EGAIS (Unified State Automated Information System) is an automated system designed for state control over the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products. EGAIS (Unified State Automated Information System) is an automated system designed for state control over the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products.

Why do you need the EGAIS system?

Each enterprise that is engaged in the retail sale of alcoholic beverages must necessarily connect to the EGAIS system and install a special software module at the cash desks, which will allow data to be transferred to this alcoholic beverages accounting system. Data transfer using this program is carried out automatically. Thanks to this system, the completeness and reliability of data related to the production and circulation of drinks that contain alcohol is ensured.

Using the EGAIS system, all imports of certain brands are controlled, and low-quality goods can also be identified. The EGAIS system allows you to analyze the development of this type of industry.

Who will have to cooperate with EGAIS

As legislative acts state, such representatives of the alcohol market as producers and importers have been participating in the Unified State Automated Information System for quite some time. The Federal Service for Regulation of the Alcohol Market has planned to gradually cover new market representatives. They are joining EGAIS gradually.

- Manufacturers of beer and beer drinks We were the first to record production and turnover of manufactured products:

- large companies producing more than 300,000 deciliters per year - from October 1, 2020;

- firms with smaller production volumes – from January 1, 2016.

- Wholesalers purchasing, storing and supplying alcoholic goods are required to record their turnover in the Unified State Automated Information System (EGAIS) from January 1, 2020.

- For retailers selling (stores) should register in EGAIS the fact of purchasing alcohol-containing goods from a supplier, and then for some of them, additionally, the fact of selling it to the consumer. They are joining EGAIS in stages:

- Individual entrepreneurs purchasing alcohol for the purpose of retail sale are not required to confirm the fact of sale; confirmation of purchase is sufficient - from January 1, 2020;

- the same conditions for catering organizations (cafes, bars, restaurants), where alcoholic beverages are sold to visitors along with other food products;

- firms selling such assortment at retail in urban areas undertake to confirm delivery from January 1, 2020, and sales from July 1, 2020;

- the same companies operating in villages submit information to EGAIS on the fact of purchasing alcoholic goods from January 1, 2020, and on the fact of its sale - from July 1, 2020.

For companies located in Crimea , the deadlines are slightly shifted:

- wholesalers should register with EGAIS before July 1, 2016;

- for retail sellers in urban areas - until January 1, 2017, in villages - until January 1, 2020.

In small settlements with fewer than 3,000 people, or remote ones where it is impossible to access the Internet, it is allowed not to note the fact of sales of alcohol products. But purchases from a manufacturer or supplier will have to be “disclosed” from January 1, 2020 - for this, entrepreneurs are given a week after the delivery arrives from the nearest city or town with the Internet.

Who does not need to use EGAIS?

Legal entities for whom purchased alcohol is used exclusively as a raw material, for example, pharmaceutical companies, confectionery companies, are not required to transmit data regarding turnover through EGAIS.

What is needed to connect to the EGAIS system

To connect to the EGIS system you will need the following:

| Device | Description |

| Computer | It must be connected to the Internet, the speed of which must be 256 kbit/s or higher; |

| JaCarta crypto key | This is the key that will need to be used when working with the EGAIS system |

| Electronic signature | This is a qualified electronic signature that is recorded on a crypto-key for entering EGAIS. To generate this signature, you will need the following data: extract from the Unified State Register of Legal Entities, SNILS, INN, OGRN, passport, the crypto key itself. |

| UTM (Universal Transport Module) | This is software with which purchase and sales data is transferred to the Rosalkogolregulirovaniye server. This module can be downloaded from the website egais.ru when registering in your personal account. |

| commodity accounting program for EGAIS | This program can be downloaded from the Internet if the company sells only beer, but if the company deals in stronger drinks and needs to report on sales, then it will have to go all out, i.e. buy this program for ease of use. |

What is EGAIS?

