In this lesson you will learn what financial literacy is and why it is needed. The article will not contain a boring list of basics. This material contains only the most necessary extracts from various books. Therefore, it will save you a lot of time on studying.

They may not tell you about this at school. There are recommendations here that will help you get rid of debt quickly. They will also help to form good capital in a short time.

Therefore, this material is recommended for both children and adults who want to become financially independent and fulfill their dreams.

What is financial literacy and why is it needed?

Financial literacy

- these are skills in managing income and expenses, as well as competent distribution of financial capital.

The main goal is to ensure that your income exceeds your expenses.

Why is financial literacy necessary for the population? After all, people somehow live just fine without it.

Money

is a constant and integral part of our lives. Our world and life are material. That's why money always accompanies us.

Unfortunately, most citizens simply do not have enough money. They have a lot of debt.

2/3 according to VTsIOM data ( All-Russian Center for the Study of Public Opinion

) in general, there are no savings. More than half live on credit. But even those who have learned to save often lose money.

Reasons for financial loss:

- People think that income levels will rise steadily

- They put all their money in one bank/company, whose license could be revoked tomorrow

- They believe that “dating” will help in bankruptcy

- Trust funds to scammers and pyramids

- They hope for incomprehensible recommendations and maybe Russian

- Funds are not divided into parts and everything is stored in one currency

- Keep money at home or in safe deposit boxes

- They believe that everything should be in business. However, business is also a risk.

- They think they will be forever young and healthy and so on.

Why is this happening? Because people do not have basic knowledge about money.

We were taught many things at school, but not how to become happy, beautiful and rich. We were given almost no useful practical knowledge for adult life.

But you want stability, a better standard of living and passive income.

Everyone dreams of something different. For example, quit your job, travel the world and build a house. Or buy an apartment in the center, live in Bali, and so on.

This is exactly why you need to study financial literacy from scratch. Start leveling up today and tomorrow you can make your dream come true!

Having basic basic knowledge in this area, you can save and increase your money.

Even with a small income, you can create capital, passive income and fulfill all your dreams.

You don't even have to work hard for this. Below, we will tell you how to achieve all this.

Resources to Improve Your Financial Education

There is a lot of information on the Internet and in print publications on filling gaps in matters of handling money. There are thematic websites, blogs, YouTube channels, online courses and entire schools.

It’s easy for those starting to learn the basics of finance on their own to get confused. Let's look first at proven sources of information, which were created either with the support of government agencies or well-deserved financial institutions. organizations:

- Fingramota.org

An educational website created with the support of the expert group on financial education under the Federal Service for Financial Markets of the Central Bank of the Russian Federation. It publishes a lot of useful material on finance. There are articles, videos and presentations.

- Banki.ru

The information portal publishes news, ratings of banks and banking products. You can select debit or credit cards based on your options. There are convenient calculators for calculating interest on deposits and loan payments.

- Fgramota.org

Finnish educational portal literacy with the support of the Russian Economic School and the Citi Foundation. Knowledge of financial management is presented in a fun way in the form of a game, an online book, and tests.

- ABC of finance

The name itself contains the basic principle of the portal - studying the topic of finance from the very beginning. There are examples of drawing up personal financial plans for families with different income levels. The valuable advice that experts give can be applied to creating your own plan.

- School of primary financial education FinStart

The school was created by Andrey Paranich, a member of the expert council on financial literacy and protection of the rights of consumers of financial services of the Bank of Russia. On the website you can access the FinStart Distance Learning Program for free.

It is designed for 2 months of daily classes at a time convenient for the student. The topics are quite interesting. For example, “Personal finance planning”, “Loans”, “Investments. The beginning of the journey”, etc.

Don't forget about the official sites:

- Bank of Russia,

- Ministry of Finance of the Russian Federation,

- Federal Tax Service, etc.

More details about online education are discussed in the article about financial literacy courses.

Basics of financial literacy for dummies and schoolchildren

Now I will list the basic rules of financial literacy that everyone should know about. This is especially true for beginners, parents and schoolchildren. Because in schools and in some books this may not be taught.

This is a simple step-by-step instruction on the path to guaranteed creation of your capital and passive income.

