Kontur.Accounting - the optimal service for the simplified tax system

Automated calculation of taxes and transactions with employees.

The simplest accounting possible. The service itself will generate KUDiR, declaration and reports. Try for free

The tax on the simplified tax system of 15% is calculated quite simply. It is important to correctly account for income and expenses, make advance payments on time and at the end of the year calculate the minimum tax to clarify the amount to be paid. In this article we will tell you how to calculate tax.

Where are expenses counted?

To correctly fill out a tax return for a single “simplified” tax, a special tax register has been introduced - the book of income and expenses (KUDiR). The amounts of expenses taken into account for taxation are entered in column 5 of Section I “Income and Expenses”. Based on the results, the difference between the income received, recognized on a cash basis, and the expenses taken into account (to determine the advance payment) is determined quarterly, and at the end of the year, a declaration according to the simplified tax system is filled out and the tax is calculated.

Object income

The choice in favor of the “income” object is justified if the activities of an individual entrepreneur are not associated with large expenses that can be used to reduce the tax burden.

The simplified tax system “income” takes into account the amount of cash received from transactions, as well as the assignment of rights and repayment of debt.

When generating data using simplified language, a businessman:

- Maintains primary accounting records of income received - statements from current accounts and cash receipts

- Takes into account the payment of insurance premiums from the salary, temporary disability certificates for hired personnel and personal payments

Entrepreneurs must conduct KUDiR in accordance with strict procedures. In addition, you should keep records of fixed assets and intangible assets; such information is necessary in the event of a transition to a general taxation regime at the own request of a businessman or when taking into account the limit on the simplified tax system. At the “income minus expenses” facility, maintaining a book is also a mandatory procedure when maintaining records.

What expenses are included in the tax base?

Only paid, documented and economically justified expenses reduce the “simplified” tax base. The Tax Code of the Russian Federation has approved a list of expenses allowed for write-off (Article 346.16 of the Tax Code of the Russian Federation). Let us list the main expense items under the simplified tax system “income minus expenses”.

List 2020 with explanation:

- Fixed assets - the cost of purchase or manufacture; further retrofitting and modernization; reconstruction and repair.

- Intangible assets – acquisition and creation on your own.

- Material expenses - purchase of raw materials, materials.

- Goods – their cost, as well as storage and transportation costs.

- Rent is a fee for receiving property for temporary use (including leasing).

- Labor costs—staff wages, production bonuses, allowances for working conditions; payment of sick leave.

- Compulsory insurance of employees - contributions to extra-budgetary funds (PFR, FSS, FFOMS), social benefits in connection with maternity; property and liability insurance.

- VAT: the amount of tax allocated in invoices, paid to the supplier, contractor for purchased goods, works, services.

- Services of credit institutions: for banking transactions, including interest on loan agreements;

- Customs duties are non-refundable amounts of duties paid when importing goods.

- Transport: maintenance and servicing of the transport fleet; compensation for the use of personal cars within the approved standards.

- Travel allowances: for visas and the issuance of international passports, vouchers, travel tickets, rental housing, daily allowances, fees for entry or travel, transit.

- Auditing, accounting, legal services – payment for services rendered under relevant contracts; notary expenses.

- Postal and telephone services - according to documents received from communication companies.

- Stationery – purchased for production purposes.

- Advertising – if one advertises one’s own products or manufactured goods, as well as a trademark owned by the company.

- Tax payments - all paid under current legislation, except for the invoiced VAT, which is subject to payment to the budget, and tax according to the simplified tax system.

- Court expenses.

- Cash register expenses are money spent on servicing cash register equipment.

- Payment for damage to roads according to the Platon system.

A complete exhaustive list of costs is given in Art. 346.16 Tax Code of the Russian Federation. All expenses are recognized only after they are actually paid (cash method). Let's take a closer look at writing off individual expenses.

Transition of business to online cash registers

Entrepreneurs who keep records using the simplified tax system with the object “income minus expenses” are required to switch to online cash services before July 1, 2020.