EGAIS is a unified system for recording the turnover of alcoholic beverages on the Russian domestic market. In fact, it controls the movement of goods from production facilities to the final consumer. Strong alcohol and beer products are also taken into account. The EGAIS system was introduced to combat counterfeit and low-quality alcohol, which, according to statistics, accounts for about 30% of the total turnover. The degree of control depends on the strength of the alcohol, so for strong drinks a blot record has been introduced, but for beer the conditions are much more relaxed. Thanks to the system, you can trace the history of each bottle.

Everyone wins - the state receives its share of taxes for economic development, the manufacturer becomes competitive, the retailer earns customer loyalty by providing all the information about the product.

Step-by-step instructions for connecting to the EGAIS system

In order to connect to the EGAIS system, you must comply with certain requirements and do everything in a certain sequence, namely:

- Check the availability of the Internet on the computer where this system will be installed;

- Purchase a qualified electronic signature on the Rutoken or JaCarta media, with which an electronic document will be signed for subsequent data transfer to the EGAIS system;

- Installation of the JaCarta Unified Client or Driver on Rutoken EDS 2.0, which corresponds to the bit level of the selected operating system (32-bit or 64-bit);

- Installing the latest version of JAVA;

- Install the component “Fsrar-Crypto 2”;

- Make sure that the INTERNET EXPLORER browser version 9 or higher is installed on your computer;

- Using INTERNET EXPLORER, go to the egais . ru and click on the “enter your personal account” , then click on the “ Read the terms and conditions and check their compliance”

- After this, connect the key drive to the computer and click on the “Start scan” . During the scan, you will be asked to install the components that are necessary to work with electronic signatures and allow work with ActivX.

Important!!! If the last step was not completed during the check, then you need to install the driver on the appropriate media.

For "Rutoken" - the "Rutoken" control panel

For "JaCarta" - the single client program "JaCarta"

After successful verification, the “Go to your personal account” button will become available .

- “Go to your personal account” button, you must enter the PIN code in the appropriate fields (For Rutoken it is 123456789, for JaCarta - 987654321), after entering, click on the “Show certificates” and the certificate of the organization that is registered on the egais . ru

- To enter your personal account, you need to click on the certificate with the mouse.

After the connection has been successful and you have entered your personal account, you need to check the availability of retail outlets, obtain an RSA key, make settings for the universal transport module,

How to install the transport module (UTM)

Download the installation file of the universal transport module to your computer and install:

This program is the link between the Unified State Automated Information System database and the computer on which all invoices will be processed, alcohol supplies will be confirmed, and so on.

After successful installation, the corresponding Rosalkonadzor icon should appear in the desktop tray (near the clock). When you hover over it, you can see whether the utility is working or not.

When you call the context menu, you can go to the UTM home page.

You can see background information here:

- UTM version;

- Database creation date;

- Validity period of certificates recorded on hardware media (GOST and RSA). This information can also be viewed in the Rutoken panel[1].

- Detailed information about certificates in the adjacent tabs;

- List of documents sent to the server;

- Received incoming TTN (trade and transport invoices).

In fact, that’s it, the connection of the individual entrepreneur to the EGAIS system is complete. If you see your TTN in the inbox tab, then everything is working.

The whole point of the article is in a short video, with a quick demonstration of the main steps for registering in EGAIS and installing the transport module:

Now we need to move on to the next stage, or rather work with the TTN: reconciliation, confirmation, and so on. This cannot be done in UTM; we will need a separate program, which can be paid or free.

I use the EGAISIK service, it costs 200 rubles per month and makes it easy to confirm deliveries, as well as generate a file for the quarterly alcohol declaration.

