What is NAO

In 2014, the definitions relating to the organizational and legal forms of legal entities were revised. Federal Law No. 99 of May 5, 2014 amended the legislation and abolished the concept of closed joint stock company. At the same time, a new division was introduced for business entities, distinguishing them according to the criterion of openness to third parties and the possibility of third-party participation.

Article 63.3 of the Civil Code (CC) defines new concepts. According to the article, business societies are:

- Public (software). These are companies whose shares are freely traded in accordance with Law No. 39 of April 22, 1996 “On the Securities Market.” An alternative requirement for classifying an organization as software is to indicate its public nature in its name.

- Non-public (BUT). All others that are not public.

The legislative formulation does not provide a clear definition of a non-public company, and is based on the exclusionary principle (everything that is not software is non-public). Legally, this is not very convenient because it creates a clutter of language when trying to define terms. The situation is similar with establishing the meaning of a non-public joint stock company (NAO). It can only be determined by analogy (NAO is an AO with signs of NO), which is also uncomfortable.

But the legal procedure for transition to new definitions is simple. Law No. 99-FZ recognizes as public joint-stock companies all joint-stock companies created before September 1, 2014 and meeting the qualification criteria. And if such a company, as of July 1, 2020, has an indication in its charter or name that it is public, but in fact is not a PJSC, then it is given five years to begin public circulation of securities or re-register the name. This means that July 1, 2020 is the final date when, according to the law, the transition to the new wording must be completed.

Organizational and legal form

Public and non-public joint stock companies are distinguished according to Article 63.3 of the Civil Code. The defining feature is the free circulation of the company's shares, so it would be a mistake to mechanically translate old definitions into new ones (for example, to assume that all OJSCs automatically become PJSCs). According to the law:

- Public joint stock companies include not only open joint stock companies, but also closed joint stock companies that have publicly placed bonds or other securities.

- The category of non-public joint-stock companies includes closed joint-stock companies, plus open joint-stock companies that do not have shares in circulation. At the same time, the category of non-commercial organizations will be even wider - in addition to non-profit joint-stock companies, this also includes LLCs (limited liability companies).

Considering the specific nature of a closed joint stock company, which simplifies the task of concentrating assets in the hands of a group of individuals, combining it into one group with an LLC is quite logical. The legislative need to create a category of non-profit organizations becomes extremely clear - this is the unification into one group of business entities that exclude outside influence. At the same time, a non-public limited liability company can be transformed into a non-public joint stock company without any particular difficulties (the reverse process is also possible).

The difference between a public joint stock company and a non-public one

When comparing PJSC and NJSC, it is important to understand that each of them has its own advantages and disadvantages, depending on the specific situation. For example, public joint-stock companies provide more opportunities for attracting investments, but at the same time they are less stable in corporate conflicts than non-public joint-stock companies. The table shows the main differences between the two types of business entities:

| Characteristics | Public JSC | Non-public joint-stock companies |

| Name (until July 1, 2020, the previous wording will be recognized by law) | Mandatory mention of public status (for example, PJSC "Vesna") | Indication of lack of publicity is not required (for example, JSC Leto) |

| Minimum authorized capital, rubles | 1000 minimum wages (minimum wages) | 100 minimum wage |

| Number of shareholders | Minimum 1, maximum unlimited | Minimum 1, when the number of shareholders begins to exceed 50 people, re-registration is required |

| Trading shares on the stock exchange | Yes | No |

| Possibility of open subscription for placement of securities | Yes | No |

| Preferential acquisition of shares | No | Yes |

| Presence of a board of directors (supervisory board) | Yes | You don't have to create |

Three funny letters

From now on, Russian companies will be called nothing more than public or non-public. An entire era with its endless LLCs, CJSCs and OJSCs, generated by the confusion of the 90s, goes back into history. The authorities decided to restore order here, designed to improve the investment climate in the country. But small enterprises that have the status of joint stock companies may come under attack. The new requirements for public companies will be unaffordable for them. So they will have to choose a closed form of organization.

The “dashing” 90s were remembered not only for gang wars and the appearance of new Russians. After the fall of the Soviet Union, joint stock companies and limited liability companies suddenly began to appear in Russia. The process was avalanche-like. Yesterday's canteens and repair shops turned into business structures. People who were not yet accustomed to the conditions of a capitalist economy were just beginning to become acquainted with the basics of market life. The result was the creation of a very wide business field in which millions of companies were formed. According to the Unified State Register of Legal Entities as of July 2014, there are 3.7 million LLCs, about a thousand ODOs, 125 thousand CJSCs and 31 thousand OJSCs registered in Russia.

