Any commercial activity, regardless of the amount of income, must be carried out legally. Accordingly, its implementation requires the execution of certain documents.

The concept of “self-employed” has been on everyone’s lips lately. Unlike the familiar individual entrepreneur, this term is new. The difference between the concepts is great. To understand, you must first understand who self-employed citizens are and how they differ from individual entrepreneurs.

Difficult choice

Who is a self-employed citizen?

Self-employed can be called a person who receives payment for his work without hiring employees.

Such citizens can be divided into two groups. The first category includes self-employed citizens who are exempt from paying personal income tax (personal income tax) until the end of 2020. This implies activities such as:

- caring for sick people and minor children;

- cleaning of residential premises;

- tutoring.

Self-employed

The second category includes those who are required to pay NIT (tax on core income). The scope of activity of such self-employed citizens is much wider. This:

- photographers;

- copywriters;

- landlords of their own real estate;

- hairdressers, manicurists and pedicurists;

- drivers;

- jewelers;

- home appliance repair technicians;

- designers;

- sellers of their own products.

Unlike those included in the first group, such self-employed citizens can cooperate not only with individuals. They can also provide services or offer their products to organizations and individual entrepreneurs.

Also, self-employed people who pay NAP can work for hire on the basis of an employment contract.

Important! You can get a job at your previous job or with a former employer only after two years have passed from the date of dismissal.

The territory in which self-employed people can carry out their activities is very limited. At the moment, this is only possible in the Moscow and Kaluga regions, as well as in Tatarstan. It is in this territory that a citizen must be registered.

Business ideas for the self-employed

To become self-employed, you need to understand what a person wants to do and whether this will be his only income. According to the law, a taxpayer who already has official income can also become self-employed. For example, he can work for a large financial corporation, and in his spare time he can make handmade bags and sell them online. In addition to the 13% tax on his salary, he will pay professional tax on income from his hobby.

A simple part-time job can grow into a business, which can be re-registered as a legal entity or individual entrepreneurship.

Main examples of activities of the self-employed:

- remote work via the Internet: copywriting, web design, marketing research and work with social networks;

- organization of events;

- photo and video shooting;

- stylist and manicure services;

- production and sale of home cooking;

- renting out an apartment;

- tutoring;

- legal advisor and accountant services.

Some of the listed activities can develop into a business: making culinary products or taking photos and videos. With good management, owners can open their own studios and register a legal entity or individual entrepreneur. This will help increase business and hire workers.

Earning money from home

It may start as a hobby, but after a while it will bring a good income. Today, thanks to social networks and the Internet, many people have found themselves in a wide variety of industries: cooking, painting, handicrafts and tailoring. They can not only make for themselves, but also take individual orders.

| Kind of activity | Expenses | Description of activity |

| Making cakes | Products, decoration, special tools for the pastry chef. Packaging is also necessary - paper boxes, a car to deliver orders and not waste money on a courier. | A self-employed person can make cakes at home according to a recipe and post photos on social networks, attracting customers. |

| Manicure services | High-quality manicure accessories, lamps, containers for processing tools, various varnishes. | After purchasing everything you need, you can receive clients at home by placing an ad online. |

| Soap making | Purchase of materials, as well as various forms and tools. | A self-employed person makes soap and sells it through the Internet or cosmetics stores |

| Tailoring | Purchase of a sewing machine, materials, accessories, a machine for printing images on clothes. | Sewing individual models for clients or collections for sale online and in clothing stores. |

All these types relate directly to the production and sale of their own products. They cannot be tackled without experience and certain basic knowledge.

Self-employed people can work from home or rent a studio to turn it into a work area - the law does not prohibit this.

Earning money on the Internet

The Internet is a global source of income for the self-employed. There you can find a side job or your main activity. These include copywriting, web design, market research or social media work. Earning money on the Internet directly depends on the experience and skills of a freelancer.

A freelancer can register on special exchanges that help find a customer and carry out certain projects. He can also independently search for clients via the Internet and acquaintances.

Other types of income for the self-employed

Also, the activities of the self-employed can include organizing events, photography and video shooting, repairing household appliances, as well as construction and installation work. A self-employed person can carry out individual orders and work for legal entities, paying 6% tax, or for private clients, paying 4%.

