Nowadays, when there are constant changes in legislation, registration rules and tax code norms, such a difficult procedure as registering a JSC or PJSC can only be done by qualified specialists in the provision of legal services. Think about it: if your registration is denied, you lose not only the money paid for all kinds of fees, but also valuable time. In more detail - Difficulties associated with registering JSC / PJSC.

To save you time and nerves, we offer our registration services. But if you still decide to go through the registration procedure yourself, we will tell you about the procedure in more detail.

Stage 1. Data collection

- Organization name You can register a full name, an abbreviated name, as well as a name in a foreign language.

Please note that there are a number of restrictions when choosing a name (it is prohibited to use full or abbreviated official names of federal government bodies, government bodies of constituent entities of the Russian Federation and local governments, etc.) - Legal address

According to the law, each legal entity must have a location address at which the registration of this legal entity is carried out and at which its executive body can always be found.In order to register a joint stock company at its location address, you must have either the right to its property or the legitimacy of its ownership on the part of the owner (certificate of ownership / Unified State Register Extract), as well as your relationship to it (lease agreement or letter of guarantee from the owner ).

- Founders

The founders of a company are citizens and (or) legal entities (one or more) who made the decision to establish it. A company cannot have another business company consisting of one person as its sole founder (shareholder).Differences between JSC (PJSC) and CJSC (JSC)

The main difference between the forms is that in a JSC shares are distributed only among a predetermined strictly defined (closed) circle of persons (for example, only among its participants), and in a PJSC shares can be sold to any persons (the circle of persons is open), they can subscriptions are announced and they can go on sale for free.

- Authorized capital Authorized capital is the amount of funds initially invested by the owners to ensure the authorized activities of the organization.

Contributions to the authorized capital, in accordance with the Law, can be cash, securities, various material assets or property rights that have a monetary value.JSC The minimum authorized capital is 10,000 rubles.

PJSC The minimum authorized capital is 100,000 rubles.

- Distribution of shares of the management company between the founders;

The distribution of shares in the authorized capital allows participants to determine the scope of rights of each of them in connection with the management of the company and the receipt of profit (dividends). PJSC has an obligation to disclose information (annual report, annual financial statements; securities prospectus; notices of the general meeting of shareholders; other information). While the JSC does not have such an obligation. The JSC publishes this information only in cases where the number of shareholders is more than 50 or the JSC’s securities are publicly placed. - Types of economic activities (what the organization will do); In order to carry out entrepreneurial activities, these types of activities must be recorded in the constituent documents and registered with the tax office. You need to decide on the types of activities in accordance with the OKVED OK 029-2014 classifier (NACE REV. 2).

- General Director and Chief Accountant General Director and Chief Accountant are officials of the organization.

The general director is responsible for the current activities of the organization (he is the executive body of the organization). The chief accountant is responsible for reliable accounting and tax reporting. As officials, the general director and chief accountant bear administrative, civil and criminal liability for actions committed on behalf of the company. - Taxation system It is necessary to decide on the taxation system.

Today the following types are distinguished:

- General taxation system (OSNO),

Simplified taxation system (USNO) 6%, when the object of taxation is income;

- Simplified taxation system (STS) 15%, when the object of taxation is income reduced by the amount of expenses;

- Unified tax on temporary income (UTII).

The choice of the most optimal taxation system depends on the amount of income, profit, composition of expenses, as well as on the taxation system used by counterparties.

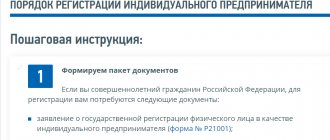

Stage 2. Preparation of a package of documents

In accordance with the approved requirements, it is necessary to prepare the following package of documents:

- Application for state registration (form No. P11001) When submitting a set of documents to the tax office by a representative using a notarized power of attorney, the founder must have this form certified by a notary.

If there are several founders, then they all go to a notary to certify form No. P11001. Documentation requirements - Application for transition to a specific taxation system different from the main system.

- Charter (2 originals).

- Decision (if there is only one founder) (1 copy for the tax office, 1 copy for ourselves - if there is more than one sheet, then we staple it).

- The minutes of the general meeting of founders are relevant if there is more than one founder (1 copy for the tax office, we keep 1 for ourselves - if there is more than one sheet, then we staple it).

