Modern methods of investing money allow you to quickly make a profit and increase your initial capital. In order to rationalize investments, experienced investors draw up a reference plan.

A business plan for an investment project allows you to significantly reduce risks and predict the profitability of a particular project. As part of drawing up the document, specialists fully study the market area and take into account all possible subtleties.

What is a business plan for an investment project?

A business plan is a set of activities aimed at providing an economic and technical justification for the need to invest funds. In the process of developing a document, specialists must carry out: an analysis of the effectiveness of capital investments, an assessment of the current market realities and economic feasibility.

Moreover, the business plan involves a set of actions necessary to resolve problems that arise during the implementation of the project.

In simple terms, a business plan for an investment project is a justification for the need for investments and takes into account all the intricacies of injecting funds into the project.

In most cases, business projects allow you to evaluate:

- level of stability and liquidity of the future project;

- the possibility of returning funds in case of failure;

- opportunities for cooperation with other industries;

- the need to involve government agencies;

- a list of difficulties that arise as the project progresses.

The action plan is one of the most important documents for potential investors and creditors. The future viability of the planned business depends on how well the document is drawn up.

An example of how investments can be calculated.

Main types

There are quite a few types of investment concepts. They are classified according to different indicators. Among the main categories of projects, several examples can be identified :

- Duration of implementation - projects can be short-term (less than three years), medium-term, or long-term (over 5 years).

- The volume of financing is small and medium, large and mega-large.

- Specialization – commercial, scientific and technical, industrial, environmental.

- Scale – from global and large-scale to local.

- The level of risks, as an example, is low and high.

Every year thousands of investment business plans are launched in the Russian Federation.

Why is it necessary to develop an investment business plan?

In general, an investment plan allows you to:

- Provide an analysis of the business scheme supported by calculations. Investors will under no circumstances invest money in unclear projects. To ensure transparency and soundness of the business, it is imperative to draw up a plan.

- Assess all risks. In the process of creating a reporting document, specialists analyze competitors, assess possible crises and collapse of pricing policy.

- Calculate the financial benefits of a promising project. The plan for a long-term project allows you to estimate the payback period, the need for capital investment and the life expectancy of the business scheme.

- Tell us about the concept of the proposed product. Providing the investor with complete information about the product or service being produced is also done during the presentation of the business plan.

Russian industrial enterprises additionally use planning for:

- adapting foreign business schemes to Russian realities;

- carrying out project evaluation;

- assessing the need for additional training of personnel.

Note! Planning is an optional element for short-term projects. Such business schemes, as a rule, do not exist for long, and therefore there is no need to assess prospects.

Choose an investment option that suits your age

Age has an impact on investment strategy. The younger you are, the more justified the risk. You have more time to recover from market downturns, crises and mistakes.

When an investor is 20 years old, he can allocate most of his money to aggressive investments. The kind that are focused on growth and small cap companies.

If an investor is nearing retirement, he or she will build a portfolio of less aggressive options and look at stable income and large-cap companies.

Structure of a business plan for an investment project

The country's legislation does not establish any framework for creating a plan.

What should a detailed business plan contain?

In the most typical form of a document, there are five main aspects to consider:

- generalization and formulation of the main advantages of investing in the project;

- description of the characteristics and goals of the activity;

- overview of the investment industry;

- financial aspects;

- results of marketing research.

Typically a planning document is 20-40 pages long. The overall size of the document should be neither too large nor too small.

A huge volume can make an investor bored, and a small number of pages will certainly make a person doubt the seriousness of the business scheme.

What does an investment business planning document include?

In most cases, a business document consists of four sections:

- title page;

- content;

- main sections;

- applications.

The main sections of the plan must contain:

- summary;

- business strategy;

- description of the product or service;

- analytical calculations on sales markets;

- production plan;

- organizational plan;

- investment plan;

- predicting project success;

- analysis of the effectiveness of the business scheme;

- legal plan.

Business plan content table

The amount of text material required to compile a full-fledged business document is shown in the table below:

| Element | Page volume |

| Summary | 1 |

| Product or service description | From 2 to 5 |

| Market analysis | From 3 to 7 |

| Marketing plan | From 3 to 6 |

| Production plan | From 4 to 7 |

| Project development plan | From 3 to 6 |

| Possible risks | From 1 to 3 |

| Application section | Volume is not limited |

| Overall volume | From 20 to 40 |

The data shown above is only indicative and may be subject to change depending on the specifics of the project and planned activities.

A competent description of the production part of the business plan will allow investors to become more invested in the project. For the rest of the project participants, it makes sense to deeply prescribe the marketing policy of the business.

To attract the attention of investors, there are several simple recommendations:

- if the volume of the document is small, you should compensate for this with an extensive application;

- in-depth market analysis and business assessment must be present in the document;

- When drawing up the document, special attention should be paid to the production and financial sections;

- It would be a good idea to describe in detail all possible risks and objectively evaluate the product.

Description of the product or service being produced

The business documentation section describes in detail the essence of the product or service, talks about the importance of the idea on an industry and market scale.