The process of transferring a business to online cash registers

Before replacing a cash register, it is better for individual entrepreneurs to ask specialists in the field of cash registers in advance whether it is possible to modify the old equipment. If this is not possible, then feel free to start looking for a suitable cash register.

To do this you will need:

- Before purchasing, check whether the cash register is included in the list of permitted cash registers by the tax service.

- Consider a schedule for replacing the ECLZ (electronic control tape).

- Provide the outlet with a reliable Internet connection for uninterrupted operation of the system.

After purchasing a new generation cash register, deregister the old one with the tax office.

Select a fiscal data operator and enter into a service agreement with him, then proceed to the online cash register registration procedure. Despite the fact that such an innovation has brought a lot of trouble to the activities of entrepreneurs, they will have to purchase and register a “new” cash register. The fine for untimely fulfillment of this requirement is equivalent to an amount of 3000 rubles.

Write-off of expenses for fixed assets under the simplified tax system “income minus expenses”

The cost of fixed assets is included in the costs of the simplified tax system depending on when the fixed assets were acquired - before the transition to the “simplified system” or after (clause 3 of article 346.16 of the Tax Code of the Russian Federation).

If expenses for fixed assets arose during the period of application of the simplified tax system, they are accepted from the moment the fixed assets are put into operation.

If costs arose before the start of the “simplified” application, their recognition depends on the operating life of the OS:

- up to 3 years – the entire amount is written off in equal parts every quarter during the first year;

- from 3 to 15 years - 50% during the 1st year, 30% - the next year, 20% - the 3rd year;

- 15 years or more - within 10 years of using the simplified tax system.

Write-off begins after payment of the fixed asset and its commissioning. Expenses are reflected on the last day of each reporting period (quarter).

Who can apply the simplified tax system

Of course, many taxpayers would like to work at such low tax rates. Most small businesses comply with the conditions and criteria for the simplified system specified in Article 346.12 of the Tax Code of the Russian Federation.

The transition to the simplified tax system in 2020 immediately upon state registration is possible for all entrepreneurs, except for those who will hire more than 100 workers from the very beginning. In addition, the simplification for individual entrepreneurs cannot be used if it is intended to produce excisable goods, extract and sell minerals, with the exception of commonly occurring ones.

For organizations, there are more restrictions when switching to the simplified tax system, for example, the presence of branches or the share of participation of other organizations in them, which exceeds 25%.

To make the transition to the simplified tax system in 2020, you must promptly submit a notification about choosing this mode:

- within 30 days from the date of registration of an entrepreneur or legal entity

- no later than December 31 of the current year in order to have the right to work on a simplified basis starting next year

At the same time, for already operating organizations that want to switch to a simplified system from other tax regimes, the following restrictions apply:

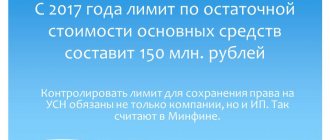

- income for nine months of the current year should not exceed 112.5 million rubles

- the residual value of fixed assets according to accounting data should not exceed 150 million rubles

These restrictions do not apply to working individual entrepreneurs who want to switch to a simplified system, as stated in the letter of the Ministry of Finance dated November 5, 2013 No. 03-11-11/47084.

However, the limits that must be observed in the process of operating on the simplified tax system apply to both organizations and individual entrepreneurs. The taxpayer does not have the right to apply this preferential treatment if his annual income exceeds 150 million rubles, or the number of employees is more than 100 people.

Write-off of expenses under the simplified tax system “income minus expenses”: retail trade

The cost of goods is included in the tax base in a special way. For write-off, 3 points are important:

- the goods must be received and capitalized;

- the supplier has received payment;

- goods are sold to the buyer.

Only if all 3 conditions are met simultaneously, the cost of the goods can be included in expenses. Costs for storage, transportation, and servicing of goods are also recognized as they are sold (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Write-off of transportation expenses using the simplified tax system “income minus expenses”

Transport costs can be taken into account in different ways, depending on the purpose of their occurrence:

- related to the acquisition and delivery of OS - are included in the cost of this OS;

- Expenses incurred during the acquisition of goods can be written off in two ways - by including them in the cost of goods, or as expenses for their transportation;

- Company vehicle expenses are written off as incurred.

