Simplified form of balance sheet (STS)

A simplified form of the balance sheet is given in Appendix 5 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Compared to the usual (traditional) balance sheet form, the simplified one contains fewer lines in assets and liabilities. But this does not mean that something may not be reflected in the balance sheet or may not be included in full.

It is not always necessary to fill out all lines of the simplified balance sheet. This is possible when the company does not have any assets or liabilities at the reporting date. For example, a company uses only leased property and does not create fixed assets itself. In this case, the corresponding balance line is not filled in.

Who can do accounting?

Small businesses and individual entrepreneurs can do their own accounting, but they can also engage third-party firms or accountants to do this, who will keep records for them and prepare reports to the tax and other organizations. The choice of who will do this depends on the capabilities of the organization, its size and the qualifications of the manager. According to Russian legislation, accounting of small enterprises can be carried out by: a third-party organization providing accounting services, the manager himself, an accountant invited/located at the established point.

Enterprises that are on the simplified tax system, business entities that are on the simplified tax system (USNO) and imputation (UTII), placing their shares for public sale, must keep accounting records in full with filling out all forms and reports. Moreover, if the enterprise simultaneously has the simplified tax system and the UTII, then it is necessary to keep records for each type of taxation separately.

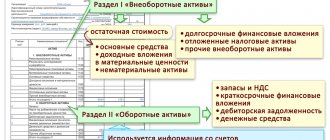

We fill out the balance sheet asset in a simplified form

You must enter data in the following 5 lines:

This shows the residual value of assets (balance of accounts 01 and 03 minus balance of account 02) and adds expenses for construction in progress (account 08).

NOTE! Financial investments, accounts receivable and inventories in the balance sheet assets must be shown without taking into account reserved amounts (account balances 59, 63, 14), that is, in a net valuation (PBU 4/99).

Simplified balance sheet liability

This section of the report, consisting of 6 lines, is filled out in the following order:

All credit balances on accounts 80 (minus the debit balance of account 81), 82, 83 and 84 are entered here. If a loss is reflected on account 84 (i.e. there is a debit balance), then it is taken into account in the same way as the data reflected on account 81. If the overall result is negative, it will be shown in parentheses.

The figure in this line should reflect the balance of the company's debt on long-term loans and borrowings (account 67). In this case, accrued interest, the maturity of which as of the reporting date is less than 12 months, is excluded.

Filled out for the amount of long-term liabilities listed in the loan balances in accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76.

This line includes the balance of account 66, as well as the balance of accrued interest that was not taken into account when filling out information on long-term loans and borrowings.

This shows the sum of credit balances in accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76 for all short-term liabilities.

A line that may be missing or not filled in if all the necessary information about obligations is reflected in the 5 previous lines.

NOTE! After filling out the liability and asset lines of the balance sheet, you need to compare the results obtained. The sum of all asset lines must be equal to the result of adding the liability lines.

Balance sheet under a simplified taxation system

When switching to a simplified taxation system, many questions arise regarding accounting. These points are spelled out in the legislative framework, but subsequent changes to this legislation and the publication of many additional letters introduce a certain amount of confusion.

According to the current legislation, enterprises, organizations, individual entrepreneurs using the simplified taxation system (USNO - simplified taxation system) do not have to keep financial statements (often a balance sheet) and submit them to the tax office, unless otherwise provided by law.

In what cases is a balance sheet drawn up?

Under the simplified taxation system, accounting is carried out in the following cases:

1. Form of ownership of a company or organization - LLC or JSC. For these forms of ownership, accounting is required, since dividends are calculated based on the profits shown in the balance sheet (since it shows the overall picture of the company's cash flow more accurately than tax reporting).

2. If accounting and balance sheet maintenance is specified in the constituent documents.

3. If applied simultaneously: simplified taxation system and UTII. With a single tax on imputed income and the simplified tax system, accounting is kept separately for each type of activity with a different type of taxation: accounting is kept separately for the simplified tax system, and separately for the UTII.

4. Drawing up a balance sheet and maintaining accounting records for the own needs of an enterprise, individual entrepreneur, since it more fully reflects the real state of affairs than tax reporting.

5. For small businesses that are issuers of securities placed publicly.

Simplified balance

The simplified taxation system makes it possible to draw up a simplified balance sheet. What is a simplified balance sheet? This is a regular balance, which is filled out in a more simplified form - some fractional accounts are combined into a general account.

