Without an application to close an individual entrepreneur in form P26001, it is impossible to obtain a record sheet from the Unified State Register of Individual Entrepreneurs from the tax authority about the termination of a person’s activities as an individual entrepreneur. It is also necessary to receive notification of deregistration of an individual entrepreneur. Only after going through the procedure for obtaining these documents can you close your individual entrepreneur and deregister from the Federal Tax Service.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What to do before writing an application

Before filling out the document, you need to pay the state fee for closing. It is 160 rubles.

If employees work for an individual entrepreneur, then it is necessary to notify them of the closure at least two weeks in advance. Preferably in writing. Otherwise it will be a violation of labor laws.

You also need to decide on how to submit your application. You can submit it to the local authority of the Federal Tax Service in paper form, by mail or electronically. But this cannot currently be done through the Public Services portal. The tax authority has its own website and a corresponding section in it. You can submit an application to close an individual entrepreneur there, but to do this you need to have your own digital signature. If there is no electronic seal, then you will have to do it the old fashioned way, in paper form.

How to fill out form P26001

Application P26001 is filled out according to the same rules for all registration forms:

- When filling out by hand, all letters must be printed in capital letters and written in black ink. Each symbol has a separate familiar place; empty cells are filled with dashes.

- When using a computer, only 18-point Courier New font is allowed. The font color is also black, the letters are capitalized, but dashes in empty cells are optional in this case.

- In paragraph 2, you must select the method of receiving documents on deregistration (in person, by mail or through an authorized representative).

- Application P26001 is not signed in advance. The applicant's signature must be certified by an employee of the Federal Tax Service or a notary.

Requirements for filling

The form will be familiar to those who have applied to open an individual entrepreneur. Requirements for filling:

- All letters must be entered on the form only in printed form.

- All letters must be capitalized.

- It is acceptable to fill only with a black pen, with maximum brightness of the shade. This is due to the fact that the completed document will be processed by machine.

- Each character (including periods, commas, colons, and spaces) needs its own cell.

- The information must completely match the data already available in the system. ID numbers, passports, OGRNIP, TIN and other data must not be distorted. A mismatch of at least one character results in cancellation of the document acceptance.

- Abbreviations and hyphenations are possible only in accordance with the rules of Russian spelling.

- Duplicate information is not welcome.

The machine does not understand and does not accept corrections or illegible written letters.

If you decide to fill out the columns in Word on your computer, then the font size should be 18, and its name should be Courier New.

How to suspend activities

Perhaps the most important question for entrepreneurs who want to step away from business for a while is: how to suspend the activities of an individual entrepreneur? Let us answer right away that Russian legislation does not provide for such a possibility in principle.

The current Civil Code of the Russian Federation and other by-laws proceed from the fact that the activities of an individual entrepreneur can only be terminated.

Therefore, if an individual entrepreneur does not conduct business, then it is impossible to document this in any way, that is, legally the fact that the entrepreneur does not carry out commercial activities does not arise.

Therefore, the temporary suspension of the activities of an individual entrepreneur comes down only to the fact that he himself does not take any actions aimed at making a profit. Moreover, the entrepreneur has the right to do this at any time from the moment of his state registration.

In practice, there are often situations when a very long period of time passes from the moment of registration to the actual start of business. At the same time, the legislation does not contain any restrictions on the time of commencement of activity, as well as on the time of its implementation.

The status of an individual entrepreneur is unlimited, and therefore the suspension of its activities is possible at any time and depends only on the desire of the entrepreneur himself. He does not need to justify or confirm this decision to anyone.

Russian legislation does not provide for an application to suspend the activities of an individual entrepreneur, since such a concept is absent in the law. There are no other forms of documents that must be submitted in order to prove the fact of suspension of work. At the same time, the individual entrepreneur is not relieved of all the responsibilities that are assigned to him in accordance with the norms of the current legislation.

Back to contents

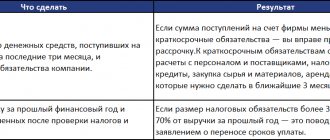

Responsibilities of an individual entrepreneur during suspension

So, even if an individual entrepreneur has not carried out activities for a long time, he is still obliged to submit all established reporting forms to the Federal Tax Service, Pension Fund of the Russian Federation, and Social Insurance Fund. In addition, he must pay a fixed fee to the Pension Fund, as well as transfer tax payments if he is on a single tax on imputed income or a patent taxation system.

In other cases, for example, when using the general tax regime, payment of taxes is not provided, but only if the entrepreneur does not receive any income, which must be confirmed by submitting zero tax returns.

Suspension of entrepreneurship also does not relieve one from other obligations that are associated both with business and with the implementation of actions of an individual.

