What should you pay attention to?

The risk analysis in the business plan should contain not only possible risks, but also special methods and calculations that will help reduce or prevent their occurrence and minimize the consequences.

Risks in the business plan should be described in more detail if large sums are planned to be invested in the project. If the project is not too large in scale, then you should not pay special attention to the analysis.

Before you include risks in your business plan, you must do the following:

- Compile a comprehensive list of risks related to the functioning of the business. It is necessary to take into account every detail, every little thing that can affect the development of the business. For example, if you plan to engage in agriculture, then you need to pay attention to statistics, find out with what regularity droughts or, conversely, heavy rains with hail occur in the region, and what demand the product is in among local residents.

- Determine possible risks in percentage terms. In this case, it is necessary to use the estimates and forecasts of specialists. What field the expert will be from depends on the focus of the business plan. This could be a technologist, an agronomist, a builder and others.

- Assess possible losses that may result from emerging risks. They are valued in monetary and physical terms.

- Risks are best described in the order in which they are likely to occur. For each risk, indicate potential damage. It is better to arrange the data in a table.

- Risks that are least likely to occur should be immediately excluded from the list.

Taking into account risks in business planning

Definition 1

Risk is the probability of an unfavorable event, the effect of which may lead to the loss of some part of the resources, the receipt of profit not in full, or the emergence of an additional expense item.

Investment projects are always accompanied by various types of risks. The presence of the likelihood of risks becomes the reason for a thorough analysis by firms of all investment projects. Investment risk assessment is a mandatory component of all business projects and business plans.

The depth of risk analysis depends on the specific activities of the company and the scale of the project. For large projects, a thorough study of risks is carried out using special mathematical tools of probability theory. In simpler projects, risk assessment is carried out using expert judgment.

There are many types of risks, and therefore entrepreneurs should assess those risks that are most likely to occur. To do this you need:

Finished works on a similar topic

- Coursework Risks of business planning 460 rub.

- Abstract Risks of business planning 250 rub.

- Test work Risks of business planning 210 rub.

Receive completed work or specialist advice on your educational project Find out the cost

- Identify all possible risks;

- Assess the likelihood of each occurrence;

- Calculate expected losses when they occur;

- Rank risks by likelihood of occurrence;

- Determine the acceptable level of risk and do not take into account those risks whose probability of occurrence is lower than the acceptable level.

After analyzing all possible risks and identifying the most significant ones, the entrepreneur must, for each risk, draw up a list of organizational measures to prevent and neutralize risks.

Risk categories

All risks of a business plan should be divided into categories to more accurately understand the essence of the issue.

Commercial

Risks of this kind arise already in the course of the activities of any enterprise and depend on various external factors:

- A decrease in demand for a product or service, resulting in a reduction in revenue.

- Competing firms use unfair policies in their work.

- Changes in the cost of materials that are necessary for the normal functioning of the enterprise. As a result, prices for goods or services have to be increased in order to recoup costs. Higher prices, in turn, can lead to decreased demand.

- Increase in the number of competing firms.

- Increasing prices for services necessary for normal operation: utilities, transport. This also includes an increase in prices for renting premises and equipment.

Financial

This category includes risks associated with a possible delay in payment for goods supplied by counterparties, the wrong choice of investors, or other sources of financing, for example, loans or pledges.

Risks within the enterprise

The main role here is played by the employees of the enterprise. Such a risk assessment in a business plan plays an important role, since any misunderstandings in the work between employees can lead to not the best consequences:

- Strikes, sabotage, as a result of which production may stop. They can arise due to delays in wages or incorrect company policies.

- Trade secrets have been violated, all important information goes to competitors.

- Not the most qualified workers were selected, which may result in inspections, fines, and litigation.

Principles of the management process

Managing risks and opportunities for distribution and other businesses requires a range of techniques. The main ones include the following:

- Normative. It consists in establishing specific limits and standards for the performance of certain actions. At the same time, it is recommended to set maximum volumes for the production of products, shipment of goods on credit, raising borrowed funds, and the size of investments.