Checking retail outlets

In order to check whether all retail outlets have been added to the EGAIS system, you need to go to the “Get key” section. This section reflects all the retail outlets that the company has. Each retail outlet must have its own checkpoint. If the enterprise has several points and they all have one checkpoint, then you need to contact the Federal Tax Service to obtain a checkpoint that will apply only to one outlet. Each outlet must have its own carrier, either Rutoken or JaCarta.

| A store | The procedure for checking and installing a point of sale |

| Licensee organization | The list of retail outlets will be generated automatically from the license register. You need to check that the necessary retail outlets are on this list. If there is no point in the list, you need to contact your licensing authority to change the data. |

| Non-licensee organization (trade only beer) | In the “Add (LE)” section we enter all our counterparties. After entering all the data, a notification is sent to the Federal Tax Service to confirm the data. After successful confirmation by the Federal Tax Service, the outlet will appear in the “Get key” section. If a refusal comes from the Federal Tax Service, you need to repeat this action several times. In case of repeated refusal, you must contact the Federal Tax Service to check the data. |

| Individual entrepreneur | In the “Counterparties” section, click the “Add (IP)” button. Enter information about the address of the retail outlet. The data is sent to the Federal Tax Service for confirmation. After successful confirmation, the outlet will appear in the “Get Key” section. The appearance of the key in this section may take three days. |

Liability and fines

Violation of retail sales rules:

- Fine for employees from 20 to 40 thousand rubles.

- Fine for an organization from 100 to 300 thousand rubles.

The goods may be confiscated.

Production of alcoholic beverages without a license:

- For employees, a fine ranges from 500 thousand to 1 million rubles. or disqualification for up to 3 years

- For a legal entity, a fine in the amount of one fifth of the income for the previous year, but not less than 3 million rubles. Suspension of activities is possible for up to 90 days

Confiscation of equipment, goods, etc. is possible.

The sale of alcohol by individuals is illegal:

- Fine for individuals from 30 to 50 thousand rubles. with confiscation of goods

- An entrepreneur or wine producer will be fined from 100 to 200 thousand rubles. with confiscation of goods

Violations in the procedure for recording alcohol, if you do not work with the Unified State Automated Information System:

- A fine for an employee is from 10 to 15 thousand rubles.

- For legal entities from 150 to 200 thousand rubles.

For an unissued receipt for alcohol:

- The fine for the employee will be 2 thousand rubles.

- For legal entities, about 10 thousand rubles.

Violations on a large scale are subject to criminal liability. For production and turnover on a large scale, a fine, correctional labor or imprisonment for up to three years will be imposed. For particularly large violations, the fine will increase to 4 million rubles. and may be sentenced to imprisonment for up to 5 years.

Do you need help connecting to EGAIS?

Don’t waste time, we will provide a free consultation and help you connect to EGAIS.

Obtaining an RSA key for each department

An RSA key is a key that provides a secure connection between the workstation and the EGAIS system. It is recorded on the same media as the CEP. Each retail outlet must have a separate key medium on which the RSA key and EPC will be recorded.

You can get an RSA key in your Personal Account in the “Get Key” section. In this section, select the outlet for which you need to generate a key and click the “Generate key” button. A window will open for entering a PIN code (for JaCarta 11111111, for Rutoken 12345678) and click “Generate key”. After this, the RSA key will be written to the media, and a corresponding notification will appear.

Functions of EGAIS

In the case where the company’s field of activity is related to the trade of alcoholic beverages, there is a need for reporting to the Unified State Automated Information System. A special module (UTM) is installed on the online cash register, the main task of which is to send data to the information system.

EGAIS performs the following tasks:

- monitoring and analytics of the development of trade turnover in this area;

- accounting for the turnover of alcoholic beverages, from the manufacturer to the retailer, in terms of different alcohol contents in drinks;

- accounting for imported alcohol and its share in the domestic market;

- control of the number of excise stamps and comparison with real sales;

- control of document flow, identification of counterfeit goods.

It is the last point that is considered the most important mission of the system to eliminate “shadow” business and legalize all sites.

