Many documents must be signed personally by the responsible person, otherwise they will be deprived of legal force. But the director, the head of an enterprise (company), is also a person, he can get sick and go on vacation.

Today, a signature can be affixed in person, in electronic digital format (which is not always convenient) or in facsimile. This term does not have an official legal status, but since 2020 it has been widely used by entrepreneurs in business transactions and office work to conclude transactions.

If executed with high quality, such a signature, according to the norms of civil legislation, is no different from a handwritten signature and acquires legal force. Although there are pitfalls. In practice, its use may be risky or even prohibited .

What is a facsimile signature

Facsimile translated into Russian as “do like this” is a reproduction of an identical copy of the signature of the authorized person or the person signing the documents.

This option of turning an original into a copy or reproducing a copy of any graphic original (seal, stamp, drawing, monogram, drawing, manuscript, engraving, signature) is a useful assistant for managers of state-owned enterprises, officials, and businessmen. Additional Information! Using facsimiles, you can restore ancient drawings and manuscripts, make copies of any graphic elements (words, numbers, letters, drawings, personal signatures, symbols). However, you cannot create a model, reduce a copy of an architectural structure, or burn the original piece of music to a CD.

Similarities and differences between seal, stamp and facsimile

A stamp is a carrier of information that is important for the company in its work. It is used to stamp similar entries in documents, but does not give the paper legal force.

Seal – round, triangular, rectangular attribute with information on the company organization (IIN, logo, OGRN). The documents certified by her become legally significant.

The similarity of a facsimile to a seal is that it gives the paper legal force. The difference is in the area of use. A stamp is placed on the financial documentation upon signing. Facsimiles are not used on them.

Necessity and benefits of use

The need to use facsimiles arises in large organizations where the volume of document flow is large, and the manager has to spend a lot of time putting a personal signature. Other reasons are excessive busyness, absence of a manager at the workplace.

The documentation requires signing within a certain period of time. Advantages of using facsimiles:

- speeding up the document flow process so that employees do not waste time studying and signing documentation upon receipt;

- the ability to recognize the official who put such a signature;

- designation in the document of complete confidential information that allows the company (organization) to neutralize the financial risks of losses;

- reflection of exclusively reliable information in the generated document;

- quick conclusion of transactions between firms and companies;

- simplifying the exchange of documentation within and outside the company.

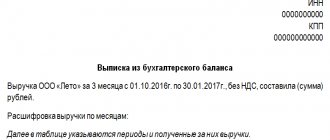

Reference! Facsimile makes the work of accountants and entrepreneurs simplified and accelerated. A company or firm with a high workload, processing for signing a large number of documents every day has the right to approve the procedure for its use independently. An original copy of the signature speeds up the document flow process, which is important when the manager or his deputy is often absent from the enterprise. It can be affixed to primary documents (regulatory acts, instructions, regulations, notices, invitations, letters, invoices, contracts, invoices, acts) that determine the procedure for conducting office work.

Civil transactions

According to the Civil Code of the Russian Federation, an original copy of an official’s signature is allowed to be used for concluding civil transactions. The parties must draw up an agreement between themselves on the procedure for using a facsimile to acquire legal force, and reflect in detail the terms in the text of the main agreement.

The agreement must clearly state all possibilities for signing documentation using facsimiles or enter into an additional agreement between the parties. Otherwise, the legal transaction may be invalid in case of disputes in court. A document may turn out to be a falsification if it is supported by a facsimile in cases prohibited by law.

The scope of application of the original copy of the manager’s signature is extensive, so there is no single position on its use from the point of view of legislators. According to Art. 160 of the Civil Code of the Russian Federation, the signature can be used in civil transactions. But one of the parties must accept it by creating an additional agreement.

In order to avoid financial problems at the time of using facsimiles, lawyers advise closely cooperating companies to differentiate the possibilities of use for different documents, i.e. then develop a detailed list.

It is important for entrepreneurs to first study the judicial practice and legal norms related to the use of facsimiles. Sign an agreement to accept a facsimile signature so that such documents, when considered in court, can become significant evidence and acquire legal significance.

Controversial positions

It happens that courts consider cases on the extent of lawful use of facsimiles on documentation. Specific cases of permission or prohibition are not described in the legislation. For example, tax authorities do not accept applications for VAT deductions from taxpayers, stating that primary financial reports must be signed personally by the head of the enterprise. Although certification of documents using facsimile will not lead to special tax consequences.

Facsimile is used in many cases . There is no single position of legality regarding use. One thing is clear that it is allowed to be used in civil transactions. The Civil Code of the Russian Federation nevertheless provides for the legality of signing documents in this way.