Personal financial plan:

- Record the current situation

- Write financial goals (this is what you dream about)

- Take control of your expenses starting today

- Plan your budget

- We increase income

- Form an airbag

- Financially protect yourself and your loved ones in case of unforeseen circumstances

- Pay off debts

- Regularly invest at least 10% of your income

- Reinvest interest

Only after this will you definitely come to creating the capital of your dreams. Now let's look at all this in detail below.

Ways to eliminate financial illiteracy

Where to start improving your education level in finance? There are several methods, choose the one that seems optimal to you:

- Reading specialized literature. For example, I made a good selection of books on financial literacy.

When I was preparing material from books, I had to read them all. I don't regret the time spent at all. Today, my husband and I have already developed a family strategy for saving money for short-term and long-term goals. We opened a deposit, invested some of the funds in a mutual fund, and some in an individual investment account. We will replenish deposits every month.

- View online lessons, paid and free.

By the nature of my activity, I rotate among information businessmen who organize similar courses. When choosing free classes, you must clearly understand that the main goal of any trainer is not to enrich you with their knowledge and experience, but to attract you to paid training. I'll be glad if I'm wrong.

- Personal consultation.

The consultant will develop for you a personal financial plan, savings and savings strategy, and much more. The services are not cheap. I looked at the price list on Vladimir Savenok’s website. He is the first independent financial consultant in Russia, who has written many books on this topic. I would be happy to schedule a consultation with him.

- Independent study of available materials on websites and blogs.

I’ll tell you more about trustworthy web resources in the next paragraph.

- Personal experience.

Not the best way, but probably the most effective. This is the way to analyze your own mistakes. Personal experience is priceless, but is there time to get it?

Where does financial literacy begin?

Financial literacy first of all begins with fixing the current situation. And also from motivating yourself for further actions.

Take a pen and notebook. Now write down ( write down

) the situation you are in now.

You may be in debt or broke. You can have a good income with a lot of expenses down to zero. Or you simply have money in deposits, and you are afraid to move anywhere.

In general, whatever the situation, you need to understand what is happening. This is where you need to start.

Record all your assets!

This could be a business or real estate that generates income. This may also include free money and securities.

Write down your obligations next to it. Many people probably have a mortgage. This also includes loans, credit cards and any debts.

And then you need to see what your capital is.

“Assets” - “liabilities” = “capital”

Capital will be the starting fixing point in the current situation.

Motivation

Now let's talk about motivation. This is also a very important point. Because some people, no matter what, don’t start doing anything.

For some, the discomfort zone has already equated somewhere to the comfort zone. That is, they are simply accustomed to this situation.

And not many people dare to tell themselves the basic truth. Take a look and fix the very starting point that was mentioned above.

There are different types of motivation.

Motivation from...

Now I will create an uncomfortable situation. I'll give you a magic kickoff that will make you start moving. Namely, gain knowledge, take the first steps towards financial literacy, pay off debts and form capital.

Below I will ask you simple but very important questions:

- Do you understand where the money goes?

- How do you keep track of expenses and income?

- What % and what do you spend on? For example, for clothes or food.

- Do you have a family, children? These are those who depend on you financially.

- Who is the breadwinner in the family? What is the income ratio?

- Are you a businessman or an employee?

- Do you have any financial goals? For example, a house or a car. If so, which ones? What is the timeframe for implementation and cost of the goal? They need to be formed so that the dream becomes a goal.

- Are your goals realistic with your current income?

- Do your financial goals include educating your children?

- Are there any debts? Mortgage, loans or credit cards.

- Do you feel like a squirrel in a wheel, always running after money and dependent on work?

- Do you have real estate?

- What is your current income level?

- How much free money do you have now? In what currency?

- Is there money for emergencies? For example, for sick leave or car repairs.

- Do you have money to survive at least 6 months if you lose your job?

- Does income stability always depend on your competence? Or can you lose your income and job for completely different reasons? What are the risks of loss of income in your situation?

- If your parents get sick, will you pay for treatment?

- Do you have money to live on if the family loses the income of the main breadwinner?

- Do you want to achieve financial freedom?