Setting up UTM for working with EGAIS

To configure the universal transport module, you need to go to the “Transport module” section in your personal account. Then clicks the “Download transport module” button. To install, you need to run the downloaded file. At the final stage of preparation for installation, you must specify the RSA key to be used. To do this, enter the PIN (12345678 for Rutoken or 11111111 (8 units) for Jacarta), click the “Search” button and tick the found RSA key. Next, UTM will ask you to select Internet access settings. Select the option you want and click Next. UTM will check access to FSRAR servers and display the results. Click Next. In the next window, enter the PIN for the CEP (12345678 for Rutoken or 0987654321 for JaCarta), click “Search” and select the found certificate. UTM will check access to FSRAR servers and display the results. Click Next. In the next window, enter the PIN for the CEP (12345678 for Rutoken or 0987654321 for JaCarta), click “Search” and select the found certificate. Next, the UTM will be automatically installed and configured. Upon successful installation, the interface will be displayed in the browser at https://localhost:8080

EGAIS for retail

Retail enterprises are required to record all stages of receiving products from wholesalers, suppliers or manufacturers (balancing, returns, recalculation, as well as sales and distribution of goods to retail outlets). As for current balances, the store is given the opportunity to take them into account in EGAIS, i.e. In case of damage or mis-grading of products, the company does not incur material losses - every bottle will be sold.

Obviously, the key for registering alcoholic products in the unified EGAIS database is an extremely necessary thing for the legal wholesale and retail sale of alcohol-containing products.

Penalties for not connecting to the EGAIS system

According to the Code of Administrative Offenses (Administrative Code of the Russian Federation), all organizations and individual enterprises are required to connect to the Unified State Automated Information System, but if after a certain date they do not connect to the specified system, then penalties will be imposed on the enterprise, namely:

| The person who is fined | Amount of fine |

| Executive | From 10,000 rubles to 15,000 rubles |

| Entity | From 150,000 rubles to 200,000 rubles |

In addition to the administrative fine, organizations that have not connected to the EGIS system will not be able to confirm the goods received from the supplier. At this moment, the supplier’s balances in the EGIS system will not be written off. And therefore, suppliers will stop shipping goods to those buyers who are not connected to the EGIS system.

EGAIS alcohol system: how to work with it

Today, a new version of EGAIS 3.0 has been developed, which allows you to control not only the release and final sale, but also monitor the entire chain of movement of alcohol products. The new model works more efficiently, while not much has become more complicated for business participants. The same requirements and reporting remain as before. The changes affected, first of all, the intermediate chain, wholesalers, transport services, etc. Below you will find instructions on how to work in EGAIS.

Errors with the EGAIS RSA key

During the process of generating a PCA certificate, certain difficulties may arise. In most cases there are two reasons. The first is problems with the web resource. The second is incorrect settings of computer equipment. To resolve problems with the EGAIS RSA key, you will need to perform the following steps:

- Turn off all antivirus programs installed on your computer equipment.

- Make sure that you have a newer version of the OS , for example, Windows 7, 8 or 10. It is advisable that all current updates are already running.

- Download the latest version of Internet Explorer .

- Make every effort to the latest model of FSRAR-Crypto crypto plugins install the appropriate drivers for successful transactions on the electronic platform.

If, when updating the EGAIS RSA key, any difficulties arise and the “PIN code request” column does not appear, then it is necessary to make the appropriate adjustments in the settings in the computer equipment. In most cases, incorrect settings are a consequence of failure to perform key generation operations .

When working using the RuToken system, you will need to go to the Control Panel, where you will need to select Settings; opposite the Rutoken line, you need to select the value Microsoft Base Smart Card Crypto Provider. After this, you need to try to generate the key again. If difficulties arise, you need to update the drivers.

In addition, the problem occurs when the PIN code is entered incorrectly. If you enter the data incorrectly several times, the media may become blocked . Then you will have to contact a certification center. Additionally, the error may be caused by a mismatch between the PCA key address specified in the license. If data discrepancies are identified, you will need to contact the technical support of Rosalkogolregulirovanie. You can make a corresponding request either in person or through your Personal Account. It is worth noting that in some cases, after making adjustments, it may be necessary to re-generate the PCA key.

