Source/official document: Approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78

Document title: Logbook for tracking the movement of waybills (Standard inter-industry form No. Format: .docx Size: 70 kb

Format: .docx Size: 70 kb

Print Preview Bookmark

Save to yourself:

Every transport company must keep a log of waybills. This is necessary for monitoring and accounting for gasoline costs, monitoring technical condition and other issues. Waybills show, in fact, all the work on the vehicle. This includes mileage, all repair and maintenance issues.

In addition, this form is used to determine working hours and calculate wages for drivers. Therefore, it is important to fill out all the data very accurately, so that in the end it does not turn out that due to a small inaccuracy the document will be invalid. You can register your travel itinerary on the pages of our portal completely free of charge. There you will see an example of filling out, which will allow you to avoid making obvious mistakes.

Why is a waybill movement log needed?

Logbook for the movement of waybills

According to current legislation, all business entities that have vehicles on their books are required to keep records of fuel consumption based on entries in waybills. This obligation is assigned to both organizations and enterprises, and individuals registered in the form of individual entrepreneurs.

To systematize the workflow regarding the preparation and processing of waybills, a special document is used - the Journal of the movement of waybills. It is designed to control the timing of the transfer of waybills to the dispatcher and their subsequent submission to the accounting department for writing off fuel costs.

Where can I download the form 8 travel log and a sample of how to fill it out?

Many beginners, and sometimes even experienced workers, need to have a sample of the journal for issuing waybills in front of them in order to correctly enter data. The easiest way to download it is by following the link on the website. Since Form 8 is no longer mandatory, we provide you with a sample that could be developed in-house.

***

All companies operating vehicles must issue waybills and keep a corresponding log. Without these documents, the company is unlikely to be able to write off fuel and lubricants expenses in tax accounting.

Similar articles

- The nuances of drawing up an order on waybills - sample

- Waybills: forms in 2020

- Sample of filling out a waybill for individual entrepreneurs

- Sample of drawing up a waybill for a truck

- Bus waybill: form and sample

Is it obligatory to keep a logbook for the movement of waybills?

Since the introduction of the Journal in 1997, the document has been mandatory for organizations and enterprises, regardless of their form of ownership and legal structure. The company, on whose balance sheet vehicles were listed, was required to keep a Journal of the movement of waybills.

In 2013, legislative changes came into force, according to which the obligation to maintain a Journal for organizations and entrepreneurs was abolished. Thus, from this period, the decision on the need to use the Journal when recording the movement of waybills is made by each business entity individually, based on production needs.

According to current practice, the Journal is currently used in their activities by large companies, as well as motor transport and logistics companies that own a large fleet of vehicles.

Where and how is it used?

According to the law, the form must be maintained by all companies that use vehicles in their activities. The documents indicate all the information about them. Before traveling, drivers are given a waybill, as well as documents giving the right to operate the vehicle.

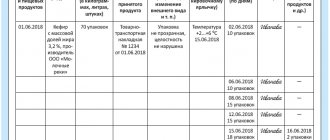

It necessarily records detailed information about the route, fuel remaining and refueling, technical condition features, as well as the exact time of departure for the route and the time of its completion. Large enterprises fill out the document daily. It makes it easy to track the driver’s hours of work and the technical condition of the vehicle.

Small companies that do not transport passengers issue certificates for 30 days. This document must be recorded in the travel log. All data is entered there.

Form of the Logbook for the movement of waybills

The journal for recording the movement of waybills (Form No. 8) is filled out on a unified form approved by Decree of the State Statistics Committee of the Russian Federation No. 78 dated November 28, 1997. Unlike the waybill form, which, due to legislative innovations, has undergone some changes in recent years, Form No. 8 of the Journal accounting for the movement of waybills has remained unchanged since the introduction of the document in 1997.

From 1997 to 2013, enterprises and organizations filled out the document exclusively in accordance with the approved form. Since 2013 (that is, since the abolition of obligations to maintain the Journal), Form No. 8 has been of a recommendatory nature. In other words, business entities have the right to change the form, adding new columns to it and excluding unnecessary ones, based on the specifics of the activities of a particular organization.