- Do you want to live on passive income?

- Do you want to no longer be afraid of lack of money, work interruptions and other financial problems?

- Do you understand that for this you need to improve your financial literacy?

Now let's imagine that 5 years have passed and you have arrived at a certain point. You forgot about these step-by-step steps and think you don't need these questions.

What happens if nothing changes and you forget about financial literacy in 5 years? And in 10 years?

Think about what your life will be like. Where and on what do you live? For what money? Where do you work and how do you relax?

In general, try to imagine all this in detail.

Pension

According to Rosstat, the statistics are quite sad. The average pension in Russia is about 14,000 rubles

per month. And this takes into account the “rich” regions. As a rule, these are Moscow and St. Petersburg.

And now we can only guess how sad the situation in the regions is. I don't think any of us want to count on that kind of pension.

Now think about the following. If nothing changes, then how and on what will you live in retirement age.

Motivation for...

Now let's move on to some nice motivation. That is, after discussing inconvenient, painfully simple questions. But no one asks themselves these questions every day.

Sometimes in this turmoil and rat race we feel comfortable hiding from such inconvenient questions. Because there is much greater discomfort in answering them and starting to do something.

So, the good news is that it is not difficult to change your life. This can be done even in small steps. And if you do this, you will finally get rid of debt.

Who's in debt now?

Think about the fact that you are now debt-free. Imagine a situation where you have removed this burden from your soul.

How are you feeling:

- You clearly understand how much and where your money goes and know how to manage your expenses.

- Do you have money for all unexpected expenses?

- Your loved ones and you live in peace and confidence in the future

- You live in the dream apartment that was a financial goal 3 years ago

- Do you have a country house, a comfortable car?

- You have passive income. You can afford not to work or do what you love

The Downside of Finance

Before you begin your journey into the world of finance, decide what money means to you. According to their attitude towards money, people are divided into two camps. Some consider them evil, that is, they have a predominant negative attitude. After all, money causes envy, permissiveness, and greed. They are constantly lacking and, in general, they corrupt.

Others believe that money brings goodness, that is, a positive attitude. After all, they allow you to help others, travel, do what you love, and so on. What is your attitude towards money? What do you associate them with?

Money itself is neutral and only our attitude towards it gives money power.

If you have negative associations towards money, then they need to be changed to positive ones. After all, if we are afraid of “losing money” (negative association), for example, then all our actions, on a subconscious level, will obey this association. We will spend a long time thinking and doubting an investment opportunity that has arisen, instead of making the necessary calculations and making a reasoned decision.

positive

Money influences all areas of our lives. A financially literate person knows that by paying more attention to finances, he changes his life for the better. The main thing is not to go to extremes.

Money cannot solve all our problems, but its presence provides additional opportunities to solve problems.

What else distinguishes a financially literate person from others?

First is what it does and how it does it. This includes the following:

- — maintaining a personal or family budget on a regular basis;

- — planning your expenses, even unforeseen and spontaneous ones;

- - allocating a certain percentage of all your income to a protective fund;

- — having a strategy for securing your pension;

- — long-term investment;

- — constant learning new knowledge and reading specialized literature;

- — personal self-development and increased self-control;

Secondly, a financially literate person does not work for a salary, although he can go to work. He creates multiple sources of passive or residual income to ensure his current and future life.

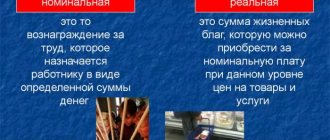

The term salary comes from combining two words: wages. That is, a person sells his time and knowledge to other people in exchange for money or salary. He must spend N hours at work for 5, or even 6, days a week, throughout the year, with the exception of vacations and weekends. This is the least productive type of activity when translated into the language of money (payment per hour of our time).

Passive income allows you to earn income with a minimum of effort. Sources of passive income can be your apartment, which you rent out, or a garage, and so on.

Thirdly, a financially literate person understands loans. He knows how to use them correctly and certainly applies this knowledge in practice.

Many articles about financial culture and literacy say that you need to give up loans. But this is only partly correct advice!

A financially literate person uses other people's money rationally, be it bank loans or credit cards. He knows exactly what and how much loan funds he will spend on, and moreover, he will still earn money from it.

