What is account 08 used for in accounting?

08 accounting account is an account designed to accumulate costs for the acquisition or construction of a non-current asset in order to form its initial cost.

At the same time, non-current assets include fixed assets, intangible assets, profitable investments in non-current assets, land plots, and other environmental management facilities.

This account reflects information on the costs of capital new construction, reconstruction, modernization of re-equipment of existing facilities, the cost of acquiring movable and immovable property, land plots, purchasing intangible assets, productive and working livestock included in the main herd, costs of creating perennial plantings.

Reflection of this data on account 08 allows you to generate in a timely manner complete information on all costs incurred, monitor all stages of commissioning of objects, and also establish the initial cost of a non-current asset in accordance with current rules.

On the account, the initial cost of each object is formed on the basis of actual expenses incurred by the company.

Attention! It is important to understand that once an object is put into operation, its value can no longer continue to be taken into account on account 08. For this, the corresponding accounting accounts must be used - 01, 03, 04.

Intangible assets and 08th account

Intangible assets (IMA) are assets that have a certain value, are capable of generating income for an enterprise, but do not have a clear tangible form. The rules for accounting for intangible assets are established by PBU 14/2000. PBU 17/2 establishes the rules for accounting for expenses on research, experimental, design and technological developments.

On the 08th account there are two sub-accounts in which information about intangible assets is accumulated. These are subaccounts 08-5 “Purchase of intangible assets” and 08-8 “Performance of research, development and technological work.”

Moreover, if the results of scientific research, experiments, design documentation and developed technologies find their application in the production process of products (works, services) or in the management activities of the enterprise, then the costs of their implementation upon completion of the work are written off from credit 08-8 to debit 04 -th account “Intangible assets”.

If, as a result of research, experiments, design developments or testing of technologies, positive results are not obtained, or if these results are not implemented in the production of products (works, services) or do not influence management processes in the organization, then such expenses are written off from credit 08-8 in debit 91 “Other income and expenses”.

Subaccount 08-5 “Acquisition of intangible assets” relates to those intangible assets that are acquired in several stages and have associated costs. All these expenses until the completion of the process of obtaining rights to intangible assets are collected in subaccount 08-5. Upon completion of the acquisition process, upon receipt of documents confirming the rights to own intangible assets or the right to use them, expenses from credit 08-5 are written off to the debit of account 04.

The question often arises: is intangible design documentation for the construction of fixed assets? For an organization that develops design documentation, these intellectual property objects are intangible assets and the costs of their creation are collected in subaccount 08-8, if such an asset does not have the characteristics of a “good” for such an organization and is not intended for sale/resale.

For organizations that receive this documentation as a result of contractual relations, and along with it the rights to use it and transfer it to third parties, such documentation must also be included in the intangible assets. But if the contract for the creation of design documentation does not indicate that, along with the documents, the rights to dispose of this intellectual property are transferred from the contractor to the customer, then the costs of creating the project and developing design documentation must be attributed to the costs of creating (constructing) that object The OS for which such documentation was created.

Account characteristics

The question of which account 08 is active or passive is answered by the Chart of Accounts, which establishes that it is active and is reflected in the balance sheet as part of non-current assets in the first section.

The initial balance in the debit of account 08 shows the cost of expenses incurred for the acquisition and construction of non-current assets that have not yet been put into operation. The debit of the account reflects the costs incurred for the creation or purchase of long-term objects, and the credit must reflect the cost of the property transferred for operation.

The balance at the end of the period shows the amount of costs incurred by the entity for the creation or acquisition of non-current assets that have not yet gone through the commissioning process. It is calculated as the sum of the balance on account 08 at the beginning of the period plus the turnover in the debit of the account and subtracting the credit turnover.

What about depreciation on investments in non-current assets?

Order of the Ministry of Finance No. 94n clearly determined whether depreciation is calculated from account 08: no. Depreciation can only be calculated from the month following the month in which the property was taken into account. Therefore, while the asset is listed on the account. 08 as part of capital investments, depreciation cannot be charged.

When the property is accepted for accounting according to the main accounting account (01, 05), calculate depreciation in accordance with the chosen method for calculating depreciation charges. For example, using the linear method or the method proportional to the volume of production.

