What is more profitable than the simplified tax system “income minus expenses” or the simplified tax system “income”? We calculate the benefit. Equilibrium point simplified

Advantages and disadvantages of the USN-DR tax system

Advantages of USN-DR Disadvantages of USN-DR

Main parameters of USN-DR

Basic restrictions for the simplified tax system “income minus expenses” For whom the simplified tax system-DR is not allowed What to do with primary documents for the simplified tax system-DR (step-by-step instructions) How to switch to the simplified tax system-DR and how to go back Timing for the transition to the simplified tax system Pitfalls

Will the tax office check if you switch to the simplified tax system-DR?

Bank criteria for business verification

Reduced rates for regions

How to find “your” law (step-by-step instructions): Examples of simplified preferential rates:

Dangers and pitfalls

Expenses not taken into account when calculating tax on the simplified tax system-DR: Business cards to a current account

Costs of accounting outsourcing USN-DR in numbers Let's summarize

What is more profitable than the simplified tax system “income minus expenses” or the simplified tax system “income”

Further, for brevity, we will call the simplified tax system “income minus expenses” - simplified tax system-DR, and the simplified tax system “income” - simplified tax system-D.

We count the benefits

Let's calculate the monetary benefits using the example of a small business.

Example:

LLC “Digital” is a DIGITAL company with a turnover of 1 million rubles. per month. According to statistics in the DIGITAL industry, the salaries of specialists are 30-40%, another 30% are administrative expenses and the remaining 30% are received by the owner.

Let's see what taxes the company will pay under each tax system:

| simplified tax system 6% | simplified tax system 15% | |

| Income per month, rub. | 1 000 000 | 1 000 000 |

| Expenses per month, rub. | 700 000 | 700 000 |

| Profit, rub. | 300 000 | 300 000 |

| Tax simplified tax system, rub. | 60 000 | 45 000 |

| Net profit, rub. | 240 000 | 255 000 |

For Digital LLC, the USN-DR is more profitable, the savings will be 15,000 per month or 180,000 per year (255 tr. - 240 tr. = 15 tr.) In

our example, there is absolutely white tax savings - 15,000 rubles per month. This amount amounts to 180 thousand rubles per year. The figure is not bad and makes you think about new possibilities.

To find your benefits in practice, start counting your expenses. Almost 90% of small DIGITAL businesses do not bother counting their expenses.

But expenses include not only employee salaries and office rent. Add also payments to freelancers, and bank expenses, and office supplies, and household goods.

Remark:

To work in DIGITAL you need a modern device (laptop or all-in-one), which needs to be replaced with a new one at least once every three years. And also keyboards, microphones, mice, and so on.

Add up all the expenses, and you will be horrified by the amount received - the expenses will turn out to be much more than you expected. If now it seems to you that there are no or few expenses in your business, just start counting them - the real picture will surprise you.

Equilibrium point simplified

The simplified equilibrium point is the ratio of income and expenses at which taxes under the simplified tax system-D and simplified tax system-DR are equal. At this point, the business does not care which system to use from a mathematical point of view.

The simplification equilibrium point is needed to know in advance the moment after which it will become profitable to change the taxation system.

If expenses are less than the calculated level, then you can safely remain on the simplified tax system; if more, it is more profitable to switch to the simplified tax system-DR.

How to calculate the equilibrium point simplified:

Where:

P – amount of expenses as a percentage of income;

C15 – the simplified tax system-DR rate in your region for your type of activity;

C6 – the simplified taxation system-D rate in your region for your type of activity.

STS rates vary in different regions. The standard one, as in Moscow, is 6% on income and 15% on “income minus expenses.” Also, for example, according to the simplified tax system-D there are rates of 4%, 3% and 1%. According to the simplified tax system-DR – 10%, 7% and 5%. Your benefit will depend on what rate is approved in your region.

In practice it looks like this:

How is the simplified tax base determined?

