Activity

In their work, bank employees perform a number of operations that can be divided into several categories:

- providing settlement and cash services, conducting banking operations, lending to legal entities and individuals, accepting savings and deposits;

- checking the correctness of documentation for payments, preparing various statements of current accounts, sales of securities, currency exchange;

- timely maintenance of an operational journal;

- Providing reference information for bank clients.

Important qualities

The profession of a bank employee requires the presence of a variety of personal and professional qualities, without which the work will not be effective.

In recent years, the fashion for working in a bank has also changed the approach to selecting candidates. More and more specific requirements appear in vacancies that are in no way related to objective functional responsibilities. Some banks are looking not only for smart, beautiful, stress-resistant employees, but also for those who “will explain the inaccessible in an accessible way.”

Generally recognized important qualities:

- perseverance;

- sustained attention;

- analytical thinking;

- self-control;

- tendency to be scrupulous when working with numbers;

- honesty;

- accuracy;

- demandingness both towards oneself and towards others;

- integrity;

- emotional stability;

- good operational as well as long-term memory.

Features of work

Any bank employee, regardless of the position he occupies, must be able to delve into details and resolve controversial situations with lightning speed. Prolonged concentration, which is especially important in this area, should not quickly lead to fatigue. The slightest mistake can entail either greater financial or material liability, or simply trouble for the employee and the client.

Separately, leadership qualities can be highlighted for an employee in this industry. Having a passive character and report, the employee will not be able to work with clients, and in the event of a conflict, he will not respond quickly, and most importantly, in such a way that both the bank and the client are satisfied.

Reviews about the profession

“If career growth is a priority, it is necessary to expand your professional horizons, develop communication and management skills, and generalize knowledge about the work of the bank and the banking industry as a whole. Gradually, such a specialist will rise through the ranks, heading a sector, division, department, department. If he wants to become a professional, he should study as deeply as possible the area of banking activity to which he is ready to devote himself. In this case, you can work as a credit inspector for many years, bringing more and more profit to your bank, increasing your own well-being.”

Mikhail Kravchenko, and. O. Director of the Moscow Banking School (College) of the Central Bank of Russia.

Education

An employee in the banking sector must have a secondary vocational education (college, technical school), a higher education (most often economics), and sometimes two higher education degrees (relevant for managerial positions and management staff).

Research shows that in this area the largest percentage of work is in the specialty or in a related industry. However, in recent years the trend has been that the increase in graduates with a banking education is not equal to the number of open vacancies.

Typically, former students of economic universities find employment in large companies, banks, concerns or special institutes. Some of them open private practices in this area and do business.

Satisfaction with the profession is more than 80% - this is exactly the percentage of employees who plan not to change their chosen field of activity. And 20% are ready to change direction or get a related education.

Qualification and Education Requirements

99% of employers indicate a sufficiently high level of professional training (HPE) as the main requirement. The main “forge” of banking personnel is finance faculties. For us it is “Banking”, specialty “Finance and Credit” of the Faculty of Economics.

Accountants and economists are hired as cashiers. Future managers are more free to choose where to study. Many graduates of our management courses (profile “Human Resource Management”, “Strategic Management”) have successfully found employment as regional directors of financial and credit organizations, managers of branches/branches.

Additional skills and abilities

The financial services market is constantly growing; it was the first to switch to automated systems and digital technologies. All this determines high demands on employees. The most important of them:

- good knowledge of special software;

- English proficiency;

- online service promotion skills;

- modern methods of analysis (business value, financial stability of the borrower).

Career

A bank employee starting a career in this field has great opportunities for career growth. Most private banks prefer to hire 3rd-4th year university students or graduates without work experience. This is how they get hardworking employees who are “greedy” for work. By educating them to suit their needs and instilling corporate values in them, the company in this case receives a loyal employee who is ready to grow and develop within the same structure.

Starting work as a junior department employee or assistant, within a few years each employee has the opportunity to grow into a department head. Clearly defined career programs make the banking industry very attractive to employees.

Professional skills: what to write in a resume?

Professional skills are part of the set required for a particular profession. This also includes technical skills (more on them below). Hard skills are job-specific and are typically listed in job advertisements and job descriptions.

For example:

An English tutor needs teaching skills; (based on personal quality - sociability); the skill of financial analysis and reporting is necessary for the financial director (based on the flexible skill of attention to detail).

In contrast to soft skills, they do not develop throughout life, but only over time and within the chosen career. Also, unlike soft skills, they can be objectively measured and assessed.

Tip: 91% of employers want to hire employees with ready-made job skills. List the problems you solved with this skill, as well as the accomplishments that came with it.

If you simply write “time management” on your resume, you will be little different from hundreds of competitors who are applying for this job just like you.

Wrong:

“I know about Scrum methodologies”

Right:

“Used extensive knowledge of Scrum methodologies to complete over 12 projects within budget and on time.”

Professional skills are a distillation of your experience. Everything you have learned in your professional career. This is an important part of the resume that attracts the attention of employers.