However, it is possible to include depreciation accrued on fixed assets and intangible assets involved in the creation or acquisition of property.

What subaccounts are used?

Analytical accounting of unfinished non-current assets is carried out by groups of this property.

The following subaccounts can be opened for account 08:

- “Purchase of land” – to reflect the costs of purchasing land.

- “Purchase of environmental management facilities” – to account for the amount of expenses for the purchase of environmental management facilities.

- “Construction of fixed assets” – to account for the costs of construction of fixed assets. This takes into account the cost of purchased equipment requiring installation, and the costs of this process themselves. Inside the subaccount, analytics can be maintained by cost components (materials, wages, deductions, etc.)

- “Purchase of fixed assets” – to account for the cost of purchasing fixed assets. If the OS does not require installation, then it is taken into account in this subaccount.

- “Purchase of intangible assets” – to account for the costs of purchasing intangible assets.

- “Transfer of young livestock to the main herd” – in livestock farming, when livestock is raised independently by an economic entity.

- “Purchase of adult livestock” - in livestock farming when purchasing adult livestock.

- “Planting and growing perennial plants” - in crop production to account for the costs of growing trees.

- "Purchase of operating systems on lease."

- "Other unfinished investments"

You might be interested in:

Accounting account 76 - in what case is it used, characteristics, postings

Analytical accounting and write-offs

Analytical accounting for account 08 is carried out on the basis of the organization’s recorded assets. It reflects the costs of:

- construction and acquisition of fixed assets;

- purchase of intangible assets;

- technological research and development;

- formation of the main herd.

After identifying the final price for the above assets, their value is transferred from account 08 to other accounts. If the purchase price of an asset is not subject to change, account 08 performs a transit function.

Important: the final cost of the asset includes all additional costs associated with it. VAT is included in account 19.

Among other things, through account 08, contributions to the authorized capital of the organization are made, as well as acquired, created and gratuitously received assets.

A balance sheet will help check the correct operation of account 08. A zero balance and equal turnover will mean that all postings were made without errors.

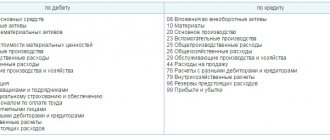

Which accounts does it correspond with?

Account 08 can correspond with the following accounts.

From the debit of account 08 to the credit of accounts:

- Account 02 - when calculating depreciation of fixed assets that are used for modernization or creation of other operating systems;

- Account 05 - when calculating depreciation of intangible assets that were used to create other fixed assets or intangible assets;

- Account 07 - regarding the cost of equipment that was transferred for installation at the site;

- Account 10 - regarding the cost of materials that were used for the construction or modernization of the OS facility;

- Count 11 - when transferring young animals to the main herd;

- Account 16 - regarding the deviation in the price of inventories that were used in the creation of the fixed asset;

- Account 19 - when writing off VAT tax, which is not subject to reimbursement from the budget;

- Account 23 - when writing off the costs of auxiliary production to increase the cost of the capital investment object;

- Account 26 - when writing off general business expenses to increase the value of the capital investment object;

- Account 60 - when reflecting non-current assets received from suppliers, reflecting construction costs;

- Account 66 - when calculating interest on short-term loans and credits with the help of which the capital investment object was acquired (until it was accepted for operation);

- Account 67 - when calculating interest on long-term loans and credits with the help of which the capital investment object was acquired (until it was accepted for operation);

- Account 68 - when writing off amounts of non-refundable taxes on a capital investment object;

- Account 69 - when reflecting the accrual of social contributions on the salaries of workers who were involved in work with the object of capital investment;

- Account 70 - when calculating wages to employees who were involved in work with the investment object;

- Account 71 - when writing off expenses for accountable persons for a capital investment object;

- Account 75 - when one of the founders of the capital investment object makes a contribution to the authorized capital;

- Account 76 - when reflecting other services related to the commissioning of a capital investment facility;

- Account 79 - upon receipt or transfer of capital investment objects to the parent organization or branch;

- Account 80 - when transferring a capital investment object as a contribution under a joint activity agreement;

- Account 86 - upon receipt of a capital investment object in the form of investments or financing;

- Account 91 - when capitalizing MTs that were identified as a result of inventory and are intended for use when working with a capital investment object;

- Account 94 - the amounts of previously identified shortages and losses are written off to the capital investment object;

- Account 96 - when creating reserves at the expense of the investment object;

- Account 97 - deferred expenses are written off to the cost of the capital investment object;

- Account 98 - capital investment items received for free are taken into account.

