Concept and grounds for granting a deferment or installment plan for the payment of taxes and fees

In accordance with the provisions of the current Tax Code of the Russian Federation, the concept of providing a deferment or installment plan for the payment of taxes and fees means a certain change that concerns the immediate deadline for paying a particular tax.

The current procedure establishes that the period for which a deferment or installment plan can be granted should not exceed one calendar year. In a special procedure, installment plans or deferments can be granted for a period of up to three years, if such a decision was made by the Government of the Russian Federation.

The procedure for granting an installment plan or deferment for the payment of taxes and fees requires the existence of grounds provided for by the tax legislation of the Russian Federation. These grounds include the following:

- causing a person certain material damage as a result of force majeure and special circumstances, for example, natural force;

- in case of delays in a person’s financing of their budget, or if this person has paid for a government order;

- the existence of a threat of bankruptcy of a person, or the court’s issuance of a settlement agreement, as well as the drawing up of a special schedule for the further repayment of existing debt;

- in case of a special property situation of this person, if it excludes the possibility of prompt repayment and payment of taxes and fees in full;

- if the work on selling certain goods or providing any services is seasonal in nature, in accordance with the list of seasonal work approved by the current legislation of the Russian Federation;

- when it comes to paying taxes for the movement of certain goods across state borders. In this case, a deferment or installment plan may also be granted if there are appropriate conditions and grounds for changing the payment deadline to be lawful.

When can you expect tax payment deadlines to be postponed?

The reasons why an organization or individual entrepreneur may be granted an installment plan for paying taxes are indicated in clause 2 of Art. 64 Tax Code of the Russian Federation. You have the right to apply for a postponement of the payment deadline if you meet at least one of the conditions:

- the activities of an organization or individual entrepreneur are subsidized from the budget, funds are transferred with delays and irregularly;

- your company suffered damage as a result of a natural disaster, technological disaster, or other force majeure circumstances;

- there are not enough funds to pay taxes or after paying all budget payments the taxpayer will be on the verge of bankruptcy;

- The organization’s revenue is seasonal;

- taxes, penalties and fines were assessed as a result of a tax audit, and the amount is so significant that their one-time payment is impossible;

- you are an importer of goods and apply for payment of customs duties in installments according to the rules of Art. 59 of the Customs Code of the Eurasian Economic Union.

How to confirm a difficult financial situation

If you want to postpone payment deadlines, calculate your financial indicators. They will help you understand what you are entitled to claim. So, what numbers will confirm the right to postpone the tax payment deadline?

How to calculate your financial indicators

The installment amount cannot exceed the value of the net assets of the company or entrepreneur (clause 2.1 of Article 64 of the Tax Code of the Russian Federation).

The procedure for granting a deferment or installment plan for tax payment

The legislation of the Russian Federation establishes a special procedure and conditions, due to the observance of which interested parties are granted a deferment or installment plan and the established payment period is changed.

The initial stage of this procedure is the submission of a written application from the person interested in the provision.

The application must be submitted to the appropriate authority that has the authority to accept these documents.

Then, no later than five days from the date of filing, a copy of this application should be sent to the tax authority located at the place of registration or registration of the person.

The following documents must be attached to the written application: certificates from the banking institution about the person’s regular financial turnover for the six-month period before submitting the application, certificates about cash balances on existing open accounts, a complete list of counterparties.

An additional and very important document is the obligation of the person, which implies mandatory compliance with all established conditions for the period of change in the deadline for paying a tax or fee. The final document will be confirmation of the presence of one or several grounds that provide a legal opportunity to change the procedure and deadline for paying taxes and fees.

The documentary basis can be a well-founded conclusion about the occurrence of special circumstances, an act of assessing the damage that was caused by force majeure, etc.

How to get an installment plan?

In addition to the application for a deferment (installment plan) for tax payments, documents of clause 5 of Art. 64 Tax Code of the Russian Federation:

- certificates from banks on monthly turnover for each of the six months preceding the submission of the application and on cash balances;

- list of counterparties-debtors. It is necessary to indicate for each debtor the prices of contracts and the terms of their execution, attach copies of these contracts and primary documents on them (invoices, certificates of services rendered (work performed), etc.);

- obligation to comply with the terms of the deferment (installment plan), as well as the expected debt repayment schedule.

