In order to formulate the cost of production, as well as for making management decisions, it is important to correctly distribute costs. The chosen procedure is used when calculating income tax. Although the legislation contains a list of expenses, the Instructions for using the chart of accounts stipulate that under the item “Main production” only amounts directly related to the production of products should be displayed. You will learn how to more efficiently distribute direct and indirect costs from this article.

Definition

Direct costs are costs associated with the manufacture of a certain type of product that can be included in the cost price. These include:

- cost of raw materials and basic materials;

- price of purchased products and semi-finished products;

- fuel and electricity costs;

- workers' compensation;

- depreciation of equipment.

Indirect costs are costs associated with the manufacture of products that cannot be directly attributed to a specific type of work. They are distributed throughout the entire range. The coefficients and indicators by which classification occurs are laid down in the accounting policy.

Direct costs, overhead costs

Direct costs are those costs that can be directly and directly attributed to a specific type of product produced by the enterprise.

DIRECT COSTS - part of the enterprise’s expenses for the production of products that are directly related to the manufacturing process and can be included in the cost of individual types (units) of products by the direct accounting method.

Direct costs include: raw materials, basic materials and purchased semi-finished products, wages (basic and additional) of production workers, wear and tear of tools and special-purpose devices, costs of developing the production of new types of products and other special costs.

The separation of direct costs depends on the characteristics of the organization of production, equipment and technology. In enterprises (in workshops) specialized in the production of one type of product, all costs are direct. Direct costs are established on the basis of progressive rates of expenditure of various types of resources.

OVERHEAD COSTS - costs that are not directly related to the production of an individual product or type of work and are attributable to the entire output. These include: costs of maintenance, operation and ongoing repairs of buildings, structures and equipment; social insurance contributions and other mandatory payments; maintenance and wages of administrative and management personnel; expenses associated with losses from defects and downtime, etc. They are included in the cost of manufactured products, but not directly, but indirectly, i.e., in proportion to the amount of wages, the cost of raw materials, etc. In trade, overhead costs are usually classified as costs associated with storage, packaging, transportation and marketing of products.

31.Depreciation. Sinking fund.

Depreciation of fixed assets as a method of monetary compensation for wear and tear creates conditions for their “immortality,” and enterprises have the opportunity to compensate and restore fixed assets as they age.

Depreciation is a method of including in parts the cost of fixed assets (during their service life) in the costs of manufactured products and the subsequent use of these funds to reimburse consumed fixed assets.

After the sale of products (stage T - D), part of the amount of money corresponding to the transferable value of fixed assets goes to the depreciation fund , in which funds are accumulated to an amount approximately corresponding to the original cost of fixed assets (minus their depreciation). The depreciation fund (the amount of accumulated money) is used to purchase new material elements of fixed assets to replace worn-out ones, i.e. fixed assets are being restored.

32. Annual depreciation. depreciation rate. concept and definition procedure.

The annual amount of depreciation charges is determined:

• with the linear method - based on the original cost or (current (replacement) cost (in case of revaluation)) of an object of fixed assets and the depreciation rate calculated based on the useful life of this object; • with the reducing balance method - based on the residual value of the object of fixed assets funds at the beginning of the reporting year and the depreciation rate calculated based on the useful life of this object and a coefficient not higher than 3 established by the organization; • when writing off the cost by the sum of the numbers of years of the useful life - based on the original cost or (current (replacement) cost (in case of revaluation) of an object of fixed assets and a ratio, the numerator of which is the number of years remaining until the end of the useful life of the object, and the denominator is the sum of the numbers of years of the useful life of the object.

During the reporting year, depreciation charges for fixed assets are accrued monthly, regardless of the accrual method used, in the amount of 1/12 of the annual amount.

For fixed assets used in organizations with a seasonal nature of production, the annual amount of depreciation charges on fixed assets is accrued evenly throughout the period of operation of the organization in the reporting year.