For small enterprises and businesses, generalized information is provided for the following accounts:

1. Accounts 07, 10, 11 are included in 10 “Materials”.

2. Accounts 20, 23, 25, 26, 28, 29 – “Main production” and “Sales expenses” (accounts 20 and 44).

3. Accounts 41, 43 – 41 “Goods”.

4. Accounts 51, 52, 55, 57 – 51 “Current accounts”.

5. Accounts 62, 71, 73, 75, 76, 79 “Settlements with debtors and creditors.”

6. Accounts 80, 82, 83 – 80 “Authorized capital”.

7. Accounts 90, 91, 99 – 99 “Profits and losses”: 90, 91.99.

For enterprises and individual entrepreneurs with a small turnover, a small number of transactions per month, it is possible to maintain a balance sheet and other reporting in a simplified form. That is, you can keep records of business transactions in the Accounting Journal, which serves as an information source about the property, funds and resources of a business entity. This Book can be used to prepare a balance sheet and other reports for the required period.

In addition to drawing up a balance sheet, for small businesses that are on a simplified taxation system, you can maintain accounting records using the cash method, Income and Expense Books. The use of the cash method is recommended for small firms, subject to several basic points:

- the decision to maintain accounting using the cash method must be enshrined in the accounting policy of the enterprise;

- information on accounts can be presented in a generalized form (using only the main accounts, as for a simplified balance sheet);

- a small number of transactions performed per month.

To determine the appropriate type of accounting, you need to take into account several parameters: the size of the enterprise, organization, individual entrepreneur, the rationality of using the chosen type of accounting, the type of activity of the business entity and the conditions of its business.

Who can do accounting?

Small businesses and individual entrepreneurs can do their own accounting, but they can also engage third-party firms or accountants to do this, who will keep records for them and prepare reports to the tax and other organizations.

The choice of who will do this depends on the capabilities of the organization, its size and the qualifications of the manager.

According to Russian legislation, accounting of small enterprises can be carried out by: a third-party organization providing accounting services, the manager himself, an accountant invited/located at the established point.

Enterprises that are on the simplified tax system, business entities that are on the simplified tax system (USNO) and imputation (UTII), placing their shares for public sale, must keep accounting records in full with filling out all forms and reports. Moreover, if the enterprise simultaneously has the simplified tax system and the UTII, then it is necessary to keep records for each type of taxation separately.

Source: https://biznesinalogi.com/balans-pri-uproshhennoj-sisteme-nalogooblozheniya/

To whom and when should the balance be submitted?

The simplifier filled out the balance. What's next? It does not matter in what form this balance sheet is drawn up (traditional or simplified). A company using the simplified tax system is obliged to submit a report (as part of other mandatory accounting reports) to all interested authorities.

The annual report must be submitted to the tax authorities and the statistical office no later than March 31. This period is determined by both tax (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation) and accounting (clause 2, article 18 of law No. 402-FZ) legislation.

If you are just starting a business and registered after September 30 of the reporting year, you only need to prepare and submit a balance sheet for the first time at the end of the next year. For example, a company was registered on 10.10.2017 - for the first time it is obliged to report on the results of 2020 for all activities from 10.10.2017 to 31.12.2018 (Clause 3 of Article 15 of Law No. 402-FZ).

For presentation to management, owners or counterparties, the balance sheet can be drawn up at any other frequency (clause 4, article 13 of law No. 402-FZ). In this case, the state (represented by tax authorities and statistics) is not required to submit reports.

NOTE! If your company does not send the balance to the tax authorities or does so late, the fine will be 200 rubles. (clause 1 of article 126 of the Tax Code of the Russian Federation). Administrative punishment under Art. 15.6 Code of Administrative Offenses of the Russian Federation. If your balance is not received by the statistical authorities, you may be punished under Art. 19.7 Code of Administrative Offenses of the Russian Federation.

Reporting for "simplifiers"

General rules apply to the reporting of economic entities that apply the simplified taxation system. This requirement was introduced by Law No. 402-FZ. At the same time, the simplified tax system is very often used by companies classified as small businesses. And they, as you know, can keep records and submit reports in a simplified form. Therefore, in practice, most entities submit simplified reporting to the simplified tax system.

It is important to understand that there is no separate type of reporting for a company using the simplified tax system. The following rule applies here:

- entities on the simplified tax system that belong to the category of small businesses can independently choose the reporting form - traditional or abbreviated;

- entities on the simplified tax system that do not meet the criteria for small businesses are required to report in full.

We have already written about how to check whether a company belongs to the small category.