Restrictions

Before deciding to obtain a patent and become self-employed, a citizen should pay attention to some important points.

Simplified tax system and patent - what is their difference and which system is more profitable

Registration of a patent makes it possible to provide services or sell your own products. But this activity must be carried out by the patent owner personally without hiring employees. Self-employed citizens are prohibited from using hired labor.

Note! There can be only one type of activity. When receiving self-employed status, a citizen chooses it himself. Thus, the services provided can only be provided within one occupation.

In addition, there are areas of activity that are inaccessible to self-employed citizens. Namely:

- sale of real estate and transport;

- sale of excisable goods;

- rental of non-residential premises;

- extraction of mineral resources and their subsequent sale;

- resale of finished goods;

- acceptance of payment for goods, the destination of which is a third party.

Important! Lawyers, notaries and appraisers cannot operate as self-employed.

Self-employment with the prospect of running your own business

With a full-fledged business, a citizen carries out a type of activity that allows him to receive passive income and shift some of the worries to employees. If a self-employed person wants to achieve financial independence in the future, then it is necessary to invest in areas that are easy to expand and are not related to talent. These areas are:

- Agriculture and crop production. With this option, a person sells the product directly to the buyer or supplies it in bulk to the store. Huge profits will come from selling arugula, ginger, champignons, and indoor plants for bouquets.

- Mini food production. The idea involves making sausages, sauces, stews and selling them to friends and neighbors.

- Trade on the Internet. This is a promising area. It’s better to start with the organizer of joint purchases, ending with the director of your own store.

- Domestic services. The most profitable activities will be services, the implementation of which requires the use of expensive equipment. These can be construction types, sanitation.

How to get a patent

Can a self-employed person rent or rent out premises?

To legalize their activities and obtain self-employed status, a citizen should contact the tax authority to obtain a patent. It is advisable to do this 10 days before the start of commercial activities.

Patent

The list of required documents is small:

- passport of a citizen of the Russian Federation;

- a document confirming that the citizen is not an individual entrepreneur;

- application for a patent (it is written directly at the tax office);

- receipt of payment of state duty.

After receiving a patent, a citizen can provide services and sell goods of his own production quite legally.

Important! Carrying out activities that generate even a small income without a patent is a violation of the law. For such actions, not only fines can be applied, but also criminal prosecution. The population of the country is obliged to conduct business legally.

Self-employed

Its status is determined by Federal Law No. 422 of November 27, 2018. From January 1, 2020, self-employment can be registered only in 23 regions of Russia: in Moscow, St. Petersburg, Tatarstan, Bashkortostan, Krasnoyarsk and Perm territories, Nenets, Yamalo-Nenets and Khanty-Mansi Autonomous Okrugs (Yugra), in the regions - Moscow, Kaluga, Voronezh, Volgograd, Leningrad, Nizhny Novgorod, Novosibirsk, Omsk, Rostov, Samara, Sakhalin, Sverdlovsk, Tyumen, Chelyabinsk.

To obtain status, you must contact the tax service (clause 7.3 of article 83 of the Tax Code (TC) of the Russian Federation). You need to have with you:

- Passport of a citizen of the Russian Federation.

- Taxpayer Identification Number (TIN).

- An extract from Rosreestr confirming the absence of individual entrepreneur status.

- Statement of the established form.

Next, you wait for the notification about registration, open a bank card to receive payment for the services you provide, and start working.

What is included in the concept of IP

An individual entrepreneur (hereinafter referred to as IP) is a citizen who independently conducts and manages commercial activities.

STS or UTII - which is more profitable for individual entrepreneurs, is it possible to switch to another regime

Almost every citizen of Russia, as well as foreigners living on its territory under temporary registration, can obtain the status of an individual entrepreneur. Citizens who have reached the age of majority can conduct business activities. You can register as an individual entrepreneur after reaching 16 years of age, but only with the written permission of your parents.

To open an individual entrepreneur, you do not need to create a charter and authorized capital. The registration procedure is quite simple. To apply to the tax service for registration, a future entrepreneur should prepare the following documents:

- copy of the passport;

- completed application (form P21001);

- receipt of payment of state duty.

For your information! To register, you should contact the tax office at your place of residence. You can submit documents in person, online or by mail.

