Form of the act of provision of services, the procedure for its preparation and signing

The current legislation does not have requirements for the form of the acceptance certificate for services provided, but given that such an act can be used as a primary accounting document, its form can be determined by the head of any of the parties to the contract (customer or contractor) on the basis of Part 4 of Article 9 Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

Based on paragraph 4 of Article 421 of the Civil Code, the parties can jointly develop a form of act, which can be an annex to the service agreement. In this case, the contract itself must make reference to this annex as an integral part of the contract. Such a condition can be stated as follows:

“In confirmation of the provision of services, the parties draw up an act of provision of services in the form agreed upon in Appendix No. 1, which is an integral part of this agreement.”

It is also recommended that the parties agree on the procedure for drawing up and signing the act of provision of services, indicating:

- deadlines for drawing up and signing the act;

- persons authorized to sign the act;

- consequences of evasion of signing the act by one of the parties.

Deadline for signing the acceptance certificate for services provided

The deadline for signing the acceptance certificate for services provided must be determined according to the general rules of Articles 190 - 194 of the Civil Code (i.e., a calendar date, the expiration of a period of time, or an indication of an event that must inevitably occur). Eg:

“The fact of provision of services by the contractor and their receipt by the customer must be confirmed by an act of provision of services. This act must be drawn up and signed by the parties within ______ (time period indicated) after the end of the period for the provision of services, provided that the services are provided by the contractor.”

If the deadline for drawing up and signing an act of acceptance of services is not agreed upon in the contract, then in this case the act must be signed in accordance with Article 314 of the Civil Code within a reasonable time after completion of the process of providing services.

Persons signing the act of provision of services

The parties can establish in the contract authorized representatives who will sign the act of provision of services. To do this, you must indicate:

- surname, name, patronymic and position of the person;

- documents confirming the authority of this person, which must be presented when signing the act.

This condition of the contract can be stated as follows:

“The signing of the act of provision of services will be carried out by:

- on behalf of the customer: chief accountant __________________, acting on the basis of power of attorney No. __, issued by “__” _______ ___;

- on behalf of the executor - consultant ____________________, acting on the basis of power of attorney No. __, issued by "__" _______ ___.

To confirm the authority to sign the act, representatives of the parties present certified copies of powers of attorney, as well as identification documents.”

If the contract is concluded by the customer in favor of a third party, an act signed by the contractor and the recipient of services may be accepted as evidence of the provision of services.

If the parties did not indicate in the contract the person authorized to carry out acceptance, and the act itself was not signed by a person who has the right to act on behalf of the organization without a power of attorney, then such an act cannot be accepted as evidence of receipt of services by the customer (clause 1 of Article 183 of the Civil Code) . Therefore, the contractor will not be able to demand payment for services on the basis of clause 1 of Art. 781 of the Civil Code, but subsequent approval of the transaction by the represented (clause 2 of Article 183 of the Civil Code) entails the emergence, change, termination of rights and obligations under this transaction from the moment of its completion. Direct subsequent approval can be expressed in written or oral approval, even if it is not addressed to the counterparty, in the recognition of the counterparty's claim by the representative, in specific actions indicating the approval of the transaction.

Consequences of the customer’s evasion from signing the act

There are cases when the contractor provides services, prepares an act, signs it and hands it over to the customer for signing, but the customer avoids signing the act without explaining the reasons. To avoid such cases, the parties have the right to provide in the contract the following:

- in case of evasion or unmotivated refusal of the customer to sign the act of provision of services, the contractor has the right to draw up a unilateral act;

- the act will serve as confirmation of the provision of services by the contractor and their receipt by the customer, as well as the basis for payment for the services listed in this act.

This condition of the contract can be stated as follows:

“The services specified in the act are considered provided by the contractor, accepted by the customer in full and are subject to payment in accordance with the terms of the contract, unless the customer sends reasoned objections within 7 days from the date of delivery of the act by the contractor.”

How to apply correctly?