Results

A simplified report is easier to fill out, but the information presented cannot be shortened. The balance sheet must reliably reflect the value of the property and the amount of the company's liabilities as of the reporting date. The finished balance is sent to tax authorities, statistical authorities and all interested parties.

Small businesses, according to Federal Law No. 209 dated July 24, 2007, in 2020 included organizations and individual entrepreneurs with a staff of up to 100 people and revenue excluding VAT of up to 800 million rubles. In this case, the organizational and legal form can be:

These rules do not apply to joint stock companies and they do not have the right to apply simplified accounting. And individual entrepreneurs are allowed not to keep accounting records at all and not to submit any financial reports (Article 6 No. 402-FZ).

The simplified requirements for legal entities are stricter: among other things, the value of their depreciable fixed assets on the balance sheet cannot exceed 100 million rubles.

The balance sheet for an LLC using the simplified tax system for 2020 can be compiled according to the simplified scheme provided for by Federal Law No. 402 and Order of the Ministry of Finance dated July 2, 2010 No. 66n. However, the detail of reporting is left to the discretion of the LLC: full and short versions are acceptable. What balance does the LLC submit to the simplified tax system? Read about it below.

Annual form for individual entrepreneurs and LLCs on the simplified tax system: what balance to submit for 2019

A regular 3-page report with numerous attachments or a simplified 2-page report with explanations if necessary (for example, in case of losses)? Depending on the type of activity of the organization and the accounting accounts it uses: if rare accounts are used that are not in the short form of the report, then it is better to use the full version. For companies engaged in such common activities as trade, transportation or construction, the lightweight version of the form reflects the results of financial activities quite fully.

Do I need to report to individual entrepreneurs using a simplified form? Not necessarily, but if you wish, you can prepare reports in any form based on the data in the income (and expenses) ledger.

Is it possible for NPOs to report in a simplified manner? Yes, instead of a report on financial results, NPOs fill out a simplified report on the use of targeted funds. The lightweight version is much shorter. You can see how to correctly fill out the balance sheet of an NPO using the simplified tax system in the example (Fig. 1).

Limits for applying the simplified tax system in 2020

Hello! In this article we will talk about the limits that allow you to apply the simplified tax system from 2020. Today you will learn:

- What are the limits for entrepreneurs on; Which profit items are classified as “simplified” income; In what cases is the right to use the simplified tax system lost; How to switch from simplified tax system to OSN.

It is beneficial to use the simplified tax system for management, and therefore this is widespread among and.

It has several advantages that set it apart from other taxation methods. Before starting to use the “simplified tax”, you have the right to choose one of two tax rates: 6%, if your activity contains income items and minimizes expenses (in this case, the entrepreneur pays only 6% of the profit amount); 15% if the company has both income and expenses (first the difference between the profits and expenses received for the year is calculated, and then 15% is deducted from the amount received - this is the tax payable).

Simplified balance sheet.

The procedure for filling out the balance sheet and financial performance report

Author of the article Yulia Bakirova 6 minutes to read 17,425 views Contents Individual organizations have the right to conduct accounting in a simplified form and create simplified financial statements. Such organizations include: small businesses, Skolkovo project organizations and non-profit organizations (except for those recognized as foreign agents). At the same time, small businesses can choose the form of preparation of financial statements independently.

They can provide reporting using both general and simplified forms. The composition of the reporting will depend on this.

How to make a simplified balance sheet for the simplified tax system for 2019: form and recommendations

First you need to close the accounting reporting period. To balance the balance, accounts 90, 91 and 99 are closed on December 31 of the reporting year - this is called reformation. For a simplified balance sheet under the simplified tax system in 2019, this procedure is the same as for a regular one. The necessary transactions are presented in the table; an example of filling out a statement of financial results based on these transactions is shown in Fig. 2. For such entities, subaccounts for value added tax and excise taxes (90-3, 90-4, 91-3) are irrelevant.

The LLC balance sheet on the simplified tax system for 2020 is due at the end of the year until March 31, 2020. One copy of the organization form must be submitted to the Federal Tax Service, and the second to Rosstat. Let's take a closer look at filling out this simplified reporting form for an LLC in our material.

Sample of a finished balance sheet under the simplified tax system in 2019

Simplified financial statements of a profitable company for 2020 (full set, thousand rubles).

Financial statements are unprofitable). An example of filling out a balance sheet under the simplified tax system “income minus expenses” (Form 2) with a loss is slightly different from the “profitable” option. There are no differences in the LLC balance sheet under the simplified tax system for 2020.