Vice-President of the Russian Union of Industrialists and Entrepreneurs (RSPP) Viktor Pleskachevsky, in a conversation with Lenta.ru, noted that at the moment in the Russian Federation a unique form of enterprise organization has developed, which combines public and private elements. “This system is imperfect and generated by the privatization of the 90s,” said Mr. Pleskachevsky. According to him, it was most clearly manifested in the closed joint-stock company. Thus, the legal entity registered itself as a joint stock company. This means that it must issue these same shares and trade them. But there is another word here - “closed”. That is, shares issued by the company do not go to the market, but are distributed to the founders. As a result, we have the same Soviet closed enterprise, but with a fashionable sign of a joint-stock company. It is not subject to the requirements of a public company, such as the obligation to make its financial statements public. So CJSC are stewing in their own juice.

In general, there are about 150 thousand joint-stock companies in Russia. This is a big number. The vice-president of the Russian Union of Industrialists and Entrepreneurs told Lenta.ru that in Germany there are only about a thousand public companies that issue shares. Not much more in the US and UK. As a rule, these are large companies. Their shares can be purchased by investors around the world. “In Russia, a station restaurant could become a joint-stock company. These were the rules of privatization. If you want to own a company, create a joint stock company. As a result, both large and small companies ended up in the same legal pile,” said Viktor Pleskachevsky.

Photo: Mikhail Mordasov / RIA Novosti

The favorite form of organization of Russian entrepreneurs is LLC. LLC participants are not liable for the obligations of the enterprise and bear the risks of losses only to the extent of their share in the authorized capital. Unlike closed joint stock companies, this form of ownership is also common abroad. German GmbH or English Ltd. - an analogue of Russian LLCs. According to the amendments, they will now be called non-public companies. The list of non-public and additional liability companies (ALS) will be added to the list. The key difference between such companies and LLCs is the joint liability of the participants for the company’s obligations. The amount of liability is correlated with the size of the contribution of each participant to the authorized capital of the company.

Finally, there are tens of thousands of open joint-stock companies in Russia. If they comply with all legal requirements, their status will be updated to public companies. But the requirements for them are quite stringent, since entering the open market is associated with risks. The well-being of investors depends on the success or failure of such a company. Therefore, a public organization must be as transparent as possible - undergo regular audits, hold shareholder meetings, and make open decisions. According to Mr. Pleskachevsky, of all the joint-stock companies in Russia, no more than one hundred enterprises can be called truly public.

Amendments to the Civil Code, which came into force on September 1, are designed to push companies to make a final decision on their organizational form. Closed and open joint-stock companies (CJSC and OJSC), as well as additional liability companies (ALC), are abolished. They will be replaced by new forms of organization - public and non-public. The main feature of a public legal entity will be free trading of company shares. In addition, to maintain the status, it is necessary to update the charter and reflect the publicity of the company in the name. All other joint stock companies, as well as limited liability companies (LLC), will now be called non-public.

The introduction of new organizational forms should go smoothly. Thus, Ekaterina Plekhova, deputy head of the business registration department of the law firm URVISTA, said in an interview with Lenta.ru that JSCs will have to edit their charters, and not in a short time. No state fees will be charged from enterprises for changing status. So the transition period will take place in a calm manner, and not like in 2009, when a similar situation arose with LLC. Then, we recall, according to Federal Law No. 312, limited liability companies had to undergo the re-registration procedure. The companies were given only six months to do this. The result is queues at government departments and corruption. “Legislators have learned their lesson. Now it will be easier for companies,” says Ms. Plekhova. OJSCs that do not perform the duties of a joint stock company will simply receive the status of a non-public company.

Alena Retivykh, a lawyer at the Muranov, Chernyakov and Partners Bar Association, explained to Lenta.ru that many companies should think about obtaining non-public status. This will benefit businesses that do not intend to attract widespread investment in the near future. Otherwise, the company may not be able to withstand the burden of increased costs. “The list of regular expenses of the joint-stock company has included payment for the services of a specialized registrar for maintaining the register of shareholders, certification of decisions of general meetings only by a notary or registrar, and a mandatory annual audit. While the main expense item for an LLC is only the notarization of transactions for the purchase and sale of shares in the LLC,” comments the lawyer.

