Notice of transition to a simplified taxation system from 2020 is a document that must be filled out and submitted to the Tax Inspectorate if you are an entrepreneur or the head of a small company and want to switch to a simplified system. First, check whether your company meets the conditions that the legislation imposes on taxpayers for the simplified tax system. If everything is in order, proceed to filling out the form in accordance with our recommendations.

To switch to the simplified tax system, a legal entity or individual entrepreneur submits to the Federal Tax Service inspection at the place of registration a notification according to the form No. 26.2-1 recommended by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] . The order also contains instructions on how to fill out a notice of transition to the simplified tax system. You must submit it before December 31, 2019.

However, this still requires meeting a number of criteria.

Switch to this special mode if you are an individual entrepreneur and:

- the number of people working in the company is less than 100;

- you do not use the Unified Agricultural Tax.

Use the simplified tax system from 2020 if you are the head of an organization and:

- your number of employees is less than 100;

- income for 9 months of 2020 will not exceed 112 million rubles when working on the simplified tax system (clause 2 of article 346.12 of the Tax Code of the Russian Federation);

- the residual value of fixed assets is less than 150 million rubles;

- the share of other companies in the authorized capital is less than 25%;

- the company has no branches;

- your activity does not relate to the financial sector (banks, insurers);

- earnings for last year amounted to less than 150 million rubles (clause 4 of article 346.13 of the Tax Code of the Russian Federation).

How to receive a notification

The notification nature is a distinctive feature of the transition to the simplified tax system. But this does not mean that you need to receive a notification about the transition to a simplified taxation system (Form 26.2-1) from the tax service. Quite the opposite: you inform the Federal Tax Service of your intention to use the simplified tax system in the next calendar year. Previously, there was a notification form about the possibility of using a simplified taxation system - this form served as a response to the taxpayer’s application. But it lost force back in 2002 by order of the Federal Tax Service of Russia No. ММВ-7-3/ [email protected] Now there is no need to wait for permission from the tax authorities to use the simplified form. Submit the notification yourself.

There is also no need to confirm the right to use this regime. If you do not meet the conditions, this will become clear after the first report, and only then will you have to be financially responsible for the deception. The tax service has no reason to prohibit or allow the transition to a simplified system; its use is the taxpayer’s decision. In addition, the notification about the transition to the simplified tax system of form 26.2-1 has the nature of a recommendation. It is allowed to notify the Federal Tax Service of your intention to use the special regime in any form, but it is more convenient to use a ready-made one.

Transition to simplified tax system with UTII

If a taxpayer decides to part with the imputation and switch to another tax regime, including the simplified tax system, this is not always easy to do. What to do if the right to use UTII has been lost and there is an intention to become a “simplified”, read the article “If you “flee” from UTII, you can’t always immediately switch to the “simplified””

find out how to accurately transfer to the simplified tax system from a single tax on imputed income from our article “How to switch from UTII to the simplified tax system (transition procedure)”

Taxpayers who have been accustomed to working on imputation for many years, and now decide to use the simplified tax system, may make mistakes when calculating the tax base. To prevent this from happening, read our article “Have you changed UTII to “simplified”? Find out what income and expenses are not taken into account for the simplified tax system"

Whatever tax regime you used previously, in order to switch to the simplified system, you will in any case have to submit a notification to the tax authority about the transition to the simplified tax system.

Step-by-step filling instructions

The recommended form was introduced by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] “On approval of document forms for the application of the simplified taxation system.” Newly created companies and individual entrepreneurs submit a notification using the same form, only they attach documents for registration to it. Newly created enterprises have the right to inform the Federal Tax Service about the application of the simplified tax system within 30 days from the time they register.

How to fill out an application

The notification form is only one page, so you will not have much difficulty filling it out. All entries are made in capital block letters in black font. Empty cells are filled with dashes.

- If an application for the simplified tax system is submitted along with documents for registration of an individual entrepreneur, then the TIN field is not filled in. There will also be dashes in the checkpoint field, because individuals do not have such a code.

- The “Taxpayer Identification” field is filled in according to the recommendation of the Federal Tax Service:

- 1 – when submitted along with documents for registration of individual entrepreneurs;

- 2 – when submitted within the first 30 days from the date of registration or deregistration under UTII;

- 3 – when working entrepreneurs switch from other taxation systems.

- The next four lines are intended to indicate the full name of the individual being registered as an individual entrepreneur.