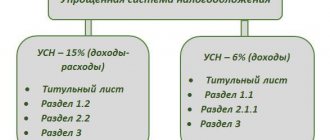

Current legislation offers small business representatives to choose one of 2 simplified taxation system options. They differ in the principle of calculating the simplified tax system in terms of the tax base and the rate used:

| simplified tax system 6% | simplified tax system 15% |

| The fiscal base is defined as the amount of income received by the taxpayer in the reporting period. Expenses do not affect the amount of the obligation to the budget, which makes calculating the simplified tax system of 6% simple for both companies and individual entrepreneurs. This option is suitable for commercial structures:

| The tax base for this type of simplification is determined as the difference between the revenues received in the reporting period and the expenses incurred. As a result, calculating the 15% simplified tax system is convenient for business entities whose business involves significant expenses. It is important that the latter be documented and have economic feasibility. |

Regardless of the type of simplified tax system chosen, taxpayers adhere to the cash method of recognizing income and expenses. This means that transactions are recorded in the period when:

- funds addressed to the counterparty have left the current account (cash) of the enterprise;

- customer payments have been received by the company.

Also see “STS 6 or 15%: which is better to choose.”

Advantages and disadvantages of the USN-DR tax system

Advantages of USN-DR

Your taxes may be lower if your spending share is above the "equilibrium point"

There are no other advantages, but even this benefit is a killer advantage. True, for the opportunity to pay less taxes you have to sacrifice something. These are the shortcomings of the system.

Disadvantages of USN-DR

- Not all expenses can reduce your tax base. There are restrictions enshrined at the legislative level. Only if your expense falls on the “list” does it reduce your tax base.

- You need to carefully collect primary documents for expenses . Individual entrepreneurs using the simplified 6% rule, as a rule, do not collect incoming primary income, and they don’t need it. LLCs at simplified 6% work differently. By law, documents must be collected, but since this often does not affect taxes, many LLCs do not bother with unnecessary paperwork. True, for such negligence you can receive a fine of 15 to 30 thousand rubles for gross violation of record keeping. But since tax officials rarely come to small businesses with such checks, some entrepreneurs believe that this will not affect them. The second group of LLCs on the simplified tax system of 6% are those who collect primary income and keep correct records - during the transition it will be much easier for them.

- Need an accountant. Many individual entrepreneurs using the simplified tax system of 6% keep records on their own. It is more difficult to manage an LLC on the simplified tax system of 6% yourself - there is a balance sheet, transactions, debit / credit - there is a high probability of making a mistake. USN 15% income minus expenses is carried out without an accountant, if you are not an accountant yourself, it is frivolous and reckless.

- The cost of accounting services on the simplified tax system-DR is higher than on the simplified tax system-D. The explanation is simple: calculating 6% is much easier than collecting documents and verifying expenses, therefore the price of service is 6% lower.

These “disadvantages” are essentially features of the system. And if the transition is beneficial for you, go ahead.

How to calculate tax with a simplified tax system of 15%?

What is better, simplified tax system 6% or 15%, we do not consider in this article. Let’s say, based on the planned level of income and expenses, the use of the simplified tax system-15% turned out to be more profitable: how to calculate the tax if a businessman has chosen this object?

The principle of calculating the 15% tax on the simplified tax system is that a company or individual entrepreneur applying such a taxable object transfers 15% of the difference between income and expenses to the Federal Tax Service. The tax base for the simplified tax system of 15% is calculated quarterly on an accrual basis. This means that when applying the simplified “15 percent” in 2020, at the end of 1 quarter, half a year, 9 months and a year, a businessman must re-determine all his income and expenses, that is, calculate them from January 1, and the advance payment at the end of each quarter pay minus advances made earlier in the same year.

© photobank Lori

The following situation may arise: let’s say in the first quarter revenues exceeded expenses, and the company paid the required 15% of the difference. But at the end of the six months, total expenses turned out to be more than income, the tax base went negative, and as a result, there was simply nothing to count on in advance. In this case, the payment previously paid for the 1st quarter will be considered an overpayment. At the end of 9 months and a year, the businessman will make a similar calculation again, and perhaps the situation will change.

But if, at the end of the year, income does not exceed expenses, then the Federal Tax Service will have to pay the so-called minimum tax - 1% of the amount of income received excluding expenses. The obligation to remit this minimum tax will also arise if its amount turns out to be greater than the normally calculated 15% of the difference between income and expenses. An important point: the minimum tax for the simplified tax system of 15% “income-expenses” is calculated only at the end of the year. In the first three quarters of the year, if there is no tax base for calculating the payment, then the advance payment according to the simplified tax system is simply not paid.

Main parameters of USN-DR

For the simplified tax system “income minus expenses” there are basic restrictions:

- Income – up to 150 million rubles. in year.

- Employees – up to 100 people.