When drawing up such an act, it is recommended to adhere to a certain structure. It is important to reflect all the necessary information in the text of the document. You must not make mistakes or provide false information. Otherwise, the document will be declared invalid.

For gross violation of the rules for accounting for income and expenses, according to Article No. 120 of the Tax Code of Russia, a fine of 10,000 to 40,000 rubles is imposed. The act is usually drawn up on an A4 sheet. You can write it manually or using printing technology. The document includes text and tabular parts.

The acceptance certificate under a service agreement must consist of the following structural elements:

- a cap . Located at the top of the sheet. The title, number of the document, and the date of its preparation are given;

- main block Information about the contractor and the customer, the grounds for drawing up the act, a list of services provided, and their prices are indicated. It is also noted that the client has no claims against the contractor. The total amount to be paid is given;

- conclusion . These are the signatures of the customer and the contractor with a transcript, the date of execution of the document.

The document is drawn up in two copies. Each version must have signatures and seals.

Services can be legal, consulting, medical, transport, etc. The content of the document varies depending on the type.

Legal

There are many agencies in Russia that provide various types of legal services: business support, legal support for start-up entrepreneurs, drafting documents, examination of contracts, litigation, etc. A contract must be concluded between the client and the contractor.

Legal services are provided by legal specialists. As a rule, based on the results of the work, an acceptance certificate is signed. It is a guarantee for the client and the performer.

The document provides the following information:

- date and place of compilation;

- client data;

- name of the legal agency;

- list of services and their cost;

- total price;

- presence (absence) of claims from the customer;

- signatures of both parties.

Consulting

Consultations are conducted by experts from various fields of activity. This could be administration, finance and credit, management, marketing, etc.

Examples include consulting on human resources management, production organization, and information technology. The structure of the act of acceptance and delivery of services provided is standard.

The expenses given in the document must be confirmed by relevant papers and are economically justified.

Consultations are usually provided by auditors, lawyers, individual entrepreneurs, and banks.

Medical

Medical institutions specialize in counseling, examination, examination, nursing care, and treatment. Many hospitals and clinics strive to draw up an act of service provision. This is due to the fact that the text of the document will contain the phrase that the client has no claims against the doctors of the hospital or clinic.

As a rule, it is issued on paper. But it is acceptable to use an electronic version with a digital signature.

The document reflects the following information:

- place and date of signing;

- name of the medical organization;

- last name, first name, patronymic of the service recipient;

- name and terms of provision of medical services;

- the total cost;

- the fact that there are no complaints from the client;

- confirmation of the completion of medical services in full within the established time frame;

- signatures with transcript.

Transport

Transport services mean the organization of transportation of passengers or cargo.

They are formalized by the relevant acts. The document is usually accompanied by route and waybills, invoices, etc. The act must indicate the duration of the flight and the amount of money to pay for transportation.

Points of departure and arrival and stops are also marked. A document is drawn up and signed upon completion of transportation. Its structure and writing rules are standard.

A document is drawn up for mutually beneficial guarantees between the parties to the contract for the transportation of passengers or cargo.

Contents of the service acceptance certificate

Chapter 39 of the Civil Code does not establish requirements for the content of the service acceptance certificate. Nevertheless, the service acceptance certificate can be used for accounting purposes, provided that it contains the following mandatory details of the primary accounting document (Part 2 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”):

- title of the document (service acceptance certificate);

Note : a primary report that does not have a name does not confirm expenses, so the Federal Tax Service will assess additional income tax

- date of drawing up the act;

- the name of the economic entity that compiled the document (legal entities indicate their names; individuals must indicate their full name; it is also better to indicate the TIN, since the Federal Tax Service carries out identification using the TIN, otherwise expenses may be deducted. If the TIN is correct, there is an error in the name (full name) and the checkpoint will help take into account expenses (Letter of the Federal Tax Service of Russia dated February 12, 2015 No. GD-4-3/2104));

- content of the fact of economic life (that is, information about the services provided - types, volume and date of receipt of services). If you do not want to argue with the inspectors, detail the services provided in the report as much as possible, i.e. indicate not only the name of the service, but also describe in detail the actions performed by the contractor;

- the value of the natural or monetary measurement of a fact of economic life (price of services provided and (or) time spent in hours). Acts usually do not indicate time spent in hours, since for many types of services it is difficult to determine. Nevertheless, inspectors often require that the work time (in hours) of service providers be indicated in reports;

- the position of the persons who completed the transaction and are responsible for its execution (that is, persons authorized to sign the act on behalf of the parties to the agreement), as well as their signatures indicating the names and initials or other details necessary to identify these persons.

