Legislative norms

All organizations providing services to the public must use cash registers and strict reporting documents in their work, information about which must be entered into the register of strict reporting forms. This is indicated in the Federal Law dated May 22, 2003 No. 55-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards.” The head of the company has the right to independently choose the most convenient method of settlements with consumers.

If an organization uses strict reporting documents (BSO) in its work, it must maintain a BSO accounting book, which should be filled out in a timely manner.

The use of BSO in the work should be based on Regulation No. 359 of 05/06/2008 on the implementation of cash payments and (or) settlements using payment cards without the use of cash register equipment. It contains basic information about such forms.

Accounting for strict reporting forms

According to the instructions mentioned above for the use of charts of accounts, manufactured or purchased forms must be reflected in the accounting records. They are not inventories, therefore accounting is carried out using off-balance sheet account 03 “Strict reporting forms”. The accountant records the number of BSOs that are stored in the institution or issued to employees. For these purposes, the account can be divided into subaccounts 03.1 “Strict reporting forms in the warehouse”, 03.2 “Strict reporting forms in the sub-report”, etc.

In accounting, the receipt of forms is reflected in the credit of account 302 26 730 “Increase in accounts payable for settlements for other works and services.” At the same time, their receipt should be reflected in the debit of off-balance sheet account 03 “Strict reporting forms”. The basis for accounting are the supplier’s documents - invoices or certificates of work performed. The double entry method is not used in this case: only the facts of receipt of forms or their disposal are recorded.

The method of evaluating the forms must be indicated in the accounting policy of the institution: either at the purchase price, or, which is most common in practice, each form for 1 ruble.

The institution is required to keep a journal for other transactions (form 0504071) in account 03 “Strict reporting forms”. The journal is filed together with primary documents indicating the movement of the BSO.

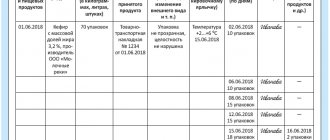

In addition, for each type of forms a separate book of strict reporting forms is maintained (form 0504045). It indicates the date of receipt or issue of forms, their quantity and cost. At the end of the reporting period, the data is analyzed and the balance is displayed. The pages of such books are numbered, and the books themselves must be laced and sealed.

Requirements for maintaining a book

The obligation to maintain a BSO registration book is enshrined in legislation - on May 6, 2008, a decree was issued on maintaining a book of strict reporting forms No. 359.

There is no approved form for this document, so organizations have the right to use the approved form 0504045, which is used in government agencies, or develop their own.

The pages of the document are bound and numbered.

Next, it is signed by the director and certified by the seal of the organization (if any)

An example of filling out an accounting book of strict reporting forms according to form 0504045

The document is maintained by an employee appointed by order of the manager. Typically this responsibility falls to the accountant or cashier. The responsible employee is responsible for the posting, storage of BSO, receipt of funds from clients and issuance of the required copy. He also makes entries in the journal.

Internal control over accounting is carried out during inventory simultaneously with checking cash balances. External verification is carried out by the tax authorities. The result of the inspection is indicated in the report.

A sample of filling out a journal of strict reporting forms

Who fills out the BSO accounting book and how long is it kept?

The procedure for registering and maintaining the accounting book must be approved by a local act of the organization or entrepreneur. This document must name a specific official who assumes responsibility for receiving, properly storing, recording and issuing strict reporting forms for use in the organization. An agreement on full financial responsibility is concluded with this official. It is this official who makes entries in the accounting book as forms are received and disposed of.

How to calculate the average number of employees? We invite you to learn the formula and algorithm of actions from the article. How to open a laundry? Instructions for creating a business are given here.

What to do if the cashier-operator's journal is lost? Here lies the answer.

The storage period for the accounting book is not legally fixed anywhere. However, from the shelf life of counterfoils, damaged and written-off forms, which is 5 years, we can conclude that the accounting book should be stored, accordingly, no less than the latest forms, the records of which it contains.

Thus, in the order on accounting and use of forms, you can set the storage period for the accounting book as 5 years from the date of the last entry in it. After this period, the book, along with its spines and damaged and written-off forms, must be destroyed. In addition, the destruction of the book is possible no earlier than a month after the last inventory.

Filling procedure

The book is intended for internal accounting of BSO. It reflects information about the receipt of BSOs and their issuance to the responsible employee. The information is grouped with the details of the BSO; the procedure for filling out the BSO accounting log involves entering information about incoming and outgoing documents. It happens like this:

- When entering data on receipt, the acceptance date, name, series, number and number of copies are indicated. The full name, position and signature of the responsible person are indicated;

- The procedure for disposing of documents is similar to their acceptance.

Incorrectly filled out sheets cannot be thrown away; they are attached to the journal, and later written off using a special write-off act, issued based on the results of the inventory. The use of a log of damaged strict reporting forms is not mandatory for the organization.

How to fill?

Filling out a book intended for accounting for BSO often causes difficulties precisely because its standard form does not exist. The law contains only the most general requirements. Thus, in Regulation No. 359, which regulates the rules for conducting payments without the use of cash registers, it is written that the accounting book must be bound and fully numbered, each sheet must be signed by the manager (entrepreneur) and the chief accountant and have the seal of the organization (entrepreneur).

As for keeping records in the accounting book, they can be done in a fairly free form. When forms are received, a record is made that must contain information about the organization from which the forms came, the date, and, without fail, the numbers of the received forms. If the forms (as is most often the case) are stapled into books, then it is enough to write down the number of the first and last form in the block.

