Practical use

Why do you need a KS-3 certificate?

The KS-3 certificate is the basis for payment for completed construction and installation work. The amount in the KS-3 certificate must correspond to the amount in the KS-2 act (or several KS-2 acts) for the reporting period.

The contractor submits to the customer for signing, together with the work performed and as-built documentation, Certificate KS-3 , Certificate KS-2 and Invoice (if the contractor works under the simplified taxation system (USN), then the invoice is not provided).

The accounting department of the customer (general contractor) cannot make payment for work performed without a signed KS-3 certificate.

Where to download form KS-3

The certificate form in form KS-3, approved by Decree of the State Statistics Committee of the Russian Federation dated November 11, 1999 No. 100, can be downloaded on our website.

The forms, the form of which was approved by the State Statistics Committee, could be supplemented with rows and columns in the tables, as well as other necessary information. Since now the KS-3 form is used on the basis of other documents, it is better not to adjust its form.

For more information about the point of view of the Russian Ministry of Finance on adding information to the KS-3 certificate, read our article “Is it possible to supplement KS-3 with new details?” .

Filling KS-3

How to fill out KS-3

Order a certificate KS-3 A certificate in form KS-3 is filled out periodically, usually no more than once a month, in accordance with the contract, until the work is completed and/or equipment is delivered. Moreover, if during the entire period of work under the contract there were more than two reporting periods (percentages), then columns 4 “from the beginning of the work” and 5 “from the beginning of the year” are filled in with an accrual total in each subsequent certificate, after the first.

Procedure for filling out KS-3

You can use the following general procedure for filling out a certificate in form KS-3 .

In some cases, the customer asks to decipher the cost of work into the cost before indexing and indexed, indicate indices for construction and installation work, construction work, commissioning, design and survey work and others, indicate the full details of the Investor, Customer, General Contractor, Contractor, indicate additional data or supplement the standard format, but general the order does not change .

- Find out if there is an “investor” for your property. If it is not there, remove the “Investor:” field from the form.

- Indicate the contract number and date.

- Indicate the serial number of the certificate. If KS-3 is being filled out for the first time for this object (first percentage), then indicate No. 1. For each subsequent certificate, the following numbers are used in order. As a rule, a new numbering begins with the new year.

- Indicate the date of compilation.

- Write down the reporting period. It is desirable that the reporting period corresponds to a month, for example, from September 1 to September 30. But it is also desirable that the end date of the reporting period corresponds to the date of compilation (clause 4).

Accounting departments of different customers have different opinions about the dates in KS-3. 1. For some, it is important that the reporting periods of KS-3 certificates correspond to months, even if the date of preparation does not fall at the end of the month. For example: KS-3 No. 1 dated 09/27/2016 and the reporting period from 09/01/2016 to 09/30/2016, KS-3 No. 2 can be drawn up on 10/19/2016 and the reporting period for it will begin from the end of the previous one, i.e. from 10/01/2016, and will continue until 10/31/2016. 2. For others, it is important that the KS-3 certificates cover all calendar days, and the end date of the reporting period corresponds to the date of preparation, even if the reporting period is rolling over months. For example: KS-3 No. 1 of 09/27/2016 and the reporting period from 09/01/2016 to 09/27/2016, KS-3 No. 2 of 10/19/2016 and the reporting period from 09/27/2016 to 10/19/2016. 3. Still others do not attach importance to the correspondence of the end of the period with the date of preparation of the certificate and the transition between months. Also, often the dates for the possible interest period are specified in the contract, for example “no later than the 25th day of the reporting month”

- In column 2, indicate the type of work and the object, for example, “Construction and installation work on the object “Construction of a non-residential facility, Moscow”, in accordance with the contract

- In column 6, write down the cost of work performed during the reporting period, in accordance with the act/acts of KS-2

- Columns 4 and 5 are filled in cumulatively, depending on the funds already disbursed, respectively, from the beginning of the work and from the beginning of the year.

