The act of writing off strict reporting forms, a sample and form of which are available for download below, is an important document for many organizations. It confirms the fact of the destruction of the BSO.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

A strict reporting form is a paper that confirms the fact of receiving funds from citizens. Payment goes to a legal entity or individual entrepreneur for the services provided. It is strictly prohibited to formalize transactions between BSO legal entities.

The legislative framework

The writing off of strict reporting forms is regulated by law by Government Decree No. 359 of May 6, 2008. It describes all the nuances of the procedure. Also, recommendations for working with BSO are described in Order of the Ministry of Finance No. 52N dated March 30, 2020. These are the two main documents and should be referred to when you have questions about the topic.

The rules require that acts of this kind be kept for 5 years (or rather, their roots). Even if a mistake was made when filling out the BSO, it cannot be destroyed immediately. Once a document has been completed, it should automatically be stored until written off.

Storage and inventory

Paragraphs 14 to 16 of the Resolution concern the issue of storage of forms. The legislation specifically sets out the requirements. First of all, it is worth mentioning that the entrepreneur is obliged to create conditions for the safe storage of BSO. After each working day, the forms are sealed and placed in a safe or secure metal box; documents are also stored in specially designated rooms (for example, in the accounting department).

The shelf life of forms (copies or tear-off parts of the form) is 5 years. After a month and after the last inventory, the documents can be disposed of. You must first draw up a corresponding act. There is no strict storage time limit for unused forms. Excess or outdated BSO forms (with outdated individual entrepreneur data) are also destroyed after inventory and the preparation of a liquidation act. An example of a liquidation act is given below.

Act on write-off of BSO

The inventory of forms is usually carried out simultaneously with the inventory of the cash register. Thus, the proper fulfillment of the requirements for the storage and use of BSO is checked, and residuals or shortages are identified. To carry out an inventory of individual entrepreneurs, it is necessary to approve the inventory commission - indicate the persons involved. The results are recorded in the IVN-16 form, a sample of which is given below. When carrying out a planned inventory, the form is drawn up in two copies.

Form IVN-16

When identifying SSO deficiencies, it is necessary to understand the reasons and take the necessary measures to prevent a recurrence of this in the future. The law does not provide for liability for the loss of strict reporting forms, but the entrepreneur has the right to take disciplinary action against the responsible employee.

Speaking of fines. For the absence of a BSO accounting book or its maintenance with violations, an individual entrepreneur can be brought to both administrative and tax liability. According to Article 120 of the Tax Code of the Russian Federation, for gross violation of accounting, a fine ranges from 10,000 rubles (if the violation occurs during one tax period) to 30,000 rubles (more than one tax period). If the procedure and storage period for reporting are not observed, Article 15.11 of the Code of Administrative Offenses may be applied and, accordingly, a fine (in relation to the responsible person or individual entrepreneur) in the amount of 2,000 rubles to 3,000 rubles.

Despite the ease of use, strict reporting forms are quite demanding to use. An individual entrepreneur is required to keep detailed records of BSO and comply with storage conditions. Maintaining a BSO accounting book and frequent inventory are two mandatory processes that accompany working with strict reporting forms. Subject to the established procedure for handling these documents, an individual entrepreneur can really make his life much easier by eliminating the need to use a cash register.

Is this form required?

Municipal and state institutions successfully use form 0504816 according to OKUD for these purposes. For them, it is approved by law and recorded as the only possible one. With commercial organizations, the procedure may be softer. The company has the right to develop and reserve the right to use one or another form to fill out the act of writing off strict reporting forms. But for this you need to include it in the accounting policy and develop an order.

Thus, the prospect of independent formation is rarely considered. Most often, the usual form 0504816, which is accepted with a bang by inspection authorities, is downloaded. It has gained a foothold in business circles. In addition, it is convenient and has columns for placing all the necessary data.

Document elements

The act of writing off strict reporting forms is quite simple. At the beginning there is:

- A reference to the legislative act that prescribes its use. It is contained only in those forms that are not formed by organizations independently. The slightest discrepancy with the standard form - and the organization does not have the right to publish a link to the law in the upper right corner.

- Visa of the head of the institution. It includes: signature, transcript of the signature, position of the boss, seal of the organization (if any).

- The name of the document with the number assigned to it. It is this number, together with the date of signing the act, that is its identification mark when entered in subsequent registration documents.

- Mini table with codes. There are located: the OKUD code (it is already entered in the attached form), the date of signing the act, the OKPO code.

- Name of the organization. If necessary, the name of the structural unit. This point is especially relevant when writing off strict reporting forms when conducting an inventory within one division of the company.

- Full name of the financially responsible person, his position.

- Accounting information: credits and debits of the account to which the act is posted. This information is filled in after the act of writing off strict reporting forms is received by the accounting department.