Photo: Andrey Stenin / Kommersant

So small open joint-stock companies may find themselves left out of the reform - the responsibility placed on public companies is too great, and increased costs may have a detrimental effect on business profitability. To stay afloat, they will have to move into the non-public sphere of business. It’s worth thinking about strict requirements when creating a new company. For example, the minimum authorized capital of an LLC should now be 10 thousand rubles. In a closed joint-stock company - 100 minimum wages. All of these are non-public companies. The minimum requirements for the authorized capital of an OJSC (public company) are already one thousand minimum wages.

The remaining public enterprises will have to get used to strict oversight. When entering the open market, they will have to carefully fulfill their duties. In particular, requirements for disclosure of information and a special management structure. In addition, such companies must be subject to regular audits. Taken together, all this should increase the transparency of companies and make them more reliable in the eyes of investors. For this reason, amendments were made to the Civil Code.

Characteristics and distinctive features

From a legal point of view, a non-public joint stock company is a special category of business entities. The main distinguishing features include:

- Restrictions on the admission of participants. These can only be the founders. They act as the only shareholders, since the company's shares are distributed only among them.

- The authorized capital has a lower limit of 100 minimum wages, which is formed by contributing property or cash.

- Registration of a non-public JSC is preceded by the preparation of not only the company’s charter, but also a corporate agreement between the founders.

- The management of the NAO is carried out through a general meeting of shareholders with a notarized recording of the decision.

- The amount of information that a non-public JSC must place in the public domain is much less than that of other types of JSC. For example, non-public joint stock companies, with few exceptions, are exempt from the obligation to publish annual and accounting reports.

Disclosure of information about activities to third parties

The principle of publicity implies placing information about the company’s activities in the public domain. Information that a public company must publish in print (or online) includes:

- Company annual report.

- Annual accounting reports.

- List of affiliates.

- Statutory documentation of a joint stock company.

- Decision to issue shares.

- Notice of a meeting of shareholders.

For non-public joint stock companies, these disclosure obligations apply in a reduced form and apply only to organizations with more than 50 shareholders. In this case, the following will be published in publicly available sources:

- Annual report;

- Annual financial statements.

Certain information about a non-public JSC is entered into the Unified State Register of Legal Entities (USRLE). This data includes:

- information on the value of assets as of the last reporting date;

- information about licensing (including suspension, re-issuance and termination of a license);

- notification of the introduction of surveillance as determined by the arbitration court;

- subject to publication in accordance with Articles 60 and 63 of the Civil Code of the Russian Federation (notifications of reorganization or liquidation of a legal entity).

Charter

In connection with legislative changes caused by the emergence of new organizational and legal forms (public and non-public joint stock companies), JSCs must carry out a reorganization procedure with amendments to the charter. For this purpose, a board of shareholders is convened. It is important that the changes made do not contradict Federal Law No. 146 of July 27, 2006 and must contain a mention of the non-publicity of the organization.

The typical structure of the charter of a non-public joint-stock company is determined by Articles 52 and 98 of the Civil Code of the Russian Federation, as well as Law No. 208 of December 26, 1995 “On Joint-Stock Companies”. Mandatory information that must be indicated in this document includes:

- name of the company, its location;

- information about placed shares;

- information about the authorized capital;

- amount of dividends;

- procedure for holding a general meeting of shareholders.

What is PAO?

On September 1, 2014, amendments to the Civil Code concerning the activities of legal entities came into force. This date marks the liquidation of CJSC, LLC and the beginning of the work of new organizational forms of business activity - PJSC (interpretation: public joint-stock companies), JSC, LLC (non-public joint-stock companies).

Before changes in legislation, large corporations and small organizations operated under a single legal framework. If a small organization had even two shareholders, the management was obliged to delegate powers by creating a board of directors or organizing a meeting of shareholders within a certain time frame, to elect an auditor who in fact controls its actions and protects its interests. The amendments improved the law and eliminated the need for organizations to comply with its requirements only formally due to the global discrepancy between the legal and economic models.

Organizational management and governing bodies

In accordance with current legislation, the charter of a joint stock company must contain a description of the organizational structure of the company. The same document should consider the powers of governing bodies and determine the procedure for making decisions. The organization of management depends on the size of the company, can be multi-level and has different types:

- General Meeting of Shareholders;

- supervisory board (board of directors);

- collegial or sole executive body (board or director);

- audit committee.

