Hello, Vasily Zhdanov is here, in this article we will look at the net profit rate. Calculating the net profit margin of the net profit margin allows you to develop a simple and intuitive measure of a company's profitability in relation to its total revenue. This is a simple way to determine how much profit is received per ruble of sales. Business owners, investors and shareholders generally prefer a higher net profit margin ratio (also called the "net profit margin") because it indicates the overall financial health of the company and informs whether the firm's business model is efficient and sustainable.

Net profit margins are used to evaluate the effectiveness of a company's management and predict future profitability based on management's sales forecasts. By comparing net income to total sales, investors can see what percentage of revenue goes to pay operating and non-operating expenses and what percentage is left to pay out to shareholders or reinvest in the company.

What is the net profit margin?

Net profit margin is a financial ratio used to calculate the percentage of net profit a company earns to total income. It measures the amount of net profit a company receives per ruble of revenue received.

Net profit margin is usually expressed as a percentage, but can also be expressed as a decimal.

Important! Each company's net profit margin may vary depending on the industry in which the firm operates.

Why calculate net profit?

The amount of net profit measures the efficiency of the entire enterprise. This parameter is required for various purposes by both external and internal stakeholders.

| User/stakeholder | Purpose and uses |

| Investor | Assess the investment attractiveness of the business. To do this, analyze the amount of net profit and the dynamics of its changes. The ability of a company to produce a large net profit at the end of the reporting period indicates its high profitability |

| Creditor | Assessing the company's creditworthiness. It is determined by the amount and dynamics of net profit, on which the solvency and creditworthiness of the organization depends. Money is the most liquid asset. The more free capital a company has after paying taxes and all inevitable costs, the easier it will be for it to pay off long-term and short-term obligations |

| Business owner or shareholder | Assess the effectiveness of the organization as a whole. An integral characteristic of an organization’s activities is net profit, which reflects the effectiveness of all management decisions made in the reporting period. The larger it is, the more efficient the management, the greater the dividend payments and the easier it is to attract new shareholders and sell company shares. |

| Provider | Assess the stability of the organization's functioning. Suppliers are interested in net profit as a marker of the sustainable development of the client company: the more significant net income it received during the reporting period, the more it can be counted on to pay suppliers on time for purchased materials and raw materials, as well as fulfill obligations to contractors |

| Top manager | Assess the stability of the company's financial development. The manager of an enterprise is interested in the amount of net profit and its dynamics as guidelines for developing strategies and planning further activities - from global to very specific plans and schedules. It is also necessary to calculate net profit to distribute contributions to various funds: production, salary, reserve |

We recommend

“Types of company profit: what are they and how to calculate” Read more

Concept

Net profit margin is a profitability ratio that measures the percentage of net profit to sales. Comparing the net income of two different periods or two different companies can sometimes be inappropriate due to differences in size.

The indicator is used to describe a company's ability to generate profits, as well as to look at different scenarios, such as rising costs, which are considered ineffective. It is widely used in financial modeling and company valuation.

Net profit margin is a strong indicator of a firm's overall success and is usually reported as a percentage. An increase in revenue may lead to losses if it is followed by an increase in expenses. On the other hand, lower revenues, as well as tight cost control, could lead to a further increase in the company's profits.

A high ratio means that a company is able to effectively control its costs and provide goods or services at a price significantly higher than its costs. Therefore, a high ratio may be due to the following factors:

- effective management;

- low costs (expenses);

- strong pricing strategies.

A low net profit margin means that the company has an inefficient cost structure and poor pricing strategy. Therefore, a low indicator value may be due to:

- ineffective management;

- high costs (expenses);

- weak pricing strategies.

Important! Investors should use the net profit margin figure as a general indication of a company's profitability, and begin to dig deeper into the reasons for increasing or decreasing efficiency as appropriate.