- Insurance. In this case, some threats are transferred to the insurance company. For this purpose, insurance is provided for employees, property, financial threats, and liability.

- Diversification. This method involves expanding the enterprise through the use of diverse areas of activity.

Important! In order for business to be successful, it is recommended to apply various risk mitigation measures in combination. Analysis and forecasting of probable threats play an important role.

Experts identify the following principles of threat management:

- do not take risks if you can do without it;

- think about the consequences of risk;

- do not create peak situations in order to obtain excess profits;

- keep threats under control;

- minimize hazards by distributing them among clients;

- create reserves to cover possible losses;

- constantly monitor changes in the situation;

- quantitatively measure the level of risks;

- identify new sources of problems or critical areas.

Loss assessment

Based on the degree of possible losses, the risk assessment of a business plan can be divided into the following categories:

- Acceptable losses. In this case, the company may lose a smaller part of the possible profit.

- Critical losses. The amount of losses is estimated, which significantly exceeds the amount of profit.

- Catastrophic losses. The company cannot pay the amount of losses, which may result in bankruptcy.

Any type of risk, regardless of its degree, can be prevented, thereby reducing possible damage.

Recommended Internet service “Business risks: check yourself and your counterparty”

To make your business as successful as possible and minimize all threats, it is recommended to carefully select counterparties. To choose the right business partner and reduce the risk of concluding transactions with organizations, you can use the appropriate electronic service “Check yourself and your counterparty.”

This resource allows the taxpayer to quickly obtain information about partner companies that have been entered into the Unified State Register of Legal Entities. This way you can determine whether the counterparty is at the stage of liquidation or whether the manager is on the list of disqualified persons.

In addition, the service provides information about people who refused to participate or manage the company in court. Also on the portal there is a list of companies with which there is no contact by address or other details.

Minimizing losses

In a business plan, it is important not only to assess risk, but to use methods to minimize it, one of which can be insurance.

Thanks to insurance, it is possible to reduce the practical majority of property losses, as well as various credit, commercial, and production risks. It is necessary to understand that if the likelihood of risks occurring is too high, the insurance company may refuse to insure this type of risk or increase rates for its services.

What does a financial plan consist of?

Let's highlight the main sections:

- financial analysis of the previous three to five years of operation of the enterprise;

- economic analysis of the state of the concern at the time of preparation of the project;

- profit and cash flow forecast;

- conclusions about the effectiveness of the implementation of the plan.

Of course, each part deserves detailed study.

Financial analysis of past years and the current state of the company is a set of calculations and interpretation of the main liquidity ratios. This assessment is designed to identify the level of solvency of the company, its profitability and the intensity of asset use. In order to make this analysis, you need to make some calculations. Thus, the coefficients of the monetary indicators of interest for each period are calculated, compared with each other and considered in dynamics. First of all, the investor must consider the project’s activities, assess development prospects, make a forecast and determine the degree of effectiveness of investment measures.

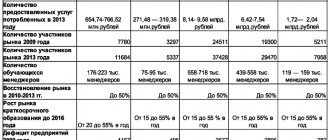

Such research is simply necessary to determine the company's capabilities when launching into the target market. To answer the question of how effectively it can enter the sales market, you need to work out a marketing strategy, the key parts of which will be:

- selection of sales site;

- market segmentation;

- the growth and size of the sales platform;

- features of the development of the target segment;

- identification of competitors, the part of the market they occupy, identification of advantages and disadvantages, development trends;

- identifying the target audience of buyers and determining their opinion about the product being sold;

- segment-by-segment analysis of trade and income;

- occupied share of retail space and planned in the future;

- pricing and credit policy, after-sales and warranty services;

- promotion methods, advertising;

- marketing expenses;

- accommodation;

- technology of price formation, determination of its structure. The cost of a product can be formed based on both the idea of its value and the actual costs incurred in the production of this type of product;

- design (development of logos, trademarks, packaging, design, etc.);

- period of introduction to the target market;

- distribution methods - methods that allow products and services to reach the buyer;

- strategy for planning marketing and sales routes for various geographical areas and markets;

- identifying ways to make a profit in each individual channel, analyzing the approach in comparison with industry-wide practice;

- the target audience;

- methods of interaction with customers, one part of the market segments can be covered directly, and the other through distributors and sales representatives.