Key skills in a resume example for different fields

The SHRM study found that 46% of HR professionals say the most unfilled jobs are those requiring technical skills, such as analytics or engineering.

IBM says 2.72 million jobs requiring data science skills will be created next year, leaving a huge hiring gap. The demand for skilled employees will continue to grow steadily for many years to come.

Who is not suitable for?

Employees note that this industry is not suitable for creative people who want to make independent decisions, work from home or run their own business. Clear regulations and strict procedures oblige people to be at work on time, and working with clients in this case is associated with more stress than in the service sector.

It is also difficult for single players and non-team players to work in this area. The economic sector is structured in such a way that periodically requires consultations from colleagues with extensive experience. A bank employee who does not have a high level of communication skills will not be able to function effectively.

The field is closely connected with the use of modern IT solutions and technologies. Those who are not very computer friendly will find it difficult to understand the essence of the work.

Examples of professional skills for different professions

Key skills for project managers

- experienced team leader with the ability to initiate/manage different functional teams and multidisciplinary projects;

- critical thinking, decision making and problem solving skills;

- planning and organization;

- excellent interpersonal skills;

- Project management skills: influence, leadership, ability to negotiate and delegate authority;

- conflict resolution;

- ability to adapt to conditions;

- stress resistance.

Key skills for teachers

- motivation;

- initiative and high energy;

- developed oral and personal communication skills;

- decision making, critical thinking, organizing and planning skills;

- tolerance and flexibility in different situations.

Key skills for accountants

- analytical thinking, planning;

- accuracy and attention to detail;

- organization, ability to prioritize;

- problem analysis, use of judgment, ability to solve problems effectively.

Key skills for customer service

- developed communication skills;

- problem analysis and solution;

- organizational skills, focus on customer service;

- ability to adapt, ability to work under pressure;

- initiative.

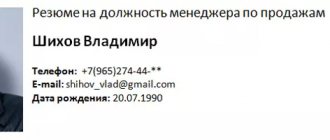

Example resume

A bank employee is often required in large banks. In order to get a job there, you need to send a resume. A bank employee’s resume is his business card, which not only reflects the professional qualities of the future employee, but also speaks about how he approaches the performance of his job duties.

When analyzing a resume, the HR manager pays attention even to the little things: errors in cases and declensions, typos, illiterate formatting, and negligence characterize the employee negatively and reduce his chances of getting hired.

An ideal sample resume for a bank employee should contain a list of key skills, a description of the functional responsibilities performed in previous positions, and the type of education.

For example:

May 2014 - February 2020, MasterPoStroy LLC, accountant.

Responsibilities: conducting cash transactions, payroll, maintaining “Client-Bank”.

February 2005 - December 2013, Pridnestrovian Savings Bank, senior accountant-cashier.

Responsibilities: cash services for individuals, work with deposits, loans, legal entities, currency exchange, issuance of plastic cards.

Education: Moscow State University, 2002-2007, “Economics and Finance of Small Business”, master’s degree.

Personal skills on a resume

Of course, as important as hard skills are, soft skills at work can be just as important, if not more so. Take, for example, an internal study conducted by Google

in 2013, called

Project Oxygen

, which looked at all the data in an attempt to determine which employee skills and characteristics were significant to a company's success, and which were the most valuable.

Even at Google, a company founded on the idea that technical skills determine success, STEM experience

(science, technology, engineering and mathematics)

ranked last among the eight skills of Google's top performers.

If you haven't guessed yet,

the other seven are soft skills on a resume, here's the list:

- mentoring;

- communication skills and listening skills;

- understanding others;

- empathy for colleagues;

- ability to think critically;

- solve problems;

- ability to communicate clearly.

These results received further support from Google in Project Aristotle

, which analyzed which teams achieved the best results. The assumption that A-teams equipped with better scientists would perform better was refuted, as some of the strongest, new ideas came from B-teams that offered less STEM experience but had stronger soft skills.

What is more important: qualities or skills?

iCIMS Hiring Insights

report found

that

94% of

HR professionals give employees with strong soft skills a better chance of promotion and leadership positions than those with years of experience but weak soft skills.

The report is based on an online survey of 400 recruiters conducted by Wakefield Research between June 22 and July 3, 2020.

94% of recruiters believe soft skills are important for leadership and management positions.

Recruiters rank problem solving as the most important skill (38%), followed by verbal communication (26%), adaptability (17%) and time management (13%).

Tip: Failure to show soft skills in an interview can cost you your job. According to the report, 75% of recruiters cut short an interview because the candidate did not demonstrate the soft skills required for the role they were applying for.

There is an important difference between hard skills (the know-how to do your job) and soft skills (the way you do your job). Professional skills will ensure your resume is viewed. Soft skills will help you stand out and get you a new job or promotion, but soft skills alone won't help you. But they will become increasingly important as jobs become robotic.