Compensations for the use of personal cars and motorcycles are written off within the established norms: for motorcycles - 600 rubles, for passenger cars with an engine capacity of no more than 2 thousand cubic meters. cm – 1200 rubles; above this amount - 1,500 rubles per month (Resolution of the Government of the Russian Federation dated 02/08/2002 No., as amended on 02/09/2004).

In any case, expenses must be paid and documented.

Responsibility for tax violations

If a declaration is not submitted on time and is more than 10 days overdue, the tax office has the right to fine the entrepreneur and block the bank account.

Delay in submitting the report entails a fine of 5 to 30% of the amount of unpaid tax for a full or partial month, but not less than 1,000 rubles.

In addition to imposing a fine, a penalty is charged, which is calculated as a percentage equal to 1/300 of the refinancing rate established by the Central Bank of the Russian Federation on the date of the delay.

Failure to pay a single tax or understatement of the tax base will entail a fine of 20 to 40% of the calculated amount of the liability.

In addition to late payment or submission of the annual declaration, fines are also applied by the Pension Fund for providing false information or errors in reporting.

Fee for violations:

- 6-NDFL. Delay for a period of 30 days or more entails a fine of 1,000 rubles. Each document not submitted is assessed at 500 rubles.

- For errors or failure to submit a report on Form 2-NDFL, the entrepreneur will need to pay from 100 to 1,000 rubles

- Late submission of the SZV-M report involves payment of a fine in the amount of 500 rubles for each hired employee. Moreover, the report must be submitted no later than the expiration of 30 days after the employee is hired, regardless of whether there is a delay in the payment of wages to staff or not.

For refusal to comply with requirements, Rosstat is expected to impose a fine in the amount of 10,000 to 20,000 rubles.

Write-off of expenses under the simplified tax system “income minus expenses”: postings

Individual entrepreneurs are not required to keep accounting on the simplified tax system; they just need to fill out the KUDiR. But legal entities are forced to organize accounting for the preparation of financial statements. They must reflect in the accounting documents the facts of business transactions, including expenses. To do this, use standard wiring:

| Debit | Credit |

| 20, 25, 26 | 10 - write-off of material costs, stationery 68 - taxes 69 – contributions for compulsory insurance 70 – labor costs 76 – services of other debtors and creditors (for example, audit services) |

| 90 | 41 – write-off of the cost of goods upon sale. |

To recognize expenses, they must be paid:

| Debit | Credit |

| 60, 76 | 50 – issued to the supplier, contractor, other creditors in cash from the cash register 51 – paid by non-cash funds from a current account |

| 68,69 | 51 – taxes, fees, insurance contributions to the budget are listed |

| 70 | 50 – salary was issued from the cash register 51- salary was transferred to the employee’s card account |

Example

Furniture LLC, operating on the simplified tax system “income minus expenses,” purchased boards worth 420,000 rubles from IP Sviridov at the beginning of March. The delivery was paid from the bank account within 3 days. Tables were made from these boards within a month. For a month of work, employees were paid a salary for March - 280,000 rubles, insurance contributions for 84,000 rubles (salaries and contributions were paid in April). The accountant reflected transactions for March expenses as follows:

D10-K60 – 420,000 rubles, purchase of materials;

D60-K51 – 420,000 rubles, transferred to Sviridov for materials;

D20-K70 – 280,000 rubles, salary accrued;

D20-K69 – 84,000 rubles, insurance premiums.

In KUDiR for the current month (March) in gr. 5 of Section I the following entry was made:

420,000 – the cost of paid materials is included.

Salary expenses (RUB 280,000) and contributions (RUB 84,000) will be included in the next reporting period (since salaries for March have not yet been paid and contributions have not been transferred).