Example of gross profit calculation

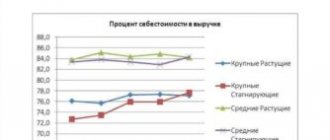

Let's look at how the gross profit indicator is calculated using the example of the activities of two organizations. Let’s take companies engaged in the production of confectionery products, but located in different cities “Lazur” and “Zarya”. The second one has a slightly different assortment, but the same direction of activity.

| Name/month | 1 | 2 | 3 | 4 | 5 | 6 | Total |

| Revenue thousand rubles | 2989 | 3330 | 3444 | 3797 | 5017 | 4885 | 23 463 |

| Cost of sales thousand rubles. | 978 | 1077 | 1165 | 1310 | 1542 | 1572 | 7644 |

| Gross profit thousand rubles | 2012 | 2253 | 2279 | 2488 | 3476 | 3313 | 15819 |

| Gross profit margin % | 67,3 | 67,6 | 66,2 | 65,5 | 69,3 | 67,8 | 67,4 |

Based on the tabular data, there is a monthly increase in gross profit from 2 million rubles. up to 3.3 million rubles The main factors influencing growth in this case are cost and revenue. For six months of activity, the organization’s profit amounted to 23.4 million rubles, the cost of sales was 7.6 million rubles, and the gross profit was 15.8 million rubles. Thus, each company received 2.6 million rubles monthly. gross profit. Organizations will be able to use it to cover management and sales costs, as well as interest on loans.

What does this indicator mean?

A net profit margin indicates that a business is pricing its products correctly and has good cost control. This is useful for comparing the performance of businesses in the same industry because they all share the same business environment and customer base and may have approximately the same cost structure.

Net profit margin is used primarily for internal comparison. It is difficult to accurately compare the coefficient for different enterprises. The operating and financing mechanisms of individual businesses are so different that they have different levels of expenses. Therefore, comparing one to the other makes no sense. A low profit margin indicates a low margin of safety: a higher risk that declining sales will result in lost profits and a net loss or negative margin.

The net profit margin affects all types of business activities of the company, including:

- total income;

- all outgoing cash flow;

- additional sources of income;

- cost of goods sold;

- other operating expenses;

- debt payments, including interest paid;

- investment income;

- income from secondary operations;

- one-time payments for emergency events such as lawsuits and taxes.

The net profit margin is one of the most important indicators of a company's financial condition. By tracking the increase and decrease of the ratio, the company can forecast profit based on revenue. Because companies express their net profit margins as a percentage rather than in rubles, it is possible to compare the profitability of two or more businesses, regardless of their size.

Investors can evaluate whether a company's management is generating enough profit on sales and whether operating and overhead costs are being contained. For example, a company may have growing revenue, but if its operating expenses grow at a faster rate than its revenue, its net income will decrease. Ideally, investors want to see margin expansion, meaning the net profit margin will rise over time.

Most public companies and corporations report net income quarterly in their income statement as well as in their annual reports. Companies that can grow their net income over time are typically rewarded with rising stock prices, which is closely tied to earnings growth.

Calculation of formula indicators

In the financial results report, the indicators included in the rate of return formula come from accounting data.

The revenue shown on line 2110 corresponds to the amount generated on the credit of account 90, minus the taxes (VAT and excise taxes) listed in the debit of the same account.

The amount of net profit can be taken as the balance of account 99 before the balance sheet reformation. In the financial results report, it is sequentially calculated from revenue (line 2110) by performing arithmetic operations with this amount using data included in each subsequent line of this report from certain accounting accounts:

- In line 2120 - as shown in the debit of account 90, the numbers received from accounts 20, 23, 41, 43.

- In line 2210 - as shown in the debit of account 90, the numbers received from account 44.

- In line 2220 - as shown in the debit of account 90, the numbers received from account 26.

- In lines 2310, 2320, 2340 - as equal to the income shown on the credit of account 91, minus VAT, if these incomes contain it.

- In lines 2330 and 2350 - as equal to the expenses shown in the debit of account 91, minus the VAT amounts related to income shown in the debit of account 91.

- In line 2300 - as equal to the amount written off from accounts 90 and 91 to account 99.

