New rules for crediting and returning overpayments

From October 1, 2020, the provisions of Federal Law No. 325 of September 29, 2019 will come into force, which simplify the procedure for offset or refund of overpayments of taxes. Until October 1, tax authorities can redistribute overpaid taxes only within the budget of one type. Federal tax goes to the federal budget, regional tax goes to the regional budget, local tax goes to the local budget. For example, by overpaying VAT, a federal tax, you cannot pay off a debt on property tax, a local tax.

Starting from October, it will be possible to offset overpayments against future tax payments or pay off debts for another tax without reference to the budget level. For example, due to the income tax overpaid to the federal budget, it is possible to pay off arrears or a fine to the regional budget for transport tax or to the local budget for land tax.

If there is a tax debt to any budget - federal, regional or local - it is impossible to return the overpayment of taxes in money. The debtor, due to the overpayment, is obliged to first pay off his obligations for taxes, fines and penalties (Clause 6 of Article 78 of the Tax Code of the Russian Federation).

The rules for offset and refund of overpaid insurance premiums remain the same. For example, overpayment of pension insurance contributions cannot be “spread” onto social or health insurance contributions (clause 1.1 of Article 78 of the Tax Code).

How does overpayment of taxes occur?

Overpayment occurs due to errors either by the organization itself or by the tax authority.

Taxpayers themselves are wrong:

- when calculating tax. Accounting may make a mistake when calculating the tax base, applying the wrong tax rate, or not applying tax benefits and deductions;

- when filling out payment orders for the payment of taxes, penalties, and fines. Any error in the BCC or tax amount results in an overpayment for one tax and an underpayment for another.

Overpayment may occur due to advance payments. For example, a company transferred advances for income tax during the year, but at the end of the year the tax turned out to be less than the amount of the transferred advances. So the company overpaid income taxes.

Tax inspectors may mistakenly collect taxes twice. This occurs when a tax, fine or penalty is unilaterally written off from a current account. For example, the taxpayer has already transferred taxes, but the money has not yet reached the tax office. And the Federal Tax Service writes off the amounts without acceptance. Then there may be an overpayment.

Note! Overpayment of taxes must be recorded on the organization’s front card with the Federal Tax Service. If, for example, a company transferred taxes through a problem bank, but they did not go to the budget, it will not be possible to offset or return them.

The courts believe that recognition of the obligation to pay a tax as fulfilled does not give rise to the taxpayer’s automatic right to return or offset the amount of such tax.

They confirmed that the taxpayer does not have the right to compensate for his losses at the expense of the budget (Determination of the Supreme Court of the Russian Federation No. 307-KG18-10845 of August 8, 2020).

How to find out about an overpayment

Both the taxpayer himself and tax inspectors can find overpayments of taxes. You can order a reconciliation report from the tax office or check your transfers in your personal account on the Federal Tax Service website. Within five working days after submitting the documents, tax officials must issue a reconciliation report and send it to the taxpayer.

If the tax authorities were the first to discover the overpayment, they are obliged to notify the organization - within 10 working days they must send a written message and indicate the date the overpayment was discovered (clause 3 of Article 78 of the Tax Code of the Russian Federation). The date of discovery of the overpayment is the day when the inspector discovered the excess for a particular tax. Regardless of whether the tax inspectorate informed the taxpayer about the fact of an overpayment or not, the overpayment can be disposed of within three years from the date of occurrence.

Taxes to the budget for the taxpayer can be transferred by any other person - an organization, an entrepreneur or a citizen without the status of an individual entrepreneur (paragraph 4, paragraph 1, article 45 of the Tax Code). But only the taxpayer himself has the right to return the excess or offset the payment. Third parties cannot do this (paragraph 5, paragraph 1, article 45 of the Tax Code).

About paying tax before and after making a claim.

According to tax authorities, which is often found in practice, since the procedure for forced collection of a tax begins from the moment a demand for its payment is issued, the voluntary execution by the taxpayer of a decision to bring to tax liability before receiving the specified demand cannot be qualified as a collection. To these relations, if the inspection decision is subsequently recognized as invalid, Art. 78 of the Tax Code of the Russian Federation, regulating the refund of overpaid tax amounts.