In addition to the listed documents, the interested person must additionally submit (clause 5.1 of Article 64 of the Tax Code of the Russian Federation):

- the conclusion of the authority on the fact of a natural disaster (technological disaster) and the assessment report of the damage caused - if the reason for applying for a deferment (installment plan) was damage caused under emergency circumstances;

- information about uncollected amounts of payment for a completed government order (this document can be drawn up either by the manager of budget funds or by the taxpayer himself) - in case of non-receipt of funds from the budget;

- a certificate stating that the share of income from seasonal activities is at least 50% of the organization’s total revenue - if the organization carries out activities that are seasonal in nature.

Changing the deadline for paying taxes, fees, insurance premiums, penalties, and fines can be ensured:

- pledge of property (Article 73 of the Tax Code of the Russian Federation);

- guarantee (Article 74 of the Tax Code of the Russian Federation);

- bank guarantee (Article 74.1 of the Tax Code of the Russian Federation).

In this case, the surety agreement, pledge agreement, and bank guarantee are subject to registration with the tax authority.

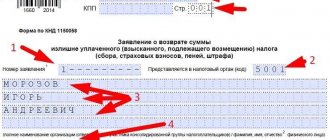

Calculation of interest on tax arrears

The accrual of penalties, fines and interest on the existing amount of tax debt, as legal measures, are aimed, first of all, at the speedy fulfillment by a person of his financial obligations. Interest is a certain amount of money that a person is obliged to pay after paying the principal debt. Interest is always expressed in monetary terms.

Payment by the debtor of the principal amount of debt on established taxes and fees does not relieve him from the need to pay accumulated interest. The accrual of interest can be stopped, but only if such a decision is made by a judicial authority, or under other circumstances that have appropriate grounds.

If the interested party was granted a deferment or installment plan for the fulfillment of financial obligations for taxes and fees, the accrued interest may also be included in this installment plan.

The changes made to the procedure for paying a certain amount of taxes and fees will also affect the established procedure for paying existing interest. At the same time, the process of interest growth itself stops from the moment when the decision to grant a deferment or installment plan for tax payment was made by the authorized body.

Documents for providing installment plans or deferred tax payment

The final decision on granting a deferment or installment plan for the payment of tax, as well as on the refusal to satisfy these requirements of an interested person, can only be made by an authorized body.

As regular practice shows, cases of refusals are by no means uncommon. In most situations, this is due to the fact that the interested party was unable to provide comprehensive evidence of the need to grant a deferment.

That is why the legislation of the Russian Federation defines a clear procedure, conditions, grounds and rules for filing an application for deferment. Particular attention is paid to the list of required documents that are submitted to the authorized tax authority.

The main one is a written statement in which the interested person expresses his request for an installment plan, and also motivates the need for such provision with certain reasons.

The next step is to collect the necessary applications for your application. This includes bank statements showing the current state of financial accounts, as well as a written undertaking that the person agrees to comply with the conditions established by law if he is granted an installment plan to pay taxes and fees.

The most important documents will be the immediate reasons that will confirm that the person really was unable to make payment on time, for reasons beyond his control.

For example, a report from an insurance agent, an assessment of material damage, and even an extract from a police report on theft of property, etc.

Documents for obtaining tax deferment

When applying for an installment plan or deferment of tax payments, you must submit documents (Article 64 of the Tax Code of the Russian Federation):

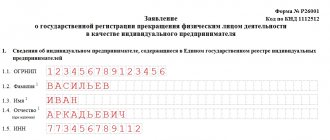

- Application for tax deferment (sample letter to the tax office for deferment);

- Bank certificate about cash balances on all accounts, monthly turnover, presence/absence of a card index;

- List of debtors indicating contracts, copies of contracts;

- Obligation to comply with the terms of the deferment;

- Documents confirming the existence of grounds for granting this deferment: as a result of force majeure circumstances - the conclusion of the authority on the fact of a natural disaster and the assessment report of the damage caused; in case of non-receipt of funds from the budget - information about the uncollected amounts of payment for the state order; if production is seasonal, it is necessary to provide a certificate stating that the share of income is no more than 50% of the organization’s total revenue.