- Next to the line “switches to a simplified taxation system,” enter the number “2,” which indicates the transition to the simplified tax system from the date of registration of the individual entrepreneur.

- In the taxable object field, enter “1” for “Income” or “2” for “Income minus expenses.”

- Enter the year of application – 2020.

- In the next three lines, put dashes, because they are intended to transition to simplification of organizations that are already operating in some kind of mode.

- The lower left part of the sheet is intended for entering the data of the applicant or his authorized representative. If the notification is submitted personally by the entrepreneur, then indicate the taxpayer attribute “1”, and put dashes in the fields for indicating the name. According to the footnotes, only the name of the representative of the individual entrepreneur or the head of the legal entity is indicated here.

- At the bottom of the sheet you must indicate the applicant number and the date of application.

Two copies of the completed document are submitted to the inspection, and the inspector will mark acceptance on one of them. In principle, the second copy with a mark is confirmation of the individual entrepreneur’s transition to a simplified version, so it must be kept as evidence. Additionally, you can request from the inspection an Information Letter in form No. 26.2-7, which will confirm that the entrepreneur actually works under a simplified regime.

Guidelines for completing Form 26.2-1

Let's look at how to fill out the form line by line. Let us point out the differences that are important to take into account when entering data about organizations and individual entrepreneurs.

Step 1. TIN and checkpoint

Enter the TIN in the line - the number is assigned when registering a company or individual entrepreneur. Entrepreneurs do not enter the checkpoint - the code for the reason for registration, since they simply do not receive it during registration. In this case, dashes are placed in the cells.

If the notification is submitted by an organization, the checkpoint must be included in the application for transition to the simplified tax system 2020 (the sample filling for an LLC shows how the “checkpoint” form window is filled out).

Step 2. Tax authority code

Each Federal Tax Service Inspectorate is assigned a code, which is indicated when submitting applications, reports, declarations and other papers. Firms and individual entrepreneurs submit forms to the inspectorate at the place of registration. If you don’t know the code, look it up on the Federal Tax Service website. An example is the code of the Interdistrict Inspectorate of the Federal Tax Service No. 16 for St. Petersburg.

Step 3. Taxpayer attribute code

At the bottom of the sheet is a list of numbers indicating the taxpayer’s characteristics:

- 1 is placed when submitting a notification by a newly created entity along with documents for registration;

- 2 - if a person is registered again after liquidation or closure;

- 3 - if an existing legal entity or individual entrepreneur switches to the simplified tax system from another regime.

Step 4. Company name or full name. IP

For individual entrepreneurs, the main identifier is the last name, first name and patronymic. Include them in the application for the transition to the simplified tax system from 2020; The sample filling for individual entrepreneurs shows that empty cells of the form are filled with dashes.

If you are the head of a company, then enter the full name of the organization. Fill in the remaining cells with dashes.

Step 5. The number in the line “switches to simplified mode” and the date of transition

Specify one of three values. Each number is deciphered below:

- 1 - for those who switch to the simplified tax system from other taxation regimes from the beginning of the calendar year. Don't forget to enter the year of transition;

- 2 - for those who register for the first time as an individual entrepreneur or legal entity;

- 3 - for those who stopped using UTII and switched to the simplified tax system not from the beginning of the year. Does not apply to all UTII payers. To switch from UTII to simplified taxation in the middle of the year, you need reasons. For example, stop activities that were subject to UTII and start running a different business.

Step 6. Object of taxation and year of notification

Enter the value corresponding to the selected taxation object:

- The simplified tax system “Income” is taxed at a rate of 6% - expenses cannot be deducted from the tax base. Regions have the right to lower interest rates starting from 2020. If you chose this type of object, put 1;

- The simplified tax system “Income minus expenses” has a rate of 15%, which regions have the right to reduce to 5%. Expenses incurred are deducted from income. If the choice is “Income minus expenses”, put 2.

Be sure to indicate the year in which you are submitting the notice.

Step 7. Income for 9 months

Enter the amount of income for 9 months of 2020; for an organization it cannot exceed 112,500,000 rubles for the right to apply the simplified system in the future period. This restriction does not apply to individual entrepreneurs.

Step 8. Residual value of fixed assets

The residual value of the organization's fixed assets as of October 1, 2019 cannot exceed 150,000,000 rubles. There are no restrictions for individual entrepreneurs.