- In the signature section, enter the positions and surnames of the I.O. signatories.

Above you can download blank forms and samples of filling out a certificate in the KS-3 form for filling out yourself or order it from us.

Scope of application of the KS-3 form

Typically, the unified form KS-3 - we will consider a sample of filling out in 2020 below - is compiled in 2 original copies (for the customer and the contractor), and the 3rd (for the investor) is drawn up only at his request.

It contains information about the work actually performed on it since the beginning of construction of the object (or construction, then the information in the certificate is given object by object). The certificate is compiled on an accrual basis based on the data included in the acts of the KS-2 form, breaking them down into those relating to periods from the beginning of construction, from the beginning of the year and for the reporting period. The certificate is submitted by the contractor (subcontractor of the contracting company) to the customer in the form of a report on the cost of the work performed, mentioned in the estimate documentation for construction and installation work (hereinafter referred to as construction and installation work), as well as other costs not included in the prices for construction and installation work.

Answers to individual taxpayer questions can be found in ConsultantPlus:

Learn from an expert by getting trial access to the K+ system for free.

Since the beginning of 2013, after the adoption of the new law on accounting, the requirement for the mandatory use of most unified forms has been canceled, but many forms of documents, including in the construction industry, continue to be used. Form KS-3 is among them.

You can learn about the reaction of the inspection authorities to errors when filling out the KS-3 form from our article “What are the grounds for refusing a VAT refund?” .

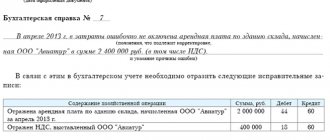

What form is used to prepare an accounting certificate on the book value of property?

There is no officially approved form of this document, therefore the organization has the right to independently develop a form for a certificate of the book value of property, a sample of which should be approved by an appropriate order signed by the manager. You can also take as a basis samples of this document that are already widely available.

In any case, the certificate must contain the following details:

- Title of the document;

- Name of the organization;

- date of compilation;

- the period or date on which information on the book value of the property is reflected;

- list and cost of objects;

- “live” signatures of the manager and chief accountant with their transcripts.

The certificate, depending on the needs of the organization, may contain a list of fixed assets:

- in terms of inventory numbers;

- in the context of enlarged groups of fixed assets (buildings, machines, equipment, etc.).

Also, depending on the purposes of compilation, the certificate may contain information:

- on a certain date of one reporting period (for example, on December 31, 2019);

- in dynamics for comparable dates of two, three or more periods (at the end of 2020 and 2020)

In some cases, if the certificate is intended for a third-party user, it may be necessary to compile it in a form that is convenient for the recipient. As a rule, when banks request such a certificate, they use a form developed by them. And such a certificate will have to be drawn up in accordance with the required format, even if the organization has approved its own template. This is not a violation.

This document is compiled by an accounting employee who has access to the financial performance indicators of the organization. Then, without fail, it is endorsed by the chief accountant and manager.

Despite the fact that the certificate is not part of the financial statements, its preparation must be approached no less carefully. Any errors in digital data are unacceptable, as is the inclusion of deliberately false information in order to influence the decision of a third-party user of the information.

Help form 3 sample

The KS-3 certificate is drawn up in two copies, one of which remains with the customer, the second is transferred to the contractor. A third party, if there is one (investor or creditor), can receive a third copy if it expresses a desire and sends a corresponding request to either party.

The information contained in KS-3 concerns the cost of construction work performed, as well as the composition of costs by type. All data must correspond to the preliminary estimate, and also include those costs that were not taken into account in advance. The latter include:

Places for issuing a document confirming the price of the purchased goods

The place where such a document is received directly depends on the answer to the question to which authority it is required to be presented. It is worth noting that the form is very easy to download from an Internet resource. To do this, just type in the search engine - certificate of cost of goods sample.