Last but not least, he uses specialized vocabulary or financial language in his daily communication.

Forming financial goals

Next, you need to write down the financial goals we are talking about. For example, the same house or car.

And for dreams to become goals, they need to be digitized:

- Write down the cost of the goal

- Set due date

- Assess the feasibility of execution based on current income

Goals may be different. For example, 20 million towards pension. Or 30,000 rubles of passive income after a certain period.

However, in addition to these global goals, we will also need some nice goodies before the main task is accomplished. These are already more achievable goals.

For example, we want a new smartphone or something else. Therefore, write not only for the horizon of 10 - 30 years, but also for the next month or week.

And check the boxes when such goals are achieved.

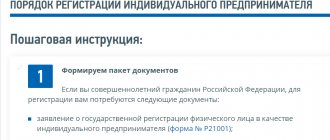

What is being done in Russia to improve the financial literacy of the population

The Central Bank, the Ministry of Finance and the Ministry of Education are involved in the formation of financial literacy. In 2020, an agreement was concluded to introduce the principles of financial literacy into educational standards.

The State Duma has been discussing the inclusion of the subject “Fundamentals of Business” in the school curriculum for several years. Since 2020, lessons of this profile are held from 5th to 9th grade. They have been added to the Social Studies course.

For the education of the youngest, there is a section on the Central Bank website - Children about money. Here the basics are taught through fairy tales, puzzles, and games.

We control the expenditure of the financial budget - ways

In general, the very essence and purpose of financial literacy is very simple. The idea is to ensure that your expenses are much less than your income.

For those people who live in minus or zero, this does not happen.

There is also a separate subcategory of people who can save. However, something went wrong and the person is again at zero.

Therefore, capital can only be formed by those who have constantly provided themselves with savings from some part of their income.

In order for expenses to be less than income, they must be controlled.

It is cost control

will help you get there. And this is regardless of how much you earn today. Even if you earn 1 million, you can also be in debt or broke.

Thus, you will not be able to generate capital. And especially considering that there is always a risk of loss of income.

How should you control costs?

Applications and notes for recording expenses

There are a variety of expense control apps for this purpose. You can install them right now on your computer or smartphone. For example, CoinKeeper, Zen Money or Money Lover. Choose the one that will be comfortable for you.

Recording expenses on your smartphone

But you can also use the old method. This is a piece of paper or notebook. Some will be comfortable with Excel or regular notes.

Choose what is convenient. And for those who find it difficult to control expenses, it is advisable to use either applications or notes.

Because those who record are probably already doing it now. And for those who have not done this yet, it will be difficult. Therefore, for such people this process should be as simple as possible.

And it is advisable to record everything at the time of purchase. Because then you might forget or get tired.

And fixing it exactly at the moment of making a purchase will make your transaction conscious.

Before purchasing, you will constantly think about whether I really need this or whether I will endure it. What is more valuable on the scale - my home, my financial goal, or these clothes?

Who controls you now?

Talented marketers who have packaged their product or your future well. That is, the passive income on which you will live.

What kind of shopping experience do you want? Become an investor and buy securities or have 100,500 shoes in your closet?

Think carefully about this!

In general, such a fixation at the time of purchase will help you spend money consciously. After all, any fixation of the result automatically improves it.

This even works with weight loss!

So start weighing yourself on a scale every day. Even in the absence of any restrictions or diets, you will begin to eat consciously. As a result, your weight will improve if you are not happy with it today.

Smart spending of money

There are other useful tips on this matter. Helps someone make purchases with cash

. Because mythical expenses appear on the map. Therefore, such purchases are not very noticeable.

Don't spend it in the first days

your salary. You don't want it to turn out that you've been kicking around for a few days. Therefore, in the first days, pay only the most necessary payments. And then, with a cool head, spend your income wisely.

Also buy more affordable analogues

. Typically, many people buy the same product. For example, washing powder, tea, clothes or coffee.

However, there are analogs that are quite good in quality. For example, the same tea from another company may be cheaper. But at the same time it will not be worse in quality.