- In line 2410 - as equal to the amount of income tax accrued according to the declaration and shown in the accruals on the credit of account 68.

- In line 2421 - as equal to the difference between PNO and PNA, which ended up on account 99 from account 68.

- In line 2430 - as equal to the difference between the credit and debit turnover of IT in account 77 (a positive value when credit turnover predominates and a negative value when debit turnover predominates).

- In line 2450 - as equal to the difference between the debit and credit turnover of ONA on account 09 (a positive value when debit turnover predominates and negative when credit turnover predominates).

- In line 2460 - as equal to the sum of other data (except for the above) present on account 99.

All values in the financial results report are reflected taking into account the sign: positive ones - in their absolute values, and negative ones - in parentheses. Thus, in order to get the final result in the form of a net profit value, you need to sum the values of all the listed lines, taking into account the sign that is indicated for them.

In a simplified form of the report, the definition of net profit will be similar and, through the names of the lines, will have the following form:

Revenue + ordinary expenses (with a – sign) + interest payable (with a – sign) + other income + other expenses (with a – sign) + income tax (with a – sign).

When using the old form of the report on financial results (profit and loss statement approved by Order No. 67n), the indicated line numbers of the current report will be replaced as follows:

- 2110 to 010;

- 2120 to 020;

- 2210 to 030;

- 2220 to 040;

- 2310, 2320, 2340 at 080, 060, 090;

- 2330 and 2350 at 070 and 100;

- 2410 by 150;

- 2421 by 200;

- 2430 to 142;

- 2450 to 141;

- 2460 for the line number additionally entered in the old report form.

Calculation restrictions

Net profit margin can be affected by isolated situations, such as the sale of an asset, which will temporarily increase profits. Net profit margin does not impact sales or revenue growth, nor does it provide insight into whether management is managing its operating costs.

It is best to use several ratios and financial indicators when analyzing a company. Net profit margin is commonly used in financial analysis, along with gross and operating profit margins.

Important! When calculating net profit margin, analysts typically compare the metric to different companies to determine which business performs best.

This indicator can vary greatly between companies in different industries. For example, a company in the automotive industry may report high profit margins but lower revenue compared to a company in the food industry. A company in the food industry may show a lower profit margin but higher revenue.

It is recommended to compare only companies in the same sector with similar business models.

Other limitations include the potential for misinterpretation of net profit margins and cash flow figures. Low net income does not always indicate a poorly performing company. Also, a high rate does not necessarily mean high cash flows.

Difference between gross and other types of profit

- Difference from contribution margin

According to some sources, gross profit and contribution margin are identical. However, it is worth noting that this does not always happen. The main difference is that gross profit is the difference between revenue, all variables and the share of fixed costs.

Marginal profit is the difference between the income received from the sale of a product and variable costs, that is, all those related to the production of this product. Thus, this includes the costs of raw materials, materials necessary for manufacturing, energy costs, workers' salaries and others, calculated in volume for a specific product. Thanks to marginal profit, you can determine how profitable the production of a particular product is. It is worth noting that this indicator refers to the part of the proceeds, which subsequently goes to generate net profit and pay off fixed expenses.

Using marginal analysis of products produced by an organization, you can easily determine which products are profitable and which are not. The value of this indicator is influenced by variable costs and price, so to increase it you will have to either increase the cost of the product or the sales volume.

The formula for calculating contribution margin is as follows:

MP=OD-PZ

,

Where:

- MP

– marginal profit; - OD

– total income; - PV

– variable costs.

- Difference from gross income

An organization's gross receipts or income includes all assets derived from the organization's activities. This includes taxes, as well as other related payments that were included in the value of the assets sold. The formation of this indicator is influenced not only by the sales volume and price of the product, but also by demand, productivity, assortment and other minor factors.

- Difference from net profit

In this case there are also some differences. Unlike net profit, gross profit is calculated without taking into account tax deductions and other similar payments. After calculating gross profit before tax, the volume of net income is formed.

