Nominal wages

Nominal wages are understood as monetary remuneration in a fixed amount, which the employer pays to the employee either for a certain volume of goods produced or work performed in a fixed time, or for the number of hours worked. This concept also includes various bonuses and incentive payments. The size of the employee's nominal salary is fixed in the employment contract with the employer, or in the pay slip, which reflects the salary for a certain time period.

Types of wages

Nominal wages are usually divided into two types: accrued and paid. Nominal accrued wages are payments for the employee’s labor activity, calculated in accordance with the accounting system adopted by the enterprise. The paid nominal salary is the amount of money remaining after paying tax deductions from accrued wages, and given to the employee according to the statement.

The calculation of nominal wages is based on several calculation systems:

- Salary. Under this system, an employee receives a salary for his work in the amount of the salary fixed in the staffing table.

- Time-based. The basis for calculation is the time worked by the employee, which is paid at established rates.

- Piecework. Here the base is either the individual contribution of the employee to the total output (the volume of production produced by them) or his share in the total output of the team.

- Piece-time work. In this case, in addition to the fulfilled standard, the employee can receive incentive payments for exceeding the set plan.

- Chord. Under this system, an employee receives remuneration based on the shifts worked according to the schedule. Salaries are issued both upon completion of one of the stages of the production process, and upon completion of work.

- Scheduled and time-based. This calculation system provides remuneration for the fact that the employee has produced a certain standard of production and completed it within the allotted time.

- Mixed. In such a system, all of the above methods can be used in various combinations.

When nominal and real incomes are compared

The ratio of types of wages allows you to monitor inflation processes. An imbalance between real consumer demand and income supply shows the unsettled nature of economic processes, in which abrupt fluctuations in each direction are an unfavorable factor in economic development.

By comparing real and nominal wage indices, the following indicators are judged:

- Inflationary processes;

- Unemployment level;

- Needs for qualified personnel;

- The need to take corrective measures.

Real wage

Real wages

Real wages are the number of banknotes within which an employee has the opportunity to purchase various goods and services necessary for a comfortable existence. That is, this is the money that the employee received in his hands at the end of a certain working period and can now spend on food, medicine, clothing, payment for housing and communal services, education and recreation. This salary represents an indicator of a person's level of well-being.

Real wages are defined as high or low relative to current prices for goods and services necessary for life. As for the price level, in a capitalist-type economy this is a constantly changing value, but in the Russian economy the change is mainly in the direction of increase. Accordingly, over time, the real wages of most Russians can hardly be assessed as high.

Codependence of nominal and real wages

It seems that nominal wages always directly reflect real wages. However, this is not the case in cases of economic crisis and currency depreciation, when the increase in the amount of accrued wages “does not keep pace” with the rise in prices for goods and services. For the same amount as yesterday, the consumer cannot afford to purchase the same volume of goods and services. In such a situation, the process of inflation is evident.

NOTE! The experience of developed countries reflects the difference between real and nominal wages over a smaller base time frame. The amount accrued per working hour and its relationship with the number of labor results created during the same time are taken into account.

In Art. 22 of the Labor Code of the Russian Federation talks about the employer’s obligation to promptly and fully provide remuneration to employees for their work. In addition, the employer is required to strive to increase its actual content (Article 134 of the Labor Code of the Russian Federation, Letter from Rostrud No. 1073-6-1 dated April 19, 2010).

Difference and relationship

Similarities

Both nominal and real wages represent the cost of labor power. Both types of wages will have a monetary value and will be calculated in the currency in which the employer makes payments to its employees. Both of these types of salaries cannot have the same amount, since contributions to the state are made at the expense of the employer, and accordingly, he includes these expenses in the wages of his employees.

Difference

How do real wages differ from nominal wages? The fact that the real salary is strictly tied to the existing prices of consumer goods and services, and the nominal one is just a certain amount earned by a specialist without taking into account inflation and taxes, the size of which does not reflect the real economic situation. That is, the first is formed in the form of a set of goods that can be purchased with the amount received, and the second is expressed in the cost of a certain type of work performed or hours worked.

Connection

A simple Phillips curve

In order for a nominal salary to turn into a real one, all tax and pension contributions made by the employer must be subtracted from its value. Accordingly, the amount of nominal wages can often be calculated by the employer based on its own costs of doing business. Since the business owner is forced to make considerable tax contributions to the state, it is quite understandable that he will strive to save on the cost of paying employees. At the same time, the question of whether the employee can comfortably live on the money that is actually paid to him is unlikely to worry the employer.