Who to ask for help

In addition, such a certificate can be prepared and signed:

- From the manufacturer or seller of the purchased product, as this will be the most valid confirmation of value. A certificate received, for example, in a store should contain complete information about the point of sale, actual information about the price and, if possible, documentary evidence of the completed transaction, in the form of an invoice or a copy of the invoice on which the buyer made the payment.

- From an expert. It will help you give a real assessment of a previously purchased item. Such a specialist is called in when it is necessary to conduct an independent assessment and establish the actual amount of money spent.

Important to remember! The price of any production product is not constant. Therefore, it is necessary to involve an expert when there is a fact of deliberate overestimation or underestimation of value.

Form No. 3, registration at the place of stay: sample filling

- Enter the full names, patronymics and surnames of the property owner and the registered person.

- Indicate your residence address without abbreviations.

- Enter information about the date from which registration is being made.

- It is necessary to enter information about the permanent registration of the citizen.

- Indicate the basis on which registration is carried out.

- Enter information from identity documents of citizens.

- Enter the date of issue.

But when it comes to registering minors, these principles do not apply. A certificate of registration at the place of residence (Form No. 3) is issued even without the consent of the owner, but only if we are talking about registering children with their parents. The thing is that today all minors under 14 years of age are required to register with one of their parents. Therefore, the owner’s consent and presence at this procedure is not required. Discharging the child will be problematic.

Why do you need a certificate of the book value of the fixed assets?

A certificate of the book value of property (fixed assets) is a very informative document that gives an idea of the value of the organization’s non-current assets as of a certain date. It can be used for the following purposes:

- for internal analysis of the organization's solvency;

- for management accounting purposes;

- for provision to a bank, insurance company or third-party investor.

This document is especially often required to be submitted to the bank when applying for a commercial loan. After all, a certificate of the book value of the borrower-legal entity’s real estate gives an idea of the financial picture of the organization’s activities.

This document is being compiled:

- at the end of the reporting period (usually annual);

- upon request - for any date.

The availability of such information to an interested party (bank, investor) allows him to assess the solvency and reliability of the organization, which influences the decision on lending or investing funds.

If necessary, such a certificate may include information not only about fixed assets, but also about the organization’s current assets (cash, accounts receivable, etc.). In this case, it would be more correct to call the certificate “certificate of the book value of assets.”

Form No. 3: certificate of temporary registration

The permanent registration of an adult or a minor child at the place of permanent residence is not canceled when temporary registration is issued. However, the absence of proof of residence at the address, also known as Form No. 3, is punishable by an administrative fine.

In general, in order to obtain a certificate that temporary registration of an adult or child at the place of residence has been issued, the applicant must present a personal passport or birth certificate of the child, as well as papers on the basis of which registration is carried out (title documents, social or other rental agreement , other). If we are talking about registering a tenant who lives in premises obtained under rental conditions, a notarized agreement for such a transaction is required. If it is not there, the owner of the property must be personally present when registering.

We recommend reading: The Bar acts on the basis of principles

KS-3: sample filling in 2020

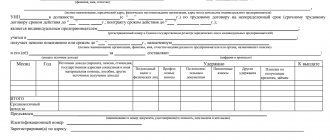

The sample for filling out the KS-3 certificate for 2020 consists of two parts: the title and the main (in the form of a table).

The title part provides information about the parties to the transaction (as in the KS-2 form) and information about the concluded contract. The time period accepted for the report and the date of preparation of the certificate are also indicated here.

In the tabular section, in the 4th column, the cost of construction and installation work and expenses should be indicated, which is entered on an accrual basis from the beginning of the work under the contract (including the reporting period). In the 5th column, the cost of construction and installation works is indicated incrementally from the beginning of the calendar year, and in the 6th column data is entered only for the period for which they are reporting.

The final line reflects the total amount of construction and installation work and expenses excluding value added tax. VAT itself is entered in a separate line, and in the “Total” column the added amount including VAT is indicated.