Accounting Rules

The main one for an accountant is Federal Law No. 402-FZ dated November 6, 2011. It obliges all enterprises to ensure that accounting records are maintained according to established standards. The head of the company is responsible for its organization and the reliability of the data.

The Regulations on accounting at an enterprise (Order of the Ministry of Finance dated July 29, 1998 No. 34n) formulate the key rules that an accountant must adhere to:

The director of the company, in agreement with the chief accountant, approves the list of persons who have the right to sign on primary accounting documents.

All operations must be reflected in the programs at the time they are performed. As a last resort, immediately after the transaction.

The company’s internal document flow rules stipulate the frequency of formation, the procedure for signing primary documents, and the timing of their transfer within the organization. Authorized persons are responsible for the accuracy of the data in these documents.

Reporting must comply with legal requirements. Then the tax authorities will not have any questions. And for investors or creditors, accounting will become a reliable basis for making thoughtful management decisions.

Reporting

The balance sheet is the main reporting form that characterizes the amount (or size) of property, as well as the financial position of the enterprise in a specific period of time. In accordance with the Federal Law of the Russian Federation “On Accounting”, reporting is a unified system of data on the property and financial condition of an organization and the results of its economic activities, which is compiled on the basis of accounting data in the forms (or samples) established by state legislation. The last, or final stage of the accounting work of an enterprise is the careful preparation and consideration of the financial statements of this enterprise.

Accounting methods

Each fact of the enterprise’s economic activity is subject to systematization and analysis. Must be taken into account:

- debts;

- income;

- expenses;

- movement of goods;

- production costs.

All businesses must keep records of assets, debts and sources of financing. However, accounting for large corporations and firms with 5 employees will vary.

The accounting policy is formed by the enterprise independently and approved by order. In fact, this is a set of accounting methods that management chooses:

- asset inventory;

- write-off of depreciation of their cost;

- method and degree of grouping of costs;

- assessment of production processes;

- rules for applying the chart of accounts and maintaining registers and reporting.

On what basis does an organization choose one or another method of accounting? For example, accounting may not be kept:

- Individual entrepreneurs, organizations related to the Skolkovo Information Center, non-profit organizations and small businesses on the simplified tax system;

- Divisions of foreign companies working according to the laws of their country when organizing accounting.

Sometimes it is necessary to change or adjust the approved enterprise policy. For example, an LLC moves from the category of large enterprises to the category of small ones and chooses a simplified form as a method of accounting.

Financial accounting rules

The legal and regulatory framework requires accounting to adhere to certain rules, or principles. Let's list these principles:

- use of double entry;

- keeping records and drawing up primary documentation in Russian and in rubles;

- current expenses should be taken into account separately from financial investments and capital costs;

- mandatory documentation of each economic fact;

- maintaining accounting registers, the contents of which constitute a commercial secret of the business entity;

- accounting is carried out in monetary terms;

- mandatory periodic inventory of liabilities and property assets;

- consolidation of rules, principles, methods of accounting by establishing them in the accounting policies of an operating enterprise.

Forms of accounting at an enterprise

There are several forms of accounting. Each of them has its own characteristics and is suitable for a limited number of enterprises.

A simple form of accounting . Suitable for small businesses carrying out no more than 30 transactions monthly.

Form of accounting using accounting registers . A small business enterprise can use accounting sheets of forms No. B-1 - B-9.

Memorial order form of accounting. It is based on separate maintenance of systematic and chronological records. Synthetic accounting is kept in the general ledger, analytical accounting is kept in cards or books. It is possible to use memorial orders for small enterprises.

Journal-order form of accounting . Two registers are used - the order journal and the auxiliary (cumulative) statement.

Automated form of accounting . The basis is comprehensive automation (from primary documents to reporting).

It is very important to choose the right form of accounting for your enterprise. It will provide an optimal reflection of data and allow you to systematize it for the company’s internal purposes. When choosing, you need to consider:

- size and structure of the enterprise;

- used accounting registers and connections between them;

- automation of accounting processes;

- sequence of data entry.