It is not at all necessary to make entries in the accounting book about each block issued to the buyer. Typically, forms are issued to the person conducting direct settlements with the population in a quantity sufficient to work for a certain period. If these are separate forms, then they can be issued every day; if they are a stapled block, then the whole block is issued. In this case, the date and numbers of the issued forms are again recorded, and the signatures of the person responsible for the correct maintenance of the accounting book and the person who received the forms are required.

Further, the forms can either be used for their intended purpose, then the responsible person hands over the completed counterfoils. Forms may be damaged. In this case, a corresponding entry is made in the accounting book indicating the reason and number of the damaged form, and the damaged form itself must also be preserved.

Sometimes the question arises, what should an entrepreneur who works alone do, how to keep an accounting book? Who will issue the forms and to whom? Most often, it is advised to still have two columns, for the issuer and for the recipient of the BSO, in which the entrepreneur signs himself. Thus, it issues the BSO to itself, but the accounting order is not violated and you can clearly see all the operations involving the movement of the BSO.

Sample BSO accounting log

There is no approved ledger form. However, it must contain certain details. Self-developed forms can be used, but many use the OKUD form 0504045 as the basis for this document.

To start using the journal you need to:

- number the pages of the book

- stitch it, affix the signatures of the director, chief accountant and affix the company seal

There is no need to register the book with the tax office.

When creating a book, its details relate to the header and filling out the table.

In the first case, it is usually necessary to provide the following columns:

- Name of the form. The fact is that a situation is possible when certain types of these forms are used for work. Then a separate magazine should be made for each of them, and the name should be present in the header of the magazine.

- Name of the company, name of the department where records are kept.

- When did accounting begin?

- The position and surname of the person who is responsible for maintaining a journal of such forms is indicated. Details of the order for the intended purpose are required.

Data on the movement of forms must be reflected in a special table. It should contain the following columns:

- Date of movement of the forms.

- From whom it was received or to whom it was transferred. It is necessary to indicate the series and numbers of the forms.

- The document is fixed. Moreover, when receiving them to the unit, its indication is mandatory, and issuance is carried out on the basis of internal work rules.

- The last column contains information about the balance of forms.

During the accounting process, a notional price is applied. It is accepted arbitrarily. Usually the cost of one form is equal to one ruble. This provides additional convenience when keeping records. Thus, the balance and movements are reflected in one of the off-balance sheet accounts, and the presence, albeit conditional, of a price allows the application of accounting rules.

When the journal is stitched and numbered, the ends of the cord are usually glued with paper, which must bear the seal of the enterprise and the signatures of the director and chief accountant. In addition, the date of registration is indicated there.

Accurate and correct documentation is one of the important conditions for a successful business.

Top

Write your question in the form below

Filling out the book

Filling instructions:

- “Establishment” line must contain the full name of the company or the entrepreneur’s data, which corresponds to the constituent documents. For example, individual entrepreneur Serov F.K. or Vostok LLC.

- Be sure to indicate the name of the company division that draws up the magazine. If the organization does not have structural divisions, a dash is placed in this line.

- “Opening date” – the field in which you need to enter the start date of logging. In most cases, it will coincide with the date of receipt of the first forms. Also, the “Closing Date” will subsequently contain the day, month and year of the end of the journal.

- "OKPO Code" . This is a field that should contain, in accordance with the notification from Rosstat, the OKPO code. In cases where the code was not assigned, a dash is placed in this place.

- "Account number" . This field is filled in only if the book is opened in an organization that maintains accounting, then in most cases the number “006” is indicated - an off-balance sheet account.

- "Name" . This field is used to indicate the form of the forms. These can be tickets, vouchers, receipts, subscriptions, etc.

- “Form code” – information about the form code is entered in this field. In cases where the strict reporting document itself does not have this code, you can put a dash in the field.

BSO accounting book: general information

BSO accounting for individual entrepreneurs, as well as for organizations, is kept in a book or journal of BSO accounting. There is no legally approved form. The Resolution describes general recommendations for compiling this book. Let's look at them in detail. The accounting book must be bound and sealed with the signature and seal (if any) of the entrepreneur. To do this, each sheet is numbered, holes are made with a hole punch for stitching and fastened with rope/thread, including the title pages. The ends of the rope are tied and a piece of paper is glued to them, on which the date, signature of the entrepreneur and seal (if any) are placed. Thus, you get a ready-to-use and sealed journal for keeping records of forms. On the numbered pages of the book there must be space for the date, signature and seal of the individual entrepreneur. Due to the fact that when accepting or issuing forms, it is necessary to indicate the date, number, quantity, persons issuing or receiving BSO, as well as their signatures, when forming a journal column, appropriate columns should be provided for this information.

As mentioned above, there is no approved form, and you can create it yourself or purchase a ready-made copy. Entrepreneurs can download the BSO accounting book and register it in accordance with the instructions given. An approximate version of the content and general appearance of the book is presented below. The individual entrepreneur can add or remove the necessary columns at his own discretion.

An individual entrepreneur can also buy a BSO accounting book or order it from a printing house (optional). But in any case, you will need to flash and seal (seal) in accordance with the requirements. There is no need to have the book certified by the tax office. When using an automated system (automated system), when printing, data on the form is automatically entered into the accounting book. If the tax office receives a request for information from the AS, the entrepreneur is obliged to provide it. 1C also provides the ability to create a book.