Be prepared to provide explanations to tax inspectors in case of losses. You can immediately issue an explanatory note about the reasons for their occurrence. Enterprises and individual entrepreneurs using the simplified regime are not required to compile it in full. Losses can be explained by writing off overdue accounts receivable, etc. Tax officials can also clarify your intentions to correct the situation.

We remind you that an organization can switch to a simplified tax system by sending a notification to the Tax Service. The article on our portal will help you do this.

Is it necessary to approve the balance sheet of an LLC using a simplified form? From what year does the simplified tax system submit the balance?

The question of which year the simplified tax system is used to submit balances has recently been of great interest to taxpayers using the simplified regime. Until 2013, this form of reporting was not mandatory for small businesses. At the beginning of 2013, amendments were made to the Federal Law of December 6, 2011 No. 402-FZ. From this moment on, accounting reporting became mandatory not only for OSNO, but also for organizations using the simplified tax system. Individual entrepreneurs do not submit financial statements.

Thus, to the question of whether it is necessary to approve the balance sheet of an LLC on a simplified basis, the answer will be as follows: it is necessary, although this was not required before.

Simplified LLCs must submit reports to two authorities: the Federal Tax Service and Rosstat at the place of registration.

According to Art. 14 of Law No. 402-FZ, financial statements include:

- balance;

- income statement;

- applications to these two forms.

Applications are not required for most businesses and are only provided in certain cases. Applications include reports on changes in capital, cash flows, and the intended use of funds.

If necessary, additional explanations can be attached to the listed financial statements. They can be presented in the form of a table or text. It is also necessary to attach an audit report stating that the data is reliable. This clarification applies only to organizations that, in accordance with paragraph 10 of Art. 13 of Law No. 402-FZ are subject to mandatory audit.

Nonprofit organizations may not file an income statement. Instead, they submit a report on the intended use of funds and attachments to it.

Small businesses (SMEs) have the right to submit reports in a simplified form. In particular, they can fill out indicators only for the main items, without detailing the information. They fill out appendices to reporting only when failure to submit the appendices will lead to the impossibility of reliably assessing the results of the LLC’s activities and its financial position. If there is no such data, then they can only submit a balance sheet and a statement of financial results (letter of the Ministry of Finance of Russia dated 04/03/2012 No. 03-02-07/1-80).

Most of the simplifiers can be classified as small businesses. Therefore, it will be important to consider the features of filling out the balance in a simplified form.

Accounting for accounting transactions using the simplified tax system

Before finding out whether you need to submit a simplified balance sheet, let’s understand the specifics of company accounting using the simplified tax system.

A simplified method of accounting and the preparation of financial (accounting) statements in a simplified form is permitted for the following economic entities:

- small businesses;

- companies that have the status of participants in Skolkovo development and research projects;

- non-profit companies.

The exceptions are the entities named in clause 5 of Art. 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Unlike full-fledged accounting, when using simplified accounting you can (information of the Ministry of Finance of the Russian Federation dated June 29, 2016 No. PZ-Z/2016):

- partially abandon the use of PBU;

- do not use the double entry method - relevant only for micro-enterprises and non-profit organizations;

- use a simplified system of accounting registers or completely abandon them;

- record transactions using the cash method;

- do not apply revaluation and depreciation of assets;

- prepare financial statements in a reduced volume.

Accounting rules also apply to simplified entrepreneurs. Clause 1 part 2 art. 6 of Law No. 402-FZ exempts individual entrepreneurs and individuals in private practice from maintaining accounting records and presenting a balance sheet.

However, simplified entrepreneurs must at least keep accounting of fixed assets so as not to exceed the limit of their residual value in the amount of 150 million rubles, otherwise the individual entrepreneur will have to switch to OSN (letter of the Ministry of Finance dated August 29, 2017 No. 03-11-11/55403).

To help, IP ConsultantPlus has prepared a ready-made solution with complete information about the accounting and reporting of individual entrepreneurs on the simplified tax system. If you don't have K+ yet, take advantage of the free trial so you don't miss anything in your work.

The ability to maintain simplified accounting does not relieve taxpayers who have chosen simplified accounting from the obligation to maintain a full book of income and expenses (KUDiR, approved by order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n).

How simplifiers should fill out the balance sheet

Data must be indicated rounded to whole numbers in thousands of rubles. Corrections, blots, or erasures are not allowed in the balance sheet.