Step 9. Full name company manager or representative

In the final part, indicate your full name. the head of the company or his representative, who has the right to sign papers by proxy. Don't forget to indicate by number who signs the form:

- 1 - the leader himself;

- 2 - trusted representative.

The entrepreneur does not need to write his last name in this line; put dashes.

All the benefits of the simplified tax system once again

- the opportunity to legally conduct business without paying personal income tax of 13%;

- the tax on property used in the activities of an entrepreneur is leveled;

- forget about VAT;

- ease of calculation. We pay either 6 percent of total income, or 15 percent of income minus expenses.

By the way! When they say that the simplified tax system replaces the entire tax burden placed on an entrepreneur, they are lying. Personal income tax from employee salaries, please pay on time in accordance with the law.

When switching to a simplified version, remember the conditions under which you will not be allowed to do this!

- Your company has representative offices and branches (of course, the tax authority has been notified about them accordingly). Those. if you work together with Vitalik in Perm, printing business cards, and in Kazan Maxim and Katya distribute them, this does not mean that you have a Kazan branch and, accordingly, this condition under which the simplified tax system cannot be applied is not relevant.

- You must have less than 100 employees. Officially arranged, of course. There may be one and a half thousand people working for you, but if you work alone for official services, there will be no conditions for not using the simplified tax system. Another thing is that questions will arise about your labor productivity, otherwise everyone would work alone in their company.

- The residual value is more than 100 million rubles. Otherwise, you are too rich to use “simple” modes.

- Other companies should not have a stake in yours that exceeds 25%. This is an irrelevant condition for individual entrepreneurs.

- For the first three quarters of the year in which the application to switch to the simplified system is submitted, income should not exceed 45 million rubles.

- Total annual income should not exceed 60 million rubles.

Attention: in the last two paragraphs, the amounts 45 and 60 must also be additionally multiplied by the simplified tax system deflator coefficient, which changes annually. However, since 2020, this coefficient has become equal to 1, but its revision is possible in the future.

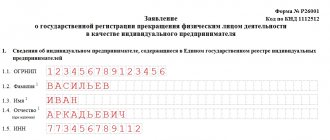

Let's start filling out the application according to form No. 26.2-1. By the way, it is according to KND 1150001.

Our application will be submitted by a newly minted entrepreneur, Konstantin Yusupovich Okhtyvo. He decided to switch to a simplified taxation regime immediately from the moment of registration of an individual entrepreneur.

TIN field - everything is clear here without further ado. KPP (reason code for registration) - the individual entrepreneur does not have it. Don't look, you won't find it anyway. Leave the field empty.

Tax authority code

Below we see the tax authority code. Where can I get it from? It's simple: go to the tax service service (https://service.nalog.ru/addrno.do), enter your address in the field, and you will be given a tax code that is tied to your place of registration. This is what you need to enter in the appropriate field of the form.

We figured out the code.

Submission deadlines

The deadline for submitting a notification directly depends on the reasons for which an organization or individual entrepreneur is switching to the simplified tax system:

- When registering an LLC or individual entrepreneur for the first time, the notification must be submitted either simultaneously with the general package of documents for registration, or within 30 days after it.

As mentioned above, if a businessman forgets to submit an application to switch to a simplified tax regime within thirty days, he will automatically be transferred to the general taxation regime, which he will be able to change only next year.

- An existing organization or individual entrepreneur, when switching from another taxation system or when opening a new type of activity for which it is planned to apply the simplified tax system , must submit an application no later than December 31 of the year preceding the one from which the simplified tax system will be applied.

Submitting an application

Note!

To switch to the simplified tax system in 2020 from another tax regime, you had to submit a notification to the Federal Tax Service in Form 26.2-1

by December 31, 2020.

If you have not done this, then you will be able to switch to the simplified tax system only from next year.

An application for switching to the simplified tax system is submitted to the tax office in 2 copies (for Moscow - in 3 copies), one of which, already marked as accepted, must be returned. It must be preserved. Read more about how to confirm the right of an entrepreneur or company to apply the simplified tax system here.

To be completed when changing the tax regime

If you are changing the tax system, how to fill out a notice of transition to the simplified tax system 2020 in form 26.2-1: there are special rules here.

In the “Taxpayer Identification” line, enter 3 if you are switching from another regime, or 2 if you are switching from UTII.

In the line to indicate the reason for the transition to a simplified taxation system, put 1 and fill in the year from which the simplified tax system is applied.

In addition to general details, you must fill in the amount of income received for 9 months and indicate the residual value of the fixed assets.