When writing off the cost in proportion to the volume of production (work), depreciation charges are calculated based on the natural indicator of the volume of production (work) in the reporting period and the ratio of the initial cost of the fixed asset item and the estimated volume of production (work) for the entire useful life of the fixed asset item.

Depreciation rate—

This is the amount of depreciation established as a percentage of the book value for a certain period for a specific type of fixed asset.

For accounting purposes, the depreciation rate is calculated using two formulas:

na = (OSp - OSl): (Ta × OSp) × 100%

where is Nam

- annual depreciation rate,

%

;

OSB

— initial cost of fixed assets, in rubles;

OSl - liquidation value of fixed assets, in rubles;

Ta

— standard service life (depreciation period) of fixed assets, in years

Another formula is used to calculate the depreciation rate based on the useful life of the fixed asset:

na = (1 / T) × 100%,

(2.2)

where na –

depreciation rate for fixed assets, %;

T -

useful life of a fixed asset, in years.

33. Indicators of efficiency of use of fixed assets.

When assessing the efficiency of an enterprise's fixed production assets, two groups of indicators are distinguished:

1) generalizing;

2) specific

General indicators of the efficiency of using fixed production assets include:

— capital productivity;

— capital intensity;

— capital-labor ratio;

— profitability of fixed assets;

— coefficient of input of fixed production assets;

— retirement rate of fixed production assets

Capital productivity (fB) is understood as an indicator of the efficiency of use of fixed production assets, characterizing the volume of products (services) produced by an enterprise in cost measures (OP) by a unit of fixed production assets (CP). It can be calculated using the formula (618):

Capital intensity (FM) is an indicator inverse to the capital productivity indicator, i.e. it shows how much the enterprise needs to purchase fixed production assets to produce the required volumes of products (services). It can be calculated using the formula (619):

The capital equipment of labor (fn) is understood as an indicator of the efficiency of the use of fixed production assets by the enterprise's employees, which is calculated as the ratio of the value of the active part of fixed production assets F (II, III, IV) (i.e. II, III and IV groups of fixed assets by classification given in paragraph 62) and the number of industrial production personnel in the maximum workload change of the enterprise (Chpvp), i.e. according to the formula:

The profitability of fixed assets (Rf) is understood as an indicator of the efficiency of use of fixed assets of an enterprise, which is calculated as the ratio of profit from the main production and non-productive activities of the enterprise (P) to the average annual cost of fixed assets (FSR), i.e. according to formula (621):

The coefficient of input of fixed production assets into production (renewal coefficient) (KVN) shows how much assets were introduced (Fvv) compared to their value at the end of the reporting period (Fcl) and p is calculated using the formula (622):

The coefficient of disposal of fixed production assets from production (kVie) shows the amount of funds that were withdrawn (FViv) compared to their value at the beginning of the reporting period (FPP). It is calculated using the formula (623):

34.Working capital and working capital in construction. Composition and structure.

Working capital is the funds of an enterprise intended for the formation of circulating production assets and circulation funds in order to ensure the continuity of the production process and sales of products.

Working capital of an industrial enterprise consists of working capital and circulation funds.

Working capital is a part of production assets that is completely consumed in each production cycle and transfers its entire value to newly created products. The natural - material content of working capital is the objects of labor that are in production reserves (raw materials, basic and auxiliary materials, fuel, purchased products and semi-finished products, containers, spare parts for repairs, tools and other low-value and wear-out items), objects of labor that entered into the production process (unfinished products, semi-finished products of own production), and the costs of future years for the establishment of new products and improvement of technology.

Compound

The structure of working capital reflects the relationships (in the form of shares, percentages) that develop between the components of working capital or their individual elements. It depends on the sector of the economy and reflects the specifics of the production cycle.