- Listing the composition of the commission. It includes the full name of the chairman (separately) and members of the commission indicating their positions.

The document continues with a reference to the order that formed the listed commission for the destruction of the BSO. The period during which the documents will be written off must be indicated below.

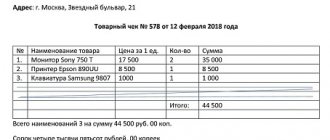

The main part of the act of writing off strict reporting forms is a table listing documents suitable for destruction. The convenience of a table lies in the abundance of data that can be placed in it. Although the table given in the form requires the following to be indicated in each line:

- Numbers and series of the form to be written off.

- Reasons for write-off.

- Dates of document destruction.

The duration of the table is determined only by specific conditions, in particular, the number of SSBs, the difficulty of making a decision on their write-off, etc.

The final part of the document, which can be located either on the same page or at a considerable distance from the beginning (depending on the size of the attached table), is the signature of the commission headed by the chairman. Each signature requires decryption. The positions of everyone who signs their “autographs” are also indicated here.

Requirements for strict reporting forms

The strict reporting form is the primary accounting document on the basis of which transactions with funds are processed.

In accordance with paragraph 1 of Art. 2 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards” all organizations when making cash payments or payments using payment cards when selling goods ( works, services) are required to use cash register equipment (CCT). However, this requirement has a number of exceptions. Organizations and individual entrepreneurs can make cash payments and (or) payments using payment cards without using cash registers, in the following cases:

- Due to the specifics of its activities, when carrying out the types of activities specified in paragraph 3 of Art. 2 of Law No. 54-FZ, for example, such as: sale of newspapers and magazines, travel tickets and coupons in public transport, sale of ice cream and soft drinks by the glass in kiosks and other types of activities, the list of which is closed.

- Due to the nature of its location. Organizations and entrepreneurs located in remote or hard-to-reach areas, as well as pharmacy organizations and separate units located in paramedic and paramedic-obstetric centers located in rural settlements where there are no pharmacy organizations.

- When providing services to the public, subject to the issuance of appropriate strict reporting forms.

- When the UTII payer carries out activities that do not fall under the previous paragraphs, subject to the issuance at the request of the buyer (client) of a document (sales receipt, receipt or other document confirming the receipt of funds). The document is issued at the time of receipt of funds and must contain the details established by law. These types of activities include, for example, retail trade, provision of services to organizations for repair, maintenance and washing of vehicles.

Under what conditions are BSO subject to destruction?

The organization has the right to destroy any of the strict reporting forms only if its five-year storage period has expired. In addition to this, the organization should not conduct an inventory.

According to existing legislation, writing off strict reporting forms is only possible if the inventory was carried out more than a month ago. However, it is precisely the fact of conducting an inventory in practice that serves as the starting point for writing off the stubs of strict reporting forms that have expired.

Reflection of BSO in the accounting department of an enterprise

The legislation does not provide for uniform rules for accounting forms, but the rules for their receipt by the organization and storage are set out fully and clearly.

BSO arrives at the company along with an accompanying document (consignment note), which indicates their quantity, type, series, number and other details. Admission is carried out by a commission that counts documents and checks their numbers. If no errors are found, an acceptance certificate is drawn up in free form. It is signed by the head of the enterprise and serves as the basis for accepting the BSO for accounting.

There are two types of acceptance certificates: temporary (responsible persons receive BSO for a clearly defined period) and quantitative (company employees are given an indefinite number of forms). The act must contain information about the number of papers received from the printing house, their series and numbers.

In the chart of accounts, there is a separate group for reflecting strict reporting forms. Costs associated with their printing are deducted from the income tax base. At the frequency established by law (usually once a month), an inventory of documentation is carried out.

If the form is damaged

A damaged form, contrary to popular belief, cannot be destroyed immediately. By law, it is stored in the same way as the spines of existing BSOs, for 5 years. It is also recorded in the organization's books. This is necessary to maintain chronological order, create and maintain a system in the document flow of strict reporting forms.

Thus, this action is enshrined in law for a reason. Any randomly taken strict reporting form from registration documents no older than 5 years must be available for study.

The head of the organization is responsible for filling out the act of writing off strict reporting forms. However, in most cases, he delegates these responsibilities to his employees. This could be a personnel officer, accountant or any other employee. The main thing is that this functionality is included in the employee’s employment contract.

conclusions

The write-off of BSO is carried out by the business entity in strict accordance with the approved regulations. Such forms may be deregistered for various reasons.

The basis for write-off may be either the end of the mandatory storage period or extraordinary circumstances.

An important role in this case is given to the correct execution of all necessary documents, as well as strict adherence to the prescribed procedure.

The management of an economic entity is responsible for the correctness and legality of all necessary procedures.