Conducting commercial activities as an individual entrepreneur has its own nuances.

- An entrepreneur can only manage the business personally; it is prohibited to attract a third party to the position of director;

- individual entrepreneurship cannot be sold or transferred to another person;

- An entrepreneur is required to make insurance and tax contributions regardless of whether the activity generates income or not.

An entrepreneur can dispose of profits independently, without reporting to the tax service. At the same time, he is exempt from maintaining accounting records, but is required to pay taxes and fees.

After registering as an entrepreneur, a citizen is required to register with the Pension Fund and the Social Insurance Fund. In addition to the fact that from the moment of registration until the closure of an individual entrepreneur, the citizen’s length of service is counted, he can also count on a future pension.

The conduct of commercial activities for individual entrepreneurs is not limited geographically, nor is the number of business points. But he is obliged to pay taxes and fees only at the place of registration indicated in the passport. That is, in the same tax office where you registered as an individual entrepreneur.

An individual entrepreneur can engage in activities in almost all areas of business, but there are some restrictions. The following types of activities are not available for individual entrepreneurs:

- security;

- insurance;

- implying the production and sale of alcoholic products;

- financial (banking services, pawnshops, investments);

- related to the production, repair and sale of weapons and special equipment for the Russian Armed Forces.

Note! The opportunities for doing business as an individual entrepreneur are quite wide, but the responsibility to the state is also serious. Penalties are provided for violators.

What you need to know about individual entrepreneurship (IP)

An individual entrepreneur is an individual engaged in entrepreneurial activities without forming a legal entity.

Register as an individual entrepreneur according to the law of the Code of Administrative Offenses of the Russian Federation, Article 14.1. Any person who conducts regular activities aimed at making a profit must carry out business activities without state registration or without a special permit (license). There is a narrow list of persons who cannot engage in entrepreneurship in Russia:

- state and municipal employees;

- military personnel;

- persons with limited legal capacity (also those who are registered at a drug treatment clinic);

- foreigners and stateless people (stateless people), if they do not have registration in Russia.

In addition to taxes, which depend on the form of taxation chosen, individual entrepreneurs must pay insurance premiums for themselves and their employees.

Unlike legal entities, you can dispose of profits at your own discretion and withdraw as many funds from your accounts as necessary and at any time.

An individual entrepreneur can hire employees and thus scale the business, while he becomes a full-fledged employer and bears the same responsibility of the Labor Code of the Russian Federation, Chapter 48. Peculiarities of regulating the labor of employees working for employers - individuals, as well as legal entities.

Advantages of individual entrepreneurship

- Simplified registration system: you can register yourself, and this will require a small package of documents Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6 / [email protected] (as amended on May 25, 2016) “On approval of forms and requirements for document preparation submitted to the registration authority during state registration of legal entities, individual entrepreneurs and peasant (farm) households" (Registered with the Ministry of Justice of Russia on May 14, 2012 No. 24139). And from 2020, when registering an individual entrepreneur in electronic form, you do not need to pay a state fee. However, to draw up electronic documents you will need an electronic signature.

- An individual entrepreneur has no obligation to keep accounting records.

- Can be used anywhere in Russia.

Disadvantages of individual entrepreneurship

- In addition to taxes, all individual entrepreneurs are required by the Federal Law “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation” dated November 27, 2017 No. 335-FZ (latest edition) to pay insurance premiums for two types of insurance: pension and medical. Regardless of incoming income.

- Reporting must be kept at the place of residence of the person, that is, at the registration address of the individual entrepreneur. Accordingly, if you are registered in Izhevsk, but conduct business in Kazan, then you will need to register as an individual entrepreneur and submit all reports at the place of registration in Izhevsk.

- For non-payment of taxes, violations of activity, debts to employees, each entrepreneur is liable with his own property.

Main differences and similarities

Self-employed citizens and individual entrepreneurs are very similar in some respects, but there are also fundamental differences.

