How to write an application for a refund of overpaid tax

The legislation of the Russian Federation provides for the return of overpaid contributions to the budget.

To return them, you need to fill out the form “Appendix No. 8”, approved by order of the Federal Tax Service of the Russian Federation. Moreover, this must be done within 3 years, otherwise the money will be lost and it will no longer be possible to return it. This document is a form consisting of 3 sheets. Legal entities fill out and send the first two sheets to the tax authority, while individuals need to fill out the third sheet in addition to the first 2 sheets.

Filling out the application form is not difficult and is identical to filing a tax return.

The application is sent in the following cases:

- a person made payments to the tax structure greater than the required amount.

- The advance transfer exceeded the amount of contributions required for enrollment.

- After submitting the updated declaration.

- When returning VAT.

An application is filled out on a unified form (Appendix No. 8). When filling it out, the following rules must be observed:

- You must use block letters to complete the application.

- There should be no errors or inaccurate information on the form. If a mistake is still made, it is better to rewrite the form.

- The request is filled out in 2 copies - one for the tax office, the second for the payer of contributions.

- The form consists of 3 sheets:

- On the first sheet, general information about the payer of contributions and the tax is filled out.

- The second contains the bank details to which the excess amount will be returned.

- On the third - information about the payer.

- When drawing up a document, it is required to display what type of tax will be used to refund the funds.

- The signature on the application must be made only in the presence of a tax inspector.

Lists of documents for obtaining tax deductions

Letter No. ED-4-3/ [email protected] approved the following lists of documents that the tax authorities have the right to require for receipt by the taxpayer:

- property tax deduction when purchasing an apartment (or room) on the secondary market;

- property tax deduction when purchasing an apartment under an agreement on shared participation in construction (investment), an agreement on the assignment of the right of claim;

- property tax deduction when purchasing a land plot with a residential building located on it;

- property tax deduction for the cost of paying interest on a targeted loan (credit) aimed at purchasing housing;

- social tax deduction for treatment;

- social tax deduction for education.

The same Letter from the Federal Tax Service approved a sample application for the distribution of a property tax deduction between spouses, which is provided in a set of documents for obtaining a standard, social and (or) property tax deduction.

How to submit an application to the Federal Tax Service for a refund of overpaid tax in 2020

The document is sent to the tax authority at the registration address. This can be done in various ways:

On a personal visit . In this option, the form is filled out directly at the tax office and signed in the presence of a service employee. The form is provided by the inspectorate employee.

Sending by registered mail . The application form and examples of how to fill it out can be seen on the Federal Tax Service website. Before filing an application, it is advisable to obtain advice from a tax specialist.

Electronic sending . This method is most often used by enterprises and individual entrepreneurs. The form is submitted using the Internet with a certified electronic signature.

Identification of overpaid funds is carried out based on the results of a reconciliation report between the tax authority and the payer. Sometimes the Federal Tax Service independently detects overpayments, but most often this happens on the initiative of individuals and legal entities.

Overpayment is most often made under the following circumstances:

- Errors in payment order . When filling out a payment order, due to the accountant’s carelessness, amounts are transferred that do not correspond to what is necessary.

- Errors in calculations . Here, shortcomings may arise due to ignorance of the legislation, as a result of which the tax base is used incorrectly, in which outdated rates are applied. If such errors are identified, additional updated declarations are sent to the inspection.

- Reducing the amount of duty . Sometimes, when filing an income tax return, enterprise employees forget about crediting advance payments.

Useful links on the topic “Sample application for personal income tax refund”

- Tax on interest on deposits

- Tax control of accounts

- Why are benefits declarative in nature?

- Personal income tax on inheritance

- Tax liability for failure to submit documents

- Confirmation of Russian tax resident status

- When and what to report to the Federal Tax Service

- Convention on the International Exchange of Tax Information

- Taxpayer personal account

- Tax benefits for pensioners - procedure for provision and sample application

- How to pay taxes online

- Should children pay taxes?

- How to get a deferment (installment plan) for paying taxes

- Tax audits

- What should a complaint to the tax inspectorate contain?

Tax return

Taxes

- UTII

- Land tax

- Personal income tax (NDFL)

- Income not subject to taxation

- Who are tax residents and non-residents

- Sale of an apartment by a tax non-resident of the Russian Federation

- The procedure for calculating and paying personal income tax upon the sale of a share in the authorized capital of an LLC, shares of an OJSC, securities

- Personal income tax on payments by court decision

- Tax on the sale of currency and income on Forex

- How to reduce personal income tax when buying and selling a car

- How to reduce personal income tax when selling and buying a home

- Procedure for paying personal income tax if an employee is on a business trip abroad

Tax deductions

- Property tax deductions

- How to get a property deduction when buying a home on credit

- How to get a deduction for improving housing conditions

- When can you get a deduction of 2,000,000 rubles when purchasing a room or a share of an apartment?