The largest is the division of an enterprise's working capital, depending on its placement in the reproduction process (i.e., the circulation process) or on a functional basis. It shows the part of working capital in the form of circulating production assets employed in the production process and in the process of circulation or sale. In industry, the ratio between these elements of working capital is about 7:3

35. Factors influencing the structure and composition of working capital.

| Factors influencing the structure of working capital in production | Factors influencing the structure of working capital in the sphere of circulation |

| Material and technical features of the industry | Number and location of suppliers of material and raw materials and consumers of products |

| Duration of the production cycle (in enterprises with a long production cycle there is a large proportion of work in progress; in enterprises with a short production cycle there is a large weight of production inventories) | Form of logistics organization |

| Nature of consumed raw materials and manufactured products | Frequency of deliveries |

| The nature of the organization of production (level of specialization, concentration, cooperation and combination of production) | Payment forms for materials and products |

| Product quality (if an enterprise produces low-quality products that are not in demand among buyers, then the share of finished products in the warehouse increases sharply) |

36) The working capital of an organization is the totality of material and monetary assets. Participating and completely consumed in one production cycle of production of products (goods or services of a production nature)

Part of the OS. which operates in a production environment is called working capital (OF)

Funds of the organization. Those in circulation are called circulation fund (CF)

The most important indicators of the efficiency of using working capital are:

- current liquidity ratio;

- turnover ratio;

-duration of one revolution, in days;

- working capital utilization ratio;

-profitability of working capital.

The working capital turnover ratio shows the number of revolutions that working capital makes during the planning period and is determined by the formula:

To turnover=Proceeds from sales / Average value of working capital

The average duration of turnover of working capital (turnover in days) is determined by the ratio of the product of the average balance of working capital and the number of days in the period to the amount of product sales for this period:

Duration of turnover=360 / Asset turnover

Also, to assess the efficiency of using working capital, the working capital load factor is calculated. It characterizes their amount per 1 ruble of products sold.

Loading = Average working capital / Sales revenue

Return on working capital shows how much profit the company receives per ruble of its working capital over an estimated period of time.

Equipment profitability cap.=Net profit / Average working capital

37) 1. turnover ratio

(

K

about) working capital shows how many turnovers were made by working capital during the period under study or how many products were sold per 1 ruble. working capital:

where RP is sales revenue (volume of products sold), rub./year; OBSsr.g – average annual balance of working capital (according to the balance sheet), rub.

2.duration of one revolution

(

T

rev) characterizes over what period of time (how many days) one revolution occurs:

;

38, 39) Planning and determining personnel requirements is carried out simultaneously with planning the production program and labor productivity.

Labor productivity is the ability of living labor to create a certain amount of output per unit of time, thus labor productivity is a criterion of labor intensity.

The economic significance of increasing labor productivity lies in reducing the costs of living and past materialized labor for production, in reducing its cost.

Labor productivity is characterized by two main indicators:

1) Production;

Distribution of expenses by type of product

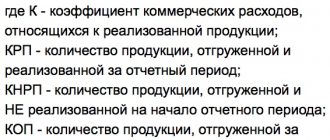

This process depends on the industry characteristics of the organization and the chosen costing method. It is important to correctly establish the relationship between manufactured products and incurred costs. Indirect costs can be distributed in two stages. First, they are grouped by place of origin (workshop, division or department). Then they are redistributed by type of product. It is important to determine the basis for classifying expenses. For example, when calculating administration salaries, the number of employees can be used, for calculating electricity - area, etc.

Expenses associated with the manufacture of products are reflected in accounts 20 “Main”, 23 “Auxiliary production”. Analytical cost items are opened in their sections. Accounting is done with the following entries:

DT 20 (23) CT 2, 4, 5 - production costs are written off;

DT 20 CT 28 – losses from defects are taken into account.

Indirect expenses are reflected in the items “General production”, “General business” and “Sales costs”. The first group includes:

- expenses for the use of machinery and equipment;

- depreciation and repair costs of operating systems used in production;

- utility fees;

- rental of premises, machinery and equipment used in production;

- remuneration of workers.

This is reflected in the chart of accounts as follows:

DT 25 KT 02, 60, 69, 70 - the costs of servicing the main production facilities are taken into account.