You might be interested in:

Account 10 in accounting: what it is used for, characteristics, subaccounts, postings

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 01 - when commissioning a capital investment as an OS object;

- Account 03 – when commissioning a capital investment that is supposed to be rented out;

- Account 04 – when commissioning a capital investment as an intangible asset;

- Account 76 - when writing off part of the cost of capital investment as insurance compensation, when making claims to contractors, etc.

- Account 79 – upon receipt or transfer of capital investment objects to the parent organization or branch;

- Account 80 - upon return of the investment object upon termination of the joint activity agreement;

- Account 91 - when writing off losses, selling part of the capital investment, disposal, etc.

- Account 94 - identified shortfalls or losses in investments in assets are written off;

- Account 99 - writing off part of the cost of the investment object as a loss (as a result of an emergency, natural disaster, etc.)

Accounting for the leased asset on the lessee's balance sheet in 1C: Enterprise Accounting 8

Published November 28, 2015 10:07 pm Author: Administrator Leasing always presents certain difficulties for an accountant. Especially many questions arise when accounting for the leased asset on the lessee’s balance sheet. In this article we will try to figure out how to work with the new features of the 1C: Enterprise Accounting 8 program in this situation. Currently, the program automates such operations as the receipt of property under lease, its acceptance for accounting, the calculation of depreciation on it, the reflection of current leasing payments, including the write-off of VAT on these payments, as well as the repurchase of property received under lease.

The first operation is reflected in the document “Receipt of leasing”. To go to the document, select the “OS and intangible assets” section.

In the selected document you will need to indicate the amount of all payments under the leasing agreement, that is, the full cost together with the redemption amount.

You will also need to note the accounts for accounting for rental obligations and accounting for VAT on rental obligations. After all, if you pay attention to the chart of accounts, you will notice that it has been replenished with sub-accounts for accounting for transactions with leased property, including transactions in foreign currency and in conventional units.

When posting the receipt document, entries will be generated to the debit of the non-current assets account and deferred VAT will be generated. It is important to note that ownership of leased property does not transfer. No invoice will be issued for this transaction.

To put an object of fixed assets into operation, we refer to the document “Acceptance for accounting of fixed assets”, which is located in the same section “Fixed assets and intangible assets”.

How does this acceptance differ from ordinary acceptance for accounting? Firstly, the method of receipt is “Under a leasing agreement.” That is, on the “Non-current asset” tab, you need to select the value “Under a leasing agreement” in the “Method of receipt” field. Based on this action, the details “Counterparty” and “Agreement” will appear, which also need to be filled out - this is the second difference in the document. “Counterparty” in this case is the lessor, and “Agreement” is the leasing agreement.

Thirdly, accounting accounts. On the “Accounting” tab, the accounting account (01.03) is indicated, as well as accrual parameters and the depreciation account (02.03).

Fourthly, the tax accounting amount is the amount of the lessor's expenses. Therefore, on the “Tax Accounting” tab, we indicate the initial cost for tax accounting purposes. This cost is the amount of the lessor's expenses for the acquisition of the leased asset. It is also necessary to fill out the method for reflecting expenses for leasing payments and do not forget about the parameters for calculating depreciation. Based on the fact that the property is listed on the lessee’s balance sheet, then in the “Procedure for including cost in expenses” field, “Accrual of depreciation” is indicated, and the “Accrue depreciation” flag is set.

When this document is posted, we receive a reflection of the initial cost of the property that was leased in the debit of account 01.03. According to accounting, the cost will be excluding VAT, and according to tax accounting, it will be the amount of the lessor’s costs. On the debit of account 01.K we will see the difference between the initial cost of the leased asset in accounting and accounting records, and account 08.04 will be closed.

As for subaccount 01.K “Adjustment of the value of leased property”, it takes into account the part of the cost of the organization’s fixed assets that are leased that is not depreciated in the NU.

