The general tax system for individual entrepreneurs provides that income received by individual entrepreneurs from business activities is subject to personal income tax at a rate of 13%. In this case, the tax is calculated from the amount of income of the individual entrepreneur, reduced by expenses (if there are documents confirming them) or by a professional tax deduction in the amount of 20% of the amount of income (clause 1 of Article 221, clause 1 of clause 1 of Article 227 of the Tax Code of the Russian Federation ).

Let's explain with an example. Let’s say that an individual entrepreneur on OSNO received income in the amount of 820,000 rubles for the year. At the same time, his expenses amounted to 400,000 rubles. Then the tax base will be 420,000 rubles. (820,000 rubles - 400,000 rubles), and the personal income tax amount is 54,600 rubles. (RUB 420,000 x 13%).

If he does not have documents confirming his expenses, then he will be able to reduce his income only by 20% standard. And he will have to pay 85,280 rubles to the budget. ((RUB 820,000 - 20% x RUB 820,000) x 13%).

With this procedure for calculating tax, it is clear why the responsibility for maintaining a book of income and expenses (KUDiR) is assigned to individual entrepreneurs on OSNO (clause 2 of article 54 of the Tax Code of the Russian Federation, paragraphs 2, 4 of the Procedure for accounting for income and expenses for individual entrepreneurs, approved by the Order Ministry of Finance No. 86n, MNS No. BG-3-04/430 dated 08/13/2002).

Advance payments of individual entrepreneurs under the general taxation regime in 2017

The entrepreneur must transfer personal income tax to the budget at the end of the calendar year. And during this year he must pay advance payments. Their amount is determined by tax authorities, but based on the information provided by the individual entrepreneur.

If you have just started operating as an individual entrepreneur under the general tax regime, then after a month from the date of receiving your first income, within 5 working days (clause 7 of Article 227 of the Tax Code of the Russian Federation) you must submit to the Federal Tax Service a declaration on the expected income of an individual in the form 4-NDFL (approved by Order of the Federal Tax Service of Russia dated December 27, 2010 No. ММВ-7-3/). In accordance with the data specified in it, controllers will determine the amount of advance payments and issue you tax notices.

The procedure for paying advance payments is as follows (clause 9 of Article 227 of the Tax Code of the Russian Federation):

- for January - June, half of the annual amount of advance payments is paid no later than July 15 of the current year;

- for July - September 1/4 of the annual payment amount is paid no later than October 15 of the current year;

- for October - December, 1/4 of the annual payment amount is also paid no later than January 15 of the following year.

Starting from the second year of work (and beyond), tax authorities will determine the amount of advance payments based on the income actually received by the individual entrepreneur for the previous year (Letter of the Federal Tax Service of the Russian Federation dated April 25, 2008 No. ШС-6-3/).

If during the course of business activities it becomes clear that the individual entrepreneur has greatly underestimated or overestimated the amount of expected income in 4-NDFL - by more than 50%, then he must re-submit the declaration to the Federal Tax Service. Then the tax authorities will recalculate the amounts of advance payments for unfulfilled payment deadlines (clause 10 of Article 227 of the Tax Code of the Russian Federation).

As noted above, the amount of personal income tax at the end of the year is determined based on the income actually received by the entrepreneur, and not the expected one. And of course, taking into account the advance payments paid by him, i.e. the amount of tax is reduced by them (clause 3 of Article 227 of the Tax Code of the Russian Federation). The amount of tax to be paid additionally will have to be transferred to the budget no later than July 15 of the year following the previous one (

If a businessman operates under the general taxation system, he should know the specifics of calculating personal income tax for individual entrepreneurs on OSNO.

If a Russian citizen is going to become an individual entrepreneur, he needs to decide in advance which tax system he will use. A lot here depends on what type of entrepreneurial activity is planned as a business. For some types of work and services, it is possible to use such convenient and beneficial tax regimes as UTII, patent and simplified tax regime. However, they also have one undeniable drawback, namely restrictions on the type of activity, the number of employees and the amount of annual revenue. If an individual entrepreneur does not fall into the acceptable category, he has no choice but to use OSNO, that is, the general taxation regime.

Moreover, it is this system that is installed by default in cases where the entrepreneur did not indicate the desired mode during registration. If a businessman loses his right to use a patent or another convenient system during the tax period, the individual entrepreneur automatically switches to the general personal income tax tax system.

Most entrepreneurs do not like this tax system. And there are many reasons for this. The first of them can be called very complex reporting to regulatory authorities and a large number of different taxes that must not only be paid on time, but also calculated correctly. Otherwise, you may receive a hefty fine. However, some entrepreneurs simply have no other choice, so they have to take advantage of all the pros and cons of OSNO.

All rules regarding the payment of personal income tax by individual entrepreneurs on OSNO are reflected in Russian tax legislation, namely in Articles 23 and 227. Often the most problems arise with taxes on personal income, that is, with the calculation and payment of personal income tax.

Procedure for accounting for individual entrepreneur expenses

There are 3 conditions under which an individual entrepreneur can take into account expenses to calculate personal income tax. Expenses should be:

- paid;

- used in the professional activities of individual entrepreneurs;

- confirmed by documents (invoices, acts, invoices).

If for some reason an entrepreneur cannot provide documentary evidence of his expenses, then in this case he can take advantage of a professional deduction in the amount of 20% of the amount of income received.

However, it is impossible to take into account both documented expenses and the 20% standard.

IP expenses have recognition criteria, which are reflected in the Procedure for accounting for income and expenses and business transactions for individual entrepreneurs adopted by the Ministry of Finance of Russia (order No. 86n dated August 13, 2002):

1. There is a connection between the income and expenses of an individual entrepreneur.

2. Expenses for the purchase of raw materials, materials, goods are recognized for taxation after their actual payment. The moment of their accounting is not related to the date of receipt of income from the sale of goods (work, services), for the production (fulfillment, provision) of which these expenses were incurred (see decision of the Supreme Court of the Russian Federation of June 19, 2017 No. AKPI17-283, decision of the Supreme Arbitration Court of the Russian Federation No. VAS-9939/10).