Differences and similarities

Self-employed and individual entrepreneur - what is the difference? It is more convenient to present this kind of information in the form of a table.

| IP | Self-employed | |

| Scope of activity (territorial restrictions) | Conducting commercial activities is possible throughout Russia. | Activities are limited to a few areas. |

| Income | The amount of annual income is unlimited under the general taxation system¹. | The income limit is 2.4 million rubles*. in year. |

| Wage-earners | Can use hired labor. | Cannot attract employees. |

| Employment | There is an opportunity to work for hire and at the same time be an individual entrepreneur. | Can work, but not with a former employer (only after 2 years). |

| Reporting | Individual entrepreneurs are required to submit tax returns (with the exception of individual entrepreneurs on PSN). If there are employees, they maintain personnel records. Sometimes you also need to take a statistical test. | They don't keep reports. |

| Income accounting | All individual entrepreneurs are required to maintain tax records, and it is also recommended to maintain accounting records. | Accounting consists of recording income in the “My Tax” program. |

| Insurance premiums and length of service | Experience is accrued for the entire existence of the individual entrepreneur. Fixed contributions to the Pension Fund are mandatory. | Contributions to the Pension Fund are made voluntarily. If contributions are ignored, no experience will be accrued. |

| Availability of a cash register | Required to use cash register equipment. | It is only mandatory to issue checks to clients through the “My Tax” program. |

| Activities | There is an opportunity to conduct commercial activities in various fields. | Activities are limited to only one selected area of activity. |

| Fines | The Federal Tax Service provides for fines for non-payment of taxes, concealment of income and failure to submit reports. It is also possible to apply penalties from other regulatory authorities. | Fines are provided for providing false information about income and for refusing to issue a check to a client. |

| Taxes | The tax amount depends on the chosen tax regime and region. Tax contributions are paid regardless of whether there is a profit from the activity at the moment. | The tax rate is fixed: 4% on income from work with individuals, 6% on income from legal entities. |

¹ Except:

- STS (simplified taxation system) - limit 150 million rubles. in year;

- PSN (patent taxation system) - limit 60 million rubles. in year.

We can conclude that there are more differences between individual entrepreneurs and the self-employed, but there are also common features:

- citizens arriving in these statuses manage commercial activities independently;

- business is conducted legally in accordance with the law;

- payments are made to the budget from the income received.

Note! Each future businessman decides for himself what status to receive. But, before making a choice, you should carefully understand all the nuances and also think about the prospects for developing your business.

How to move from self-employment to business

One of the main criteria for establishing a professional tax is an annual income of 2.4 million rubles. It doesn’t matter what a freelancer does, his profit should not exceed this level.

The main essence of business is earning money and increasing income. A self-employed person, having started his activity as a hobby, can grow and become an individual entrepreneur or legal entity. To do this, he needs to contact the Federal Tax Service and switch to a different taxation regime.

Individual entrepreneurs and other legal entities have their pros and cons. The main advantage is the possibility of making a profit in excess of 2.4 million rubles per year and hiring employees.

The main disadvantage is the increase in the tax base and liability for non-payment of taxes. Also, in addition to taxes, it will be necessary to obtain various permits from regulatory authorities.

Example. Vasily works as a self-employed pastry chef. The maximum tax is 6% on transactions with legal entities. His annual income was 900 thousand rubles. Relatives began to help Vasily. After some time, he decides to open his own studio, where people could buy sweets not only through the website. He also needs to hire employees for his studio: a cashier, a pastry chef, and a courier. Vasily decides to become an individual entrepreneur.

Costs when Vasily switches to individual entrepreneur:

- 13% income tax + registration of cash registers;

- 13% of employee salaries + insurance payments to the Pension Fund and Social Insurance Fund;

- permits from Rospotrebnadzor and medical records;

- employee salaries;

- rental of premises;

- purchase of commercial equipment and special equipment;

- accountant services;

- advertising and promotion.

With proper management, Vasily’s income will increase several times, but his responsibility, including tax, will also increase. By attracting additional confectioners, production will increase, which in turn will increase cake sales and profits.

Also, opening a studio in a densely populated area will provoke spontaneous sales from clients living nearby, which will also become additional profit. An additional service for the delivery of confectionery products by courier will also increase sales and revenue. With self-employment, such powerful development is impossible.

Advice for future entrepreneurs

Before opening your own business, you need to calculate whether the activity makes sense and whether the costs are justified. With spontaneous development, you can quickly warm up and lose all the money invested.