- Fixed assets – up to 150 million rubles.

USN-DR is not allowed for:

- organizations with branches. To bypass this restriction, you can open a separate division instead of a branch and continue to work on the simplified tax system-DR;

- business where the founder is a legal entity with a share of more than 25%;

- foreign organizations;

- those who did not notify the Federal Tax Service correctly and on time;

- microfinance organizations, outstaffing and a number of other activities.

The main feature of the simplified tax system-DR is the primary documents, which now need to be collected very carefully.

What to do with primary documents on the simplified tax system-DR (step-by-step instructions)

- Collect all incoming acts, invoices on paper or via EDI (electronic document management). Approximately 60-70% of suppliers in the DIGITAL sector are in EDI. This is convenient and profitable - all archives are at hand, documents are not lost.

- Keep records.

- Pin it in a large archive folder.

How to switch to USN-DR and how to go back

The procedure for switching to the simplified tax system-DR or back is simple:

- Application in 2 copies. You can print it, fill it out by hand and take it (or send it by mail) to the tax office, or send it via EDI if you have such a service activated.

- One copy was handed in, the second was received with a mark of acceptance. Proof that you have the right to apply the simplification is an application with a tax stamp of acceptance or an application with confirmation of sending via EDI.

No additional papers are required, the tax office will not issue any confirmation. Whether you have the right to use the simplified tax system or not, the tax office will confirm only during an audit.

Time frame for transition to simplified tax system

- For new companies:

- simultaneously with registration;

- within 30 calendar days from the date of state registration (the application is submitted to the local tax office).

- For existing companies:

- until December 31 of the current year (to start working on the new system next year).

The deadlines for transition between simplifications are the same.

If the simplified tax system is not suitable and you need to go to OSNO, then this can be done before January 15 of the current year in order to apply OSNO this year.

Underwater rocks

When changing the tax system, be sure to take into account the transition period.

ATTENTION! When switching from OSNO to simplified tax system and vice versa, additional amounts of taxes may arise. Consult an accountant or tax advisor!

Purchases and expenses of previous years (for example, when they were on the simplified tax system-D) will not reduce the tax base of the current year. That is, if you are planning a large purchase (for example, a laptop), then make it after switching to “income minus expenses.”

For an accountant, the transition period when changing an object from the OSNO to the simplified tax system also means following certain rules.

Will the tax office check if you switch to the simplified tax system-DR?

The transition between taxation systems is not a reason to initiate an audit. If there have been no claims against your company from the tax authorities before, and the 6% checkbox in front of your individual entrepreneur is not worth checking, they will not specifically check it. If you are not included in the verification plans of the Federal Tax Service, then the transition itself will not provoke an audit.

If you had a big business, you used aggressive optimization and suddenly decided to switch to the simplified tax system, be prepared that they will be interested in the company. But it will be an unpleasant coincidence.

It's not the tax office you should be afraid of, but the banks!

Tax officials cannot check everyone, and the state made a conceptual decision. Banks have been put in a position where they are forced to give a “tip” to check any business.

Bank criteria for business verification

- Taxes – less than 0.9% of turnover. Don't do aggressive optimizations. You can pay taxes less than 1% of turnover only if you are 100% sure of your crystal purity and are ready to accept an audit at any time.

- Salaries and taxes are not paid from the current account (or paid in small amounts).

- Payroll is less than the minimum wage (in Moscow 18,781 rubles).

- Personal income tax is paid, but insurance premiums are not.

- No or meager account balances compared to turnover.

- The purpose of the payment does not correspond to the activities of the company.

- Money is credited for one reason and written off for another.

- The revolutions increased sharply.

- There are no regular payments for rent, telephone, utilities, office supplies, and household goods.

- Money comes in with VAT and goes out without VAT. However, VAT does not correspond to turnover.

Reduced rates for regions

When it is possible to apply a reduced rate, it should be applied.

There are 85 subjects in the Russian Federation. And many pass local laws with benefits.

How to find “your” law (step-by-step instructions)

- Type in the search engine “nalog.ru simplified system (...your region..)”.

- The very first announcement is the website of the tax service. Click!

- On the page that opens, at the bottom right, find the “Features of regional legislation” tab. Click!

- After clicking on the hyperlink, information about the preferential rates of the region and who can apply them opens.

- Look for your type of activity, year and other nuances. Found it?

