Characteristics of an accounting account 58

Account 58 in accounting is represented by balance sheet lines 1170 and 1240 “Financial investments” and reflects the implementation of various actions with changes in the size of the controlled company’s contribution to securities (hereinafter referred to as securities), shares and bonds of other enterprises, fixed capital of organizations, the cost of loans issued to other entities.

Analytical accounting for this account is structured in such a way as to provide access to information about short-term and long-term deposits. If investments are accounted for within several interrelated companies, the functioning of which is maintained by consolidated financial statements, then entries to account 58 are made separately.

Deposits in interest-bearing bonds and other types of securities, as well as loans issued to other organizations are reflected in account 58 if their repayment period is no more than 1 year. Investments in securities for which there is no set redemption period are also displayed on account 58, provided that these deposits were made without the purpose of generating income on them for more than 1 year.

The actual expenses for the purchase of assets as financial investments are considered:

- funds that are paid in accordance with the agreement to the seller;

- funds paid by enterprises for information and consulting services related to the intention to make financial investments;

- commission that is paid to the intermediary when carrying out a transaction for the acquisition of assets as investments, etc.

Creation of a reserve for depreciation of financial investments

Financial investments for which the current market value cannot be determined must be tested for impairment. If the impairment test confirms a permanent significant decrease in the value of financial investments, then the enterprise must create a reserve for them.

Typically, current market value cannot be determined:

- For shares not traded on the organized securities market;

- For contributions to the authorized capital of LLC.

The amount of the reserve is formed from the difference between the initial and estimated cost of financial investments. The procedure for creating a reserve must be specified in detail in the accounting policy.

It should be noted that not all investments created reserves are accounted for in account 59. For example, for loans provided by an enterprise, a reserve is created in account 63.

It is important to know that financial investments are tested for impairment at least once a year, and, as a rule, as of December 31.

Is count 58 active or passive?

The answer to the question, active or passive account 58, is clear. Investments of financial resources are assets of the company. To include an investment in the asset line, an entity must meet the following criteria:

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

- Transactions with documentation confirming the right to invest assets and receive income from them in the form of cash must be executed in accordance with all requirements.

- The enterprise must be prepared to accept some risks.

- The company must be able to obtain economic benefits.

Thus, investments reflect the participation of a specific organization in the financial transactions of another economic entity. Before investments are included in the balance sheet, they must be reflected in account 58.

Account 58 in accounting

Debit turnover on account 58 “Financial investments” occurs when an organization invests its free assets:

- In authorized capital or securities;

- Debt securities, bills, bonds;

- Provides a loan to a non-employee of an organization or legal entity, etc.

Credit turnover on account 58 “Financial investments” occurs in the following cases:

- Sales of securities or shares in the authorized capital;

- Leaving society;

- Free transfer;

- Transfer of securities in the form of a contribution to the authorized capital of other organizations;

- Redemption (redemption) of securities;

- Repay loans.

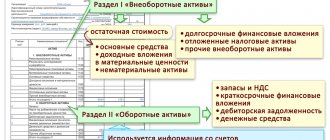

The diagram shows the sub-accounts opened to the account by type of financial investment:

Analytical accounting for account 58 “Financial investments” must ensure the disclosure of certain information, which is presented in the diagram:

Legislative basis for the balance sheet line “Financial investments”

All financial actions carried out by the organization are regulated by the relevant legislative acts of the state on accounting. The balance sheet line “Financial investments” is regulated by the following regulatory documents:

- Regulations on accounting audit PBU 19/02 based on order of the Ministry of Finance of the Russian Federation dated December 10, 2002 No. 126 (amended in 2010);

- Law “On Accounting” dated December 6, 2011 No. 402-FZ;

- Civil Code of the Russian Federation;

- Tax Code of the Russian Federation.

In order to make financial investments fully and legally, an enterprise must comply with all standard requirements established at the legislative level. The legal regulation of this topic includes several stages. The decrees of the President of Russia are considered the highest, and the documents of the organization itself are considered the lowest, according to the industry direction and the amount of economic benefit received.

Subaccounts and analytics

To separately account for amounts received in different currency units, the company’s accountant can open additional sub-accounts for account 58:

- 58.1 – statutory contributions, contributions to joint stock companies;

- 58.2 – investing in securities;

- 58.3 – loans issued to individuals. persons and companies in any form;

- 58.4 – contributions to the general property mass under a simple partnership agreement.

The number of subaccounts is not limited to those indicated, since it is necessary to maintain analytical accounting for each group of objects. An accountant can open other sub-accounts if this is specified in the organization’s accounting policies.

Examples of postings to account 58

When reflecting investment entries on account 58, it is necessary to take into account all production factors and conditions of the organization’s industry, as well as the cost of securities in fact and at par.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

You can carry out operations when purchasing shares as follows:

- Dt 58-1 Kt 76 (purchase of c/w);

- Dt 91-2 Kt 76 (accounting for the amount of the commission fee in other costs);

- Dt 76 Kt 51 (accounting for the value of shares, including intermediary commission).