It should also be taken into account that if an individual entrepreneur has employees, then he is obliged to fulfill the duties of a tax agent in relation to them, as well as to ensure compliance with their labor rights in the event of suspension of activities. Consequences of suspension of activities

Temporary suspension of an individual entrepreneur's business does not entail any legal consequences for him, but only if the current legislation was not violated during this period. In life, the situation develops in such a way that an entrepreneur, wanting to retire, simply winds down the business: closes a retail outlet, closes down workshops, etc. and begins to engage in other activities not related to entrepreneurship.

This continues until he receives a pile of notifications from the tax authorities about fines imposed on him for unsubmitted reports, untransferred tax payments and other mandatory fees. At the same time, the individual entrepreneur has not been operating for a long time.

It is useless to sue in such a situation, since the Federal Tax Service is right in such a situation: while a citizen is considered an individual entrepreneur, he bears all the responsibilities provided for such status, and the actual termination of activities is not a basis for termination of the duties of an individual entrepreneur.

Let us remind you that the law does not provide for any declaration of termination of the activities of an individual entrepreneur; there is only the possibility of termination of activities on the basis of an application from the individual entrepreneur himself or by a court decision, in cases established by law.

Therefore, if an entrepreneur does not plan to run a business, especially for a long time, then it makes sense to submit documents to terminate the status of an individual entrepreneur. Moreover, the legislation does not limit the possibility of multiple termination and receipt of this status. (See step-by-step instructions for closing an individual entrepreneur)

In this regard, the answer to the question of whether it is possible to suspend the activities of an individual entrepreneur is as follows: an entrepreneur can stop engaging in entrepreneurial activities, but at the same time he retains the powers of an individual entrepreneur, which entails the preservation of all his responsibilities.

This option is possible when a break in activity is not planned for a long period. In another situation, it is advisable to terminate your registration as an individual entrepreneur, otherwise such suspension can lead to serious consequences.

Back to contents

Components of the application

Since 2013, a simplified form has existed. It includes the following fields to fill out:

- OGRNIP number;

- separately - last name, first name, patronymic;

- TIN number;

- to whom and how is the response to the completed paper issued: to the applicant, his authorized representative, in person or by mail;

- telephone;

- E-mail address;

- signature of the applicant or his authorized representative;

- position, signature and its transcript of the employee receiving the application.

If the applicant does not submit the document personally, but prefers to send it by mail, then there is a space on the paper for the notary’s marks. Any authorized person who has the right to certify a notarial act can also perform the functions of confirming a document.

Important point! You only need to sign in the presence of a tax inspector. If the application is sent by mail (and personal presence is not possible), then a notary must be present when signing.

For reliability, the TIN of the person who is the guarantor of the applicant’s authenticity is indicated. The last point is needed for insurance in case of judicial practice on issues of illegal closure of an individual entrepreneur. The entire lower quarter of the application is left for official tax service marks. There is no need to fill it out.

What to do after closing

After receiving the liquidation document, the individual entrepreneur receives the status of an individual, but this does not relieve him of some obligations.

Further actions:

- Closing a bank account. This is not necessary, but this step will free you from having to pay for cash register services. Most banks charge a set amount, regardless of whether there have been movements on the account or not.

- Deregistration of cash register equipment (CCT). For this purpose, an employee of the technical center is invited. service, which will withdraw a fiscal receipt. You need to contact the tax office with an application, form KND-1110021, KKT registration card, and fiscal report. There is no need to pay state duty.

- Destruction of the seal, if it has been registered. To do this, you also need to contact the Federal Tax Service with an application.

Closing an individual entrepreneur does not relieve one from the obligation to pay off contractors. An entrepreneur is liable with all his property, so cessation of activity and lack of income will not be an obstacle to debt collection.

It is recommended to transfer the debt before the trial. Otherwise, in addition to the amount under the contract, you will have to pay legal costs, penalties and fines.

What documents will be needed for submission?

If you express a desire to terminate your activities as an individual entrepreneur, you will definitely need a Russian passport and, if available, a passport of a representative (trusted person). The latter can be a relative, friend, or a specialist hired for this purpose: lawyer, attorney, etc. You will also need notarized copies or originals of the TIN, OGRNIP of the legal entity.

Another important point is a fresh (no later than five working days from the date of application) extract from the Unified State Register of Individual Entrepreneurs. Without it, an application to close an individual entrepreneur cannot be accepted by the tax authority.

The cost of obtaining an extract in our country ranges from 200 to 500 rubles.

Submission of documents

Deregistration of an individual entrepreneur is carried out by the Federal Tax Service at the place of registration.

An application for deregistration of an individual entrepreneur can be submitted in the following ways:

- by personally contacting the tax office. This option is the simplest and does not require extra costs. The only downside is the queues;

- through a representative. By contacting a company that provides such services, you can save some time, but you will have to pay for such services and for issuing a power of attorney;

- Russian Post. Send a registered letter with a description of the contents. This option is suitable in situations that do not require urgency. The deregistration application form must be filled out without errors, otherwise the documents will be sent back.