Based on the agreement, it is necessary to carry out monthly accrual of leasing payments, which occurs using the document “Receipt (act, invoice)” with the transaction type “Purchases”.

In the calculations, it is required to enter an account for accounting for debt on lease payments, depending on the specific situation: 76.07.2, 76.27.2 or 76.37.2. The tabular section indicates the account for accounting for rental obligations; we also select, if necessary: 76.07.1, 76.27.1 or 76.37.1.

Below the tabular part we can enter and register an invoice, then VAT will be deducted.

After completing the document, we see a reflection of the accrual of the next lease payment, the write-off of part of the lease obligations, the write-off of the amount of “deferred” VAT and the reflection of “input” VAT on the amount of the accrued lease payment. Since we are considering property that is on the balance sheet of the lessee, its value is repaid through depreciation charges. To calculate the amount of depreciation for a month for both accounting and tax accounting, you need to perform month closing.

When we turn to the “Closing of the month” processing, we see the regulatory operations that are relevant for our situation: “Depreciation and depreciation of fixed assets” and “Recognition of leasing payments in the NU”. When performing the first of these operations, the amounts accrued on account 02.03 are written off as expenses. When implementing the following regulatory operation, the difference between the lease payments that were made through receipt documents and the accrued depreciation in tax accounting is calculated. When we work with the closure of the month, we can use the help-calculation “Recognition of expenses for fixed assets received under lease.”

The selected report illustrates the amounts of lease payments in the accounting and tax accounting of the lessee.

If suddenly, after accepting the leased property for accounting, it was necessary to change the method of reflecting expenses on lease payments, then in this case the document “Changing the reflection on lease payments” is provided, located in the section “Fixed assets and intangible assets”.

When creating, select the position of the same name.

In the “Method” field, indicate the new required method.

In the future, to correctly carry out the transfer of ownership, you should refer to the document “Repurchase of leased items”, through the section “Fixed assets and intangible assets”.

The document in question has been implemented specifically for the lessee to transfer data from subaccounts for leased property to subaccounts of its own fixed assets; pay off the remaining lease obligations, reflect the VAT claimed; pay off the remaining VAT on rental obligations.

As soon as we select the required organization and indicate the required counterparty and agreement, the remaining information is filled in automatically. Table data can be adjusted if necessary.

On the “Accounting” tab, we check the accounts in which our own fixed assets will now be accounted for.

Filling out the “Tax Accounting” tab is based on the chosen order of including the redemption value in expenses. When calculating depreciation, we determine the remaining useful life; when selecting “Inclusion in expenses upon acceptance for accounting,” the method of reflecting expenses.

The document also contains the “Depreciation bonus” tab, so if the inclusion order is selected “Depreciation calculation”, then the organization can, if necessary, use the right to apply a depreciation bonus.

As a result, all mutual settlements regarding the leased asset are closed. After the transfer of ownership, the value of the now own fixed asset is written off as expenses through depreciation.

If you need more information about working in 1C: Enterprise Accounting 8, then you can get our book for free using the link.

Author of the article: Kristina Savvina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #29 aigul1509 12/28/2017 22:40 Good afternoon! Could you please tell me if there is an article on early redemption of the leased asset?

Quote

0 #28 Olesya T 05.26.2017 17:28 Good afternoon! Please explain, what is the difference between the procedure for accounting for leasing on the balance sheet of the lessee for a small enterprise that does not apply PBU 18/02? Thank you very much in advance for your answer!

Quote

+9 #27 Elena Zimenkova 04/18/2017 22:07 Good afternoon! Help me to understand! The balance on account 01.k after closing the month and recognizing expenses on leasing payments became negative. Initially, according to DT account 01K (the difference between the cost in accounting and accounting records) was 92,000, monthly depreciation was 44,209, leasing services were monthly in the amount of 139,140.29, respectively, according to CT 01K, the amount of 94,931.29 was reflected monthly. Accordingly, the balance on the account. 01K became negative. What's wrong and where is the error?

