Every company has property, which may include money, equipment and other tangible and intangible assets. The property mass is called assets. This is the company's source of income. Assets come in many varieties. To obtain the required value, calculations are required. They are required when paying imputed tax. However, keeping records of assets is important not only for tax deductions. These indicators reflect the state of the company.

Assets

Assets

(from the word “active”) is what the organization owns, its property (answers the question “what is it?”).

The organization's property, depending on its composition and functions, is divided into two groups: non-current assets (fixed capital) and current assets (working capital). Each group includes balance sheet items - separate balance sheet lines.

Balance sheet: Section I. Non-current assets

Fixed assets

include articles:

- intangible assets,

- research and development results,

- Intangible search assets,

- material prospecting assets,

- fixed assets,

- profitable investments in material assets,

- financial investments,

- deferred tax assets (DTA),

- Other noncurrent assets.

Let's look at each article in more detail:

What refers to non-current assets of an enterprise

SAIs include several main groups. The classification of these resources is contained in the balance sheet f. 1. Regulatory requirements for the formation of accounting indicators in the balance sheet - in PBU 4/99. Namely in Sect. IV of the said Regulations defines the content of Form 1.

Non-current assets include the following components:

- Intangible assets (IMA) are SAIs of an organization that do not have a tangible, that is, tangible, form. These are, for example, assets such as software, databases, trademarks, marks, licenses, patents, various rights, business reputation, know-how, etc.

- Fixed assets (FPE) – used for more than 12 months. equipment, tools, machinery, vehicles, buildings, structures, buildings and other assets.

- Profitable investments in MC (tangible assets) are investments in assets with the aim of transferring them for further use on the side or for the purpose of increasing, creating, acquiring one’s own SAI. For example, these are leasing items, rental items, costs of construction and installation works (construction and installation works), unfinished construction, etc.

- Financial investments are long-term investments in various securities, authorized capitals of third-party structures, lending to other organizations, etc.

Note! We figured out that non-current assets consist of 4 main groups. But in addition there are several more groups, one of which is considered to be other SAIs. What is included in other non-current assets and on what line such resources are reflected in the balance sheet - more on this below.

Intangible assets (IMA)

Regulates PBU 14/2007 “Accounting for intangible assets”

An intangible asset is a long-term asset with a duration of more than 12 months or a normal operating cycle if it exceeds 12 months. The object does not have a tangible form, but its actual value can be established; it must generate income. The organization must have the right to such an object and have properly executed documents: patents, certificates, other documents of protection, an agreement on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization, documents confirming the transfer of the exclusive right without an agreement, and others.

Intangible assets include:

- works of science, literature and art;

- programs for electronic computers;

- inventions;

- utility models;

- breeding achievements;

- production secrets (know-how);

- trademarks and service marks;

- business reputation arising in connection with the acquisition of an enterprise as a property complex (in whole or part thereof).

Research and development results

Regulates PBU 17/02 “Accounting for R&D expenses”

Research and development results - this item reflects the costs of completed research, development and technological work (R&D).

The following works are taken into account as part of R&D expenses:

- for which results were obtained that are subject to legal protection, but were not formalized in the manner prescribed by law;

- for which results were obtained that are not subject to legal protection in accordance with the norms of current legislation.

Features of accounting for fixed assets in budgetary organizations

As stated in the legislation, a budget organization has the right to dispose of this property, but not to sell it. All income from its use goes to a separate balance sheet and remains at the mercy of the organization. Therefore, there is a peculiarity in accounting for property displayed on the balance sheet.

Main account “01” – Fixed assets. His subaccounts:

- 1 – intended for those items that were purchased with budget money.

- 2 – property acquired as a result of entrepreneurial activity.

- 3 – valuables accepted as a gift.

Intangible search assets

Regulates PBU 24/2011 “Accounting for costs for the development of natural resources”

Intangible exploration assets include:

- the right to carry out work on the search, assessment of mineral deposits and (or) exploration of mineral resources, confirmed by the presence of an appropriate license;

- information obtained as a result of topographical, geological and geophysical studies;

- exploration drilling results;

- sampling results;

- other geological information about the subsoil;

- assessment of the commercial feasibility of production.

Return on current assets

The mere presence of current assets on the balance sheet only informs the user about their size. Having analyzed the values of financial and other current assets in the balance sheet by period, the economist can determine the level of provision of the technological cycle with appropriate resources, optimize the structure of consumed funds, and get rid of illiquid inventories.

One of the important indicators of rational use of working capital and assessment of company productivity is profitability. It is determined by the ratio of the amount of profit received to the amount of the average annual cost of operating assets (the amount of operating assets at the beginning and end of the year, divided by 2), and it demonstrates the company’s ability to provide a volume of profit related to the working capital used. The higher the value obtained, the more efficiently the OA are used.