So, to successfully work in the all-Russian system, in addition to the crypto key and installing the UTM, you need to take care of generating an RSA key.

Accounting system

Although the systems for accounting for the sale of alcohol and wood are similar in name and have common principles of operation, there are different tools for them. The LesEGAIS system is currently up and running, undergoing some changes and modernizations. Thus, each unit of wood is entered into a common database with information about it collected and a barcode containing this data. At the same time, any sales, even small ones, must be registered.

How is beer written off in EGAIS?

When selling bottled products, when sales are carried out through an electronic cash register, all actions are performed automatically. A barcode is read from each bottle sold by a scanner, and the product in pieces is written off to the database. Since this product is currently sold without excise stamps, recognition of each individual container is not necessary.

The product is written off for bottling exclusively manually, in multiples of used beer kegs.

You can control the balances of EGAIS beer and write off the sold unlabeled product no later than one day after the date of sale. You can identify a specific batch by using the “Bottling Date” attribute, which is located in the data stored in the Automated Information System, and write off products from this batch when selling it.

Important: non-alcoholic beer is not registered in the system, and it is also not included in the quarterly declaration.

Details and subtleties of accounting for the turnover of alcoholic beverages can be obtained on the official RAR resource.

How to renew the RSA EGAIS Rutoken certificate

In connection with the renewal of the certificate, all subjects of the alcohol market are required to update the RSA key. At the very beginning , you will need to remove the old certificate and only then install a new one .

- For owners of Rutoken . Log in to the control panel, find the field with the name of the key and select “Delete”. After confirming the operation and entering the PSA EGAIS Rutoken pin code, the previously installed certificate will be deleted.

- For Jakarta owners . Login to the administration system, select the initialization field, enter the administrator password and then clear the old certificate.

After deletion, it is necessary to update the RSA key of EGAIS Rutoken. All manipulations will need to be completed on the official web portal. When generating a key, you will need to enter a PIN code. If all identification details are entered correctly, the certificate will be registered. If you encounter any difficulties when renewing your PCA EGAIS key, please contact technical support . Specialists can connect remotely to your computer device in order to resolve the issue as quickly as possible.

Notes from an IT specialist

Connecting to EGAIS, one can say without exaggeration, has become the most pressing topic of the past year for food retail and catering organizations selling alcoholic beverages. It is clear that, like any new system, EGAIS will cause certain difficulties during implementation and initial operation. But objective problems are aggravated by extremely incomplete and often contradictory information about this system. Therefore, we decided to start over and figure out how EGAIS works and works.

EGAIS - Unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products. The system is designed to implement state control over the alcoholic beverages (AP) market on the territory of the Russian Federation. The first implementation of this system occurred in 2006, when producers and importers of alcoholic beverages were connected to it. This process was accompanied by many difficulties and led to serious upheavals in the alcohol market.

The second stage involves connecting the wholesale and retail chains, as well as beer producers, to EGAIS. By the nature of their activity, wholesalers and manufacturers are of little interest to us, especially since they have both IT departments and in-house lawyers, in general there is someone to take care of the issue, and we will pay the most attention to retail, as the most vulnerable market segment in this situation.

For retail, the implementation of the system is also divided into two stages: from 01/01/2016 it is required to provide confirmation of purchases of alcoholic products through EGAIS, and from 07/01/2016 - confirmation of the fact of retail sale of each unit of alcoholic products. The exception is beer trade and catering; they are limited only to confirmation of purchases.

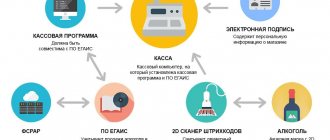

General operating principle of EGAIS

So, let's try to figure out how EGAIS is structured and works. Let's pay attention to the following diagram:

The key element of the system at a retail trade enterprise is the Universal Transport Module - UTM . Its task is to ensure the reception and transmission of data between Unified State Automated Information System and the enterprise’s inventory accounting software. And since accounting for alcohol is serious, to confirm the accuracy of the transmitted data and ensure the security of the communication channel, the JaCarta (aka crypto-key) is used, which contains a qualified electronic signature - CEP and a certificate to ensure a secure communication channel.