Quote

0 #26 Tatyana 03.26.2017 13:31 I quote Natalya Ukhova:

I quote Tatyana: Hello, Olga! Please help me deal with the early redemption of leased property. No one gives an answer to such a difficult topic. I make a document “Repurchase of the leased asset”, it turns out to be some kind of nonsense. According to CT account 02 Depreciation of leased property in NU, the amount with a minus remained hanging. On account 02, depreciation of fixed assets according to NU is the same amount with a plus. Why was depreciation according to NU not written off? Maybe this document is not suitable for early redemption?

Hello!

Does closing the month not adjust the amounts in accounts 01 and 02? Also, tell me, do you keep records according to PBU 18/02? Natalya, we do not comply with PBU 18/02. When closing the month, transactions are not adjusted. In the document “Repurchase of the leased asset” itself, the entries are as follows: according to NU Dt 20.01 Kt 02.03 with a plus, and then reversal. But then I don’t understand what the program is doing. The accumulated depreciation during leasing for us is 500 thousand according to the accounting book, 264 thousand according to the NU. The document makes the following entries: Dt 02.03 Kt 02.01 500 thousand according to the BU AND NU. I don’t understand why the amount is NU?? The following posting is only according to NU: Dt 02.03 Kt 01.01 275 thousand (we have accumulated depreciation 264 thousand) Result: in the Turnover according to Dt 01.01. (NU) the amount is 11 thousand less than the redemption amount, and Kt 02.01 (NU) 500 thousand (it shouldn’t be there at all), Kt 02.03 500 thousand with a minus. Why such wiring? Thanks in advance for your answer! Quote 0 #25 Ukhova Natalya 03.25.2017 22:26 I quote Tatyana:

Hello, Olga! Please help me figure out the early redemption of leased property. No one gives an answer to such a difficult topic. I make a document “Repurchase of the leased asset”, it turns out to be some kind of nonsense. According to CT account 02 Depreciation of leased property in NU, the amount with a minus remained hanging. On account 02, depreciation of fixed assets according to NU is the same amount with a plus. Why was depreciation according to NU not written off? Maybe this document is not suitable for early redemption?

Hello!

Does closing the month not adjust the amounts in accounts 01 and 02? Also, tell me, do you keep records according to PBU 18/02? Quote 0 #24 Ukhova Natalya 03.25.2017 22:22 Quoting Irina VV:

Hello, please tell me how in the program 1C:Enterprise 8.3 (8.3.9.1850) Enterprise Accounting (basic), edition 2.0 to reflect the transfer of ownership of the operating system after the end of the leasing agreement, if depreciation is not completely written off according to the accounting book and the operating system is purchased at the redemption price by a separate purchase agreement sales.

Good afternoon

There is an article on your question on ITS: its.1c.ru/…/…, if you do not have a subscription, you can sign up for a free demo version for 7 days. Quote +1 #23 Tatyana 03/24/2017 23:21 Hello, Olga! Please help me deal with the early redemption of leased property. No one gives an answer to such a difficult topic. I make a document “Repurchase of the leased asset”, it turns out to be some kind of nonsense. According to CT account 02 Depreciation of leased property in NU, the amount with a minus remained hanging. On account 02, depreciation of fixed assets according to NU is the same amount with a plus. Why was depreciation according to NU not written off? Maybe this document is not suitable for early redemption?

Quote

0 #22 Irina VV 03.23.2017 18:00 Hello, please tell me how in the program 1C: Enterprise 8.3 (8.3.9.1850) Enterprise Accounting (basic), edition 2.0 to reflect the transfer of ownership of the operating system after the end of the leasing agreement, if according to the accounting book it is not completely written off depreciation and fixed assets are purchased at the redemption price through a separate purchase and sale agreement.

Quote

0 #21 TatyanaAn 01/31/2017 15:40 Hello. My 1K account for differences in NU leasing became negative after a few months, this is not correct. The fact is that leasing payments are not uniform throughout the term, at first they are very large, but by the end of the leasing agreement they decrease, but depreciation remains the same. But 1K can’t be negative, can it?

