The analysis of the profit or loss received by the enterprise based on the results of the reporting period should be based on the structure of this indicator. This will provide an opportunity for further planning of expenses and stabilization of income values. The dynamics of the indicator and its composition can be analyzed based on tax and accounting data of the enterprise.

The concept of income and expense of an organization

Every commercial enterprise is created for the purpose of generating income (economic benefit). To obtain a more significant amount of income, owners choose the type of activity that, in their opinion, will ensure a stable and high level of profitability of the enterprise.

When forming the final result of work based on the results of the current reporting (interim or main period), each organization receives a loss or profit from its core activities. If the proceeds from the sale of goods and services exceed the amount of funds invested in the production process, the enterprise has income for the analyzed period. If the costs of carrying out an activity exceed the revenue received, then the enterprise receives a loss based on the results of its work. Determining the income and loss of an enterprise is not unambiguous; with the help of accounting transactions, entries and primary documents, it is necessary to constantly analyze the structure of revenue and expenses. Both profit and loss are formed not only as a result of the main activity of the organization; there are a number of positions that influence the final economic result of a particular company or enterprise not in the direction chosen as prevailing. In accounting, management and tax accounting, these positions are reflected in the “Other income and expenses” account 91 and its subaccounts.

List of receipts and disposals that can be included in other income and expenses

Let's consider each subaccount separately.

Subaccount 91.01 of account 91 of accounting is a passive subaccount, that is, it has a loan balance, since other income is credited to subaccount 91.01. Income that may be considered other is listed in clause 7 of PBU 9/99.

Subaccount 91.02 of account 91 of accounting is active, which means there is only a debit balance. Amounts related to other expenses are recorded as the debit of subaccount 91.02. Expenses that can be considered other are disclosed in clause 11 of PBU 10/99.

Let us remind you that these lists are open, that is, any other economically profitable and correctly documented receipts and disposals, other than income and expenses for core activities, are treated similarly to others.

The complete list of accounts with which subaccount 91.01 corresponds for credit, and subaccount 91.02 for debit, is given in Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

Enterprise income structure

In accordance with the regulations of PBU 9/99, the income of an enterprise includes an increase in the economic benefit of the organization in connection with the receipt of assets (cash, current and non-current assets) and the fulfillment of obligations, which leads to an increase in capital (the exception is the investment of owners through the authorized capital). The following receipts are not income:

- Advances from the buyer.

- Mortgaged property.

- Amounts of taxes received that are subject to transfer from budgets of different levels (excise taxes, VAT, duties, sales tax, etc.).

The income of each commercial enterprise can be divided into two consolidated types: other and income from the main activity. Revenue from the sale of released (manufactured) products, services provided, work performed within the chosen area is classified as income from the main line of business (account 90), other types of income include the following:

1. Operating (91 accounts):

- Sale of property.

- Interest on loans issued.

- Income from the rental of operating systems.

- Participation in the authorized capital of a third organization, etc.

2. Non-operating (91 accounts):

- Inventory surplus.

- Exchange rate differences are positive.

- Penalties received from counterparties.

- Overdue debt of the creditor organization (over 3 years).

3. The organization receives emergency income as a result of emergency situations (insurance payments, sale of parts of property damaged by a natural disaster, etc.).

Moment of revenue recognition

It has a big impact on your income. The procedure in accordance with which revenue is recognized is regulated in PBU 9/99, clause 12. Rent or license fees may not act as income from main activities. In this case, it is recognized in accounting in accordance with the assumption of temporary certainty of business events and the terms of the contract. To record revenue other than income from core activities, three conditions must be met simultaneously:

- The company has the right to receive it. It may come from a corresponding agreement or be confirmed in another way.

- The amount of revenue can be determined.

- There is confidence that as a result of a particular operation there will be an increase in the company's economic benefits.

If the specified conditions are met, revenue is recognized in accounting from:

- Providing temporary use/possession of the company's own assets for a fee.

- Participation in the capital of other companies.

- Granting for temporary use/possession of rights arising from patents for inventions, designs or other objects of intellectual work.

- Sales of fixed assets and other assets other than money (except foreign currency), goods, products.