Basic forms of accounting: features and differences

Let's consider the most popular of the listed forms of accounting:

Memorial warrant

The memorial order system is the optimal form of accounting for budgetary organizations, since it allows you to clearly and consistently reflect information on each account.

Record keeping is carried out through memorial orders drawn up on the basis of verified and grouped by specific characteristics of primary documents. All completed memorial orders for the current reporting period are entered in chronological order into the registration journal, after which information on them, specifically for each synthetic account, is reflected in the General Ledger.

Magazine-home

One of the most common and applicable in any industry and form of enterprise activity. Experts consider this form of accounting to be a simplified version of the memorial order system, which allows for convenient and detailed generation of information necessary for financial reporting.

Keeping records using this form involves entering information data from primary and consolidated accounting documents into journals and statements, which indicate the amounts reflecting the debit and credit turnover on the corresponding account. At the end of the current accounting period, the final entries for each account are transferred to the General Ledger, according to which the company’s balance sheet is formed.

Simplified

A simplified form of accounting is used for small enterprises that have a small number of business operations in the reporting period.

Two options for maintaining records in a simplified form are allowed - simple and using property registers.

In the first option, all business transactions are reflected exclusively in the Business Transactions Book without the use of double entry. In the second option, in addition to the Business Operations Accounting Book, the use of accounting registers - statements is additionally provided.

The main difference between the listed forms of accounting is the registers used. The choice of the optimal form remains with the enterprise, based on the specifics of its activities. Any of the used forms of accounting can be automated, which greatly simplifies the organization and maintenance of accounting for any modern enterprise.

Accounting software

Today there are many computer programs for accounting businesses. The following products are available to representatives of small businesses (IE, LLC):

| Name | Online address | A comment |

| My business | https://www.moedelo.org/ | For freelancers and small businesses |

| Elbe | https://kontur.ru/elba | For individual entrepreneurs and small LLCs on the simplified tax system, UTII and patent |

| Fingu.ru | https://fingu.ru/ | An outsourced accountant will be able to keep records, generate reports and submit them to the tax service |

| 1C: BusinessStart | https://1cbiz.ru/ | For beginning entrepreneurs |

| Infin. Online | https://www.infin.ru/ | Online accounting, as well as a system for managing purchases, sales and personnel |

The most popular programs based on 1C:

- 1c accounting

- 1C: BukhService.

List of current IFRS standards:

- International Accounting Standards (IAS)

- International Financial Reporting Standards (IFRS)

- Standing interpretations Committee

- International Financial Reporting Interpretations Committee (IFRIC)

International Accounting Standards (IAS) – (translated from English - international accounting standards)

These standards were adopted by the International Accounting Standards Committee (IASB). In 1973, organizations in a number of countries in the field of accounting and auditing created this committee and from that time the IFRS system began to develop. The work of the IASB was carried out until it was transformed into the IASB. The standards developed between 1973 and 2001 by the IASB are called IAS.

International Accounting Standards (IAS)

| Standard number | Name | Validity |

| 1 | 2 | 3 |

| IAS 1 | "Presentation of Financial Statements" | valid from January 1, 1975 – present |

| IAS 2 | "Stocks" | valid from January 1, 1976 – present |

| IAS 7 | "Cash Flow Statements" | valid from January 1, 1979 – present |

| IAS 8 | "Accounting Policies, Changes in Accounting Estimates and Errors" | valid from January 1, 1979 – present |

| IAS 10 | "Events after the end of the reporting period" | valid from January 1, 1980 to present |

| IAS 12 | "Income taxes" | valid from January 1, 1981 – present |

| IAS 16 | "Fixed assets" | valid from January 1, 1983 – present |

| IAS 17 | "Rent" | valid from January 1, 1984 to January 1, 2020 |

| IAS 19 | "Employee Benefits" | valid from January 1, 1985 – present |

| IAS 20 | “Accounting for government subsidies and disclosing information on government assistance” | valid from January 1, 1984 – present |