Quote

0 #20 Ukhova Natalya 01/21/2017 18:01 I quote Lyudmila V:

HELLO! I have an LLC on the simplified tax system, dr. Please tell me about the postings in 1s accounting 8.3 basic. Under the leasing agreement, the total amount, including VAT, is 855 thousand. Incl. 1. leasing payments 840 thousand; 2. leasing payments due after transfer of 449 thousand; 3. Commission for processing a leasing transaction is 15 thousand. According to the right of redemption, the cost is 1 thousand rubles. The commission for the transfer of ownership upon redemption is 10 thousand rubles, it will not be charged if there are no delays in payments - there is none. The fee for making changes to the contract is 3 thousand rubles - there are no changes. Leasing term 12 months. Accounting with the lessee. We were given a discount on payment of an advance payment of 78 thousand. The total amount of the leasing agreement, taking into account the discount, became 777 thousand. Advance payment including discount 312 thousand. The difference between the amount of the advance and the amount of the advance payment will be reimbursed by receiving a subsidy from the budget. We will also reimburse the costs of comprehensive insurance of 29 thousand and 9 compulsory motor insurance to the lessor. Regression graph. Monthly invoices arrive - what is provided for temporary possession of the leased item - what to do with them? Another invoice has arrived - a subsidy to compensate for the lessor's losses upon presentation of a discount on the tax payment of 78 thousand? We initially paid 1.advance payment 312 thousand; 2. commission for registration of the contract is 15 thousand; 3. Compensation for comprehensive insurance 29 thousand 4. compensation for compulsory motor insurance 9 thousand. HONESTLY I'M SHOCKED how to plant everything - I'm a newbie. THANK YOU

Good afternoon, it is very difficult to answer such broad questions, we usually consider them in a personal consultation =) To reflect leasing transactions on the lessee’s balance sheet, you can use our article presented above, or the article on the ITS resource: its.1c.ru/…/ … If you don’t have a subscription, you can get free demo access for 7 days.

Quote 0 #19 Lyudmila V 01/17/2017 14:30 HELLO! I have an LLC on the simplified tax system, dr. Please tell me about the postings in 1s accounting 8.3 basic. Under the leasing agreement, the total amount, including VAT, is 855 thousand. Incl. 1. leasing payments 840 thousand; 2. leasing payments due after transfer of 449 thousand; 3. Commission for processing a leasing transaction is 15 thousand. According to the right of redemption, the cost is 1 thousand rubles. The commission for the transfer of ownership upon redemption is 10 thousand rubles, it will not be charged if there are no delays in payments - there is none. The fee for making changes to the contract is 3 thousand rubles - there are no changes. Leasing term 12 months. Accounting with the lessee. We were given a discount on payment of an advance payment of 78 thousand. The total amount of the leasing agreement, taking into account the discount, became 777 thousand. Advance payment including discount 312 thousand. The difference between the amount of the advance and the amount of the advance payment will be reimbursed by receiving a subsidy from the budget. We will also reimburse the costs of comprehensive insurance of 29 thousand and 9 compulsory motor insurance to the lessor. Regression graph. Monthly invoices arrive - what is provided for temporary possession of the leased item - what to do with them? Another invoice has arrived - a subsidy for compensation of the lessor's losses upon presentation of a discount on the tax payment of 78 thousand? We initially paid 1.advance payment 312 thousand; 2. commission for registration of the contract 15 thousand; 3. Compensation for comprehensive insurance 29 thousand 4. compensation for compulsory motor insurance 9 thousand. HONESTLY I'M SHOCKED how to plant everything - I'm a newbie. THANK YOU

Quote

-1 #18 Ukhova Natalya 01/10/2017 17:45 I quote Natalya R:

Good evening, sorry, I asked the question incorrectly again, I wrote it in tabular form, it was drawn in by a line. The leasing payments have not ended. Non-depreciable difference on leased property is 468,830.47. Lease payments are not over yet. After the next payment, the balance on DT in NU became “-“, and the balance on DT in BP “+”, before the last payment it was the other way around. Maybe it was not the shock absorber that closed. difference. But what will happen to 01K now? Please help me figure it out!

Also, could you tell me that in the accounting policy settings there is a checkbox “PBU 18 is applied”?