- Is a non-working pensioner entitled to receive a property tax deduction in connection with the purchase of an apartment?

- List of medicines for which social tax deduction is provided

- List of expensive types of treatment for which a social tax deduction is provided (approved by Decree of the Government of the Russian Federation of March 19, 2001 No. 201)

Tax liability for:

- failure to provide documents

- failure to provide tax reporting;

- incomplete payment of taxes;

- failure to appear when called to the tax authorities

Filling procedure

The application is filled out on an A4 sheet, which is supplemented by a unified form “Appendix No. 8” approved by the tax service.

Documents are drawn up in 2 copies, with a signature and seal on both copies. If a person doubts that he will be able to fill out the form on his own, you can turn to the services of special companies or consultants. To correctly fill out the application, you must fill out the following information:

- Full information about the applicant. The upper right section of the form displays:

- for individuals - full name, tax identification number, place of registration

- for legal entities persons - name of the company, tax identification number, checkpoint, legal place of registration.

- In the text section fill in:

- A request for the return of overpaid funds, with reference to the provisions in the Tax Code. You can ask to carry over the excess amount to offset taxes in the coming period.

- Tax period when the overpayment occurred.

- Details of the completed payment, codes KBK and OKTMO.

- Amount of funds to be returned. Displayed in numbers and words.

- Bank details where the money should be returned.

- Signature of the applicant and date of preparation.

The completed request can be sent to the Federal Tax Service using the following options:

- Personally, or through a trusted person, with a notarized power of attorney.

- Via the Internet by logging into the personal account of the fee payer. To do this, you need to register on the website nalog.ru, and also obtain a digital electronic signature.

- Send the application by registered certified mail via the post office, with a list of enclosed materials.

KBK and OKTMO

Let’s take a closer look at what KBC and OKTMO are that need to be included on the title page. These are, first of all, types of codes established by law.

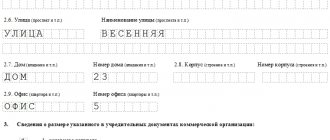

OKTMO is an all-Russian classifier of MO territories. When filled out, it must match the number indicated in the declaration (in section 1 - page 030 and on sheet A - page 050).

We recommend additional reading: 3-NDFL declaration

KBK - budget classification code is a 20-digit code that reflects the chain of revenues to the state budget. Accordingly, each financial transaction associated with cash flow is assigned its own BCC. To fill out an application for a personal income tax refund, the code is 182 1 0100 110.

When drawing up an application in free form, you do not need to enter OKTMO and KBC. The corresponding fields are entered only in the sample recommended by the Federal Tax Service.

Return deadlines

After delivery of materials to the inspection and its acceptance of the received materials, if all information required for the return of excess amounts transferred is correctly filled out and provided, a decision is made within 10 days.

If there is insufficient information provided, the tax office sends a notification to the person who submitted the documents, indicating the reasons for the refusal or with a request to send additional materials that are not available for a positive resolution of the issue.

Notification of the decision is sent to the applicant no later than 5 days from the date of the decision.

If everything is in order with the documents, then according to clause 6 of Art. 78 of the Tax Code of the Russian Federation, the tax inspectorate is obliged to return the excess amount within 30 days.

In practice, it often happens that the money does not reach the applicant’s account for many months.

This is due to the fact that tax inspectors can warn about the verification of payments by the duty payer who has made a request for the return of excess transferred duty amounts. The period of such verification sometimes reaches 3 months.

The deadlines for sending an application to the inspectorate for the return of funds and the deadlines for the applicant to complete the request can be expressed in the table:

| Deadline for sending the request | Money back deadline |

| The request must be sent within 3 years from the date of overpayment of the fee (not from the date of detection). | The overpaid tax must be returned to the applicant within 30 days from the date of registration of the request. |

What if the tax office refused to return the overpayment?

If the return of the declared overpayments to the budget was not carried out after registration of the application, and the tax authorities did not initiate an audit in relation to the taxpayer, there is no need to “pull the rubber” in the hope that the transfer will be made.

In this case, the taxpayer must independently check the correctness of the application and forms (Appendix No. 8) registered by the tax institution. It is especially necessary to check that the bank details are filled out correctly (in case they are displayed incorrectly and the money is transferred to another taxpayer).

If everything is filled out correctly and there is no need for additional verification, and there is no receipt of funds into the account, it is necessary to remind the tax office employees about this, with reference to the legislation regarding the tax service, which is obliged to complete the transfer within a period of up to one month from the date of receipt request and required information. Moreover, if there is no response to an oral appeal and the taxpayer has not received the money, he has the right to appeal to the management of the inspectorate with a complaint. In addition, if this does not help, then the same complaint can be written to a higher structure.