If in some article you need to show a zero indicator, then it will be enough to put a dash in the required line.

LLCs using the simplified tax system submit a balance sheet to the Federal Tax Service and Rosstat at the end of the reporting year (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation). Reports must be submitted no later than March 31. That is, the balance for 2020 must be submitted before 04/02/2018 (since 03/31/2017 is a Saturday).

Sometimes organizations fill out not only final reports, but also interim ones. However, they do not need to submit such reports to regulatory authorities. It is compiled by them solely to simplify understanding and generate basic reporting.

Actions in case of violation of the identity of assets and liabilities of the balance sheet

The structure of balance sheet items implies equality of assets and liabilities. If the balance does not converge, it is necessary to consistently check transactions for the reporting period. The probability of an error occurring is observed:

- When doubling transactions. It is necessary to check all indicators of the balance sheets;

- In case of incorrect closing of accounts before new data appears. It is necessary to repeat the operation to close accounts;

- Incorrect attribution of retained earnings or unliquidated losses;

- Carrying out rounding of data after the formation of the balance in larger units.

Additionally, the accuracy of the reflection of reserves, taxes, fixed assets, and information from counter-additional accounts that balance the main indicators is checked. Of particular importance is the control of data on second-order accounts (operations in the context of analytics). through government services / through the tax office / through SBIS / through Sberbank online.

LLC balance sheet on the simplified tax system for 2020

The simplified balance sheet is submitted in the form given in Appendix No. 5 to Order No. 66n. In it, small enterprises, when filling out a balance sheet for 2017, must reflect the general indicators for three years (2017, 2016 and 2015).

A simplified balance sheet, like a regular one, consists of an asset and a liability. The totals for them are calculated in lines with codes 1600 and 1700. After filling out the form, the indicators of these two lines should be the same.

The asset reflects the amount of non-current and current assets, and the liability - the amount of equity, borrowed funds and debt of creditors.

The general balance is filled in the same way. It must be filled out according to the form given in Appendix No. 1 to Order No. 66n. SMPs can submit their balance sheet both in a simplified form and in a general form. This is not prohibited by law.

Filling out simplified reporting forms

A simplified balance sheet has enlarged items that include several accounting objects. The table below shows what is included in each balance line.

| Line title | Explanation |

| Assets | |

| Tangible non-current assets | Fixed assets, unfinished capital investments in them |

| Intangible, financial and other non-current assets | Intangible assets, results of research and development, investments in intangible assets, research and development, long-term financial investments (issued loans, bills, bonds), etc. |

| Reserves | Materials, goods, work in progress, finished products |

| Cash and cash equivalents | Cash in various currencies, converted into rubles, in the bank and at the cash desk. Their equivalents are highly liquid investments that can be quickly exchanged for cash without significant risk of loss, such as demand deposits |

| Financial and other current assets | Accounts receivable, advances issued, short-term financial investments, other immaterial current assets |

| Passive | |

| Capital and reserves | Authorized capital, additional capital, reserve capital, retained earnings. NPOs include in this line target funds, a fund of real estate and especially valuable movable property and other target funds |

| Long-term borrowed funds | Credits and borrowings for a period of more than a year and interest on them |

| Other long-term liabilities | Lender and targeted financing for a period of more than a year, reserves for upcoming expenses for a period of more than a year, etc. |

| Short-term borrowed funds | Credits and borrowings for a period of less than a year and interest on them |

| Accounts payable | Creditor to counterparties, personnel, budget, founders, advances received, etc. |

| Other current liabilities | Reserves for future expenses, targeted financing, deferred income with a period of less than a year, etc. |

The simplified statement of financial results does not highlight the types of expenses for core activities and some other indicators that detail its data when prepared in the usual form. The table below shows the components of this report.

Simplified balance sheet for simplified tax system 2020 - example of filling out

Based on the available data, let’s consider an example of filling out a simplified balance sheet for the simplified tax system 2020.

When filling out the balance, you need to remember that its lines are coded; their codes can be viewed in Appendix No. 4 to Order No. 66n. Only aggregated indicators need to be included in the simplified balance sheet (that is, without detail). Therefore, the line code will need to be indicated according to the indicator that has the largest share in the structure.