However, the courts, as an analysis of arbitration practice shows, do not support such statements by the tax authority, noting: the amount that the taxpayer transferred to the budget on the basis of the tax authority’s demand for payment, which was subsequently recognized as illegal (invalid), is also qualified as excessively collected.

According to the interpretation by the Constitutional Court of the provisions of Art. 78, 79 of the Tax Code of the Russian Federation (Definition No. 503-O dated December 27, 2005), excessive payment of tax, as a rule, occurs when the taxpayer, calculating the amount of tax payable to the budget independently (that is, without the participation of the tax authority), for some reason reason, including due to ignorance of tax law or honest misconception, makes an error in calculations. If the tax is credited to the budget on the basis of a request for tax payment (which, in accordance with clause 4 of Article 69 of the Tax Code of the Russian Federation, indicates the amount of tax accrued by the inspection and subject to payment to the budget), despite the fact that such a demand is sent to the taxpayer based on the results of a desk audit or during proceedings in a case of a tax offense (clause 5 of Article 88, clause 4 of Article 101 of the Tax Code of the Russian Federation), then in the event of an incorrect calculation of tax amounts there is no reason to talk about the fact of excessive payment of tax. Accordingly, Art. 78 of the Tax Code of the Russian Federation cannot be applied.

Issuing a demand for payment is a coercive measure, and the transfer of funds in pursuance of the inspector’s decision cannot be considered as the voluntary fulfillment by the taxpayer of the obligation to pay the corresponding amounts. The transfer of funds by the company in this case represents the collection of arrears by the tax authority.

How can you manage your overpayment?

If an organization or individual entrepreneur has identified an overpayment of taxes, then the excess can be offset against the debt, left in a personal account with the Federal Tax Service for future payments, or the money returned to the current account. Let's consider each point separately.

Credit for arrears

If there is arrears on other taxes, fees, fines, penalties, inspectors will first pay off the arrears to the budget through overpayments. The inspectorate independently decides which tax debt can be closed and informs the organization. But they can only dispose of overpayments that are no more than three years old.

An organization can independently submit an application for credit indicating a specific tax. It is advisable to reconcile the calculations with the budget before doing this. If the amount indicated in the application does not coincide with the data of the tax office, the tax authorities will return the application.

The tax office makes a decision on offset or refusal to offset overpaid amounts against arrears within 10 working days:

- from the moment the overpayment was discovered, if the organization did not apply to the inspectorate with an application for credit against a specific tax;

- from the date of receipt of an organization’s application for credit against a specific tax, if the organization has submitted such an application;

- from the date of signing the act of reconciliation of calculations with the budget, if the inspection and the organization carried out a reconciliation;

- from the moment the court decision comes into force, if the organization has achieved offset through the court;

- from the day following the day of completion of the desk tax audit, which took place without additional assessments;

- if a desk audit revealed violations - from the day following the day the decision entered into force.

Credit towards future payments

If there is no arrears, you need to send an application to the inspectorate for crediting money using the approved KND form 1150057. Applications for crediting taxes overpaid to regional budgets at the location of separate divisions of the organization can be submitted both to the tax inspectorate at the location of the organization and to the tax inspectorates at location of separate units.

The application deadline is within three years from the date of payment of the excess tax or contribution. The application must be accompanied by documents confirming the overpayment - a payment order or an updated declaration. The tax office must make a decision on the offset within 10 working days from the date of receipt of the application from the organization.

Overpayments cannot be counted against future payments of taxes, fees, penalties and fines by other taxpayers. Such offset of Tax Code is not provided (letter of the Ministry of Finance dated March 6, 2017 No. 03-02-08/12572).

Extrajudicial return procedure

In the event of an out-of-court refund procedure, the taxpayer must first contact the tax authority with a corresponding application. The application is submitted in any form, and the deadline for its submission is three years from the date of calculation of the tax or three years from the day when the taxpayer became aware of the fact of excessive collection of tax from him.

The decision to return or offset the amount of overpaid or collected tax is made by the tax authority within 10 days from the date of receipt of the relevant application from the taxpayer. The tax amount is refundable within one month from the date of application.