The complaint must be made in writing and delivered personally by the taxpayer. If it is not possible to personally deliver the complaint, the letter can be sent by a valuable letter at the post office with an inventory of all materials in the envelope.

It is not recommended to find out the reason for the lack of receipt of money into the account over the telephone, since a telephone conversation cannot be presented as evidence for a delay in transfer.

If, after the expiration of the legal period for responding to the complaint, the refund is not made, the taxpayer has the right to file a statement of claim in court.

Usually, in such cases, the court takes the side of the payer of the contributions, except in circumstances where the data necessary for the return of money is incorrectly displayed.

Peculiarities of actions when the tax inspectorate ignores a request for a refund of excessively transferred duties:

- It must be remembered that the countdown of the time for the return of personal income tax begins from the moment the request for return is registered, but not earlier than from the date of the desk reconciliation by the inspection staff.

- The fee payer can send an appeal for the return of the overpayment only after confirming the validity of the personal income tax overpayment, i.e. after a desk verification has been completed by inspection staff.

- The most convenient way to generate an application for personal income tax return is provided by the electronic service “Personal Account...”.

- In this service you can also see the time when money was credited to the account displayed by the taxpayer in the return request. In this case, when funds are received, the status button for personal income tax return will be in the “Fulfilled” mode, and the “Execution Date” and “Execution Amount” fields will be filled in - this will indicate that the duty refund has been completed.

- If an individual does not have the opportunity to use the electronic service “Personal Account...”, a request form for a refund of overpaid duty can be found on the website of the Federal Tax Service of Russia.

How to serve

A request for a refund of overpaid contributions from the tax office can be presented in person to the inspectorate at the place of registration of the contribution payer, or through the post office by sending a valuable envelope describing its contents.

The necessary materials are attached to the written appeal, which confirm the validity of the overpayment (payments, checks confirming the transfer of contributions).

The application is filled out in 2 copies, one of which is sent to the inspection, and the second to the sender of the request, noting the number and date of registration of the submitted letter.

It is necessary to pay attention to the fact that, given that the deadline for submitting a request for a refund of excess amounts from the tax service is 3 years, it is necessary to keep evidentiary documents (payments, receipts, checks) in the accounting department for 3 years.

To return amounts that were transferred by mistake, the taxpayer indicates the bank details and open account number. Typically, such an account is opened in Sberbank.

Therefore, in order to receive money, the request must display:

- personal information about the requester.

- Information about bank details showing the account number (you can attach a certificate from the bank with the specified information about the open account).

- Amount to be refunded.

Sample filling

- Application for a refund of overpaid tax. Sample 2020, pdf

Example

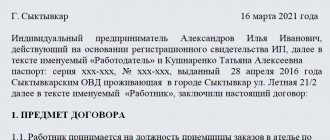

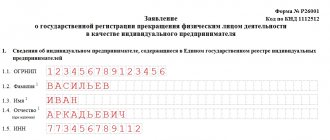

Let's consider an example of an application for deduction, citizen I.A. Morozov:

- The application is submitted for the first time – “1”.

- The code of the territorial branch of the Federal Tax Service is “5001”.

- In each separate line, the full name is indicated - MOROZOV IGOR ANDREEVICH.

- The status of an individual is “1” (taxpayer).

- The article number for the return of overpaid personal income tax is 78.

- Code for indicating the required operation “1” - tax refund.

- The amount is written down (must match the specified value in 3-NDFL) - 27865 rubles. 78 kopecks.

- The period indicated in the form of 8 characters is “GD.00.2019”.

- OKTMO – 6170100—.

- BCC for this type of financial transaction is always 18210102030011000110.

- In the section “I confirm the accuracy of the information,” o, indicating that the application is submitted by the taxpayer personally. Therefore, there is no need to fill out the lines about the document confirming the authority of the representative.

- Enter the contact phone number of Morozov I.A. in the format +79101111111.

- The citizen’s signature is placed and the date of filing the application with the tax office is March 16, 2020.

- Next, fill out the second sheet. It duplicates the TIN number and full name of the taxpayer. In the remaining fields, enter the details of the current account to which the amount to be returned must be transferred. Including, account type – “02”, BIC – 041708602 and account number – 42817819310000148198.

- The recipient's BCC and personal account number are not filled in.

- If the TIN was not registered on the title page, then it would be necessary to fill out passport data on 3 pages as follows:

Each sheet is numbered in three-digit format 001,002,003. The last page must be included in the application, even if not completed.