- Download, open and study the local law, or entrust this matter to a specialist.

Examples of simplified preferential rates

In St. Petersburg there is a preferential rate for the simplified tax system-DR - 7% (for all types of activities).

In the Tula region, benefits have been established for the simplified tax system-D - 1% and for the simplified tax system-DR - 5%. But there are other restrictions: the rates are valid only for the first 2 years and only for newly registered individual entrepreneurs and LLCs that are not engaged in trade. The benefit is valid until December 31, 2020.

In the Sverdlovsk region (Ekaterinburg) for IT and DIGITAL there is a preferential simplified taxation system-DR rate of 7%.

There are no benefits in the Nizhny Novgorod region. For simplified tax system-DR the rate is 15%.

In the Oryol region there are benefits for the IT sector (software development, consultations on software development, website creation): 3% on the simplified tax system and 5% on income minus expenses.

Both preferential rates and restrictions can be completely unpredictable - check the text of the law in your region carefully.

Dangers and pitfalls

The main danger of the “income minus expenses” simplification is unaccounted expenses. Not all expenses reduce your tax base.

Expenses not taken into account when calculating the tax on the simplified tax system-DR

- Manager services, management accounting services, budgeting consultations.

- Marketing expenses for your own needs (but subcontracting work for clients is possible). Only if the service is reformulated as advertising can it be included as an expense.

- Personnel training is not in licensed educational organizations.

- Assessing the future of non-employee personnel.

- Personnel selection, personnel consulting.

- Voluntary insurance (liability, property).

- Penalties under contracts.

- Charity.

Remark:

It is important to control the name of the expense.

For example, marketing expenses are not tax deductible expenses. But advertising costs are included.

Therefore, before accepting documents into account, you need to correctly determine the direction of expenses. If marketing services can be called advertising, then this must be done, but correctly.

Business cards to current account

Be careful with corporate cards because some expenses are controlled by the government. Making expenses from corporate cards means actually purchasing for corporate needs.

What purchases from business cards can the tax office check:

- purchases from individuals (they may be charged personal income tax and insurance premiums);

- wood (EGAIS Forest);

- alcohol (EGAIS);

- medications (alcohol);

- precious metals and stones (registered with the Assay Office).

In order not to make excuses a thousand times, do not make such purchases through the current account of a company or individual entrepreneur if these are personal expenses.

A full list of eligible expenses can be found here:

List of expenses that will reduce tax under the simplified tax system of 15%.

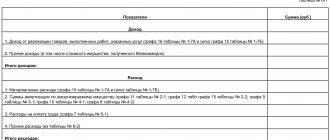

Taxpayer expenses

The list of expenses that a taxpayer can indicate on a simplified basis (income minus expenses) of 15% is given in Art. 346.16 Tax Code of the Russian Federation. All expenses must be supported by relevant documents. The most common expenses are:

- payment of wages to employees;

- transfer of taxes on compulsory insurance;

- payment of travel expenses;

- payment of rent for premises of a production workshop or office;

- purchasing accounting software;

- acquisition and modernization of fixed assets and intangible assets.

It is important to note that all costs during simplification (income minus expenses) can be included in expenses only after they have been paid. The cost of purchased goods can be taken into account in expenses only after they are sold (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Costs of accounting outsourcing USN-DR in numbers

The cost of servicing a company using the USN-DR is slightly more expensive than the USN-D. I take the figures for calculations from the price list of the Profdelo company .

Example:

Let’s take the same one that we considered beneficial at the very beginning of the article.

Initial data:

- 1M income per month;

- 20 clients;

- up to 100 bank payments;

- 5 employees.

Cost of accounting services:

| Rubles per month | simplified tax system 6% | simplified tax system 15% | |

| IP | OOO | IP/LLC | |

| Bookkeeping (accounting) | 11 000 | 26 000 | 29 000 |

| Office work (invoices, acts, contracts) | 4 000 — 5 000 | 4 000 — 5000 | 4 000 — 5 000 |

| Personnel accounting | 1 000 — 2 000 | 1 000 — 2 000 | 1 000 — 2 000 |

| Total per month | From 16 000 | From 31,000 | From 34,000 |

Savings (from the first case in the article): 15,000 per month or 180,000 per year