If we are talking about overpaid tax, if the established refund deadline is violated, the tax authority is obliged to pay interest at the refinancing rate in effect on the days the refund deadline was violated, for each day of delay. In case of excessively collected tax - for the entire period of diversion of funds from the taxpayer.

Refund to the taxpayer of the amount of overpaid tax if he has arrears on other taxes of the corresponding type or arrears on the corresponding penalties, as well as fines subject to collection in cases provided for by the Tax Code of the Russian Federation, is made only after the amount of overpaid tax is offset against the arrears.

Offsetting the amount of the overpayment is another way to restore the rights of the taxpayer. As already indicated, the amount can be used to offset the arrears registered with the taxpayer, as well as to offset current payments for taxes of the same type. It is worth noting that the tax authority independently offsets the amount of overpayment against the existing arrears, i.e. makes a forced offset. At the same time, this procedure is subject to the deadlines established for the collection of arrears, if missed, the tax authority loses the right to a forced offset.

It is also necessary to pay attention to the problem existing in judicial arbitration practice. When a taxpayer submits a return with an incorrectly calculated tax amount, the specified amount is recognized as such based on the results of a tax audit.

The fact is that the taxpayer is obliged to submit an updated tax return with the correct amount of tax, which is a mandatory step in recognizing the amount of tax as overpaid, in accordance with judicial arbitration practice. The updated tax return is also subject to a desk audit, the period of which is three months. Accordingly, until the end of the audit, the amount of tax as overpaid is not refunded.

Refund of overpayment

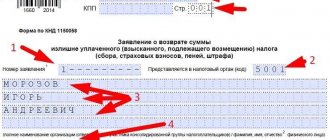

To return money to the current account, the organization submits an application in the KND form 1150058 within three years from the date of the overpayment. To make a decision, inspectors have 10 working days from the moment they receive the application or sign the reconciliation report. After 5 working days, tax authorities are required to inform the organization or individual entrepreneur about the decision made (clause 9 of Article 78 of the Tax Code). After a month, return the overpayment to your bank account. If the taxpayer made a mistake and provided incorrect details, the refund will be processed after clarification.

Refund of overpaid taxes is a right, not an obligation, of the taxpayer. An organization or individual entrepreneur can waive their right, which does not contradict paragraph 6 of Art. 78 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia No. 03-07-11/63803 dated December 11, 2014).

We return the tax through the inspection.

An application to the tax authority can be submitted:

- personally by the taxpayer;

- in electronic form with an enhanced qualified electronic signature via telecommunication channels;

- through the taxpayer’s personal account.

If the fact of excessive collection of tax is established, the inspection, within 10 days from the date of receipt of the application for the return of the amount of excessively collected tax, makes a decision on the return of this amount of tax (clause 2 of Article 79 of the Tax Code of the Russian Federation).

For your information:

The forms of documents used by tax authorities when carrying out the offset and refund of amounts of excessively collected taxes (including the form of the decision on refund) are approved by Order of the Federal Tax Service of Russia dated 03.03.2015 No. ММВ-7-8 / [ email protected]

Before the expiration of this period, tax authorities are required to send to the territorial body of the Federal Treasury an order for the return of the amount of excessively collected tax, issued on the basis of a decision to return this amount of tax in order to refund the tax to the taxpayer in accordance with the budgetary legislation of the Russian Federation. Having made the return, the treasurers will notify the inspectorate of the date of the return and the amount of money returned to the taxpayer.

If the overpayment is more than three years old

An organization can offset or return an overpayment within three years from the date of payment of the excess tax amount. The payment date is calculated differently. For example, for VAT, which is paid without advance payments, the three-year period will be counted from the date of transfer of the tax. And for income tax, which provides for advance payments, the period will be calculated from the moment of filing the declaration.

If the organization missed the deadline for filing an application, you can go to court. When considering a case in court, the limitation period of 3 years will be calculated according to the norms of civil, and not tax legislation. And the countdown of the period does not start from the moment of payment of the excess amount, but from the moment when the organization learned or should have known about it (clause 1 of Article 200 of the Civil Code). But you will have to prove that you learned about the overpayment later than it occurred. And it's not that simple.