In the absence of one or more of the listed details, the act may be considered improperly drawn up and will not constitute confirmation of the provision of services. For example, the courts recognize acts that do not contain the position of the person who signed them and a seal containing the customer’s details as inadequate evidence of the provision of services.

Among the required details there is no such detail as “M.P.” (“Print Place”) However, our mentality cannot get used to the idea of abandoning the seal - no matter who signs the document, in almost all cases, a document with a seal still gives us greater confidence. If the very idea of refusing to print does not seem seditious to you and your business partners, you can refuse it when developing and agreeing on an act on the services provided. But our advice: be careful - do not neglect the established business customs (Part 1, Article 5 of the Civil Code) and use the seal on bilateral and multilateral external primary accounting documents (in particular, on acceptance certificates for work performed/services rendered in civil -legal contract).

In addition to the required details, the certificate of services provided must also indicate:

- a link to the details of the contract for the provision of paid services;

- type (name) of the service provided;

Note : It is better to indicate a specific (rather than general) name of the service. The name in the act must match the name in the contract

- period of service provision;

Note : if it is not clear from the act in what period the contractor provided the services, then the Federal Tax Service can withdraw expenses

- cost of services with allocation, incl. VAT amounts.

The parties may agree in the contract on additional requirements for the content of the service provision act. For example, they may provide that the act must reflect information about the amount of time spent on providing each type of service or a condition that the signature of the authorized person in the act must be affixed with the seal of the organization (if any).

If the requirements for the content of the act on the provision of services are not agreed upon, then the parties can draw up an act, providing in it the information specified in Part 2 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. It should be borne in mind that the act must also include a list of services provided and information about their volume, otherwise it will not be recognized as adequate evidence of the provision of services and the contractor will not have the right to demand payment for them under Art. 781 Civil Code.

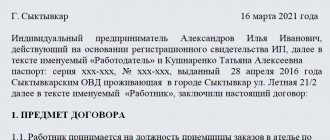

Based on the above, the service acceptance certificate may take the following form:

Explanations on the topic

| Main points | Requisites | Download |

| If you make payment minus a penalty, then in the certificate of services performed you must indicate the amount of payment under the terms of the contract, the amount of the penalty collected, the procedure for its calculation and the basis for its application, as well as the total amount to be paid to the supplier. | Letter of the Federal Antimonopoly Service dated December 10, 2015 No. ATs/70978/15 | |

| In case of termination of the contract by agreement of the parties, the customer pays only for the work that is confirmed by the act. | Letter of the Ministry of Finance of Russia dated November 10, 2017 No. 24-03-07/74487 | |

| As an act of performed services, you can use the form of a universal transfer act. You can add additional indicators to it. | Letter of the Federal Tax Service of Russia dated December 23, 2015 No. ED-4-15/22619 |

Sample of filling out the service acceptance certificate

Certificate of acceptance of services provided

for October 2014

under the Paid Consulting Services Agreement No. 123 dated March 1, 2014.

| Saint Petersburg | October 31, 2014 |

Romashka LLC (TIN 00000000000), hereinafter referred to as the “Customer”, represented by General Director I.I. Ivanov, acting on the basis of the Charter, on the one hand, and Odnodnevka LLC (TIN 00000000000), hereinafter referred to as the “Executor” ", represented by director Petrov P.P., acting on the basis of the Charter, on the other hand, drew up this Certificate of acceptance and delivery of services provided (hereinafter referred to as the Certificate) under the Paid Services Agreement No. 123 dated March 01, 2014 (hereinafter referred to as the Agreement ) about the following.