- Document confirming payment of the state duty - 4,000 rubles for state registration (must be paid by the applicant and the original payment must be provided). You can generate a receipt for payment of state duty using the “Payment of state duty” service.

- A letter of guarantee to the legal address, along with a copy of the certificate of ownership or an extract from the Unified State Register.

Stage 3. Submission of documents to the Federal Tax Service

Each region has tax registration authorities. Today, the main registration authority of the capital and the key link in the process of registering a legal entity is MI Federal Tax Service No. 46. The applicant (or a representative with a notarized power of attorney) must submit the prepared package of documents to the tax office at the place of registration of the Company. If there are several founders, then they will all be applicants during the initial registration.

In return, the applicant receives a receipt stating:

- Full name of the applicant.

- Date when documents must be received.

Based on this document, the applicant (Applicants) or any other person by proxy will be able to receive the documents given in step 4.

Stage 4. Receiving documents from the Federal Tax Service

After 5 working days (including the day of submission and the day of receipt of documents), based on the receipt issued when submitting documents to the tax office, the applicant or person by proxy receives:

- Record sheet on the creation of a company.

- Certificate of registration of a Russian organization with the tax authority at its location (TIN Certificate).

- Charter

Stage 5. Opening a current account

For the organization to function fully, you need to open a bank account. The requirements for documents required to open a current account vary depending on the bank.

An approximate list of documents is as follows:

- Charter

- Extract from the Unified State Register of Legal Entities (often no later than a month from the date of issue, but the Bank may set a shorter validity period).

- Certificate of state registration of the Company (if the company was registered before January 1, 2020).

- Certificate of tax registration (TIN Certificate).

- Record sheet on the creation of a company.

- The decision to create a company or protocol, if the company has more than one founder.

- Foundation agreement (if the company was created by several founders)

- Order on the appointment of the general director and chief accountant.

- Documents for the legal address confirming ownership and the legality of your registration at this address.

- Bank card.

- Bank questionnaire.

- Bank account agreement - 2 copies..

Stage 6. Registration of the issue of shares

The final stage of JSC registration is registration of the issue of shares of the Company.

Documents for state registration of the issue and a report on the results of the issue of shares distributed among the founders (acquired by the sole founder) of the joint-stock company upon its establishment must be submitted to the registration authority no later than 30 days after the date of state registration of the joint-stock company.

It should be noted that for violation of the procedure for issuing securities, the legislation of the Russian Federation provides for administrative (and in some cases even criminal) liability in the amount of 500,000 to 700,000 rubles. to a legal entity.

In addition to registering shares, Companies are required to transfer the maintenance of their register of shareholders to a person - the Registrar, who has a license provided by law.

Stage 7. Registration with funds

At the time of registration, the company is automatically registered with the following funds:

- Pension Fund of Russia (PFR)

- Social Insurance Fund (SIF)

Next, notifications from funds about registration are sent to the organization’s legal address. If the notifications have not been received, it is possible to receive duplicate notifications in your hands

These notices are necessary for reporting, because funds assign each organization its own number, which is entered into the accounting program or written down in the report

Stage 8. Submission of financial statements

Registered joint-stock companies are required to submit financial statements, regardless of whether they conduct business activities or not.

In the absence of entrepreneurial activity, companies have an obligation to prepare and submit zero reports on a quarterly basis.

The submission of these reports is sometimes commonly referred to as drawing up zero balances, or submitting zero reports.

An organization that operates is required to submit reports monthly. The set of tax reporting depends on the tax regime that has been chosen. (FSS).

Self-registration ends at this point!

Registration of PJSC.

In practice, it turns out that a public joint-stock company (PJSC) is not registered by analogy with an ordinary JSC. From September 1, 2014, the status of a public Company can only be obtained by making changes to the name of a non-public Company in the Charter, indicating that the Company is public. But it is not enough to change the name in the Charter. Shares of a non-public company and securities of a non-public company convertible into its shares are publicly placed (by open subscription) or publicly traded under the conditions established by securities laws.

Such a non-public Company must have a registered prospectus for the issue of securities, as well as an agreement with the trade organizer on the listing of the company's shares. Only after all these conditions have been met can changes be made to the Charter and the name changed to Public Joint Stock Company (PJSC).