This category also includes interest received from providing the company’s funds for use. They are accrued for each expired reporting period in accordance with contractual terms. As for penalties, penalties, fines, and compensation for losses reimbursed to the organization, they are recognized in the time period in which the corresponding court decision was made. Amounts of deposits and accounts payable that have expired are recorded in the period in which it ended. The results of revaluation of assets in accounting are recognized in the period to which the date on which the revaluation was carried out relates. Other receipts are recorded as they are identified (formed).

Classification of expenses

The company's expenses are classified according to the requirements of PBU 10/99. A decrease in the economic indicator from the organization’s work due to the disposal of assets and the occurrence of situations related to a decrease in capital is taken into account as expenses. Depending on the type and nature of occurrence, all expenses are divided into other and received as a result of the main activity. Expenses related to the main line of business arise during the formation of production costs, manufacturing of products, in the process of providing services and carrying out work. If the organization has chosen as its main area of work the rental of non-current assets, structures, machinery and equipment, then all expenses for this type are considered the main production costs. Other expenses are divided into:

1. Operating (91 accounts):

- Taxes transferred to various budgets.

- Payment for the use of borrowed (attracted) funds.

- Payment for banking services for maintaining accounts and providing information on them.

- Acquisition of non-current assets, disposal of fixed assets as a result of wear and tear (physical or moral) or equipment failure (if repair or modernization is impossible).

2. Non-operating (91 accounts):

- Penalties, penalties, fines under contracts with counterparties (in case of violation of contractual obligations by the enterprise).

- Charity expenses.

- Overdue accounts receivable (not repaid for more than 3 years).

- Exchange rate differences are negative (if there are foreign exchange agreements).

- Shortages in excess of the norm of natural loss, discovered based on the results of the inventory (in the absence of a culprit).

3. The enterprise receives extraordinary expenses as a result of natural disasters, man-made accidents, fires, etc.

Reflection in accounting

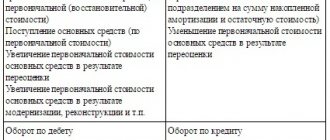

Account 91 is intended to reflect other, non-operating, operating expenses and income in the organization's accounting. The entire period preceding the annual report, other expenses and income of the organization are accumulated in active-passive accounting accounts, which in the chart of accounts (unified) of accounting is called “Other income and expenses ” . At the same time, the correspondence of account 91 depends on the item of expense and (or) income; analytical accounting should, based on the accounting policy of the organization, be carried out for each item separately, this will significantly simplify the analysis of the composition of the indicator when assessing the result of the enterprise. The following subaccounts must be opened for this account:

— 91/1 “Other income” — intended to reflect all types (except extraordinary) of an enterprise’s income not related to its main activities.

— 91/2 “Other expenses” — this subaccount reflects other, non-current, operating expenses.

— 91/9 “Balance of other income and expenses” — account 91 is closed through this subaccount.

Why do you need to close account 91 at the end of the month?

For a better understanding, let’s characterize subaccount 91.09. It can be classified as active-passive, since the balance on it can be on both sides: both debit and credit. This is due to the fact that it reflects the financial consequence of other activities, which can be both positive and negative.

There is a rule in accounting: it is necessary to close account 91 at the end of the month. This means that 91 accounts should be empty at the end of the month, that is, have a zero balance. The accountant records other income on the right, that is, in the credit of subaccount 91.01, other expenses go to the debit of subaccount 91.02. So that account 91 does not have a balance at the end of the month, the last number must correspond to subaccount 91.09 with account 99 “Profits and losses” - to reflect the financial result. That is, if income exceeded expenses, we have a profit and deposit it in the debit of subaccount 91.09. When expenses exceed income, we have a loss and enter it into the credit of subaccount 91.09. We conclude that it is necessary to close 91 accounts in order to allocate the results of the enterprise’s work to account 99.

Document flow for account 91

Postings for 91 accounts are compiled on the basis of well-formed primary documents, which are filled out by the accounting department, respectively, for each specific type of expense and income. The following types of documents are used:

- An accounting certificate is used when crediting reserves of unused payments to income (operating, non-operating, other), calculating deviations in the value of registered inventory items, and amounts of deferred income.

- An invoice is used when calculating interest on credits, loans, borrowings, income from participation in the share capital (authorized capital) of a third enterprise, income from ownership of securities.

- The inventory list, expenses and income on the basis of this document are carried out on account 91 in correspondence with active accounts for accounting for inventory, finished goods, cost accounts of the main and auxiliary production.

- The act of acceptance and transfer of fixed non-current assets when writing off the residual value of sold or written off non-current assets.