Account 01.K reflects the part of the cost of fixed assets leased that is not depreciable in NU. In theory, you need to check whether the document “Admission: Acceptance of leasing payments at NU” is entered correctly? Quote +1 #17 Natalya R 01/09/2017 22:00 Good evening, sorry, I asked the question incorrectly again, I wrote it in tabular form, it got sucked in as a line. The leasing payments have not ended. Non-amortisable difference on leased property is 468,830.47. Lease payments are not over yet. After the next payment, the balance on DT in NU became “-“, and the balance on DT in BP “+”, before the last payment it was the other way around. Maybe it was not the shock absorber that closed. difference. But what will happen to 01K now? Please help me figure it out!

Quote

+1 #16 Natalya R 01/09/2017 18:42 Good afternoon, here is the data on account 01K NU Dt468 830.47 Kt486 351.23 -17 520.76 VR DT-468 830.47 KT-486 351.23 17 520, 76 Leasing payments have not yet ended, until December NU was “+” BP “-“, but in December it was the other way around, according to math. Everything is clear to the calculations, but it is not clear what should happen to 01K. Please help me figure it out.

Quote

0 #15 Ukhova Natalya 01/09/2017 09:38 I quote Natalya R:

Hello, please tell me if it is possible for account 01.K, “Adjustment of the value of leased property” to have a negative balance on DT. Thank you

Good morning!

Tell me, at what point in accounting does a negative balance arise and according to what type of accounting (accounting, accounting)? Quote +3 #14 Natalya R 01/06/2017 11:23 pm Hello, please tell me whether it is possible to have a negative balance under account 01.K, “Adjustment of the value of leased property”. Thank you

Quote

0 #13 Ukhova Natalya 12/15/2016 11:11 I quote Evgeniy:

I quote Natalya Ukhova: I quote Evgeniy: Good afternoon! Tell me the procedure in 1C 8.3, if during the validity of the leasing agreement the total amount of the agreement was increased by an additional agreement (due to an increase in interest)? Thank you in advance!

Good afternoon

Those. did the amount in the account increase on 01.03? Has the amount of the lessor's expenses for purchasing the leased asset changed? Yes, that’s exactly it. It turns out that the amount of fixed assets in leasing changes only according to accounting? Then you can proceed as follows: 1) Tab of fixed assets and intangible assets - Parameters of depreciation of fixed assets - Change parameters of depreciation of fixed assets. In the document, leave the “Reflect in accounting” checkbox, fill out the tabular section by selecting the desired OS, then the Fill button for the list of OS, then change the Cost column to calculate depreciation. (BU), where to put the current balance for 01.03 + the amount for additional. agreement. This document will make movements in the depreciation registers and from the next month, at the end of the month, depreciation will be accrued from the new amount. 2) enter the document receipt of goods and services (amount according to additional agreement) to the account 08.04. 3) enter the document “Operation entered manually”, where to make the posting 01.03 - 08.04 for the required operating system in the lease. Quote 0 #12 Evgeniya I 12/13/2016 12:26 Quoting Ukhova Natalya:

I quote Evgeniy: Good afternoon! Tell me the procedure in 1C 8.3, if during the validity of the leasing agreement the total amount of the agreement was increased by an additional agreement (due to an increase in interest)? Thank you in advance!

Good afternoon

Those. did the amount in the account increase on 01.03? Has the amount of the lessor's expenses for purchasing the leased asset changed? Yes, exactly like that Quote 0 #11 Ukhova Natalya 12/13/2016 09:06 I quote Evgeniy:

Good afternoon Tell me the procedure in 1C 8.3, if during the validity of the leasing agreement the total amount of the agreement was increased by an additional agreement (due to an increase in interest)? Thank you in advance!

Good afternoon

Those. did the amount in the account increase on 01.03? Has the amount of the lessor's expenses for purchasing the leased asset changed? Quote 0 #10 Evgeniya I 12/09/2016 17:24 Good afternoon! Tell me the procedure in 1C 8.3, if during the validity of the leasing agreement the total amount of the agreement was increased by an additional agreement (due to an increase in interest)? Thank you in advance!

Quote

+2 Vera Kondruseva 08/29/2016 21:52 Good afternoon! If I understand correctly, then the amount of all lease payments + the redemption price of the car goes to account 01.03. What about the cost of the car indicated in the acceptance certificate and the contract? There is a completely different amount, i.e. the net value of the car without the “interest” of the leasing company. Shouldn’t depreciation be calculated on this “net” cost? Thank you very much in advance!

