an incorrectly completed act

It is especially important to comply with the rules and requirements of the law when filling out this act when the parties to the agreement are legal entities and individual entrepreneurs.

If the data, amounts and other parameters are incorrectly indicated in the act, the tax office may refuse to accept for deduction as a VAT-reducing amount the amount specified in the act and the agreement.

In addition, if during the reporting period expenses are not taken into account and the amount of payment of value added tax is not reduced by their amount, then the tax will be paid more than necessary.

If errors are made accidentally, then liability from the point of view of law will not be applied. However, for the parties to the transaction themselves, the presence of errors, clerical errors and inaccuracies can result in litigation, disputes and conflict situations.

In addition, the act may be declared invalid by a court decision if the presence of serious errors, inaccuracies, discrepancies with other documents, etc. is proven.

The customer requires final documents

Consider the following situation. The contractor carried out work under the contract from January 2014 to September 2020. All intermediate KS-ki are signed. Before making the final payment, the customer requires final documents. The contract contains the following clause: “After the actual completion of all work under this Agreement, transfer to the Customer the result of the work performed on the basis of the final acceptance certificate for the work performed in form No. KS-2 and the final certificate of the cost of work performed and expenses in form No. KS-3 " How to compose them?

Guarantees

In addition to all the mandatory data that should be indicated in the acceptance certificate for the work performed, it may contain information on the warranty period, which is expected according to the features and nature of the actions performed.

The deadline is set in accordance with GOSTs, SNiPs and other norms and rules applied for certain types of results.

In addition, as a guarantee of protecting the interests of the performer, a list or description of events may be indicated to which the guarantee cannot apply.

For example, a violation of the quality of the work done due to the occurrence of circumstances beyond the control of the performer. For example, if there is an act, the performer can protect himself from accidental loss of the result of work due to unforeseen circumstances.

If the warranty period is established in the acceptance certificate, the customer has the right to declare any identified defects during the entire agreed period and demand their elimination.

In the case of complex and lengthy work, it is possible to draw up interim acts that will indicate the acceptance of a specific type or area.

Contents of the work acceptance certificate

In accordance with paragraph 1 of Art. 720 of the Civil Code, inspection and acceptance of work is carried out by the customer in the presence of the contractor. Simultaneously with acceptance, a work completion certificate is drawn up and signed.

The Civil Code does not establish requirements for the content of the work acceptance certificate. Nevertheless, the work acceptance certificate can be used for accounting purposes, provided that it contains the following mandatory details of the primary accounting document (Part 2 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”):

- title of the document (work acceptance certificate);

- date of drawing up the act;

Note : a primary report that does not have a name does not confirm expenses, so the Federal Tax Service will assess additional income tax

- name of the economic entity that compiled the document (legal entities indicate their names; individuals must indicate their full name); It is also better to indicate the TIN, because The Federal Tax Service carries out identification using the Taxpayer Identification Number (TIN), otherwise expenses may be withdrawn. With the correct TIN, an error in the name (full name) and checkpoint will help to take into account expenses (Letter of the Federal Tax Service of Russia dated February 12, 2015 No. GD-4-3/2104));

- content of the fact of economic life (that is, information about the work performed - types, volume and date of completion of the work). If you do not want to argue with the inspectors, provide as much detail as possible in the report on the work performed, i.e. indicate not only the name of the work, but also its volume, and also describe in detail the actions performed by the contractor;

- the value of the natural or monetary measurement of a fact of economic life (the price of work performed and (or) time spent in hours). Acts usually do not indicate time spent in hours, since for many types of work it is difficult to determine. Nevertheless, inspectors often require that working time (in hours) be indicated in reports;

- the position of the persons who completed the transaction and are responsible for its execution (that is, persons authorized to sign the act on behalf of the parties to the agreement), as well as their signatures indicating the names and initials or other details necessary to identify these persons.

In the absence of one or more of the listed details, the act may be considered improperly drawn up and will not constitute confirmation of the completion of the work. For example, the courts recognize acts that do not contain the position of the person who signed them and a seal containing the customer’s details as inadequate evidence of the fact that work was performed.

Among the required details there is no such detail as “M.P.” (“Print Place”) However, our mentality cannot get used to the idea of abandoning the seal - no matter who signs the document, in almost all cases, a document with a seal still gives us greater confidence. If the very idea of refusing to print does not seem seditious to you and your business partners, you can refuse it when developing and approving the act of work performed. But our advice: be careful - do not neglect the established customs of business turnover (Part 1 of Article 5 of the Civil Code) and use a seal imprint on bilateral and multilateral external primary accounting documents (in particular, on acceptance certificates for completed work/performed civil work). -legal contract).

In addition to the required details, the work completion certificate must also indicate:

- a link to the details of the work contract;

- type of work performed;

Note : It is better to indicate a specific (rather than general) title of the work. The name in the act must match the name in the contract

- period of work;

Note : if it is not clear from the act in what period the work was performed, then the Federal Tax Service can withdraw expenses

- cost of work with allocation, incl. VAT amounts.

The parties may agree in the contract on additional requirements for the content of the work completion certificate. For example, they may stipulate that the act must reflect information about the amount of time spent on each type of work or a condition that the signature of the authorized person in the act must be affixed with the seal of the organization (if any).

If the requirements for the content of the act on the performance of work are not agreed upon, then the parties can draw up an act, providing in it the information specified in Part 2 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. It should be borne in mind that the act must also include a list of work performed and information about its volume, otherwise it will not be recognized as adequate evidence of the fact that the work was completed and the contractor will not have the right to demand payment for it.

Inclusion in the report of information about detected deficiencies in work

If during acceptance the customer finds shortcomings in the work, he has the right to indicate them in the certificate of completion of work (clause 2 of Article 720 of the Civil Code).