| IAS 21 | "The Impact of Changes in Currency Exchange Rates" | valid from January 1, 1985 – present |

| IAS 23 | "Borrowing Costs" | valid from January 1, 1986 to present |

| IAS 24 | "Related Party Disclosure" | valid from January 1, 1986 to present |

| IAS 26 | “Accounting and reporting for pension plans” | valid from January 1, 1988 to present |

| IAS 27 | "Consolidated and Separate Financial Statements" | valid from January 1, 1990 to present |

| IAS 28 | "Investments in associated enterprises" | valid from January 1, 1990 to present |

| IAS 29 | "Financial reporting in a hyperinflationary economy" | valid from January 1, 1990 to present |

| IAS 32 | "Financial instruments: presentation of information" | valid from January 1, 1996 to present |

| IAS 33 | "Earnings per share" | valid from January 1, 1999 to present |

| IAS 34 | "Interim financial reporting" | valid from January 1, 1999 to present |

| IAS 36 | "Asset Impairment" | valid from July 1, 1999 – present |

| IAS 37 | "Reserves, contingent liabilities and contingent assets" | valid from July 1, 1999 – present |

| IAS 38 | "Intangible assets" | valid from July 1, 1999 – present |

| IAS 39 | "Financial instruments: recognition and evaluation" | valid from January 1, 2001 to present |

| IAS 40 | "Investment property" | valid from January 1, 2001 to present |

| IAS 41 | "Agriculture" | valid from January 1, 2003 to present |

International Financial Reporting Standards (IFRS) - (translated from English - international financial reporting standards).

IFRS standards were developed by the International Accounting Standards Board (IASB). This is an independent organization created in 2001. Board members are responsible for developing and publishing IFRSs, as well as approving their interpretations. Transformed by the IASB from the International Financial Reporting Standards Board (IASC). Geographically, the council is located in the capital of Great Britain, London. From 2001 to the present, standards have been developed by the IASB and are called IFRS.

International Financial Reporting Standards (IFRS)

| Standard number | Name | Validity |

| 1 | 2 | 3 |

| IFRS 1 | "First application of international standards" | valid from January 1, 2004 to present |

| IFRS 2 | "Share-based payment" | valid from January 1, 2005 to present |

| IFRS 3 | "Business Combinations" | valid from April 1, 2004 – present |

| IFRS 4 | "Insurance contracts" | valid from January 1, 2005 until January 1, 2021 |

| IFRS 5 | "Non-current assets held for sale and discontinued operations" | valid from January 1, 2005 to present |

| IFRS 6 | "Exploration and assessment of mineral reserves" | valid from January 1, 2006 to present |

| IFRS 7 | "Financial instruments: information disclosure" | valid from January 1, 2007 to present |

| IFRS 8 | "Operating Segments" | valid from January 1, 2009 to present |

| IFRS 9 | "Financial instruments" | valid from January 1, 2020 – present |

| IFRS 10 | "Consolidated financial statements" | valid from January 1, 2013 to present |

| IFRS 11 | "Cooperative activity" | valid from January 1, 2013 to present |

| IFRS 12 | “Disclosure of information about participation in other enterprises” | valid from January 1, 2013 to present |

| IFRS 13 | "Fair value measurement" | valid from January 1, 2013 to present |

| IFRS 14 | “Deferred Tariff Difference Accounts” | valid from January 1, 2020 – present |

| IFRS 15 | “Revenue from contracts with customers” | valid from January 1, 2020 – present |

| IFRS 16 | "Rent" | will come into force on January 1, 2020 |

| IFRS 17 | "Insurance contracts" | will come into force on January 1, 2021 |

In addition to international standards, there are interpretations to them.

Standing interpretations Committee - standing committee on interpretations.

SICs are clarifications to standards issued by the IASB prior to 2001. The publication of these standards was carried out by the Standing Committee on Interpretations.