Top 3 articles that will be useful to every manager:

- Financial control at the enterprise

- Net profitability of the enterprise

- How to build a company's financial structure

Factors affecting the calculation

Net profit depends on a number of factors, which include:

- comparability. Low net margins in one industry, such as food, may be acceptable because inventories move quickly. Conversely, there may be a need to generate high net profits in other industries simply to generate sufficient cash flow to purchase fixed assets or finance working capital;

- leverage A company may choose to grow through debt financing rather than the equity option. In this case, it will incur significant interest expenses, which will lead to a decrease in net income. Thus, the financing decision affects the amount of net profit;

- accounting compliance. A company may accumulate items of income and expense according to different accounting standards, but this may give a misleading picture of its cash flows. High depreciation and amortization expenses can result in a low net profit margin even if cash flows are high;

- non-performing assets. Net profit margins may be radically distorted by the presence of unusually large non-operating gains or losses. For example, large proceeds from the sale of a division may create a large net profit margin even if the company's operating results are poor;

- short term focus. Company management may deliberately cut costs that reduce the business's ability to compete in the long term, such as equipment maintenance, research and development, and marketing, in order to increase net profit margins;

- taxes. If a company can apply its net operating loss carryforward to its pre-tax earnings, it can record a larger net profit margin. On the other hand, management may attempt to accelerate the recognition of non-cash expenses in order to minimize the amount of the tax liability. Thus, a particular tax scenario can significantly affect the rate.

Factors that determine business performance

Frequent use of significant sources of increasing business efficiency involves the use of a set of measures that reflect the main directions of development and improvement of activities.

It is worth noting the most important classification of business efficiency factors, based on determining the level of production management. These are internal and external factors, since they significantly influence the degree of efficiency of business activities.

Let us highlight in more detail three fundamental factors that directly influence the conduct of business and its economic results:

- Equipment, so-called means of production . With high productivity, quality service and optimal workload, you can get maximum results with minimal costs.

- Raw materials, materials and similar components . Good quality, minimal waste and low energy intensity, combined with good inventory management, should guarantee a high level of production, low defects and minimal costs.

- The technological availability of a business is a good sign of production intensity.

Is there an optimal net profit margin ratio?

If a company's profit is not negative, then the net profit margin formula should give a value between 0% and 100%. In practice, estimates greater than 30% are often difficult to find.

Typical values of this indicator depend on the focus of the business. If a company faces intense competition, then net profits are likely to be lower compared to a situation where the company is the only supplier in the market.

Important! Therefore, the normative values of this indicator are completely relative. It is also useful to compare profitability ratios with liquidity ratios such as the current ratio to get a broader picture of a company's financial position.

FAQ

Question #1: What does a higher net profit margin mean?

Answer. A higher rate is always better than a lower rate because it means the company can convert more of its sales into profit at the end of the period. The rate varies dramatically between industries, and if one industry has a lower average rate than another, this does not mean that it is less profitable. Industries such as retail may have a lower average rate than others, but they make up for it with higher sales volume, making them more profitable on an aggregate basis.

Question No. 2: What are the problems in calculating net profit margin?

Answer. Although the rate is a significant measure of financial analysis, there are some limitations to the problem.

First, it does not provide a clear picture of a company's operating profitability. This is because the rate takes into account the payment of interest and taxes. In this regard, it is better to use operating margin.

Second, the company may have several non-recurring items that reduce net income and negatively impact profitability. These costs will not be repeated in the future. In such cases, analysts typically add unit charges and restate adjusted net income.

This financial ratio is a useful tool when combined with other financial performance measures.

Question No. 3. Why is this coefficient so important?

Answer. Net profit margin is one of the most closely monitored metrics in finance. Shareholders look closely at net profit margin because it shows how well a company converts income into profits available to shareholders. Changes in net income are continually reviewed. In general, when a company's net profit margin declines over time, there can be a variety of problems with the situation, from declining sales to poor customer service to inadequate cost management.

Question No. 4. What is the standard for this indicator?

Answer. Generally, a net profit margin greater than 10% is considered excellent, although this varies depending on the industry and business structure.