In general, this section is divided into four categories:

| Category | Description |

| Product Description | Here you need to describe in detail all the advantages and disadvantages of the product. It would be a good idea to mention competitors and provide a comparison of characteristics |

| Documentation demo | All permits for business activities from the relevant government authorities should be placed in the category. If there are too many documents, some of them can be moved to the Applications section |

| Social and economic significance | Despite the fact that these parameters play a secondary role for the investor, they are very important for a clear description of the product’s prospects. In this category it is necessary to place research concerning: the number of jobs, the impact of the business on the general standard of living, the economic impact on the location of the enterprise. The last paragraph applies only to goods that carry special value or pose a danger to the environment. |

| Knowledge of the intricacies of production structure | One of the most important categories that shows the investor where his money will go. In the category you can describe the real advantages and disadvantages of the product being manufactured. In addition, you can place a product layout in a subsection. |

Market analysis for the selected industry

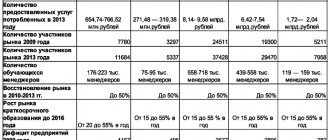

Analytical calculations are a mandatory section of any plan. The product or service being produced must be in demand among potential buyers due to its uniqueness or advantageous difference from competitors. Such information can be obtained only after an in-depth analysis of the market and systematization of information.

Analytical niche research consists of:

- descriptions of innovation processes for this industry;

- indications of trends in the field;

- identifying the target audience and creating a psychological portrait;

- analysis of all possible ways to sell a product or service;

- forecasting demand and analyzing sales of similar competing products.

Note! For maximum clarity of the obtained analytical information, it is necessary to construct charts, graphs or histograms. A visual approach to images of statistical information significantly improves the absorption of information.

Marketing plan

A competent marketing strategy is half the success in business.

Product promotion must be accompanied by a well-thought-out advertising campaign that describes:

- advantages of the manufactured product over competitors;

- main characteristics of the product or service;

- disadvantages of similar products on the market.

The general structure of the marketing section consists of:

- determining the key advantages of the product;

- planning product promotion methods;

- determining pricing rules;

- forecasting methods of marketing products.

A well-developed advertising plan allows the investor to clearly assess the likelihood of success of the business scheme and motivates him to allocate the required amount of investment.

Production plan

The section should contain information regarding:

- the estimated place of production of the goods;

- product cost;

- the process of manufacturing products from a technological point of view;

- necessary raw materials for production;

- descriptions of transport and logistics operations;

- list of personnel and salaries of each staff unit;

- analysis of the cost of manufacturing one unit of product;

- environmental safety of production.

The list of personnel must include a complete list of positions, the number of employees and the structure of the administrative and management apparatus.

This section carries a colossal semantic load, so in most business plans it has the largest volume.

Organizational plan

A description of the stages of registration of an enterprise is made in the organizational section of the plan.

The basic information contained in this section is presented below:

- list of participants in the business scheme;

- timing of the organization of the work process;

- time to install production facilities, select staff and manufacture the first product;

- features of interaction between participants in the process of implementing a business plan.

The organizational section of this document is intended to bring precision to issues of production management and interaction between performers and investors.

Financial investment planning

This section describes the main purpose of the investment.

This must include information regarding:

- the amount of funds raised;

- timing of profit;

- the need to use borrowed finance.

The financial planning section should contain only clear calculations and reliable information.

The last section of the plan, called Applications, is in no way limited in scope. Additional materials should include graphs, diagrams, comparative tables and other visual material for investors.

Brief summary of the enterprise plan

The purpose of the resume is to provide information about the product or service, indicate the time frame for the start of production, and provide a brief financial assessment of the business scheme.

Your resume must include:

- the proposed activities of the organization;

- potential of a product or service;

- main advantages of the product;

- the impact of the product or service on the market niche;

- statistical data about competing products.

The resume should be 1-2 pages long. The section must be structured in such a way as to interest the reader in becoming familiar with the remaining aspects of the business plan.

It is recommended to write a short summary last. This approach makes it possible to get rid of illusions and support arguments with the results of analytical research.

The introductory part of the plan should contain only the necessary information, supported by specific facts and research.

Evaluate your progress

Monitor your investments quarterly or semi-annually to ensure they are meeting expectations and moving you closer to your goals. If this is not the case, re-evaluate the portfolio and allocate investments in a different proportion.

There may be a situation where you do not put enough money from each salary into investments. On the other hand, you may find yourself ahead of schedule and moving too much money into assets. Both options are dangerous in their own way, so balance around the golden mean.

Read: Where to invest money: the most reliable sectors in the stock market

Source

How do investors evaluate a business plan?

The main parameters that investors look at are:

- quick payback;

- indicator of project profitability;

- net profit from business;

- internal rate of return.

Requirements for a business plan may vary depending on who the investor is: a bank, the state or an entrepreneur.

In the case of a banking institution, it is important to clearly describe in the financial document the prospects of the scheme and the ability to repay borrowed funds in a timely manner. In addition, it is important to provide the bank with the property against which the loan will be issued. This step is necessary in order to guarantee the financial institution the integrity of the borrower.

To attract capital investment from the state, the plan should indicate:

- the amount of personal funds of the organization;

- number of employees and the level of their wages;

- the amount of tax deductions.

The requirements of a business document for a private investor depend on his personal preferences. In most cases, the largest role in the decision to invest in a project is played by high projected profits and low payback periods.

Thus, drawing up a plan should be based on the desired type of investment.