Features of the simplified tax system

Any individual entrepreneur officially registered with the Federal Tax Service can choose a simplified form of taxation to conduct business.

Existing individual entrepreneurs can switch to simplified legislation in the following cases:

- Total income for the year does not exceed 150 million rubles

- Staff no more than 100 people

- PF on the company’s balance sheet cannot exceed the established amount of 150 million rubles

They do not have the right to keep records on the simplified tax system

- Firms that make profits through gambling

- Companies on the Unified Agricultural Tax

- Lawyers and lawyers engaged in private practice

- Credit, finance and investment firms

- Transition to simplified language in violation of the basic rules established by the legislation of the Russian Federation (p. 346.12 of the Tax Code of the Russian Federation)

- Companies registered outside the territorial borders of Russia and firms with foreign capital

- Insurance

- Firms engaged in the production of excisable products

For an individual entrepreneur who has decided to conduct his business using a simplified taxation system, it is necessary to familiarize himself with the features of this regime:

- the reporting period is a year

- one tax is paid to the budget

- submission of annual declaration

- tax calculation at a rate of 5 to 15% on the object “income minus expenses” and 6% on “income”

Compatible with simplified tax system.

| USN+UTII | Maybe |

| USN+Patent | Maybe |

| OSNO+USN | unacceptable |

| UTII+OSNO | Maybe |

| USN+ESKHN | unacceptable |

When planning activities on the simplified tax system with a combination of other tax regimes, it is necessary to be guided by the information from Article 346.18 of the Tax Code of the Russian Federation.

What expenses cannot be written off on the simplified tax system?

Include in the tax base expenses not directly mentioned in Chapter. 26.2 NK, not allowed. The approved list is not subject to broad interpretation. There is even a unique list of those expenses that should not reduce the tax base. Here are some of these unaccounted costs:

- acquisition of property rights;

- VAT paid to the budget received from buyers and customers;

- non-production bonuses for holidays or anniversaries; financial assistance to employees;

- the cost of fixed assets received as a contribution to the management company;

- recruitment agency services or outsourcing;

- penalties, penalties for non-compliance with the terms of contracts.

Simply put, these include all costs that cannot be clearly attributed to approved expenses.

Advantages and disadvantages

Simplified taxation is a taxation system with a minimum of document flow during accounting and tax optimization.

This mode has a huge number of advantages:

- Individual entrepreneurs operating on the simplified tax system pay only one tax, in contrast to the general regime, in which it is necessary to pay VAT, income tax, property tax, etc.

- Simplified taxation can be combined with other forms of taxation

- You only need to submit a declaration based on the results of the reporting periods to the Federal Tax Service

- The right to choose a taxation system. You can work at a rate of 6% on “income” and 15% on “income minus expenses”

- Accounting is so simple that individual entrepreneurs can conduct it independently, without the help of specialists offering accounting services

Despite a sufficient number of advantages, the system also has a number of disadvantages:

- Lack of opportunity to open branches and divisions in other cities of the country.

- Violation of the rules established by law implies loss of the right to work under the simplified tax system (exceeding the volume of annual revenue or the number of hired personnel). In this case, returning to the tax system is allowed only from next year, subject to compliance with regulated restrictions.

- Problems with possible cooperation between individual entrepreneurs and LLCs with VAT. Large companies are interested in receiving value added tax so that the tax base can be reduced using the received tax.

In practice, simplifiers are much less likely to encounter claims from tax officials compared to entrepreneurs working for OSNO.

Why is this happening:

- Individual entrepreneurs using the simplified tax system are exempt from paying VAT. Accordingly, the Federal Tax Service practically does not control the correctness of amounts received and paid.

- For entrepreneurs, the list of costs that they can apply when calculating tax is regulated by law. Therefore, it will be extremely difficult to challenge the illegality of actions during such an operation.

- An individual entrepreneur using a simplified system is exempt from paying income tax, which means the likelihood of questions arising regarding losses is reduced to zero.