- by email. To submit an application this way, you need a digital signature.

The Tax Service reviews documents for deregistration within 5 working days. If the result is positive, the entrepreneur is issued a certificate. You can obtain it in person by submitting your passport to the regulatory authority. A trusted person can also do this.

If the document is not received within the established time frame, the tax office sends it by registered mail to the registration address of the former entrepreneur.

In cases where individual entrepreneurs are not deregistered with the tax authorities for any reason, they receive a notice of refusal, indicating the reasons.

If you have debts to the Pension Fund

Previously, until 2013, in order to close, it was necessary to provide a certificate from the Pension Fund stating that the open individual entrepreneur had no debts to it. Now the situation is different. You can also close your debts, but they won’t go away. It’s just that the private applicant will have a debt to the Pension Fund. Thus, there is no need to provide a certificate of no debt along with the paper.

The tax authority to which the application was submitted will independently make a request to the pension fund. With any answer, they will close (if all other parameters are in order), only at the same time they will notify the Pension Fund of this fact.

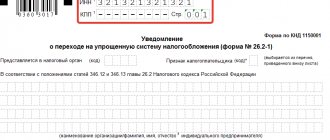

Notification form 26.2-8

To notify the tax inspectorate of the termination of the simplified tax system, a notification has been introduced - a special form 26.2-8. It is submitted to its territorial Federal Tax Service.

The notice of termination of the simplified tax system 2020 (the form can be found below) is applied on the basis of the order of the Federal Tax Service dated November 2, 2012 No. ММВ-7-3/ [email protected] (Appendix No. 8).

Below we provide a sample of filling out form 26.2-8.

Notice 26.2-8: sample filling

You can submit notification 26.2-8 to the Federal Tax Service in any of the following ways:

— electronically;

- by mail with a valuable letter with an inventory;

— personally (by an authorized person).

Apart from a mark of receipt on the second copy when submitting the form in person, or sending a receipt when sending via the Internet, the Federal Tax Service does not issue any other documents in response. That is, it is understood that the enterprise itself notifies the fiscal authorities about the termination of “simplified” types of activities (notification nature), no preliminary decision of the tax office is required.

Form 26.2-8 can be downloaded below.

Sample of filling out form 26.2-8

Important nuances

A receipt for payment of the state fee (RUB 160) must be attached to the application (on a paper clip or stapler). If the closure of an individual entrepreneur is carried out in person, and the signature on the completed form is placed in the presence of a tax inspector, then you do not need to use the services of a notary.

The processing time for the application is no more than five working days from the date of application. You can find out about the status of a specific application online through the website of the federal tax service. A valid tax return is required. It is necessary to submit it, even if it is zero. But the legal subtlety of this point is that this can be done both before filing an application to close an individual entrepreneur and after.

How to submit an application to the Federal Tax Service without personal participation

When it is not possible to cover an individual entrepreneur on your own, there are several ways out of the situation:

- entrust the closing procedure to a third party, providing him with a notarized power of attorney;

- send the application by registered mail;

- use the online service.

If we rank by popularity, the last option occupies a leading position.

By proxy

A power of attorney can be made for any person. In order for it to acquire legal force, it must be certified by a notary. To do this, the individual entrepreneur will have to approach the notary himself with the following package of documents:

- Russian passport;

- a photocopy of the passport of the citizen who will be the representative;

- TIN;

- extract from the Unified Register;

- a completed application for termination of business activity.

An extract from the Unified State Register of Individual Entrepreneurs is taken with the expectation that it is valid for only 5 days. The application is signed only in front of a notary.

By mail

When sending documents by Russian Post, you should generate a registered letter with a description of the attachment.

An alternative to this option may be to contact a courier service

Online

The easiest and fastest way is to fill out an application for closing an individual entrepreneur in 2019–2020 online. This opportunity is provided through the Internet portal of the Federal Tax Service, subject to the presence of an electronic digital signature.

Attention! Today, you can remotely close an individual entrepreneur only through the website of the Federal Tax Service. This type of service is not available on the State Services service. But those who have an account on it can use it to log in to the tax office portal.

Online application instructions:

- A section is opening for individual entrepreneurs.

- Click on the “Fill out a new application” link.

- Give consent to the processing of personal information.

- Indicate the required form.

- Enter your OGRNIP and your email.

- Carefully check that the form is filled out correctly.

- Sign the document electronically and send it.

- The papers are sent in scanned form as a separate file.

The next day, a letter will be sent to your email address with a receipt confirming the delivery of documents to the tax authority.

Attention! According to the new norms of the Tax Code of the Russian Federation (clause 32, clause 3, article 333.35), from January 1, 2020, there is no need to pay a state fee when sending an application through electronic resources.