Thanks to such analogues, you can save a decent amount of money. If you record all this and calculate it, the results may shock you.

It’s not for nothing that there is such a phrase: “ If you save, you earn!”

»

Therefore, buy analogues whenever possible. But again, you need to think about it and set yourself a goal to control expenses.

Don't be fooled by red price tags and discounts

!

It often happens that you went for some bread and brought home ten bags. Who knows this situation?

We saw the red price tag and bought ten yoghurts. Then 5 of them were thrown out. Do you think this is a good saving?

I also recommend collecting bonuses

and points when paying for goods and services. However, it must be truly necessary for you. If you don’t need the product, then it’s better not to buy it for the sake of bonuses.

How countries are fighting financial illiteracy

Governments around the world are taking part in eliminating financial illiteracy among the population. In 2020, 55% of American youth had investment accounts. But at the same time, a certain part of the middle-aged US population had accumulated no more than a couple of hundred dollars.

In New Zealand and Australia, financial literacy is a compulsory subject in the school curriculum. Brazilian schools also involve parents in teaching finance. They insist that discussing family budgets further enhances financial planning skills.

The Russian Central Bank, together with the Ministry of Finance, has developed a program to eliminate financial illiteracy of the population and is systematically implementing it. We started with schoolchildren, as well as college and university students. In 2020, the Ministry of Finance of the Russian Federation was awarded an international prize for improving financial literacy among young people. 15-year-old schoolchildren rose from 10th to 4th place. Adults, unfortunately, will have to figure this out for themselves. Mastering the basics is quite easy. But learning to invest will require more effort.

In most countries, the main emphasis in eliminating financial illiteracy is on:

- rural residents;

- migrants;

- women;

- old people.

At the same time, in the Russian Federation women showed a higher level of financial literacy. Moreover, at the age of over 40, women further increase the gap from men of the same age.

In addition to the categories listed above, the poorest segments of the population are most susceptible to debt overload and rash financial decisions. They are also much more likely to fall for the tricks of scammers and financial pyramids. But attracting this part of the population to training is the most difficult.

The process of planning a family budget - different methods

Of course, planning a budget will help you keep your feet on the ground. But to do this you need to understand what, where and how much you spend. You need to analyze your expenses. And also record income on an ongoing basis in a separate column.

Try doing this within a calendar month first. Record required expenses by category. The main things are food, taxes, medicine, travel and so on.

The rest will be good if at least 10%

you went into savings. If it is very difficult, then at least 1% followed by an increase.

And only after all this, we distribute the remaining part for various entertainments and amenities.

Budget income and expenditure table

| № | Income category | Sum |

| 1 | Salary | |

| 2 | Bonus | |

| 3 | Renting an apartment | |

| 4 | Deposits | |

| 5 | Securities |

| № | Expense category | Sum |

| 1 | Housing and communal services | |

| 2 | Products | |

| 3 | Eating out | |

| 4 | Cloth | |

| 5 | Cosmetics |

Don’t be afraid that you will be able to write and then something won’t come together. It’s better to let it be crooked and askew, but do it and then correct it in the process.

Method 50-20-30

There is also a good ready-made tool from the famous financier Alexa von Tobel:

- 50%

on what is really necessary (

food, transport, medicine, taxes, etc.

) - 20%

we spend on insurance in case of job loss, paying off debts or buying something expensive - 30%

we spend on our whims, purchase of pleasure, relaxation and entertainment

As a good and simple option, you can use this tool too.

Budget planning for the year

Of course, it will be great if you plan your budget for the year.

But if you don’t do this now, then it will be difficult to allocate the budget later. You can only roughly do this.

Therefore, I recommend starting to plan for at least a month. You may already know your upcoming major purchases for the year. Try to at least roughly plan and schedule them.

For example, you know for sure that by September 1 you will be preparing your child for school. You can also know when your vacation is. Therefore, here you can plan these expenses and roughly outline your budget for the year.

It is clear that it will also be adjusted in the process.

How to learn to save in a week

/freepik.com

Balancing debits and credits, drawing up a budget are not activities for the faint of heart, and in general, saving is a very boring process. But Lifehacker tried to add a little fun to it by packing the main principles of saving money into a short quest.