The balance sheet assets will reflect the following periods.

| Asset line | Formula for calculation | Amount to be reflected |

| 1150 | Dt 01 – Kt 02 | 700,000 - 21,000 = 679,000 rubles. |

| 1170 | (Dt 04 – Kt 05) + Dt 58 | 120,000 – 3,000 +138,000 =255,000 rub. |

| 1210 | Dt 10 + Dt 43 | 25,000 + 95,000 = 120,000 rubles. |

| 1230 | Dt 19 | 5 000 |

| 1250 | Dt 50 + Kt 51 | 14000 + 266,000 = 280 o00 rub. |

| 1600 | Sum of all asset lines | 679 + 255 + 120 + 5 + 280 = 1,339 thousand rubles. |

In the liability side of the simplified balance sheet we will reflect only three lines:

| Passive line | Formula for calculation | Amount to be reflected |

| 1370 | Kt 80 + Kt 82 + Kt 84 | 50,000 +20,000 + 175,000 = 245,000 rub. |

| 1520 | Kt 60 + Kt 62 (advances) + Kt 69 + Kt 70 | 100,000 + 605,000 + 75,000 + 314,000 = 1,094,000 rub. |

| 1700 | Sum of all liability lines | 245 + 1094 = 1,339 thousand rubles. |

After filling out the assets and liabilities of the balance sheet, you need to compare the results of lines 1600 and 1700. The indicators in these lines must match. In our example, the amount of assets is equal to the amount of liabilities and amounts to 1,339 thousand rubles. Thus, we have filled out the balance correctly and can send it to the tax and statistics services.

Simplified balance sheet for the simplified tax system 2020 - an example of filling it out can be downloaded from this link.

The chief accountant does not need to sign the simplified balance sheet; only the head of the organization must sign it.

Responsibility for submitting an incorrect balance ↑

If a taxpayer makes serious mistakes when forming a balance sheet, then he may be brought to administrative responsibility (Article 15.11 of the Code of Administrative Offenses).

The fine against an official can be up to 3 thousand rubles. If the reporting documentation is corrected before the deadline for its submission, then the official is released from liability.

However, for a gross violation of the rules for accounting for income, an organization can be held liable on the basis of Article 120 of the Tax Code of the Russian Federation.

Zero reporting. Penalties for failure to submit balance

Suspension of the activities of an enterprise for a while does not mean that it does not have to submit reports. Such LLCs still need to submit a zero balance sheet to the Federal Tax Service and Rosstat. Otherwise, the debtor will be subject to sanctions and it may even go as far as blocking the bank account.

However, a zero balance is not acceptable in principle. It cannot be like this, even if the company’s activities are stopped. At a minimum, it will need to reflect the authorized capital. It must be shown in lines 1300 and 1250. In the remaining lines, the organization will have to put dashes.

The fine for failure to submit reports in 2020 is 200 rubles for organizations. for each unsubmitted form. This norm is enshrined in paragraph 1 of Art. 126 of the Tax Code of the Russian Federation. Also, a fine will be imposed on the head of the organization and will amount to 300 – 500 rubles (Clause 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation). These fines relate to failure to submit reports to the tax authorities. And failure to submit a balance to the statistical authorities also entails prosecution on the basis of Art. 19.7 Code of Administrative Offenses of the Russian Federation. At the same time, for organizations the fine will be 3–5 thousand rubles, and for a manager – 300–500 rubles.

Zero balance

Temporary suspension of activities does not relieve the enterprise from the obligation to provide financial statements. A zero balance must be provided to Rosstat and the territorial tax office . Otherwise, regulatory authorities have the right to apply sanctions to the debtor in the form of penalties and blocking of a bank account.

It should be noted that the balance cannot be zero even if activities are stopped. At a minimum, it reflects the authorized capital of the organization in lines 1300 of liabilities and 1250 of assets. If for some reason it is not entered by the founders, then the assets of the balance sheet reflect the receivables of the founders on line 1230. The remaining lines are filled with dashes .

How to prepare reports for the simplified tax system in 1C - in this video.

Results

Thus, LLCs using the simplified tax system must submit a balance sheet to the Federal Tax Service and Rosstat at the end of the year. The balance sheet is compiled by simplifiers in accordance with generally established principles and rules. But, since many simplifiers are small businesses, they can submit financial statements not in a general form, but in a simplified one. The main essence of this simplification is that balance sheet indicators are combined into certain groups, and not detailed as in a regular report. However, if desired, an organization can submit a report using a standard form.

Currently, the Ministry of Finance has prepared a draft law to abolish the need to submit financial statements to statistical authorities, since the reporting forms used to submit reports to these two authorities are identical. This would improve the level of reporting discipline and government bodies would not duplicate each other. But for now this is just a project.