Standing interpretations Committee (SIC)

| Standard number | Name | Validity |

| 1 | 2 | 3 |

| SIC 7 | "Introduction of the Euro" | valid from June 1, 1998 – present |

| SIC 10 | “Government assistance: lack of specific connection with operational activities” | valid from August 1, 1998 to present |

| SIC 15 | "Operating lease - incentives" | valid from January 1, 1999 – until January 1, 2020 |

| SIC 25 | “Income taxes - changes in the tax status of an enterprise or its shareholders” | valid from July 15, 2000 – present |

| SIC 27 | “Assessment of the essence of transactions clothed in the legal form of lease” | valid from January 1, 2002 – until January 1, 2020 |

| SIC 29 | “Concession agreements for the provision of services: Information disclosure” | valid from January 1, 2002 to present |

| SIC 31 | “Revenue-barter transactions involving advertising services” | valid from January 1, 2002 to present |

| SIC 32 | “Intangible assets: costs for the Internet site” | valid from March 25, 2002 – present |

International Financial Reporting Interpretations Committee (IFRIC) - (translated from English - international committee on the interpretation of financial statements).

IFRICs are clarifications and interpretations of international standards published after 2001. These interpretations were issued by the International Financial Reporting Interpretations Committee.

International Financial Reporting Interpretations Committee (IFRIC)

| Standard number | Name | Validity |

| 1 | 2 | 3 |

| IFRIC 1 | “Changes to existing obligations for decommissioning, natural resource restoration and other similar obligations” | valid from September 1, 2004 to present |

| IFRIC 2 | “Shares in cooperatives and similar financial instruments” | valid from January 1, 2005 to present |

| IFRIC 4 | “Determining whether the agreement contains signs of a lease agreement” | valid from January 1, 2006 – until July 1, 2020 |

| IFRIC 5 | “Rights associated with participation in funds for financing the decommissioning of facilities, environmental restoration and environmental rehabilitation” | valid from January 1, 2006 to present |

| IFRIC 6 | Liabilities arising from activities in a specific market - waste electrical and electronic equipment | valid from December 1, 2005 to present |

| IFRIC 7 | “Applying an approach requiring restatement of financial statements in accordance with IAS 29 Financial reporting in hyperinflationary conditions” | valid from March 1, 2006 – present |

| IFRIC 9 | "Re-analysis of embedded manufacturing tools" | valid from June 1, 2006 to present |

| IFRIC 10 | "Interim financial reporting and impairment" | valid from November 1, 2006 to present |

| IFRIC 12 | “Concession agreements for the provision of services” | valid from January 1, 2008 to present |

| IFRIC 13 | "Customer Loyalty Programs" | valid from July 1, 2008 – present |

| IFRIC 14 | "AS 19 - Defined benefit plan asset limits, minimum funding requirements and their relationship" | valid from January 1, 2008 to present |

| IFRIC 15 | "Contracts for real estate construction" | valid from January 1, 2009 to present |

| IFRIC 16 | “Hedging a Net Investment in a Foreign Operation” | valid from October 1, 2008 – present |

| IFRIC 17 | “Non-cash distributions to shareholders” | valid from July 1, 2009 – present |

| IFRIC 18 | "Transfer of assets from clients" | valid from July 1, 2009 – present |

| IFRIC 19 | “Settlement of financial obligations with equity instruments” | valid from July 1, 2010 – present |

| IFRIC 20 | “Costs of stripping operations at the stage of operation of an open-pit mine” | valid from January 1, 2013 to present |

| IFRIC 21 | "Obligatory payments" | valid from January 1, 2014 to present |

In the Russian Federation, the basic rules for maintaining accounting records are enshrined in the accounting regulations (PBU).