Challenge yourself and learn to save →

Good Ways to Increase Real Cash Income

Now we return again to the importance of the issue. The basis, foundation, or goal of financial literacy is to ensure that your income exceeds your expenses.

Each of you is now in his own activity. Some people in the civil service work as a freelancer. Some people have their own company. Someone is just thinking about what to do and so on.

So at this point in your life, what is the best way to increase that income?

Increase in salary at work

Maybe you are currently employed and have a part-time job somewhere. Do something to get your salary increased.

Maybe you have been afraid to do this for a long time. And today, having decided to take this step, you can ask for a promotion.

There are also things you can do to get the bonus. You can ask for a new position. And let this not happen now, but in a week or month.

Think and write what exactly you can do to increase your income.

Maybe it’s high time for someone to change jobs altogether. Think about where and how else you can earn extra money.

How to make money out of thin air - a secret life hack

An elementary and simple life hack on how to make money out of thin air.

For example, you are currently receiving some kind of salary. Let's say 100,000 rubles. You can get a credit card and savings account.

Having received your income, you can put it into a savings account with interest. And roll the credit card during the grace period. This is when the bank lends you money without interest.

And then, when the time comes to avoid paying interest, take this money from your savings account and pay off your credit card. And the bank paid you interest!

There are also credit cards with cashback. Here they will also pay a percentage for constantly using their card. There may also be some bonuses or miles.

In general, here you get money for nothing!

Just keep in mind that this method is only suitable for those who have good enough discipline

.

Or you need to set up some kind of auto payments

. This is so that you don’t get into trouble by not paying off your credit card on time.

This is an option. So think about what suits you best.

Selling extra items

Maybe someone has 5 pairs of new shoes. You haven’t worn them and perhaps you won’t wear them again. Therefore, go to avito or another portal and sell these things.

And with the money you receive, I recommend making your first investment. For example, buy some securities. Or you can quickly pay off your debts.

So clear out your balconies, garages, basements and sheds. There may be a lot of unnecessary things there that can be sold later.

Some people own a garage that sits like a dead weight. It is not rented out and it is not used.

This is bad!

Rent it out or just sell it. You will have extra money. This will help you resolve more important issues faster.

Adviсe

Let's move on to recommendations that help you master financial literacy:

- To analyze your budget, write down in advance the required expenses (rent, taxes, food, travel, utilities, electricity, internet, phone money), all available sources of income and approximate funds for savings and investments. Try not to deviate from your plan, do not go to the store without a list, and avoid spontaneous purchases.

- It is important to formulate clear financial goals with deadlines and tasks.

- Set priorities, don’t chase luxury items, buy only what you really need and will be useful.

- Don’t be afraid of credit cards and don’t constantly live in debt, rely on your own funds, not on others.

- Remember that investments require careful analysis; do not invest money thoughtlessly without studying the risks and estimated returns.

- Constantly develop and try to move to a new level of financial literacy.

Formation of an investment financial portfolio

To ensure that you achieve capital, passive income and the life of your dreams, you need to understand the following. All your money in a good way makes up a proper financial portfolio.

Components of a financial portfolio

Funds for current expenses come first. Next comes the defensive portion of the portfolio. Next, the most interesting part is financial instruments ( investments

). They will help you achieve your goals and generate passive income.

Well, then comes the high-yield and high-risk part of the portfolio. Here you can afford to take more risks and earn more.

This is a universal portfolio option.

If you are healthy and young, you can afford to take more risks. And if there is little left until retirement, then more reliable instruments in the portfolio will prevail. For example, deposits, bonds or savings accounts.

We increase funds for current expenses

The most important part of the financial portfolio is funds for current expenses. This includes:

- An airbag

is the money that will help you live peacefully for 6 months in case of loss of income. For example, sick leave, you have a seasonal business, work interruptions, and so on. - Irregular expenses

- vacations, weddings, renovations, and so on.

Where should I keep this kind of money?

Can be stored in deposits

, in bank deposits. This is when you bring money there and they pay you interest for it.

Or you can store it in savings accounts

. This is very similar to a deposit, but only here the interest can change. The advantage is that you can withdraw money at any time without losing interest.