Law No. 208-FZ defines the general meeting as the highest governing body. With its help, shareholders exercise their right to manage the joint-stock company by participating in this event and voting on agenda items. Such a meeting may be annual or extraordinary. The company's charter will determine the boundaries of the competence of this body (for example, some issues can be resolved at the level of the supervisory board).

Due to organizational difficulties, the general meeting cannot resolve operational issues - for this purpose a supervisory board is elected. Issues that this framework addresses include:

- determination of priorities for the activities of a non-public joint stock company;

- recommendations on the amount and procedure for paying dividends;

- increasing the authorized capital of the joint-stock company through the placement of additional shares;

- approval of major financial transactions;

- convening a general meeting of shareholders.

The executive body may be sole or collegial. This structure is accountable to the general meeting and is responsible for the improper performance of its duties. At the same time, the competence of this body (especially in a collegial form) includes the most complex issues of the current activities of a non-public joint stock company:

- development of a financial and economic plan;

- approval of documentation on the company’s activities;

- consideration and decision-making on the conclusion of collective agreements and agreements;

- coordination of internal labor regulations.

Issue and placement of shares

The registration process of a joint stock company is accompanied by the introduction of special securities into circulation. They are called shares, and according to Law No. 39-FZ they give the owner the right:

- receive dividends - part of the company's profit;

- participate in the management process of a joint stock company (if the security is voting);

- ownership of part of the property after liquidation.

The putting of securities into circulation is called an issue. In this case, shares may have:

- documentary form, confirming ownership rights with a certificate;

- undocumented, when a record of the owner is made in a special register (in this case, the concepts of “securities” and “issue shares” are conditional).

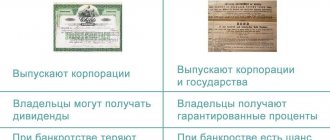

After the issue, the distribution (placement) of shares among the owners follows. The process is fundamentally different for PJSC and NJSC, implementing different methods of generating profit for these companies. A wide channel for the distribution of securities in the first case implies more careful control of activities by government agencies. The table shows the differences between public and non-public joint stock companies in the placement of shares:

| Process | Public JSC | Non-public JSC |

| Registration of share issue | It is necessary to register a public prospectus for the issue of securities (a special document with information about the issuer and the issue of shares). | Charter and founders' agreement required |

| Circle of shareholders | Is not limited | No more than 50 people |

| Placement of shares | Publicly on the stock exchange and other securities markets | Among shareholders (or under their control), there is no open subscription and free circulation on exchanges |

| Shareholder's ability to alienate (sell) shares | Under the control of other JSC participants | Free |

How CJSC and OJSC are structured

JSC is an organization that implies division into parts in the form of authorized capital. How many parts the shareholder, founder, owns depends on the purchase of the corresponding number of shares of the enterprise. Every person and even a legal entity is allowed to buy securities after their issue.

What opportunities does the purchase of shares provide to the holder?

- Receiving income from the profit earned by the joint-stock company for the reporting period. The shareholder's income is called dividends.

- If a shareholder considers it necessary to get rid of securities, he has the right to do this by selling them to interested parties. In this case, there is no need to receive an affirmative answer from other security holders and owners of the company.

The existence of a closed joint stock company is also impossible without the issue and sale of shares. The difference between JSC and CJSC is that shares are distributed only among the founders. That is, unauthorized persons cannot purchase them. Using this difference, society is called “closed”.

If the founder wishes to part with the company and withdraw from the shareholders, he has the right to resell his securities to other owners and no one else. The decision on the sale of shares is made at the general meeting of shareholders.

Certification of JSC decisions and maintaining the register of shareholders

The General Meeting of Shareholders is the highest body of the company's management, determining the further development of the organization. At the same time, the legally correct drawing up of the protocol and certification of decisions taken is of great importance, relieving participants, board members and managers from mutual claims and disputes about forgery. According to Law No. 208-FZ, protocol documentation must contain:

- time and place of the general meeting of shareholders of a non-public JSC;

- the number of votes belonging to the owners of voting shares;

- the total number of votes of shareholders who participate;

- indication of the chairman, presidium, secretary, agenda.

Hiring the services of a notary will make the protocol more secure and increase the level of reliability of this document. This specialist must personally attend the meeting and record:

- the fact of adoption of specific decisions specified in the minutes of the meeting;

- number of present shareholders of a non-public joint-stock company.