If the applicant does not attach the specified documents, the authorized body makes a decision to refuse due to the lack of documents necessary for consideration of the application. Upon request, the authorized body has the right to make a decision on a temporary (for the period of consideration of the application for a deferment or installment plan) suspension of payment of the debt amount.

When applying, additional documents may be required - acts of reconciliation of calculations for insurance premiums, penalties and fines. Sometimes the tax authority may require that the execution of your deferment or delay be secured by a bank guarantee, surety or pledge of property (clause 19 of the Procedure for granting a deferment), which must be registered with the tax authority.

Attached documents to the application for a deferment or installment plan for tax payment

Deferment or installment payment of established taxes and fees is provided for by the current legislation of the Russian Federation, primarily for maximum protection of the interests and legal rights of taxpayers. In order for the decision to grant an installment plan to be positive, you should collect in advance the necessary documents that must be attached to the application.

The established procedure allows that these documents can be submitted to the tax authority either by a personally interested person or by his representative, provided that the latter has a executed power of attorney with a list of powers of this representative.

Depending on the specific grounds that were indicated by the interested party in the application, the tax authority may require the provision of relevant documents, for example:

- an official conclusion about the actual existence of a force majeure event, which subsequently led to the impossibility of timely fulfillment of financial obligations to pay taxes and fees;

- information about movable and immovable property that belongs to the interested party not on the basis of valid property rights. This document may be required when the basis for granting a deferment is specifically the current property status of the applicant.

The tax authority may require other additional documents required in each specific case.

Accounting in 1C

In the Reports section - Regulated reports - Notifications - Create button - Mutual settlements with the tax office folder, create and fill out an Application for installment plan for tax payments (available from release 3.0.77.78).

The document consists of three parts:

- Statement;

- Timing information;

- Commitment.

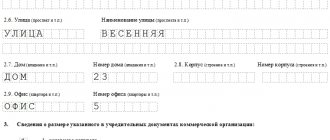

Only the organization's data is automatically filled in the Application Check them and edit them manually if necessary. Complete the form with the following information:

- status of the organization for the purpose of obtaining a deferment (installment plan);

- period of deferment or installment plan.

information on new payment deadlines and taxes using the appropriate link or by going to the panel on the left in Information about deadlines - for each tax on a separate page.

Please indicate:

- Tax — select from the list the tax for which you need to postpone the payment deadline;

- KBK — select the KBK corresponding to this tax from the list.

- The scheduled payment deadline is the tax payment deadline in accordance with the Tax Code of the Russian Federation;

- Amount - the amount of tax payable according to the declaration (the declaration must be submitted);

- The new payment deadline is the payment deadline taking into account the deferment (installments).

The obligation is filled in automatically - edit manually if necessary.

Click the Show form to print the application and obligation (the format for sending via TKS is not currently approved), sign and submit to the Federal Tax Service: PDF

- personally;

- by mail:

- through the Contact the Federal Tax Service of Russia service.

Prepare outside the program and attach to the application:

- if the deferment is more than 6 months - security documents (pledge, surety, bank guarantee);

- for installments of more than 6 months - security documents and repayment schedule.

See also:

- Anti-quarantine measures for property businesses

- Useful links for accountant work

- Hope for help, but don’t make a mistake yourself

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Cancellation of taxes for the 2nd quarter of 2020 for affected industries In the 2nd quarter of 2020, businesses and non-profits affected by coronavirus…

- Accounting and calculation of penalties Let's consider the procedure for calculating penalties for legal entities and individual entrepreneurs. From…

- How to submit reports to companies registered in the fourth quarter? You do not have access to view. To gain access: Complete...

- Rental holidays from 2020 The COVID-19 pandemic has caused a serious economic crisis. Problems have affected all industries...