Important: you don’t need to invest all your money, quit your job and take risks by taking out loans. There should always be funds for a rainy day.

The country's leading economists advise that the most important thing in business is to be able to calculate income and expenses.

A self-employed person needs to constantly improve his skills, which will help him be a sought-after specialist. At the same time, it is necessary to build a promotion strategy and not be afraid to delegate responsibility to other qualified employees who will be able to perform the entire range of organizational work.

How to promote your business

The most important thing is advertising and finding clients. You need to draw up a clear concept for running an advertising campaign. Starting from posts and photos on social networks, ending with videos and participation in global forums and specialized platforms.

Example. Vasily the pastry chef can exhibit his work on social networks, then send his sweets to bloggers, stars and culinary critics for testing, and also participate in non-professional confectionery competitions. Post all this on your channel or website. Vasily can also order contextual advertising to promote his website.

Business for the self-employed is not only a part-time job, but also an opportunity to realize their abilities, where from a simple hobby you can grow to the scale of a small or medium-sized business. With the right strategy, a self-employed person can evolve and become an individual entrepreneur or a legal entity.

Pros and cons of self-employment and individual entrepreneur

Depending on what kind of business the decision was made to engage in, the status of a citizen is chosen. Both self-employment and individual entrepreneurs have their pros and cons.

Self-employment

Before becoming self-employed, a citizen should weigh the pros and cons. The advantages include:

- simple registration;

- no need for a cash register;

- no need to register with the Pension Fund and Social Insurance Fund;

- there are no mandatory contributions if there is no profit;

- There is no need to submit reports to the Federal Tax Service; it is enough to record income in the “My Tax” program.

Disadvantages of self-employment:

- territorial limitations of doing business;

- inability to hire assistants;

- inability to engage in activities simultaneously in different areas of business;

- limited annual income;

- limited choice of business partners.

Individual entrepreneurship

Just like self-employment, individual entrepreneurs have their strengths and weaknesses. The positive points include the following:

- the opportunity to engage in commercial activities throughout Russia;

- no limit on annual income (if there is one, its size is significantly higher than for the self-employed);

- unlimited choice of activities;

- accrual of length of service and formation of pension;

- the ability to use hired workers.

There are more opportunities for doing business as an entrepreneur, but there are also disadvantages:

- obligation to pay taxes and insurance premiums;

- inability to sell or transfer the IP to a third party;

- the need to submit tax reports, in some cases also personnel and accounting reports;

- the need to use cash register equipment;

- inability to hire a third party for the position of director of an individual entrepreneur;

- the likelihood of falling under penalties from the Federal Tax Service and other authorities.

Note! Obtaining both statuses has both advantages and disadvantages. Individual entrepreneurs or self-employed people, the pros and cons of which are given above, should carefully weigh them before registering with the Federal Tax Service.

Earning money from sewing

Sewing at home in your free time brings good income. It is not necessary to make clothes - the following are also popular:

- bed dress;

- curtains;

- table textiles;

- covers for upholstered furniture.

Which of these options is right for you - decide for yourself.

Sewing pillowcases and duvet covers is something women on maternity leave can easily do. Sell ready-made items online.

Growing greens at home is a promising way to earn money without large investments

Many women who are thinking about making money start growing greens. No special experience is required, and additional vitamins are especially in demand in winter.

The following types of greens are popular:

- parsley;

- dill;

- cilantro;

- thyme;

- oregano;

- celery.

Start earning money using a home garden, planted on a windowsill, in a spare room, or a summer cottage. The earnings will be small, but you will get good experience. This method is also available to children.

What is better to choose and in what cases

It is better to opt for self-employment if:

- there is no permanent income or the nature of the work is seasonal;

- no need for employees;

- annual income does not exceed 2.4 million rubles. in year;

- it is planned to engage in only one type of activity;

- The place of registration falls under a limited list of areas.

Registration of an individual entrepreneur will be advisable in the case when:

- commercial activities are carried out throughout Russia;

- annual income is higher than 2.4 million rubles. per year and its increase is planned;

- activities are carried out in several areas of business;

- there is a need to use hired labor;

- cooperation with large enterprises is planned;

- The profit margin allows you to regularly pay taxes and insurance premiums.