Thus, registration of a PJSC consists entirely of all stages of registration of a non-public JSC, after which three additional stages must be completed:

- Register a securities prospectus;

- Conclude an agreement with the stock exchange on the listing of shares;

- Change the name to Public Joint Stock Company.

Differences between JSC and PJSC

The main difference between the two types of joint stock companies is the method of placement and circulation of their shares.

A public joint stock company is a joint stock company whose shares and securities are publicly placed (by open subscription) or publicly traded under the conditions established by securities laws. The rules on public companies also apply to joint stock companies, the charter and company name of which indicate that the company is public.

A limited liability company and a joint stock company that does not meet the criteria specified above are considered non-public.

| Public JSC | Non-public JSC | |

| Corporate name of the joint stock company | The name of public joint stock companies must contain the word “public” | The corporate name of a non-public joint stock company does not contain the “degree of openness” (for example, simply “joint stock company”) |

| Authorized capital | The minimum authorized capital must be at least a thousand times the minimum wage established by federal law on the date of registration of the company (currently 100,000 rubles) | The minimum authorized capital must be at least one hundred times the minimum wage established by federal law on the date of state registration of the company (currently 10,000 rubles) |

| Number of shareholders | The number of founders of a joint-stock company is unlimited | The number of founders of a non-public JSC is unlimited |

| Responsibilities for maintaining the register of shareholders | Public joint-stock companies must transfer the register of shareholders to an “independent organization that has a license provided for by law.” | For non-public joint stock companies there is no requirement for mandatory independence of the registrar |

| The adoption of a decision by the general meeting of participants of a business company and the composition of the company participants present at its adoption are confirmed | A public joint stock company by a person maintaining the register of shareholders of such a company and performing the functions of a counting commission (clause 4 of Article 97) | Non-public joint stock company by notarization or certification by a person maintaining the register of shareholders of such a company and performing the functions of a counting commission |

| Limitation on the number of shares, their total par value, as well as the maximum number of votes granted to one shareholder | Paragraph 5 of Article 97 of the Civil Code of the Russian Federation establishes a ban on establishing restrictions on the number of shares, their total par value and the maximum number of votes granted to one shareholder | In non-public joint stock companies, such restrictions may be established either by law or by the charter. |

| Consent to alienation of shares | The charter of a public joint stock company cannot provide for the need to obtain anyone’s consent to alienate shares of this company | The charter of a non-public JSC may stipulate the need to obtain such consent. |

| Preemptive right to purchase shares | In a public joint stock company, granting the right of pre-emption to acquire shares is not allowed, except in cases of additional issue of shares, which are defined in the Federal Law “On JSC” | Such a right may be provided for shareholders of non-public joint stock companies |

| Publication of reports | A public joint stock company is required to publicly disclose information required by law | For non-public JSCs there is no obligation to publish reports |

One of the issues that arises at the stage of preparing a new business project is the choice of the organizational and legal form in which the activity will be carried out. And, if previously there was a dilemma, which is better - an LLC or a CJSC, now, after the changes to the Civil Code came into force on September 1, 2014, you will have to choose, first of all, between an LLC and a non-public JSC.

General requirements for a closed society

You can open a closed joint stock company if the following requirements are met:

- The number of participants cannot be more than 50 persons. Minimum number – 1 participant. All shareholders must have the status of a legally capable person, both foreign and Russian citizens. The participants of the created enterprise can be legal entities.

- The minimum amount of authorized capital is 10 thousand rubles. You can contribute not only money to the society, but also property. All conditions for the formation of the authorized capital must be stipulated in the statutory documents. The founders of a closed joint stock company have the right to place restrictions on certain types of property that are not subject to inclusion in the charter of the enterprise. Before contributing property as a contribution to the authorized capital, it must be assessed by an independent expert. The value of property when forming capital cannot be higher than what it was assessed by an independent appraiser.

- Purpose of creation. Like any other business entity, a closed joint stock company is created for the purpose of making a profit. You can choose any type of activity that is not prohibited by current legislation; if necessary, you will need to obtain a license.

- The duration of the company is not limited, unless otherwise established in the charter documents.

- Every closed company must have a register of shareholders. It can be conducted by the enterprise itself or by an engaged certified registrar.