Accounting Regulations (PBU)

| Standard number | Name | Validity |

| 1 | 2 | 3 |

| Regulations on accounting and financial reporting in the Russian Federation | Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n | |

| PBU 1/2008 | Accounting policy of the organization | Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n |

| PBU 2/2008 | Accounting for construction contracts | Order of the Ministry of Finance of Russia dated October 24, 2008 N 116n |

| PBU 3/2006 | Accounting for assets and liabilities, the value of which is expressed in foreign currency | Order of the Ministry of Finance of Russia dated November 27, 2006 N 154n |

| PBU 4/99 | Organizational financial statements | Order of the Ministry of Finance of Russia dated July 6, 1999 N 43n |

| PBU 5/01 | Accounting for inventories | Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n |

| PBU 6/01 | Fixed Asset Accounting | Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n |

| PBU 7/98 | Events after the reporting date | Order of the Ministry of Finance of Russia dated November 25, 1998 N 56n |

| PBU 8/2010 | Provisions, contingent liabilities and contingent assets | Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n |

| PBU 9/99 | Income of the organization | Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n |

| PBU 10/99 | Organization expenses | Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n |

| PBU 11/2008 | Related Party Information | Order of the Ministry of Finance of Russia dated April 29, 2008 N 48n |

| PBU 12/2010 | Segment Information | Order of the Ministry of Finance of Russia dated November 8, 2010 N 143n |

| PBU 13/2000 | Accounting for state aid | Order of the Ministry of Finance of Russia dated October 16, 2000 N 92n |

| PBU 14/2007 | Accounting for intangible assets | Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n |

| PBU 15/2008 | Accounting for expenses on loans and credits | Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n |

| PBU 16/02 | Information on discontinued activities | Order of the Ministry of Finance of Russia dated July 2, 2002 N 66n |

| PBU 17/02 | Accounting for expenses for research, development and technological work | Order of the Ministry of Finance of Russia dated November 19, 2002 N 115n |

| PBU 18/02 | Accounting for corporate income tax calculations | Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n |

| PBU 19/02 | Accounting for financial investments | Order of the Ministry of Finance of Russia dated December 10, 2002 N 126n |

| PBU 20/03 | Information on participation in joint activities | Order of the Ministry of Finance of Russia dated November 24, 2003 N 105n |

| PBU 21/2008 | Changes in estimates | Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n |

| PBU 22/2010 | Correcting errors in accounting and reporting | Order of the Ministry of Finance of Russia dated June 28, 2010 N 63n |

| PBU 23/2011 | Cash flow statement | Order of the Ministry of Finance of Russia dated 02.02.2011 N 11n |

| PBU 24/2011 | Accounting for the costs of natural resource development | Order of the Ministry of Finance of Russia dated October 6, 2011 N 125n |

| Regulations on accounting for long-term investments | Letter of the Ministry of Finance of Russia dated December 30, 1993 N 160 |

All PBUs regulate the procedure for organizing accounting as a whole for all enterprises, organizations, and institutions of the national economy of the Russian Federation.

Cost of accounting services

CBS Group is among the Top 100 largest companies in Russia in auditing, consulting and outsourcing. It offers accounting services to small and medium-sized businesses. Cost of services:

| Types of services | Price, rub.) |

| Comprehensive accounting support | Prices depend on annual turnover: up to 15 million – from 14900 from 15 to 50 million – from 19990 from 50 to 100 million – 24900 from 100 to 200 million – 34900 over 200 million – from 44900 |

| Salary calculation | from 4900 |

| Outsourcing of HR records | from 4900 |

| Function of the chief accountant | from 9900 |

| Turnkey accounting | from 14900 |

| Restoration of accounting and taxes | from 34900 |

| Unlimited accounting | from 68900 |

You can calculate the cost of accounting services for a specific order using a calculator. You can submit an application or ask a question on the company’s website.

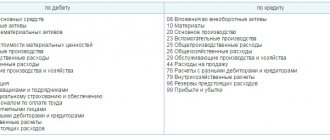

Working chart of accounts

The obligation to approve the working chart of accounts is established in paragraph 4 of PBU 1/2008. When developing a chart of accounts, it is necessary to rely on accounting policies for accounting purposes. At the same time, the working chart of accounts must take into account the specifics of the organization’s activities. This can be achieved if synthetic and analytical accounting is optimally constructed.