Decision to grant a deferment or installment plan for tax payment

A legal decision to grant a deferment or installment plan for tax payment is made by the tax authority if there are grounds, as well as all the required documents that these grounds can confirm.

A positive decision will be made if the following conditions and procedures are met:

- if the interested person - the taxpayer - suffered serious damage, which led to a sharp deterioration in his current financial situation, and also if this damage was the result of force majeure - a natural disaster, etc.;

- there is a risk of bankruptcy of the interested party if he currently pays all established taxes and fees;

- if certain conditions and the current property status of the interested person do not allow the possibility of paying taxes and fees at the present time. A sharp change in the current property situation for the better, for example, the receipt of a serious profit, etc., cancels this clause and returns to the tax authority the right to demand timely repayment of existing debt. In this case, the person is no longer provided with a deferment or installment plan.

Income condition for tax deferment

In addition to being included in the List of those entitled to individual preferences, one more important condition must be met: the person applying for the benefit must have a decrease in income .

The reduction should be at least 10% of the following possible indicators:

- total income of an organization or individual entrepreneur;

- revenue from the sale of goods (works, services);

- revenue from the sale of goods (work, services) for transactions subject to VAT at a rate of 0% (it can only be considered if the volume of such sales exceeds 50% of their total volume).

Data to confirm a decrease in income indicators should be taken from tax records.

An alternative approach is also provided , which allows not to confirm a decrease in individual indicators. So, if the income tax return for the 2020 quarter (preceding the quarter in which the benefit is applied for) shows a loss, but there is no loss in the 2020 return, then you can apply for the benefit.

Taking into account the shift in reporting deadlines and tax payment deadlines for 2020, we can conclude: you will not be able to apply for deferments and installment plans for paying taxes for 2020 immediately, but only after tax reporting has been submitted, allowing you to confirm your right to benefits.

The question also arises regarding individual entrepreneurs on the general system and regarding special regime officers. From the regulatory framework that exists now, it turns out that they may not take advantage of the right to an individual benefit at all, since in order to receive it they first need to submit a declaration for 2020. And by that time the temporary preferences will end. The Federal Tax Service confirms this conclusion: according to tax specialists, individual entrepreneurs on special taxation and special regimes have the opportunity to use only general tax holidays in connection with the coronavirus.

Decision to refuse to grant a deferment or installment plan for tax payment

The established procedure and conditions imply that installment plans cannot be provided under certain circumstances. In accordance with the rules of tax legislation, it is not provided if in relation to a person:

- criminal proceedings have been initiated in relation to an offense and a crime, one way or another regarding violation of tax norms and established rules;

- active proceedings are underway regarding a tax or administrative offense committed by a person interested in granting a deferment;

- active proceedings are underway regarding violations related to the payment of taxes and fees to customs authorities for the transportation of certain goods across the state border;

- if the tax authority has serious reasons to suspect that the provision of a deferment is required by the interested person for the subsequent concealment of part of the income or property he has in order not to be subject to the taxation procedure. In addition, the tax authority may suspect that changing the payment deadline is necessary for the person to leave the country;

- if within three years, before the person applied to the tax authority for an installment plan, a decision was made to terminate the previous installment plan due to a violation of the established procedure and obligations of the interested person.

Get an expert opinion on paying taxes and fees in two clicks

What is the essence of individual benefits?

Deferment is the postponement of the payment deadline to a later date without charging penalties, blocking accounts or other methods of collecting arrears.

An installment plan is permission to transfer not the entire amount at once, but to break the payment into several parts. The taxpayer must transfer money to the budget monthly, in equal installments, throughout the installment period. The first transfer must be made in the month following the one in which the decision to provide the benefit was made.

REFERENCE . “Coronavirus” deferments and installment plans differ from those that the Federal Tax Service gives according to the general rules (they are set out in Articles 61, 62 and 64 of the Tax Code of the Russian Federation). Due to the pandemic, a number of restrictions do not apply. In particular, now an organization against which proceedings for a tax violation have been opened will be able to receive the benefit. Even with the seasonal nature of the business, installments may exceed the size of the company's net assets. There are other concessions as well.

Find out about the taxes paid by the counterparty and the violations committed by him