3. Amounts of accrued depreciation can be included in professional deductions only for property and results of intellectual activity owned by the individual entrepreneur and used by him in carrying out business activities. Even if the property is jointly owned by spouses, one of whom is an individual entrepreneur, accrued depreciation can also be used to reduce the income of an individual entrepreneur (letter of the Ministry of Finance of Russia dated December 7, 2012 No. 03-04-05/3-1377).

4. If the work is seasonal, it is also necessary to observe the principle of linking income received and expenses incurred.

An individual entrepreneur is exempt from the obligation to maintain accounting records, however, when accounting for expenses for remuneration of employees, an individual entrepreneur can also include in professional deductions the costs of remunerating an accountant, since, according to clause 23 of the procedure for accounting for income and expenses, an individual entrepreneur can reduce his income by any accruals by wages for employees who work under employment contracts.

How can an individual entrepreneur applying the general tax regime take into account the costs of acquiring fixed assets? The answer to this question was given by 1st Class Advisor to the State Civil Service of the Russian Federation D. A. Morozov. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

If an individual entrepreneur applies several tax regimes, for example OSNO and UTII, then he must keep separate records of income and expenses for these regimes. An individual entrepreneur can include as expenses for calculating personal income tax only documented expenses associated with the general taxation regime.

Read about the specifics of paying personal income tax when applying tax regimes available to individual entrepreneurs in the article “Should individual entrepreneurs pay personal income tax (cases and nuances)?”

What income is taxed under the general system?

The base value taken when calculating the personal income tax of individual entrepreneurs on OSNO is any profit received through commercial activities. When making calculations, you need to take into account a certain tax period. The amount of income must include proceeds from goods sold, as well as funds that were identified as surplus during the inventory. The latter, in any case, without exception, must be registered, that is, capitalized.

Income is recorded for the day on which it was actually received by the entrepreneur. This applies to receipts in cash, payments in kind, and receipts to the account of an individual entrepreneur or a trustee. Many entrepreneurs do not know how to deal with advances correctly. If the buyer made an advance payment, it must be recorded on the day of receipt, since this money should become part of the base for calculating the tax.

The entrepreneur must remember the need to enter the most accurate information in the accounting journals. For those who use OSNO, this is especially important, since any miscalculations can result in serious trouble, including large fines.

Return to contents

When are advance payments made?

Before submitting reports for the year, the individual entrepreneur is required to make advance payments in the following periods:

- From January 15 to July 15 for the half year;

- By September 15 for the period July-September;

- A quarter of the annual advance payment is due by January 15th.

4-NDFL for individual entrepreneurs on OSNO - deadlines, rules for filling out the form

The amounts of these advance payments are calculated independently by the tax agent and included in the notifications that are received by the individual entrepreneur. And according to this notification, payments must be made. If the notification does not arrive within the prescribed period, you must contact a tax agent.

The calculation is made on the basis of 4-personal income tax, if the individual entrepreneur had no profit last year (usually the first 2 years of the individual entrepreneur’s existence), or based on the results of the previous reporting year. The calculation mainly involves calculating the expected income in the current reporting year.

Note! In 2020, the procedure for making advance payments will be changed. You can view the changes on the Kontur Extern website and on the Federal Tax Service website.

Tax deductions

Despite the fact that most individual businessmen do not like the general tax regime, it still has certain advantages. We are talking about tax deductions that can significantly reduce the tax base and, accordingly, save the entrepreneur a lot of money. Types of tax deductions are divided into 4 groups, namely: standard, social, property and professional. The first 3 are calculated in the same way as this process occurs with individuals working for hire. There is nothing complicated about this, and everything is done according to a standard scheme known to every accountant.

As for the professional deduction, this item is the actual expenses that an individual entrepreneur incurred in a certain tax period. Information about them must be documented. The rules for tax deductions for individual businessmen are regulated by Russian tax legislation, namely Art. 252.

Regardless of whether an entrepreneur has employees or not, he is required to submit 2 types of reports to regulatory authorities, we are talking about the third and fourth forms of personal income tax.

There is a second form, but it is only necessary for those individual entrepreneurs who work with hired employees. This document should reflect information regarding the wages of employees and other persons who received payments without income tax from a specific individual entrepreneur.

Return to contents

How are the expenses of an individual entrepreneur taken into account?

There are certain conditions that must be met in order for expenses to be taken into account when calculating personal income tax. The conditions are:

- Expenses must be paid in full;

- Expenses are associated only with the professional activities of an individual entrepreneur;

- There must be supporting documents, such as invoices, acts, invoices, etc.

There are cases when an entrepreneur cannot document his expenses, then he can take advantage of a professional deduction in the amount of 20% of the amount of income received.

Important!!! Documentary evidence and the 20% professional deduction cannot be taken into account at the same time.

According to Order of the Ministry of Finance dated August 13, 2002 No. 86n, expenses of an individual entrepreneur can be recognized under the following conditions:

| Recognition criterion | Description |

| Relationship between income and expenses | expenses can be taken into account as deductions for personal income tax only during the period of receipt of income with their help or subsequently |

| Expenses for the purchase of raw materials, materials, goods | These expenses can be included in the professional deduction only when they are written off for production, sales, etc. |

| Depreciation amounts | Amounts of depreciation can be taken into account as a professional deduction only when the property of an individual that is used in business activities must be owned. |

| Seasonal expenses | If the entrepreneur’s activities are seasonal, it is also necessary to observe the principle of the connection between expenses received and income. |

Form 3 personal income tax and its completion

This document is a declaration in which taxes on the income of individuals will be specified. The tax base for a specific period should be fully reflected here. In this case, we are talking not only about the profit that was received by the businessman from his commercial activities, but also about the expenses of the individual entrepreneur on OSNO for personal income tax.

The entrepreneur must remember that this document is very important, so it must be filled out with the utmost responsibility. It is also necessary to calculate everything correctly in order to enter correct income data into the form. The document must be submitted once per reporting period, that is, per year. Delivery times are limited. 3NDFL must be submitted to the tax office no later than May 1 of the year following the reporting year.