“When it comes to managing an entry-level employee or leading a project, a robot can't do the job well because it doesn't have the soft skills,” says Susan Vitale, workplace expert and director of marketing at iCIMS.

Advantages of the banking sector

Working as a bank employee has both pros and cons.

Advantages:

- High profit payment. Since employment and salary are official, it becomes easier for the employee to get a loan. In addition, many banks incentivize their employees by providing interest-free loans for the purchase of housing or acting as guarantors for purchases.

- Good social package. A wide range of additional incentive factors, from corporate mobile communications to health insurance.

- Career growth and professional development. Great attention is paid to personnel development in this area. For a young specialist, up to 60% of all trainings that are conducted throughout his entire career are carried out in the first 4-5 months of work.

- Reliability. Foreign investments that are actively pouring into this area make the banking industry stable and reliable.

- Prestige. The proud title of “banker” and belonging to the “white collar” motivates many employees to work better than a bonus from management.

A competent resume for a banker

There is a set of rules according to which a banker’s resume is compiled.

Such a document has a standard set of information:

- Candidate's full name

- education

- career objective

- floor

- age

- Family status

- residential address

- Contact details

- terms of cooperation

- employment (full/part-time)

- schedule

- experience

- skill level

The main objectives of a resume are to distinguish the candidate from the crowd and to interest a potential employer in his person. You can draw up such a document yourself or with the assistance of a specialist.

Sources

- https://PravoDeneg.net/trudovoe/dolzhnostej-rabotnikov-banka.html

- https://synergy.ru/about/education_articles/speczialnosti/professiya_bankovskij_rabotnik

- https://tvercult.ru/polezno-znat/bankovskoe-delo-kakie-dolzhnosti-zarplata-gde-uchitsya-chto-sdavat

- https://edunews.ru/professii/obzor/ekonomicheskie/bankovskie-rabotniki.html

- https://topobrazovanie.ru/professii/bankovskoe-delo.html

- https://delai-vibor.com/bankovskoe-delo.html

- https://vsyokartemir.ru/banki-i-kredity/spetsifika-bankovskogo-dela-i-trebovaniya-k-sotrudnikam/

- https://BusinessMan.ru/professiya-bankovskiy-rabotnik-professionalnyie-navyiki-obrazets-rezyume.html

- https://bankigid.net/spisok-dolzhnostej-po-vozrastaniyu-v-sberbanke/

- https://profytarget.ru/professiya-bankir-opisanie-obyazannostej-plyusy-zarplata/

- https://zen.yandex.ru/media/helperlife/bankir–kto-eto-i-chem-zanimaetsia-polnyi-razbor-professii-5deb65dffbe6e700b2fb95e2

[collapse]

Disadvantages of the sphere

The skills of a bank employee require narrow specialization. Many employees note that after 3-5 years, professional burnout begins due to the monotony of work.

The main disadvantages are considered:

- Monotony of functions. Working in a bank is quite routine and requires high concentration and responsibility. Every day you need to say the same phrases, perform the same actions, ask the same questions. This situation most often occurs in the customer service sector.

- Narrow specialization. Most often, the skills acquired in the banking industry cannot be applied to another industry. This does not apply only to sales people.

- Difficulty in career growth. Despite the opportunities for rapid career advancement, many employees note that in order to receive a promotion, it is necessary to have a different education than the one they have already received. Due to high workload, it is not always possible to study additionally.

Resume: column Professional skills and abilities

You can present your skills in the best light and confirm them with previous work experience. In this article, we have provided a sample list of required professional skills that must be included in your resume. You can edit this list and add additional skills to your resume to suit your needs. Below is a table with examples of professional skills that you can include on your resume. The table is divided into main professions and the skills they require.

| Skills and abilities | Top manager | Sales and Marketing, Customer Service | Programmers, designers, Research and development, teachers |

| Time management skills | + | + | |

| People management skills | + | ||

| Personal communication skills | + | + | |

| Business communication skills | + | + | |

| Oral skills | + | + | |

| Business management skills | + | + | |

| Strategic Thinking | + | ||

| Creative thinking | + | + | + |

| Organizational abilities | + | + | |

| Effective Listening Skills | + | + | + |

| Decision making ability | + | + | + |

| Problem solving skills | + | + | + |

| Negotiation skills | + | + | |

| Ability to work in a team | + | + | |

| Ability to conduct trainings | + | ||

| Ability to train others | + | ||

| Ability to learn quickly | + | + | |

| Effective Study Skills | + | + | |

| Analytic skills | + | + | |

| Ability to make risky decisions | + | + | |

| Sales skills | + | + | |

| Ingenuity | + | + | |

| Responsibility | + | + | + |

| Reliability | + | + | + |

| Creative skills | + | + | + |

| Determination | + | + | + |

| Business ethics | + | + | |

| Critical Thinking Skills | + | ||

| Customer Service Skills | + | + | + |

| Perseverance | + | + | |

| Multitasking | + | + | |

| Tact | + | + |