An alternative to contacting a notary would be the services of a registrar who maintains the register of shareholders. The procedure and procedure for confirmation in this case will be similar. According to the law, from October 1, 2014, maintaining the register of shareholders became possible only on a professional basis. To do this, joint stock companies must turn to the services of companies with a specialized license. Independent maintenance of the register is punishable by a fine of up to 50,000 rubles for management, and up to 1,000,000 rubles for legal entities.

Change of organizational form

The reform of joint stock companies, begun in 2014-2015 by Law No. 99-FZ, should be completed in 2020. By this time, all official company names must be re-registered in the form prescribed by law. Depending on the availability of publicity, the former CJSC and OJSC are transformed into PJSC and JSC. Indication of non-publicity by law is not mandatory, therefore the abbreviation NAO may not be used in the official details of the company, and the presence of shares in free circulation allows you to do without the abbreviation PJSC.

The legislation allows changing the form of ownership from PJSC to NAO and vice versa. For example, in order to transform a Non-Public JSC, you must:

- Increase the authorized capital if it is less than 1000 minimum wages.

- Conduct inventory and audit.

- Develop and approve an amended version of the charter and related documents. If necessary, the organizational and legal form is renamed to PJSC (this is not mandatory by law, if there are shares in free circulation).

- Re-register.

- Transfer property to a new legal entity.

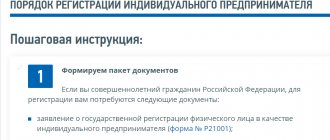

Preparation of constituent documents

When re-registering a NAO, special attention should be paid to the correct preparation of documentation. Organizationally, this process breaks down into two stages:

- Preparatory part. This involves filling out an application in form P13001, holding a meeting of shareholders and preparing a new charter.

- Registration. At this stage, the company details change (a new seal and forms will be required), which should be warned about by counterparties.

Advantages and disadvantages

If we compare the capabilities of PJSC and NJSC, then each of them has its own pros and cons. But, depending on the specific business situation, one or another option will be suitable. Non-public joint stock companies have the following advantages:

- The minimum authorized capital is 100 minimum wages for a non-public joint-stock company (for a public joint-stock company this figure is 10 times higher). But this plus immediately becomes a minus when compared with the same figure for an LLC - 10,000 rubles, which makes the form of a limited liability company more accessible to small businesses.

- Simplified form of purchasing shares. State registration of the purchase and sale agreement is not required; it is only necessary to make changes to the register.

- Greater freedom in managing the company. This is a consequence of the limited circle of shareholders.

- Restrictions on Disclosure. Not all shareholders want information about their share in the authorized capital or the number of shares to be available to a wide range of people.

- A less risky investment for investors than a publicly traded company. The absence of public trading of shares is a good protection against the unwanted possibility of a third party purchasing a controlling stake.

- Lower office costs than PJSC. The requirements for non-public documentation are not as serious as for those that are to be made public.

If we compare it with a public joint-stock company, then non-public joint-stock companies have a number of disadvantages. These include:

- The closed nature greatly limits the ability to attract third-party investments.

- The process of creating a company is complicated by the need for state registration of the issue of shares (in addition, this leads to an increase in the authorized capital).

- The decision-making process may be in the hands of a small group of people.

- Limits on the number of shareholders of 50 people compared to the unlimited number of a public JSC.

- Difficulties with leaving the membership and selling your shares.

Criteria for a Non-Public Joint Stock Company

A non-public joint stock company is a legal entity that meets the following criteria:

- The minimum amount of authorized capital is 10,000 rubles. (When registering, you do not need to contribute the entire amount of capital; funds can be contributed gradually. After 90 days, at least 50% must be ready);

- number of shareholders – no more than 50;

- the name of the organization does not indicate that it is public;

- The company's shares are not listed on the stock exchange and are not offered for purchase by public subscription.

Responsibility of participants for obligations and debts

PJSC is liable for its obligations with all its property on its balance sheet.

PJSC participants who transferred any property to the company lose their rights to it, receiving in return corporate rights of claim against the company.

Control Features

NPAO has the right to work without a board of directors and a supervisory commission if the total number of participants does not exceed 50 people. The organization is governed by general meetings of shareholders. Decisions of meetings are certified by notaries. If necessary, a counting commission is formed. However, if the members of the NPAO consider that they need a board of directors or an appointed leader, they simply form it and the number of participants.

Requirements for the charter of a joint-stock company

- name with the wording “joint stock company” and location;

- rights and obligations of shareholders with distribution of powers;

- pre-emptive right to purchase shares and the procedure for approving the sale of securities to third parties;

- audit rules.