This marketing policy is considered an integral part of the project’s financial plan, without which it is very difficult to distribute the business, develop reasonable and adequate pricing, and find optimal ways to promote the product on the market.

The technology for popularizing products is compiled with a focus on maximum results. It reasonably follows from this that its implementation cannot be expected in the near future. But the implementation and implementation of the intended strategy can be monitored during each period of work.

Marketing planning can become the basis for making operational decisions in current activities, as well as the flagship that leads the organization to achieve its goals.

To prepare a competent and effective business plan, you need to get an idea of the potential of the sales market, its development trends, and obtain information about its segments. All this information can be found in demographic surveys. Before drawing up a project budget, you need to study the capabilities of the trading platform.

Researching the sales segment requires money. But if such a possibility exists, you should study their various types - this will help determine the scale of the business. A thorough and comprehensive study of the market platform will be beneficial when drawing up a marketing strategy. It must meet the conditions of the trading platform and be maximally adapted to existing opportunities. It is the model built by managers based on their vision of the economic situation and the place of the business project in it that will influence the decision-making of investors. They can always compare the sample proposed by the company’s management with real data from independent sources and evaluate its adequacy.

But since the purposes of analysis are very diverse, the data involved in each of these numerous types of research will differ and be supplemented with new ones each time.

It is convenient to consider the financial components of the forecast plan, as well as the performance coefficients of the implemented program in the form of a table:

| Indicators | Overall for the project | By year (period) of idea implementation | ||

| 1 | 2 | t | ||

| Efficiency of the plan | ||||

| Simple payback period Dynamic profitability period Net present value Internal rate of performance Profitability index Break-even level Debt coverage ratio | ||||

| Economic values | ||||

| Profitability: – personal funds – investments – invested capital – sales – products Financial Independence Rating Economic Stress Index Capital Structure Data Turnover standards: – total wealth – equity – borrowed money – accounts receivable – accounts payable Current ratio | ||||

In addition to the table, it is worth noting that many of the information serve to determine the ability of the enterprise to fulfill obligations in the long term. For example, signs of turnover show how effective the company’s policy is in the field of prices, methods of selling products, and purchasing activities. And profitability data reflects the profitability of the company at the moment and is of great importance for assessing the feasibility of investing in a project.

Analysis of indicators over time is considered optimal; for comparison, an interval of three to five years, or even more, is taken. Which specific standards will be studied depends on the business itself and its specifics.

The profit and cash flow forecast

- estimates of the cost of raised money;

- information on the balance sheet of assets and liabilities;

- drawing up a forecast for profits/losses and cash flows;

- conclusions on the financial results of the program.

assessed according to the principle: “A ruble today is more valuable than what it will receive in a year.” Economists are well aware that money depreciates over time. And the cash flow that will come to the enterprise in a year will cost much less than the same volume in the current period. This is why discount rates exist. They allow us to equalize today's ruble with tomorrow's. Thus, various flows of income or expenses can be reduced to today's value using such an interest rate. This way we will get the real current value of the product NPV (Net Present Value). It is also called present value and is considered the most important indicator of a business proposal.

When making calculations for any economic scheme, one cannot ignore inflation. Its pace must be predicted for the entire period of implementation of investment measures. It is best to create several scenarios - both positive and negative. Any of them compiled for a financial program must contain a calculation of the net profit from the implementation of the investment project.

Thus, every monetary settlement is based on three basic plans:

- income and expenses;

- cash receipts and payments;

- balance sheet of assets and liabilities.

All these documents help assess how profitable it is for investors to invest money in a business idea. If performance is negative, participants usually decide to leave the program or, in some cases, adjust it to make it more profitable.