Legal transactions

When making legal transactions, the law does not prohibit reproducing facsimiles. However, the procedure and case should not contradict the agreement of the parties and legislative acts. The only option for the legal use of a seal is to draw up an agreement between the parties when concluding or executing a transaction.

To be able to use a facsimile, a separate document in any form must be drawn up or a complete list of cases with its use must be attached to the main contract. The text states:

- conditions;

- all documentation with the possibility of printing;

- positions and initials of employees with the right to use an original copy of the signature.

Reference! A copy of a handwritten signature, as well as a seal, in case of disagreements between companies and going to court, must be endowed with legal force.

Primary documents

It is not permissible to place an imprint of an official’s signature on primary documentation in the form of a rectangular stamp. This is prohibited by law. The papers must be signed by the chief accountant or the head of the company personally, otherwise the tax authorities may make justified claims against taxpayers.

Officials often refer to Federal Law No. 129, which states that primary documents must bear the handwritten signature of management. Taxpayers legally have the right to go to court to substantiate their claims against taxpayers.

Invoice

There is a heated debate about facsimiles on invoices. This is a pressing issue for taxpayers, because the invoice is the basis for applying tax deductions. Tax authorities express a unanimous opinion regarding such documents.

It is unacceptable to put a copy of the signature on them. An original is required, otherwise invoices will simply not be accepted before VAT is deducted.

The note! When explaining the issue of affixing a copy of a signature, tax officials refer to legislative documents and norms of the Tax Code of the Russian Federation, although the courts often come to the defense of entrepreneurs. But the case will be successful only if an additional agreement is drawn up between the parties on the use of facsimiles. The Tax Code of the Russian Federation clearly states that an invoice is not the basis for accepting a tax amount for reimbursement or deduction if it is compiled with violations or does not comply with the established procedure (Article 169 of the Tax Code of the Russian Federation).

If an invoice is issued by an individual entrepreneur, then it must be signed personally by him, indicating the details and a certificate of state registration. If compiled by an organization, then directly - by an accountant, chief executive, authorized person on the basis of an order

Agreement

The agreement can be drawn up, supported by a copy of the original signature. This does not contradict legal norms, but is subject to agreement between the parties. The main thing is that the validity of the facsimile certification inspires confidence.

When drawing up an additional agreement, it is recommended to attach a table with sample signatures and corresponding imprints of the data of persons authorized to use facsimiles. Such actions must be agreed upon between the parties involved in the transactions .

If the case goes to court, then the contract, after signing, will be recognized as legal only if a number of actions are taken that indicate acceptance of the contractual terms. If a contract is certified without a preliminary agreement or the presence of a responsible person at the time of signing, then the transaction may be challenged in court.

Reference! A copy of the signature is used when concluding contracts (Article 162 of the RF Housing Code). Documents acquire legal force, as well as with a regular signature, but if the counterparty agrees to accept the facsimile as a signature. Otherwise, such an agreement may be declared invalid by the court. The counterparty will lose if the transaction is not written in writing.

Waybills

You can certify delivery notes with a copy of the original signature when drawing up an additional agreement. Although tax authorities, again, may consider such assurance to be unlawful and refuse to deduct VAT. According to the law, the delivery note is the primary document, which means it must be signed in person by an authorized person.

But the issue is controversial. Invoices follow the standard form established by the State Statistics Committee. This means that it is not necessary to sign them by hand. There is no complete ban on reproducing facsimiles, but they can only be affixed to unified forms of invoices. If the form is developed by the organization independently, it can no longer be used.

Acts

Acts on completed work are drawn up in free form; a unified form is not provided . They display the required details and the official’s handwritten signature.

Let us recall that a facsimile is a method of producing a reproduction of a person’s hand signature. Counterparties have the right to use acts to certify the work performed, but again with a concluded agreement on use.

The news release that outlines how to use a fax signature on an invoice is below.

Legal status of facsimile signature

The Civil Code of the Russian Federation determines the admissibility of using facsimiles in two cases: if facsimiles are permitted by law and the use of facsimiles is specified in the agreement of the parties.

It is in these circumstances that a facsimile signature can become similar to a handwritten signature and will be given the same legal status.

One important point must be taken into account here: civil law is not applicable to the following relations:

- relationships based on the powerful subordination of one party to the other;

- relations between tax authorities and taxpayers;

- financial relations;

- administrative relations.

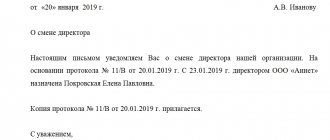

Securing the right to use a facsimile signature by agreement of the parties

The right to use facsimiles by agreement of the parties should be fixed in one of two ways:

- such an agreement between the parties to the contract is drawn up in the form of a separate document;

- the agreement is included in the text of the main contract as a separate clause.