As for how to calculate personal income tax for individual entrepreneurs on OSNO, this can be done using data from the accounting book, where all profits received in the reporting period and subject to taxation should be recorded. Next, all tax deductions are taken into account. Professionals are no exception. The resulting difference will be the tax base from which the individual businessman is obliged to pay the amount of money to the state treasury. According to the law, the interest rate of taxes on personal income is 13%.

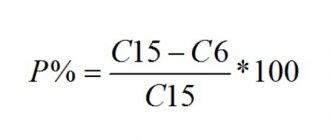

(Total profit - tax deductions) * 13% = Personal income tax for individual entrepreneurs on OSNO

If a situation arises that the amount of tax deductions is less than the total profit, the tax base is recognized as zero. Accordingly, you will not have to pay taxes for this reporting period. You cannot transfer your loss to another year, since everything is reset to zero from the beginning of the tax period.

In cases where a businessman did not conduct business throughout the reporting year, he is still required to provide the tax inspectorate with form 3NDFL, but with zero data. Only lines containing general information about the entrepreneur are filled in. In this case you do not need to pay anything.

As was the case before, the financial burden for individual entrepreneurs paying taxes on OSNO in 2020 is quite heavy. But based on tax realities, starting a large-scale business project using any other tax system may be even more unprofitable.

Therefore, for many entrepreneurs, the most pressing question is: “how to save on taxes within the framework of OSNO?”, and not “which taxation system to choose?” This article will help you learn about the main taxes of individual entrepreneurs under the general regime, as well as the possibilities of optimizing payments to the treasury.

How is personal income tax calculated for individual entrepreneurs on OSNO in 2020?

The tax is calculated from the difference between the income and expenses of the entrepreneur (professional deductions). The rate is standard, as for all individuals - 13%.

Data on income and expenses are taken from the Income and Expense Book, where a businessman must record all income and expense transactions in chronological order. The KUDiR form and the procedure for accounting for income and expenses for individual entrepreneurs are given in Order of the Ministry of Finance of Russia No. 86n , Ministry of Taxes of Russia No. BG-3-04/430 dated 08/13/2002 . Not all points from this order need to be applied; more on that below.

What is income

This is all income from business activities: revenue from the sale of goods and services, interest received on loans and borrowings, fines and penalties from buyers, and other income.

Before determining income, you need to “clear” it of VAT. How to calculate income is stated in Article 223 of the Tax Code of the Russian Federation . The day of receipt of income is considered the day when the money arrived in the entrepreneur’s account (cash method). An advance received, for which there has not yet been a shipment, is also considered income.

is not subject to personal income tax ; it is given in Article 217 of the Tax Code of the Russian Federation.

Tax deductions

Income can be reduced by deductions: professional, standard, property and social.

Professional deductions ( clause 1 of Article 221 of the Tax Code of the Russian Federation ) are expenses of an entrepreneur that are associated with making a profit, excluding VAT. These are expenses for raw materials, materials, rent, wages, insurance premiums for yourself and employees, taxes paid (except for personal income tax and VAT), etc.

Clause 22 of the Procedure for Accounting for Income and Expenses, approved by Order No. 86n of the Ministry of Finance of Russia, states that material expenses of an individual entrepreneur can only be written off as expenses in terms of goods sold, work performed and services rendered. The Supreme Court, by decision dated 1 June 9, 2017 No. AKPI17-283, declared this clause invalid . The condition from paragraph 22 contradicts the rule established by Article 273 of the Tax Code of the Russian Federation , and therefore is not mandatory. Material costs can be taken into account as expenses immediately after payment, and raw materials and materials are taken into account as expenses as they are written off for production. But there is always a risk that the tax authorities will find fault if the individual entrepreneur deviates from the Order, although the court will certainly be on his side.

To take expenses into account when calculating tax, they must be:

- paid;

- used in business activities;

- documented. If there are no documents, the purchase cannot be included in expenses.

You can do it differently - reduce income by 20% , and count from the resulting amount. This is also a professional deduction; it is prescribed in Article 227 of the Tax Code of the Russian Federation . In this case , no supporting documents are needed That is, the individual entrepreneur chooses one thing - reduces income either by expenses or by 20%. The second option is beneficial if there are no supporting documents, or expenses were less than 20% of income.

Calculation example:

At the end of the year, the individual entrepreneur received 4,200,000 rubles in income.

The entrepreneur spent a total of 3,100,000 rubles on raw materials, rent, labor, insurance premiums and taxes, and there are supporting documents for everything.

The entrepreneur spent 20 thousand on treatment, he also has documents.

(4,200,000 - 30) x 13% = 140,400 rub.

We have described the procedure for calculating tax at the end of the year. But during the year, the individual entrepreneur must also pay advance payments for this tax, and at the end of the year they pay the tax after deducting these payments. We'll tell you how they are counted and paid.

Advance payments for personal income tax for individual entrepreneurs on OSNO

In 2020, they are still counted by the tax office, and the entrepreneur receives a notification from it and pays the amounts indicated in it. When the year ends, he himself calculates the tax on actual income, subtracts the advances already transferred from it, and pays the difference, if any.

How do tax authorities calculate advance amounts?

When an individual entrepreneur starts operating on the general taxation system, after receiving the first income, he must send a 4-NDFL declaration with the expected income to the tax office (within five days after the expiration of a month after receiving the first income). Based on these amounts, tax authorities must calculate the amount of the advance payment.

If an individual entrepreneur has been working for more than a year and has already submitted the 3-NDFL declaration based on the results of last year, he no longer needs . Tax authorities will calculate advances based on the indicators of last year’s 3-NDFL declaration.

Calculation of advance payments for personal income tax for individual entrepreneurs on OSNO, example:

The 4-NDFL or 3-NDFL declaration for 2020 indicates an income of 1,500,000 rubles. The tax authorities calculated the amount of advances for the coming year and sent them to the individual entrepreneur. In total, he must pay 195,000 rubles in 2020:

- 50% of the payment, that is, 97,500 rubles until July 15, 2019;

- 25%, that is, 48,750 rubles until October 15, 2020;

- 25%, that is, 48,750 rubles until January 15, 2020.