What is nominal salary in simple words

Wages represent remuneration for work performed. It is expressed in rubles and kopecks. The exact amount of this amount is indicated in the salary slip. Of course, the employee is interested in seeing wages increase, but often the available money is only enough for the most necessary. Here we talked about nominal wages. It can be considered in two forms:

- Accrued, excluding taxes and contributions to social funds;

- Received after all required payments have been made.

What is important for an employee is the salary that he received in his hands and can spend at his own discretion.

Place in the economy

The so-called purchasing power of the population is calculated on the basis of real wages. The amount of purchasing power has an inverse relationship with the consumer price index or PPI. If consumer prices rise, then purchasing power will correspondingly fall down. In economics, it is practiced to use measures to compensate for the impact of inflation by changing the PPI value upward.

The difference between the levels of nominal and real wages will be an indicator of the magnitude of inflation. The nominal wage index is the ratio of the current wage level to the wage level of the previous year, multiplied by 100. The so-called real wage index is calculated as follows: the nominal wage index is divided by the CPI and multiplied by 100.

Inflation rate

If the size of the nominal wage does not change, and inflation rises, then the purchasing power of the population also decreases, since what a person earns will not be enough to pay for the goods and services necessary for life.

In conditions of constantly growing inflation, the size of real wages will still decline even if the level of nominal wages increases. This is observed with an artificial increase in wages through forced indexation by the state. At the same time, the degree of satisfaction with the social situation of the population will decrease.

On the contrary, an increase in nominal wages in a relatively stable economic situation will indicate an increase in the level of well-being of citizens. And a slight increase in the price index will not have a critical impact on the standard of living of citizens and will even be an additional incentive for employers to increase nominal wages.

By the way, the nominal value of the work done by an employee, which is a large mathematical value, is not yet an indicator that the employee’s wages are high. During the default period of the 90s, salaries amounted to millions, and there was nowhere to spend these enormous sums due to a shortage of consumer goods.

Inflation processes for the year

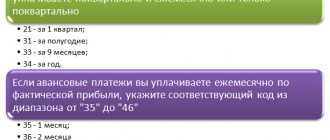

The rate of inflation is determined over annual and monthly periods. There are publications of annual size and broken down by month. The calculation of statistics is based on the consumer price index. The index is calculated as the ratio of the values of the current consumer basket to the base year. Before the start of the annual period, Rosstat makes a forecast that does not always coincide with the result.

| Year | Inflation rate |

| 2016 | 5.4% (forecast 8-8.5%) |

| 2015 | 12.9% (forecast 8%) |

| 2014 | 11.36% (forecast 5.5-6%) |

| 2013 | 6.45% (forecast 5-6%) |

To determine the decrease in real income for the year while nominal wages remain unchanged, the formula is used:

D real = D nominal / (1 + I), where:

- D real – real income;

- D nominal – nominal income;

- I is the amount of annual inflation growth. The impact of inflation on monthly income is calculated in a similar manner.

An example of the impact of inflation on real wages

Employee M. received wages for January 2020 and January 2016 in the amount of 28,000 rubles. Let's calculate the change in real wages due to inflation processes. To simplify the calculation, taxation is not taken into account.

- Let's determine the amount of decrease in real wages for 2020: Z2015 = 28,000 / 1 + 0.129 = 24,800.71 rubles.

- Let's determine the decrease in real wages for 2020: R2015 = 28,000 - 24,800, 71 = 3,199.29 rubles.

- Conclusion: The real cost of wages for employee M., with an equal nominal value, decreased in 2020 by 3,199.29 rubles.

Factors of influence

Factors influencing the calculation of nominal wages

Below are the factors influencing the calculation of nominal wages:

- Employee's personal contribution to production. This is his experience, qualifications, existing skills, the quality of the work performed, as well as the volume performed.

- Various incentives for quality work done. These are additional payments for overtime work, increased productivity and quality of goods.

- Difficult working conditions. These are harmful production conditions, difficult working conditions and an intense work schedule.

- Methods of calculating remuneration - based on salary, a certain tariff, per unit of working time or product produced.

- The amount of time worked or the production rate.

- The minimum wage is the minimum wage. This parameter is the minimum threshold for calculating a nominal salary and depends largely on decisions at the state level.

Harmful working conditions

"Gray denomination"

Since the tax burden is tied to nominal wages, the employer is always tempted to set them as low as possible, down to the minimum wage. To compensate for the resulting gap between nominal and real wages, he pays employees additional funds outside of accounting documents or in another form.

Such schemes cause harm to the state and, if possible, are monitored and suppressed. If the wage fund is suspiciously low, and its nominal values are too far from real ones, the regulatory authorities will definitely become interested in this situation. A tax audit and explanation, and possibly more serious measures, are inevitable.