- In pursuance of clause 1.1 of the Agreement, the Contractor, during the period from October 1, 2014 to October 30, 2014, fulfilled its obligations to provide services, namely, provided the following services to the Customer:

- drawing up a conclusion on the validity of dismissing an employee - 1 (cost: hourly rate (5,000 rubles) x 1.5 hours = 7,500 rubles);

- preparation of an action algorithm for carrying out the procedure for reducing the number and staff of employees - 1 (cost: hourly rate (5,000 rubles) x 5 hours = 25,000 rubles);

- preparation of objections to a tax audit report - 1 (cost: hourly rate (5,000 rubles) x 3 hours = 15,000 rubles)

- The above services were completed in full and on time. The customer has no complaints regarding the volume, quality and timing of the provision of services.

- According to the Agreement, the total cost of the services provided is 47,200 (Forty-seven thousand two hundred) rubles, including 18% VAT in the amount of 7,200 (Seven thousand two hundred) rubles.

- This Act is drawn up in two copies, one each for the Contractor and the Customer.

| From the Customer: General Director of Romashka LLC _________________ Last name I.O. m.p. | From the Contractor: Director of Odnodnevka LLC _________________ Last name I.O. m.p. |

Peculiarities

ATTENTION! The main law regulating the obligations and rights of the contractor and customer of services is the Civil Code of the Russian Federation.

This document is not drawn up in all cases, most often when the services are of high cost and of great importance to the customer. Typically, legal entities who pay for services from the account of their company or organization are involved in drawing up the act. There is a simple document form that allows you to draw it up in accordance with all legal requirements.

This simple sample does not have a unified form; it is suitable for many types of services; you just need to enter your information and data correctly. But there are sections that must be in the text of the act of acceptance of work or services.

- This is accurate and complete information about the parties who entered into an agreement for the provision of services. The names, surnames, and patronymics of the persons drawing up and signing such an act are indicated.

- There must be an accurate listing of the services that were performed under the contract for provision.

- is given to this agreement concluded before the work was completed.

- The cost of services , the costs of their implementation, and the timing are indicated

- You also need to indicate the period during which the customer is obliged to pay for the work performed. But it is possible to pay for the order before it is completed, in which case you need to write about the payment made.

The act may confirm that the customer accepts the services and confirms their quality. If he has complaints, he indicates them in the act and gives the contractor a period to correct deficiencies in the work.

The customer may not accept the service and file a claim against the contractor in court for reimbursement of material costs. The act on which the delivery and acceptance is carried out is drawn up in two copies at once, one remains in the hands of the customer, the second copy is given to the contractor.

It is important to be careful when drafting this document. On its basis, paperwork for payment of services and other accounting documents will subsequently be drawn up. If the customer does not accept the work, the act will serve as the main document for legal proceedings.

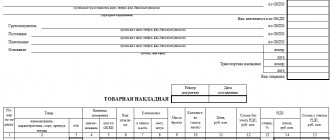

Universal transfer document

The parties can draw up an act of provision of services in the form of a universal transfer document (UDD), proposed for use by the Federal Tax Service of Russia in Letter dated October 21, 2013 No. ММВ-20-3 / [email protected] “On the absence of tax risks when taxpayers use the primary document drawn up based on invoice."

The UPD form is based on the invoice form and combines those specified in clause 2 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, mandatory details of primary accounting documents and information on invoices used for the purpose of implementing the legislation on taxes and fees, which is provided for in Chapter. 21 of the Tax Code of the Russian Federation and Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax.”

The parties may include in the contract for the provision of paid services a condition that the fact of provision of services will be confirmed by drawing up a universal transfer document. This does not contradict either the provisions of Chapter. 39 of the Civil Code of the Russian Federation on the provision of paid services, nor the requirements of Art. 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”.

The form proposed by the Federal Tax Service assumes two possible UPD statuses:

- a document combining an invoice and a transfer deed (document status “1”);

- only the transfer deed (document status “2”).