It must be borne in mind that when signing the report, the customer may not have the technical ability to include information about the shortcomings of the work. This is possible if the act was prepared by the contractor and does not contain the corresponding section or in the case where the parties provided for the use of the KS-2 form established by Order of the State Statistics Committee of November 11, 1999 No. 100, which also does not provide columns for indicating deficiencies. In such a situation, the customer should refuse to sign the act indicating the reasons for the refusal (detection of deficiencies) and provide information about the deficiencies in a separate document, which, in accordance with clause 1 of Art. 720 of the Civil Code must be delivered or sent to the contractor.

It should be taken into account that after accepting the work, the customer has the right to declare hidden defects that he has identified (clause 4 of Article 720 of the Civil Code). At the same time, if he accepted the work without inspection and signed the report, then in the future he will not be able to refer to deficiencies that could have been identified during the inspection (obvious deficiencies), unless otherwise established by the contract (clause 3 of Article 720 of the Civil Code ).

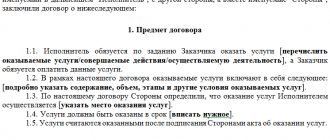

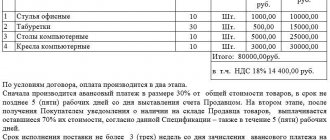

Based on all of the above, the work acceptance certificate may take the following form:

Sample act of acceptance of work performed

Acceptance certificate for completed work - form

Acceptance certificate for completed work - sample

To correctly draw up an act of acceptance of transfer (delivery) of completed work, you need to familiarize yourself with its sample, which can be downloaded. This will allow you to see which clauses and conditions are mandatory for inclusion in the text of the contract, what data will need to be clarified in advance and what documents will be required to fill it out.

According to the rules for drawing up a work completion certificate, it must include:

- name of the document and date of its preparation;

- customer and contractor data;

- nature of the work and a brief description of the essence;

- a list of persons, indicating the positions they hold, of all those included in the commission for acceptance of work;

- an indication of the shortcomings, if any, a list of ways to eliminate them; if all the work performed is completely satisfactory to the customer, then this should also be indicated;

- signatures of the parties.

As a result, it is the sample certificate of completion of work that allows you to draw up this document correctly and include in it all the data that is necessary. You can download it to study and prepare for compilation, as well as to make sure that all documents comply with legal requirements and are available.

Why is the act needed?

Not everyone understands that a concluded contract for the provision of services is only an agreement. In fact, in this document the parties only promise to fulfill certain obligations. For example, the party providing the services agrees to do the necessary work. Accordingly, the customer promises to pay for this.

However, looking at the contract, it is impossible to understand whether these promises were actually fulfilled or not. Therefore, it becomes necessary to issue an additional document. The certificate of completion of work has legal force and is documentary evidence that the parties to the transaction have fulfilled their obligations. Here not only the fact of the work is noted, but also detailed information about it is indicated. For example, the work meets all necessary standards and requirements, everything was completed on time, or there were some delays.

If the services were provided for the organization, the act can simply be called necessary. It refers to primary documentation. Based on this document, the company's accounting department writes off the money paid for the work.

When is a work completion certificate drawn up under a service agreement?

The document is drawn up in two copies, one for each party.

It is drawn up after the service provider has fulfilled its obligations. Often it is on the basis of this act that payment for services provided is made. However, there are situations when the customer does not accept the work. Accordingly, he will not sign the document. In this case, the contractor must eliminate the existing shortcomings. If he is completely confident that he is right, he needs to be prepared for a trial. Here you will have to prove that all work has been completed in full and meets quality standards. In essence, the contractor must confirm that all the terms of the previously drawn up agreement were met on his part.

Even when drawing up an agreement, participants can determine in advance the grounds that allow them to refuse their obligations. For example, you can agree that if the customer finds any shortcomings, he has the right not to accept the work. Accordingly, at this stage the act will not be signed on his part. In fact, in this case it will be considered that the work was performed in violation of the agreements. And all existing problems must be eliminated.

( Video : “We find the answer. Do we need an act of provision of services?”)

Also, the performer may encounter a situation where the customer refuses to sign his autograph on the document. However, he does not provide any explanation. This may be considered as a refusal by the customer to accept the work. However, such a refusal is considered unmotivated and therefore not correct. In this case, the executor is recommended to draw up the deed unilaterally. The absence of the customer's signature does not mean that the document is invalid. This only indicates that there are some disagreements between the parties. Naturally, with this act, which proves the completion of work and provision of services, you should go to court. Of course, the absence of the customer’s signature does not at all relieve him of the need to pay for the work.

You can develop the necessary forms yourself

There are no separate standard forms for intermediate delivery and acceptance of work and for delivery and acceptance of the final result of work (or the result of a stage of work provided for in the contract). In civil legislation, the form of the act of delivery of the work result by the contractor and its acceptance by the customer is not regulated.

Read more: Sample rental agreement for residential premises with collateral

It follows from this that the parties to a construction contract have the right not only to establish the procedure for transferring the result of work by the contractor to the customer, but also to agree on the forms of documents with which they will formalize the transfer of the result of the work performed. As a rule, in practice, forms No. KS-2 and No. KS-3 are used for these purposes.

But if necessary, “final” forms of documents reflecting the full cost of the work can be developed independently and their use agreed upon in the contract. At the same time, we recommend using wording for the act that makes it possible to unambiguously determine that it confirms the customer’s acceptance of the result of work under the contract as a whole (or the stage provided for by the contract). For example, “Acceptance certificate of the result of work performed under the contract.”

This will allow you to correctly qualify transactions for tax accounting purposes.

September 2020

| Home » For entrepreneurs » Requirements for certificates of work completed in 2020 |