When the year ends and the individual entrepreneur already knows exactly how much he earned in 2020, he will calculate 13% of the profit, deduct the advances already transferred and transfer the rest. If the difference is negative, then you do not need to pay anything extra, and the overpayment can either be returned to your account upon application, or offset against future tax.

But if during the year the entrepreneur’s income greatly increases or decreases, and the deviation from the amounts in the declarations is more than 50% , you need to submit another Form 4-NDFL with the new amount of estimated income. The tax authorities will recalculate the advances up or down and send the entrepreneur a new notification.

Where does IP start on OSNO?

At the time of registration of business activity with the Federal Tax Service, an entrepreneur, as a rule, already has his own business plan. The main goal of a businessman is to implement a project in the process of economic activity, which will allow him to receive systematic profit.

For the plan to work, an entrepreneur may need:

- capital;

- real estate objects;

- raw materials and materials;

- staff.

All of the above are the initial data for determining tax payments to the budget.

If, upon registration with the Federal Tax Service (or within 30 days from the date of receipt of the Certificate), the individual entrepreneur does not submit an application for the application of one of the special tax regimes to him, he automatically becomes a taxpayer under OSNO.

This means that from the first reporting period the individual entrepreneur needs to keep records and pay:

- Personal income tax is essentially an income tax;

- Personal income tax – withheld from employees’ salaries and transferred to the budget;

Most often, having learned about what taxes need to be paid on OSNO, individual entrepreneurs decide to hire a competent accountant who can coordinate all the intricacies of several tax bases, and thereby minimize the mandatory costs of doing business.

The World of Business website team recommends that all readers take the Lazy Investor Course, where you will learn how to put things in order in your personal finances and learn how to earn passive income. No enticements, only high-quality information from a practicing investor (from real estate to cryptocurrency). The first week of training is free! Registration for a free week of training

Maintaining a book of income and expenses

Income and expenses for the purposes of calculating the tax base are reflected in the Book of Accounting for Income and Expenses of Individual Entrepreneurs (KUDiR). The procedure for reflecting income and expenses has been approved (hereinafter referred to as Procedure No. 86n/BG-3-04/430). The KUDiR form is given in the appendix to this Procedure.

KUDiR is maintained on paper or electronically. When compiling a book in electronic form, at the end of the year, individual entrepreneurs are required to print it (clause 7).

KUDiR must be numbered and laced. The last sheet indicates the number of pages it contains, the entry is certified by the signature of a tax authority official and sealed. If KUDiR is maintained on paper, it must be certified by the tax authority before it begins to be maintained. A printed book from an electronic source is certified at the end of the tax period (clause 8 of Order No. 86n/BG-3-04/430).

Correction of errors in KUDiR should be justified and confirmed by the signature of the individual entrepreneur indicating the date of correction.

KUDiR includes information about the individual entrepreneur, the contents of the book and six sections. There are different tables and sections for different types of activities. The first sheet of the book, which contains information about the individual entrepreneur, must be completely filled out. Tax authorities require a complete reflection of all income and expense transactions.

The income of an individual entrepreneur takes into account all receipts from the sale of goods, performance of work and provision of services, as well as the value of property received free of charge.

Income from the sale of fixed assets and intangible assets is determined as the difference between the sales price and their residual value.

Expenses are understood as actually incurred and documented costs directly related to the generation of income.

Expenses directly related to generating income from business activities are divided into:

- material costs;

- labor costs;

- depreciation deductions;

- other expenses.

The features of reflecting expenses are explained in sections IV-XI of Order No. 86n/BG-3-04/430.

Entrepreneurs must store primary documents and KUDiR for 4 years (clause 48 of Order No. 86n/BG-3-04/430).

Book of income and expenses

Personal income tax payment and savings opportunities

As part of individual entrepreneurship, personal income tax is paid in two cases:

- as income tax for individual entrepreneurs located on OSNO;

- in order to tax income paid to employees.

Despite the fact that in the two indicated cases the same rate is paid - 13%, the calculation of these mandatory payments is fundamentally different.

Personal income tax as an income tax

The basic rule for optimizing personal income tax for individual entrepreneurs is maintaining a favorable ratio between income from business activities (all receipts to the current account or cash register of the enterprise) and the costs of doing business (costs of production, sales, plus non-operating costs determined by law).

With a reasonable balance of income and expenses, the amount of personal income tax can be minimized.

To confirm this, we provide a generalized scheme for calculating personal income tax:

(Total income - total expense) x 13%.

The difference indicated in brackets will be taxable profit.

In tax practice, expenses associated with business activities are usually called professional deductions.

Important! When determining the taxable base, only those expenses are taken into account that the individual entrepreneur can document. If a businessman does not have such an opportunity, tax legislation allows one to reduce income by a certain cost standard equal to 20%.

Personal income tax if there are employees

Procedure for calculating VAT

An entrepreneur using the general regime keeps records of all transactions during which goods, materials, raw materials or fixed assets owned by the individual entrepreneur are sold or otherwise disposed of.

At the same time, 18% of the total sales value is the amount that the individual entrepreneur must transfer to the budget (VAT accrual).

However, this payment can be reduced if in the reporting period the individual entrepreneur himself purchased goods necessary for conducting business activities from other payers of value added tax. 18% of their cost is VAT credited.

The difference between the amount of VAT to be accrued and to be offset is subject to payment to the budget.

Thus, the more individual entrepreneurs buy products from VAT payers, the lower their obligations to pay their own value added tax become.

What expenses reduce personal income tax from the activities of individual entrepreneurs?

According to paragraph 2 of Art.

54 of the Tax Code of the Russian Federation, individual entrepreneurs keep records of expenses in the manner determined by the Ministry of Finance of Russia. The expenses that an individual entrepreneur makes as a result of his business activities are called professional deductions for the purposes of calculating personal income tax (Article 221 of the Tax Code of the Russian Federation).