Controversial positions

The Tax Service of the Russian Federation often rejects requests from taxpayers for deductions with a claim of putting a facsimile on invoices instead of a personal signature.

Tax officials refer to the clauses of the Tax Code of the Russian Federation. The Tax Code makes it very clear that invoices must be personally signed by authorized persons.

This situation does not suit both buyers and sellers, so disputes over this position of the tax authorities continue.

Court decisions on the use of facsimile signatures on invoices

The judiciary states that until now there are no rules allowing taxpayers and tax inspectors to provide facsimile signatures.

And the verdicts of the various courts were divided:

- Some consider the use of facsimiles when issuing invoices to be unlawful.

- Others consider this acceptable, since there is no direct prohibition of the use of facsimile signatures on invoices in the Tax Code.

Supreme Court decision

The Supreme Arbitration Court of the Russian Federation ruled that if the parties documented the right to use a facsimile signature at the beginning of transactions, then invoices signed in this way are considered a document endowed with legal force.

The Supreme Arbitration Court of the Russian Federation also pointed out that it is inadmissible to provide a tax return with a facsimile.

In addition, this court considered it impossible to use facsimiles in the work of tax inspectorates.

Possible risks

The possible risks of using an analogue of a personal signature are similar to the risks accompanying the use of official and simple seals.

These risks are formulated in the form of questions:

- who has the facsimile device?

- How adequately does the person entrusted with the facsimile use his powers?

- where is the facsimile stored?

Facsimile signature allowed

Based on an analysis of various legal acts, regulations and instructions from different regions of the country, we will highlight documents on which you can put a facsimile signature:

letters of congratulations, greetings and thanks;- certificates of honor, invitation cards, notice papers;

- copies of various official papers;

- letter of credit receipt;

- cash book, receipt and expenditure orders, cash book, etc.;

- documents on accounting of raw materials and materials;

- statements and other documents recording employee salaries;

- statements and time sheets taking into account personnel and time worked;

- act of acceptance or transfer of works and services;

- certificates (the rules and procedure for using facsimiles for approval of official certificates are prescribed in the relevant regulations and instructions);

- award certificates;

- various patents, certificates, certificates of the Federal Service for Intellectual Property and other documents of this service;

- certificates of results of the Unified State Exam (USE);

- compulsory health insurance policies.

That is, facsimiles can be used when drawing up documents that do not carry major financial liability

.

Facsimile signature is prohibited

The use of facsimiles has some significant prohibitions.

It is prohibited to approve facsimiles of the following types of documents:

- laws, regulations;

- tax returns;

- employment contract;

- written authorization, power of attorney;

- bill documents;

- various payment documents;

- primary accounting documents;

- invoices;

- competition documents;

- various statements from individuals and legal entities.

Application procedure

To reduce the risk of liability for a manager at an enterprise, it is important to reflect in the agreement how the facsimile will be stored and used . An agreement for a company is a document confirming the legality of using a signature. The head of the enterprise must issue an order reflecting:

- rules, regulations for the implementation of copies;

- list of officials with the right to facsimile;

- list of documentation suitable for production;

- storage methods;

- access options and storage responsibilities.

Reference! An imprint of the signature replaces the handwritten version. This means it makes it possible to identify the manager. Entrepreneurs can grant such powers to employees by issuing a power of attorney for them, but who are responsible for storing and using facsimiles. The signature is not available to other employees. Otherwise, the rules for preparing primary documentation will be violated. The document flow of the enterprise as a whole may suffer.

Legal validity of facsimile garant-service g Smolensk

Please note that the agreement on the use of facsimiles must be signed with the handwritten signatures of officials. but the expression of consent to the implementation of such copies must be signed by the counterparties themselves. Portal and I agree to receive information messages from the administration by email. In addition, previously an agency contract dated 2a2012 dated 01 was concluded between JSC MUP ZHKKH Kommunalnik and LLC Thermal Company.

We recommend reading: Garage Cooperative Tax Payment Home Front Worker

160 of the Civil Code of the Russian Federation it follows that if the counterparty agrees to accept a facsimile as a signature, then the document will have the same legal force as with an ordinary signature. Unless the agency contract provides otherwise, the agent's report must be accompanied by the necessary evidence of expenses made by the agent at the expense of the principal.

Legality of use

The concept of facsimile is not defined at the legislative level. Although the Civil Code of the Russian Federation indicates where and how a copy of the signature can be reproduced. It is legal to use it in civil transactions, because this is reflected by law.

A facsimile signature will be quite significant when going to court if both parties, when drawing up an agreement, additionally reflect their consent to use it or sign an agreement to accept this type of signature.