According to the information provided, we can safely conclude that simplified taxation is one of the best tax regimes for small companies. Moreover, modern practice shows that the majority of entrepreneurs choose the simplified tax system.

1% of the pension contribution from excess income of 300 thousand rubles. can be included in the costs of the next period, and this procedure cannot be carried out immediately. The opportunity can be used within the next 10 years.

What happens if you write off unaccounted expenses under the simplified tax system “income minus expenses”

Punishment may follow if a mistake is discovered by tax authorities, for example, during an on-site audit. They will exclude such expenses from the tax base - income will increase by the amount not accepted. Penalties for underestimating the tax base are 20% of the unpaid tax amount. In case of deliberate distortion, the fine is 40% of the untransferred tax amount (Article 122 of the Tax Code of the Russian Federation). In addition to the fine, the tax itself and penalties for late payment will be charged.

If you discover an error on your own, you can avoid a fine - just pay additional tax and penalties, and then submit an updated declaration.

Reporting

Individual entrepreneurs, in simplified terms, are exempt from a huge number of accounting reports. It is enough to correctly calculate income under the regime at a rate of 6% and income/expenses at a tax rate of 15% and 1% for exceeding 300 thousand rubles.

Individual entrepreneur on the simplified tax system without hired personnel

In the simplified version, without employees, only one report is submitted - the annual single tax return. It sums up the results of the past period, namely: income is declared, and, if required by the taxation regime, then expenses.

The form of the annual declaration for the simplified tax system “income” and “income minus expenses” is the same. The reporting deadline is the end of April of the following reporting period. If the date falls on a weekend, the submission of the declaration is postponed to the first working day.

Each entrepreneur, in order to reduce the likelihood of unnecessary questions from Federal Tax Service employees, should develop a register form and approve it in the accounting policy of the enterprise. This is an important document, since the annual declaration is filled out based on the information on expenses and income given in it.

Individual entrepreneur on the simplified tax system with hired staff

For individual entrepreneurs who use hired labor, accounting becomes much more complicated. In addition to the annual declaration, it is necessary to maintain personnel documentation, calculate salaries, calculate insurance premiums for individual entrepreneurs and employees, withhold personal income tax, and also submit many reports.

Reporting on hired employees:

- The calculation of the amount of insurance contributions (pension, medical, temporary disability and maternity) is submitted to the tax office

- 4-FSS is provided to the Federal Social Security. service and is filled based on emergency situations during the workday that resulted in injury to an employee

- SZV-Stazh and SZV-M are submitted to the Pension Fund. Reflects information about employees who have received a pension and personal information about insured employees

- 6-NDFL includes information on the timing and amounts of income tax payment for all personnel in general. For rent at the Federal Tax Service

- 2-NDFL is submitted to the Federal Tax Service and is compiled on the basis of the amount of personal income tax paid for the year for each individual employee

You can get acquainted with the deadlines for paying taxes and submitting reports for individual entrepreneurs to the simplified tax system with hired employees using the tax calendar, regularly published on the official website of the Federal Tax Service.

Rules for submitting an annual declaration to the simplified tax system

There are several ways to submit a declaration to the Federal Tax Service:

- In person at the tax office

- By power of attorney, notarized

- Via the official website of the Federal Tax Service

- By registered mail via Russian Post

The procedure for calculating the single tax on the simplified tax system “income minus expenses” at a rate of 15%.

During the reporting year, the businessman received revenue in the amount of 17 million rubles, expenses accounted for 15 million rubles

The tax base is 2 million rubles. (17 million - 15 million).

The amount of the obligation payable to the budget is 300 thousand rubles. (2 thousand rubles x 0.15 (15%)).

We calculate the amount of the minimum tax (17 million x 0.01 (1%)) = 170 thousand rubles. You need to pay 300 thousand rubles, since the amount of the minimum tax is lower than the calculation of the tax liability.

An entrepreneur who has chosen the “income minus expenses” object on the simplified tax system does not have the right to pay less than 1% of the income received to the budget, even if the amount of the calculated liability is less.