In accordance with paragraph 1 of Art. 221 of the Tax Code of the Russian Federation, the composition of the expenses of individual entrepreneurs is determined by Ch. 25 of the Tax Code of the Russian Federation, i.e. these include:

- Material costs.

- Labor costs.

- Depreciation.

- Other expenses related to business activities.

- Amounts of insurance contributions for pension and social insurance.

- Amounts of taxes, excluding personal income tax and VAT.

The taxes that are included in the professional deductions of individual entrepreneurs also include fixed contributions for compulsory health insurance and compulsory medical insurance.

Property tax for individuals is included in deductions if the property is used in business activities.

For information on calculating property tax for individuals, read the material “How is the property tax for individuals calculated?”

When does an individual entrepreneur need to pay property tax?

Real estate – buildings, structures, premises. Economic activity cannot be carried out without the use of these facilities.

The property tax rate can also vary (from 0.1% to 2% inclusive). Its value varies depending on the inventory value of the property. Real estate is assessed by cadastral workers, and often the price they indicate does not differ from the market price.

There are practically no opportunities to minimize this particular tax. However, amounts paid towards obligations to the state for real estate will be counted as expenses of business activities and, accordingly, the net profit of the individual entrepreneur, and, consequently, personal income tax, will decrease by the amount of this tax.

Perspective

It is obvious that the general taxation system for individual entrepreneurs provides greater opportunities compared to special regimes. This is an opportunity to regulate the amount of mandatory payments, and the further development of promising areas in business. But we must not forget that OSNO at an enterprise should always be under the supervision of specialists. Otherwise, it will be difficult for individual entrepreneurs to avoid administrative pressure from bodies that control accounting and

What taxes does an individual entrepreneur on OSNO pay? This question interests many citizens who want to try themselves in business. After all, in Russia there are different ones. Each has its own advantages and disadvantages. In addition, taxes require mandatory declaration. Their frequency, as well as the number of reports, also depend on the system you choose. So what taxes does an individual entrepreneur pay on OSNO? And how often? More on all this later.

General system

But first, let’s find out whether this system is worth choosing? It’s not just that many entrepreneurs are simply trying to switch to the simplified tax system! Especially if they don’t have any employees or any special expenses.

The point is that the general taxation system includes a complete list of possible payments that an individual entrepreneur must pay. This means that it is quite logical to believe that OSNO itself is quite complex. And this turns many people off. However, this option is considered mainly by entrepreneurs who are engaged in sales and build a business, for example, at the international level.

Please note that when opening IP OSNO is automatically activated. That is, if you did not indicate a special tax regime in your application when starting your business, you will work under the general system. This is both good and bad. If you decide that this option suits you, then you can think about what taxes the individual entrepreneur pays on OSNO. It's not that difficult to understand.

Property

So, the first payment, which is mandatory, is property tax. It is paid by everyone, regardless of the taxation system. This may include transport and land taxes. So get ready - you will need to submit reports to the tax authorities on the property you own. This is important considering that individual entrepreneurs themselves are responsible for their property if they have debts.

How often does an individual entrepreneur need to submit this type of reporting to OSNO? Quarterly. Although some believe that no declarations are needed. This is wrong. Moreover, we are talking about you will have to submit the corresponding declaration once a quarter before the 30th day of the last month in the reporting period.

True, there is one nuance. When it comes to land or transport tax, you will have to report once a year. And at the same time, penalties must be paid before February 1. There is nothing difficult in this situation. The main thing to remember is that once a quarter (by the end of the month) there is a report for property; individual entrepreneurs pay land and transport taxes by 1.02.

If there are employees

What's next? Often an individual entrepreneur has some employees. And, as you might guess, they will also have to report to the state. True, not too often. In most cases, declarations are annual. And you only need to deal with all this paperwork once a year.

The report for employees (2-NDFL) must be submitted by the end of the tax reporting period. Namely, until April 30 of each year following the report. That is, in 2013 you report for 2012, in 2014 - for 2013, and so on. There is nothing difficult about it. Although some individual entrepreneurs are exempt from this tax and reporting in general.

For myself

When exactly are 2-NDFL certificates not required from you? Then when you work on your own. An individual entrepreneur on OSNO without employees is a fairly common occurrence, but in this situation it is better to switch to the simplified tax system. If you remain on the general system, be prepared to file a zero 2-personal income tax return. It's not that difficult.

The most important is the 3-NDFL report for individual entrepreneurs on OSNO (and not only with the general system). This report should probably be submitted by all entrepreneurs, as well as individuals and organizations. This is done once a year.

It is not difficult to guess that you will have to meet the tax reporting period. More precisely, by April 30 of each year you must submit a completed declaration, but individual entrepreneurs can pay the taxes themselves a little later. Until when? Until July 15th of each year. Nevertheless, many are trying to completely get rid of their debts by April 30. This option is called advance payments. In principle, it’s very convenient - you report and forget about the debt.

Algorithm for calculating and paying personal income tax for individual entrepreneurs on OSNO

Note!

Since the beginning of 2020, the procedure for calculating personal income tax by entrepreneurs has changed. Previously, advance payments were calculated by specialists from the Federal Tax Service; now individual entrepreneurs must do this themselves.

Below is a step-by-step algorithm for calculating and paying personal income tax for individual entrepreneurs on the OSN, which was relevant until 2020:

- The individual entrepreneur received his first income of the year.

- Calculated the amount of estimated income for the whole year (minus expenses).

- Filled out and submitted the 4-NDFL declaration to the Federal Tax Service (with information about the expected income).

- I received notifications from the Federal Tax Service with the calculated amounts of advances for the payment of personal income tax.

- Paid advance payments on time (specified in notifications).

- At the end of the year, I compiled and submitted the 3-NDFL declaration.

- Paid or returned the tax calculated according to the 3-NDFL declaration.

Pension Fund and Social Insurance Fund

What taxes does an individual entrepreneur on OSNO pay in addition to those already listed? For example, like any organization, as well as a citizen who is officially employed, you must pay fixed contributions to the Pension Fund and Social Insurance Fund. These are the ones you can’t hide from. No one at all.