The work plan should include only those synthetic accounts that the organization will use in practice. Please note that new synthetic accounts (not provided for in the chart of accounts) can be added to the work plan only with the approval of the Russian Ministry of Finance. This is stated in paragraphs 4 and 6 of the Instructions for the chart of accounts.

An organization can determine the structure of analytical accounting (types of subaccounts, depth of analytics, etc.) independently. In this case, analytical accounting data must correspond to the turnover and balances of synthetic accounting accounts.

In the Instructions for the chart of accounts, after the characteristics of each synthetic account, a typical scheme of its correspondence with other synthetic accounts is given. If facts of economic activity arise, correspondence for which is not provided for in the standard scheme, the organization can supplement it, observing the uniform approaches established by the Instructions (letter of the Ministry of Finance of Russia dated March 24, 2009 No. 07-02-06/90).

Where to order accounting services

The best companies providing accounting services:

- CBS Group. Address: Moscow, st. Kalanchevskaya, 20/7. Phone, +7 (977) 893-37-69. E-mail: [email protected] Website – https://cbscg.ru.

- AccountProfi-Audit . Address: Moscow, Sredny Tishinsky lane, 8. Phone: +7 (495) 374-50-93. E-mail Website – https://accountprofi.ru/.

- SKB Kontur . Address: Moscow, st. Sushchevsky Val, 18 (10th floor). Phone: +7 (495) 212-21-15. E-mail Website – https://kontur.ru/.

- Accounting Service Center (ACS). Address: Moscow, Volgogradsky Prospekt, 35. Telephone. E-mail Website – https://bisbuh.ru/.

- Audit Capital . Address: Moscow st. Cosmonaut Volkov. 10, office 213. Telephone: 8 (499) 271-75-67. E-mail Website – https://audit-capital.tk/.

- RosCo . Address: Moscow, 1st Volkonsky Lane, 13, building 2. Phone: +7 (499) 444-00-00,. E-mail Website – https://rosco.su/.

- LINKAY. Address: Moscow, st. Kotsyubinskogo, 4. Telephone. E-mail Website – https://www.audit-linkey.ru/.

- BC "Active ". Address: Moscow, st. Bolshaya Novodmitrovskaya, 23/6, office 14. Phone: 8 (800) 700-58-71. E-mail Website – https://buhactiv.ru/.

- TAKE THAT . Address: Moscow Otkrytoye shosse, 9, building 14. Telephone. E-mail: [email protected] Website – https://www.naka.ru/.

- BUHprofi . Address: Moscow, 1st Volokolamsky Prospect, 10. Telephone, 8. E-mail Website – https://www.buxprofi.ru/.

Documentation as an element of the accounting method

The basis of accounting is the documentation of all transactions performed. The registration procedure depends on the valuation method adopted - “accrual” or “payment” (cash method).

The basic approach is the accrual method, i.e. recognition of all transactions in the period in which they were actually made, regardless of receipts or payments of funds.

The cash method can only be used by companies with small turnover (up to 1 million rubles per quarter) or those that have switched to a simplified taxation system.

Accounting documents must be prepared in accordance with established rules. Most of them are unified (standard), their form is approved by the relevant government bodies. These are, in particular, bank, cash, personnel documents, etc.

Enterprises also have the right to develop forms of primary documents independently. These forms must contain the mandatory details listed in Art. 9 of Law No. 402-FZ (date, name, content of the operation, etc.).

A special type of documentation is inventory. It serves to check and confirm the availability and value of the company’s assets (liabilities) as of a certain date. Typically, an inventory is carried out before reporting, but it is also possible to carry out an unscheduled inventory (if a shortage is identified, a change in the materially responsible person, etc.).

Where to take accounting courses

Many companies and educational institutions conduct training courses in the following areas: accounting, working in 1C, taxation. You can learn a profession from scratch or improve your qualifications. Accounting for an enterprise can be mastered in the following courses:

- Moscow Business School. Address: Moscow, Leninsky Prospekt, 38A. Telephone,. E-mail: [email protected] Website – https://mbschool.ru/.