Fixed Assets (Fixed Assets)

Regulates PBU 6/01 “Accounting for fixed assets”

Fixed assets are objects capable of generating income, used for a long time (over 12 months) and intended for use in the production of products, when performing work or providing services, for the management needs of the organization.

The main assets include:

- 3buildings, structures,

- working and power machines and equipment,

- measuring and control instruments and devices,

- Computer Engineering,

- vehicles,

- tools, production and household equipment and supplies,

- working, productive and breeding livestock,

- perennial plantings,

- on-farm roads and other relevant facilities,

- capital investments for radical improvement of land (drainage, irrigation and other reclamation works);

- capital investments in leased fixed assets;

- land,

- environmental management objects (water, subsoil and other natural resources).

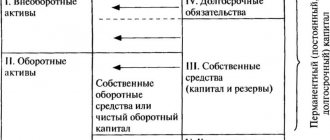

The concept of fixed and working capital

Fixed assets

REFERENCE! More specifically, fixed assets include all structures, buildings, equipment, machinery and others, which make up the majority of capital investments at the primary stage of the enterprise’s life cycle.

Working capital of the enterprise

Working capital includes all material assets that are expressed in monetary form and are directly involved in the production process, but this can only be done once. The cost of working capital is fully transferred to the cost of goods. For example, fixed assets are machines and other equipment with the help of which the production process takes place, and working capital are raw materials and supplies, without which the product will not be produced.

REFERENCE! The expression of working capital is almost always in cash and is used to carry out ongoing activities.

What is the difference between fixed assets and working capital?

- Fixed assets are buildings, structures, furniture, equipment, machines that are directly involved in the production cycle, but do not transfer their elements to the finished product. The difference between working capital is that they are included in the final result entirely; their consumption occurs in the process of one completed production cycle.

- The cost of fixed and working capital is included in the cost of goods. The difference is that fixed assets are included in it in the form of depreciation and are only partially reflected in the price, while working capital is included in the cost in full. The final cost of the product for consumers depends largely on the cost of materials and raw materials.

- Fixed assets can be replaced with new ones only after their cost has been fully recovered. This process usually takes several years. Current assets, in turn, are sold immediately. Accordingly, for the next production cycle they need to be purchased again.

Financial investments

Regulates PBU 19/02 “Accounting for financial investments”

Please note that the article “Financial investments” is in both the “Non-current assets” section and the “Current assets” section. Previously, in the old balance sheet form they were indicated more clearly: “Long-term financial investments” and “Short-term financial investments”. The meaning of the articles remained the same, only the titles became shorter.

Financial investments are:

- state and municipal securities,

- securities of other organizations, including debt securities in which the date and cost of repayment are determined (bonds, bills);

- contributions to the authorized (share) capital of other organizations (including subsidiaries and dependent business companies);

- loans provided to other organizations,

- deposits in credit institutions, d

- receivables acquired on the basis of assignment of the right of claim, etc.

- contributions of a partner organization under a simple partnership agreement.

Financial investments indicated in section I of the balance sheet are long-term, the circulation (repayment) period of which exceeds 12 months.

Classification of working capital

Current assets are classified depending on their characteristics. For example, they can be divided as follows

- by source of education:

- own working capital (balance sheet formula = line 1300 – line 1100), formed from company funds;

- acquired with borrowed capital (usually when financial difficulties arise);

- by degree of controllability:

- normalized, i.e. ensuring the continuity of the production process (inventory production, RBP, work in progress, finished goods);

- non-standardized, that is, in the sphere of circulation (except for finished products) and not affecting the production process (cash, accounts receivable, shipped goods).

If necessary, current assets are classified according to other criteria.

Other noncurrent assets

Other non-current assets are assets whose circulation period exceeds 12 months and which are not reflected in other lines of Section I of the balance sheet:

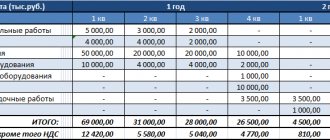

- equipment requiring installation - equipment that is put into operation only after assembling its parts and attaching them to the foundation or supports, to the floor, interfloor ceilings and other load-bearing structures of buildings and structures, as well as sets of spare parts for such equipment;

- investments in non-current assets of the organization - the organization's costs in objects that will subsequently be taken into account as intangible assets or fixed assets, as well as costs associated with the implementation of incomplete R&D;

- expenses related to future reporting periods - for example, expenses for the development of natural resources, a one-time (lump-sum) payment for the right to use the results of intellectual activity and means of individualization;

- the cost of perennial plantings that have not reached operational age;

- the amount of transferred advances and advance payment for work and services related to the construction of fixed assets.

Own and leased funds

It is not difficult to guess that all own funds are those material and technical assets that were purchased at the expense of the enterprise itself and are included in the book value. Leased properties are accounted for slightly differently. Depreciation costs are not calculated for them, and they are assigned “to the balance sheet”.

This question concerns budgetary organizations. Almost all existing equipment is considered leased, since the company cannot use it at its own discretion, as it pleases.