Let’s calculate the benefits taking into account accounting:

| Rubles per month | simplified tax system 6% | simplified tax system 15% | |

| IP | OOO | IP/LLC | |

| Cost before switching to USN-DR | 11 000 | 26 000 | 29 000 |

| Cost after transition | 29 000 | 29 000 | 29 000 |

| Additional costs | 18 000 | 3 000 | not applicable |

| Benefit | 15 000 | 15 000 | |

| Profitability: | It is not profitable to switch, additional costs will be 3,000 rubles per month | It is profitable to switch, the benefit will be 12,000 rubles per month. | |

That is, if earlier you paid 11 thousand for accounting services for individual entrepreneurs at 6%, then when switching to the simplified tax system-DR, such a service will cost you 29 thousand - the additional fee for the simplified tax system-DR is 18 thousand rubles. In the first case of this article (all figures are arbitrary), we calculated an increase in income from the transition of only 15 thousand rubles per month. This means that such a transition to the simplified tax system-DR with outsourced accounting services is not mathematically beneficial for you (15-18= -3).

If the additional fee for switching to the simplified tax system-DR is only 3 thousand per month (as is the case with an LLC), and the benefit from such a switch will be 15 thousand, then the switch is necessary and profitable: 15-3 = +12.

Determine whether the system will pay off specifically for your business using your own example. Whether to consider only the mathematical benefits, or to take into account both the difficulties with collecting documents and the prospects for scaling - you need to make this management decision yourself.

Let's sum it up

- The simplified tax system “income minus expenses” is one of the white methods of tax optimization.

- The “simplified equilibrium point” is the ratio of income and expenses at which taxes under the simplified tax system-D and simplified tax system-DR are equal. Calculating the starting point is needed to keep in mind the moment when it is already profitable to switch.

- To determine the profitability of switching to the simplified tax system-DR, you need to start counting expenses and monitoring their correct names.

- There are basic restrictions for the simplified tax system-DR, but if the business fits the parameters and the profitability is calculated, you need to move on.

- The transition between tax systems is not critical for verification.

- Accounting outsourcing for the simplified tax system-DR is slightly more expensive than for the simplified tax system-D, so the benefits must be considered in each specific case.

What is a simplified tax system of 15 percent

As you know, the simplified taxation system is a special tax regime. For organizations, it involves replacing with a single tax such taxes as (clause 2 of Article 346.11 of the Tax Code of the Russian Federation):

- income tax;

- property tax;

- VAT.

In some situations, all of these taxes still need to be paid.

Read about exceptions in our materials:

- «Income tax under the simplified tax system (nuances)»;

- “VAT under the simplified tax system: in what cases to pay and how to take into account the tax in 2020 - 2020?”;

- “How to pay property tax under the simplified tax system in 2020 - 2020?”

The simplified tax system of 15 percent is a type of “simplified tax”, in which the single tax is calculated from the difference between income and expenses at a rate of 15% (clause 2 of article 346.18, clause 2 of article 346.20 of the Tax Code of the Russian Federation).

When applying a simplified taxation system (with any object), the payer must calculate and pay advance payments no later than 25 days after the end of 1, 2, 3 quarters. At the end of the year, the balance of the tax is paid (no later than March 30 by legal entities and no later than April 30 by individual entrepreneurs) and a declaration is submitted.

For whom and why the deadlines for paying taxes and advances under the simplified tax system have been extended in 2020, find out here.

If at the end of the year the tax base turns out to be very small or if the expenses taken into account when calculating the tax exceed the income received, then it will not be possible to pay the tax in accordance with the calculation made or avoid paying the tax. The fact is that a feature of tax payment for payers using the simplified taxation system “income minus expenses” is the need to compare the tax calculated at the end of the year at a rate of 15% and the minimum tax calculated as 1% of the amount of income received for the year. If the calculated minimum tax is greater than the tax calculated in the usual manner, then a mandatory minimum tax is subject to payment.

NOTE! When forming the amount of the minimum tax to be paid, the amount of calculated advance payments must be subtracted from its calculated amount. This procedure follows from clause 5.10 of the procedure for filling out a declaration under the simplified tax system (approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected] ).

You can read about the composition and features of filling out a declaration under the simplified tax system, and also download the form in the article “Declaration form under the simplified tax system for 2020 - 2020.”

You will find a line-by-line algorithm for filling out a declaration under the simplified tax system in ConsultantPlus, having received free trial access to the system.

Our calculator “STS Calculator 15%” will help you calculate the tax.