Quote

0 Olga Shulova 08/04/2016 08:59 I quote Ivan Tarasov:

But when selecting a leasing agreement, we do not display either the counterparty or the agreement, although the release is quite new.

Hello!

Can you tell me the exact release number? Are these fields completely absent or is there no way to select something in them? Quote 0 Tarasov Ivan 08/03/2016 13:43 But when choosing a leasing agreement, we do not display either the counterparty or the agreement, although the release is quite new.

Quote

+1 Natalya Latysheva 05/31/2016 14:27 Hello! Leasing selection services are accounted for in cost accounts (25, 26, 44, 91.02) depending on the purpose of the leased property: production, administrative purposes, etc.

Quote

0 TAMARA777 05/27/2016 21:02 Good afternoon! info service for searching and selecting leasing according to contract. leasing (invoice from the lessor) on which account should it be recorded? thank you very much in advance

Quote

0 Ukhova Natalya 05/18/2016 19:55 I quote Olga1011:

Good afternoon Tell me please. and in what account should the advance payment under the leasing agreement be recorded?

Good afternoon

The document “Receipt (act/invoice)” (type of transaction: leasing services) makes CT the balance on account 76.07.2, if the agreement is in rubles. Payment and prepayment for these services are shown on DT invoice 76.07.2. For payments in foreign currency we use account 76.27.2 Quote 0 Olga1011 05/17/2016 18:35 Good afternoon! Tell me please. and in what account should the advance payment under the leasing agreement be recorded?

Quote

0 Olga Shulova 02/19/2016 22:03 I quote ???:

Good afternoon, Olga, I have recently discovered the enormous benefits of your lessons, I have a question specifically about leasing: using your example of accepting fixed assets for accounting on the NU tab, where does the amount of the initial cost (750,000) come from? If the receipt is 1,500,000? Thank you in advance for your response

Hello!

Thank you for your nice words. In this case, the amount in NU is some abstract value that is different from the amount in BU. As a rule, when purchasing fixed assets on lease, the amounts for accounting and tax accounting are always different, and for tax purposes they are smaller, because in NU, the cost of fixed assets takes into account the amount of expenses of the lessor (and NOT the lessee) for the acquisition of the leased asset Quote 0 ??? 02/17/2016 14:33 Good afternoon, Olga, I have recently discovered the great benefits of your lessons, I have a question specifically about leasing: using your example of accepting fixed assets for accounting on the NU tab, where does the amount of the initial cost (750,000) come from? If the receipt is 1,500,000? Thank you in advance for your response

Quote

Update list of comments

JComments

Postings in accounting

Let's look at typical accounting entries that use account 08.

| Debit | Credit | Operation name |

| Acquisition of fixed assets | ||

| 08/4 | 60 | OS object purchased |

| 19 | 60 | The VAT tax on the asset is reflected |

| 68 | 19 | VAT tax credited |

| 08/4 | 76 | Commissioning work completed |

| 01 | 08/4 | The OS object is put into operation |

| Creating an OS in-house | ||

| 10 | 60 | Materials for creating an OS have been purchased |

| 19 | 60 | VAT reflected on the material |

| 68 | 19 | VAT tax credited |

| 08/3 | 10 | Materials written off for the creation of the OS |

| 08/3 | 70 | The salaries of employees involved in the creation of the operating system have been calculated |

| 08/3 | 69 | Salary contributions have been calculated |

| 08/3 | 23, 26 | The costs of auxiliary and other types of production were written off |

| 01 | 08/3 | The created OS was put into operation |

| Creation of OS by contract method | ||

| 08/3 | 60, 76 | The services of a contractor for the construction of an environmental facility are reflected |

| 19 | 60, 76 | VAT on the contractor's work is reflected |

| 08/3 | 07 | The cost of equipment given to the contractor for installation is reflected |

| 08/3 | 70 | The salaries of the workers who brought the facility to a condition suitable for use are reflected. |

| 08/3 | 69 | Social contributions on salaries have been calculated |

| 08/3 | 23, 26 | Other production costs reflected |

| 01 | 08/3 | The completed OS object has been accepted for operation |

| 68 | 19 | VAT tax credited |