- Medical expert. Address: Syktyvkar, st. Pervomaiskaya, 70, building A, office 407, 414. Telephone. E-mail: [email protected] Website – https://dist-ed.ru/.

- ANO DPO MASPC. Address: Moscow, Lubyansky proezd, 15, p. 2. Phone: 8 (499) 116-69-84. E-mail: [email protected] Website – https://maspk.ru/.

- VGAPS. Address: Volgograd, st. Kanunnikova, 6. Telephone. E-mail: [email protected] Website – https://vgaps.ru/.

- TC "Education and Career". Address: Moscow, st. Zemlyanoy Val, 7. Phone: +7,. E-mail Website – https://www.kursmsk.ru/.

When you need to change something

Accounting policies are applied consistently year after year. But there are cases when the approved policy needs to be changed or adjusted, for example, when switching to simplified accounting methods. In order to be able to compare and analyze data over several years, accounting policies are changed when the reporting period changes.

Adjustments to accounting policies can be made in the following cases:

- Changes in the legislative framework. Due to the introduction of new accounting requirements into accounting regulations or standards, firms will be required to bring their accounting activities into compliance.

- Changing the way accounting is done. The manager can choose or develop independently a method of accounting that will allow for much better accounting of a particular object.

- Transition to another type of activity or significant change in working conditions.

Common accounting mistakes

The most common mistakes when doing accounting:

- Primary documents. Lack of reports, their careless execution and low quality.

- Personnel accounting. You should not limit yourself to just an employment contract. All orders, instructions and certificates must be drawn up for each employee.

- Mathematical errors. From simple typos to incorrect rounding.

- Errors in the annual balance sheet. Arithmetic errors, incoming data in the annual balance sheet diverges from the outgoing data for the previous year, incorrect reflection of information on accounting items.

- Ignorance of legislation. The accountant cannot keep up with the chaotically changing rules of accounting and tax accounting.

Main differences between financial and management accounting

There are clear distinctive features in the organization of accounting at the financial and managerial levels.

| Financial Accounting | Management Accounting |

| Accurate | Approximate |

| Collection and processing of information for production planning | Collection and processing of information for production management |

| Presented to users within the time limits strictly established by law | Presented only to a certain circle of users within a time frame determined by internal necessity |

| Accounting must be as accurate as possible and organized in accordance with regulations | Responsibility for accounting data lies only with the compiler |

| Accounting is mandatory for everyone | Accounting is not mandatory for everyone, but recommended |

| Accounting summarizing reports of the enterprise as a whole | Accounting containing data on specific types of products, depending on the goals set |

| Financial accounting structure: Assets = liabilities + equity | Management accounting structure: Assets = costs + finished goods |

| Accounting information – regular | Information available upon request |

| Accounting is not a financial secret of an enterprise | Accounting is the financial secret of an enterprise |

| Accounting is used by shareholders, authorities, and all interested parties | Accounting is used by managers, managers, owners |

| Financial accounting principles are generally accepted standards | Principles of management accounting - production necessity in the amounts prescribed by the organization |

Balance sheet as an accounting method and other forms of reporting

The formation of a balance sheet completes the work of accounting for business transactions for the period. The balance sheet is a generalized system of indicators characterizing the state of the enterprise at the reporting date.

Indicators in the balance sheet are divided into items, each of which consists of balances in groups of accounts that account for homogeneous types of assets or liabilities (inventories, debt, cash, etc.).

Articles are grouped into sections, which in turn constitute assets and liabilities. The balance sheet asset contains information about all the resources that the enterprise has, and the liability contains information about the sources of these resources. If all accounting transactions during the period were carried out correctly, then the totals of assets and liabilities of the balance sheet should be equal.

In addition to the balance sheet, the final information is reflected in other reporting forms, the main ones of which are the income statement (Form No. 2) and the cash flow statement (Form No. 4). If the balance sheet shows the state of the enterprise as of a specific date, then forms No. 2 and No. 4 reflect the financial results of activities and cash flows for the reporting period. Thus, these three forms complement each other, giving the reporting user a “three-dimensional” picture.