At the end of the month, the accumulated amounts are written off in DT 20 (23) in the part that is included in the cost of the main (auxiliary) production.

Indirect costs of the enterprise

Definition 1

Indirect costs of an organization include those that cannot be attributed directly to any specific cost object, but they are associated with supporting the activities of the organization as a whole. An example of such costs is the overhead costs of the enterprise, which remain after excluding direct costs from the total amount.

An example of indirect costs of an enterprise can be administrative expenses, for example, rental of office equipment, utilities, communication services and others. While these cost elements make a direct contribution to the activities of the enterprise as a whole, they cannot be attributed to the production of any specific product. Also examples of this type of costs are commercial expenses for marketing and advertising, legal and consulting services, etc.

Indirect costs of remunerating employees of an enterprise make it possible to produce a cost object, but cannot be directly attributed to any specific product. For example, the costs of paying managers, accounting and human resources departments are necessary to maintain the organization's activities, but do not relate to the production of a specific type of product.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Indirect costs, like direct ones, can be either variable or constant in nature. For example, fixed costs include rent for company office space, and variable costs for electricity and gas for auxiliary equipment.

General running costs

- administrative costs;

- personnel costs;

- depreciation of general purpose fixed assets;

- rental of office premises;

- payment for information, audit and other services.

The following amounts are written off:

1) to account 20 and distributed among individual types of services;

2) to account 46 “Sales” as semi-fixed costs.

At the end of the reporting period, turnover for DT 20 reflects the direct, variable costs of manufacturing products and shows the actual cost. Balance – the amount of unfinished production.

Indirect expense

These costs are considered non-core, in terms of their contribution to the cost of production of the enterprise. In other words, indirect costs do not directly affect the cost of production, but are only costs associated with production. The following expenses can be included in this group:

- Maintenance of buildings and structures. It is obvious that for a high-quality production cycle it is necessary to have appropriate conditions in the form of modern equipment and new or renovated industrial space.

- Product advertising. Expenses for popularizing products and ensuring awareness of your own brand.

- Improvement of personnel qualifications. Payment for attending various advanced training courses, seminars to present new equipment and specialized industry exhibitions.

- Office expenses. This includes various equipment and materials - from paper clips to furniture and office equipment.

Direct cost calculation and analysis

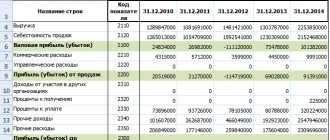

The parameters for the distribution of expenses must be fixed in the accounting policies of the organization. The financial result of the organization depends on the validity of the chosen method. Let's look at a specific example.

The company produced 300 tables of type A and 250 of type B per month. Direct production costs amounted to 225 thousand rubles. and 425 thousand rubles. respectively. The amount of indirect costs is 120 thousand rubles. During the month, 200 tables A and 100 pcs. were sold. B.

1. Let's distribute indirect costs based on direct ones.

Let's calculate the amount of variable costs:

- A: 120*225 / (225 + 425) = 41.5 thousand rubles;

- B: 120*425 / (225 + 425) = 76.1 thousand rubles.

Let's calculate the cost = (direct costs + variable costs) \ number of manufactured products:

- A: 225+ 41.5 / 300 = 0.9 thousand rubles;

- B: 425 + 78.1 / 250 = 2 thousand rubles.

Selling costs = unit cost * number of goods sold:

- A: 0.9 * 200 = 180 thousand rubles;

- B: 2 *100 = 200 thousand rubles.

TOTAL = 380 thousand rubles.

2. Let's distribute indirect costs evenly

Let's calculate the amount of variable costs:

- A: 120*300 / (300 +250) = 65.4 thousand rubles;

- B: 120*250 / (300+250) = 54.5 thousand rubles;

Unit cost:

- A: 225+ 65.4/ 300 = 0.97 thousand rubles;

- B: 445 + 54.5 / 250 = 1.99 thousand rubles.

Cost of sales:

- A: 0.97 * 200 = 194 thousand rubles;

- B: 1.99 *100 = 199 thousand rubles.