This is usually the point that causes the most confusion. JaCarta token used in the EGAIS system includes two storages: GOST and PKI. The first provides hardware support for Russian cryptography in accordance with the requirements of the FSB and FSTEC and is intended for storing CEP. In this context, an electronic signature is similar to an official signature and seal on documents, and it is logical that it should be provided with a high degree of protection against hacking and cloning. The CEP is issued in a single copy for the enterprise and is recorded in all keys by the Certification Center.

A certificate is recorded in the PKI storage for establishing a secure connection between the point of sale and the EGAIS servers; it is generated by the user independently in his personal account for each point of sale.

UTM itself is a network service and works with any applications that support it via the TCP/IP protocol. This allows flexible placement of the transport module and minimizes the need for additional software at workstations.

At the first stage, EGAIS will be used to confirm the fact of purchase of alcoholic products. Technically, it will look like this: the wholesaler sends a bill of lading to retail via EGAIS simultaneously with the shipment of products. The transport module receives this TTN and transmits it to the goods accounting system. After the actual receipt of alcoholic products, the retail outlet checks the quantity of products received with the quantity in the TTN. Then the invoice is either confirmed or adjustments are made to it, according to the actual quantity of products received. You can also refuse to accept the product and reject the TTN.

Any action with the TTN is irreversible and must be recorded in the Unified State Automated Information System. Thus, it is impossible to first confirm the invoice and then make adjustments to it; this imposes increased demands on the discipline of working with the system.

The second stage involves confirming the fact of retail sale. It provides for mandatory automation of the cash register with the ability to read the PDF417 two-dimensional barcode from excise stamps. The sale of goods will be carried out in the usual way - using a two-dimensional barcode. If alcohol is found among the products sold, the cash register software will issue a request to read the excise stamp. At the moment the check is closed, the cash register software transmits data about the alcohol sold to UTM and waits for a response from EGAIS. The system checks the authenticity and reliability of excise stamps and, if the verification is successful, the items are added to the receipt.

If the check fails, then this item is excluded from the check. This may be due to incorrect reading of the excise stamp, for example, due to its damage or contamination, or to its absence from the database. In the latter case, penalties are automatically applied to the enterprise, which entails additional risks and costs. In order to exclude them, independent verification of the authenticity of all received products using excise stamps is required. This can be done using specialized data collection terminals, but their considerable cost can seriously increase the implementation budget, and small businesses may not even be able to afford it. In this situation, everyone must draw their own conclusions, and also be more careful in choosing suppliers.

Place of UTM in the structure of the enterprise information system

As we have already said, UTM is a network service, and, therefore, can be located in any convenient location within the enterprise’s local network. At the same time, there is a statutory requirement for the physical location of the UTM at the place of implementation, so options with the location of the UTM in the central office and remote access to it, say, via VPN, should be immediately discarded.

Technically, UTM is implemented in the form of a software module that is available free of charge to all system participants; there are also software and hardware systems, for example, UTM ATOL, which is a compact network device, like a regular router.

Let's start with the simplest scheme: a small store with a merchandiser's computer and one or more cash registers.

In principle, you can place the UTM anywhere, but it is better to do this on the merchandiser’s computer, which will make it difficult for unauthorized persons to access the UTM token and software. For the smallest ones, when there is no separate workstation for the merchandiser, and the computer of one of the cash registers is used to receive goods, then the UTM with a crypto key can be placed there. The same scheme is applicable in the case of a single cash register, while receipt and confirmation of receipt can be done from any other PC, for example from the manager’s laptop.

If an enterprise has a server, then it would be logical to place the UTM and the key on it, this will ensure more stable operation of the system and make unauthorized access more difficult.