When revaluing securities, the following action must be taken: Dt 51-1 Kt 91-1 (bringing the value of shares in accordance with their market value).

The sale of securities is formalized as follows:

- Dt 58-1 Kt 76 (share value in rubles in accordance with the contract);

- Dt 91 Kt 58-1 (writing off the cost of c/w on the balance sheet);

- Dt 62 Kt 91 (negotiable value of shares);

- Dt 91 Kt 99 (profit from sales is reflected).

An interest-free loan was issued - how to reflect this in transactions

However, a loan issued in cash may also be interest-free (Articles 809, 810 of the Civil Code of the Russian Federation). In such a situation, it loses the main feature (the ability to generate income), which allows it to be included in financial investments. How to show the borrower's debt in this case? It should be reflected as a regular debt of the counterparty for settlements not related to sales to him, i.e. using account 76.

Depending on whether the transfer of funds issued as a loan is made in rubles or in foreign currency, the entry - a loan was issued to another organization - without interest will take the form Dt 76 Kt 51 or Dt 76 Kt 52.

Since accrual of income is not provided, records of transactions for recording interest and for their payment will not appear. That is, until the debt is repaid, its amount will be listed in the debit of account 76. The return will be reflected by the reverse entry to the one with which the debt was registered: Dt 51 (52) Kt 76.

Thus, in a situation where another organization has been issued an interest-free loan, the entries for it will only reflect its occurrence in accounting and write-off when the funds are returned.

Subaccounts of account 58

Account 58 - Financial investments - provides for the opening of several sub-accounts:

- 58-1 “Units and shares”. Here, accounting is kept of the presence and movement of deposits in securities of joint-stock companies, authorized (share) capitals of third-party enterprises, etc.

- 58-2 “Debt securities”. Includes accounting for investments in government securities and private companies (for example, bonds).

- 58-3 “Loans provided.” Takes into account the movement of various types of loans issued by the enterprise to legal entities and citizens (except for its employees). If an organization has issued loans to these categories of persons that are secured by bills of exchange, separate accounting is maintained for them. The issuance of a loan is reflected in the debit of account 58 in correspondence with account 51 “Current accounts” or other suitable accounts. When repaying the loan, it is necessary to make the following entry: Dt 51 Kt 58.

- 58-4 “Contributions under a simple partnership agreement”, etc. This takes into account investments in common property under a simple partnership agreement.

The implementation of the deposit is reflected in the debit of account 58 in correspondence with account 51 and other accounts for accounting for allocated property. Upon termination of a simple partnership agreement, the property is returned to the credit of account 58 in correspondence with the property accounting accounts.

Account 58 in accounting: subaccounts

This article may be accessed by:

- Subaccount 58.1 for shares and shares.

- Subaccount 58.2 on debt securities (bonds).

- Subaccount 58.3 on loans provided.

- Subaccount 58.4 for deposits under a simple partnership agreement, etc.

According to Article 58.1, the presence and movement of investments in shares of joint stock companies and share (authorized) capitals of third-party companies are recorded. According to subaccount. 58.2 is the movement of deposits in private and government debt securities. These include, in particular, bonds.

***

The characteristics of account 58 reflect its position in the enterprise’s balance sheet and the types of business transactions that are carried out with its help. Financial investments are reflected in lines 1170 and 1250. They correspond to the account in question, which is an active synthetic one. According to current legislation, long-term and short-term financial investments must be accounted for separately. Several subaccounts can be opened for a given accounting account.

The main entries in account 58 in accounting are the acquisition, revaluation and sale by the enterprise of securities of other organizations, the state, and the provision of loans. In order to fully carry out investment operations, the company must fully comply with the requirements of current legislation.

Contradictions in norms

In accordance with the account plan, accounting of funds invested in bank deposits is carried out according to subaccounts. “Deposit accounts” (55.3). Another indication is contained in clause 3 of PBU 19/02. This paragraph states that such deposits are recorded by account 58. In accounting, the deposit, according to current legislation, is reflected in the way that the enterprise chooses. In this case, the preferred option may be fixed in the financial policy and disclosed in the explanatory note attached to the financial statements.

Provision for impairment of financial investments

Financial investments are those assets that are characterized by investing in loans, deposits, securities and other enterprises.

Regardless of what type of investment is made, the main thing is to be able to correctly and correctly reflect them in accounting and tax accounting.

And here you need to know what a reserve for impairment of investments is. And further on exactly this.

Briefly about what FV is

Financial investments are the company’s actions to invest the cash resources available in circulation, the company’s intangible assets, which are aimed at acquiring various assets. Not every acquisition of assets can be recognized as an investment and, accordingly, reflected in accounting as an investment.

The main conditions for recognition of a financial asset asset:

- Availability of all documents that confirm the acquisition of the asset and the formation of its initial value;

- Transfer of all risks that the asset has to the company that acquires it;

- Receiving profit or other benefit from an asset.

PV may include:

- Securities.

- Investing in management companies of other companies;

- Loans issued at interest to other persons (except for loans to employees);

- Deposit accounts in financial institutions;

- Receivables received from other persons

In this case, all financial assets must be reflected in accounting and necessarily at their original cost.