- Responsibility. The company itself is not responsible for the obligations of its shareholders, but only for its own obligations. If the matter has reached bankruptcy, and it has been established that this was due to the fault of the shareholders, then they may be held subsidiarily liable for the obligations of the company.

Advantages and disadvantages of registering a JSC

The advantage of a non-public joint stock company provided for by the updated edition of the Civil Code of the Russian Federation is the absence of restrictions on the number of shareholders, while in an LLC the limit of 50 participants remained unchanged.

The most noticeable disadvantages of JSC:

- a more complex procedure for creating a company due to the need to register the issue of shares

- higher transaction costs: maintaining the register by the registrar, certification of decisions of the general meeting by a notary or registrar.

Documents required for registration of PJSC, JSC

Registration of a joint stock company (public, non-public) is a complex legal procedure, especially considering the frequently changing registration procedure.

- Completed form for registration of a joint-stock company with the name of the Company:

- For individuals: - scanned copies of passports of all founders and the executive body of the Company (general director); — scanned copies of TIN certificates (if available) of all founders and the executive body (general director).

- For legal entities: — extract from the Unified State Register of Legal Entities; - certificate of registration of a legal entity; - certificate of tax registration; - charter; — scanned copies of passports of all founders and the executive body of the Company (general director); — scanned copies of TIN certificates (if available) of all founders and the executive body (general director); — certificate of opening a bank account.

What you need to know before opening a joint stock company

JSCs can be created in the form of public or non-public companies. At the same time, public companies (hereinafter referred to as PJSC) include companies whose shares are publicly traded. Other companies are non-public.

In addition, paragraph 1 of Art. 66.3 of the Civil Code of the Russian Federation establishes that legislative norms on public companies also apply to joint-stock companies, the constituent documents and names of which contain information about their publicity (that is, PJSC). Consequently, the question of the form of society must be resolved immediately.

The question of whether to register a PJSC or a JSC is decided solely by the founders. The registration procedure in both cases is practically the same, with the exception of the need to submit information about the publicity of the JSC to the registration authority and to include information in the constituent documents that the JSC is public.

Registration of issue (issue) of shares

The creation of a joint stock company involves not only entering data into the Unified State Register of Legal Entities, but also registering the issue of shares.

The issue of securities is the sequence of actions of the issuer for the placement of issue-grade securities established by the Federal Law “On the Securities Market”.

The issue of securities is carried out in the following cases:

- primary issue as a result of the creation of a joint stock company or public joint stock company

- as a result of reorganization in the form of transformation, merger, separation, division

- additional issue in order to increase the authorized capital of the joint-stock company

- issue of debt securities (bonds)

In accordance with clause 3 of Article 19 of the Federal Law “On the Securities Market”, when establishing a joint-stock company, the placement of shares is carried out before the state registration of their issue (on the day of state registration of the legal entity), and the state registration of the report on the results of the issue of shares is carried out simultaneously with the state registration issue of shares

Documents for registration of the first issue of shares must be submitted no later than 30 days from the date of state registration of the JSC.

Registration of shares placed upon establishment of a joint stock company is carried out in accordance with the “Regulations on standards for issuing securities, the procedure for state registration of an issue (additional issue) of issue-grade securities, state registration of reports on the results of the issue (additional issue) of issue-grade securities and registration of prospectuses of securities "(approved by the Bank of Russia on August 11, 2014 N 428-P) (Registered with the Ministry of Justice of Russia on September 09, 2014 N 34005)

State registration of the issue of shares is carried out by the Bank of Russia.

The procedure for issuing shares, in accordance with the above Regulations, includes a number of stages:

- Making a decision on the placement of securities or another decision that is the basis for the placement of securities.

- Approval of the decision on the issue (additional issue) of securities.

- State registration of an issue (additional issue) of securities or assignment of an identification number to an issue (additional issue) of securities.

- Placement of securities.

- State registration of a report on the results of the issue (additional issue) of securities or submission of a notification on the results of the issue (additional issue) of securities.