In addition, keep in mind one more limitation: on one PC there can only be one UTM with one crypto key, and the binding of the UTM to the key occurs at the stage of installing the transport module. If at one point of sale sales are carried out by two legal entities, more precisely a legal entity (strong alcohol) and an individual entrepreneur (beer), then it will be necessary to install two UTMs on two different PCs; the scheme with replacing the key at one workplace will not work.

Finally, you can purchase a hardware UTM, the same ATOL, and place it in any convenient location on the network.

This can be convenient when it is not possible to install the UTM on a dedicated workstation. For example, for security reasons, or workplaces do not meet system requirements. However, this method requires additional costs and cannot be definitely recommended.

How many UTMs need to be installed and where?

This is also not an idle question and cannot be solved by technical considerations alone. For example, technically, no one bothers to install one UTM in the central office and connect all retail outlets to it via VPN. But here the legal requirements come to the fore, according to which any retail outlet with an address that differs down to the house number must be registered as a separate division and have a different checkpoint. Each such point is subject to licensing and must have its own UTM and crypto-key, which contains a common enterprise key and an individual PKI certificate. At the same time, the movement of alcoholic beverages between retail outlets of one enterprise must also be carried out through the Unified State Automated Information System.

For example, if we have three retail outlets, we will need to purchase three crypto keys and install our own UTM at each retail outlet. There is no need for a UTM at the central office, since it is not a point of sale of alcoholic products.

The situation is different for individual entrepreneurs selling beer (individual entrepreneurs do not have the right to sell strong alcohol). They only need to confirm the fact of receipt of beer; they cannot have separate divisions and they officially conduct their activities at the place of registration of the individual. Therefore, the location of the UTM is not regulated for them; it can be located at one of the points, in the central office or at home.

Catering enterprises deserve a separate discussion. Alcohol in them can only be sold by the glass; selling alcohol in a closed container for takeaway will be a violation, i.e. There is no retail sale of alcohol in catering establishments and only the fact of purchase is required to be confirmed. But there is one subtlety: with the introduction of EGAIS, the widespread practice in public catering when, when stocks of alcohol run out, they are promptly purchased at the nearest retail outlet, becomes impossible. Since it is impossible to reflect the receipt of such alcohol through EGAIS, it is impossible to sell it. An exception is alcohol used to prepare non-alcoholic products, for example, dishes that include alcohol in the recipe. It is not necessary to confirm the receipt of such alcohol and it can be purchased at retail.

UTM and crypto-key in public catering should be located at the place of activity. Automation of cash registers is not yet required, since there is no need to confirm the fact of retail sales.

Journal of accounting for the volume of retail sales of alcoholic and alcohol-containing products

In light of the implementation of the Unified State Automated Information System, everyone somehow forgets about the Journal; at the same time, very significant penalties are provided for its absence or incorrect and untimely filling out. There are no special requirements for keeping a journal; it can be kept either electronically or in paper form, which is important for catering and beer sales points that do not have automated cash registers.

The log records the facts of retail sales of alcoholic beverages and beer, and when selling beer and wine on tap, the fact of opening the container. The main requirement is that entries must be made in the journal no later than the next day after the cash register shift closes. Those. a situation where an accountant fills out the journal once a week based on accumulated data is unacceptable and entails the risk of penalties.

Catering establishments record in a log the facts of opening containers for any alcohol, since they have the right to sell it only on tap.

We hope that our brief overview will help you put in order and systematize information about EGAIS, and in our next articles we will move on to the practical aspects of implementation.

Risks of not connecting to the system

All organizations involved in the sale of alcoholic products, even if it is just beer, must use the Unified State Automated Information System for accounting. According to the law, from 2020, for non-use of the system, a fine of up to 200 thousand rubles will be imposed on the organization and on the head of the organization personally up to 15 thousand rubles. This is a small fine for large companies, but significant for individual entrepreneurs.

In general, connecting to EGAIS is not a difficult task for IT specialists and experienced computer users. A timely transition to this system will save the organization from fines and liquidation.