- The calculated depreciation sheet is used to write off depreciation accrued on fixed assets that are leased.

What to consider

This account is used in the process of reflecting information about the income and expenses of the organization throughout the entire working year, which are classified as other.

Others include those that cannot be associated with the main activity. For example, if an enterprise is engaged in trading activities, then expenses and income that are associated with the sale of products cannot be reflected in this document.

Other income includes the following:

- Those that were received from the rental of real estate.

- Received from the sale of assets and materials.

- Income that was received from participation in the capital of any other organizations.

- Interest received from holding securities.

- Fines.

- Damage caused by the organization.

- Differences in exchange rates.

- Debt from loans that have expired.

- Profit that was paid for work performed last year.

Speaking about other expenses, they may be associated with rent and interest on loans on amounts. It is also necessary to include here the amounts that are allocated to reserves of the type being formed. If an organization needs to make payments for banking services, then they must also be classified as other expenses. This includes paid penalties, fines and accrued penalties.

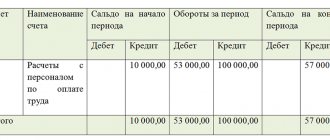

In the process of maintaining an account, it is necessary to record all income that was received, as well as expenses incurred, throughout the working month. After the end of the working month, you should perform a calculation of turnover for a separate subaccount.

Next, the credit turnover must be subtracted from the debit turnover. The difference between them will act as profit or, conversely, loss. When performing work of this type, it is necessary to calculate the difference for each of the subaccounts by summing up the opening balance, as well as the turnover for one month.

It is worth saying that in such a situation the balance should be carried forward to the next month.

Reflection on the debit of 91 accounts

In the debit (account 91), the following entries are made: expenses for the maintenance and servicing of mothballed units of property, disposal, write-off of fixed production assets, transactions with containers, losses of previous periods discovered in the current year, overdue accounts receivable, penalties, penalties for failure to fulfill contractual obligations liabilities, exchange rate differences, fees for the use of loans, credits, borrowings, costs of litigation, etc.

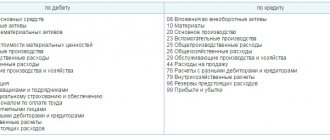

Account correspondence

| Debit | Credit |

| 91 “Other income and expenses” | 08, 07 Non-current assets |

| 10, 11, 15, 14 Current assets | |

| 20, 29, 23, 28 cost accounts, production defects | |

| 41, 43, 45 Finished, shipped products | |

| 50, 52, 59, 57, 51, 58, 55 cash | |

| 60, 63, 66, 62, 67 settlements with counterparties, loans | |

| 71, 76, 79, 73 various debtors and creditors, accountable persons | |

| 96, 99, 98 financial results, reserves, funds |

Reflection of information on account credit 91

Account 91, loan entries are made for the following types of business transactions: income from the sale of fixed production assets, proceeds from the gratuitous receipt of assets (current and non-current), fines received, penalties under agreements with counterparties, exchange rate differences, dividends received from participation in other partnerships, income from the provision of loans, advances, proceeds from the sale of intangible assets, innovative developments, amounts of overdue debt to creditors, etc.

Correspondence of possible accounts

| Debit | Credit |

| 01, 04, 07, 02, 08, 03 NMA and OS | 91 “Other income and expenses” |

| 19, 16, 15, 14, 11, 10 Current assets, VAT | |

| 21, 20, 28, 29, 23 Defects, costs by department | |

| 58, 59 reserves, investments | |

| 66, 68, 69, 67, 60, 63 Settlements, loans | |

| 70, 76, 73, 79, 71 Settlements with personnel and other creditors and debtors | |

| 98, 99, 94 financial result, funds, losses and shortages of goods and materials |

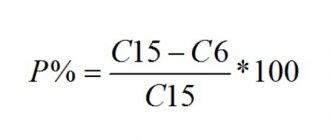

Determination of other financial results

Information on sub-accounts for accounting for other income and expenses is accumulated during the reporting period. Each month, the debit balance of expenses is compared to the credit balance of the income subaccount. The result obtained is the financial result of non-operating activities - data from all sub-accounts will be reflected in one amount on sub-account 91.09. At the end of the month (closing operation), the financial result of the organization’s work from subaccount 91.09 is transferred to the debit or credit of account 99, respectively.