In the second case, the fields are not filled in (or dashes are placed in them), which are intended for indicators established as mandatory exclusively for the invoice. The UPD status is indicated when filling out the form by checking the appropriate box. However, it is important to remember that the actual status depends on filling out the fields (details) of the form (Appendix No. 4 to the Letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3 / [email protected] ). If only the fields intended for the primary accounting document (transfer deed) are filled in, then the UTD can be used to confirm the provision of services, but will not be used as an invoice.

The Federal Tax Service of Russia in the said Letter noted that the form of the universal transfer document is advisory in nature and does not limit the rights of business entities to use other conditions that meet the conditions of Art. 9 of Law No. 402-FZ forms of primary accounting documents (from previously valid albums or independently developed) and invoice forms established by Resolution No. 1137.

Information posted on October 18, 2014. Added - 04/24/2017

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.

Author: lawyer and tax consultant Alexander Shmelev © 2001 — 2020

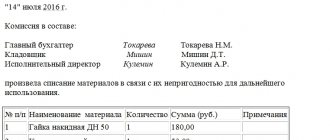

In what form is it compiled?

The format depends on the procurement object. If the subject of the contract was construction, repair, or major overhaul work, the basis for which was design and estimate documentation, then the document must be generated according to the unified form KS-2 (coding according to OKUD - 0322005, approved by Resolution of the State Statistics Committee of the Russian Federation No. 100 dated 11.11 .1999). It is useful to have a form, a sample act of provision of services in form KS-2 and an example of how to fill it out, at hand; this will help you do everything on time and without errors.

IMPORTANT!

When purchasing construction and major repairs, use the unified form KS-2!

In other cases, the act is drawn up in free form. It is most convenient to draw up a sample act of provision of services in Word. Each institution has the opportunity to create its own form. This will allow us to take into account the peculiarities of the organizational and legal form, industry and the specifics of a particular purchase. If necessary, the organization has the right to supplement the unified form KS-2. All developed forms must be approved in the accounting policies and local regulations of the customer.

The legislation does not establish strict rules for creating your own form. But for it to have legal force, you need to include the following information:

- details of the parties - names of the supplier and customer, their responsible persons, title documents;

- details of the register itself - number and date of compilation;

- details of the government contract, upon execution of which the final document is drawn up;

- the subject of the contract, as well as its main quantitative and qualitative characteristics;

- contract price including VAT and tax allocation;

- if the subject of the contract is not subject to tax, then this should also be indicated.

The finished document is signed by managers or other authorized persons.

Regulatory authorities require that the acts be filled out correctly. For this purpose, the authorities approve methodological recommendations for the generation of such reporting. The manuals prescribe both the procedure for filling out the register and the rules for applying and calculating fines and penalties for improper performance of the contract. To do this, the form includes relevant items reflecting the actual quality of the work, identified deficiencies, the amount of penalties and the amount under the contract calculated after deduction of fines and penalties.

Useful links on the topic “How to draw up a service acceptance certificate Sample (standard form) of the act”

- If the contractor performed the work poorly

- Agreement on the sale of a tourism product

- Features of the lease agreement for a safe deposit box

- Mandatory pre-trial (claims) procedure for resolving economic disputes

- Errors in the contract and their consequences

- How to correctly draw up an act of acceptance and transfer of goods, equipment and other property

- How to draw up an acceptance certificate for completed work

- Lease agreement (general form)

- Lease agreement for non-residential premises

- Loan agreement

- Contract of sale

- Car purchase and sale agreement

- Work agreement

- Work contract

- Contract for the supply of goods to a wholesale organization

- Standard form of a contract for technical inspection

- What is a contract

- How to draw up a contract

- Conclusion of an agreement

- Offer

- Acceptance

- Subject of the agreement

- Essential terms of the agreement

- Change and termination of the contract

- Features of the loan agreement

- Checking the “legal purity” of the apartment

- Features of a housing contract

- Tax risks of the contract

- Checking counterparties for integrity

- Procurement Regulations

How to fill out a certificate of completed work for services

If we take a free-form document as a basis, then in fact it consists of three large blocks:

- 1st block of documentation - name, date of compilation, location, registration number, if applicable;

- 2nd block: information about the services provided. If there were several works, it is convenient to arrange this part in a tabular form;

- 3rd block: details of participants. For legal entities – names, organizational and legal forms, authorized representatives. For individuals – full name, passport details, residence or registration address.