At the same time, the individual entrepreneur pays taxes (or rather, makes the corresponding report and makes payments) once a quarter. It can be difficult to calculate exact amounts because a lot depends on your income. Although there are fixed payments. They change and grow every year. It is advisable to submit such a report before the 25th of each quarter.

Accounting for expenses and income

What else is required from an individual entrepreneur who has decided to choose a general taxation system? Payments do not end with all of the above. Zero reporting by individual entrepreneurs on OSNO, as we have already seen, also occurs. But in addition to this, once a year you will have to present a special book of expenses and income to the tax office. It is absent, as a rule, under the simplified tax system, when an entrepreneur works alone and does not have any expenses. Only profit.

When should this book be submitted for reporting? It is easy to guess that many annual payments must be declared at the end of the tax reporting period. So this red tape will burden you until April 30 of each year. In principle, it is very convenient. After all, as you can see, many reports must be completed and submitted to the appropriate authorities at this very moment. This means you can literally get rid of all your problems in one go. Nothing difficult, right?

Personal income tax reporting for individual entrepreneurs in 2020

Declaration 3-NDFL is submitted once a year until April 30. If this day falls on a weekend, it is moved to the next working day.

Declaration 3-NDFL for 2020 must be submitted to the tax authority before April 30, 2020

.

Declaration 3-NDFL for 2020 must be submitted to the tax authority before April 30, 2021

.

Information in the 3-NDFL declaration is entered in accordance with the KUDiR (book of income, expenses and business transactions), which individual entrepreneurs are required to maintain under the general taxation regime.

More details about the 3-NFDL declaration.

VAT

Perhaps one of the reasons to remain on the general taxation system is the presence of VAT on purchases and profit making by an entrepreneur. If you come across this term, it’s not in vain that you chose OSNO. The thing is that entrepreneurs have a VAT tax. It is mandatory, like all the others.

True, reporting in this case will force you to try hard. Why? VAT tax is declared, as a rule, once a quarter. According to modern legislation, entrepreneurs are required to prepare a full report by the 25th of the last month. This sometimes makes you waste a lot of time and effort. So be prepared. It turns out that you will have to submit a VAT report to the tax office 4 times during the year. Not that much actually. Although, if you consider that entrepreneurs already have enough paperwork, then even one additional report can bring a lot of inconvenience.

How are the income of an entrepreneur determined on the general system?

The income of a private entrepreneur under the general taxation system is determined very simply. Income is revenue in monetary and non-monetary form, i.e. all amounts of funds received to the bank account or cash register of the entrepreneur as payment for goods sold, work performed or services rendered.

To put it simply, an entrepreneur’s income is determined using the cash method. That is, until the entrepreneur receives money into the account or cash register, he has no income. If an entrepreneur has not yet sold goods or provided services, but has already received money, that is, received an advance, then such amounts are included in income. For private entrepreneurs who pay value added tax, income does not include the amount of VAT included in the price of goods sold.

First income

What taxes does an individual entrepreneur on OSNO pay? In addition to the options already listed, you will need to declare your first income. To do this, you will have to draw up a 4-NDFL report. It is served once in principle. But if your profit decreases or increases by 50% over the year, you will have to draw up this report again.

By what date must the declaration be made? You need to hurry up here. After all, the 4-NDFL certificate must be submitted to the tax service before the 5th day of the month following the one in which you received your first income. In principle, there is nothing special about this. Just a report for the first profit. In practice, it is usually not necessary to re-submit 4-NDFL, only as a last resort, which is rare.

General requirements for registration of KUDiR for individual entrepreneurs on OSNO

In general, an individual entrepreneur maintains standard tax accounting under the general regime. However, when registering and maintaining an accounting book, the entrepreneur must take into account that:

- KUDiR is based on chronological order, making entries monthly, cumulatively, and so on from the beginning to the end of the current year.

- Household transactions are registered in it in fact in a positional manner according to primary documentation for a specific tax period.

- Completed and registered household chores. transactions can and should be confirmed by specific primary documents drawn up in the required form.

- When recording transactions for the purchase of any product, among other things, it is necessary to attach a document certifying its payment (checks, payment slips, strict reporting documents).

- All cost indicators are recorded in Russian rubles. Therefore, the foreign currency is subject to recalculation at the rate of the Central Bank of the Russian Federation on the date of receipt of actual income or actual expenses.

- Accounting for income, expenses, and related household expenses. operations using KUDiR should be carried out constantly, in full. The presence of inaccurate, unreliable indicators must not be allowed, since they are used when calculating the tax base.

- Accounting is carried out using the cash method. That is, simply put, if the goods are shipped, but the money does not arrive in the individual entrepreneur’s account, then the income is not shown in the accounting book. The same goes for spending. Reason: Art. 251 Tax Code of the Russian Federation.

- “Unclaimed” amounts that were returned to partners reduce the tax base and are also entered into the KUDiR, but with a negative indicator.

- All expenses that are subject to accounting must be justified and recorded in proper documents. If expenses do not lead to income, then they do not need to be displayed in the accounting book.

- Individual entrepreneurs working in the field of education, healthcare, as well as in the field of sports and culture, when filling out the KUDiR, must record in it the personal data of the individual to whom they provide services (i.e. full name, address, TIN, passport details).

This is the main list of requirements that individual entrepreneurs on OSNO should adhere to when creating tax accounting. As for the design of KUDiR, then, as is customary, it should initially be numbered and laced. At the end of the book you need to indicate the total number of pages. Next, it must be certified by an authorized employee of the Federal Tax Service, affixing his signature and seal. Only after this you can make the first entries in it.