But there is also a minus. The bank may revise these percentages at any time. He can change them both up and down.

Recently, the central bank has often reduced its key rate. The same one against which other commercial banks receive loans from the Central Bank.

Accordingly, in such a situation, rates on both loans and mortgages are reduced. This is good. But at the same time, profitability is decreasing.

You can also store funds in short and reliable bonds

. But I recommend doing this only to those people who well understand the principle of their operation.

If you are new to this, it is recommended to use banking instruments ( deposits and savings accounts

).

The protective part of the financial portfolio is life insurance

The protective part of the portfolio is risk or savings life insurance. Let's go back to the briefcase image.

If you currently have no savings or are in debt, then in unforeseen circumstances it will be much worse to go through.

Therefore, this portfolio tool will allow you to protect yourself financially in just such a case.

Let's say you have already created capital for yourself. For example, you have several million in deposits. But what happens in such a difficult situation?

Then a person has to dismantle all these tools in order to solve pressing problems. Instead of living on passive income from the accumulated money, these funds simply disappear.

Therefore, the protective part of the portfolio will allow you to financially protect yourself and your family in any situation.

Risk insurance

There are two options. This is risk and accumulative life insurance.

Risk insurance

- this is the same as a car helmet. Only the latter in this case is not for the car, but for you. That is, you bought an insurance policy. And if something happens, you will receive insurance protection.

Endowment insurance

Endowment life insurance

- this is when you enter into a contract for a long period (5 - 30 years) and make regular payments.

Here you choose the program that is right for you. Risk life insurance is suitable for those who have good discipline. These are those who have decided to take out insurance now.

Such people must constantly monitor their health in order to be insured. And your health will change every year. You will be subject to new insurance conditions.

Endowment insurance is suitable for those who want to create some capital while they have strong motivation and health. Such people want no one to take him away and sue him. So that there is definitely a certain amount.

This is especially suitable for those who are used to thinking in terms of debt and find it very difficult to save. In this case, endowment life insurance is well suited for such people.

Here insurance will be without losses. You do not lose your contribution amount, but simply save for the long term. For example, for 10 - 30 years. That is, as much as you planned for yourself.

In general, savings insurance is your savings and insurance without losses. It also provides financial protection for you and your loved ones.

You can also get 13% back of your previously paid personal income tax. This is the same as for treatment, real estate or training. Maybe someone recently returned a deduction for the institute.

Where can I apply?

This can be done with any insurance company you like and have reviewed their terms and conditions. Here are some options:

- PPF

- Allianz

- CivLife

- Metlife

- Sberbank

- Rosgosstrakh

- Renaissance and so on.

Carefully study the contract and insurance rules. Pay attention to the exclusions and insurance risks that you want to protect yourself and your family from.

Ways to quickly pay off debt

Of course, it is important to pay off your debts. What has already been discussed above will help you here. This is the principle of reasonable expenses, as well as increasing income.

You must begin to constantly record and control expenses. You also need to hold weekly family meetings and think about how you can increase your income.

With just this, you will definitely pay off your debts much faster.

Of course, there are a number of other steps you can take to help pay off your debts:

- Reissue a loan at a lower interest rate (refinancing)

- Combine small loans into one big one

- Pay more than the minimum payment

- Pay off small debts with high interest rates first. As a rule, these are credit cards and consumer loans, and then there are mortgages

Investment part of the financial portfolio

Next comes a very interesting preserved part of the portfolio. It will generate income for you. This is the part of the portfolio where you are not paying anyone interest or debt. On the contrary, they are paid to you.

In order to create it, you need to study financial investment instruments

. They can generate the same passive income for you.

What options might there be?

The simplest are deposits ( deposits

), as well as savings accounts. But there are much more profitable instruments that are also quite safe.

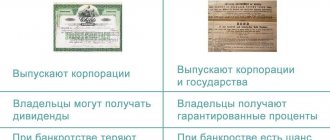

Bonds

You can invest in bonds and Eurobonds of reliable issuers. What it is?

Bonds

Someone invests money in Sberbank. This will be a deposit, a deposit and a retail instrument that is accessible and understandable to everyone.