The registration authority is obliged to carry out state registration of an issue (additional issue) of securities or make a reasoned decision to refuse its state registration within the following periods:

- within 30 days from the date of receipt by him of documents submitted in accordance with the above Regulations for state registration of an issue (additional issue) of securities and registration of a securities prospectus

- within 20 days from the date of receipt by him of documents submitted in accordance with the above Regulations for state registration of an issue (additional issue) of securities not accompanied by registration of a securities prospectus

- within 10 working days from the date of receipt of documents submitted in accordance with the above Regulations for state registration of an issue (additional issue) of securities and registration of a securities prospectus after their preliminary consideration

The registration authority has the right to verify the accuracy of the information contained in the submitted documents, and also if not all documents are submitted to the registration authority, the registration period for the issue of shares may be extended by 30 days.

The decision to refuse state registration of an issue (additional issue) of securities is made by the registration authority on the following grounds:

- violation by the issuer of the requirements of the legislation of the Russian Federation on securities

- non-compliance of documents and the composition of the information contained therein with the requirements of the Federal Law “On the Securities Market”, these Regulations, and regulations of the registering authority

- failure to submit all documents within 30 days at the request of the registration authority

- entering into a securities prospectus or a decision on the issue (additional issue) of securities false information or information that does not correspond to reality (inaccurate information)

Legal address

This is an unofficial name; the legislation includes the wording “location” - the address at which the permanent body of the legal entity is located, and in its absence, another body or person who has the right to act on behalf of the company without a power of attorney (for example, the general director). Most often, the location is the address of the company's head office. When registering, you must provide a letter of guarantee from the owner or a lease agreement as proof that the LLC will operate at this address.

Before concluding an agreement and submitting documents, it would be a good idea to check the selected address against the database of mass registration addresses. Your office address may be included in this list if more than 10 legal entities are registered with it. This sometimes happens with office centers in which fly-by-night companies have been registered en masse: the owner of the building does not always warn his tenants that problems may arise with registration.

Difficulties associated with registration of PJSC and JSC

When registering PJSC and JSC, various difficulties may arise:

- Incorrectly prepared documents. All documents submitted for registration of a PJSC (JSC) must be filled out in strict accordance with the requirements of the law and contain only reliable information. Violation of this rule will entail denial of state registration of a legal entity and, accordingly, delay of business processes. In this case, the state fee is not refunded, and when submitting documents again, you will need to pay again.

- Problems with legal address. Particular attention should be paid to the choice of legal address. Even with a real legal address and confirmation (letter of guarantee) from the owner of a non-residential premises, you can receive a refusal to state registration of a legal entity, which will simply indicate that the data provided about the address of the legal entity is unreliable. When purchasing a legal entity. The address may be refused if many other organizations are assigned to this address. The most important thing is that the address will be additionally checked a month after registration, and if there is evidence of its unreliability, the decision on registration may be canceled by a higher authority.

- Refusal to open an account. Problems when opening a current account for a legal entity may arise if the legal entity is not located at the address declared as its actual location, or if the address is mass and a large number of legal entities are registered to it. In this case, the bank has the right to require documentary evidence of the location of the legal entity (premises lease agreement, certificate of ownership of the premises). Currently, banks carry out on-site checks at the location address.

- Violation of the share registration procedure. In accordance with Article 15.17 of the Code of the Russian Federation on Administrative Offenses: “Violation by the issuer of the procedure (procedure) for issuing securities established by federal laws and other regulatory legal acts adopted in accordance with them, if this action does not contain a criminal offense, entails the imposition of an administrative fine on officials of the issuer in the amount of ten thousand to thirty thousand rubles; for legal entities - from five hundred thousand to seven hundred thousand rubles.”

- In the event that an application for transition to the simplified taxation system (STS) is submitted untimely, the transition to the simplified taxation system (STS) will be refused .

- Failure/late submission of financial statements threatens with penalties, as well as blocking of the organization's current account.

The procedure for registering a company

Based on the results of registration, each enterprise receives a unique number, with an extract from the register confirming its assignment.

Before submitting documents, it is necessary to carry out a number of activities:

- choose the name of the company;

- determine the size of the authorized capital, which cannot be less than 10 thousand rubles;

- distribute the shares of all participants, which can be done by signing the appropriate agreement;

- determine the future legal address of the company, if more than 10 companies are already registered at this address, then acceptance of documents will be refused;

- decide on the types of activities;

- choose a tax system.

After this, you can proceed to drawing up documents. The sample charter of a closed joint-stock company must be adjusted to the needs of your enterprise and the agreements reached between future participants.