This is important for closely cooperating companies so that documentation signed with a handwritten copy acquires legal significance and becomes significant evidence in disputes .

Using facsimiles in various aspects of activity

The seal gives the documents on which it is affixed legal force. It contains the name of the company, its INN and OGRN. Facsimile has similar properties. But it cannot be used in all cases.

Civil transactions

This is perhaps the most common area of application of seal and signature cliches. The law allows it to be used to confirm contracts. However, when drawing up a document, an important condition must be met. The parties must come to an agreement on this issue and formalize it on paper.

If a cliché was not used when drawing up the main agreement and it does not contain information about consent to such use in the future, all additional agreements prepared for it and certified by an imprint will be recognized in court as not concluded.

There are two ways to do this. First, write down the terms of the agreement directly in the contract. This option is preferable, because in this case the likelihood of subsequent disputes is minimal.

The second way is to formalize the agreement as a separate document. In addition to information about consent to use the cliché, it specifies who can use it and to certify which documents. The application must contain a card with sample signatures of these persons.

As we noted above, primary documentation cannot be certified by a stamp. This applies to any receipt and expense orders, cash papers. Waybills and invoices can be confirmed using cliches by agreement of the parties. However, this can lead to problems with tax recalculation and deductions.

For acts of acceptance and transfer, the legislation does not establish a unified form. Therefore, this paper can be compiled in any way. The use of a print, including electronic reproduction, is not prohibited.

Labor Relations

On the one hand, the labor and civil codes regulate completely different types of legal relations and do not overlap with each other. Therefore, the possibility of using a print, enshrined in the Civil Code of the Russian Federation, does not apply to labor relations.

On the other hand, the Labor Code of the Russian Federation does not contain either the concept or legality of certification of documents using clichés. Therefore, it is impossible to both unequivocally prohibit and unequivocally confirm the possibility of using such an assurance.

Based on this, the employer can use a stamp in his document flow instead of a manual stamp. But with the condition that this procedure is detailed in the internal acts of the organization, including a list of persons and types of documents to be certified. It is worth remembering that in legal disputes the legality of using an imprint on employment documents can be challenged.

Accounting and tax accounting

Tax and accounting papers are prepared only by manual signature of the responsible persons. The position regarding facsimiles is not indicated in the accounting law. Financial consequences may be inevitable if you sign with a copy. Such documentation will not be able to act as evidence in court when making a decision on the claim.

Tax authorities indicate that a facsimile signature cannot be used when preparing and signing tax returns. A facsimile in this case is not an alternative to a handwritten signature.

What documents can be faxed - documents with financial implications

One can say unequivocally about the possibility of using facsimiles when certifying documents that have financial implications - affixing a facsimile signature is not allowed.

According to the provisions of Letter of the Ministry of Finance of the Russian Federation dated March 15, 2010 No. 03-02-08/13, Letter of the Ministry of Finance of the Russian Federation dated October 26, 2005 No. 03-01-10/8-404, Letter of the Ministry of Taxes of the Russian Federation dated April 1, 2004 No. 18-0-09/ 000042, the use of facsimiles is not allowed on payment documents, powers of attorney and other documents that have financial consequences. Therefore, there should be no disputes on this issue.

What is facsimile signature reproduction?

Reproduction of a signature is a stamp or seal on which the original signature of the person responsible for the endorsement of documents is cut out. This is usually the signature of the head of the organization.

It is allowed to reproduce the signature if there is an existing protocol for approving the agreement of any other contracts to be concluded in the future. The agreement places importance on the documentation that will be signed in facsimile. You can also draw up an additional agreement to an already concluded contract and sign it with your own signatures of the parties.

The agreement will be considered concluded and signed by the persons upon completion of the transaction if it contains a facsimile signature, but only if signed by both parties and supported by the original round seal.

Even an invoice will be considered legally significant if:

- directed by one of the parties;

- paid by the other party;

- reflects the terms of the contract;

- supported by an additional agreement.

Facsimile of the contract

By the ruling of the Arbitration Court of the Omsk Region dated July 21, 2013, cases No. A46-8034/2014 and No. A46-8676/2014, in accordance with Article 130 of the Arbitration Procedure Code of the Russian Federation, were combined into one proceeding for their joint consideration with assignment to the combined case No. A46-8034/2014.

In accordance with paragraph 2 of Article 160 of the Civil Code of the Russian Federation, the use of facsimile reproduction of a signature using mechanical or other copying means, an electronic digital signature or another analogue of a handwritten signature when making transactions is permitted in cases and in the manner provided for by law, other legal acts or agreement of the parties.

We recommend reading: Accounting for Compensation Amounts for Deputies on a Non-Permanent Basis