At the end, the document is certified by the signatures of both parties.

If we take this form as a basis, then to fill out you will need:

| 1st block | 2nd block | 3rd block |

| 1. Set the date of compilation in the format DD-MM-YYYY. 2. In the header of the document we indicate the city of compilation. 3. In the middle we write the name “Certificate of Services Performed”. Below we indicate which agreement it was drawn up for (number, date) | 1.What services were provided. For example, repairing a printer model PRINTER 2001-20-02. 2. Duration of execution of services. 3. Specific operations that were performed during execution (replaced the cartridge and removable cover) | This block is partially located before the 2nd and immediately after it. At the beginning of the act, the participants are registered, at the end – their details, signatures of authorized persons and seals (optional) |

Reasoned refusal to sign the certificate of services rendered

If the customer has complaints about the execution of work, the certificate of completion of work is not signed, a reasoned refusal is drawn up for it. Such a document has legal force and can be used in court as evidence in disagreements between counterparties.

It is important to correctly draft such a refusal and describe in detail the claims that have arisen - otherwise the document will not have legal force.

There is no single template for such a paper, but the sample should definitely include:

- title, date of compilation and place;

- indicate previously accepted agreements, additional agreements (if they were signed);

- describe in detail the claims that have arisen and compare them with the terms of the contract;

- describe who accepted the work, whether an examination was carried out. If yes, then by whom and what are its results;

- if necessary, attach photographic material, evidence of the low quality of performance (or non-performance) of work;

- calculate the losses incurred, prove them with documents and detailed calculations;

- sign the waiver.

One copy remains with the customer, the second is sent to the contractor.

The certificate of work performed under the service contract can be classified as mandatory documentation. After all, the contract itself only confirms that the parties agreed and accepted the terms of execution, but the fact of execution itself is confirmed by the act. Download samples and templates of acts of performed services for free on our page.

Related documents

- Business trip order form (sample)

- Business trip order form (letter from the Ministry of Social Protection of the Russian Federation dated 06/09/95 No. 2117-1-34)

- Contract (employment agreement) - option

- Agreement between VTC members (employment agreement - option)

- Qualification characteristics of an accountant used in drawing up a contract for employment and remuneration

- Qualification characteristics of an accountant-auditor used when drawing up a contract for hiring and remuneration

- Qualification characteristics of a warehouse manager used when drawing up a contract for hiring and remuneration

- Qualification characteristics of the manager of the central warehouse used when drawing up a contract for hiring and remuneration

- Qualification characteristics of the collector used when drawing up a contract for hiring and remuneration

- Qualification characteristics of a cashier used in drawing up a contract for hiring and remuneration

- Qualification characteristics of an economist in accounting and analysis of economic activities, used in drawing up a contract for hiring and remuneration

- Qualification characteristics of a financial economist used in drawing up a contract for hiring and remuneration

- Qualification characteristics of a legal consultant used in drawing up a contract for hiring and remuneration

- Contract (employment agreement with special conditions)

- Contract with the chief accountant (option

- Contract with the director of the enterprise (option)

- Contract with employee (option

- Contract with the head of a structural unit

- Contract with a specialist

- Sample. Report of appearing at work while intoxicated

How to fill out a certificate of completion of work under a service agreement

Filling out a certificate of completed work for a service contract always occurs in conjunction with the signed agreement. Thus, the paper is an annex to the contract.

The act for the service agreement is filled out in the same way as described in the section above. The documentation does not have a uniform form, regardless of the type of paid services.

If a company uses its own approved sample in its activities, the document must be approved in the company’s accounting policy.