If the company decides on the need to maintain a Journal, then this fact must be recorded in the accounting policy, along with the selected document form (standard or modified).

Is it necessary to flash

The travel logbook form 8 has sequential page numbering. When introducing it, it is necessary to maintain chronological order. The title page must be signed, indicating the start date. There, on the title page, the main details of the organization itself and its full name are written.

After accounting is completed, the journal is stitched. The bound book is certified by the signatures of the management of the enterprise, the chief accountant of the company and the seal of the organization, after which it is transferred for storage to the archive of the enterprise.

Responsible for maintaining the Journal

Current legislative acts do not assign obligations to maintain a Journal of the movement of waybills for a specific position (division, etc.). Thus, enterprises have the right to independently select an employee who will be responsible for maintaining the Journal. As a rule, such an employee is the dispatcher of the transport department, who accepts waybills from drivers and passes them on to the accountant to write off fuel costs in accordance with established standards.

The person responsible for maintaining the Logbook for the movement of waybills must be recorded in the accounting policy. In general, the document indicates the position of the employee whose duties are to fill out the Journal.

Shelf life

Waybills are issued to employees working on vehicles once per working day or shift. The registration journal itself is created for an annual period, but if necessary, the period of maintenance can be reduced to one month, for example, if we are talking about single long trips such as business trips.

Due to the fact that the accounting record is primary documentation, its subsequent storage period is 5 years, after which the journal can be disposed of. It should be noted that the five-year storage period applies not only to paper, but also to electronic media.

The law does not indicate how long such a register must be kept, whether it is printed or purchased in a store. Based on waybills and their movement, drivers’ salaries, taxes and production cost base are calculated. Such primary documents, information about which is entered into the accounting journal, are stored in the organization for at least 5 years. Obviously, the register itself should be kept for the same amount of time.

Current legislation does not establish precise storage limits for this case. Keep the filed and numbered document in the organization for at least 5 years, as it contains information about the primary document (waybills). Determine by a separate order the person responsible for maintaining and storing the property. Under the signature, familiarize him with the procedure for maintaining the document.

If the organization does not keep a log of the issuance of waybills, the sample is not approved, then the tax authorities can fine you under clause 1 of Art. 126 of the Tax Code of the Russian Federation. That is, at the request of the tax inspectorate, the institution must provide the required documentation within the prescribed period. If this is not done, the Federal Tax Service will issue a fine of 200 rubles for each document.

How to Keep a Journal Correctly

Currently, the legislation does not put forward any clear requirements regarding the maintenance of the Journal, and therefore the procedure for drawing up the document remains at the discretion of the enterprise. Below is an algorithm of actions for compiling and filling out the Journal, prepared taking into account general regulatory recommendations:

Step 1. Selecting a Journal Form

At the preparatory stage, the company decides on the form in accordance with which the Logbook for the movement of waybills will be compiled. The company has the right:

- use the unified form No. 8, approved by Decree of the State Statistics Committee No. 78 of November 28, 1997;

- Form No. 8 was modified, adding new columns and removing unnecessary items;

- develop a completely new document form in accordance with the peculiarities of the company’s internal document flow.

Step-2. Selecting the person in charge

Before proceeding with the approval of the document form, the management of the enterprise should select an employee who will fill out the Journal. This can be an employee whose activities are directly related to the preparation of waybills (dispatcher or head of the transport department, one of the drivers, etc.), or an employee of another department (business manager, archive worker, etc.).

Step-3. Reflection of the procedure for filling out the Journal in the accounting policy

After choosing the form of the Journal and approving the person responsible for maintaining it, this information is reflected in the accounting policy or in another document that regulates the internal document flow of the enterprise (for example, the Procedure for maintaining internal document flow). Data on the procedure for maintaining the Journal is reflected in the form of a separate section, indicating the following information:

- start date of using the Journal (for example, the Journal is required to be filled out from 01/01/2020);

- approved form of the Journal (can be issued as an annex to the Procedure or to the accounting policy);

- person responsible for maintaining the Journal (position, structural unit);

- features of compiling the Journal (the document is compiled for 1 year, half a year, quarter, month, etc.);

- procedure for filling out the Logbook (deadline for transmitting waybills from the driver to the dispatcher, from the dispatcher to the accountant).