Activities

An individual entrepreneur can engage in any business not prohibited by the state (OKVED classifier), except for the production of alcohol, weapons, medicines, etc. Some types are subject to licensing, in accordance with Federal Law No. 99 of 05/04/2011.

A self-employed person must provide services personally and sell only self-produced goods.

Income

Individual entrepreneurs on OSNO have no income restrictions (Article 346.13, paragraph 4, paragraph 1 of the Tax Code of the Russian Federation). On the simplified tax system, the maximum income is 150 million rubles/year (Article 346.13, clause 4.1 of the Tax Code of the Russian Federation). For PSN – up to 15.92 million rubles/year, taking into account the deflator coefficient of 1.592 for 2020 (Article 346.43, clause 7, clause 8.2,4 of the Tax Code of the Russian Federation).

For a self-employed person, the ceiling is 200,000 rubles. /month or 2.4 million rubles/year (Article 4, Part 2, Clause 8 of Federal Law No. 422).

Wage labor

can hire employees. Their number depends on the taxation system:

- OSNO – no restrictions;

- simplified tax system – no more than 100;

- UNDV – no more than 100;

- patent – no more than 15.

A self-employed person cannot have employees (Article 2, Clause 7, Federal Law No. 422 of November 27, 2018).

Pension

Individual entrepreneurs transfer insurance premiums (Chapter 34 of the Tax Code of the Russian Federation, Articles 419 - 432) for themselves and their employees and have the right to an insurance pension.

A self-employed person is exempt from paying insurance premiums (Article 15, paragraph 1, paragraph 2 of Federal Law No. 422 of November 27, 2018; Article 15, paragraph 2 of Federal Law No. 422 of November 27, 2018) and has no right to it.

Is it possible to switch from one system to another?

It is not always possible to predict how business will develop in the future. As time passes, it may be necessary to change the status. Is it possible to switch from one system to another? What is self-employment and do you need to open an individual entrepreneur for this? More on this later.

The transition from individual entrepreneur to self-employment is quite simple. To do this, it is enough to notify the tax authority in writing that the entrepreneur has decided to abandon the previous taxation system and wants to become a payer of professional income tax. At the same time, it is not necessary to close an individual entrepreneur; you can be an entrepreneur and self-employed at the same time.

Note! If business development requires returning to individual entrepreneurs, there will be no difficulties either. After notifying the tax service of the transition to another taxation regime and registration, the citizen’s activity as an individual entrepreneur will be resumed.

Idea No. 4: Home craftsman

An ideal option for self-employment for men is being a home handyman. What does this include? Any work that requires male help at home: fixing plumbing and electrical equipment, help in nailing a shelf, changing door locks, and a simple solution - hammering a nail - and not everyone can do it.

Calling such masters, who are sometimes called “husbands for an hour,” is a fairly common occurrence. The main target audience is the fair sex who live without a strong male shoulder, as well as intact families or retirees who do not have the skills to carry out repair work or the free time to complete them.

What is needed to open a business: purchase of necessary tools and equipment for various types of work, it is desirable to have a car for movement from one customer to another and ease of transportation of equipment.

Who is it suitable for: running a business is suitable for hardworking men who can do many types of work at home and consider themselves a “jack of all trades.”

How can an individual entrepreneur switch to self-employment?

An individual entrepreneur can become self-employed in the same way as an individual. Step-by-step instructions for the process are provided here. Let us briefly recall the main points:

- A notification is submitted to the tax service for registration as a tax payer. This can be done on paper or in electronic form (the form was approved by the Federal Tax Service of the Russian Federation by order dated March 31, 2017 No. ММВ-7-14/ [email protected] );

- You can submit a paper copy directly to the tax and duties inspectorate, send it by registered mail, or use the services of the MFC;

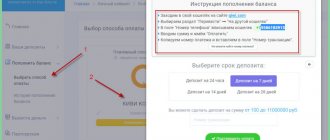

- You can fill out an electronic application on the State Services portal, in the Personal Account of the Federal Tax Service, in Sberbank and through a smartphone by installing the “My Tax” application;

- within 30 days, close the tax regime as an individual entrepreneur. This can be done directly at the tax office or through your Personal Account on the Federal Tax Service website (an electronic signature is required).