What may be required

Well, we've sorted out possible reports and taxes. But what to do next now? What documents can be useful when drawing up reports? The list of them is varied, it can be extremely difficult to decide. You can prepare for any occasion:

- details of the individual entrepreneur (entrepreneur’s passport);

- information about employees (if any, their passport details);

- income certificates (checks, contracts, etc.);

- documents on expenses (any);

- certificates of ownership;

- PTS (for transport tax);

In principle, this is usually enough. Once the list of documents is ready, prepare reports within the specified time frame. It’s better to do this using a computer - all the fields required to be filled out are labeled in simple language, which helps you quickly get through the process. In addition, after you enter all the necessary data, the declaration will be generated automatically. All that remains is to submit it to the tax office.

As you can see, individual entrepreneurs pay quite a lot of taxes on OSNO. And there is more than enough paperwork here. After all, this is a complete list of possible payments. Therefore, many try to work according to the simplified tax system. As already mentioned, this is simply an excellent option for those who operate alone. With the “simplified” system, you must report your income once a year, and once a quarter you must make contributions to the Social Insurance Fund and the Pension Fund.

Taxation in the Russian Federation is carried out on the basis of current legislation, primarily the Tax Code of the Russian Federation.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week

.

It's fast and FREE

!

Individual Entrepreneurs bear responsibility on an equal basis with legal entities, and the list of payments may differ depending on the chosen taxation system.

Unless the entrepreneur makes a different choice by submitting an application, after registration he will act according to the general procedure.

What to pay attention to

At the moment, any individual entrepreneur after registration can choose one of the following SN:

| (OSNO) | The tax burden is quite high, but there are no restrictions on types of activities. It is applied in a standard manner, but to switch to other systems, the will of the person is required |

| () | Significantly simplifies the reporting process and reduces the tax burden |

| Unified Agricultural Tax (USAT) | Special tax regime created specifically for agricultural enterprises |

| Unified tax on imputed income (UTII) | Available for selected activities only. Payment amount is fixed |

| Patent (PSN) | Also valid for certain types of activities, the list of which may differ depending on the region. Payment is made in advance, a fixed amount |

Set by default if the entrepreneur does not submit an application:

- Simultaneously with registration documents.

- Within thirty days from the date of registration as an individual entrepreneur.

If this is not done, the transition can only be made from the next calendar year.

The application is of a notification nature and can be submitted in any form, the main thing is that it contains all the required details and the clear will of the person to choose a specific SN.

When choosing, you should carefully consider your future activity, all its aspects and features. It is advisable to consult with an accountant to take into account possible profit margins and other factors.

The general system will be convenient in that initially the legislative norms describe situations that apply specifically to OSNO, while others can be specified in separate norms.

At the same time, the tax burden when applying OSNO will be high. Therefore, the choice will be obvious only when the use of another, more profitable one is unavailable due to the use of certain types of activities.

UTII and OSNO simultaneously in 2020

If an individual entrepreneur is engaged in several types of activities, it is possible to combine tax regimes. The types of activities listed in paragraph 3 of Article 346.29 of the Tax Code of the Russian Federation can be transferred to the payment of UTII. The transition to UTII exempts you from paying VAT, personal income tax and property tax in relation to income received from this type of activity.

Because of the differences in tax bases and tax rates, there is a need to maintain separate accounting. For each type of taxation, it is necessary to separately take into account income and expenses.

The method of maintaining separate accounting must be fixed in the Accounting Policy. Describe the procedure for accounting for income and expenses, the procedure for distributing general expenses. Particular attention should be paid to organizing separate VAT accounting. The accounting policy ensures reliable division of “input” VAT.

Amounts of VAT presented by sellers of goods (works, services), property rights to entrepreneurs applying simultaneously OSNO and UTII:

- are accepted for deduction from the budget, in terms of activities at OSNO;

- are included in the cost of goods (works, services), in terms of activities on UTII;

- for goods (works, services) that are used for all types of activities are distributed proportionally in accordance with clause 4 of Art. 170 Tax Code of the Russian Federation.

Key Features of General Mode

An entrepreneur on OSNO becomes obligated to pay a whole list of taxes. So, what taxes does an individual entrepreneur pay on OSNO? Their list is fixed by law:

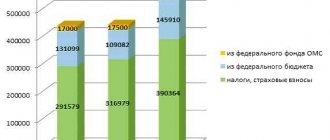

Moreover, any entrepreneur, regardless of the taxation system, has the obligation to make other payments.

We are talking about contributions to the Social Insurance Fund, the Pension Fund and medical ones. Their rate is fixed and does not depend on profit.

Income tax is calculated according to the general rule. That is, real profit is taken into account, and the person’s expenses are also taken into account.

You can start operating on a general CH under certain circumstances:

- The person does not meet the requirements for transition to another. This may be present initially or arise during the activity.

- A person needs to be registered as a VAT payer.

- The activity is characterized by the presence of benefits for the payment of income tax (for example, it relates to medical care).

- The individual entrepreneur initially does not know about the existence of other taxation systems or the procedure for switching to them.

The process of accounting and tax reporting becomes more complicated and the entrepreneur becomes a VAT payer.

This ultimately impacts consumers as the tax is considered indirect and ends up being included in the price of the product or service.

It is accrued under the following circumstances:

- Goods or services are sold on the territory of the Russian Federation.

- Goods are transferred and services are sold free of charge on the territory of the Russian Federation.

- Property rights are transferred within the country.

- Construction or installation work is carried out for own consumption.

- Goods are transferred for own consumption.

- Goods are imported into the domestic market.

For example, the head of a peasant farm (GKFH), when deciding to create such a farm, must take into account the features of not the general taxation system, but the unified agricultural tax and register properly with the Federal Tax Service.

Recognition of income and expenses for an entrepreneur on the general taxation system

The expenses and income of a private entrepreneur on the general taxation system are very closely interrelated. Without income there are no expenses. Let's consider the main situations when an entrepreneur must recognize his income and, accordingly, when he has the right to include expenses as gross.

We bought a product, paid money, sold the product, received money - there is income, there are expenses. Everything is simple here. When an entrepreneur receives money for a product, he has income. Only after this do expenses arise, even if the goods were purchased a long time ago and the entrepreneur paid for it in full.

We received the goods, did not pay money for it, sold the goods, received money for it - there is income, but no expenses. Individual entrepreneurs generate income on the general system when they receive funds. But he has no expenses, since the funds for the goods have not yet been transferred to the supplier. Expenses can be included in gross expenses only after final settlements with the supplier.