So there you go! You can absolutely also lend money to Sberbank and receive interest for it. This will be an instrument called bonds.

A simple and understandable tool, only for slightly more advanced people. That is, for those who tried to figure it out. And also asked where you can get more interest and not lose it when selling bonds early.

Stock

You can easily become a shareholder of any large well-known company. For example, the same Sberbank. Or you can take aim at Samsung and Apple.

Promotion

It's easy and simple to do!

You need to open a brokerage account and buy shares. This is the securities market. It is safe if you understand the principles of operation of investment instruments.

They will generate passive income without your participation. For example, bonds every six months.

You can receive dividends from shares.

Shares are a tool that can allow you to earn much more than renting out an apartment.

It is better to divide the entire saved part of 70% of the portfolio into small parts in different currencies and instruments.

Real estate can be purchased both successfully and unsuccessfully. There are also a number of nuances, pros and cons when investing in real estate.

By the way, it is not necessary to physically invest in real estate and rent it out. This can be done using other tools. For example, mutual investment funds (UIF).

Of course, real estate has always been an interesting part of the portfolio. And psychologically it is very healthy and calm for any person to have it.

But from an investment point of view, this is not always a comfortable and attractive instrument. Therefore, I recommend that this be only some part of your portfolio.

Now let's get back to stocks.

You can earn much more from them than from renting out real estate. Don't forget to deduct all expenses. And then it may turn out that with the yield on rental housing you will not be able to overtake even deposits.

But of course, it depends on the object itself. There are also quite successful examples of renting out real estate.

So, stocks are a tool that will help increase your income significantly. You will never achieve such results if you save money only in deposits.

Low risk structured products

Structured products come in varying degrees of risk. As a rule, they combine bonds, shares and some other instruments.

In the safe side of the portfolio, we look at low-risk structured products. Because this is a fairly calm and conservative part of the portfolio.

And in order to invest wisely in structured products, you need to have a good understanding of how the basic tools work. That is, funds, stocks and bonds. This is another reason to work on improving your financial literacy.

Ready-made solutions

This includes mutual funds, trust management, and ETFs. You contact the management company and purchase ready-made solutions.

You can purchase trust management from a management company. You can choose a decent strategy. For example, bonds or a mixture of bonds and shares.

Then you can entrust your money to the management company. This way, professional managers will earn money for you.

ETF

is a good solution that will allow you to invest in entire markets absolutely passively and without delving into it. For example, Russia or the USA.

These great tools can be supplemented with another way that can increase your income by 13%. This is the opening of an individual investment account

(IIS) and use it to purchase, for example, bonds or shares.

Thus, we will receive 13% in addition to this yield. Just think how significant a difference this is.

For example, depending on the term of the selected bond, federal government bonds are considered reliable in Russia. The yield on them is about 6 - 7%.

So, add 13% to the most reliable return, which is considered higher than the return on deposits. Let’s say in a reliable Sberbank it’s 20%.

This is a much more pleasant and reliable return than what you can get from any deposit.

Highly profitable part of the financial portfolio

The high-yield part of the portfolio includes:

- IPO

- Cryptocurrency

- Venture investments

For example, in an IPO it used to be possible to get 40% in dollars. However, this is a high-risk part of the portfolio.

You need to understand how you feel about risks. And for this you need to start investing. Fill in with the broker ( professional licensed market participant where you will open an account

) risk profiling questionnaire.

Then you will understand your attitude to risk. You want 70% of your portfolio to be securely protected. Or are you willing to risk part of it in order to obtain greater benefits.

Cryptocurrency is not yet regulated in any way by law. It's still murky water. But at the same time it remains attractive from the point of view of the risk-return ratio.

There are also various venture investments - these are investments in various small companies, startups, and so on.

What to do with the habits laid down by parents

…/Giphy.com

If your efforts to start saving fail over and over again, don’t be so quick to blame yourself. Perhaps the reason is not your lack of discipline. Most of our habits are formed in childhood, and attitude towards finance is no exception. You will have to begin to improve your relationship with money by eliminating the patterns laid down by your parents.

Overcome bad financial habits →