Financial investments

Depreciation of financial investments

If we talk about PV in terms of the formation of the initial cost, then all PV can be divided into two categories.

These are those financial assets for which the current market value can be determined at the time of accounting and those financial assets for which such a value cannot be determined.

At the same time, such a requirement for determining value is fundamentally important for accounting and evaluation, since on the basis of such classification a decision will be made: whether a reserve for impairment of financial investments is needed or not.

Thus, financial assets, which can be assessed according to several estimates, include securities, in particular, shares of an enterprise, bonds, contributions to the authorized funds of other enterprises, etc.

If the company does not have information about the current estimated value of the asset, then, in accordance with PBU 19-02, it can do this independently. The main thing here is that all securities existing on the balance sheet are not quoted on different stock exchanges and auctions.

In simple words: at the end of the reporting period, each enterprise must evaluate financial assets, for example, securities.

If at the end of the year the company realizes that the value of the share is lower than its original value, then it is obliged to reflect such a decrease in accounting. Scientifically, such a decrease in value will be called depreciation.

In order for impairment to be recognized, a number of conditions must be simultaneously met, which is regulated by PBU 19-02 “Accounting for Cash”.

Conditions that allow a decrease in the value of a financial asset to be recognized as impairment:

- The accounting value of this asset at the balance sheet date and at the previous reporting date is lower than that which was calculated at the beginning of the acquisition of such an asset;

- Over the past year, the estimated value has decreased significantly compared to what was expected at the end of the period;

- The company has no reasonable expectation that this value will increase significantly in the near future without the company incurring losses.

As soon as all three conditions are confirmed as a result of the assessment and analysis of the PV, then it is necessary to move on to the next stage - creating a reserve. By the way, it is necessary to note the frequency of checking such conditions.

According to PBU 19-02, such an audit must be carried out at least once a year and taken into account on the enterprise’s balance sheet as of December 31 of the reporting year.

But the frequency of the audit itself can be changed by the accounting policy of the enterprise, where the inspection regulations will be prescribed: for example, at least once a quarter.

Provision for impairment of financial assets

It should be noted that reserves for the impairment of investments in securities or other assets are created using the method of creating a reserve for the impairment of inventories.

In turn, the reserve for impairment of inventories is created solely on the basis of an assessment technique, which makes it possible to determine the amount of reduction in such value.

At the same time, the difference in estimates in accordance with PBU 21/2008 must necessarily be attributed to either income or expenses of the reporting period. If we are talking about financial assets, then the reserve is attributed to the expenses of the reporting period.

If a reserve has been created for the impairment of financial investments, the posting is formed based on the use of financial results. And the posting cycle will look like this:

- The impairment reserve was created by FV: D-t 91/2, and K-t 59;

- The previously created reserve was written off: D-t 59, and K-t 91-1;

When the reserve itself is created, then reserves for depreciation of financial investments in the balance sheet are taken into account when calculating the final balance on lines 1170 and 1240. The created reserve is subtracted from the final balance of account 58 and other accounts.

Formula for calculating the final balance on lines 1170 and 1240 in the balance sheet:

- The balance on line 1170 can be calculated using the formula: total for account 58+ total for account 55 - balance for account 59 + balance for account 73;

- The balance on line 1240 is determined using a similar formula: total for account 58+ total for account 55 - balance for account 59 + balance for account 73

As you can see, short-term and long-term PV are calculated in the same way: and the created reserve is taken into account using the same methodology. It’s just that each enterprise maintains synthetic and analytical accounting in the context of different types of assets. It is not accounts that are taken into account, but subaccounts.

https://www.youtube.com/watch?v=FLkYKZ6Ubsg

Thus, PV is a nomenclature that, in order to be correctly reflected in accounting, requires constant analysis, evaluation and management decision-making.

It is necessary to be able to correctly determine what is and what is not considered a financial asset, it is necessary to comply with all the conditions for accepting such assets on the balance sheet as investments, and, moreover, it is also necessary to correctly create a reserve for the depreciation of such assets. All this must be taken into account, including when developing accounting policies.

Source: https://okbuh.ru/otchetnost/rezerv-pod-obestsenenie-finansovyih-vlozheniy

Example of invoice registration 58

engages in the sale of exotic plants. During the first quarter of this year, the company purchased shares worth 10 thousand dollars, and after that it issued a loan in the amount of 200 thousand rubles to a third-party organization supplying turf. At the end of the reporting period, the loan was returned to the current account. The accountant revalued the shares with an increase of 10% at the market rate and generated the following entries:

- Dt. 58.1 – Ct. 52 – 10,000 dollars – shares were purchased for foreign currency.

- Dt. 58.3 – Kt. 51 – 200,000 rubles – loan to a third-party company supplying turf.

- Dt. 91 – Kt. 58.1 – 1000 dollars – revaluation of shares with an increase of 10%.

- Dt. 51 – Kt. 58.3 – 220,000 rubles – loan repayment with interest.