We sold the goods, did not receive any money - no income, no expenses. Income does not arise because the entrepreneur did not receive proceeds from the sale of goods to the current account or to the cash register. There are no expenses because there is no income.

We received the goods and paid for it, received an advance payment - there is income, there are expenses.

We received the goods, but have not yet paid for it, we received an advance payment - there is income, there are no expenses. Expenses will arise only when an individual entrepreneur pays the supplier for the goods.

We have received an advance payment, but have not received the goods yet - there is income, no expenses.

We made an advance payment for the goods, received an advance payment for the goods (there was no movement of goods) - there is income, there are no expenses. We recognize income using the cash method. But the entrepreneur will not be able to include expenses as gross expenses, since the goods were not actually received. And according to clause 139.1.3 of the Tax Code of Ukraine, amounts of preliminary (advance) payment for goods, works, and services are not included in gross expenses.

5 (100%) 1 vote

Presentation of class hour on the topic: “Magic words

08.10.2020

From the history of the holiday Christmas is a holiday that in many countries has given rise to a large number of symbols and traditions

08.10.2020

Celebrating Maslenitsa in Rus', presentation for a lesson on the topic

08.10.2020

What kind of reporting is submitted (table)

The accounting and tax reporting system when using OSNO is quite complex compared to others.

An entrepreneur will need to submit the following types of reports independently or with the help of a specialist accountant:

| — | Subject to availability of employees | In their absence |

| To the tax service | VAT declaration. Served once per quarter. Declaration 4-NDFL at the beginning of your activity or no later than a month after an increase or decrease in income by half. Average number of employees. Submitted once per calendar year. 6-NDFL. Once a quarter. Certificates on 2-NDFL. Submitted once per calendar year. Calculation of insurance premiums. VAT declaration. Served once per quarter. Declaration 3-NDFL. Submitted once per calendar year. Declaration 4-NDFL at the beginning of your activity or no later than a month after an increase or decrease in income by half | |

| In the FSS | Application in form 4-FSS. Served once a quarter | — |

| To the Pension Fund | SZV-M. Served every month. SZV-STAGE. Every calendar year, upon retirement of an employee | — |

In the absence of employees, the number of reports is significantly reduced.

Without employees

If there are no employees, then the individual entrepreneur should not submit any reports to the Social Insurance Fund and the Pension Fund of the Russian Federation; he is exempt from this responsibility.

In addition, it submits fewer reports to the tax office. In this case, submission must be made only in electronic form. If a person’s profit in the reporting period is zero, then the VAT return will be zero.

With employees

If there are hired workers, the reporting situation becomes somewhat more complicated. A person now needs to submit additional types of documents to the tax service, the Social Security Fund and the Pension Fund.

Applications to the Pension Fund and the Social Insurance Fund are submitted specifically for the entrepreneur’s employees. It is logical that in their absence such reporting is not required.

The average headcount will be illogical if the entrepreneur works alone. If the profit amount is also zero, then the zero option is used when filing a VAT return. There will be no difference from a similar situation in the absence of employees.

IP on OSNO. Calculation of all taxes using an example.

Colleagues, good day! Help me sort out the deal from IP to OSNO Let’s say this is the situation! The individual entrepreneur works for OSN, without employees. The first income was received on 01/10/16. I provided the Federal Tax Service with a 4NDFL certificate on 02/10/16 indicating an estimated income of 300,000 rubles. (revenue 60,000,000 – expenses 59,700,000) Advance payments for personal income tax For 6 months before July 15, 2016 (300,000*13%*1/2) = 19,500 For 3 quarters until October 15, 2016 (300,000*13%*1/4) = 9750 For the 4th quarter until January 15, 2017 (300,000*13%*1/4) = 9750 TOTAL Income for the year from the bank 100,000,000 rubles. Revenue 100,000,000 including VAT, including 15,254,237 rubles. (RUR 84,745,762 revenue excluding VAT) Expenses only Purchase from a supplier with VAT RUR 95,500,000 incl. 14,567,797 (RUB 80,932,203 revenue excluding VAT) The bank received payment to the supplier with VAT 1,000,500 rubles including VAT. (without VAT 847,458 rubles) The remaining amount of 98,999,500 during the year was transferred to the individual entrepreneur card as an individual. persons and withdrawn as income of individual entrepreneurs.

Question about reporting. The individual entrepreneur only paid VAT during the year, according to the payment deadline, 686,440 rubles (157,797) and submitted VAT returns quarterly. Now, until December 31, 2016, you need to pay the Fixed contribution to the Pension Fund (insurance part) - 19,356.48 rubles. Fixed contribution of the Federal Compulsory Medical Insurance Fund - 3796.85 rubles.

Before 04/01/2017, you need to pay a contribution to the Pension Fund for the amount of income exceeding 300,000.00 - 99,700,000.00 *1% = 997,000. The maximum contribution for 2020 is 154,851.84 rubles.

Submit your 3-NDFL declaration by April 30. And pay personal income tax by July 15 842,203 = 3,813,559*13% = 495,763 rubles (minus 39,000 previously paid advance payments) Total pay 456,763 rubles. Or 98,999,500*13% = 12,869,935 rubles.

Tax burden 686,440 +19356.48 + 3796.85 + 154,851.84 + 495,763 = 1,360,208 rubles.

Tell me what's wrong? What is the tax burden? Are taxes calculated correctly? Do you need to submit any more reports?

Advantages and disadvantages

The general tax system, like all others, has a number of advantages and disadvantages. The positive points include:

However, we should not forget about some disadvantages:

- Accounting will be more complex than under other taxation systems. This results in the need to submit more reports and declarations.

- Some documents have additional storage requirements.

- The number of tax items has been increased upward.

- In some regions there are additional taxes for entrepreneurs using OSNO.

When choosing a taxation system for subsequent activities, you need to carefully evaluate the existing advantages and disadvantages and only then make a choice.

Video: important aspects