Waybills will become fully electronic in 2021

November 27, 2019

Soon you will no longer need to fill out waybills manually; they can be generated electronically. The Ministry of Transport and the Ministry of Telecom and Mass Communications are already working on the project.

From December 2021, companies will begin issuing waybills in digital format - they will be displayed in a unified information system, which will be launched in mid-2022. Such a database will allow inspectors to see waybills online. For example, in the event of an accident, traffic police officers will be able to quickly find out whether the driver has undergone a medical examination. Source

Andrey Zanin, head of the commercial sector of AITOB, comments:

Electronic filling of waybills is far from a new feature for vehicle management systems.

However, unfortunately, not all software products presented on the transport logistics automation market have such functionality. The software on the 1C platform by default includes the ability to generate waybills according to the standards of the Ministry of Transport. Currently, in each project, AITOB implements the function of automatically issuing and filling out waybills with data from GLONASS monitoring (based on 1C: TMS Logistics. Transportation Management, 1C: Enterprise 8. Motor Transport Management, 1C: Transport Logistics, Forwarding and Motor Transport Management KORP, 1C:Enterprise 8. GLONASS/GPS satellite monitoring center).

To implement this function, only 4 steps are required:

- In the software, a waybill is issued with the following fields filled in: Vehicle, Driver, Remaining fuel and lubricants, Vehicle mileage from the previous period.

- Automotive trackers and sensors continuously monitor the operation of vehicles, record the location and direction of movement of vehicles, the passage of control points on the route, refueling and actual fuel consumption.

- Tracker data is broadcast online by 1C: Satellite Monitoring Center and promptly enters the transport accounting and management system (1C:TMS, 1C:TLE, 1C:UAT).

- In the accounting system, based on the data received, waybills are automatically filled out, depreciation is calculated, fuels and lubricants, spare parts and consumables are written off, and drivers’ working hours are monitored:

- information about actual mileage is used to automatically calculate vehicle depreciation and calculate salaries for drivers, taking into account output;

- based on data on actual fuel consumption, fuel is written off;

- information about engine hours is taken into account both when calculating depreciation and when writing off fuel and lubricants.

If the bill is adopted by the Ministry of Transport and the Ministry of Telecom and Mass Communications, additional integration with the general information system will be required.

Such a bill will not only reduce the labor costs of the transport and logistics department of the enterprise, but also eliminate accounting errors that can lead to large financial losses for the enterprise. As for medical examinations, a project with such functionality for the South Ural Mining Company (AKKERMANN trademark) is now in its final stage. We have set up a two-way data exchange with 1C: Manufacturing Enterprise Management and integration with ESMO, which allows you to monitor the relevance of medical examinations passed by drivers at two factories, in Orenburg and Perm.

The transport industry is undergoing numerous legislative changes, which leads to the inevitable digitalization of processes. Thus, after changing the procedure for issuing waybills from March 1, 2019, the demand for FMS systems (fleet management systems) increased. That allow:

- Manage supply chains involving various modes of transport and using different types of transportation, on our own and with the involvement of contractors;

- Manage tasks for the transportation of goods, calculate the planned cost of transportation and monitor the stages of task completion

- Plan the work of all departments involved in transportation management;

- Create flights taking into account various parameters and conditions of transportation, manage resources to support them, monitor execution

- Assess the needs for cargo transportation and monitor the provision of these needs;

- Manage the company's tariff policy, pricing and profitability of cargo transportation.

Companies that do not use electronic waybills have 2 years to switch to a digital version of documents.

1C software products provide the necessary functionality for this, which has been successfully implemented in dozens of projects. If you require advice on the possibilities of using the GLONASS/satellite monitoring system without a subscription fee, purchasing and installing car trackers, digitalizing logistics processes and integrated fleet management systems from , please contact:

tel: +7 (495) 419-0842 email: [email protected]