TOTAL = 393 thousand rubles.

The difference between the calculations is 13 thousand rubles. The company's financial result for the reporting period will change by the same amount.

The choice of costing method depends on the type of production, the technologies used and the characteristics of the products. The method shown is used if the product is produced in batches. Then for each order a card opens, which displays direct and indirect costs. The unit cost is calculated by dividing the amount received by the quantity of products in physical size.

Large technology organizations have a number of divisions. They produce semi-finished products and are connected to each other through a single production process. At such enterprises, costs are taken into account process by process. First, the cost for each cycle is calculated, and then these numbers are summed up and the final result is calculated.

Classification of direct and indirect costs

It should be understood that in each individual case, the classification of costs into direct and indirect requires an individual approach, since cost items can differ significantly even for companies operating in the same industry.

In general, the classification of direct costs can be presented as follows.

- Direct material costs:

- raw materials and materials;

- components and semi-finished products;

- energy for main production equipment.

- Direct labor costs:

- salaries of key production personnel.

- depreciation of capital production equipment;

- advertising costs for a specific product;

- fare;

- packaging costs;

- commissions to sales agents.

The classification of indirect costs in aggregate form is as follows.

- Indirect material costs:

- energy for auxiliary production equipment.

- wages of production support personnel;

- salaries of administrative and management personnel.

- depreciation of auxiliary production equipment;

- advertising costs for the company as a whole;

- administrative and general expenses;

- professional services costs;

- other expenses.

The figure below shows an example of the classification of direct and indirect costs.

Disadvantages of the standard scheme

In a small business, allocating costs is not difficult. But if several types of products are manufactured in one workshop on a piece of equipment, then the process becomes more complicated. In this case, employees of the planning department must develop write-off standards.

Direct costs can be distributed not only to finished products, but also to:

- structural units of the organization (directorates, departments, workshops, etc.);

- processes that occur within the company;

- OS objects;

- clients;

- sales channels, etc.

According to this classification, the same cost items can be called direct in relation to certain objects and indirect – in relation to others. This method avoids excessive accumulation of variable costs. Example: several units of products are produced on a certain group of equipment. Since it is impossible to calculate direct costs using the classical method, the costs are written off to the group of production overheads. And in the next workshop there is the same unit. But its maintenance costs are half as much. Why is this happening? Because the accounting policy determined that costs are allocated only to products. But you can use other methods of classification. The point is not that the standard approach does not allow you to correctly calculate the cost. The efficiency of the business as a whole decreases.

Another example is distribution costs. Usually they are also collected “in a heap” and distributed proportionally across the entire assortment. But from the point of view of business efficiency, it is necessary to monitor the “profitability” of not only products, but also customers. Only in this case can you evaluate the success of sales channels and abandon unprofitable ones.

List of direct expenses

Direct costs include:

- Costs for replenishment of materials.

- Costs of wages for personnel engaged in primary production.

- A group of other costs in the form of depreciation of equipment, advertising of goods, payment of commissions to sales agents and the purchase of packaging materials.

Accounting for expenses is carried out by accumulating them in account 20. The peculiarity of the service sector is that direct costs are taken into account immediately in full without reference to the level of sales.

Trade Organization

Purchased materials are accounted for at the purchase price on account 41. Transportation costs are redistributed monthly between goods sold and their balances in warehouses. Direct costs are calculated based on the average percentage taking into account the balance at the beginning of the month.

The calculation procedure is as follows:

1. The amount of inventory in the warehouse at the beginning of the month is determined.

2. The cost of goods sold and the balance at the end is calculated.

3. Average percentage = (1) / (2).

4. Direct costs = average interest * cost of balance at the end of the month.

For DT account 44, in addition to transportation costs, the following are also displayed:

- salary;

- rent;

- advertising;

- delivery of goods to the buyer;

- storage of goods;

- entertainment expenses, etc.

Accumulated expenses on account 44 are written off to the debit of account 90.